Professional Documents

Culture Documents

DFD of Sales Order Processing System

Uploaded by

Chezka Quinte0 ratings0% found this document useful (0 votes)

17 views11 pagesOriginal Title

Chapter 4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views11 pagesDFD of Sales Order Processing System

Uploaded by

Chezka QuinteCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 11

Chapter 4

DFD of Sales Order Processing

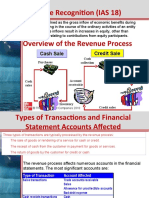

The Revenue Cycle System

The Conceptual System

• Using data flow diagrams (DFDs)

you can trace the sequence of

activities through three processes

that constitute the revenue cycle for

most retail, wholesale, and

manufacturing organizations.

OVERVIEW OF REVENUE CYCLE

ACTIVITIES

• Sales Order Procedures

• RECEIVE ORDER:

Customer orders are

documents indicating the

type and quantity of Sales Order

merchandise being

requested. Sales order is a

source document that

captures such vital

information as the name and

address of the customer

making the purchase; the

customer’s account number;

the name, number, and

description of the product;

the quantities and unit price

of the items sold; and other

financial information. The

customer order file shows

the status of customer

orders.

• CHECK CREDIT: Sales

order (credit copy) is a copy

of a sales order sent by the

receive-order task to the

check-credit task. It is used

to check the creditworthiness

of a customer. An approved

sales order contains sales

order information for the

sales manager to review

once the sales order is OVERVIEW OF REVENUE CYCLE

approved. ACTIVITIES (continued)

• Sales Order Procedures

(continued)

• PICK GOODS: A stock

release is a document that

identifies which items of

inventory must be located

and picked from the

warehouse shelves. A back-

order are records that stay

on file until the inventories

arrive from the supplier.

Back-ordered items are

shipped before new sales are

processed. Stock records

are formal accounting

records for controlling

inventory assets.

• SHIP GOODS: A packing

slip is a document that

travels with the goods to the

customer to describe the

contents of the order. A

shipping notice form is a OVERVIEW OF REVENUE CYCLE

document that informs the ACTIVITIES (continued)

billing department that the • Sales Order Procedures

customer’s order has been (continued)

filled and shipped. A bill of • BILL CUSTOMER: The sales

lading is a formal contract order (invoice copy) is the

between the seller and the copy of a sales order to be

shipping company that reconciled with the shipping

transports the goods to the notice. It describes the

customer. The shipping log products that were actually

specifies orders shipped shipped to the customer. An

during the period. S.O. pending file is used to

store the sales order (invoice

copy) from the receive-order

task until receipt of the

shipping notice. The sales

journal is a special journal

used for recording completed

sales transactions. The

journal voucher is

composed of accounting

journal entries into an

Bill of Lading accounting system for the

purposes of making

corrections or adjustments to

the accounting data. For received along with the

control purposes, all JVs customer sales invoice by the

should be approved by the billing department clerk from

appropriate designated the sales department.

authority. The journal • POST TO GENERAL

voucher file is a compilation LEDGER

of all journal vouchers posted

to the general ledger. Inventory Subsidiary Ledger

Journal Voucher

Accounts Receivable Subsidiary

Ledger

OVERVIEW OF REVENUE CYCLE

ACTIVITIES (continued)

• Sales Order Procedures

(continued)

• UPDATE INVENTORY

RECORDS: The inventory

subsidiary ledger is a

ledger with inventory records

updated from the stock

release copy by the inventory

control system. OVERVIEW OF REVENUE CYCLE

• UPDATE ACCOUNTS ACTIVITIES (continued)

RECEIVABLE RECORDS: • Sales Return Procedures

The accounts receivable • PREPARE RETURN SLIP: A

(AR) subsidiary ledger is an return slip is a document

account record that shows recording the counting and

activity by detail for each inspect of items returned,

account type, and contains, prepared by the receiving

at minimum: customer name; department employee.

customer address; current • PREPARE CREDIT MEMO:

balance; available credit; A credit memo is a

transaction dates; invoice document used to authorize

numbers; and credits for the customer to receive credit

payments, returns, and for the merchandise returned.

allowances. The ledger copy • APPROVE CREDIT MEMO:

is a copy of the sales order The approved credit memo

is issued when the credit

manager evaluates the

circumstances of the return

and makes a judgment to

grant (or disapprove) credit.

• UPDATE SALES JOURNAL

• UPDATE INVENTORY AND

AR RECORDS

• UPDATE GENERAL

LEDGER OVERVIEW OF REVENUE CYCLE

ACTIVITIES (continued)

DFD Sales Return Procedures • Cash Receipts Procedures

• OPEN MAIL AND PREPARE

REMITTANCE LIST: The

remittance advice is a

source document that

contains key information

required to service the

customers account. The

remittance list is a cash

prelist, where all cash

received is logged.

• RECORD AND DEPOSIT

CHECKS: The cash receipts

journals are records that

include details of all cash

receipts transactions,

including cash sales,

miscellaneous cash receipts,

and cash received. A

deposit slip is a written

notification accompanying a

bank deposit that specifies

and categorizes the funds

(such as checks, bills, and

coins) being deposited.

• UPDATE ACCOUNTS

RECEIVABLE RECORDS

Credit Memo OVERVIEW OF REVENUE CYCLE

ACTIVITIES (continued)

• Cash Receipts Procedures

(continued)

• UPDATE GENERAL

LEDGER

• RECONCILE CASH

RECEIPTS AND DEPOSITS:

A clerk from the controller’s

office (or an employee not

involved with cash receipts

procedures) reconciles cash

receipts by comparing (1) a

copy of the prelist, (2) deposit

slips, and (3) related journal

vouchers.

Cash Receipts Journal

DFD of Cash Receipts Procedure

Remittance Advice Physical Systems

• Physical accounting information

systems are a combination of

computer technology and human

activity.

• As a general rule, smaller

businesses tend to rely less on

technology and more on manual

procedures, whereas larger

companies tend to employ

advanced technologies.

• Point-of-sale (POS) systems are

revenue systems in which no

customer accounts receivable are

maintained and inventory is kept on

the store’s shelves, not in a

separate warehouse.

BASIC TECHNOLOGY REVENUE

CYCLE

• The computers used in these

systems are independent

(nonnetworked) personal

computers (PCs).

• In addition, in such systems,

maintaining physical files of source Structures for AR and Inventory

documents is critical to the audit Subsidiary Files

trail.

BASIC TECHNOLOGY SALES

ORDER PROCESSING SYSTEM

• Sales Department

• Credit Department Approval

• Warehouse Procedures

• The Shipping Department

• The Billing Department

• Accounts Receivable, Inventory

Control, and General Ledger

Departments

Basic Technology Sales Order BASIC TECHNOLOGY CASH

Processing System RECEIPTS SYSTEM

• Mail Room

• Cash Receipts

• Accounts Receivable

• General Ledger Department

• Controller’s Office

Basic Technology Cash Receipts

System

INTEGRATED CASH RECEIPTS

SYSTEM

• Mail Room

ADVANCED TECHNOLOGY • Cash Receipts Department

REVENUE CYCLE • Automatic Data Processing

• Advanced technologies allow Procedures

systems designers to integrate • Controller’s Office

accounting and other business Integrated Cash Receipts System

functions through a common REVENUE CYCLE RISKS AND

information system. INTERNAL CONTROLS

• The objective of integration is to • Risk of Selling to Un-Creditworthy

improve operational performance Customers

and reduce costs by identifying and • Physical Controls

eliminating nonvalue-added tasks. • TRANSACTION

AUTHORIZATION

• SEGREGATION OF DUTIES

INTEGRATED SALES ORDER • IT Controls

PROCESSING SYSTEM • AUTOMATED CREDIT

• Sales Procedures CHECKING

• The process begins with

sales clerks receiving REVENUE CYCLE RISKS AND

customer orders, which may INTERNAL CONTROLS (continued)

be hard-copy documents or • Risk of Shipping Customers

may be received via e-mail, Incorrect Items or Quantities

fax, or phone. • Physical Controls

• Using a computer terminal • INDEPENDENT

connected to a central sales VERIFICATION

order system, the clerk • IT Controls

enters the sales order. • SCANNER TECHNOLOGY

• AUTOMATED INVENTORY

Integrated Sales Order System ORDERING

REVENUE CYCLE RISKS AND

INTERNAL CONTROLS (continued)

• Risk of Inaccurately Recording

Transactions in Journals and

Accounts

• Physical Controls

• TRANSACTION

AUTHORIZATION

• ACCOUNTING RECORDS

• Prenumbered documents

are documents (sales orders,

shipping notices, remittance

advices, and so on) to a central system by many

sequentially numbered by the users with different access

printer that allow every privileges but prevent them

transaction to be identified from obtaining information for

uniquely. which they lack authorization.

• SPECIAL JOURNALS REVENUE CYCLE RISKS AND

• SUBSIDIARY LEDGERS INTERNAL CONTROLS (continued)

• GENERAL LEDGERS • Risk of Unauthorized Access to

• FILES Accounting Records and Reports

• INDEPENDENT (continued)

VERIFICATION • IT Controls (continued)

REVENUE CYCLE RISKS AND • MULTILEVEL SECURITY

INTERNAL CONTROLS (continued) (continued): The access

• Risk of Inaccurately Recording control list (ACL) is a list

Transactions in Journals and containing information that

Accounts (continued) defines the access privileges

• IT Controls for all valid users of the

• DATA INPUT EDITS resource. An access control

• AUTOMATED POSTING TO list assigned to each

SUBSIDIARY AND GL resource controls access to

ACCOUNTS system resources such as

• FILE BACKUP directories, files, programs,

REVENUE CYCLE RISKS AND and printers. The role-

INTERNAL CONTROLS (continued) based access control

• Risk of Misappropriation of Cash (RBAC) is a formal technique

Receipts and Inventory for grouping users according

• Physical Controls to the system resources they

• TRANSACTION require to perform their

AUTHORIZATION assigned tasks. A role is a

• SUPERVISION formal technique for grouping

• ACCESS CONTROLS users according to the

• SEGREGATION OF DUTIES system resources they

• IT Controls require to perform their

• MULTILEVEL SECURITY assigned tasks.

REVENUE CYCLE RISKS AND Summary of Revenue Cycle Risks

INTERNAL CONTROLS (continued) and Controls

• Risk of Unauthorized Access to

Accounting Records and Reports

• Physical Controls

• ACCESS CONTROLS

• SEGREGATION OF DUTIES

• IT Controls

• PASSWORDS.

• MULTILEVEL SECURITY:

Multilevel security employs

programmed techniques that

permit simultaneous access

• At the end of the clerk’s shift, a

supervisor unlocks the register and

retrieves the internal tape.

END-OF-DAY PROCEDURES

• At the end of the day, the cash

POINT-OF-SALE (POS) SYSTEMS receipts clerk prepares a three-part

• POS systems are used extensively deposit slip for the total amount of

in grocery stores, department the cash received.

stores, and other types of retail • One copy is filed and the other two

organizations. accompany the cash to the bank.

• Inventory is kept on the store’s • Because cash is involved, armed

shelves, not in a separate guards are often used to escort the

warehouse. funds to the bank repository.

POINT-OF-SALE CONTROL ISSUES

Point of Sale System • Authorization

• Supervision

• Access Control

• Accounting Records

• Independent Verification

REENGINEERING USING EDI

• Doing Business via EDI

• Electronic data interchange

(EDI) is the intercompany

exchange of computer-

processable business

information in standard

format.

• EDI is more than just a technology.

• EDI poses unique control problems

for organizations.

REENGINEERING USING THE

INTERNET

DAILY PROCEDURES • Doing Business on the Internet

• The Universal Product Code • Thousands of organizations

(UPC) is a label containing price worldwide have home pages

information (and other data) that is on the Internet to promote

attached to items purchased in a their products and solicit

point-of-sale system. sales.

• When all the UPCs are scanned, • Typically, Internet sales are

the system automatically calculates credit card transactions that

taxes, discounts, and the total for are sent to the seller’s e-mail

the transaction. file.

• The clerk enters the transaction • Unlike EDI, which is

into the POS system via the exclusively a B2B

register’s keypad, and a record of arrangement between trading

the sale is added to the sales partners, Internet sales are

journal in real time. both B2B and business-to-

consumer (B2C)

transactions.

• Connecting to the Internet

exposes the organization to

threats from computer

hackers, viruses, and

transaction fraud.

• Most organizations take

these threats seriously and

implement controls, including Update of Accounts Receivable from

password techniques, Sales Orders

message encryption, and

firewalls, to minimize their

risk.

Appendix – Sales Return System

• Receiving Department

• Sales Department

• Processing the Credit Memo

Basic Technology Sales Returns

System

Appendix - Legacy Systems

• Batch Processing Using Sequential

Files

• DATA ENTRY

• EDIT RUN

• SORT RUN

• AR UPDATE AND BILLING

RUN

• SORT AND INVENTORY

UPDATE RUNS

• GENERAL LEDGER

UPDATE RUN

• Batch Processing Using Direct Update of Inventory from Sales

Access Files Orders

• KEYSTROKE

• EDIT RUN

• FILE UPDATE RUN

Batch Processing with Sequential

Files

Direct Access Update for AR and

Inventory Files Concurrently

Batch Sales Order System

You might also like

- CH04 Revenue Cycle PDFDocument73 pagesCH04 Revenue Cycle PDFZion Ilagan0% (1)

- Chapter 4 - AIS ReportingDocument21 pagesChapter 4 - AIS ReportingLoreto Mascariñas Jr.No ratings yet

- Record and Deposit ChecksDocument12 pagesRecord and Deposit ChecksAnonymous WmvilCEFNo ratings yet

- AIS Chapter 4 Revenue CycleDocument6 pagesAIS Chapter 4 Revenue CycleKate Alvarez100% (1)

- Auditing the Revenue Cycle Using ACL SoftwareDocument7 pagesAuditing the Revenue Cycle Using ACL SoftwareJovie SalvacionNo ratings yet

- AUD02 - 02 Transaction CyclesDocument54 pagesAUD02 - 02 Transaction CyclesMark BajacanNo ratings yet

- Chapter 4 Transaction CyclesDocument24 pagesChapter 4 Transaction CyclesconsulivyNo ratings yet

- Revenue Cycle (Part I)Document34 pagesRevenue Cycle (Part I)Rosario TaguinotNo ratings yet

- Audit of Sales and Collection CycleDocument4 pagesAudit of Sales and Collection Cyclenadxco 1711No ratings yet

- Chapter 2Document7 pagesChapter 2Jolina T. OrongNo ratings yet

- Chap 4Document7 pagesChap 4Christine Joy OriginalNo ratings yet

- Chapter 5Document5 pagesChapter 5Jam PuaNo ratings yet

- Chapter 4Document6 pagesChapter 4Christine Joy Original100% (1)

- Audit of The Revenue and Collection CycleDocument5 pagesAudit of The Revenue and Collection CycleLalaine ReyesNo ratings yet

- Accounting 16A Part 2Document31 pagesAccounting 16A Part 2Lelouch Britanian100% (1)

- AT 06-06 Transaction Cycles Part 1Document9 pagesAT 06-06 Transaction Cycles Part 1Eeuh100% (1)

- Transaction CyclesDocument7 pagesTransaction CyclesJames LopezNo ratings yet

- Audit of Acquisition and Payment CycleDocument30 pagesAudit of Acquisition and Payment CycleontykerlsNo ratings yet

- Chapter 8Document67 pagesChapter 8JOHN MARK ARGUELLESNo ratings yet

- Accounting Revenue CycleDocument59 pagesAccounting Revenue CycleNikkiNo ratings yet

- CH 14 Audit of Sales and Collection Cycle Tests of Controls and Substantive Tests of TransactionsDocument11 pagesCH 14 Audit of Sales and Collection Cycle Tests of Controls and Substantive Tests of TransactionsAldwin CalambaNo ratings yet

- Chapter 4Document8 pagesChapter 4Christine Joy OriginalNo ratings yet

- Revenue CycleDocument7 pagesRevenue CycleArly Kurt TorresNo ratings yet

- Chapter 14Document30 pagesChapter 14Tumpal Sagala100% (1)

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument8 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Chapter 4 The Revenue CycleDocument6 pagesChapter 4 The Revenue CycleRose Vera Mae EncinaNo ratings yet

- Lecture 2 Audit of The Sales and Collection Cycle Tests of ControlsDocument46 pagesLecture 2 Audit of The Sales and Collection Cycle Tests of ControlsShiaab Aladeemi100% (1)

- Accounting Information System Chapter 4 6 CompressDocument14 pagesAccounting Information System Chapter 4 6 CompressSharmaine LiasosNo ratings yet

- Chapter Two Audit of Receivables and Sales: Page - 1Document20 pagesChapter Two Audit of Receivables and Sales: Page - 1mubarek oumer100% (1)

- Jan Marie Valencia Kharla Baladjay Recca Anna Laranan Rex Martin GuceDocument46 pagesJan Marie Valencia Kharla Baladjay Recca Anna Laranan Rex Martin GuceElsie AdornaNo ratings yet

- AT 06-07 Transaction Cycles Part 2Document12 pagesAT 06-07 Transaction Cycles Part 2EeuhNo ratings yet

- The Revenue Cycle: Journal Vouchers/EntriesDocument16 pagesThe Revenue Cycle: Journal Vouchers/EntriesAstxilNo ratings yet

- Chapter 2 HandoutDocument13 pagesChapter 2 HandoutChezka QuinteNo ratings yet

- Chapter 2 HandoutDocument13 pagesChapter 2 HandoutChezka QuinteNo ratings yet

- Understanding Revenue CyclesDocument13 pagesUnderstanding Revenue CyclesMelvin Ray MarisgaNo ratings yet

- The Revenue CycleDocument46 pagesThe Revenue CycleDuaaaaNo ratings yet

- Expenditure CycleDocument26 pagesExpenditure CycleAlex MchembangoyeNo ratings yet

- Lesson G - 1 Ch09 Rev. Cycle Act. Tech.Document79 pagesLesson G - 1 Ch09 Rev. Cycle Act. Tech.Blacky PinkyNo ratings yet

- AIS Chapter 4 Revenue CycleDocument8 pagesAIS Chapter 4 Revenue CycleReviewers KoNo ratings yet

- Kunci Jawaban Auditing Chapter 14 Arens 15th EditionDocument8 pagesKunci Jawaban Auditing Chapter 14 Arens 15th EditionArfini Lestari100% (2)

- Audit of The Revenue and Collection Cycle: Tests of Controls and Substantive Tests of Transactions Revenue and Collection CycleDocument20 pagesAudit of The Revenue and Collection Cycle: Tests of Controls and Substantive Tests of Transactions Revenue and Collection Cycleem cortezNo ratings yet

- Jawaban CH 14Document28 pagesJawaban CH 14Heltiana NufriyantiNo ratings yet

- Jawaban CH 14Document28 pagesJawaban CH 14Heltiana Nufriyanti80% (5)

- UntitledDocument8 pagesUntitledCyrene CruzNo ratings yet

- Chapter 4: The Revenue CycleDocument4 pagesChapter 4: The Revenue CycleKrissha100% (1)

- Auditing 4 Chapter 1Document19 pagesAuditing 4 Chapter 1Mohamed Diab100% (1)

- At.3511 - Specific Audit Procedures (Part 1)Document5 pagesAt.3511 - Specific Audit Procedures (Part 1)John MaynardNo ratings yet

- Chapter3 Final 1-DoneDocument157 pagesChapter3 Final 1-Donelebahaidang090No ratings yet

- Audit Midterm Exam Transaction CyclesDocument17 pagesAudit Midterm Exam Transaction CyclesKhizzyia Paula Gil ManiscanNo ratings yet

- Chapter 4Document29 pagesChapter 4Genanew AbebeNo ratings yet

- Term Paper On PPPPPPPPPDocument17 pagesTerm Paper On PPPPPPPPPSharif KhanNo ratings yet

- At.3213 - Application of Audit Process To Transaction Cycles Part 1Document9 pagesAt.3213 - Application of Audit Process To Transaction Cycles Part 1Denny June CraususNo ratings yet

- Revenue and Collection CycleDocument12 pagesRevenue and Collection CycleLydelle Mae CabaltejaNo ratings yet

- activity-2084Document7 pagesactivity-2084Joie Cyra Gumban PlatonNo ratings yet

- AIS Reviewer AIS Reviewer: Accountancy (The National Teachers College) Accountancy (The National Teachers College)Document13 pagesAIS Reviewer AIS Reviewer: Accountancy (The National Teachers College) Accountancy (The National Teachers College)Aldwin CalambaNo ratings yet

- The Expenditure Cycle: Purchases and Cash Disbursements ProceduresDocument4 pagesThe Expenditure Cycle: Purchases and Cash Disbursements ProceduresAnne Rose EncinaNo ratings yet

- Kimberly Nicole B. Ledona Bsa 2B: GUIDE QUESTIONS: Report On Revenue CycleDocument3 pagesKimberly Nicole B. Ledona Bsa 2B: GUIDE QUESTIONS: Report On Revenue CycleKimberly NicoleNo ratings yet

- Revenue Recognition (IAS 18) : Cash Sale Credit SaleDocument28 pagesRevenue Recognition (IAS 18) : Cash Sale Credit Salecheapo printsNo ratings yet

- The Revenue Cycle: Accounts Receivable DR Sales CR Cost of Goods Sold DR Inventory CR Cash DR Accounts Receivable CRDocument26 pagesThe Revenue Cycle: Accounts Receivable DR Sales CR Cost of Goods Sold DR Inventory CR Cash DR Accounts Receivable CRJyle Mareinette ManiagoNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Group 2 - E - ForgeDocument13 pagesGroup 2 - E - ForgeChezka QuinteNo ratings yet

- Grameen BankDocument3 pagesGrameen BankChezka QuinteNo ratings yet

- Difference of Creativity and InnovationDocument2 pagesDifference of Creativity and InnovationChezka QuinteNo ratings yet

- Group 2 Eforge Concept PaperDocument54 pagesGroup 2 Eforge Concept PaperChezka QuinteNo ratings yet

- Group 2 E - Forge - Peer EvaluationDocument3 pagesGroup 2 E - Forge - Peer EvaluationChezka QuinteNo ratings yet

- GROUP 2 - Module 3 AssignmentDocument1 pageGROUP 2 - Module 3 AssignmentChezka QuinteNo ratings yet

- Group 2 - E - Forge - Chapter 2&3Document26 pagesGroup 2 - E - Forge - Chapter 2&3Chezka QuinteNo ratings yet

- Frame Basak's Unsafe Infrastructure ChallengeDocument2 pagesFrame Basak's Unsafe Infrastructure ChallengeChezka QuinteNo ratings yet

- Comparison Between Senate Bill No 438 and Republic Act No1425 CompressDocument4 pagesComparison Between Senate Bill No 438 and Republic Act No1425 CompressChezka QuinteNo ratings yet

- Chapter 2 HandoutDocument12 pagesChapter 2 HandoutChezka QuinteNo ratings yet

- Kanya-Kanyang RizalDocument1 pageKanya-Kanyang RizalChezka QuinteNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasChezka QuinteNo ratings yet

- Indolence of The Filipinos ReflectionDocument1 pageIndolence of The Filipinos ReflectionChezka QuinteNo ratings yet

- Chapter 2 HandoutDocument13 pagesChapter 2 HandoutChezka QuinteNo ratings yet

- Chapter 2 HandoutDocument13 pagesChapter 2 HandoutChezka QuinteNo ratings yet

- Chapter 2 HandoutDocument12 pagesChapter 2 HandoutChezka QuinteNo ratings yet

- Chapter 3Document8 pagesChapter 3Chezka QuinteNo ratings yet

- Synopsis FormatDocument8 pagesSynopsis FormatShakanksh SinhaNo ratings yet

- Other SPIRE Documents PDF CatalogueDocument118 pagesOther SPIRE Documents PDF CatalogueNgân Hàng Ngô Mạnh TiếnNo ratings yet

- Buy Microsoft Office 2021 - Get 15% Discount at CheckoutDocument3 pagesBuy Microsoft Office 2021 - Get 15% Discount at Checkoutkoen banksNo ratings yet

- Pragya Bharti FinalDocument1 pagePragya Bharti FinaladhiraNo ratings yet

- Opportunity Recognition and Entry StrategyDocument34 pagesOpportunity Recognition and Entry Strategymahbobullah rahmaniNo ratings yet

- Account Executive or Operations Manager or Sales Manager or DireDocument4 pagesAccount Executive or Operations Manager or Sales Manager or Direapi-76879480No ratings yet

- ATIC Catalog 2015 Web Complete Restricted EditingDocument44 pagesATIC Catalog 2015 Web Complete Restricted EditingNatalia BurlacuNo ratings yet

- Final Project Documentation (Feasibility Report ch1, SRS ch2, Design Document ch.3)Document69 pagesFinal Project Documentation (Feasibility Report ch1, SRS ch2, Design Document ch.3)Areej 56No ratings yet

- Mysql vs. SqliteDocument15 pagesMysql vs. SqlitePedro Leite (Mindset Épico)No ratings yet

- Magic Quadrant For Enterprise Video Content ManagementDocument7 pagesMagic Quadrant For Enterprise Video Content ManagementFrancis TorresNo ratings yet

- (MCQ'S) Production Planning and ControlDocument5 pages(MCQ'S) Production Planning and ControlHVFTOOLS HVFNo ratings yet

- ISO 27001 Documentation Simplified Checklist and GuideDocument7 pagesISO 27001 Documentation Simplified Checklist and GuideS100% (1)

- Activity Exemplar - Communication PlanDocument5 pagesActivity Exemplar - Communication PlanJordan K WellsNo ratings yet

- Create Multiple Purchase Orders in SAPDocument11 pagesCreate Multiple Purchase Orders in SAPVasshu ManglaaNo ratings yet

- B0750ra AaDocument354 pagesB0750ra Aaabdel taibNo ratings yet

- 1612149543493resume SHILPIDocument2 pages1612149543493resume SHILPIShilpi KumariNo ratings yet

- CPS BDM Brochure (LG) PDFDocument16 pagesCPS BDM Brochure (LG) PDFFelipe Reyes GallardoNo ratings yet

- Pmbok® Guide 6th Summary: For PMP Exam Practitioners and Experienced Project ManagersDocument54 pagesPmbok® Guide 6th Summary: For PMP Exam Practitioners and Experienced Project ManagersM Shabrawi100% (1)

- Sap SD - TGDocument171 pagesSap SD - TGmahesh gaikwadNo ratings yet

- Exacaster Blog Post - BriefDocument2 pagesExacaster Blog Post - BriefFaria MasoodNo ratings yet

- Jazz Minor Scales - Trumpet - LexcerptsDocument8 pagesJazz Minor Scales - Trumpet - LexcerptsLexcerptsNo ratings yet

- ARK Block ChainDocument50 pagesARK Block ChainHasan Al-AbadiNo ratings yet

- SAP Note - Change Cost Element 43Document3 pagesSAP Note - Change Cost Element 43LiviuNo ratings yet

- Capital Com White Paper 20200415Document82 pagesCapital Com White Paper 20200415raluca1507No ratings yet

- Case Critique 7 PDFDocument4 pagesCase Critique 7 PDFKarl LumandoNo ratings yet

- 1defining and Measuring E-Commerce OECDDocument13 pages1defining and Measuring E-Commerce OECDKemal AnugrahNo ratings yet

- Darwin D. Martillano Head of APAC Operations HighlightsDocument8 pagesDarwin D. Martillano Head of APAC Operations HighlightsDarwin MartillanoNo ratings yet

- BriefDocument7 pagesBriefsudipta.nexusNo ratings yet

- Lorem Ipsum Placeholder Text HistoryDocument1 pageLorem Ipsum Placeholder Text HistoryPratyush PrasadNo ratings yet

- TelnetDocument2 pagesTelnetsadeqNo ratings yet