Professional Documents

Culture Documents

Daily Equity Market Report - 27.10.2021

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 27.10.2021

Uploaded by

Fuaad DodooCopyright:

Available Formats

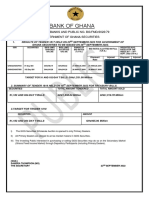

27TH OCTOBER 2021

DAILY EQUITY MARKET REPORT

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: GSE-CI slips by 4.11 points Indicator Current Previous Change

as FanMilk declines by 10%; market returns 46.88% YtD. GSE-Composite Index 2,851.90 2,856.01 -4.11 pts

YTD (GSE-CI) 46.88% 47.10% -0.47%

The benchmark GSE Composite index (GSE-CI) at the close of trading slipped GSE-Financial index 2,082.12 2,082.12 0.00 pts

by 4.11 points to close trading at 2,851.90, translating into a YTD return of YTD (GSE-FSI) 16.79% 16.79% 0.00%

46.88% as the highest gainer on the market; FanMilk PLC. (FML) lost 50 Ghana Market Cap. (GH¢ MN) 64,140.60 64,183.66 -43.06

Volume Traded 70,436 270,832 -73.99%

Pesewas to close at GH¢4.50 representing a YtD return of 316.67%. The GSE

Value Traded (GH¢) 107,157.65 324,667.35 -66.99%

Financial Stock Index (GSE-FSI) also remained unchanged at 2,082.12

translating into a YTD return of 16.79%.

TOP TRADED EQUITIES

Ticker Volume Value (GH¢)

Two equities recorded gains as Benso Oil Palm Plantation (BOPP) gained

RBGH 30,000 18,000.00

GH¢0.40 to close trading at GH¢4.80 followed by Total Petroleum Ghana

MTNGH 26,090 31,308.00

(TOTAL) which gained a pesewas to close at GH¢5.02. Market Capitalization FML 5,300 23,850.00

subsequently decreased by GH¢43.06 million to close trading at GH¢64.14 BOPP 4,319 20,731.20

GOIL 1,995 3,391.50 29.2% of value traded

billion representing a growth of 17.96% in 2021.

GAINERS & DECLINER

A total of 70,436 shares valued at GH¢107,157.65 were traded between seven

Ticker Close Price Open Price Change YTD

(7) equities with Scancom PLC. (MTNGH) recording the most trades (GH¢) (GH¢) Change

BOPP 4.80 4.40 9.09% 140.00%

accounting for 29.2% of the total value traded.

TOTAL 5.02 5.01 0.20% 77.39%

EQUITY UNDER REVIEW: FAN MILK PLC. (FML) FML 4.50 5.00 -10.00% 316.67%

Share Price GH¢4.50 KEY ECONOMIC INDICATORS

Price Change (YtD) 316.67% Indicator Current Previous

Market Capitalization GH¢522.93 million Monetary Policy Rate September 2021 13.50% 13.50%

Dividend Yield 0.00% Real GDP Growth Q2 2021 3.90% 3.10%

Earnings Per Share GH¢-0.1560 Inflation September 2021 10.60% 9.70%

Avg. Daily Volume Traded 7,384

Reference rate October 2021 13.47% 13.46%

Value Traded (YtD) GH¢4,866,727.00 Source: GSS, BOG, GBA

INDEX YTD PERFORMANCE

60.00%

50.00% 46.88%

40.00%

30.00%

20.00% 16.79%

10.00%

0.00%

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Introduction To Kinematics and MechanismsDocument25 pagesIntroduction To Kinematics and Mechanismsdhilip_sacetNo ratings yet

- Oleg A. Starykh, Andrey V. Chubukov and Alexander G. Abanov - Flat Spin-Wave Dispersion in A Triangular AntiferromagnetDocument4 pagesOleg A. Starykh, Andrey V. Chubukov and Alexander G. Abanov - Flat Spin-Wave Dispersion in A Triangular AntiferromagnetGravvolNo ratings yet

- Design of Engine Cylinder Block : M NareshDocument4 pagesDesign of Engine Cylinder Block : M NareshMudavath NareshNo ratings yet

- Brgy. Reso BirDocument2 pagesBrgy. Reso BirCazy Mel EugenioNo ratings yet

- Language Applied To Volcanic ParticlesDocument3 pagesLanguage Applied To Volcanic Particlesjunior.geologiaNo ratings yet

- CDM Project in INdonesiaDocument15 pagesCDM Project in INdonesiaarianzNo ratings yet

- 16b. Present Continuous TenseDocument9 pages16b. Present Continuous TenseGung PanjiNo ratings yet

- XXXVI. Paper and Board For Food Contact: As of 01.04.2022Document17 pagesXXXVI. Paper and Board For Food Contact: As of 01.04.2022刘佳奇No ratings yet

- Refresher Module - Surveying (Earthworks) : Methods of Calculating VolumeDocument2 pagesRefresher Module - Surveying (Earthworks) : Methods of Calculating VolumeOctavia BlakeNo ratings yet

- Industry AnalysisDocument8 pagesIndustry AnalysisTerry WagnerNo ratings yet

- Offer Letter Bigfoot Retail - Sumit KumarDocument2 pagesOffer Letter Bigfoot Retail - Sumit KumarSumit KumarNo ratings yet

- Peyote Hearts ChristaBeadsDocument11 pagesPeyote Hearts ChristaBeadspaolallaqueNo ratings yet

- Ent 425 Insect Collection LabelsDocument1 pageEnt 425 Insect Collection LabelsCM NajitoNo ratings yet

- A Practical Approach To Building A Sporting NationDocument20 pagesA Practical Approach To Building A Sporting NationNUPUR GUPTANo ratings yet

- STS - Prelim Long QuizDocument1 pageSTS - Prelim Long QuizKent GallardoNo ratings yet

- Tutorial 06 Questions With Possible Solutions: IS333: Project Management - Semester I 2021Document5 pagesTutorial 06 Questions With Possible Solutions: IS333: Project Management - Semester I 2021Chand DivneshNo ratings yet

- Shao2018 PDFDocument232 pagesShao2018 PDFbichojausen0% (1)

- IMUNOPROFILAKTIKDocument26 pagesIMUNOPROFILAKTIKSatriyo K. PalgunoNo ratings yet

- 10 Typografi - Font KOKOHDocument1 page10 Typografi - Font KOKOHFarchan All in oneNo ratings yet

- Module 1Document14 pagesModule 1Sungha Jhun0% (1)

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument31 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementRonak ChhabriaNo ratings yet

- BMC TemplateDocument2 pagesBMC TemplateVlad AlvazNo ratings yet

- 6 Trimble HD-GNSS White PaperDocument13 pages6 Trimble HD-GNSS White PaperpuputrahsetyoNo ratings yet

- A Report On Square Pharmaceuticals LTDDocument45 pagesA Report On Square Pharmaceuticals LTDrakib_001171% (14)

- Morgan Stanley - Interview GuideDocument9 pagesMorgan Stanley - Interview GuideSidra BhattiNo ratings yet

- Scribd Premium CookieDocument6 pagesScribd Premium CookieZnerskiscribdtrialNo ratings yet

- Fs1-Episode 11Document22 pagesFs1-Episode 11Jamille Nympha C. BalasiNo ratings yet

- Questionnaire On Training EvaluationDocument5 pagesQuestionnaire On Training EvaluationAbhresh SugandhiNo ratings yet

- Our Town October 11, 1929Document34 pagesOur Town October 11, 1929narberthcivicNo ratings yet

- Honda ShineDocument8 pagesHonda ShineAnantha RajaNo ratings yet