Professional Documents

Culture Documents

Navy Federal Flagship Checking Account Fees Terms

Uploaded by

Rodrigo SantosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Navy Federal Flagship Checking Account Fees Terms

Uploaded by

Rodrigo SantosCopyright:

Available Formats

Navy Federal®

Flagship Checking Account Fees and Terms As of 4/9/2021

Minimum deposit to open ........................................................$0.00

Monthly service fee ...............................................................$10.00 Monthly service fee is waived with average daily balance of $1,500 or more.

Dividends ................................................................................... Yes Current rates may be obtained online at navyfederal.org.

Bill Pay service fee ...................................................................$0.00

Navy Federal ATM fee ..............................................................$0.00

Account

CO-OP Network® ATM fee ......................................................$0.00

Opening and

The owner of a non-Navy Federal ATM may charge a fee. Up to $10.00 in ATM fee

Usage PLUS® System ATM fee (overseas included) ............................$1.00

rebates per statement period. Direct deposit required.

Non-sufficient funds (NSF) fee................................................$29.00 Per item

Returned check fee (deposited or cashed).............................$15.00 Per item

Assessed after 365 days of inactivity on accounts with a combined checking and savings

Dormant checking account fee ................................................$3.00

balance of less than $50.00 and no other Navy Federal products during that time.

Stop-payment fee ..................................................................$20.00 If stopping a series of checks, the fee is $25.00.

Navy Federal Credit Union offers Checking Protection options in order to authorize overdraft transactions and avoid NSF fees.

If you choose not to opt in to any kind of overdraft service, ATM and point-of-sale (POS)

No overdraft service.................................................................$0.00

debit card transactions that would cause an overdraft will be declined at no cost to you.

Overdraft transfer fee from savings ..........................................$0.00

Payment of a check that exceeds your approved credit limit is $10.00, and the return

Checking Line of Credit (CLOC) transfer fee.............................$0.00

Overdraft loan payment fee is $29.00.

Options Optional Overdraft Protection Service (OOPS)........................$20.00

Total overdrafts cannot exceed $500, including fees. However, your account may become

overdrawn in excess of the $500 limit due to fees. See the Optional Overdraft Protection

Service (OOPS) Disclosure (Form 657).

Maximum number of overdraft fees per day ....................................3

Minimum overdrawn balance required to trigger a fee ............$15.00 You will not be charged a fee on transactions of $5.00 or less.

Extended overdraft fee.............................................................$0.00

Navy Federal Credit Union posts items presented on your account in the following order:

1. All Credits

2. ATM Debits (from smallest to largest)

3. POS Debits (from smallest to largest)

4. ACH Debits (from smallest to largest)

5. Checks1 (from smallest to largest)

Funds deposited to your account are generally available for withdrawal (Longer Delays May Apply):

Cash Deposit With Teller .................................................................. same business day

Cash Deposit With ATM................................................................... next business day2

Check Deposit With Teller ................................................................ next business day3

Processing Check Deposit With ATM ................................................................. next business day2

Direct Deposit .................................................................................. same business day4

Policies

Wire Transfer Deposit ...................................................................... same business day

Mobile Deposits ............................................................................... next business day5

1

Subject to Funds Availability Policy.

2

The first $225 will be available immediately. Any remaining funds will be available the second business day after the date of deposit. Deposits at nonproprietary

ATMs (ATMs we do not own or operate) are not available until the fifth business day after the date of deposit.

3

The first $225 of a deposit of checks will be available on or before the first business day after we receive your deposit. The remaining amount will be available

for withdrawal the second business day following the date of deposit.

4

Direct deposit is available the same business day, but at midnight.

5

Up to $225 of mobile check deposits will be available immediately after the deposit is approved. The balance of deposits greater than or equal to $1,000 will

generally be available by the second business day.

Dispute If you have a dispute regarding your account or the service you have received, please contact us at 1-888-842-6328.

Resolution

Federally insured by NCUA.

© 2021 Navy Federal NFCU 401D (4-21)

You might also like

- Telstra Strategic Issues and CEO Leadership Briefing PaperDocument16 pagesTelstra Strategic Issues and CEO Leadership Briefing PaperIsabel Woods100% (1)

- Metro Pcs Bill 9.27Document3 pagesMetro Pcs Bill 9.27Jay L0% (1)

- Lesson Plan SETS 2 PDFDocument10 pagesLesson Plan SETS 2 PDFHelmi Tarmizi83% (6)

- Discover Card Member Agreement With NAFDocument14 pagesDiscover Card Member Agreement With NAFRichard BurkhartNo ratings yet

- Technical Assessment Humanitarian Use of Hawala in SyriaDocument52 pagesTechnical Assessment Humanitarian Use of Hawala in SyriaRodrigo SantosNo ratings yet

- Payment Information Account Summary: March 9 20Document3 pagesPayment Information Account Summary: March 9 20Mark Williams100% (2)

- Marine Biofouling (LIBRO)Document316 pagesMarine Biofouling (LIBRO)Laura Alejandra Montaño100% (1)

- Fees VW ADocument4 pagesFees VW Amaliknawaz1253No ratings yet

- Fees VW ADocument4 pagesFees VW AAngel Mayroni Jimenez GonzalezNo ratings yet

- Service Charges High Yield SavingsDocument4 pagesService Charges High Yield SavingsNader and Gabrielle AlsheikhNo ratings yet

- PNC Bank - Virtual Wallet Student FeesDocument5 pagesPNC Bank - Virtual Wallet Student FeesBobNo ratings yet

- Personal Deposit Account AgreementDocument12 pagesPersonal Deposit Account AgreementLocationNo ratings yet

- Interest Rates and Interest Charges: Safe 1 Credit Union Mastercard Credit Card Disclosure SummaryDocument3 pagesInterest Rates and Interest Charges: Safe 1 Credit Union Mastercard Credit Card Disclosure SummaryPaul ThurmanNo ratings yet

- Personal Fee Schedule: Some Fees Are Waived For Certain Accounts, As Described in This ChartDocument1 pagePersonal Fee Schedule: Some Fees Are Waived For Certain Accounts, As Described in This ChartSandi MarianNo ratings yet

- Amerant - MISC-DOMENGDocument2 pagesAmerant - MISC-DOMENGscribd01No ratings yet

- Chapter 7 BE EX SolutionsDocument30 pagesChapter 7 BE EX SolutionsThu Ngan NguyenNo ratings yet

- UI Claimants HandbookDocument40 pagesUI Claimants HandbookBecca crutcherNo ratings yet

- Credit Card TermsDocument68 pagesCredit Card TermsmsvkumarNo ratings yet

- Revenue and Monetary Assets: Changes From Eleventh EditionDocument21 pagesRevenue and Monetary Assets: Changes From Eleventh EditionMenahil KNo ratings yet

- Business Deposit Accounts Fee ScheduleDocument15 pagesBusiness Deposit Accounts Fee ScheduleJohnNo ratings yet

- Business Bonus Account v79.0Document3 pagesBusiness Bonus Account v79.0prabeshmanNo ratings yet

- Consumer Client Manual CitibankDocument32 pagesConsumer Client Manual CitibankGuillermo CarranzaNo ratings yet

- Form T.R. 17 Certified Pay BillDocument2 pagesForm T.R. 17 Certified Pay BillMuhammad Adil100% (1)

- Fundamental Accounting Principles Wild Shaw 20th Edition Solutions ManualDocument39 pagesFundamental Accounting Principles Wild Shaw 20th Edition Solutions ManualDouglasColeybed100% (43)

- Financial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFDocument60 pagesFinancial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFClaudiaAdamsfowp100% (10)

- Single Channel FacilitiesDocument1 pageSingle Channel FacilitiestonapzNo ratings yet

- Manage Your Attain Checking AccountDocument2 pagesManage Your Attain Checking AccountieatpinktacozNo ratings yet

- BofA CoreChecking en ADADocument2 pagesBofA CoreChecking en ADAFrank TilemanNo ratings yet

- October 2023Document5 pagesOctober 2023isaiahdesmondbrown1No ratings yet

- Pay your minimum dues to avoid late feesDocument2 pagesPay your minimum dues to avoid late feesediealiNo ratings yet

- Amtb Misc DomengDocument2 pagesAmtb Misc DomengDavid GómezNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- BillSTMT 4588260001812272 19Document2 pagesBillSTMT 4588260001812272 19EhitishamNo ratings yet

- Most Important TNC PLDocument4 pagesMost Important TNC PL9463684355No ratings yet

- Banking & Finance Policies and Procedures Manual (Extract)Document51 pagesBanking & Finance Policies and Procedures Manual (Extract)Gilbert KamanziNo ratings yet

- Reloadable Visa debit card agreementDocument54 pagesReloadable Visa debit card agreementSameer AryaNo ratings yet

- Miscellaneous Service Fees For Personal, Commercial and Corporate AccountsDocument4 pagesMiscellaneous Service Fees For Personal, Commercial and Corporate Accountsgordon_juanNo ratings yet

- Personal Financial Services Charges - Your Guide: 1 July 2019Document32 pagesPersonal Financial Services Charges - Your Guide: 1 July 2019hernyNo ratings yet

- Chase AgreementDocument30 pagesChase AgreementDijana MitrovicNo ratings yet

- No Monthly Fees or Minimums for Asterisk-Free Checking AccountDocument3 pagesNo Monthly Fees or Minimums for Asterisk-Free Checking AccountMarcells Danyel JordanNo ratings yet

- CH04 Accounting For RevenueDocument12 pagesCH04 Accounting For RevenueI STAN BANGTANNo ratings yet

- Netspend All-Access Account: Monthly UsageDocument2 pagesNetspend All-Access Account: Monthly UsageSam BojanglesNo ratings yet

- Group AssaignmentDocument6 pagesGroup Assaignmentzeritu tilahunNo ratings yet

- Service FeesDocument1 pageService FeesWayne ChuNo ratings yet

- Financial Accounting Fundamentals 6th Edition Wild Solutions Manual DownloadDocument39 pagesFinancial Accounting Fundamentals 6th Edition Wild Solutions Manual DownloadElizabethLewisixmt100% (38)

- SWATI SBI - OrganizedDocument5 pagesSWATI SBI - OrganizedVinod MNo ratings yet

- Chapter 7Document11 pagesChapter 7Justin ManaogNo ratings yet

- Your TELUS Bill: Account SummaryDocument4 pagesYour TELUS Bill: Account Summarydummy accountNo ratings yet

- Payment Information Account Summary: July 9, 2020Document3 pagesPayment Information Account Summary: July 9, 2020Mark Williams0% (1)

- Receivables AssignmentDocument24 pagesReceivables AssignmentRhona RamosNo ratings yet

- PFSADocument84 pagesPFSAAkinlabi HendricksNo ratings yet

- Financial and Managerial Accounting 7th Edition Wild Solutions Manual DownloadDocument39 pagesFinancial and Managerial Accounting 7th Edition Wild Solutions Manual DownloadElizabethLewisixmt100% (41)

- Solution Manual For Financial and Managerial Accounting 8th by WildDocument45 pagesSolution Manual For Financial and Managerial Accounting 8th by WildTiffanyFowlercftzi100% (41)

- Supplementary Product Disclosure StatementDocument31 pagesSupplementary Product Disclosure Statementhoi99999No ratings yet

- cardholder-agreement-edv01odcashDocument54 pagescardholder-agreement-edv01odcashTruLuv FaithNo ratings yet

- TD Simple Savings Account GuideDocument3 pagesTD Simple Savings Account GuideMery MelendezNo ratings yet

- Deposit Account EssentialsDocument30 pagesDeposit Account EssentialsmattloyaltyNo ratings yet

- Easy Checking SnapshotDocument2 pagesEasy Checking SnapshotsupportNo ratings yet

- Chasebankusanationalassociation 489913 Wilmingtondelaware 19Document39 pagesChasebankusanationalassociation 489913 Wilmingtondelaware 19Efrain CabreraNo ratings yet

- SOC July December 2022 For CirculationDocument26 pagesSOC July December 2022 For Circulationwaqas wattooNo ratings yet

- Chapter 9 Solutions PDFDocument7 pagesChapter 9 Solutions PDFAA BB MMNo ratings yet

- Google Pay Balance Monthly Statement: 81641294083046 Apr 6, 2021 - Apr 7, 2021Document1 pageGoogle Pay Balance Monthly Statement: 81641294083046 Apr 6, 2021 - Apr 7, 2021Rodrigo SantosNo ratings yet

- 2019 Tewksbury Arrest ReportDocument109 pages2019 Tewksbury Arrest ReportRodrigo SantosNo ratings yet

- Your Credit Score: Mariner Finance, LLC Your Credit Score and The Price You Pay For CreditDocument2 pagesYour Credit Score: Mariner Finance, LLC Your Credit Score and The Price You Pay For CreditRodrigo SantosNo ratings yet

- U.S. Bancorp Investments Client Relationship Summary: What Investment Services and Advice Can You Provide Me?Document23 pagesU.S. Bancorp Investments Client Relationship Summary: What Investment Services and Advice Can You Provide Me?Rodrigo SantosNo ratings yet

- WebBank Privacy Policy SummaryDocument2 pagesWebBank Privacy Policy SummaryRodrigo SantosNo ratings yet

- Monroe County Sheriff Office: Court DateDocument252 pagesMonroe County Sheriff Office: Court DateRodrigo SantosNo ratings yet

- Monroe County Sheriff Office: Court DateDocument252 pagesMonroe County Sheriff Office: Court DateRodrigo SantosNo ratings yet

- Enterprise + National Rental Discount InstructionsDocument2 pagesEnterprise + National Rental Discount InstructionsRodrigo SantosNo ratings yet

- Dyno InstructionsDocument2 pagesDyno InstructionsAlicia CarrNo ratings yet

- Chapter 5Document31 pagesChapter 5Marvin VinasNo ratings yet

- R7 Injection CheatSheet.v1Document1 pageR7 Injection CheatSheet.v1qweNo ratings yet

- Identifying The Orders of AR and MA Terms in An ARIMA ModelDocument11 pagesIdentifying The Orders of AR and MA Terms in An ARIMA ModelNeha GillNo ratings yet

- Public Authority CasesDocument11 pagesPublic Authority CasesAbhinav GoelNo ratings yet

- Achmad Nurdianto, S.PD: About MeDocument2 pagesAchmad Nurdianto, S.PD: About Medidon knowrezNo ratings yet

- In2it: A System For Measurement of B-Haemoglobin A1c Manufactured by BIO-RADDocument63 pagesIn2it: A System For Measurement of B-Haemoglobin A1c Manufactured by BIO-RADiq_dianaNo ratings yet

- Günter Fella: Head of Purchasing AutomotiveDocument2 pagesGünter Fella: Head of Purchasing AutomotiveHeart Touching VideosNo ratings yet

- Well Plan Release NotesDocument28 pagesWell Plan Release Notesahmed_497959294No ratings yet

- Herbarium Specimen Preparation and Preservation GuideDocument9 pagesHerbarium Specimen Preparation and Preservation GuideJa sala DasNo ratings yet

- PassionForProcesse en 04-13Document20 pagesPassionForProcesse en 04-13Mutas MattaNo ratings yet

- Get Lucky LetraDocument1 pageGet Lucky LetraDante Jhonatan Kamt GarciaNo ratings yet

- Travel directions LPU-Batangas from Manila, Laguna, Quezon, CaviteDocument1 pageTravel directions LPU-Batangas from Manila, Laguna, Quezon, CaviteMark Levin Munar100% (1)

- Arduino PWM To DC Voltage Op Amp Converter - Henry's BenchDocument8 pagesArduino PWM To DC Voltage Op Amp Converter - Henry's BenchAlan A. TorresNo ratings yet

- BrochureDocument2 pagesBrochureNarayanaNo ratings yet

- Management Science PDFDocument131 pagesManagement Science PDFAngela Lei SanJuan BucadNo ratings yet

- SpinView Getting StartedDocument16 pagesSpinView Getting StartedRicardo SequeiraNo ratings yet

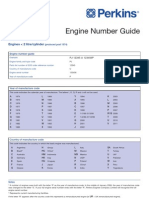

- Perkins Engine Number Guide PP827Document6 pagesPerkins Engine Number Guide PP827Muthu Manikandan100% (1)

- MSC Dissertation Gantt ChartDocument6 pagesMSC Dissertation Gantt ChartProfessionalPaperWritingServiceUK100% (1)

- 9607 Syllabus Media StudiesDocument28 pages9607 Syllabus Media StudiesmisterNo ratings yet

- Advances in Cultivation of Commercial Seaweed SpeciesDocument21 pagesAdvances in Cultivation of Commercial Seaweed SpeciesDHEERAJ KUMARNo ratings yet

- 4 1 Separation of VariablesDocument9 pages4 1 Separation of Variablesapi-299265916No ratings yet

- ERA News Mar 23 - Final - 0Document10 pagesERA News Mar 23 - Final - 0Băltoiu Son AlisaNo ratings yet

- Find Out Real Root of Equation 3x-Cosx-1 0 by Newton's Raphson Method. 2. Solve Upto Four Decimal Places by Newton Raphson. 3Document3 pagesFind Out Real Root of Equation 3x-Cosx-1 0 by Newton's Raphson Method. 2. Solve Upto Four Decimal Places by Newton Raphson. 3Gopal AggarwalNo ratings yet

- "View" "Slide Show.": Resources Chapter MenuDocument91 pages"View" "Slide Show.": Resources Chapter Menuelty TanNo ratings yet

- Guia Instalacion ENTECDocument15 pagesGuia Instalacion ENTECHislim SaidNo ratings yet

- Challan FormDocument2 pagesChallan FormSingh KaramvirNo ratings yet