Professional Documents

Culture Documents

Rectification of Errors - Questions

Uploaded by

Bhargav Raval0 ratings0% found this document useful (0 votes)

152 views6 pages Here are the rectifying entries for the errors:

1. Purchases A/c Dr. Rs. 500

To Furniture A/c

2. Building A/c Dr. Rs. 50

To Repairs A/c

3. Trade Expenses A/c Dr. Rs. 100

To Drawings A/c

4. Rent A/c Dr. Rs. 100

To Landlord's A/c

5. Clerk's Salary A/c Dr. Rs. 125

To Clerk's Personal A/c

6. Shaw & Co.'s A/c Dr. Rs. 100

To Shah & Co.'s A/c

Original Description:

b

Original Title

Rectification of Errors- Questions

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document Here are the rectifying entries for the errors:

1. Purchases A/c Dr. Rs. 500

To Furniture A/c

2. Building A/c Dr. Rs. 50

To Repairs A/c

3. Trade Expenses A/c Dr. Rs. 100

To Drawings A/c

4. Rent A/c Dr. Rs. 100

To Landlord's A/c

5. Clerk's Salary A/c Dr. Rs. 125

To Clerk's Personal A/c

6. Shaw & Co.'s A/c Dr. Rs. 100

To Shah & Co.'s A/c

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

152 views6 pagesRectification of Errors - Questions

Uploaded by

Bhargav Raval Here are the rectifying entries for the errors:

1. Purchases A/c Dr. Rs. 500

To Furniture A/c

2. Building A/c Dr. Rs. 50

To Repairs A/c

3. Trade Expenses A/c Dr. Rs. 100

To Drawings A/c

4. Rent A/c Dr. Rs. 100

To Landlord's A/c

5. Clerk's Salary A/c Dr. Rs. 125

To Clerk's Personal A/c

6. Shaw & Co.'s A/c Dr. Rs. 100

To Shah & Co.'s A/c

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

(a) In case of cash book, wrong castings result in wrong calculation of the balance c/d.

Example 3: The following cash transactions of M/s. Tularam & Co. occurred:

Jan. 1 Balance - cash Rs.1,200 bank Rs.16,000;

Jan. 2 Cheque issued to M/s. Bholaram & Co., a supplier, for Rs.22,500;

Jan. 6 Cheque collected from M/s. Scindia & Bros. Rs.42,240 and deposited for clearance;

Jan. 7 Cash sales Rs.27,200 paid wages Rs.12,400;

Jan. 8 Cash sales Rs. 37,730 cash deposited to bank Rs. 35,000.

Date Particulars Cash Bank Date Particulars Cash Bank

2017 Rs. Rs. 2017 Rs. Rs.

Jan. 1 To Balance b/d 1,200 16,000 Jan. 2 By M/s Bholaram & Co. A/c 22,500

Jan. 6 To M/s. Scindia & Bros. 42,420 By Wages A/c 12,200

Jan. 7 A/c To Sales A/c 27,200 By Bank A/c By 34,500

Jan. 8 To Sales A/c 37,370 Balance c/d 19,070 71,420

Jan. 8 To Cash A/c 34,500

65,770 93,920 65,770 93,920

How would you rectify the following errors in the book of Rama & Co.? ref ICAI -BoS

1. The total to the Purchases Book has been undercast by Rs.100.

2. The Returns Inward Book has been undercast by Rs. 50.

3. A sum of Rs. 250 written out as depreciation on Machinery has not been debited to Depreciation Account.

4. A payment of Rs. 75 for salaries (to Mohan) has been posted twice to Salaries Account.

5. The total of Bills Receivable Book Rs. 1,500 has been posted to the credit of Bills Receivable Account.

6. An amount of Rs.151 for a credit sale to Hari, although correctly entered in the Sales Book, has been posted as

Rs. 115.

7. Discount allowed to Satish Rs. 25 has not been entered in the Discount Column of the Cash Book. the

amount has been postedcorrectly to the credit of his personal account.

(i) The purchase of machinery for Rs. 2,000 has been entered in the purchases book. The effect of the

entry is that the account of the supplier Ram & Co. has been credited by Rs. 2,000 which is quite

correct. But the debit to the Purchases Account is wrong : the debit should be to Machinery Account. To

rectify the error, the debit in the purchases Account has to be transferred to the Machinery Account.

The correcting entry will be to Credit Purchases Account and debit the Machinery Account. Please see

the three entries made below: the last entry rectifies the error:

Wrong Entry: Rs. Rs.

Purchases Account Dr. 2,000

To Ram & Co. 2,000

Correct Entry:

Machinery Account Dr. 2,000

To Ram & Co. 2,000

Rectifying Entry:

Machinery Account Dr. 2,000

To Purchases Account 2,000

(ii)Rs.100 received from Kamal Kishore has been credited in the account of Krishan Kishore. The error is

that there is a wrong credit in the account of Krishan Kishore and omission of credit in the account of Kamal

Kishore; Krishan Kishore should be debited and Kamal Kishore be credited. The following three entries make

this clear:

Wrong Entry: Rs. Rs.

Cash Account Dr. 100

To Krishan Kishore 100

Correct Entry:

Cash Account Dr. 100

To Kamal Kishore 100

Rectifying Entry:

Krishan Kishore Dr. 100

To Kamal Kishore 100

(iii)The sale of old machinery, Rs.1,000 has been entered in the sales book. By

this entry the account of the buyer has been correctly debited by Rs.1,000.

But instead of crediting the Machinery Account. Sales Account has been

credited. To rectify the error this account should be debited and the Machinery

Account credited. See the three entries given below:

Wrong Entry: Rs. Rs.

Buyer’s Account Dr. 1,000

To Sales Account 1,000

Correct Entry:

Buyer’s Account Dr. 1,000

To Machinery Account 1,000

Rectifying Entry:

Sales Account Dr. 1,000

To Machinery Account 1,000

Illustration

The following errors were found in the book of Ram Prasad & Sons. Give the necessary entries to correct

them.

(1) Rs. 500 paid for furniture purchased has been charged to ordinary Purchases Account.

(2) Repairs made were debited to Building Account for Rs. 50.

(3) An amount of Rs.100 withdrawn by the proprietor for his personal use has been

debited to Trade Expenses Account.

(4) Rs.100 paid for rent debited to Landlord’s Account.

(5) Salary Rs.125 paid to a clerk due to him has been debited to his personal account.

(6) Rs.100 received from Shah & Co. has been wrongly entered as from Shaw & Co.

(7) Rs. 700 paid in cash for a typewriter was charged to Offlce Expenses Account.

You might also like

- Charge Sheet & Reply-2ndDocument4 pagesCharge Sheet & Reply-2ndMd. Adil Hossain100% (4)

- D BC01034 (1) Article 3Document12 pagesD BC01034 (1) Article 3JIA WENNo ratings yet

- Riverscape Fact SheetDocument5 pagesRiverscape Fact SheetSharmaine FalcisNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- PaperDocument4 pagesPaperamirNo ratings yet

- 6-Correction of ErrorsDocument8 pages6-Correction of Errorszohaib anwarNo ratings yet

- 8 Rectification of Error 08-2022 RegularDocument5 pages8 Rectification of Error 08-2022 RegularVasanta ParateNo ratings yet

- Ch-2, Unit-6, Rectification of ErrorDocument6 pagesCh-2, Unit-6, Rectification of ErrorAFTAB KHANNo ratings yet

- Unit 20Document20 pagesUnit 20Valorant SmurfNo ratings yet

- Rectification of ErrorsDocument7 pagesRectification of Errorskshitijraja18No ratings yet

- FA Question Bank TT1-1Document14 pagesFA Question Bank TT1-1rock SINGHALNo ratings yet

- FINANCIAL ACCOUNITNG B.com-I Rizwan AnjumDocument2 pagesFINANCIAL ACCOUNITNG B.com-I Rizwan AnjumsajidNo ratings yet

- 2 JournalDocument18 pages2 JournalPraveen Yadav100% (1)

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- Correction of ErrorsDocument5 pagesCorrection of Errorsmuhammad arifNo ratings yet

- Basic Account 1Document10 pagesBasic Account 1COMPUTER WORLDNo ratings yet

- What Are The 3 Types of Accounts in Accounting?: What Is An Account?Document8 pagesWhat Are The 3 Types of Accounts in Accounting?: What Is An Account?ShubhamNo ratings yet

- A1757587756 - 23892 - 20 - 2019 - Rectification of ErrorsDocument27 pagesA1757587756 - 23892 - 20 - 2019 - Rectification of ErrorsGaurav AnandNo ratings yet

- Value Based Questions Accountancy XIth PDFDocument5 pagesValue Based Questions Accountancy XIth PDFcerlaNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- What Are The Golden Rules For AccountingDocument28 pagesWhat Are The Golden Rules For AccountingWong KianTatNo ratings yet

- Journal Ledger & Trial BalanceDocument11 pagesJournal Ledger & Trial BalanceTushar SahuNo ratings yet

- Errors Suspense AccountDocument21 pagesErrors Suspense AccountShayan KhanNo ratings yet

- Lesson 1 - Introduction To LedgerDocument18 pagesLesson 1 - Introduction To LedgerNikhita MehraNo ratings yet

- ProjectDocument4 pagesProjectSwati DubeyNo ratings yet

- Rectification of Error1Document4 pagesRectification of Error1Typical GamerNo ratings yet

- Module - 7 Problems On Rectification of ErrorsDocument2 pagesModule - 7 Problems On Rectification of ErrorsYash PratapNo ratings yet

- Journal Entries The Rules of Double Entries Purchase Sale Transactions Accounting AccountDocument8 pagesJournal Entries The Rules of Double Entries Purchase Sale Transactions Accounting AccountirishjadeNo ratings yet

- Journal PostingDocument22 pagesJournal PostingPoonam JadhavNo ratings yet

- Journal Entries Example PDFDocument6 pagesJournal Entries Example PDFshlokshah2006No ratings yet

- Class 11 AccoutancyDocument5 pagesClass 11 AccoutancyRavikumar BalasubramanianNo ratings yet

- Executive Post Graduate Diploma in Management Subject: Management Accounting & Analysis Question PaperDocument4 pagesExecutive Post Graduate Diploma in Management Subject: Management Accounting & Analysis Question PaperUpasana vNo ratings yet

- Rectification of ErrorsDocument4 pagesRectification of ErrorsRoshini ANo ratings yet

- Basic Journal Entry's2Document8 pagesBasic Journal Entry's2Venkatesh Babu100% (2)

- Class 11th Final TestDocument7 pagesClass 11th Final TestmenekyakiaNo ratings yet

- Class Exercises - Accounting Errors - AnswersDocument4 pagesClass Exercises - Accounting Errors - Answerseshakaur100% (2)

- Test Papers AccountsDocument16 pagesTest Papers Accountsmamta.bdvrrmaNo ratings yet

- Assignment Rectification of ErrorsDocument1 pageAssignment Rectification of ErrorsNida FatimaNo ratings yet

- Journal Entries of Accrued ExpensesDocument11 pagesJournal Entries of Accrued ExpensesAnonymous c8ocmuJNo ratings yet

- T Account PostingDocument2 pagesT Account PostingWaqar Aamir KatiarNo ratings yet

- MAA Assignment RKDocument9 pagesMAA Assignment RKKrishna RayasamNo ratings yet

- Delhi Pubic School, Nacharam Accountancy - Xi Question BankDocument9 pagesDelhi Pubic School, Nacharam Accountancy - Xi Question BanklasyaNo ratings yet

- Question Bank BKDocument8 pagesQuestion Bank BKVivek JaiswarNo ratings yet

- Rectification of ErrorsDocument17 pagesRectification of ErrorsPraveen HaridasNo ratings yet

- Chapter - 05 Rectification of ErrorsDocument5 pagesChapter - 05 Rectification of ErrorsPayal SinghNo ratings yet

- Financial and Management Accounting MB0025Document27 pagesFinancial and Management Accounting MB0025manuunamNo ratings yet

- Worksheet RoeDocument2 pagesWorksheet RoeJaijeet SinghNo ratings yet

- Acc - Chapter 15 AmroDocument12 pagesAcc - Chapter 15 AmroWassim AlwanNo ratings yet

- Sample PaperDocument5 pagesSample PaperPriyanshi KarNo ratings yet

- Journal Entries ExamplesDocument9 pagesJournal Entries Examplesmoon_mohi50% (2)

- TS Grewal Solutions For Class 11 Accountancy Chapter 13 - Rectification of ErrorsDocument57 pagesTS Grewal Solutions For Class 11 Accountancy Chapter 13 - Rectification of ErrorsDhruv ThakkarNo ratings yet

- 11th AccountDocument6 pages11th Accountumesh chandraNo ratings yet

- Acc Xi Class Test-I 2022Document4 pagesAcc Xi Class Test-I 2022shaurya kapoorNo ratings yet

- Test 1 Rectification and Subsidiary Books 21.05.2019Document2 pagesTest 1 Rectification and Subsidiary Books 21.05.2019bhumikaaNo ratings yet

- Account Past Questions Compilation (2009june - 2022 June)Document319 pagesAccount Past Questions Compilation (2009june - 2022 June)Arjun AdhikariNo ratings yet

- Basics & Journal Entry of AccountancyDocument45 pagesBasics & Journal Entry of AccountancyPrincipal MHK, AnklleshwarNo ratings yet

- Accounts AnswersDocument12 pagesAccounts AnswersRafiya95z MynirNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 1 PDFDocument13 pages11 Sample Papers Accountancy 2020 English Medium Set 1 PDFpriyaNo ratings yet

- Cbse Class 11 Accountancy Sample Paper Set 1 QuestionsDocument6 pagesCbse Class 11 Accountancy Sample Paper Set 1 QuestionsNishtha 3153No ratings yet

- Kendriya Vidyalaya Sangathan, Mumbai Region Term-II Examination 2021-22 Accountancy (055) Set-Iii XIDocument5 pagesKendriya Vidyalaya Sangathan, Mumbai Region Term-II Examination 2021-22 Accountancy (055) Set-Iii XIIRSHAD HUSSAINNo ratings yet

- Particulars: Rs. RsDocument7 pagesParticulars: Rs. RsAnmol ChawlaNo ratings yet

- AssignmentDocument8 pagesAssignmentSameer SawantNo ratings yet

- Ra 10587Document14 pagesRa 10587Cesar ValeraNo ratings yet

- Certification of IlliteracyDocument1 pageCertification of IlliteracyMeg Bantolo100% (1)

- Con Law II Mentor OutlineDocument10 pagesCon Law II Mentor OutlineLALANo ratings yet

- MEANING & Definition of LawDocument8 pagesMEANING & Definition of LawharshitaNo ratings yet

- Pe BulleDocument16 pagesPe BulleDaniel CordovaNo ratings yet

- Criminal Complaint Against Clint FreebergDocument3 pagesCriminal Complaint Against Clint FreebergFOX 11 NewsNo ratings yet

- Share Purchase Option Contract ModelDocument4 pagesShare Purchase Option Contract ModelScribdTranslationsNo ratings yet

- Evening Street Review Number 24, Summer 2020Document170 pagesEvening Street Review Number 24, Summer 2020Barbara BergmannNo ratings yet

- FAL 2-Circ 50-Rev 3Document2 pagesFAL 2-Circ 50-Rev 3GiveawayNo ratings yet

- This CMO Is The Implementation of Cargo Targeting System in Philippine CustomsDocument3 pagesThis CMO Is The Implementation of Cargo Targeting System in Philippine CustomsCDEC Here to ServeNo ratings yet

- SP Festin PDFDocument33 pagesSP Festin PDFTrisha Ace Betita ElisesNo ratings yet

- Constitution and By-Laws: Section 1Document7 pagesConstitution and By-Laws: Section 1Jerhine May DaquioNo ratings yet

- Advert For The Provision of Garbage Collection and Cleaning Services Within Kericho CountyDocument2 pagesAdvert For The Provision of Garbage Collection and Cleaning Services Within Kericho CountyADMIN SSA HOLDINGS CO.No ratings yet

- Chapter: Billion-Dollar - Charlie SummaryDocument2 pagesChapter: Billion-Dollar - Charlie SummaryRgenieDictadoNo ratings yet

- APUNTES DerechoDocument41 pagesAPUNTES DerechoVerónica Rueda PuyanaNo ratings yet

- Telekomunikasi Indonesia Annual Report 2013 Laporan Tahunan TLKM Company Profile Indonesia InvestmentsDocument423 pagesTelekomunikasi Indonesia Annual Report 2013 Laporan Tahunan TLKM Company Profile Indonesia InvestmentshijrahNo ratings yet

- Reserva TroncalDocument1 pageReserva TroncalMikee TeamoNo ratings yet

- 9 SMI-ED Philippine Technology, Inc. vs. Commissioner of Internal RevenueDocument16 pages9 SMI-ED Philippine Technology, Inc. vs. Commissioner of Internal RevenueAriel Conrad MalimasNo ratings yet

- Illustrative Branch Audit Report FormatDocument5 pagesIllustrative Branch Audit Report FormatCA K Vijay SrinivasNo ratings yet

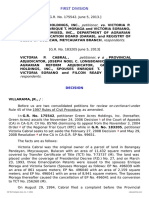

- Green Acres Holdings, Inc. v. CabralDocument16 pagesGreen Acres Holdings, Inc. v. CabralMark Anthony ViejaNo ratings yet

- Silence! The Court Is in Session by Vijay TendulkarDocument4 pagesSilence! The Court Is in Session by Vijay Tendulkarrumi royNo ratings yet

- Status AffidavitDocument4 pagesStatus AffidavitJaz CiceroSantana Boyce100% (1)

- BaliDocument391 pagesBaliAri cNo ratings yet

- Ave Verum Corpus MozartDocument3 pagesAve Verum Corpus MozartAbner Lira100% (2)

- Offences Affecting The Human Body - Section 302, 303, 304, 304A, 304B, 305, 306, 307, 308, 309, 311, 312, 313, 314, 315, 316, 317, 318 of Indian Penal CodeDocument4 pagesOffences Affecting The Human Body - Section 302, 303, 304, 304A, 304B, 305, 306, 307, 308, 309, 311, 312, 313, 314, 315, 316, 317, 318 of Indian Penal CodebijuprasadNo ratings yet

- 3 Brgy. Reso - TripartiteDocument2 pages3 Brgy. Reso - TripartiteBarangay TaguiticNo ratings yet

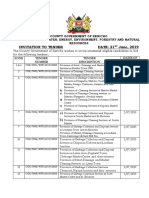

- Final Result of LAT Test Held On 21st July, 2019Document3 pagesFinal Result of LAT Test Held On 21st July, 2019ChudduNo ratings yet