Professional Documents

Culture Documents

Tax - Notes - Inclusions and Exclusions

Uploaded by

Camille Danielle Barbado0 ratings0% found this document useful (0 votes)

14 views11 pagesThis document discusses inclusions and exclusions from gross income under the Tax Code of the Philippines. It defines gross income as all income from any source, including compensation for services. Compensation income includes salaries, wages, bonuses, allowances, fringe benefits, commissions, and other remuneration from an employer-employee relationship. It is taxable unless specifically exempt. The document outlines what constitutes an employee, employer-employee relationship, and regular versus supplemental compensation. It also discusses taxation of retirement pay, professional fees, commissions, and allowances.

Original Description:

tax

Original Title

Tax_Notes- Inclusions and Exclusions

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses inclusions and exclusions from gross income under the Tax Code of the Philippines. It defines gross income as all income from any source, including compensation for services. Compensation income includes salaries, wages, bonuses, allowances, fringe benefits, commissions, and other remuneration from an employer-employee relationship. It is taxable unless specifically exempt. The document outlines what constitutes an employee, employer-employee relationship, and regular versus supplemental compensation. It also discusses taxation of retirement pay, professional fees, commissions, and allowances.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views11 pagesTax - Notes - Inclusions and Exclusions

Uploaded by

Camille Danielle BarbadoThis document discusses inclusions and exclusions from gross income under the Tax Code of the Philippines. It defines gross income as all income from any source, including compensation for services. Compensation income includes salaries, wages, bonuses, allowances, fringe benefits, commissions, and other remuneration from an employer-employee relationship. It is taxable unless specifically exempt. The document outlines what constitutes an employee, employer-employee relationship, and regular versus supplemental compensation. It also discusses taxation of retirement pay, professional fees, commissions, and allowances.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 11

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

Gross income (inclusions) – Section 32 (A) performed by an employee

of the Tax Code for his employer whether paid

in cash or in kind.

All income derived from whatever

Includes:

source (whether coming from legal

Salaries and wages

or illegal source), including but not

Emoluments (salary,

limited to: (not all inclusive) fee, or profit from

o Compensation services (in employment or office)

whatever form paid) Honoraria

Fees Taxable bonuses

Salaries Allowances

Wages Transportation

Commissions

Representatio

o Gross income derived from

n

the conduct of trade or

Entertainment

business/ exercise of

Fringe benefits fees

profession (business income)

Director fees if

o Gains derived from dealings

the director is

in property

at the same

o Interest

time an

o Rents employee of

o Royalties the employer

o Dividends Taxable pensions and

o Annuities retirement pay

o Prizes and winnings Commission

o Pensions Compensation for

o Partner’s distributive share services on the basis

from the net income of the of a percentage of

general professional profits

partnerships Commissions on

Shall include all types of income not insurance premiums

specifically enumerated under Sec Tips

32 (A) of the Tax Code and are not Marriage fees

exempt or excluded from income Baptismal offerings

taxation Sums paid for saying

o Income derived by masses for the dead

youtubers, vloggers, and Other contributions

online sellers. received by a

clergyman,

evangelists or

religious worker for

COMPENSATION INCOME

services rendered.

Income arising out of

May be paid on the basis of piece-

employer-employee

work (percentage of profits) because

relationship.

the basis upon which the

Rules on compensation

remuneration is paid is immaterial in

income are applicable only

determining whether the

to individual tax payers,

remuneration constitutes

except nonresident alien

compensation.

not engage in trade or

May be paid in money or in some

business.

medium other than money:

Corporations, estate, and

o Stocks

trusts are not covered by the

rules on compensation due to o Bonds

lack of employer-employee o Other forms of property

relationship. If compensation is paid in cash, full

Encompassed all amount received is the measure of

remuneration for services compensation income.

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

If services are paid in medium other representation, transportation and

than money, the fair market value of others paid to an employee per

the thing taken in payment is the payroll period.

amount of compensation. Supplemental compensation –

If compensation is paid in kind includes payments to an employee

(stocks of the employer), the fair in addition to the regular

market value of the stock at the time compensation:

the services were rendered is the o Overtime pay

measure of compensation. o Fees (including director’s

Income tax of the employee fees)

assumed or paid by the employer in o Commission

consideration of the latter’s services o Profit sharing

is considered compensation income o Monetized vacation and sick

of the latter. leave

o Fringe benefits received by

rank-and-file employees

Employee – (defined by RR 2-98) o Hazard pay

Individual performing services under o Taxable 13th month pay and

an employer-employee relationship. other benefits

No distinction is made between o Other remunerations

classes or grades of employees. received from an employee-

Superintendents, managers, and employer relationship, with or

officers are considered as without regard to payroll

employees. period.

Employer-employee relationship Compensation income received after

termination of employee-employer

Exists when the person for whom relationship

the services were performed has the

right to control and direct the The related compensation income

individual who performs the was earned at the time the

services, not only as to the result employer-employee relationship was

accomplished, but also as to details not yet terminated.

and means by which such results Income was derived out of an

are accomplished. employer-employee relationship

Ex. Separation pay

Professional fees – income derived from

sale of services

Not arising from employer-employee FRINGE BENEFITS AND 13TH MONTH

relationship PAY

Any goods, service or other benefit

furnished or granted by an employer

Payment of commission as remuneration for in cash or in kind, in addition to basic

services rendered/products sold salaries, to individual employees

Common way to reward sales Fringe benefits subject to fringe

personnel. benefit tax cover only those fringe

Should be viewed as income arising benefits given or furnished to a

from employer-employee managerial or supervisory

relationship. employee.

Fringe benefits furnished to rank and

Retirement pay – unless exempt, taxable file employees are subject to basic

compensation income. tax and consequently to withholding

tax on compensation in accordance

CLASSIFICATION OF COMPENSATION

with RR 2-98.

INCOME:

FIXED OR VARIABLE ALLOWANCES

Regular compensation – includes

basic salary, fixed allowances for

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

Received by a public officer or indirectly is the beneficiary under the

employee or officer or employee of a policy.

private entity, in addition to the

DEDUCTIBLE EXPENSE OF THE

regular compensation, foxed for his

EMPLOYER

position or office, is compensation

subject to income tax and Any amount given by the employer

consequently, creditable withholding as benefits to its employees whether

tax on compensation income. classified as de mimis benefits or

Ex. Transportation allowance, fringe benefits shall constitute as

representation allowance, deductible expense upon such

communication allowance, living employer.

away from home allowance

(LAFHA). TIPS AND GRATITUIES – paid directly to

an employee by a customer of the employer

ADVANCES AND REIMBURSEMENTS that are not accounted for by the employee

FOR TRAVELLING AND to the employer are considered as taxable

ENTERTAINMENT EXPENSES income subject to basic tax

Reasonable amounts of The same shall be subject to

reimbursements/advances for withholding if accounted for by the

travelling and entertainment employee to the employer (included

expenses which are pre-computed in the bill paid by the customers)

on a daily basis and are paid to an

employee while he is on assignment VACATION AND SICK LEAVE

or duty need not be subject to the ALLOWANCES

requirement of substantiation and to Amounts of “vacation allowances or

withholding. sick leave credits” which are paid to

Any amount paid specifically, either an employee treated as

as advances or reimbursements for compensation income.

travelling, representation and other Salary of an employee on vacation

bona fide ordinary and necessary or on sick leave, which are paid

expenses incurred or reasonably notwithstanding his absence from

expected to be incurred by the work, constitutes compensation.

employee in the performance of his Monetized value of unutilized

duties are not compensation subject vacation leave credits of 10 days or

to withholding: less which were paid to the

o It is for ordinary and employee during the year, being de

necessary travelling and minimis benefits, are not subject to

representation or income tax and to withholding tax.

entertainment expenses paid

or incurred by the employee REPRESENTATION AND

in the pursuit of the trade, TRANSPORTATION ALLOWANCES

business or profession; (RATA)

o Employee is required to

Granted under sec 34 of the general

account/ liquidate for the appropriations act to certain officials

foregoing expenses in and employees of the government

accordance with the specific are considered reimbursements for

requirements of the expenses incurred in the

substantiation for each performance one’s duties rather than

category of expenses as additional compensation.

pursuant to Sec. 34 of the Excess of RATA, if not returned to

Tax Code. the employer, constitutes taxable

PREMIUMS ON LIFE INSURANCE compensation income of the

employee.

Covering the life on an employee

paid by the employee is taxable STIPENDS OF RESIDENT PHYSICIANS

income to the employee, where the Received during their intensive

insured employee, directly or training in the residency program of

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

a hospital are subject to creditable personal and additional

withholding tax (CWT) exemptions over

o Shall include not only fees, compensation income).

but also per diems,

In the case of manufacturing,

allowances, and any other

merchandising, or mining business, gross

form of income payments not

income

subject to withholding tax on

compensation. Sales, less cost of goods sold plus

any income from investments and

COST OF LIVING ALLOWANCE (COLA)

from incidental or outside operations

Of minimum wage earners is exempt or sources.

from income tax.

Forms part of the new wage rates or

statutory minimum wage BAD DEBT RECOVERY

Covered by the income tax

exemption of MWEs under RA 9504, Subsequent recovery of bad debt

as implemented by Revenue previously written off in the books is

Regulations No. 10-08 a taxable income provided that write-

o Covers the statutory off of the account resulted to a lower

minimum wage (inclusive of taxable income at the time of write-

COLA under NCR Wage off – Tax Benefit Rule

Order No. NCR-16) – o The taxpayer is obliged to

including holiday pay, declare as taxable income its

overtime pay, night shift subsequent recovery of bad

differential pay and hazard debts in the year they were

pay. collected to the extent of the

tax benefit enjoyed by the

INCOME OR GAIN FROM THE EXERCISE taxpayer when the bad debts

OF STOCK PLANS were written-off and claimed

as deduction from income.

BIR ruled under BIR ruling 119-2012

o If the taxpayer realized a

dated Feb. 22, 2012 that any income

reduction of the income tax

or gain derived by an employee from

due him on account of a

the exercise of stock option is

deduction for bad debts, his

considered as additional

subsequent recovery of the

compensation subject to income tax

same from the debtor shall

and to withholding tax on

be treated as a receipt of

compensation (WTC).

taxable income.

If the taxpayer did not benefit from

the deduction of the said bad debt

BUSINESS INCOME

written off; it did not result t any

Gross income derived from

reduction of his income tax in the

the conduct of trade or

year of such deduction, the

business or the exercise of

subsequent recovery shall not be

profession.

treated as receipt of realizes taxable

They may arise from the sale

income but a mere recovery or

of products or services.

return of capital which is not taxable.

Fees received by a

professional person TAX REFUND

Rents received by a

Tax benefit rule also applies with

person in the real

respect to refund or credit for taxes.

estate business

Taxable if the tax, when paid, was

Taxed at progressive rates

deducted from gross income (local

on net business income

taxes and fringe benefit tax).

(income from the practice of

Shall be reported as income in the

a profession; net income after

year it was received, if the

deduction of certain specified

expenses and any excess of

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

accounting method employed by the A transaction whereby nothing of

taxpayer is the cash method. exchangeable value comes to or is

o If the accounting method received by a taxpayer does not give

used is the accrual basis, the rise to or create taxable income

tax refund must be reported Gain or profit is essential to the

in the year the refund was existence of taxable income.

ordered. The condonation of indebtedness

Taxes which were not previously must result in the debtor acquiring

allowed as deductions from the something of exchangeable value in

gross income should not form part addition to what he has before.

of taxable income when refunded. While there was a reduction or

Tax refunds that are not taxable extinguishment of liabilities, there

o Income tax (except fringe was no corresponding increase in

benefit tax) assets.

o Estate tax The debt condonation did not have

o Donor’s tax the effect of making the subsidiary’s

o Special assessment assets greater that they were before.

o Stock transaction tax Not subject to income tax nor

donor’s tax

o Income tax paid to a foreign

country if the taxpayer Court Approved Debt Restructuring

claimed a credit for such tax

in the year it was paid. Gain resulting from condonation of a

company’s debts to its various

CANCELLATION OR CONDONATION OF creditors pursuant to a court-

DEBTS approved debt restructuring is not

subject to income tax

Income can come in many forms,

Will not be subject to donor’s tax

including the cancellation or

since the condonation was not

condonation of debts.

implemented with a donative intent

but only for business consideration.

The restructuring was not a result of

Subject to basic income tax the mutual agreement of the debtors

If services were rendered by and creditors. – through court action.

the debtor, in consideration of

which the indebtedness was

cancelled by the creditor.

GAINS RECEIVED FROM

Taxable income ni debtor

DEALINGS IN PROPERTY

Subject to donor’s tax

Sale, barter, exchange

If the creditor, without

Includes all income derived

receiving any consideration

from the disposition of

from the debtor and purely

property (real or personal, for

as an act of liberality,

sale or in exchange of other

cancels the indebtedness.

property, or both) which

Subject to 10% final tax

results in gain or loss.

If the debtor is a shareholder

The gain from the transaction

of a corporation that cancels

shall be taxable gain

the indebtedness, such

Loss shall be deductible if

cancellation constitutes

incurred in trade, profession,

indirect dividend.

or business.

Property Sold Type of Applicable

Before the condonation or forgiveness of Gain tax

indebtedness will give rise to taxable Ordinary asset Ordinary Basic tax

income, there must be an increase in the (graduated

assets of the debtor thereby enriching the rate –

latter. individuals)

(Regular

corporate

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

income tax income subject to 20% final

rate – withholding tax.

corporate Interest income derived from

tax payers investments in government

Capital asset securities are also subject to

Shares of Capital Capital 20% final tax

stock gains tax

(domestic Interest income Applicable tax

corporation Arising from Basic tax

not listed indebtedness (graduated rate for

in the local individuals and

stock regular corporate

exchange) income tax for

Real Capital Capital corporate

property in gain gains tax taxpayers)

the Ph Arising from: bank

Other Capital Basic tax deposits

types of gain Bank deposit, 20%;25% FWT

capital deposit

assets substitute,

trust fund,

mutual fund

Gains arising from expropriation of and other

properties or other dispositions of properties similar

to the government of real properties are arrangements

taxable. Deposit under 15%

FCDU

Includes taking by the government

Long term Exempt for

through condemnation proceedings. bank deposit individual taxpayers

The transfer of property through or investment other than

condemnation proceedings, and the NRANET

payment of just compensation is a

sale or exchange and profit from the

transaction constitutes capital gain.

RENTAL INCOME

Rent paid by the lessee for

INTEREST INCOME the use or lease of property is

Generally, taxable unless taxable income to the lessor.

exempted by law, whether or Section 32 (A)(5)

not usurious. Amount paid for

Should only refer to such the use or

interest as arising from enjoyment of a

indebtedness (whether thing (real or

business or non-business, personal) or right.

legal or illegal); compensation May be in the form of:

for the loan or forbearance of Cash, at stipulated

money, goods, credits. prize

Ex. Interest derived from Obligations of the

lending money, goods, or lessor to 3rd persons

credits from one person to paid or assumed by

another or interest earned in the lessee in

the normal conduct of trade or consideration of the

business are subject to basic contract of lease such

tax. as real property taxes

Interest income on deposits assumed by the

made in banking institutions as lessee on the

well as interest income in property being

deposit substitutes are passive leased, insurance or

other fixed charges.

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

Such same were made pursuant to an

payments agreement with the lessor and the

shall be building erected or improvements

considered made are not subject to removal by

rental the lessee.

payments to The lessor does not realize taxable

be reported by gain from leasehold improvements

the lessor as turned over by the lessee at the end

part of its of the lease where leasehold

taxable improvements are considered fully

income. depreciated and where the condition

Advance payment of said property is such that

Prepaid rent – necessary renovations and

shall be extraordinary repairs have to be

reported as undertaken to restore the same to

income in full useful condition.

in the year of The lessee may claim depreciation

receipt, of the improvements as deduction

regardless of from the lessee’s gross income over

the accounting the remaining term of the lease or

method used the life of the improvements,

by the lessor. whichever is shorter.

Security The lessor may at his option report income:

deposit that is

applied to Outright method (lump-sum method)

rental is a o Report as income the fair

taxable market value of such

income of the buildings or improvements

lessor. o FMV upon completion of the

o NON-TAXABLE RENT – not improvement

considered as income on the Spread-out/annual method

part of the lessor. o Spread over the life of the

Advance rentals lease the estimated

representing option depreciated value (book

money for the value) of such buildings or

property improvements at the

Security deposits to termination of the lease and

insure faithful report as income for each

performance of year the lease an aliquot part

certain obligations of thereof.

the lessee o Annual income =

When a person borrows money from Book value , end of leaseterm

another, the amount borrowed is not Remaining term of the lease

income, as the same is neither profit nor o Cost of leasehold

gain. improvements

Less: accumulated

True in cases of deposits given by a depreciation

lessee to the lessor as security. Book value, end of lease

Divided by the remaining

term of the lease

LEASEHOLD IMPROVEMENT Annual income

Improvement made to a leased

asset.

Building erected or improvements PRETERMINATION OF LEASE

made by the lessee on the leased If for any reason other than a bona

premises are taxable only if the fide purchase from the lessee by the

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

lessor, the lease is terminated, the individual taxpayers other

lessor realized additional income for than NRA-NETBs.

the year to the extent that the value Subject to 20% final tax

of such improvement exceeds the Royalties derived within the

amount already reported as income PH other than royalties

on account of such improvement. subject to 10% final tax.

Computation for the additional Subject to basic tax

income – pre-termination Royalties generated in the

active pursuit and

FMV upon termination

performance of the

Less: income already corporation’s primary

recognized/reported purpose

Royalties derived by resident

Income, year of pre- citizens and domestic

termination corporations from sources

ROYALTY INCOME – share of the without the PH.

earnings as from invention, book or

play, paid to the inventor, writer, etc.

for the right to make, use, or publish DIVIDEND INCOME

the same. Payments made by a

In nature are passive corporation to its stockholder

income, subject to final members.

withholding tax. Portion of corporate profits

If the royalty was generated paid out to stockholders,

in the active pursuit and direct or indirect.

performance of the May be subject to basic tax,

corporation’s primary final tax or exempt from tax.

purpose, the same is not

Direct dividend – the paying corporation

passive income but

acknowledges the distribution of dividend

considered ordinary

through a resolution of the Board of

business income subject to

Directors declaring such distribution as

basic tax.

distribution of dividend.

Income derived or

generated from activities Subject to tax

that are in accordance with

Indirect dividend – distribution of profits

the purposes provided in its

disguised as payment of services,

articles of incorporation of

properties, etc.

the company are in the

nature of ordinary business Subject to tax

income. Ex.

o Payment of property

Payment constitutes compensation for

personal services – the payee has no purchased from shareholders

propriety interest in the property that gave in excess of its fair values

rise to the income. o Payment to shareholders for

services rendered in excess

of the fair value of such

services.

Payment constitutes royalty income – payee

o Cancellation by a corporation

has propriety interest.

of indebtedness of a

shareholder.

TAX TREATMENT ON ROYALTY INCOME TAX TREATMENT OF DIVIDEND INCOME

Subject to 10% final tax Subject to basic tax

Royalties on books, other Dividends from foreign

literary works and musical corporations

compositions from sources

within the PH received by

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

Share in the net income of a another corporation, such as

general professional subsidiary corporation

partnership Also known as dividends in

Subject to final tax kind.

Cash/property dividends Subject to tax

actually or constructively Liquidating dividends

received by individuals from Generally, is not a dividend

domestic corporation or from income.

a joint stock company, When the company distribute

insurance or mutual fund all of its assets in complete

company and regional liquidation or dissolution, the

operating headquarters of gain realized or loss

multinationals. sustained by the shareholder,

Inter-corporate dividends whether individual or

received from domestic corporation, is a taxable

corporation by non-resident income or deductible loss of

foreign corporations. the latter.

Share of an individual in the Characterized as gain from

distributable net income after sale or exchange of shares

tax of a partnership (other subject to ordinary income

than gpp) of which he is a tax.

partner. Gain is measured by the

Share of an individual in the difference between the fair

net income (after tax) of an market value of the assets

association, joint account, or received and the adjusted

a joint venture or consortium cost to the shareholders of

taxable as corporation for their respective shares.

which he is a member or co- In determining the FMV of

venturer. patents and trademarks

Exempt from tax (brands), the average of the

Inter-corporate dividends low and high values of the

received from domestic valuation of an independent

corporation by other domestic professional firm may be

corporations and resident used as a basis.

foreign corporations.

Situs of Dividend

From DC = income within Stock dividends

From FC = within or without Reflects the corporation

transferring an amount from

“surplus” (retained earnings) to

TYPES OF DIVIDENDS “capital stock” or paid-up

capital.

Cash dividends

Paid out in the form of

Dividends paid out in

additional shares of the issuing

currency.

corporation, usually issued in

Usually taxable to the

proportion to shares owned.

recipient in the year they are

An increase in the value of

paid.

capital investment is not

Most common method of

income.

sharing corporate profits with

Exempt from income tax

the shareholders of the

Taxable if it gives the

company.

shareholder an interest

Subject to tax

different from that which his

Property of dividends

former stock represented.

Dividends paid out in the

Ex. The corporation

form of noncash asset from

gave shareholders

the issuing corporation or

the option to received

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

either cash or scientific, educational,

property dividend artistic, literary or civic

instead of stock achievement provided the

dividend. recipient was:

Selected without any

action on his/her part

ANNUITY INCOME to enter the contest or

Specified income payable at proceeding (not

stated intervals for a fixed or constituting gains

a contingent period, often for from labor)

the recipient’s life, in Not required to render

consideration of a stipulated substantial future

premium paid either in prior services as a

installment payments or in a condition to receive

single payment. the prize/award.

The amount received o All prizes and awards

representing return of granted to athletes in local

premium is considered return and international sports

of capital, hence, should be competitions and

excluded in the determination tournaments, whether held

of taxable income. in the PH or abroad and

The annuity received sanctioned by their

representing interest or respective national sports

amounts over the premiums association

paid are considered return on o PCSO/Lotto winnings not

capital; should form part of exceeding 10k received by

the recipient’s taxable individual taxpayers, except

income. NRA-NETB

Proceeds of life insurance Subject to basic tax

paid to the beneficiaries upon o Prizes and other winnings

death of the insured are not derived from resident citizens

taxable. and domestic corporations

from sources without the

PH.

PRIZES AND OTHER WINNINGS o Prizes and winnings received

by corporations, if any

Prize – award to be given to a person or a o Prizes received by individuals

group of people to recognize and reward

from sources within the PH

actions or achievements.

amounting to not more

Given to publicize noteworthy, or than 10k. (except NRA-

exemplary behavior, and to provide NETB)

incentives for improved outcomes Subject to 20% final tax

and competitive efforts. o Prizes received by individuals

Taxable unless exempt. (except NRA-NETB) from

sources within the PH

Winnings – for tax purposes, exceeding 10k.

rewards/income by virtue of chance or bets. o PCSO/Lotto winnings

Taxable unless exempt. exceeding 10k received by

individuals except NRA-

NETB

TAX TREATMENT OF PRIZES AND o Other winnings (other than

OTHER WINNINGS PCSO and Lotto winnings)

from sources within the PH

Exempt from tax regardless of amount.

o Prizes and award made Subject to 25% final tax

primarily in recognition of o Prizes and other winnings

religious, charitable, (including pcso and lotto

TAX – INCLUSIONS & EXCLUSIONS FROM THE GROSS INCOME

winnings) received by NRA- - Flow of wealth to the taxpayers

NETB which are not considered part of the

gross income for purposes of

computing the taxpayers’ taxable

PENSIONS income due to the ff:

- In general, are subject to o Exempted by the

income tax except pensions fundamental law /statute

and requirement benefits o Does not come within the

exempt under the law. definition of income

- Not taken into account in

determining gross income.

PARTNER’S SHARE IN THE NET

INCOME OF A GENERAL

PROFESSIONAL PARTNERSHIP Deductions – subtracted from the gross

(GPP) income.

- Section 26 of the Tax Code,

GPP is not subject to income

tax. Exemption from taxation

- Partners shall be liable for

income tax on their separate - Grant of immunity to particular

and individual capacities. persons

Each partner shall

report as gross

income, his or her

distributive share

(actual/constructive)

in the net income of

the GPP.

Partner’s share in the income of:

General partnership (GP)

o Treated as dividend income

of the partners

o Subject to applicable final

withholding tax on passive

income

o Not included in the

computation of taxable

income subject to basic tax

o Not included in the partner’s

income tax return.

General professional partnership

(GPP)

o Not treated as dividend

income

o Subject to basic tax

o Included in the ITR of the

taxpayer or in the

determination of the partner’s

taxable income.

EXCLUSIONS FROM GROSS INCOME

You might also like

- Birth Certificates Are Federal Bank NotesDocument6 pagesBirth Certificates Are Federal Bank Noteskaos100% (1)

- HR Block Income Tax Return Checklist Individuals 0620 FADocument1 pageHR Block Income Tax Return Checklist Individuals 0620 FAdeNo ratings yet

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- Partnerships: Save $ and Experience The DifferenceDocument2 pagesPartnerships: Save $ and Experience The DifferenceFinn KevinNo ratings yet

- Income Tax Payment Procedures in TanzaniaDocument3 pagesIncome Tax Payment Procedures in Tanzaniashadakilambo100% (1)

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- CIR v. DLSU DigestDocument2 pagesCIR v. DLSU DigestNinya Saquilabon60% (5)

- Overview Malaysian Construction IndustryDocument42 pagesOverview Malaysian Construction IndustryAhmad Mustanir Hadadak83% (12)

- GI Inclusions, Exclusions and DeductionsDocument16 pagesGI Inclusions, Exclusions and DeductionsBonDocEldRic100% (1)

- TX TSNDocument55 pagesTX TSN유니스No ratings yet

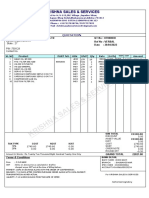

- InvoiceDocument1 pageInvoicesonu baliyanNo ratings yet

- ERC Regulation and Electricity Price Structure by Engr. Alvin Jones Ortega ERC PDFDocument28 pagesERC Regulation and Electricity Price Structure by Engr. Alvin Jones Ortega ERC PDFJoyNo ratings yet

- 2016 Bar Exam Suggested AnswersDocument17 pages2016 Bar Exam Suggested AnswersAnonymous WJT0oARK5No ratings yet

- Income Tax Inclusion From Gross IncomeDocument5 pagesIncome Tax Inclusion From Gross IncomeHeinie Joy PauleNo ratings yet

- Income Tax Inclusion From Gross IncomeDocument5 pagesIncome Tax Inclusion From Gross IncomeSharmaine Clemencio0No ratings yet

- Ange - Chapter 4 Reviewer TaxationDocument11 pagesAnge - Chapter 4 Reviewer Taxationdevy mar topiaNo ratings yet

- Ange - Chapter 4 Reviewer TaxationDocument11 pagesAnge - Chapter 4 Reviewer Taxationdevy mar topiaNo ratings yet

- Gross Income: Definition Means All Gains, Profits, and IncomeDocument19 pagesGross Income: Definition Means All Gains, Profits, and IncomeKathNo ratings yet

- 2019 Last Minute Lecture in TRAIN LawDocument8 pages2019 Last Minute Lecture in TRAIN LawAto BernardoNo ratings yet

- 5-Deductions From Gross IncomeDocument7 pages5-Deductions From Gross IncomeMs. ANo ratings yet

- Unit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesDocument36 pagesUnit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesVENKATESWARLUMCOMNo ratings yet

- Chapter 4 - ReviewerDocument11 pagesChapter 4 - Reviewerdevy mar topiaNo ratings yet

- Computation Income From SalaryDocument15 pagesComputation Income From SalaryIzma HussainNo ratings yet

- Computation Income From SalaryDocument14 pagesComputation Income From SalaryHajra MalikNo ratings yet

- Week 4-6Document12 pagesWeek 4-6Mariah ConcepcionNo ratings yet

- Recognition of Income From Business, Trade or Profession Is EitherDocument1 pageRecognition of Income From Business, Trade or Profession Is EitherYzah ParaynoNo ratings yet

- Module 2. Lesson 4. Inclusions To Gross IncomeDocument13 pagesModule 2. Lesson 4. Inclusions To Gross IncomeRaniel AnidoNo ratings yet

- Taxation of Residual Income: Cma K.R. RamprakashDocument25 pagesTaxation of Residual Income: Cma K.R. RamprakashShriya JoseincheckalNo ratings yet

- Pagatpat, Aischelle Mhae RDocument4 pagesPagatpat, Aischelle Mhae RElleNo ratings yet

- Ast TX 801 Items of Gross Income (Batch 22)Document5 pagesAst TX 801 Items of Gross Income (Batch 22)Elijah MontefalcoNo ratings yet

- Gross IncomeDocument5 pagesGross IncomeNavarro Cristine C.No ratings yet

- Salary and Its TaxationDocument12 pagesSalary and Its TaxationBasit BandayNo ratings yet

- 03 Concept+of+Income+ (Midterm)Document45 pages03 Concept+of+Income+ (Midterm)jeff herradaNo ratings yet

- Items and Concept of IncomeDocument48 pagesItems and Concept of Incomejeff herradaNo ratings yet

- Module 9 Inclusions and Exclusions From Gross IncomeDocument10 pagesModule 9 Inclusions and Exclusions From Gross IncomeKurt CyrilNo ratings yet

- Gros Income and It's CoverageDocument122 pagesGros Income and It's CoverageCenelyn PajarillaNo ratings yet

- Part 3 - Beda NotesDocument6 pagesPart 3 - Beda NotesNoelle SanidadNo ratings yet

- Taxes Fact Sheet 2Document6 pagesTaxes Fact Sheet 2Kevin PerrineNo ratings yet

- 2 Salary - Control Sheet - SirTariqTunio - ARTTDocument1 page2 Salary - Control Sheet - SirTariqTunio - ARTTZari MaviNo ratings yet

- TX - Employment IncomeDocument21 pagesTX - Employment IncomeSarad Kharel0% (1)

- Allowable Deductions (Sec.34) : Employer and Employee Relationship Only)Document3 pagesAllowable Deductions (Sec.34) : Employer and Employee Relationship Only)Arrianne ObiasNo ratings yet

- Chap 13 - Income From BusinessDocument14 pagesChap 13 - Income From BusinessMuhammad Saad UmarNo ratings yet

- Distribution of Dividends - Business - Guichet - Lu - Administrative Guide - LuxembourgDocument1 pageDistribution of Dividends - Business - Guichet - Lu - Administrative Guide - LuxembourgChristos FloridisNo ratings yet

- GROSS INCOME - InclusionDocument8 pagesGROSS INCOME - InclusionNessa Mae Leaño JamolinNo ratings yet

- Inclusion and Exclusion of Gross IncomeDocument70 pagesInclusion and Exclusion of Gross IncomeEnola HeitsgerNo ratings yet

- 1) What Is Income?: Frequently Asked QuestionsDocument1 page1) What Is Income?: Frequently Asked QuestionsDeopito BarrettNo ratings yet

- Taxable Income Gross Income - "All Income Derived FromDocument7 pagesTaxable Income Gross Income - "All Income Derived FromDan MichaelNo ratings yet

- Module 10 - Fringe Benefit TaxDocument27 pagesModule 10 - Fringe Benefit Taxairwaller rNo ratings yet

- Notes - Income From SalaryDocument13 pagesNotes - Income From SalarySajan N ThomasNo ratings yet

- HR Block Income Tax Return Checklist Individuals 0620 FADocument1 pageHR Block Income Tax Return Checklist Individuals 0620 FAAlNo ratings yet

- AUSTRALIAN TAXATION - Part 1Document1 pageAUSTRALIAN TAXATION - Part 1Vero EntertainmentNo ratings yet

- 04 Regular Income Taxation Exclusions and Inclusions To Gross IncomeDocument22 pages04 Regular Income Taxation Exclusions and Inclusions To Gross IncomeRuth MuldongNo ratings yet

- (Megafileupload) Tax Calculator 2009-2010Document8 pages(Megafileupload) Tax Calculator 2009-2010faslam1No ratings yet

- Regular Income Taxation Exclusions and Inclusions To Gross IncomeDocument22 pagesRegular Income Taxation Exclusions and Inclusions To Gross IncomeKatrina MaglaquiNo ratings yet

- CLWTAXN MODULE 5 Income Taxation of Individuals Notes v022023-1-1Document7 pagesCLWTAXN MODULE 5 Income Taxation of Individuals Notes v022023-1-1kdcngan162No ratings yet

- InTax - Items - of - Gross - Income TAMAYAO - GARCIA RESADocument5 pagesInTax - Items - of - Gross - Income TAMAYAO - GARCIA RESAAbby NavarroNo ratings yet

- Cash From Operations: Cash Flow Statement Notes and DescriptionsDocument2 pagesCash From Operations: Cash Flow Statement Notes and DescriptionsNahom AsamenewNo ratings yet

- FS2122-INCOMETAX-02: BSA 1202 Atty. F. R. SorianoDocument11 pagesFS2122-INCOMETAX-02: BSA 1202 Atty. F. R. SorianoKatring O.No ratings yet

- Income From SalariesDocument15 pagesIncome From SalariesAyesha MominNo ratings yet

- De La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesDocument4 pagesDe La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesJere Mae MarananNo ratings yet

- Inclusions & Exclusions From The Gross IncomeDocument55 pagesInclusions & Exclusions From The Gross IncomeAlthea Mae DelfinNo ratings yet

- Definition of SalaryDocument2 pagesDefinition of SalaryJaikishan FabyaniNo ratings yet

- Salary 2018 19Document36 pagesSalary 2018 19Mahaveer DhelariyaNo ratings yet

- SlaaDocument36 pagesSlaaGovind BharathwajNo ratings yet

- W6-Module Concept of Income-Part 1Document14 pagesW6-Module Concept of Income-Part 1Danica VetuzNo ratings yet

- Income Tax: Ca - Cma - Cs Inter / EPDocument55 pagesIncome Tax: Ca - Cma - Cs Inter / EPINDIRA GHOSHNo ratings yet

- GEC6 Handout 12 - Act - Barbado CDDocument2 pagesGEC6 Handout 12 - Act - Barbado CDCamille Danielle BarbadoNo ratings yet

- Camarines Norte State College: Republic of The PhilippinesDocument3 pagesCamarines Norte State College: Republic of The PhilippinesCamille Danielle BarbadoNo ratings yet

- STS - Handout 4Document6 pagesSTS - Handout 4Camille Danielle BarbadoNo ratings yet

- STS ReviewerDocument6 pagesSTS ReviewerCamille Danielle BarbadoNo ratings yet

- Does Technology Play A Role in Making People Feel More IsolatedDocument3 pagesDoes Technology Play A Role in Making People Feel More IsolatedCamille Danielle BarbadoNo ratings yet

- STS - LM1Document2 pagesSTS - LM1Camille Danielle BarbadoNo ratings yet

- Antikythera Mechanism: Akin To Clock in The Way That TheDocument4 pagesAntikythera Mechanism: Akin To Clock in The Way That TheCamille Danielle BarbadoNo ratings yet

- PE ReviewerDocument21 pagesPE ReviewerCamille Danielle BarbadoNo ratings yet

- Lesson 3.0magellan's Voyage Around The World: Camarines Norte State CollegeDocument5 pagesLesson 3.0magellan's Voyage Around The World: Camarines Norte State CollegeCamille Danielle BarbadoNo ratings yet

- Taxation Atty. Macmod, Cpa Partnership, Estates & Trusts: ST NDDocument1 pageTaxation Atty. Macmod, Cpa Partnership, Estates & Trusts: ST NDFaye Cecil Posadas CuramingNo ratings yet

- Sales - UDP-100-22-23 RachTR Chemicals PVT LTDDocument2 pagesSales - UDP-100-22-23 RachTR Chemicals PVT LTDRachTRNo ratings yet

- Seventy-Five Thousand Four Hundred Ninety-EightDocument1 pageSeventy-Five Thousand Four Hundred Ninety-Eightkhuram MehmoodNo ratings yet

- 19001914V1.0 Vol. 1Document532 pages19001914V1.0 Vol. 1JvlValenzuelaNo ratings yet

- PESTEL Analysis of BulgariaDocument27 pagesPESTEL Analysis of BulgariaVaishnavi GotmareNo ratings yet

- 7Document3 pages7Carlo ParasNo ratings yet

- Aguinaldo Industries Vs CIRDocument5 pagesAguinaldo Industries Vs CIRMonaVargasNo ratings yet

- Hotel BookingDocument2 pagesHotel BookingdevbnwNo ratings yet

- RV ICE S: Krishna Sales & ServicesDocument1 pageRV ICE S: Krishna Sales & ServicesSaikatNo ratings yet

- Airtel Bill Mar 24-3Document1 pageAirtel Bill Mar 24-3Suryakant AgrawalNo ratings yet

- Consolidated Invoice - Natixis Real Estate Capital LLC, A Delaware Limited Liability Company - Project TPG Warehouse FacilityDocument5 pagesConsolidated Invoice - Natixis Real Estate Capital LLC, A Delaware Limited Liability Company - Project TPG Warehouse FacilityrhenkeNo ratings yet

- Commerce 4Document49 pagesCommerce 4PAMAJANo ratings yet

- 1268049518moneysaver Shopping GuideDocument24 pages1268049518moneysaver Shopping GuideCoolerAdsNo ratings yet

- Sky at A GlanceDocument2 pagesSky at A GlanceMuhammad Abdul RahimNo ratings yet

- International Transfer Pricing - Case and QuestionsDocument4 pagesInternational Transfer Pricing - Case and Questionsharshnvicky123No ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document5 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNo ratings yet

- A Guide To International Estate Planning For Cross-Border FamiliesDocument20 pagesA Guide To International Estate Planning For Cross-Border FamiliesYaquifoxNo ratings yet

- Rmo 27-89 PDFDocument1 pageRmo 27-89 PDFPeter Joshua OrtegaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Hasibul Hassan ShantoNo ratings yet

- Economy DA - MSDI 2019Document99 pagesEconomy DA - MSDI 2019ConnorNo ratings yet

- Ra 4850Document8 pagesRa 4850HamidNo ratings yet

- Masagana Sk-App-2022Document54 pagesMasagana Sk-App-2022Mark Joseph San DiegoNo ratings yet

- Lesotho Tax System (w1)Document3 pagesLesotho Tax System (w1)Limpho Teddy PhateNo ratings yet