Professional Documents

Culture Documents

SUMMARY OF EQUATIONS by Kaye Anna S. Reyes

SUMMARY OF EQUATIONS by Kaye Anna S. Reyes

Uploaded by

Kaye Anna ReyesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SUMMARY OF EQUATIONS by Kaye Anna S. Reyes

SUMMARY OF EQUATIONS by Kaye Anna S. Reyes

Uploaded by

Kaye Anna ReyesCopyright:

Available Formats

SUMMARY OF EQUATIONS (BUSINESS FINANCE)

MANAGEMENT OF SHORT TERM LIABILITIES

SIMPLE INTEREST RATE OF A LOAN

iCB = Interest Paid x 12

Proceeds of the loan Number of months

that the borrower may use that the

firm has use of the proceeds

Example: The borrower obtains a $1,000 loan for a year and pays $60 in interest when the loan is

repaid. In that case the rate of interest is:

iCB = $60 x 12

$1,000 12

EFFECTIVE INTEREST RATE ON A LOAN

Cash x % x 12

Cash – (Cash x %) 12

AMOUNT OF LOAN

The amount of the loan = Funds needed

1.0 - The origination fee

(in decimal

SIMPLE INTEREST RATE OF A LOAN

Cash x % x 12

Cash – (Cash x %) 12

COST OF TRADE CREDIT

iTC = Percentage discount x 360

100% minus payment period minus

percentage discount discount period

Example: For 2/10, n/30, the cost of trade credit is:

iTC = 0.02 x 360

1 - 0.02 30 – 10 = 36.7%

Note: 2/10, n/30 means 2%, amount due paid 10 days and amount full due is in 30 days.

Note:

TIME VALUE OF MONEY P = Present Value

FVIF = Future value interest

FUTURE VALUE OF A DOLLAR

PVIF = Present Value

P0 x FVIF (PercentI,yearN) = Pn interest

rate (look in interest table)

I = Percentage or interest

rate)

N = number of time

THE PRESENT VALUE OF A DOLLAR

periods/ year

Pn x PVIF (I,N) = P0

DISCOUNTING: P0 = Pn

(1 + i)

Future Value of Annuity Due

FVAD = PMT (1+i)1 + PMT (1+i)2 + ...+ PMT (1+i)n

Future Value of Ordinary Annuity

FVOA = PMT (1+i)0 + PMT (1+i)1 + ...+ PMT (1+i)n-1

THE FUTURE VALUE OF AN ANNUITY OF A DOLLAR

PMT x FVAIF (I,N) = FVA

FUTURE VALUE ANNUITY DUE

Example: An employer offers to start a pension plan for a 45-year old employee. The plan is to

place $1,000 at the end of each year in an account that earns 6% annually. The employee wants

to know how much will be in the account by retirement at age 65. What is the future value of

annuity?

PMT x FVAIF (I, N) = FVA

FVA (1+i) = Annuity Due

Answer:

$1000 x 36.786 = $36,786

$36,786 (1+.06) = $38.9932

$1000 x 38.9932 = $38,993.20

THE PRESENT VALUE OF AN ANNUITY OF A DOLLAR

PMT x PVAIF (I,N) = PV

PMT = annuity payment

PVAIF (I,N) = interest factor for the present value of an ordinary annuity at I percent and N

time periods

PV = present value of the annuity

PRESENT VALUE ANNUITY DUE

PV (1+i) = Annuity Due

You might also like

- Issue CASE STUDYDocument6 pagesIssue CASE STUDYTilaVathy0% (1)

- Stanbic Bank Uganda Annual - Report For 2015Document132 pagesStanbic Bank Uganda Annual - Report For 2015The Independent Magazine100% (1)

- Ulang Kaji MTES 3043Document5 pagesUlang Kaji MTES 3043江芷羚No ratings yet

- Discount Rate: Concept 9: Present ValueDocument5 pagesDiscount Rate: Concept 9: Present Valuekaustavdas1989No ratings yet

- TCH302-Topic 3&4-Time Value of Money & Applications PDFDocument38 pagesTCH302-Topic 3&4-Time Value of Money & Applications PDFHà ThưNo ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneyChimmy ParkNo ratings yet

- ch1 Notes CfaDocument18 pagesch1 Notes Cfaashutosh JhaNo ratings yet

- Topic 2-Time Value of MoneyDocument38 pagesTopic 2-Time Value of MoneyK61CAF Tạ Thảo VânNo ratings yet

- Lecture Notes-Interests and Future ValuesDocument25 pagesLecture Notes-Interests and Future ValuesOlawuyi OluwatamiloreNo ratings yet

- Lecture Notes-Interests and Future ValuesDocument25 pagesLecture Notes-Interests and Future ValuesKr Ish NaNo ratings yet

- Interest Rate.Document25 pagesInterest Rate.Hanoof AhmedNo ratings yet

- Eco Lec 9-13Document5 pagesEco Lec 9-13Lorman MaylasNo ratings yet

- Ch2 - Time Value of Money-2Document82 pagesCh2 - Time Value of Money-2Fatih 707No ratings yet

- Time Value of Money: Gitman and Hennessey, Chapter 5Document43 pagesTime Value of Money: Gitman and Hennessey, Chapter 5Faye Del Gallego EnrileNo ratings yet

- The Time Value of MoneyDocument58 pagesThe Time Value of MoneyvijayluckeyNo ratings yet

- Corporate Finance: Chapter 3: Time Value of MoneyDocument26 pagesCorporate Finance: Chapter 3: Time Value of Moneynaila FaizahNo ratings yet

- Up Chapter 6-7 (1) - 2 (Compatibility Mode)Document39 pagesUp Chapter 6-7 (1) - 2 (Compatibility Mode)EftaNo ratings yet

- Ceng - 24: Engineering Economy: Interest Is The Manifestation of The Time Value of MoneyDocument7 pagesCeng - 24: Engineering Economy: Interest Is The Manifestation of The Time Value of MoneyJayvee ColiaoNo ratings yet

- MODULE ECONOMICS Chapter 2Document24 pagesMODULE ECONOMICS Chapter 2Michael AliagaNo ratings yet

- TVMDocument38 pagesTVMbenjamin.labayenNo ratings yet

- Cheena Francesca J. Luciano-Q2-Genmath-Week-3-4-Handout-WorksheetDocument9 pagesCheena Francesca J. Luciano-Q2-Genmath-Week-3-4-Handout-WorksheetCheena Francesca LucianoNo ratings yet

- Basic QuantDocument12 pagesBasic Quantchickenmurgi365No ratings yet

- Module 02 TimeValueofMoneyDocument6 pagesModule 02 TimeValueofMoneyjean barrettoNo ratings yet

- CH08a TimeValue-ToPostDocument32 pagesCH08a TimeValue-ToPostthao nguyenNo ratings yet

- FM 2020 Assignment With Math AnswerDocument10 pagesFM 2020 Assignment With Math AnswerMohammad Zahirul IslamNo ratings yet

- Time Value of MoneyDocument29 pagesTime Value of Moneyrohan angelNo ratings yet

- Test EdiDocument2 pagesTest EdiHeba AbdullahNo ratings yet

- Math 108 Chapter 4 Amortization and Sinking FundDocument6 pagesMath 108 Chapter 4 Amortization and Sinking FundMary Jane Aguinaldo100% (2)

- Engineering Economy: Simple Interest Effective Rate of InterestDocument10 pagesEngineering Economy: Simple Interest Effective Rate of InterestPaul Gerard AguilarNo ratings yet

- Solution Manual For Bond Markets Analysis and Strategies 9th Edition by Fabozzi ISBN 0133796779 9780133796773Document25 pagesSolution Manual For Bond Markets Analysis and Strategies 9th Edition by Fabozzi ISBN 0133796779 9780133796773allenwoodonktbqdway100% (24)

- SeminarDocument16 pagesSeminarShairamie P. QuiapoNo ratings yet

- Capital Budgeting ReportDocument29 pagesCapital Budgeting ReportJermaine Carreon100% (1)

- Financial Market AnalysisDocument21 pagesFinancial Market Analysishareesh008No ratings yet

- 1-Ravi Kishore Manual (MYRAO)Document402 pages1-Ravi Kishore Manual (MYRAO)Ahsan RazaNo ratings yet

- BF3326 Corporate Finance: Time Value of MoneyDocument40 pagesBF3326 Corporate Finance: Time Value of MoneyAmy LimnaNo ratings yet

- 1 Time Value of MoneyDocument85 pages1 Time Value of MoneySeth D'MelloNo ratings yet

- Chapter 4 - Time Value of MoneyDocument8 pagesChapter 4 - Time Value of MoneyGalindo, Justine Mae M.No ratings yet

- Time Value of MoneyDocument20 pagesTime Value of MoneyАндрей РешетнякNo ratings yet

- Time Value 2020Document37 pagesTime Value 2020Dennis AleaNo ratings yet

- Time Value of MoneyDocument37 pagesTime Value of MoneyNicole PunzalanNo ratings yet

- Time Value of Money Time Value of MoneyDocument29 pagesTime Value of Money Time Value of MoneyEunice Dimple CaliwagNo ratings yet

- LAS BF Q3 Week 6 7 8 IGLDocument6 pagesLAS BF Q3 Week 6 7 8 IGLdaisymae.buenaventuraNo ratings yet

- Module 2 Time Value of MoneyDocument7 pagesModule 2 Time Value of MoneyZaid Ismail ShahNo ratings yet

- Bus Fin Mod 6Document33 pagesBus Fin Mod 6taebearNo ratings yet

- Review of Business FinanceDocument23 pagesReview of Business FinanceRubab ChaudhryNo ratings yet

- Class 4 AnswersDocument4 pagesClass 4 AnswersБота ОмароваNo ratings yet

- BBFH 202 Business Finance 1Document4 pagesBBFH 202 Business Finance 1tawandaNo ratings yet

- Mpb-404 Financial ManagementDocument6 pagesMpb-404 Financial ManagementMohammad Zahirul IslamNo ratings yet

- Fin 440 - Chapter - 5Document10 pagesFin 440 - Chapter - 5Mehedi HasanNo ratings yet

- FMECO CONCEPT NOTES by Ca Test SeriesDocument329 pagesFMECO CONCEPT NOTES by Ca Test SeriesTanvirNo ratings yet

- Time Value of Money Time Value of MoneyDocument19 pagesTime Value of Money Time Value of MoneyAhmad KhanNo ratings yet

- Engineering Economy Module 2Document33 pagesEngineering Economy Module 2James ClarkNo ratings yet

- PresTheme2-Eng-Time Value of MoneyDocument39 pagesPresTheme2-Eng-Time Value of MoneyKristina PekovaNo ratings yet

- Pertemuan 3 Dan 4 TEUSDAYDocument51 pagesPertemuan 3 Dan 4 TEUSDAYItzyoman YomanNo ratings yet

- Lecture 9 To 11 TVMDocument92 pagesLecture 9 To 11 TVMNakul GoyalNo ratings yet

- Time Value of Money PDFDocument52 pagesTime Value of Money PDFStar CelestineNo ratings yet

- Module 2Document55 pagesModule 2pavithran selvamNo ratings yet

- Lecture 2 Financial ArithmeticDocument23 pagesLecture 2 Financial ArithmeticmaxNo ratings yet

- Chap005 - V2Document66 pagesChap005 - V2Thủy Tiên Nguyễn ĐỗNo ratings yet

- Real Estate Economics Mortgage Instruments: Jing Li Singapore Management UniversityDocument72 pagesReal Estate Economics Mortgage Instruments: Jing Li Singapore Management UniversityKwan Kwok AsNo ratings yet

- FM - Lecture 2 - Time Value of Money PDFDocument82 pagesFM - Lecture 2 - Time Value of Money PDFMi ThưNo ratings yet

- Simple Interest Rate of A LoanDocument3 pagesSimple Interest Rate of A LoanKaye Anna ReyesNo ratings yet

- Worksheet Template For John Lee CPADocument5 pagesWorksheet Template For John Lee CPAKaye Anna ReyesNo ratings yet

- Don Bosco Technical Institute-Victorias: Where Soul Empowers TechnologyDocument2 pagesDon Bosco Technical Institute-Victorias: Where Soul Empowers TechnologyKaye Anna ReyesNo ratings yet

- Receivable Amount Due Days Outstanding: Business Finance Working Capital Management ExerciseDocument3 pagesReceivable Amount Due Days Outstanding: Business Finance Working Capital Management ExerciseKaye Anna ReyesNo ratings yet

- Commercial Bank CreditDocument2 pagesCommercial Bank CreditKaye Anna ReyesNo ratings yet

- Turban Legend by R. Zamora LinmarkDocument1 pageTurban Legend by R. Zamora LinmarkKaye Anna ReyesNo ratings yet

- Kaye Anna S. Reyes - The Revolution According To Raymundo MataDocument1 pageKaye Anna S. Reyes - The Revolution According To Raymundo MataKaye Anna ReyesNo ratings yet

- The Safe House by Sandra Nicole RoldanDocument4 pagesThe Safe House by Sandra Nicole RoldanKaye Anna Reyes100% (1)

- Case Study 1 Kaye Anna S Reyes 12 KowalskiDocument1 pageCase Study 1 Kaye Anna S Reyes 12 KowalskiKaye Anna ReyesNo ratings yet

- Case Study: Enron Corporation Scandal: Group 8Document6 pagesCase Study: Enron Corporation Scandal: Group 8Kaye Anna ReyesNo ratings yet

- Kaye Anna S. Reyes - Endterm PT - SPEECHDocument4 pagesKaye Anna S. Reyes - Endterm PT - SPEECHKaye Anna ReyesNo ratings yet

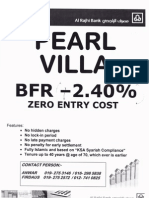

- Al Rajhi BankDocument4 pagesAl Rajhi BankSimon LeeNo ratings yet

- Monetary Policy 1Document27 pagesMonetary Policy 1Adeola AdekunleNo ratings yet

- Credit Risk ManagementDocument86 pagesCredit Risk ManagementSagar Paul'g100% (1)

- Benefit Cost Analysis HandoutDocument16 pagesBenefit Cost Analysis HandoutGemma P. TabadaNo ratings yet

- International Business The Challenges of Globalization 8th Edition Wild Solutions ManualDocument17 pagesInternational Business The Challenges of Globalization 8th Edition Wild Solutions Manualalanfideliaabxk100% (31)

- LIBF Level 3 Unit 2 GlossaryDocument18 pagesLIBF Level 3 Unit 2 GlossaryShadiya ShaoNo ratings yet

- Foundations of Financial Management Canadian 10th Edition Block Solutions ManualDocument38 pagesFoundations of Financial Management Canadian 10th Edition Block Solutions Manualcinquegrillfm0gph100% (16)

- Gen. Math Test Q2 Wk1 2Document8 pagesGen. Math Test Q2 Wk1 2Liecky Jan BallesterosNo ratings yet

- Engineering Economy Question and Answer 5eDocument10 pagesEngineering Economy Question and Answer 5eCarlo Mabini BayoNo ratings yet

- Weekly ArgusDocument66 pagesWeekly Argusjean pierreNo ratings yet

- The Islamic Inter Bank Money MarketDocument32 pagesThe Islamic Inter Bank Money MarketSvitlana OsypovaNo ratings yet

- Equifax Credit Report With Score: Consumer Name: ANKIT KDocument13 pagesEquifax Credit Report With Score: Consumer Name: ANKIT KAnkit ShawNo ratings yet

- Solution Homework 5Document5 pagesSolution Homework 5AtiaTahira100% (1)

- Working Capital ManagementDocument55 pagesWorking Capital ManagementSamina Ashrabi UpomaNo ratings yet

- Economic Determinants of Household Consumption Expenditures in West Africa: A Case Study of Nigeria and GhanaDocument15 pagesEconomic Determinants of Household Consumption Expenditures in West Africa: A Case Study of Nigeria and Ghanarieke sNo ratings yet

- 7 HOUSING FINANCE 1 MergedDocument192 pages7 HOUSING FINANCE 1 MergedKristien GuanzonNo ratings yet

- Ch08 189-220Document32 pagesCh08 189-220vancho_mkdNo ratings yet

- Chapter 10 NotesDocument9 pagesChapter 10 NotesashibhallauNo ratings yet

- SBM (Summary Notes - Alternative)Document172 pagesSBM (Summary Notes - Alternative)Sofia NicoriciNo ratings yet

- Mathematics & Decision MakingDocument9 pagesMathematics & Decision MakingXahed AbdullahNo ratings yet

- Northwell Health, IncDocument12 pagesNorthwell Health, IncKaushik DuttaNo ratings yet

- How To Start Your Investment Journey?Document59 pagesHow To Start Your Investment Journey?ElearnmarketsNo ratings yet

- FIN 435 - Exam 3Document54 pagesFIN 435 - Exam 3Kawser islamNo ratings yet

- A Report On Gems & Jewellery SectorDocument27 pagesA Report On Gems & Jewellery SectorSaksham Jain100% (1)

- Effective Interest RatesDocument2 pagesEffective Interest RatesZaid Tariq AlabiryNo ratings yet

- Financial MarketsDocument10 pagesFinancial MarketsZiania CristhelNo ratings yet

- Samplepractice Exam 9 April 2017 Questions and AnswersDocument24 pagesSamplepractice Exam 9 April 2017 Questions and AnswersAngel Queen Marino SamoragaNo ratings yet

- Chapter 3: Investment Banking: The Role of Investment BankersDocument13 pagesChapter 3: Investment Banking: The Role of Investment BankersAnne CruzNo ratings yet