Professional Documents

Culture Documents

Daily Equity Market Report - 13.10.2021

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 13.10.2021

Uploaded by

Fuaad DodooCopyright:

Available Formats

13TH OCTOBER 2021

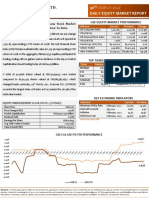

DAILY EQUITY MARKET REPORT

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: The Ghana Stock Market

slips further, loses 8.81 points to return 46.58% YTD. Indicator Current Previous Change

GSE-Composite Index 2,845.93 2,854.74 -8.81pts

The Accra Bourse slipped as the benchmark GSE Composite index (GSE-CI) YTD (GSE-CI) 46.58% 47.03% -0.96%

GSE-Financial index 2,066.41 2,062.36 4.05pts

lost 8.81 points to close trading at 2,845.93 translating into a YTD return of

YTD (GSE-FSI) 15.91% 15.68% 1.47%

46.58%. The GSE Financial Stock Index (GSE-FSI) however closed higher as it Market Cap. (GH¢ MN) 64,077.00 64,169.24 -92.24

gained 4.05 points to close the trading day at 2,066.41 points, also translating Volume Traded 262,159 321,059 -18.35%

Value Traded (GH¢) 378,628.19 894,420.54 -57.67%

into a YTD return of 15.91%.

TOP TRADED EQUITIES

Three (3) equities; Benso Palm Plantation PLC (BOPP), Enterprise Group PLC. Ticker Volume Value (GH¢)

(EGL) and Cal Bank PLC (CAL) recorded gains to close at GH¢4.00, GH¢2.50 CAL 101,999 76,568.17

MTNGH 92,608 111,129.60

and GH¢0.75 respectively as against one decliner Scancom PLC. (MTNGH)

ETI 22,207 1,776.56

which lost GH¢0.01 pesewas to close at GH¢1.20.

GOIL 14,666 24,932.20

Due to this, Market Capitalization decreased by GH¢92.24 million to close

29.3% of value traded

EGL 5,585 13,962.50

trading at GH¢64.07 billion representing a YTD growth of 17.84% in 2021.

GAINERS & DECLINER

A total of 262,159 shares valued at GH¢378,628.19 exchanged hands in Ticker Close Price Open Price Change YTD Change

(GH¢) (GH¢)

seventeen (17) equities as Cal Bank PLC (CAL) recorded the most trades, BOPP 4.00 3.79 5.54% 100.00%

accounting for 29.3% of the total value traded. EGL 2.50 2.40 4.17% 78.57%

CAL 0.75 0.74 1.35% 8.70%

EQUITY UNDER REVIEW: FAN MILK PLC. (FML) MTNGH 1.20 1.21 -0.83% 87.50%

Share Price GH¢ 5.00

Price Change (YtD) 362.96% KEY ECONOMIC INDICATORS

Market Capitalization GH¢581.04 million Indicator Current Previous

Dividend Yield 0.00% Monetary Policy Rate September 2021 13.50% 13.50%

Earnings Per Share GH¢0.1188 Real GDP Growth Q2 2021 3.90% 3.10%

Avg. Daily Volume Traded 7,561 Inflation September 2021 10.60% 9.70%

Value Traded (YtD) GH¢4,649,857.00 Reference rate October 2021 13.47% 13.46%

Source: GSS, BOG, GBA

INDEX YTD PERFORMANCE

60.00%

50.00%

40.00%

30.00%

20.00%

10.00%

0.00%

27-Aug

22-Apr

25-May

25-Jan

23-Feb

17-Mar

25-Mar

30-Mar

9-Apr

17-May

15-Jan

28-Jan

6-Apr

27-Apr

7-Jun

22-Mar

19-Apr

20-May

10-Jun

23-Jun

23-Jul

23-Sep

20-Jan

24-Aug

15-Jun

17-Sep

DATE

3-Mar

12-Mar

12-Jan

5-Feb

10-Feb

6-Aug

11-Aug

9-Mar

6-May

11-May

28-Jun

19-Jul

28-Jul

28-Sep

1-Oct

6-Jan

19-Aug

28-May

2-Jun

18-Jun

1-Jul

1-Sep

15-Feb

26-Feb

2-Aug

16-Aug

6-Oct

11-Oct

2-Feb

18-Feb

14-Apr

30-Apr

6-Jul

9-Jul

14-Jul

6-Sep

9-Sep

14-Sep

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Daily Equity Market Report - 11.10.2021Document1 pageDaily Equity Market Report - 11.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report 25.10.2021 2021-10-25Document1 pageDaily Equity Market Report 25.10.2021 2021-10-25Fuaad DodooNo ratings yet

- Daily Equity Market Report - 25.04.2022Document1 pageDaily Equity Market Report - 25.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 31.12.2021Document2 pagesWeekly Capital Market Report - Week Ending 31.12.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.04.2022Document1 pageDaily Equity Market Report - 07.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 16.12.2021 2021-12-16Document1 pageDaily Equity Market Report 16.12.2021 2021-12-16Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.04.2022Document1 pageDaily Equity Market Report - 27.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 17.12.2021Document2 pagesWeekly Capital Market Report - Week Ending 17.12.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.04.2022Document1 pageDaily Equity Market Report - 06.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.04.2022 2022-04-04Document1 pageDaily Equity Market Report 04.04.2022 2022-04-04Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.08.2021Document1 pageDaily Equity Market Report - 26.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.04.2022Document1 pageDaily Equity Market Report - 05.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 02.12.2021 2021-12-02Document2 pagesWeekly Capital Market Report Week Ending 02.12.2021 2021-12-02Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.12.2021Document2 pagesWeekly Capital Market Report - Week Ending 10.12.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 29.10.2021Document2 pagesWeekly Capital Market Report - Week Ending 29.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2021Document1 pageDaily Equity Market Report - 08.09.2021Fuaad DodooNo ratings yet

- Power Finance Corporation 18 08 2021 EmkayDocument10 pagesPower Finance Corporation 18 08 2021 EmkayPavanNo ratings yet

- 2557 - OnDate - 4-3-2021weekly Market Update 040321Document3 pages2557 - OnDate - 4-3-2021weekly Market Update 040321অপুর্ব ভৌমিকNo ratings yet

- Daily Equity Market Report - 24.08.2021Document1 pageDaily Equity Market Report - 24.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.11.2021Document1 pageDaily Equity Market Report - 30.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 25.08.2022Document1 pageDaily Equity Market Report - 25.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.03.2022Document1 pageDaily Equity Market Report - 22.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.09.2021Document1 pageDaily Equity Market Report - 09.09.2021Fuaad DodooNo ratings yet

- Organisational Structure of Ministry of Environment, Forest & Climate Change (Divisions Under Forestry & Wildlife Sector)Document1 pageOrganisational Structure of Ministry of Environment, Forest & Climate Change (Divisions Under Forestry & Wildlife Sector)OkponkuNo ratings yet

- Fertilizer - Sector Update - GlobalDocument1 pageFertilizer - Sector Update - Globalmuddasir1980No ratings yet

- Daily Equity Market Report - 03.08.2022Document1 pageDaily Equity Market Report - 03.08.2022Fuaad DodooNo ratings yet

- KML BSC Monthly Template EN v3Document3 pagesKML BSC Monthly Template EN v3Rinny Heryadi HadjohNo ratings yet

- October AccomplishmentDocument17 pagesOctober AccomplishmentReyma GalingganaNo ratings yet

- 2021 Business PerformanceDocument22 pages2021 Business PerformanceSebastian SinclairNo ratings yet

- Daily Equity Market Report - 24.08.2022Document1 pageDaily Equity Market Report - 24.08.2022Fuaad DodooNo ratings yet

- Daily Wo 17 Februari 2024Document1 pageDaily Wo 17 Februari 2024agusNo ratings yet

- Daily Equity Market Report - 01.09.2021Document1 pageDaily Equity Market Report - 01.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.03.2022Document1 pageDaily Equity Market Report - 15.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- (Invoice) Polygon-Support-AprilDocument2 pages(Invoice) Polygon-Support-AprilSourajyoti GuptaNo ratings yet

- LHBPDocument26 pagesLHBPandras88No ratings yet

- Weekly Progress Report From 21-Oct-2023 To 26-Oct-2023 XDocument70 pagesWeekly Progress Report From 21-Oct-2023 To 26-Oct-2023 XErickson MalicsiNo ratings yet

- Dixon 1QFY22 Result Update - OthersDocument14 pagesDixon 1QFY22 Result Update - OthersjoycoolNo ratings yet

- Daily Equity Market Report - 01.12.2021Document1 pageDaily Equity Market Report - 01.12.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.08.2022Document1 pageDaily Equity Market Report - 17.08.2022Fuaad DodooNo ratings yet

- LEMBAR KERJA Laporan Keuangan 1thnDocument19 pagesLEMBAR KERJA Laporan Keuangan 1thnCool ThryNo ratings yet

- Daily Equity Market Report 29.11.2021 2021-11-29Document1 pageDaily Equity Market Report 29.11.2021 2021-11-29Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Sales Progress 181021Document1 pageDaily Sales Progress 181021Sarohman RohmanNo ratings yet

- Nigerian Stock Recommendation For August 7th 2023Document4 pagesNigerian Stock Recommendation For August 7th 2023DMAN1982No ratings yet

- Daily Equity Market Report - 12.07.2022Document1 pageDaily Equity Market Report - 12.07.2022Fuaad DodooNo ratings yet

- IPC Register - 01-09-2022Document8 pagesIPC Register - 01-09-2022shakibNo ratings yet

- Daily Equity Market Report - 27.07.2022Document1 pageDaily Equity Market Report - 27.07.2022Fuaad DodooNo ratings yet

- Valuation MatrixDocument34 pagesValuation MatrixHaseebPirachaNo ratings yet

- State Bank of India stock pointer after management meetDocument9 pagesState Bank of India stock pointer after management meetvajiravel407No ratings yet

- Daily Equity Market Report 27.06.2022 2022-06-27Document1 pageDaily Equity Market Report 27.06.2022 2022-06-27Fuaad DodooNo ratings yet

- Trading Journal Template 24Document84 pagesTrading Journal Template 24Dery AnggaraNo ratings yet

- Daily Equity Market Report - 06.09.2022Document1 pageDaily Equity Market Report - 06.09.2022Fuaad DodooNo ratings yet

- Weekly Mutual Fund Update 9th June 2019Document5 pagesWeekly Mutual Fund Update 9th June 2019Aslam HossainNo ratings yet

- Daily Equity Market Report 25.07.2022 2022-07-25Document1 pageDaily Equity Market Report 25.07.2022 2022-07-25Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- STMNT 112013 9773Document3 pagesSTMNT 112013 9773redbird77100% (1)

- 74695bos60485 Inter p1 cp5 U1Document20 pages74695bos60485 Inter p1 cp5 U1Just KiddingNo ratings yet

- Technics Oil & Gas: Initiation of CoverageDocument15 pagesTechnics Oil & Gas: Initiation of Coveragecentaurus553587No ratings yet

- DOF Local Finance Circular 3 92Document3 pagesDOF Local Finance Circular 3 92Mykel King Noble100% (4)

- Analysis and Interpretation of Customer Service QualityDocument38 pagesAnalysis and Interpretation of Customer Service QualityArunKumarNo ratings yet

- Forex Indicators GuideDocument3 pagesForex Indicators Guideenghoss77No ratings yet

- 2006-07 - GrasimDocument117 pages2006-07 - GrasimrNo ratings yet

- Volume Profile TradingDocument8 pagesVolume Profile TradingSimon Tin Hann Pyng100% (2)

- M-FAC 4861 - 3 - IFRS 16 Leases Lecture Notes-1Document47 pagesM-FAC 4861 - 3 - IFRS 16 Leases Lecture Notes-1AceNo ratings yet

- Foreign Portfolio Investments in India: Causes and Impact/TITLEDocument25 pagesForeign Portfolio Investments in India: Causes and Impact/TITLElogeshNo ratings yet

- Distressed Debt InvestingDocument5 pagesDistressed Debt Investingjt322No ratings yet

- Digitalization of Securities MarketDocument8 pagesDigitalization of Securities Marketmrinal kumarNo ratings yet

- PR1MA Sales Booking Form Office Copy - TemporaryDocument1 pagePR1MA Sales Booking Form Office Copy - TemporaryBryan Abd AzizNo ratings yet

- Problem #7: Recording Transactions in A Financial Transaction WorksheetDocument17 pagesProblem #7: Recording Transactions in A Financial Transaction Worksheetfabyunaaa100% (1)

- Dusty R BouthilletteDocument16 pagesDusty R Bouthillettedanw5646No ratings yet

- Ias 14Document5 pagesIas 14Khalida UtamiNo ratings yet

- Eugene Fama ThesisDocument7 pagesEugene Fama Thesiskriscundiffevansville100% (1)

- ITO notice for escaped incomeDocument2 pagesITO notice for escaped incomeSukalp WarhekarNo ratings yet

- Cadbury Schweppes DF 2006Document1 pageCadbury Schweppes DF 2006JORGENo ratings yet

- Alchian and Klein - 1973 - On A Correct Measure of InflationDocument20 pagesAlchian and Klein - 1973 - On A Correct Measure of Inflationjpkoning100% (1)

- Banking TSN 2018 2nd ExamDocument54 pagesBanking TSN 2018 2nd ExamAngel DeiparineNo ratings yet

- EuroHedge Summit Brochure - April 2011Document12 pagesEuroHedge Summit Brochure - April 2011Absolute ReturnNo ratings yet

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap020 PDFDocument26 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap020 PDFYopie ChandraNo ratings yet

- Facing A Challenging Financial FutureDocument8 pagesFacing A Challenging Financial FutureCommunity and Voluntary ServiceNo ratings yet

- A Study of Determinants of Investors BehDocument9 pagesA Study of Determinants of Investors BehMegha PatelNo ratings yet

- How To Buy CryptocurrenciesDocument2 pagesHow To Buy CryptocurrenciesObinna ObiefuleNo ratings yet

- 1.financial Performance of A Co-Operative BankDocument2 pages1.financial Performance of A Co-Operative BankN.MUTHUKUMARAN71% (7)

- DNB Bank in Lithuania overviewDocument9 pagesDNB Bank in Lithuania overviewDonata BrukmanaitėNo ratings yet

- Accountancy & Auditing-I Subjective - 1Document4 pagesAccountancy & Auditing-I Subjective - 1zaman virkNo ratings yet

- 17Q June 2016Document95 pages17Q June 2016Juliana ChengNo ratings yet