Professional Documents

Culture Documents

ART 0705 UseDerivatives

Uploaded by

khinthetzunOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ART 0705 UseDerivatives

Uploaded by

khinthetzunCopyright:

Available Formats

Use Derivatives to Reduce Risk and

Avoid the Accounting Headaches

Learn why embedded caps and floors

may be your best option.

by: Darnell R. Canada

Managing Director

Darling Consulting Group

For many years, banks have viewed interest rate derivatives as a

valuable means to effectively manage interest rate risk. More recently

however, an ever increasing number of banks have shied away from the

use of derivatives. The main reason: complicated, confusing and

expensive accounting costs associated with the application of Financial

Accounting Standards Board (FASB) Statement 133.

See Page 2 for complete article

Darling Consulting Group

978.463.0400

Page 1

For many years, banks have viewed interest rate derivatives as a valuable

means to effectively manage interest rate risk. More recently however, an ever

increasing number of banks have shied away from the use of derivatives. The main

reason: complicated, confusing and expensive accounting costs associated with the

application of Financial Accounting Standards Board (FASB) Statement 133.

Unfortunately, the reduced use of derivatives to manage risk is occurring at a

time when the complexities of managing a bank’s balance sheet are increasing.

Today’s environment of more educated customers; intense competitive pressures;

more volatile markets and the flat/inverted yield curve make the management of

interest rate risk more difficult.

To manage interest rate risk and avoid the complexities and costs of FASB

133, many bankers have begun using variable rate funding structures that have

embedded derivates. Examples of derivatives include interest rate caps, floors

and/or corridors. Currently, these funding structures are exempt from FASB 133

accounting rules because the derivatives are contractually “clearly and closely”

related to the rates paid on the borrowing.

In almost all cases, the variable rate index used on these borrowings will be 90

day LIBOR. The cost of the embedded derivative will be added to the funding rate

and will be quoted as LIBOR plus a spread that will reset/reprice every 90 days.

Examples of each structure and how they might be used to reduce interest rate risk

are discussed below.

Variable Rate Borrowings with Embedded Caps – This type of borrowing would be

tied to 90 day LIBOR and would be capped when LIBOR exceeds a

predetermined threshold. These borrowings are usually for two to five years and

are quoted at LIBOR plus a spread. For example, in today’s environment 90 day

LIBOR is 5.36%. A floating rate borrowing with a 5.36% embedded cap on

LIBOR will cost LIBOR (5.36%) plus 17 basis points (bps) for two years. If rates

rise from current levels, the rate on this borrowing will not exceed the current

rate (5.53%) for two years. If rates fall, the cost of this borrowing will fall with

LIBOR.

Banks might consider this funding structure if (1) their balance sheet is exposed

to both rising and falling rates or (2) if bank management does not think that

rates will rise further but can not afford the risk if they do.

Darling Consulting Group

978.463.0400

Page 2

Floating Rate Funding Interest Rate Cap Capped Funding

10.00 5.00 10.00

9.41

9.00 4.00 9.00

3.88

8.41

8.00 3.00 8.00

7.41 2.88

7.00 7.00

2.00 1.88

6.41

Funding Cost

6.00 6.00

Funding Cost

1.00

Cap Benefit

5.41 0.88 5.53 5.53 5.53 5.53 5.53

5.00 5.00

1.36 2.36 3.36 4.36 4.41 -0.12 -0.12 -0.120.00-0.12 -0.12 4.53

4.00 5.36 6.36 7.36 8.36 9.36 1.36 2.36 3.36 4.36

4.00 5.36 6.36 7.36 8.36 9.36

3.41 1.36 2.36 3.36 4.36 5.36 6.36 7.36 8.36 9.36 3.53

-1.00

3.00 3.00

2.41 -2.00 2.53

2.00 2.00

1.41 -3.00

1.53

1.00 1.00

0.00 -4.00 0.00

-1.00 -5.00 -1.00

90 Day LIBOR 90 Day LIBOR 90 Day LIBOR

Variable Rate Borrowings with Embedded Floors – This type of borrowing would also

be tied to 90-day LIBOR and would have an interest rate floor embedded in the

funding that would pay the borrower if LIBOR fell below a specified rate level.

The payment to the borrower would be recognized in the form of a lower interest

rate on the borrowing. For example, a three year variable rate borrowing with an

embedded floor at today’s 90-day LIBOR rate of 5.36% would cost LIBOR plus

51bps (5.87%). This means that if LIBOR goes below the current rate of 5.36%,

the borrower will immediately receive a payment on the floor equal to the

prevailing LIBOR rate less the 5.37% strike rate. NOTE: This payment would

be in addition to the benefit realized from having floating rate funding as rates

move lower.

If LIBOR were to increase by 2% (i.e. 200 basis points), the cost of this funding

would increase to 7.87%. However, if rates were to fall 200BP, the cost of this

borrowing would fall to 1.87% (the market change of -200BP plus a 200BP

payment on the embedded floor).

Banks that might consider using this funding structure will have exposure to a

falling interest rate environment.

Floating Rate Funding Interest Rate Floor Floored Funding

10.00 5.00 10.00 9.87

9.41

9.00 4.00 9.00 8.87

8.41

8.00 3.00 8.00 7.87

7.41

7.00 7.00 6.87

6.41 1.90 2.00

Funding Cost

Funding Cost

6.00 1.54 6.00 5.87

Cap Benefit

5.41 0.90 1.00

5.00 0.54 5.00

4.41 0.00

1.36 2.36 3.36 4.36

4.00 5.36 6.36 7.36 8.36 9.36 -0.46 -0.46 -0.46 -0.46 -0.46 1.36 2.36 3.36 4.36

4.003.875.36 6.36 7.36 8.36 9.36

3.41 1.36 2.36 3.36 4.36

-1.00 5.36 6.36 7.36 8.36 9.36

3.00 3.00

2.41 -2.00

2.00 1.872.00

1.41 -3.00

1.00 1.00

0.51 0.51

0.00 -4.00 0.00

-1.00 -5.00 -1.00

90 Day LIBOR 90 Day LIBOR 90 Day LIBOR

Darling Consulting Group

978.463.0400

Page 3

Variable Rate Funding with an Embedded Corridor – This type of borrowing would

also be indexed to 90-day LIBOR. Unlike the Variable Rate Funding with an

Embedded Cap (discussed above), this funding structure would only provide rate

protection while LIBOR is within a specific range. For example, a Bank might

use 2-year borrowings with a 5.36%/6.36% embedded corridor (i.e. the Bank gets

paid if LIBOR is between 5.36% and 6.36%. This structure would currently cost

90-day LIBOR (5.36%) plus 14BP or 5.50%.

If 90-day LIBOR were to increase by 100BP, then the cost of funding would

remain at 5.50% (6.50% less the 1.00% corridor benefit equals 5.50%).

If 90-day LIBOR were to increase by 200BP, this funding cost would increase to

6.50% (7.50% less the 1.00% corridor benefit equals 6.50%).

If rates were to fall 200BP, then the funding cost would drop to 3.50%.

This structure is often attractive to banks when the balance sheet is exposed to

rising rates but the bankers believe that rates are near their peak or are likely to

only move in a narrow range.

Floating Rate Funding Interest Rate Caps Capped Funding

10.00 5.00 10.00

9.00 4.00 9.00

8.41 8.50

8.00 8.00

3.00

7.41 7.50

7.00 7.00

2.00 6.50

6.41

Funding Cost

Funding Cost

6.00 6.00

Cap Benefit

1.00 0.91 0.91 0.91 0.91 5.50 5.50

5.41

5.00 5.00

-0.09 -0.09 -0.090.00-0.09 -0.09 4.50

2.41 3.41 4.414.41 5.41

4.00 6.41 7.41 8.41 1.36 2.36 3.36 4.36

4.00 5.36 6.36 7.36 8.36 9.36

1.36 2.36 3.36 4.36 5.36 6.36 7.36 8.36 9.36 3.50

3.41 -1.00

3.00 3.00

2.41 -2.00 2.50

2.00 2.00

1.50

1.00 -3.00 1.00

0.00 -4.00 0.00

-1.00 -5.00 -1.00

90 Day LIBOR 90 Day LIBOR 90 Day LIBOR

Conclusion

The need to protect net interest income - from either normal interest rate

cycles and/or disadvantageous customer behaviors is not likely to go away any time

soon. Unfortunately, hedging with the use of caps and floors has been made very

difficult and complex as a result of recent FASB pronouncements and auditor

scrutiny. The least risky and most pragmatic way to employ these instruments and

avoid the accounting headaches is to use funding structures with embedded

derivatives.

Darling Consulting Group

978.463.0400

Page 4

Darnell R. Canada

Managing Director

Darling Consulting Group, Inc.

dcanada@darlingconsulting.com

Tel: 978.463.0400 x123

Darnell Canada is a managing director at Darling Consulting Group, Inc., the nation’s premier ALM

solutions provider. DCG’s services include consulting, education, core deposit studies, process reviews,

model audits, and ALM/budgeting software.

Darnell has over 10 years of experience working directly with community banks to help them improve

overall performance through proactive management of liquidity, interest rate risk and capital, and by

developing strategies that best fit the risk/return dynamic of their balance sheets. Additionally, he counsels

institutions that seek advice on enhancing the overall effectiveness of their ALM processes. Darnell is a

frequent contributor to professional publications, and has participated in a wide range of educational

programs for the banking industry, including the ABA’s Stonier School of Banking.

Prior to joining DCG, Darnell was a field office examiner with the Federal Deposit Insurance Corporation

(FDIC) in the department of Safety and Soundness. He is received a B.S. in finance from Bentley College

and a M.S. in finance from Boston College. Darnell lives in Massachusetts with his wife and twin sons.

This article first appeared in the May 2007 issue of the Bank Asset/Liability Management newsletter,

Copyright Alex eSolutions Inc. Subscription is available at 704-541-0489 or 800-572-2797.

Darling Consulting Group

978.463.0400

Page 5

You might also like

- Applied Time Series Econometrics: A Practical Guide for Macroeconomic Researchers with a Focus on AfricaFrom EverandApplied Time Series Econometrics: A Practical Guide for Macroeconomic Researchers with a Focus on AfricaRating: 3 out of 5 stars3/5 (1)

- Square Full PaperDocument190 pagesSquare Full Paperyabz123No ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

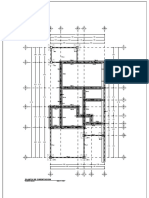

- CIMENTACIONDocument1 pageCIMENTACIONOSCAR FABIAN PEÑA ORTIZNo ratings yet

- BNP Paribas Short Term Fund Direct Plan Weekly Dividend Payout OptionDocument1 pageBNP Paribas Short Term Fund Direct Plan Weekly Dividend Payout OptionSunNo ratings yet

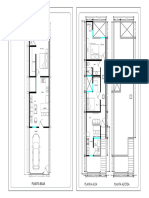

- A D E H F B: Planta Alta ESC. 1: 100Document1 pageA D E H F B: Planta Alta ESC. 1: 100Dani HernándezNo ratings yet

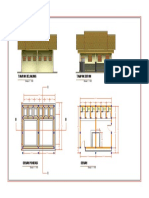

- Architectural plans for building facadesDocument1 pageArchitectural plans for building facadesBalázs ZoltánNo ratings yet

- Filipino Subject Specifications and Research CompetenciesDocument31 pagesFilipino Subject Specifications and Research CompetenciesMard A. MacNo ratings yet

- Secc. Mayor (M) Secc. Menor (M) W/H W (M) H (M) R (Mpa) : Rpilar (Mpa) Ancho Pilar - FospilarDocument3 pagesSecc. Mayor (M) Secc. Menor (M) W/H W (M) H (M) R (Mpa) : Rpilar (Mpa) Ancho Pilar - FospilarRonald Cornejo MarmanilloNo ratings yet

- Secc. Mayor (M) Secc. Menor (M) W/H W (M) H (M) R (Mpa) : Rpilar (Mpa) Ancho Pilar - FospilarDocument3 pagesSecc. Mayor (M) Secc. Menor (M) W/H W (M) H (M) R (Mpa) : Rpilar (Mpa) Ancho Pilar - FospilarRonald Cornejo MarmanilloNo ratings yet

- Structural analysis of reinforced concrete pillarsDocument3 pagesStructural analysis of reinforced concrete pillarsRonald Cornejo MarmanilloNo ratings yet

- MSFIN 223 - Case 1 - Du Pont (Cauton, Cortez, Dy, Lui, Mamaril, Papa, Rasco)Document3 pagesMSFIN 223 - Case 1 - Du Pont (Cauton, Cortez, Dy, Lui, Mamaril, Papa, Rasco)Leophil RascoNo ratings yet

- Plan-Converted Merged OrganizedDocument20 pagesPlan-Converted Merged OrganizedDarel John CagapeNo ratings yet

- Plant Manager's Office - LatestDocument1 pagePlant Manager's Office - LatestAzel Mica GarciaNo ratings yet

- Architectural blueprint floor plan front and back viewsDocument1 pageArchitectural blueprint floor plan front and back viewsAndika MahbengiNo ratings yet

- 20230124-AM-Deck-FY21Document31 pages20230124-AM-Deck-FY21Valeri AgustinaNo ratings yet

- Mccarthy Kovach Assembly-1Document1 pageMccarthy Kovach Assembly-1api-305320178No ratings yet

- Mccarthy Kovach Assembly-1Document1 pageMccarthy Kovach Assembly-1api-305320178No ratings yet

- Thematic Report - Rockstars of 2QFY24 ResultDocument46 pagesThematic Report - Rockstars of 2QFY24 ResultdeepaksinghbishtNo ratings yet

- Proyecto Casa Habitación-ModelDocument1 pageProyecto Casa Habitación-ModelCarlos MedranoNo ratings yet

- Bond Price With Excel FunctionsDocument6 pagesBond Price With Excel Functionsapi-3763138No ratings yet

- Demo PlatformDocument2 pagesDemo PlatformMarlhen EstradaNo ratings yet

- Square Full ReportDocument191 pagesSquare Full ReportAbe ZafarNo ratings yet

- TEST METHOD:AASHTO T127, ASTM C136 (Dry) ASTM C117 Procedure A (Wet), BS 812 PART 103Document8 pagesTEST METHOD:AASHTO T127, ASTM C136 (Dry) ASTM C117 Procedure A (Wet), BS 812 PART 103Mubashar Islam JadoonNo ratings yet

- A Summer Internship Project PresentationDocument17 pagesA Summer Internship Project Presentationkaushalsharma2488No ratings yet

- Manufacturers Pump Curve Data Pump Curves For New ConditionsDocument1 pageManufacturers Pump Curve Data Pump Curves For New Conditionsanto3harrish3fdoNo ratings yet

- كشف منزلDocument6 pagesكشف منزلMohammed HamidNo ratings yet

- Lean Portfolio Management v1 New en 1Document3 pagesLean Portfolio Management v1 New en 1eric - searaNo ratings yet

- Base01 PDFDocument1 pageBase01 PDFMario MartinezNo ratings yet

- LOSA DE AZOTEA DIAGRAMADocument1 pageLOSA DE AZOTEA DIAGRAMAFERNANDO ALFONSO SALVADOR MORALESNo ratings yet

- At EntrepisoDocument1 pageAt EntrepisoFERNANDO ALFONSO SALVADOR MORALESNo ratings yet

- Site PlanDocument1 pageSite PlanezakbelachewNo ratings yet

- 0104sdsr41a PDocument6 pages0104sdsr41a PPatricio SilvaNo ratings yet

- Cash On Delivery Sales ReportDocument3 pagesCash On Delivery Sales ReportvtalexNo ratings yet

- Assignements in Corporate FinanceDocument1 pageAssignements in Corporate FinanceshehurinaNo ratings yet

- GDP growth rates for various countries from 1995 to 2019Document3 pagesGDP growth rates for various countries from 1995 to 2019Nguyễn Huyền ThươngNo ratings yet

- 2022 fb1 06 enDocument1 page2022 fb1 06 enharish muraliNo ratings yet

- Beta Debt To Capital Ratio (WD) Equity To Capital Ratio (WC) Debt To Equity Ratio (D/E)Document2 pagesBeta Debt To Capital Ratio (WD) Equity To Capital Ratio (WC) Debt To Equity Ratio (D/E)Glizette SamaniegoNo ratings yet

- Stability: Air Void Voids in AggregateDocument9 pagesStability: Air Void Voids in AggregatetekalgnNo ratings yet

- Bivariate Regression+Case+StudiesDocument15 pagesBivariate Regression+Case+StudiesMANJISTHA MUKHERJEENo ratings yet

- Global Sales and Production Around The World Webinar - May 2023Document47 pagesGlobal Sales and Production Around The World Webinar - May 2023nguyenngoctuan066No ratings yet

- Hit-Office ERP - PPT.NDocument50 pagesHit-Office ERP - PPT.NAmit AbhangNo ratings yet

- Financing Real Estate and Housing: The Indian Perspective: Keki Mistry Managing Director, HDFCDocument20 pagesFinancing Real Estate and Housing: The Indian Perspective: Keki Mistry Managing Director, HDFCsagarstNo ratings yet

- Operational Success of Islamic Banking Branches & Windows in BangladeshDocument30 pagesOperational Success of Islamic Banking Branches & Windows in BangladeshFahim RahmanNo ratings yet

- 5-Year Budget & Effort CalculatorDocument10 pages5-Year Budget & Effort CalculatorCh Raheel BhattiNo ratings yet

- Diagrama Momento CurvaturaDocument1 pageDiagrama Momento Curvatura33YURYNo ratings yet

- Financial_Model (1)Document30 pagesFinancial_Model (1)Tanya KhandelwalNo ratings yet

- Cadbury Kraft AnalysisDocument358 pagesCadbury Kraft Analysisakashprasad0205No ratings yet

- Chapter 5 - SupportDocument15 pagesChapter 5 - SupportwafarasoolNo ratings yet

- TA Recovery Paper - ChartsGraphs 05.01.18 MFDocument4 pagesTA Recovery Paper - ChartsGraphs 05.01.18 MFJohn SmithNo ratings yet

- Hesperidin 1H NMRDocument1 pageHesperidin 1H NMRDuc Anh NguyenNo ratings yet

- Morning Star Report 20190725103353Document1 pageMorning Star Report 20190725103353SunNo ratings yet

- Balance Sheet New TypeDocument293 pagesBalance Sheet New TypeMubashir AhmadNo ratings yet

- Mod 4 Valuation and ConceptsDocument5 pagesMod 4 Valuation and Conceptsvenice cambryNo ratings yet

- TAGTF MYR Fund Performance and Volatility UpdateDocument7 pagesTAGTF MYR Fund Performance and Volatility UpdateJ&A Partners JANNo ratings yet

- Produced by An Autodesk Educational ProductDocument1 pageProduced by An Autodesk Educational Productahmed6kamal-41No ratings yet

- Autodesk Student Version Sanitation Water DiagramDocument1 pageAutodesk Student Version Sanitation Water DiagramBramantyo WijayaNo ratings yet

- LU5 Homework AnswersDocument15 pagesLU5 Homework Answersh9rkbdhx57No ratings yet

- Performance Appraisal FormDocument4 pagesPerformance Appraisal Formhazim jaafarNo ratings yet

- Internal Forces G, HDocument6 pagesInternal Forces G, HRui JiaNo ratings yet

- S P R A S: Trategic Lanning For Ecords and Rchives ErvicesDocument122 pagesS P R A S: Trategic Lanning For Ecords and Rchives ErviceskhinthetzunNo ratings yet

- Strategicmanagementandstrategicplanningprocess ChapterDocument30 pagesStrategicmanagementandstrategicplanningprocess ChapterEve EnriquezNo ratings yet

- Atrilla, Omran, & Pointon, 2005Document9 pagesAtrilla, Omran, & Pointon, 2005Fabio SettiNo ratings yet

- Accessing The World Bank's Open Learning CampusDocument2 pagesAccessing The World Bank's Open Learning CampuskhinthetzunNo ratings yet

- Market-Timing The Business Cycle: Review of Financial Economics March 2015Document11 pagesMarket-Timing The Business Cycle: Review of Financial Economics March 2015khinthetzunNo ratings yet

- Financial Performance Analysis of Top Ethiopian Private BanksDocument55 pagesFinancial Performance Analysis of Top Ethiopian Private BanksAnonymous ej7PpdNo ratings yet

- InterpretationonFinancialStatementsByMr V AnojanDocument30 pagesInterpretationonFinancialStatementsByMr V AnojankhinthetzunNo ratings yet

- 49883-J Curve by Mohsen BahmaniDocument2 pages49883-J Curve by Mohsen BahmanikhinthetzunNo ratings yet

- Burma Prospect For A Democratic FutureDocument1 pageBurma Prospect For A Democratic FuturekhinthetzunNo ratings yet

- Financial Statement Analysis ProjectDocument3 pagesFinancial Statement Analysis ProjectRushikesh KothapalliNo ratings yet

- Against The Current The Survival of Authoritarianism in BurmaDocument19 pagesAgainst The Current The Survival of Authoritarianism in BurmakhinthetzunNo ratings yet

- Constitutionalism Before Constitutions Burmas Struggle To BuildDocument39 pagesConstitutionalism Before Constitutions Burmas Struggle To BuildkhinthetzunNo ratings yet

- 2008 Constitution BreachesDocument5 pages2008 Constitution BreacheskhinthetzunNo ratings yet

- Statutory Audit ProgramDocument7 pagesStatutory Audit ProgramSuman Pyatha0% (1)

- Train With Bain 2 HandoutDocument7 pagesTrain With Bain 2 HandoutAnn100% (1)

- Hospital's Legal Opinion On Chapter 55ADocument8 pagesHospital's Legal Opinion On Chapter 55AEmily Featherston GrayTvNo ratings yet

- NDBT Feb 2022Document5 pagesNDBT Feb 2022shamim0008No ratings yet

- SMB Strategy and Planning ToolkitDocument36 pagesSMB Strategy and Planning ToolkitJovany GrezNo ratings yet

- StAR - Stolen Asset Recovery Initiative - Corruption CasesDocument4 pagesStAR - Stolen Asset Recovery Initiative - Corruption CasessurambayaNo ratings yet

- Review JurnalDocument12 pagesReview JurnalMahatma RamantaraNo ratings yet

- Advanced Compliance Reporting - HANADocument133 pagesAdvanced Compliance Reporting - HANAZORRO50% (4)

- Iso 9001 Lead ImplementerDocument7 pagesIso 9001 Lead ImplementerwircexdjNo ratings yet

- Turkey's Growing Mining SectorDocument23 pagesTurkey's Growing Mining SectorKashi MughalNo ratings yet

- Key Notes - Bankers Committee RetreatDocument3 pagesKey Notes - Bankers Committee RetreatLola OniNo ratings yet

- Macro Organizational Behavior Case QuestionsDocument3 pagesMacro Organizational Behavior Case QuestionsHisham AshrafNo ratings yet

- UBCV2-SFDocument9 pagesUBCV2-SFJonjon BuenoNo ratings yet

- Case Study of Constructability Reasoning in MEP CoordinationDocument11 pagesCase Study of Constructability Reasoning in MEP CoordinationBenjamin LucioNo ratings yet

- Terms of Delivery - Sauter Feinmechanik GMBHDocument7 pagesTerms of Delivery - Sauter Feinmechanik GMBHCarloncho LonchoNo ratings yet

- Last 6 Months Bank StatementDocument8 pagesLast 6 Months Bank StatementGajanandNo ratings yet

- Reliance Comman Application Form Sip and LumsumpDocument4 pagesReliance Comman Application Form Sip and Lumsumpmoney spsNo ratings yet

- E SufianaDocument25 pagesE SufianaRokibul Islam ChowdhuryNo ratings yet

- Reverse Logistic Group4Document5 pagesReverse Logistic Group4Tavleen KaurNo ratings yet

- Muller and Phipps - Google SearchDocument1 pageMuller and Phipps - Google Searchwarishaabbasi13No ratings yet

- New Tablet Menu Project CharterDocument3 pagesNew Tablet Menu Project CharterBasit Ali QureshiNo ratings yet

- Govt. of Andhra Pradesh (APTC Form - 47) : / Temporaray Head of Account DeductionsDocument16 pagesGovt. of Andhra Pradesh (APTC Form - 47) : / Temporaray Head of Account DeductionsDr MaldannaNo ratings yet

- BUSINESS FINANCE Las Week 3 and 4Document8 pagesBUSINESS FINANCE Las Week 3 and 4ggonegvftNo ratings yet

- Session 6 - Conflicts of Interest in Business - The Accounting ProfessionDocument27 pagesSession 6 - Conflicts of Interest in Business - The Accounting Profession20201211053 NUR AZIZAHNo ratings yet

- Balaji Company ProfileDocument14 pagesBalaji Company ProfileBalaji DefenceNo ratings yet

- Long-Term Construction Contracts & FranchiseDocument6 pagesLong-Term Construction Contracts & FranchiseBryan ReyesNo ratings yet

- EconDocument12 pagesEconfranz justin kyle syNo ratings yet

- Kunci Jawaban Soal UKK 2016/2017Document42 pagesKunci Jawaban Soal UKK 2016/2017Nur hayatiNo ratings yet

- Sony and Zee Ink Merger DealDocument2 pagesSony and Zee Ink Merger DealMr PicaedNo ratings yet

- Sola Guia Czarina D. Portfolio 2021-2-1Document18 pagesSola Guia Czarina D. Portfolio 2021-2-1Charrie Faye Magbitang HernandezNo ratings yet