Professional Documents

Culture Documents

A Study On User Perceived Trust in Mobile Wallet

Uploaded by

IAEME PublicationOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On User Perceived Trust in Mobile Wallet

Uploaded by

IAEME PublicationCopyright:

Available Formats

International Journal of Management (IJM)

Volume 12, Issue 3, March 2021, pp.125-133, Article ID: IJM_12_03_011

Available online at http://iaeme.com/Home/issue/IJM?Volume=12&Issue=3

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

DOI: 10.34218/IJM.12.3.2021.011

© IAEME Publication Scopus Indexed

A STUDY ON USER PERCEIVED TRUST IN

MOBILE WALLET

Arun Prasad G.S

Research Scholar, College of Management, SRM Institute of Science and Technology,

Kattankulathur, Tamil Nadu, India

Dr. Arivazhagan R

Associate Professor, College of Management, SRM Institute of Science and Technology,

Kattankulathur, Tamil Nadu, India

ABSTRACT

The Mobile Wallet is an electronic wallet that keeps the information about payment

cards on a mobile device. It presents a great opportunity for the user to make online or

offline payments across platforms instantly. As no opportunity comes without risk, if

the system is not robust, the economic importance given to this technology would lead

to cybercrimes that would eventually result in a financial loss for the users. But, the

financial institutions and mobile wallet companies are taking effective measures to

ensure the user interest is protected and transactions are secured. While steps are being

taken to ensure safer transactions, we aren’t sure whether the customers are

considering this while transacting through mobile wallets. In response to this problem,

this study proposes to investigate the users’ perception towards Mobile Wallet’s

security and trust. Descriptive research design is adopted and data was collected from

people who are using mobile wallets. Around 147 responses were collected by using the

non-probability, purposive sampling technique through an online survey, email survey,

and personal interview. Then data was analyzed through suitable statistical tools and

results were validated through appropriate discussions. Study reveals five significant

variables that influence trust among users and out of which technology was playing a

significant role.

Key words: Cashless Payments, Mobile wallets, Perceived Trust, Reliability, Security

features, Social Influence

Cite this Article: Arun Prasad G.S and Arivazhagan R, A Study on User Perceived

Trust in Mobile Wallet, International Journal of Management (IJM), 12(3), 2021, pp.

125-133.

http://iaeme.com/Home/issue/IJM?Volume=12&Issue=3

http://iaeme.com/Home/journal/IJM 125 editor@iaeme.com

A Study on User Perceived Trust in Mobile Wallet

1. INTRODUCTION

With the adoption of core banking solutions, net banking, and card payments, the way we make

large transactions has changed significantly. Similarly, in the payment space, Mobile wallet, or

digital wallet, is also trying to bring about a revolution in low-value transactions. Mobile

wallets, not only provide customer convenience but also provides marketers with a lot of

insights to understand consumer behavior, the choice to formulate their marketing strategy

accordingly as all online transactions are completed. The key advantage of using a mobile

wallet is that we get a convenient, one-stop shopping experience where we can make purchases

in the store, pay bills, book tickets, transfer funds, redeem coupons, receive loyalty points

without ever leaving an app.

According to Sampath Sharma Nariyanuri (S&P) [1] India Mobile payments report, India’s

drive towards cashless payments accelerated in 2019. Mobile payments that bypass card rails

rose 163% to$286 billion in 2019. Point-of-sale transactions completed using debit and credit

cards, including online and in-app transactions, grew 24% to $204 billion. As per Mint

Financial daily [2], Digital payment firms such as PhonePe, Paytm, Amazon Pay, and others

have seen a nearly 50% spike in transactions through their digital wallets since the start of the

covid-19 crisis. The recent surge in digital wallet transactions shows that post covid19 outbreak,

more people opted for online methods to pay instead of cash. Also according to National

Payments Corporation of India (NPCI) recent data, the total transaction performed through UPI

excluding Bhim & USSD has almost doubled compared to the previous financial year (F.Y

2019-20) with 24% contribution coming from the above payment type against total financial

transactions recorded[3]. UPI transactions are largely performed through mobile wallets. The

above information indicates payment apps usage is on the rise in India, driven by extensive

promotional activities and also backed by government initiatives on the digital economy.

With the penetration of the Smartphone Industry, the likelihood of more consumers

embracing digital wallets for payments appears to be too bright. Also, the Covid pandemic

situation certainly has taken this adoption to the next level. However, user perception and

acceptance of mobile wallets are very critical in the long run for its sustainability. Any

technology which involves financial transactions needs public trust. Users should have the trust

and confidence that the technology is more secured and protected. Information on the security

aspects of the technology has to be communicated in detail to the users and they should aware

of the layers of protection.

1.1 Mobile Wallets

In the traditional meaning of the term, "wallet" refers to a purse or folding case containing

money or personal details such as an identification card. An E-wallet or Digital wallet means

an electronic wallet that stores both financial as well as personal information [4]. In a mobile

wallet, all things that a physical wallet would hold can be stored. It can store debit cards, credit

cards, loyalty cards and therefore gives customers more diversified and secured options to make

payments. With this technology, you can pay your bills online as well as offline without having

to pay by cash or use your credit or debit card every time.

With government promotion on paperless and e-documents with various initiatives like

mParivahan for transport information (Driving licence, RC, Insurance) and other identity

documents, the need to carry a physical wallet doesn’t exist. A mobile wallet, therefore a perfect

alternative for a real wallet. In addition to that, Mobile wallets play an important role in

promoting financial inclusion in the country by extending financial services to all segments of

the people, including those who aren’t part of the traditional banking system. In emerging

economies, mobile applications provide a platform to target a larger population having no bank

account but having a mobile phone [5].

http://iaeme.com/Home/journal/IJM 126 editor@iaeme.com

Arun Prasad G.S and Arivazhagan R

The key benefit of using a mobile wallet is that we get a convenient one-stop shopping

experience where we can make transactions in the store, pay bills, book tickets, transfer money,

redeem coupons, get loyalty points. Some of the other benefits of using a mobile wallet include

variety, rewards & offers, security, simplified user interface.

2. LITERATURE REVIEW

Various studies have been examined under literature review. Deepak Chawla and Himanshi

Joshi [6] in their study confirms the importance of security as the main predictor of trust. Also

through another study, they emphasized the need to develop strategies to enhance the

confidence among old consumers about the security of the mobile wallet [7].

A Seetharaman [8] through his study considers transaction security as one of the strong

influencers for adopting the mobile wallet. Earlier studies confirm that the user’s family,

friends, peers, and social groups significantly influence the user's intention to adopt to Mobile

wallet. Nidhi Singh, Neena Sinha, Francisco J. Liebana- Cabanillas [9] study also substantiates

this claim. Also, they added that the influence of such individuals has a greater reputation, and

word-of-mouth recommendations inspire or discourage users from trying out new technology.

In his study regarding m-banking, Amit Shankar [10] indicated that Security and privacy

are a major concern of consumers while using m-banking, banks can reduce this by introducing

and arranging different awareness programs. Though mobile banking is similar to Mobile wallet

with its functionality, Saurav Mittal and Vikas Kumar [11] in their study clarified that the Indian

mobile wallet users are quite sure about the security of their transactions and privacy of data

and also indicated that customers are excited to have more innovative solutions and use the

wallets for more number of transactions in future. The simplicity of any technology should also

be accompanied by a high level of security to ensure attracting a wider range of customers as

indicated by Aladeeddin [12].

Social influence refers to the degree to which opinions of family, relatives, and friends affect

the decision of the consumer to use a product or service [13]. Madan and Yadav [14] in their

study found that social influence is a significant factor in predicting behavioral intentions in

respect of mobile wallet adoption. They added that social influence is perceived to have more

credibility than any other source of information as it directly motivates users to adapt to the

technology. The belief of the people important to an individual which includes family, friends,

and reference groups which would affect their intention to accept or reject a certain idea as per

Gokhan Aydin in his study [15]

According to Dr.Poonam [16] In recent years, mobile wallet acceptance is very high due to

its simplicity and security features. Jay Trivedi revealed in his study [17] that social influence

is one of the important factors which influence consumer’s behavioral intentions regarding

mobile commerce. Dr. Anupam Saxena [18] in her study explained the importance of security

aspects in accepting mobile payments among its users.

3. PROBLEM STATEMENT

User-perceived trust in the mobile wallet is very critical in the long run for its sustainability.

For which users, should have confidence that the technology is more secured and protected.

Also, it is important to know whether the recent rise in adoption is only a temporary

arrangement to have contactless transactions or people slowly trusting and seeing the mobile

wallet as a reliable option for transactions. While steps are being taken by Mobile wallet

companies to ensure safer transactions, we aren’t sure whether the customers are considering

this while transacting through mobile wallets. In response to this problem, this study proposes

to investigate the users’ perceived trust towards Mobile Wallet concerning its security aspects.

http://iaeme.com/Home/journal/IJM 127 editor@iaeme.com

A Study on User Perceived Trust in Mobile Wallet

4. RESEARCH OBJECTIVES

• To analyze the importance of trust in accepting Mobile wallets among its users.

• To determine whether any difference exists within the demographic groups (Gender,

Age & Education) related to trust in accepting Mobile wallet.

• To identify the major factors influencing the trust of users along with their significance.

5. RESEARCH METHODOLOGY

Being descriptive research, the Purposive sampling technique was used to collect the data from

the respondents. The selected respondents were the ones who were using Mobile wallet services

on their mobile phones. The sample size for the study was 147 respondents. Data was collected

through an online survey, email survey, and personal interview. Statistical tools of SPSS and

MS Excel were used to analyze the data.

6. ANALYSIS AND DISCUSSION

6.1 Frequencies Test

The dependent variable “I feel Mobile wallet is more secured and Trusted” has a median value

of 4 which indicates the importance of trust in acceptance of mobile wallets

Table 1 Frequencies Test

Valid 147

N

Missing 0

Mean 3.76

Median 4.00

Mode 4a

Sum 553

6.2 Hypotheses Analysis

The following hypotheses tests have been undertaken to find out whether there is any difference

exist within the demographic variable groups (Gender, Age, Education) in relation to the

dependent variable (SE1). Each demographic variable has been taken separately and the

difference among the group is analyzed in relation to the testing variable (SE1).

H1: There is no significant difference within respondent’s gender group in relation to the

trust of using Mobile wallet

H2: There is no significant difference within respondent’s age group in relation to the trust

of using a mobile wallet

H3: There is no significant difference within the respondent’s education group in relation

to the trust of using a mobile wallet

Hypotheses Test Results.

The Testing variable for all the Hypothesis Tests is “I feel Mobile wallet is more secured

and Trusted” (SE1)

http://iaeme.com/Home/journal/IJM 128 editor@iaeme.com

Arun Prasad G.S and Arivazhagan R

Table 2 Hypotheses Test

Test Type Grouping Groups N Mean Sum of

Variable Rank Ranks

Two – Independent – Sample Test Male 87 71.64 6233.00

(Mann Whitney Test) Gender 77.42 4645.00

Female 60

Tests for several Independent samples 41 76.34

Test 15 – 24 77.05

73

(Kruskal - Wallis Test) 25 – 39 62.07

Age 27

40 – 55> 55 74.50

6

Tests for several Independent samples Higher Sec. 4 82.50

Test Graduate 94 72.83

(Kruskal - Wallis Test) Education Post 30 78.27

Graduate 19 71.26

M.Phil/Ph.D

Interpretation

The following hypotheses have proved our assumptions right and confirmed that there is no

significant difference within the demographic group variables (Gender, Age, Education) in

relation to the testing variable “I feel Mobile wallet is more secured and Trusted “ (SE1).

Table 3 Test Statistics

Test Type Group Variable - Group Variable – Group Variable -

Gender (H1) Age (H2) Education (H3)

Mann-Whitney U 2405.000

Wilcoxon W 6233.000

Z -.841

Asymp. Sig. (2-tailed) .400

Kruskal Wallis Test 2.838 .661

Chi-Square

3 3

df .417 .882

Asymp. Sig.

.400 > 0.05 .417 > 0.05 .882 > 0.05

Hypothesis Results (H0 is not rejected) (H0 is not rejected)

(H0 is not rejected)

Based on the results, H0 is not rejected in all hypotheses, and with this, we can conclude

there is no significant difference within each demographic variable group in relation to trust.

6.3 Factor Analysis

Table 4 KMO and Bartlett's Test

Parameters Values

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. .921

Approx. Chi-Square 1351.575

Bartlett's Test of Sphericity df 66

Sig. .000

http://iaeme.com/Home/journal/IJM 129 editor@iaeme.com

A Study on User Perceived Trust in Mobile Wallet

Table 5 Total Variance Explained

Component Initial Eigenvalues Extraction Sums of Rotation Sums of Squared

Squared Loadings Loadings

Total % of Cumulative Total % of Cumulative Total % of Cumulative

Variance % Variance % Variance %

1 7.355 61.292 61.292 7.355 61.292 61.292 4.541 37.843 37.843

2 1.110 9.248 70.540 1.110 9.248 70.540 3.924 32.697 70.540

3 .758 6.313 76.853

Factor analysis was carried out to minimize the number of variables into few factors. KMO

and Bartlett’s Test validated the sampling adequacy and significance of variables. With a KMO

Value of 0.921, Sampling adequacy was justified with 92%. Since the significant value is

0.000, we may confirm that the variables taken for this analysis were significant. (P<0.05). The

Number of reduced factors was identified by using Eigenvalues one and above.

Table 6 Rotated Component Matrix a

Component

1 2

I feel Mobile wallet is more secured and trusted. .712

Have not heard any security issues related to mobile wallet .730

I feel my mobile wallet is more secured than my physical wallet .723

Technology is very reliable and I am confident of making payments anytime .807

Even if I lose my phone, I know my mobile wallet has security settings that ensure only

.806

I can access it

I feel every UPI transaction is secured with OTP and other security features .758

I know the encrypted payment codes are used for secured payment communication .726

My friends and relatives are using a mobile wallet. .794

Most of my friends and relatives are happy with the mobile wallet .826

I have recommended my friends and relatives to install a Mobile wallet .799

I encouraged others to use Mobile wallet whenever there is an opportunity to use .750

I have been encouraged by friends to use the mobile wallet .711

The Total variance table shows that all the variables were reduced to two factors. These two

factors were explained around 71% of the variance. The number of variables in each factor was

identified by using factor loadings of 0.5 and above. With this condition, the first factor includes

all variables which come under security, and the second factor consists of all variables which

come under social influence. Therefore, the names of the factor were retained as the names of

the construct, and the result justified the construct validity of security and social influence.

6.4 Regression Analysis Output

Regression analysis was carried out to identify the influence and importance of significant

variables. Security and trust on “ I feel Mobile wallet is more secured and trusted” was taken

as a dependent variable. Security and social influence-related items were taken as the

independent variable. Model summary of regression analysis disclosed the R Square value of

0.682 which means 68% of variance explained by all 11 independent variables and the ANOVA

http://iaeme.com/Home/journal/IJM 130 editor@iaeme.com

Arun Prasad G.S and Arivazhagan R

table of regression analysis shows a significant value of 0.000. This explains all independent

variables were significant to carry out regression analysis.

The coefficient table of regression analysis reveals five different independent variables as

significant variables. (P<0.05), They are SE2: Have not heard any security issues related to a

mobile wallet, SE4: Technology is very reliable and I am confident of making payments

anytime, SI1: My friends and relatives are using a mobile wallet, SI2: Most of my friends and

relatives are happy with the mobile wallet and SI4: I encouraged others to use Mobile wallet

whenever there is an opportunity to use

Table 7 Model Summary

Model Summary ANOVA

Model R R Adjusted Std. Error of F Sig.

Square R Square the Estimate

1 .826a .682 .656 .681 26.266 .000b

Table 8 Coefficients

Unstandardized Standardize t Sig.

Coefficients d

Coefficients

B Std. Beta

Error

(Constant) -.050 .251 -.201 .841

Have not heard any security issues related to mobile wallet .181 .064 .184 2.813 .006

I feel my mobile wallet is more secured than my physical .082 .077 .088 1.072 .286

wallet

Technology is very reliable and I am confident of making .430 .096 .413 4.481 .000

payments anytime

Even if I lose my phone, I know my mobile wallet has

-.046 .082 -.049 -.563 .574

security settings that ensure only I can access it

I feel every UPI transaction is secured with OTP and other

.108 .088 .106 1.226 .222

security features

I know the encrypted payment codes are used for secured

.093 .092 .086 1.016 .311

payment communication

My friends and relatives are using a mobile wallet. .195 .091 .182 2.146 .034

Most of my friends and relatives are happy with the mobile

.244 .128 .256 1.912 .058

wallet

I have recommended my friends and relatives to install a

.068 .080 .075 .856 .393

Mobile wallet

I encouraged others to use Mobile wallet whenever there is

.261 .137 .270 1.908 .059

an opportunity to use

I have been encouraged by friends to use the mobile wallet .020 .071 .021 .290 .773

Unstandardized coefficients are used to identify the influence of each independent variable

on the dependent variable. Data shows one unit of increase in SE2 will influence 0.181 units

of trust on Mobile wallets and also one unit of increase in SE4 will influence 0.430 units of

trust on the mobile wallet. Also, one unit of increase in SI1, SI2, and SI4 will influence 0.195,

0.244, and 0.261 respectively of trust on the mobile wallet.

Standardized coefficients are used to identify the importance of variables. As per the results

of regression analysis, technology is playing a significant role with 0.413 followed by referrals

with a value of 0.270.

http://iaeme.com/Home/journal/IJM 131 editor@iaeme.com

A Study on User Perceived Trust in Mobile Wallet

7. RESULTS AND DISCUSSION

Out of 147 respondents, 59% of responses are from males and 41% are from females. In age,

28% belongs to Generation Z (15-24), 50% of Generation Y (25 to 39), 18% of Generation X

(40 to 55) and above 55 Years constitute the remaining 4%. Frequency analysis has given a

basic understanding of the demography profile of the respondents. The dependent variable “I

feel Mobile wallet is more secured and Trusted” has a median value of 4 which indicates the

importance of trust in acceptance. Mann Whitney Test and Kruskal - Wallis test were used to

test the hypothesis. These tests resulted that, there is no significant difference within the

demographic group variables (Gender, Age, Education) to the testing variable “I feel Mobile

wallet is more secured and Trusted“ (SE1). Therefore, H0 is not rejected in all hypotheses,

and with this, we can conclude there is no significant difference within each demographic

variable group in relation to trust.

Factor analysis was carried out to minimize the number of variables into few factors. KMO

and Bartlett’s Test validated the sampling adequacy and significance of variables. Finally, all

the variables were reduced into two factors, fortunately, these two factors were the same as

research constructs such as security and social influence. Hence this analysis also justified the

construct validity. The reliability of these two factors was tested and which yields the results as

both the factors were very reliable.

Regression analysis was performed for identifying significant variables and their influence

on the trust factor. This analysis resulted that, around 68% of variance explained by all 11

independent variables and all these variables were significant to perform regression analysis.

Finally, regression analysis reveals five different independent variables as significant variables

(P<0.05). They are SE2: Have not heard any security issues related to the mobile wallet; SE4:

Technology is very reliable and I am confident of making payments anytime; SI1: My friends

and relatives are using a mobile wallet; SI2: Most of my friends and relatives are happy with

the mobile wallet and SI4: I encouraged others to use Mobile wallet whenever there is an

opportunity to use. Out of these significant variables technology (SE4) plays a vital role

followed by referrals (SI4).

8. CONCLUSIONS

Digital Payments are gradually becoming more popular among users. While there are various

reasons for its acceptance, this study emphasizes the importance of Trust in accepting the

mobile wallet in specific. The findings of this study indicate that trust is common among all its

users regardless of demographic factors. Trust levels are similar in groups of gender, age, and

education, and no significant difference was found. The dependent variable “I feel Mobile

wallet is more secured and Trusted” has a median value of 4 which indicates the importance of

trust in acceptance of mobile wallets. Technology is the major contributor to the trust factor

among the respondents. It also indicates that the trust levels would certainly go up if the product

is referred by the reference groups. We can also assume that the mobile wallet companies have

done a decent job in disseminating awareness on security advances to enhance the trust of users.

This trust in security has also led to referrals with confident users recommending mobile wallets

to their social groups.

REFERENCES

[1] Sampath Sharma Nariyanuri, “2020 India Mobile Payments Market Report”, S&P Global

Market Intelligence.

[2] Mint Financial daily, E-Paper,“E-Wallet transactions surge amid covid-19”, (3 Aug 2020)

http://iaeme.com/Home/journal/IJM 132 editor@iaeme.com

Arun Prasad G.S and Arivazhagan R

[3] National Payments Corporation of India (NPCI) , “Retail Payments Statistics on NPCI

Platforms” Report (FY.2019-2020) & (FY.2020-21)

[4] Jinimol. P. “A study on E-wallet “, International Journal of Trend in Scientific Research and

Development. Vol.2. No.4. Pg No. 358

[5] Cox. C, “The Mobile wallet: It’s not just about payments”, Illinois Bankers Association,

Chicago, IL.

[6] Deepak Chawla and Himanshu Joshi (2019), “Customer attitude and intention to adopt mobile

wallet in India”, International Journal of Bank Marketing, Vol. 37. No.7, pg. 20-21.

[7] Deepak Chawla and Himanshu Joshi (2020), “The moderating role of gender and age in the

adoption of mobile wallet”, International Journal of Bank Marketing, Vol. 37. No.7, pg. 20-21.

[8] A. Seetharaman, Karippur Nanda Kumar, S. Palaniappan and Golo Weber (2017), “Factors

influencing behavioral intention to use the Mobile Wallet in Singapore”, Journal of Applied

Economics and Business Research(JAEBR), 7(2): Pg. 15

[9] Nidhi Singh, Neena Sinha, Franciso J. Liebana- Cabanillas (2020), “Determining factors in the

adoption and recommendation of mobile wallet services in India: Analysis of the effect of

innovativeness, stress to use and social influence

[10] Amit Shankar “Factors Affecting Mobile Banking Adoption Behavior in India” Journal of

Internet Banking and Commerce. Vol.21, No.1

[11] Saurabh Mittal, Vikas Kumar “Adoption of Mobile Wallets in India”, IVP Journal of

Information and Technology. Vol.14. No.2

[12] Alaeddin O., Altounjy R., Zainudin Z., Kamarudin F, Polish Journal of Management Studies,

Vol.17. No.2. Pg No. 27

[13] Riquelme, H. E., & Rios, R. E. (2010), “The moderating effect of gender on the adoption of

mobile banking”, International Journal of Bank Marketing, Vol.28, No.5, pp. 328-341

[14] Khusbu Madan, Rajan Yadav (2016), “Behaviour intentions to adopt mobile wallets”: a

developing country’s perspective”, Journal of Indian Business Research, Vol.8, Issue 3, PP. 11

[15] Gokhan Aydin (2016), “Adoption of Mobile Payment Systems: a study on mobile wallets,

Journal of Business Economics and Finance, Vol.5, Issue 1, PP .8

[16] Dr. Poonam Painuly, Shalu Rathi, 2016, “Mobile Wallet: An upcoming mode of business

transactions”, International Journal in Management and Social Science. Vol.4, No.5. PP .356.

[17] Mr. Jay Trivedi, 2016, “Factors Determining the Acceptance of E-Wallet”, International Journal

of Applied Marketing and Management. Vol.1 No.2 PP .44.

[18] Dr. Anupama Saxena, Dr. Shalini Nath Tripathi, 2021, “Exploring the security risks and safety

measures of mobile payments in fintech environment in India”, International Journal of

Management. Vol.12. No.2. PP.

http://iaeme.com/Home/journal/IJM 133 editor@iaeme.com

You might also like

- Acceptance of Mobile Payments by Retailers Using UTAUTDocument7 pagesAcceptance of Mobile Payments by Retailers Using UTAUTSaeed A. Bin-NashwanNo ratings yet

- A Case Study On Paytm Users' Behaviour in Salem City, TamilnaduDocument7 pagesA Case Study On Paytm Users' Behaviour in Salem City, TamilnaduAnonymous GPhWDJvNo ratings yet

- About e WalletDocument8 pagesAbout e WalletSavitha VjNo ratings yet

- Cashless Payment VS Conventional Payment System - Consumer Influencing Factors in Indian ContextDocument8 pagesCashless Payment VS Conventional Payment System - Consumer Influencing Factors in Indian ContextSyed Faisal AliNo ratings yet

- Mobile Wallet ProjectDocument21 pagesMobile Wallet ProjectGeetika AroraNo ratings yet

- Cashless PaymentDocument45 pagesCashless PaymentSai PhyoNo ratings yet

- Mobile Wallets Key Drivers and Deterrents of Consumers Intention To AdoptDocument30 pagesMobile Wallets Key Drivers and Deterrents of Consumers Intention To AdoptSimon ShresthaNo ratings yet

- Chapter1 With RrlCOMPLETE 1Document49 pagesChapter1 With RrlCOMPLETE 1elishamae.balbis08No ratings yet

- Growth of Digital Transactions in Transforming EconomyDocument4 pagesGrowth of Digital Transactions in Transforming EconomyInternational Journal of Innovative Science and Research Technology100% (2)

- E-Wallet ResearchDocument22 pagesE-Wallet ResearchMrudul BhattNo ratings yet

- Mobilink-Network Partial List of PartnersDocument5 pagesMobilink-Network Partial List of PartnersEksdiNo ratings yet

- Square Inc. Bitcoin Investment Whitepaper PDFDocument3 pagesSquare Inc. Bitcoin Investment Whitepaper PDFBen AdamteyNo ratings yet

- E-Wallet Penetration - Literature Review 2Document2 pagesE-Wallet Penetration - Literature Review 2kirankumarchandra100% (1)

- Package Crypto': R Topics DocumentedDocument13 pagesPackage Crypto': R Topics DocumentedErnan Baldomero100% (1)

- Using E-Wallet For Business Process Development: Challenges and Prospects in MalaysiaDocument23 pagesUsing E-Wallet For Business Process Development: Challenges and Prospects in MalaysiaMd. Mahmudul AlamNo ratings yet

- Questionnaire For WalletDocument4 pagesQuestionnaire For WalletShubhendu Tiwari0% (1)

- 8 Ball Pool Hack 2019 - 8 Ball Pool Free Coins (Android & Ios)Document2 pages8 Ball Pool Hack 2019 - 8 Ball Pool Free Coins (Android & Ios)RON7Prod HD100% (1)

- Customer Protection Officer Test - ES MJGBDocument5 pagesCustomer Protection Officer Test - ES MJGBGB Manuel JavierNo ratings yet

- Cashless AbstractDocument55 pagesCashless AbstractAbhishek PradhanNo ratings yet

- Block Chain TechnologyDocument15 pagesBlock Chain TechnologyNaresh Kumar PegadaNo ratings yet

- E PaymentDocument22 pagesE PaymentxanshahNo ratings yet

- Mobile Payment Tutor Institution Date A Systematic Literature Review On Mobile PaymentDocument14 pagesMobile Payment Tutor Institution Date A Systematic Literature Review On Mobile PaymentShikz Alexine100% (1)

- IRJM Paper5 June2013Document14 pagesIRJM Paper5 June2013Anurag SahrawatNo ratings yet

- E WalletDocument15 pagesE WalletManoj Kumar Paras100% (1)

- Submitted To Submitted byDocument20 pagesSubmitted To Submitted bypreetgodan100% (2)

- Literature Review Effects of Demonetization On Retail OutletsDocument18 pagesLiterature Review Effects of Demonetization On Retail OutletsAniket RoyNo ratings yet

- Mobile MoneyDocument104 pagesMobile MoneySuleiman AbdulNo ratings yet

- Impact of E-BankingDocument6 pagesImpact of E-Bankingaryaa_statNo ratings yet

- Tulawan Christine Components of TourismDocument10 pagesTulawan Christine Components of TourismChristine Pura Tulawan100% (1)

- Electronic Payment System in Nepal: Group 5Document19 pagesElectronic Payment System in Nepal: Group 5Anuska JayswalNo ratings yet

- Customer Perception Towards Mobile Wallets Among YouthDocument7 pagesCustomer Perception Towards Mobile Wallets Among YouthMoideenNo ratings yet

- Mobile Payment Systems SeminarDocument26 pagesMobile Payment Systems Seminarkrishnaganth kichaaNo ratings yet

- Paytm Payment Solutions - Feb15Document30 pagesPaytm Payment Solutions - Feb15AlienOnEarth123100% (1)

- Evolution of Online Shopping ProjectDocument12 pagesEvolution of Online Shopping Projectvan_1234No ratings yet

- If I Had A Million Cryptos: Cryptowallet Application Analysis and A Trojan Proof-of-ConceptDocument21 pagesIf I Had A Million Cryptos: Cryptowallet Application Analysis and A Trojan Proof-of-ConceptMr. JojoNo ratings yet

- Internet MarketingDocument55 pagesInternet MarketingRaiful IslamNo ratings yet

- Admit CardDocument1 pageAdmit CardChandra JyotiNo ratings yet

- Name: Choolun Pawan Kumar Choolun: Ansha Guness Nitisha Lollith Komal DeekshaDocument32 pagesName: Choolun Pawan Kumar Choolun: Ansha Guness Nitisha Lollith Komal DeekshaEINSTEIN2DNo ratings yet

- E Cash Payment System PaperDocument37 pagesE Cash Payment System Paperakash0% (1)

- Customer Awareness On Green BankingDocument21 pagesCustomer Awareness On Green BankingMayurNo ratings yet

- A STUDY ON CASHLESS ECONOMY IN INDIA AND ITS IMPACT ON SOCIETY - Complete ReportDocument102 pagesA STUDY ON CASHLESS ECONOMY IN INDIA AND ITS IMPACT ON SOCIETY - Complete Reportkritika soniNo ratings yet

- Design of A National Identity Card SystemDocument50 pagesDesign of A National Identity Card SystemDinomarshal PezumNo ratings yet

- NanoByte - Full Whitepaper - 21 Feb 22Document20 pagesNanoByte - Full Whitepaper - 21 Feb 22tuyul polosNo ratings yet

- Umrah Package 2Document6 pagesUmrah Package 2Faisal MalikNo ratings yet

- Internet BankingDocument93 pagesInternet BankingRajesh TyagiNo ratings yet

- Polytechnic University of The Philippines Sto. Tomas Branch Sto. Tomas, BatangasDocument51 pagesPolytechnic University of The Philippines Sto. Tomas Branch Sto. Tomas, BatangasJona Ramos BustamanteNo ratings yet

- Marshall Final ReportDocument37 pagesMarshall Final ReportPradeep JosephNo ratings yet

- CryptoBnb Whitepaper v3.4Document24 pagesCryptoBnb Whitepaper v3.4Ritz JumolaNo ratings yet

- E-Wallet (Digital Payment)Document49 pagesE-Wallet (Digital Payment)MaxNo ratings yet

- Mobile WalletDocument29 pagesMobile WalletDoan Cuong Pham0% (1)

- When Will I Get One?Document3 pagesWhen Will I Get One?sonupatankarNo ratings yet

- Bitcoin PDFDocument9 pagesBitcoin PDFravitejaNo ratings yet

- Consumer Behaviour in Online Shopping Prashant PriyadarshiDocument79 pagesConsumer Behaviour in Online Shopping Prashant PriyadarshiaaigniesNo ratings yet

- Crypto-Currency: The Revolution That Is Even Greater Than The Internet!Document30 pagesCrypto-Currency: The Revolution That Is Even Greater Than The Internet!Zest TanNo ratings yet

- Bitcoin Risk Management Study Spring 2014Document28 pagesBitcoin Risk Management Study Spring 2014Bobby Ong100% (1)

- The Effect of Cashless Banking On Ethiopian EconomyDocument11 pagesThe Effect of Cashless Banking On Ethiopian EconomyAnonymous kbmKQLe0JNo ratings yet

- Project Report On Socail Media Marketing 2013Document20 pagesProject Report On Socail Media Marketing 2013Bharati VarmaNo ratings yet

- Chapter Five: E-Commerce Payment SystemsDocument17 pagesChapter Five: E-Commerce Payment SystemsAgmasie TsegaNo ratings yet

- Business Research Methods: Research On Awareness and Preference For Mobile WalletsDocument18 pagesBusiness Research Methods: Research On Awareness and Preference For Mobile WalletsPriyank agarwalNo ratings yet

- Determinants Affecting The User's Intention To Use Mobile Banking ApplicationsDocument8 pagesDeterminants Affecting The User's Intention To Use Mobile Banking ApplicationsIAEME PublicationNo ratings yet

- Impact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesDocument10 pagesImpact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesIAEME PublicationNo ratings yet

- Gandhi On Non-Violent PoliceDocument8 pagesGandhi On Non-Violent PoliceIAEME PublicationNo ratings yet

- Voice Based Atm For Visually Impaired Using ArduinoDocument7 pagesVoice Based Atm For Visually Impaired Using ArduinoIAEME PublicationNo ratings yet

- Modeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyDocument14 pagesModeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyIAEME PublicationNo ratings yet

- Broad Unexposed Skills of Transgender EntrepreneursDocument8 pagesBroad Unexposed Skills of Transgender EntrepreneursIAEME PublicationNo ratings yet

- A Study On The Reasons For Transgender To Become EntrepreneursDocument7 pagesA Study On The Reasons For Transgender To Become EntrepreneursIAEME PublicationNo ratings yet

- Analyse The User Predilection On Gpay and Phonepe For Digital TransactionsDocument7 pagesAnalyse The User Predilection On Gpay and Phonepe For Digital TransactionsIAEME PublicationNo ratings yet

- Visualising Aging Parents & Their Close Carers Life Journey in Aging EconomyDocument4 pagesVisualising Aging Parents & Their Close Carers Life Journey in Aging EconomyIAEME PublicationNo ratings yet

- Attrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesDocument15 pagesAttrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesIAEME PublicationNo ratings yet

- Influence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiDocument16 pagesInfluence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiIAEME PublicationNo ratings yet

- A Multiple - Channel Queuing Models On Fuzzy EnvironmentDocument13 pagesA Multiple - Channel Queuing Models On Fuzzy EnvironmentIAEME PublicationNo ratings yet

- A Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurDocument7 pagesA Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurIAEME PublicationNo ratings yet

- A Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaDocument9 pagesA Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaIAEME PublicationNo ratings yet

- Role of Social Entrepreneurship in Rural Development of India - Problems and ChallengesDocument18 pagesRole of Social Entrepreneurship in Rural Development of India - Problems and ChallengesIAEME PublicationNo ratings yet

- A Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiDocument16 pagesA Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiIAEME PublicationNo ratings yet

- Optimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsDocument13 pagesOptimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsIAEME PublicationNo ratings yet

- Dealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsDocument8 pagesDealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsIAEME PublicationNo ratings yet

- Financial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelDocument9 pagesFinancial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelIAEME PublicationNo ratings yet

- Various Fuzzy Numbers and Their Various Ranking ApproachesDocument10 pagesVarious Fuzzy Numbers and Their Various Ranking ApproachesIAEME PublicationNo ratings yet

- EXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESDocument9 pagesEXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESIAEME PublicationNo ratings yet

- A Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksDocument10 pagesA Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksIAEME PublicationNo ratings yet

- Application of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDDocument19 pagesApplication of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDIAEME PublicationNo ratings yet

- Moderating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorDocument7 pagesModerating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorIAEME PublicationNo ratings yet

- A Review of Particle Swarm Optimization (Pso) AlgorithmDocument26 pagesA Review of Particle Swarm Optimization (Pso) AlgorithmIAEME PublicationNo ratings yet

- Quality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceDocument7 pagesQuality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceIAEME PublicationNo ratings yet

- Knowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentDocument8 pagesKnowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentIAEME PublicationNo ratings yet

- Analysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsDocument13 pagesAnalysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsIAEME PublicationNo ratings yet

- Analysis On Machine Cell Recognition and Detaching From Neural SystemsDocument9 pagesAnalysis On Machine Cell Recognition and Detaching From Neural SystemsIAEME PublicationNo ratings yet

- Prediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsDocument13 pagesPrediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsIAEME PublicationNo ratings yet

- BRPAT00098400000056652 NewDocument8 pagesBRPAT00098400000056652 NewWorld WebNo ratings yet

- WWW - Manaresults.co - In: Code No: MB1648/R16Document2 pagesWWW - Manaresults.co - In: Code No: MB1648/R16keerthiNo ratings yet

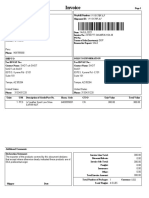

- Invoice 24748777-24648536 DD1503-100 14.07.2021Document3 pagesInvoice 24748777-24648536 DD1503-100 14.07.2021Adrian Cordova LopezNo ratings yet

- Entrepreneurship Development Notes 2022FDocument44 pagesEntrepreneurship Development Notes 2022FAlvin MoraraNo ratings yet

- 3.3 and 3.4 Edexcel Unit Assessment PDFDocument13 pages3.3 and 3.4 Edexcel Unit Assessment PDFRUTH ONo ratings yet

- Microeconomics - CH9 - Analysis of Competitive MarketsDocument53 pagesMicroeconomics - CH9 - Analysis of Competitive MarketsRuben NijsNo ratings yet

- MKTG446 Case 11-2Document2 pagesMKTG446 Case 11-2kanyaNo ratings yet

- Ba 623 Case AnalysisDocument8 pagesBa 623 Case AnalysisSarah Jane OrillosaNo ratings yet

- Solution Chapter 6 Financial Statements Pre Adjustments 1Document8 pagesSolution Chapter 6 Financial Statements Pre Adjustments 1IsmahNo ratings yet

- Receivables Study Guide Solutions Fill-in-the-Blank EquationsDocument19 pagesReceivables Study Guide Solutions Fill-in-the-Blank EquationsPelin CanikliNo ratings yet

- Chapter 5 Pad104Document6 pagesChapter 5 Pad1042022460928No ratings yet

- Sales Order AcknowledgementDocument1 pageSales Order Acknowledgementjose16marNo ratings yet

- Wallstreetjournal 20161231 The Wall Street JournalDocument44 pagesWallstreetjournal 20161231 The Wall Street JournalstefanoNo ratings yet

- Jurnal Akrab Juara - Mei Genap 2021 - Irwin Ananta VidadaDocument18 pagesJurnal Akrab Juara - Mei Genap 2021 - Irwin Ananta Vidadasyafrizal rizalNo ratings yet

- 24.01.2023 Cause List C - Ii 52Document5 pages24.01.2023 Cause List C - Ii 52silk smitaNo ratings yet

- Icici Stack Report by Group 2Document14 pagesIcici Stack Report by Group 2Madhav KhuranaNo ratings yet

- (Mall) BRS 2022 - Pitch DeckDocument90 pages(Mall) BRS 2022 - Pitch DeckSugih LiawanNo ratings yet

- P02 Statement of Cost of Goods Manufactured Sold XDocument102 pagesP02 Statement of Cost of Goods Manufactured Sold XjulsNo ratings yet

- Project Report For Manufacturing & Trading of Embroidery SareeDocument11 pagesProject Report For Manufacturing & Trading of Embroidery SareeSHRUTI AGRAWALNo ratings yet

- Tax Types QuestionsDocument5 pagesTax Types QuestionsJoseph Tinio CruzNo ratings yet

- Pyq Fin250Document3 pagesPyq Fin250shfirdaus044No ratings yet

- Duqm Project 1 Cold Store ProjectDocument15 pagesDuqm Project 1 Cold Store ProjectmohsenmouseliNo ratings yet

- APML Case Study - Group Assignment - Group 6Document4 pagesAPML Case Study - Group Assignment - Group 6Tripti Gupta0% (1)

- RPPT FinalDocument8 pagesRPPT FinalArpann DekaNo ratings yet

- Akmpr7229l Partb 2022-23Document3 pagesAkmpr7229l Partb 2022-23BB StudioNo ratings yet

- Thriveni Sainik Mining Private Limited 2023Document8 pagesThriveni Sainik Mining Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Score:: Points %Document3 pagesScore:: Points %Ketan KulkarniNo ratings yet

- Momentum Trading (Research Paper)Document11 pagesMomentum Trading (Research Paper)Duke NguyenNo ratings yet

- Tade Barrier Cigarettes Case Study - Global OperationsDocument23 pagesTade Barrier Cigarettes Case Study - Global OperationsDIKY RAHMANNo ratings yet

- 2008 Unit 2 Paper 2 JulyDocument7 pages2008 Unit 2 Paper 2 JulyMia ColemanNo ratings yet