Professional Documents

Culture Documents

Accounting For Production Losses

Uploaded by

Vince Christian PadernalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Production Losses

Uploaded by

Vince Christian PadernalCopyright:

Available Formats

lOMoARcPSD|7304102

Accounting for Production Losses

Accountancy (Wesleyan University-Philippines)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Vince Christian Padernal (padernalvce@gmail.com)

lOMoARcPSD|7304102

Accounting for Production Losses

Introduction:

Accounting for production losses such as scrap, spoiled goods, and defective goods are also discussed

below. These production losses are an unavoidable part of ordinary manufacturing operations.

Body:

In a job order costing system, production losses that happens in the manufacturing process includes cost

of scrap materials, spoiled goods (spoilage) and reworking defective goods. A cost accounting system

must be designed to record these losses so that the unit cost will be as accurate as possible.

Accounting for Scrap

Scrap – residue of manufacturing process. These are materials left over when making a product. Scrap

materials often has a value and usually stored until it is sold to scrap dealers or other entity.

1. Recognizing scrap at the time of sale

a. If the value of scrap is low or immaterial

Cash or Accounts Receivable xxx

Scrap Revenues xxx

b. If the value of scrap is material

i. Scrap is attributable to a specific job – the proceeds from the sale are deducted

from the cost of materials that have been charged to that job.

Cash or Accounts Receivable xxx

Work in Process Inventory xxx

ii. Scrap is common to all jobs

Cash or Accounts Receivable xxx

Manufacturing Overhead Control xxx

2. Recognizing scrap at the time of production

a. Scrap is attributable to a specific job

Scrap Inventory xxx

Work in Process Inventory xxx

b. Scrap is common to all jobs

Scrap inventory xxx

Manufacturing Overhead Control xxx

When the scrap is sold:

Cash or Accounts Receivable xxx

Scrap Inventory xxx

When scrap is sold for less than the value at which it is recorded:

Cash or Accounts Receivable xxx

Work in Process Inventory xxx

Scrap Inventory xxx

Waste – raw materials left over from a production process for which there is no further use. It is not

usually salable at any price and must be discarded.

Downloaded by Vince Christian Padernal (padernalvce@gmail.com)

lOMoARcPSD|7304102

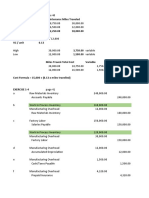

Accounting for Spoiled Goods

Spoiled goods – goods that have been damaged through imperfect machining or processing.

Illustration

Assume that Job 888 calls for the production of 200 painted office tables. These tables were put into

production and costs accumulated to date are as follows:

Materials Php 456,000

Direct labor 240,000

Applied overhead (150% of DL) 360,000

Total cost charge to Job 888 Php 1,056,000

Unit cost (Php 1,056,000 / 200) Php 5,280

Suppose that ten tables are spoiled. These spoiled tables may be sold at its net disposal value of Php

3,000 each (a loss of Php 2,280 per table). Job 888 is sold with a 30% mark up on cost.

1. Spoilage is attributable to a specific job (Due to customers specifications)

Spoiled Goods Inventory 30,000

Work in Process Inventory 30,000

Finished Goods 1,026,000

Work in Process Inventory 1,026,000

Cash or Accounts Receivable 1,333,800

Sales 1,333,800

Cost of Goods Sold 1,026,000

Finished Goods 1,026,000

Cash or Accounts Receivable 30,000

Spoiled Goods Inventory 30,000

2. Spoilage is common to all jobs (Due to internal failure)

Spoiled Goods Inventory 30,000

Manufacturing Overhead Control 22,800

Work in Process Inventory 52,800

Finished Goods Inventory 1,003,200

Work in Process Inventory 1,003,200

Cash or Accounts Receivable 1,304,160

Sales 1,304,160

Cost of Goods Sold 1,003,200

Finished Goods Inventory 1,003,200

Spoilage cost charged to

Specific job All production

Total cost of 200 tables Php 1,056,000 Php 1,056,000

Less: Scrap value of Job 888 30,000

All production (Php 5,280 x 10) 52,800

Cost of goods tables 1,026,000 1,003,200

Divided by goods tables 190 190

Downloaded by Vince Christian Padernal (padernalvce@gmail.com)

lOMoARcPSD|7304102

Cost of goods tables Php 5,400 Php 5,280

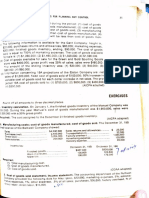

Accounting for Defective Goods

Defective goods – units of production that fail to meet production standards but that can be brought up

to standard by adding more materials, labor, and overhead. The additional cost required to bring these

goods up to standard are call rework costs.

Illustration

Assume that the ten spoiled tables are reworked. The additional costs of reworking the tables equal Php

9,500 (comprising of Php 2,000 direct materials, Php 3,000 direct labor, and Php 4,500 manufacturing

overhead). The journal entry to record the total costs of the ten spoiled goods before considering

rework costs is:

Work in Process Inventory 52,800

Materials 22,800

Payroll 12,000

Applied Manufacturing Overhead 18,000

1. Rework cost is charged to a specific job

Work in Process Inventory 9,500

Materials 2,000

Factory Payroll 3,000

Applied Manufacturing Overhead 4,500

Finished Goods Inventory 52,300

Work in Process Inventory 52,300

Cash or Accounts Receivable 67,990

Sales 67,990

Cost of Goods Sold 52,300

Finished Goods Inventory 52,300

2. Rework cost is charged to all jobs

Manufacturing Overhead Control 9,500

Materials 2,000

Factory Payroll 3,000

Applied Manufacturing Overhead 4,500

Finished Goods Inventory 1,056,000

Work in Process Inventory 1,056,000

Cash or Accounts Receivable 1,372,800

Sales 1,372,800

Cost of Goods Sold 1,056,000

Finished Goods Inventory 1,056,000

Summary:

These production losses usually originate from lack of quality control and should be prevented if not

eliminated at all.

Downloaded by Vince Christian Padernal (padernalvce@gmail.com)

lOMoARcPSD|7304102

References:

Cost Accounting Principles and Procedural Applications by Pedro P. Guerrero, 2014-2015 edition

Downloaded by Vince Christian Padernal (padernalvce@gmail.com)

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Operational Profitability: Systematic Approaches for Continuous ImprovementFrom EverandOperational Profitability: Systematic Approaches for Continuous ImprovementNo ratings yet

- Manufacturing Accounts FormatDocument7 pagesManufacturing Accounts Formatlaguda babajide100% (10)

- Chapter 3 Job Order CostingDocument20 pagesChapter 3 Job Order Costingazam_rasheedNo ratings yet

- Iodine Clock ReactionDocument3 pagesIodine Clock Reactionsunny_415No ratings yet

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- Chapter 11 - Joint and by ProductDocument41 pagesChapter 11 - Joint and by ProductSheena Belleza Fernan89% (28)

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- ExercisesDocument7 pagesExercisesMaryjane De GuzmanNo ratings yet

- Chapter 6-Process Costing: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8Document68 pagesChapter 6-Process Costing: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8Jose Dula IINo ratings yet

- CH 02 Job Order Costing TestbankDocument66 pagesCH 02 Job Order Costing TestbankVince Christian PadernalNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentCharles BarcelaNo ratings yet

- Bio-Fertilizer Data SheetDocument1 pageBio-Fertilizer Data SheetOnyekachi MacaulayNo ratings yet

- 1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsDocument8 pages1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsMeg sharkNo ratings yet

- The and First: Following CostsDocument20 pagesThe and First: Following CostsVince Christian Padernal100% (1)

- Production Losses in Job OrderDocument4 pagesProduction Losses in Job OrderJoshua CabinasNo ratings yet

- Acco 20073 - Cost Accounting & Control: ApplicationsDocument23 pagesAcco 20073 - Cost Accounting & Control: ApplicationsMaria Kathreena Andrea AdevaNo ratings yet

- Nasoalveolar Moulding Seminar at MalakkaraDocument54 pagesNasoalveolar Moulding Seminar at MalakkaraAshwin100% (1)

- Mechanical Operation Slurry TransportDocument113 pagesMechanical Operation Slurry TransportIsrarulHaqueNo ratings yet

- MSC Nursing Approved Thesis Topics 2009-12Document32 pagesMSC Nursing Approved Thesis Topics 2009-12Anonymous 4L20Vx60% (5)

- Job Order Costing Spoilage Defective - StudentDocument4 pagesJob Order Costing Spoilage Defective - StudentVince Christian PadernalNo ratings yet

- Finished Goods Inventories XX Work in Progress XX To Record The Completed JobDocument6 pagesFinished Goods Inventories XX Work in Progress XX To Record The Completed JobClarissa TeodoroNo ratings yet

- Manufacturing OperationsDocument14 pagesManufacturing OperationsGet BurnNo ratings yet

- No. 4-37 Page 146Document6 pagesNo. 4-37 Page 146Nemalai VitalNo ratings yet

- ACC104 - Job Order Costing - For PostingDocument22 pagesACC104 - Job Order Costing - For PostingYesha SibayanNo ratings yet

- Completing The Cost Cycle and Accounting For Production LossesDocument10 pagesCompleting The Cost Cycle and Accounting For Production LossesKhai Ed PabelicoNo ratings yet

- Chapter 20Document13 pagesChapter 20Nguyên BảoNo ratings yet

- Cost Acctg FormulaDocument2 pagesCost Acctg FormulaMYRLAN ANDRE ELY FLORESNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- BS230 - Assignment #2Document8 pagesBS230 - Assignment #2Malcolm TumanaNo ratings yet

- Cost Systems: TermsDocument19 pagesCost Systems: TermsJames BarzoNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Banitog, Brigitte C. BSA 211Document8 pagesBanitog, Brigitte C. BSA 211MyunimintNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingjungoosNo ratings yet

- Busi 1002 RDocument11 pagesBusi 1002 RHarry HamiltonNo ratings yet

- Finished Goods ControlDocument7 pagesFinished Goods ControlMohammad Fadil solhinNo ratings yet

- Mod7 Part 2 Manufacturing OperationsDocument24 pagesMod7 Part 2 Manufacturing Operationsmarjorie magsinoNo ratings yet

- Budgetedmanufacturing Overhead Budgeted Machine Hours: Problem 3-43Document3 pagesBudgetedmanufacturing Overhead Budgeted Machine Hours: Problem 3-43Yanwar A MerhanNo ratings yet

- Jawaban CH 3 (2) Problem 3-43 AKB ASLABDocument5 pagesJawaban CH 3 (2) Problem 3-43 AKB ASLABRantiyaniNo ratings yet

- Afar1 Grp4 Acctng4materials Jit BackflushDocument39 pagesAfar1 Grp4 Acctng4materials Jit BackflushAngela Miles DizonNo ratings yet

- Sample Problems With AnswerDocument7 pagesSample Problems With AnswerCatherine OrdoNo ratings yet

- Sample Problems With AnswerDocument7 pagesSample Problems With AnswerCatherine OrdoNo ratings yet

- MGT Accounting, Intermideiate-SolutionsDocument31 pagesMGT Accounting, Intermideiate-SolutionsRONALD SSEKYANZINo ratings yet

- Cost AccDocument27 pagesCost AccAngel PulvinarNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Just-In-Time With PDF Final ADocument17 pagesJust-In-Time With PDF Final AMirante DalapaNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Chapter 3 Cost AccountingDocument2 pagesChapter 3 Cost AccountingJacob DiazNo ratings yet

- Kunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34Document3 pagesKunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34RantiyaniNo ratings yet

- Acco 20073 Instructional Materials CompressDocument23 pagesAcco 20073 Instructional Materials CompressNestyn Hanna VillarazaNo ratings yet

- Process CostingDocument35 pagesProcess CostingAditya Chandrayan75% (4)

- Cost Sheet BAFDocument16 pagesCost Sheet BAFShaji KuttyNo ratings yet

- Cost Accounting TutorialDocument49 pagesCost Accounting TutorialpreciousegualanNo ratings yet

- Manufacturing Account NotesDocument7 pagesManufacturing Account Notesdayna davisNo ratings yet

- Chapter 3 Cost Accounting CycleDocument11 pagesChapter 3 Cost Accounting CycleSteffany RoqueNo ratings yet

- تمرين 1Document4 pagesتمرين 1نجم الدين طه الشرفيNo ratings yet

- Pgp26 Cma 4 CostsheetDocument15 pagesPgp26 Cma 4 CostsheetRaghav khannaNo ratings yet

- Exercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingDocument4 pagesExercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingCynthia WongNo ratings yet

- 5.1 - Accounting For Production Losses (Job Order Costing)Document7 pages5.1 - Accounting For Production Losses (Job Order Costing)Karyl FailmaNo ratings yet

- Accounting QuestionsDocument7 pagesAccounting QuestionsleneNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Week 5 Tutorial SolutionDocument6 pagesWeek 5 Tutorial SolutionRosemarie Mae DezaNo ratings yet

- To Record Raw Materials Purchased On AccountDocument4 pagesTo Record Raw Materials Purchased On AccountKathleen MercadoNo ratings yet

- Huron CorporationDocument4 pagesHuron CorporationAitesam UllahNo ratings yet

- Company: ManufacturingDocument8 pagesCompany: Manufacturingzain khalidNo ratings yet

- Solution To Chapter 3 E3 23,24,26,28,30, E3 38,31,33, P3 45Document7 pagesSolution To Chapter 3 E3 23,24,26,28,30, E3 38,31,33, P3 45Mark GilNo ratings yet

- ELEMOS, Marianne Joselle D.-BSM21-HW#4Document8 pagesELEMOS, Marianne Joselle D.-BSM21-HW#4Marianne ElemosNo ratings yet

- Module 5 Accounting For Manufacturing BusinessDocument5 pagesModule 5 Accounting For Manufacturing Businessmariella ellaNo ratings yet

- Accounting For Joint ProductsDocument16 pagesAccounting For Joint ProductsVince Christian PadernalNo ratings yet

- Obligations and Contracts - Hector de LeonDocument905 pagesObligations and Contracts - Hector de LeonEszle Ann L. ChuaNo ratings yet

- Present Value TablesDocument4 pagesPresent Value TablesstcreamNo ratings yet

- MSDS TSHDocument8 pagesMSDS TSHdwiNo ratings yet

- Operations Manual: Conical Burr Coffee GrinderDocument15 pagesOperations Manual: Conical Burr Coffee Grindercherrera73No ratings yet

- Organisational Behaviour DEC 2022Document10 pagesOrganisational Behaviour DEC 2022Rajni KumariNo ratings yet

- Substation Off Line and Hot Line CommissioningDocument3 pagesSubstation Off Line and Hot Line CommissioningMohammad JawadNo ratings yet

- Cable Test Bridge KMK 7Document2 pagesCable Test Bridge KMK 7zaki3speedNo ratings yet

- Bio 2Document3 pagesBio 2ganchimeg gankhuuNo ratings yet

- Bylaws-Craigs Mill Hoa 2013Document10 pagesBylaws-Craigs Mill Hoa 2013api-243024250No ratings yet

- ASME Single Certification MarkDocument3 pagesASME Single Certification MarkahmadghasusNo ratings yet

- Lifan 152F Engine Parts (80Cc) : E 01 Crankcase AssemblyDocument13 pagesLifan 152F Engine Parts (80Cc) : E 01 Crankcase AssemblySean MurrayNo ratings yet

- Reading Passage 1: IELTS Recent Actual Test With Answers Volume 1Document17 pagesReading Passage 1: IELTS Recent Actual Test With Answers Volume 1Amogha GadkarNo ratings yet

- Offshore Drilling Operation in East Indonesia Oil and Gas FieldsDocument3 pagesOffshore Drilling Operation in East Indonesia Oil and Gas FieldsMuhammad Galih Eko SaputroNo ratings yet

- Paraffin Wax Deposition: (The Challenges Associated and Mitigation Techniques, A Review)Document8 pagesParaffin Wax Deposition: (The Challenges Associated and Mitigation Techniques, A Review)Jit MukherheeNo ratings yet

- CORONADocument25 pagesCORONAMohammedNo ratings yet

- 2018 Wassce Integrated Science 1Document6 pages2018 Wassce Integrated Science 1Theophilus Asante-TannorNo ratings yet

- Structure of AtomDocument90 pagesStructure of Atomnazaatul aaklimaNo ratings yet

- Ark of The Covenant Montessori Chamber of Learning PoblacionDocument3 pagesArk of The Covenant Montessori Chamber of Learning PoblacionMaiAce Sean Shawn SynneNo ratings yet

- Inquiries Research Titles SOP ExamplesDocument10 pagesInquiries Research Titles SOP ExamplesEunice Pineza ManlunasNo ratings yet

- MOLYKOTE 1000 Paste 71-0218H-01Document2 pagesMOLYKOTE 1000 Paste 71-0218H-01Victor PomboNo ratings yet

- Algerian Carob Tree Products PDFDocument10 pagesAlgerian Carob Tree Products PDFStîngă DanielaNo ratings yet

- Rozdział 12 Słownictwo Grupa BDocument1 pageRozdział 12 Słownictwo Grupa BBartas YTNo ratings yet

- Master of International HealthDocument5 pagesMaster of International HealthJesper Domincil BayauaNo ratings yet

- Labor To DigestDocument32 pagesLabor To Digestphoenix rogueNo ratings yet

- Aliyani Association Between Vitamin D Deficiency and Psoriasis A CasecontrolstudyDocument5 pagesAliyani Association Between Vitamin D Deficiency and Psoriasis A CasecontrolstudyAzmi FadhlihNo ratings yet

- 10 Achievement ChartDocument3 pages10 Achievement ChartLyka ollerasNo ratings yet

- ASTM C309: Do Liquid Hardeners Meet This Standard?Document2 pagesASTM C309: Do Liquid Hardeners Meet This Standard?Kishore Nayak kNo ratings yet