Professional Documents

Culture Documents

Budgeting Answer

Uploaded by

addsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgeting Answer

Uploaded by

addsCopyright:

Available Formats

LESSON 5 – FINANCIAL PLANNING

Activities/Assessments:

Exercise 5-1: Plano Company has developed the following flexible budget formula for its annual indirect labor cost: Total

costs = P12, 600 + 0. 80 per machine hour. Operating budgets for the current month are based upon 10, 000 machine hours.

How much will be the indirect labor cost to be shown in its planning budget?

Answer Total costs = P12, 600 + 0. 80 per machine hour = P12, 600 x P0.8 (10, 000) = P20, 600

:

Exercise 5-2: Congress Company budgets sales at P4, 000, 000 and expects a profit after interest but before tax of 10% of the

sales. Expenses are estimated as follows: Selling = 15% of sales; administrative = 9% of sales; Finance = 1% of sales. Labor is

expected to be 40% of the total manufacturing costs. Factory overhead is to be applied at 75% of direct labor costs.

Inventories are to be as follows:

January 1 December 31

Materials 250, 000 300, 000

Work-in-Process 200, 000 320, 000

Finished Goods 350, 000 400, 000

Required: Determine the following:

a. Cost of goods sold c. Factory overhead

b. Total manufacturing costs d. Materials purchases

Sales 100% P4, 000, 000

Cost of sales (a) (65%) (2, 600, 000)

GP 35% P1, 400, 00

Selling expense 15%

Administrative 9%

Finance 1% (25%) (1, 000, 000)

Profit after interest but before tax 10% P400, 000

SUBJECT: ACCO20123 FINANCIAL MANAGEMENT 1

PREPARED BY: RODISON E. DE GUIA, CPA

Exercise 5-3: Past Collections experienced by House Company proved that 60% of the net sales billed in a month are collected

during in the month of sales, 30% are collected in the following month, and 10% are collected in the second following month.

A record of monthly net sales of previous months is as follows:

2020 November P450, 000

December 460, 000

2021 January 480, 000

February 420, 000

March 500, 000

April 550, 000

May 600, 000

June 700, 000

On January 1, 2021, the net accounts receivable balance showed P229, 000.

Required: Determine the following:

a. The monthly collection from January to June.

b. The balance of accounts receivable per month.

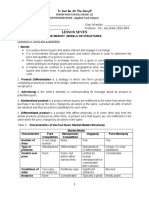

SOLUTION GUIDE TO EXERCISE 5-3

SUBJECT: ACCO20123 FINANCIAL MANAGEMENT 2

PREPARED BY: RODISON E. DE GUIA, CPA

Exercise 5-4: ZENKI Company is now in the process of preparing a production budget and budgeted purchases of raw

materials in the third quarter. Past experience has shown that end-of-month inventories of finished goods must equal 40% of

the next month’s sales. Each unit of product requires 2 pounds of material and it cost P1.5 per pound. The inventory Finished

Goods and Raw materials at the end of June was 20, 000 units and 30, 000 pounds, respectively. The company’s budgeted

amount is shown below:

Sale in Raw materials,

Units End. (lbs.)

July 60, 000 35, 000

August 90, 000 40, 000

September 120, 000 45, 000

October 100, 000 50, 000

Required:

a. Prepare a production budget for the third quarter per month and in total.

b. Prepare budgeted purchases of raw materials in Pounds and in Pesos.

c. Assume: Each product of Zenki requires 1.5 of direct labor hours and it pays P5 per direct labor hour while the factory

overhead is applied at 80% of direct labor cost. Compute the total amount of conversion costs incurred during the

period.

Solution Guide:

SUBJECT: ACCO20123 FINANCIAL MANAGEMENT 3

PREPARED BY: RODISON E. DE GUIA, CPA

Exercise 5-5: Planners Company has developed the following flexible budget formula for its annual indirect labor cost: Total

costs = P 19, 200 + 0. 80 per machine hour. Compute the total amount of indirect labor cost to be shown in its planning

budget assuming that the company consumes:

a. 10, 000 machine hours = 19, 800 x (0.8 x 10, 000) = P27, 200

b. 12, 500 machine hours = 19, 800 + (0.8 x 12, 500) = 29, 200

c. 8, 900 machine hours = 19, 800 + (0.8 x 18, 900) = 26, 320

d. 15, 200 machine hours = 19, 800 + (0.8 x 15, 200) = 31, 360

e. 13, 400 machine hours = 19, 800 + (0.8 x 13, 400) = 29, 920

Exercise 5-6: DBM Manufacturing budgets sales at P8, 000, 000 and expects a profit after interest but before tax of 10% of

the sales. Expenses are estimated as follows: Selling = 8% of sales; administrative = 16% of sales; Finance = 1% of sales. Labor

is expected to be 50% of the total manufacturing costs. Factory overhead is to be applied at 60% of direct labor costs.

Inventories are to be as follows:

January 1 December 31

Materials 500, 000 600, 000

Work-in-Process 400, 000 640, 000

Finished Goods 700, 000 800, 000

Required: Determine the following budgeted amount:

a. Selling Expenses i. Total manufacturing costs

b. Administrative expenses j. Applied FOH

c. Finance costs k. Direct labor

d. Net profit l. Direct materials used

e. Cost of goods sold m. Total materials available for use

f. Cost of goods available for sales n. material purchases

g. Cost of goods manufactured o. Gross Profit

h. total cost of goods placed into process

Sales 100% P8, 000, 000

Cost of sales e. (65%) (5, 200, 000)

GP o. 35% P2, 800, 00

Selling expense a. (8%) (640, 000)

Administrative b. (16%) (1, 280, 000)

Finance c. (1%) (80, 000)

Profit after interest but before tax d. 10% P800, 000

RM, Beg. 500,000

Add: Purchases 1,208,000 n.

Total materials available for use 1,708,000 m.

Less: RM, End. 600,000

RM used 1,108,000 l.

Direct Labor (50% of TMC) 2,770,000 k.

FOH (60% OF DLC) 1,662,000 j.

Total Manufacturing Costs 5,540,000 i.

Add: WIP, Beg. 400,000

Total cost of production put into process 5,940,000 h.

Less: WIP, end. 640,000

SUBJECT: ACCO20123 FINANCIAL MANAGEMENT 4

PREPARED BY: RODISON E. DE GUIA, CPA

Cost of Goods Manufactured 5,300,000 g.

Add: Finished Goods, Beg. 700,000

Cost of Goods Available for Sale 6,000,000 f.

Less: Finished Goods, End. 800,000

Cost of Sales 5,200,000 e.

Raw Materials

Use

Beg. 500,000 d 1,108,000 DM used 1, 108, 000

Purchases 1,208,000 End. 600,000 DL (50% of TMC) 2, 770, 000

Tota

Total 1,708,000 l 1,708,000 FOH (60% of DLC) 1, 662, 000

Total TMC 5, 540, 000

WIP FG

Beg. 400,000 CGM 5,300,000 Beg. 700,000 CGS 5,200,000

TMC 5,540,000 End. 640,000 CGM 5,300,000 End. 800,000

Tota Tota Tota Tota

l 5,940,000 l 5,940,000 l 6,000,000 l 6,000,000

Exercise 5-7: Past Collections experienced by COLLECTOR Company proved that 40% of the net sales billed in a month are

collected during the month of sales, 30% in the following month, 20% are collected in the second following month and the

balance are collected in the third following month. A record of monthly net sales of previous months is as follows:

January - P500, 000

February - 560, 000

March - 600, 000

April - 680, 000

May - 650, 000

June - 700, 000

July - 725, 000

August - 740, 000

September - 800, 000

Required: Compute the following:

a. The balance of Accounts Receivables on March 31, 2021

b. The monthly collections from April to September

c. The ending balance of accounts receivable per month (April to September)

d. total collections for the 2nd quarter and for the 3rd quarter.

SUBJECT: ACCO20123 FINANCIAL MANAGEMENT 5

PREPARED BY: RODISON E. DE GUIA, CPA

a. Computation of Beginning AR, April 1.

From Jan. Sales (500, 000 x 10%) P50, 000

From Feb. Sales (560, 000 x 30%) or (112, 000 + 56, 000) 168, 000

From Mar. Sales (600, 000 x 60%) or (180, 000 + 120, 000 + 60, 000) 360, 000

Beginning Balance of AR, April 1 P578, 000

b. Schedule of Monthly Collections

Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec.

Jan. P500, 000 200, 000 150, 000 100, 000 50, 000

Feb. 560, 000 224, 000 168, 000 112, 000 56, 000

Mar. 600, 000 240, 000 180, 000 120, 000 60, 000

Apr. 680, 000 272, 000 204, 000 136, 000 68, 000

May 650, 000 260, 000 195, 000 130, 000 65, 000

June. 700, 000 280, 000 210, 000 140, 000 70, 000

July 725, 000 290, 000 217, 500 145, 000 72, 500

Aug. 740, 000 296, 000 222, 000 148, 000 74, 000

Sept. 800, 000 - - - - - 320, 000 240, 000 160, 000 80, 000

Total P614, 000 P640, 000 P671, 000 P698, 000 P718, 500 P757, 000

Month of sales - 40% 2nd following month - 20%

Following month - 30% 3rd following month - 10%

c. Schedule of 2021 Monthly Accounts Receivable

April May June July August September

Beginning P578, 000 P644, 000 P654, 000 P683, 000 P710, 000 P731, 500

Net credit sales 680, 000 650, 000 700, 000 725, 000 740, 000 800, 000

Total P1, 258, 000 P1, 294, 000 P1, 354, 000 P1, 408, 000 P1, 450, 000 P1, 531, 500

Collections (614, 000) (640, 000) (671, 000) (698, 000) (718, 500) (757, 000)

Ending P644, 000 P654, 000 P683, 000 P710, 000 P731, 500 P774, 500

d. 2nd Quarter – P614, 000 + 640, 000 + P671, 000 = P1, 925, 000

3rd Quarter – P698, 000 + P718, 500 + P757, 000 = P2, 173, 500

SUBJECT: ACCO20123 FINANCIAL MANAGEMENT 6

PREPARED BY: RODISON E. DE GUIA, CPA

SUBJECT: ACCO20123 FINANCIAL MANAGEMENT 7

PREPARED BY: RODISON E. DE GUIA, CPA

You might also like

- O Variations in Accounting Methods o TimingDocument8 pagesO Variations in Accounting Methods o TimingAeris StrongNo ratings yet

- ACCTG 101 Chapter 1 11Document60 pagesACCTG 101 Chapter 1 11Jemalyn TarucNo ratings yet

- Accounting ReviewerDocument15 pagesAccounting ReviewerDeryll MacanasNo ratings yet

- Quizzes - Chapter 4 - Types of Major Accounts.Document3 pagesQuizzes - Chapter 4 - Types of Major Accounts.Mechaella Shella Ningal ApolinarioNo ratings yet

- Cash Flow Statement for Joshtine CompanyDocument3 pagesCash Flow Statement for Joshtine CompanyTshina Jill BranzuelaNo ratings yet

- Here are the answers:1. Total Assets = $1,044,5002. Total Liabilities = $237,900 3. Total Owner's Equity = $806,6004. Total Revenues = $350,0005. Total Expenses = $13,4006. Net Income = $336,600Document28 pagesHere are the answers:1. Total Assets = $1,044,5002. Total Liabilities = $237,900 3. Total Owner's Equity = $806,6004. Total Revenues = $350,0005. Total Expenses = $13,4006. Net Income = $336,600Dia Did L. RadNo ratings yet

- Accounting ReviewerDocument5 pagesAccounting ReviewerNoelyn PaghubasanNo ratings yet

- Completing Accounting Cycle ProblemsDocument8 pagesCompleting Accounting Cycle ProblemsCha Eun WooNo ratings yet

- Comprehensive Prob Bank Recon - Sample ProblemDocument2 pagesComprehensive Prob Bank Recon - Sample ProblemKez MaxNo ratings yet

- Time Value of Money OutlineDocument14 pagesTime Value of Money OutlineEmman LubisNo ratings yet

- Financial Accounting & Reporting ReviewerDocument21 pagesFinancial Accounting & Reporting ReviewerRosemarie GoNo ratings yet

- FABM2 Module - 1Document3 pagesFABM2 Module - 1Jennifer NayveNo ratings yet

- Answer Key - Exercise Problems Investment in Debt SecuritiesDocument5 pagesAnswer Key - Exercise Problems Investment in Debt SecuritiesApply Ako Work EhNo ratings yet

- Introduction To Financial ManagementDocument17 pagesIntroduction To Financial ManagementAisah ReemNo ratings yet

- BAM 127 Day 11 - TGDocument8 pagesBAM 127 Day 11 - TGPaulo BelenNo ratings yet

- Quiz 2 Accounting Principles Without AnswerDocument4 pagesQuiz 2 Accounting Principles Without AnswerJazzy MercadoNo ratings yet

- Quiz BowlDocument2 pagesQuiz Bowlaccounting probNo ratings yet

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- FUNDACC1 - Reviewer (Theories)Document12 pagesFUNDACC1 - Reviewer (Theories)MelvsNo ratings yet

- SHAREHOLDERSDocument6 pagesSHAREHOLDERSJoana MarieNo ratings yet

- CFAS ReviewerDocument17 pagesCFAS ReviewerJoshua Vladimir RodriguezNo ratings yet

- Lesson 1 Statement of Financial PositionDocument22 pagesLesson 1 Statement of Financial PositionMylene SantiagoNo ratings yet

- Accounting for Merchandise Business Practice SetsDocument7 pagesAccounting for Merchandise Business Practice SetsElla Mae SaludoNo ratings yet

- Partnership Operations: Illustrations: Case 1. EquallyDocument15 pagesPartnership Operations: Illustrations: Case 1. EquallyChe NelynNo ratings yet

- CFAS - Final Exam ADocument11 pagesCFAS - Final Exam AKristine Esplana ToraldeNo ratings yet

- BAM 127 Day 8 - TGDocument9 pagesBAM 127 Day 8 - TGPaulo BelenNo ratings yet

- Q1Document3 pagesQ1Joylyn CombongNo ratings yet

- Wasting Assets Impairment of AssetsDocument14 pagesWasting Assets Impairment of AssetsJohn Ferd M. FerminNo ratings yet

- Exercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotDocument15 pagesExercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotCherry Doong CuantiosoNo ratings yet

- Assets Liabilities Owner'S Equity Income ExpensesDocument2 pagesAssets Liabilities Owner'S Equity Income ExpensesRalph Christer Maderazo0% (1)

- AC 3 - Intermediate Acctg' 1 (Ate Jan Ver)Document119 pagesAC 3 - Intermediate Acctg' 1 (Ate Jan Ver)John Renier Bernardo100% (1)

- Notes For Civil Code Article 1177 and Article 1178Document5 pagesNotes For Civil Code Article 1177 and Article 1178Chasz CarandangNo ratings yet

- True or FalseDocument76 pagesTrue or FalsepangytpangytNo ratings yet

- PrelimsDocument24 pagesPrelimsRhea BadanaNo ratings yet

- 3 Adjusting Entries HandoutsDocument10 pages3 Adjusting Entries HandoutsJuan Dela CruzNo ratings yet

- Sec Code of Corporate Governance AnswerDocument3 pagesSec Code of Corporate Governance AnswerHechel DatinguinooNo ratings yet

- Quiz Chapter-2 Partnership-Operations 2020-EditionDocument7 pagesQuiz Chapter-2 Partnership-Operations 2020-EditionShaz NagaNo ratings yet

- Accounting 2Document28 pagesAccounting 2cherryannNo ratings yet

- Questionnaire Expenditure CycleDocument1 pageQuestionnaire Expenditure Cycleleodenin tulangNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- Exercises in Statement of Financial PositionDocument5 pagesExercises in Statement of Financial PositionQueen ValleNo ratings yet

- Assets: Pedro Castro Statement of Financial Position October 1, 2016Document2 pagesAssets: Pedro Castro Statement of Financial Position October 1, 2016Mandy Bloom0% (1)

- Module Part I Preface To UNIT I PDFDocument43 pagesModule Part I Preface To UNIT I PDFsvpsNo ratings yet

- CH 9 - Completing The Cycle - MerchandisingDocument38 pagesCH 9 - Completing The Cycle - MerchandisingJem Bobiles100% (1)

- Accounting For RECEIVABLES PDFDocument3 pagesAccounting For RECEIVABLES PDFZeus GamoNo ratings yet

- Provisions, Cont. Liability, & Cont. AssetsDocument40 pagesProvisions, Cont. Liability, & Cont. Assetsyonas alemuNo ratings yet

- Job Costing Finished Goods InventoryDocument46 pagesJob Costing Finished Goods InventoryNavindra JaggernauthNo ratings yet

- CFAS Notes Chapter 2 Conceptual FrameworkDocument3 pagesCFAS Notes Chapter 2 Conceptual FrameworkUyara LeisbergNo ratings yet

- Financial Reporting EssentialsDocument20 pagesFinancial Reporting EssentialsAnastasha Grey100% (1)

- Intacc 3Document102 pagesIntacc 3sofiaNo ratings yet

- Performance Task 2Document1 pagePerformance Task 2wivadaNo ratings yet

- Re BVPS EpsDocument4 pagesRe BVPS EpsVeron BrionesNo ratings yet

- CF Objective of Financial ReportingDocument6 pagesCF Objective of Financial Reportingpanda 1No ratings yet

- Cfas - Chapter 4 - Exercise 1Document8 pagesCfas - Chapter 4 - Exercise 1BlueBladeNo ratings yet

- Week 1 Calculate Future Value and Present Value of Money: Business FinanceDocument6 pagesWeek 1 Calculate Future Value and Present Value of Money: Business FinanceTwelve Forty-fourNo ratings yet

- Acctg7-MIDTERM REVIERDocument9 pagesAcctg7-MIDTERM REVIERDave ManaloNo ratings yet

- Adjusting Entries ProblemsDocument5 pagesAdjusting Entries ProblemsDirck VerraNo ratings yet

- Learning Activity Sheet Business FinanceDocument9 pagesLearning Activity Sheet Business FinanceVon Violo BuenavidesNo ratings yet

- Q1 SMEsDocument6 pagesQ1 SMEsJennifer RasonabeNo ratings yet

- Master SiomaiDocument18 pagesMaster SiomaiShierdy Lynn E. NorialNo ratings yet

- Faith, Growth & SuccessDocument1 pageFaith, Growth & SuccessaddsNo ratings yet

- Faith, Growth & SuccessDocument1 pageFaith, Growth & SuccessaddsNo ratings yet

- Module 4 - Types of Application SoftwareDocument7 pagesModule 4 - Types of Application SoftwareaddsNo ratings yet

- Q and A Partnership Business LawDocument50 pagesQ and A Partnership Business LawJohn Bernie100% (2)

- Budgeting AnswerDocument7 pagesBudgeting AnsweraddsNo ratings yet

- Group 2 Cardinal SummaryDocument2 pagesGroup 2 Cardinal SummaryaddsNo ratings yet

- Chapter 6 Multiple-Choice Questions on Auditing Standards & ProceduresDocument20 pagesChapter 6 Multiple-Choice Questions on Auditing Standards & ProceduresJeffreyBeridaNo ratings yet

- Discipline and Grievance ManagementDocument176 pagesDiscipline and Grievance ManagementTMTCS HR100% (1)

- Transaksi Interperusahaan - Obligasi UpstreamDocument11 pagesTransaksi Interperusahaan - Obligasi UpstreaminugNo ratings yet

- How To Draft Publicity Guidelines For Product and Corporate Ads During An IPODocument14 pagesHow To Draft Publicity Guidelines For Product and Corporate Ads During An IPODinesh GadkariNo ratings yet

- Ambit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFDocument15 pagesAmbit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFRobert StanleyNo ratings yet

- Overview of CIRIA's Guides and A Brief Introduction To LeanDocument12 pagesOverview of CIRIA's Guides and A Brief Introduction To LeanPietroNo ratings yet

- Business Plan The Wine Store Business PlanDocument18 pagesBusiness Plan The Wine Store Business Plandan6780% (1)

- S 522 Subcontracting Tests CalibrationDocument7 pagesS 522 Subcontracting Tests CalibrationRama Reddy100% (1)

- 145 Ijmperdfeb2018145Document10 pages145 Ijmperdfeb2018145TJPRC PublicationsNo ratings yet

- Tabel Penelitian TerdahuluDocument3 pagesTabel Penelitian TerdahuluFachrurozie AlwieNo ratings yet

- Yogesh Project Sem6Document28 pagesYogesh Project Sem6Sushrut chauhanNo ratings yet

- Advanced Financial Accounting QuizDocument53 pagesAdvanced Financial Accounting Quizanon nimusNo ratings yet

- CH 14 - MCQ PDFDocument11 pagesCH 14 - MCQ PDFYAHIA ADELNo ratings yet

- Assignment PDFDocument31 pagesAssignment PDFKhanNo ratings yet

- Acqualisa: 1. Is This A Good Product?Document39 pagesAcqualisa: 1. Is This A Good Product?Sirsha PattanayakNo ratings yet

- Target AudienceDocument9 pagesTarget Audiencenikita andhaleNo ratings yet

- Employee WalfareDocument107 pagesEmployee Walfarejitendra jaushikNo ratings yet

- Evaluating HRM EffectivenessDocument11 pagesEvaluating HRM EffectivenessVishal Jagetia100% (4)

- Unit SBDocument6 pagesUnit SBPaola Andrea Peña AraujoNo ratings yet

- Ethics in Production/Operation ManagementDocument29 pagesEthics in Production/Operation ManagementSuyog Pitale78% (18)

- Citi BankDocument40 pagesCiti BankZeeshan Mobeen100% (1)

- Financial Accounting and Accounting StandardsDocument31 pagesFinancial Accounting and Accounting StandardsAlbert Adi NugrohoNo ratings yet

- Strategic Brand ManagementDocument4 pagesStrategic Brand Managementivan rickyNo ratings yet

- Chapter 1aDocument33 pagesChapter 1aVasunNo ratings yet

- Final Accounts SolutionDocument11 pagesFinal Accounts SolutionmerakiNo ratings yet

- Atb Cell ManualDocument63 pagesAtb Cell Manualramyarayee100% (1)

- Econ Micro Canadian 1st Edition Mceachern Solutions ManualDocument13 pagesEcon Micro Canadian 1st Edition Mceachern Solutions ManualMrsJenniferCarsonjrcy100% (57)

- Partnership Formation ReviewerDocument24 pagesPartnership Formation ReviewerJyasmine Aura V. AgustinNo ratings yet

- LELE21M880POD22001056Document4 pagesLELE21M880POD22001056Bhavik KakkaNo ratings yet

- The Power of Emotional Branding Towards Brand Identity: DR - Fermin G. Castillo, JRDocument6 pagesThe Power of Emotional Branding Towards Brand Identity: DR - Fermin G. Castillo, JRJez San JoseNo ratings yet

- SHS LESSON 7 Market Models or StructuresDocument12 pagesSHS LESSON 7 Market Models or StructuresPaul AnteNo ratings yet