Professional Documents

Culture Documents

E-Money - Mobile Money - Mobile Banking

Uploaded by

abdulqaderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E-Money - Mobile Money - Mobile Banking

Uploaded by

abdulqaderCopyright:

Available Formats

E-Money – Mobile Money – Mobile Banking – What’s the Difference?

When I speak at conferences or with people interested in the use of mobile phones for

financial service delivery, I am often asked what is the difference between e-money, mobile

money, mobile banking, and a range of other terms that are often used wily-nily in reference

to this emerging business opportunity. It is a good question. People are confused. And

rightfully so. There are no universally accepted definitions. While this lack of uniformity may

not be important much of the time, it does become critical at the regulatory level as well as

when potential players are trying to have a meaningful conversation with each other.

In an attempt to create some clarity around terminology, I researched documents from

thought leaders in the e-money and branchless banking space to see if I could find any

consistency among the terms used. The definitions provided below are the result of that

effort. Writings from CGAP, the GSM Association, and the European Union were all leveraged

heavily. (You can find links to all terms that have been taken directly from source material.)

Do you think having some consensus around terminology would be an important step for the

industry? How would you change the definitions that I have complied to make them more

universally acceptable? Your comments and thoughts are welcomed.

E-Money

Simply put, electronic money or e-money is the electronic alternative to

cash. It is monetary value that is stored electronically on receipt of funds, and which is used

for making payment transactions. E-Money can be held on cards, devices, or on a server.

Examples include pre-paid cards, electronic purses, such as M-PESA in Kenya, or web-based

services, such as PayPal. As such, e-money can serve an umbrella term for a number of more

specific electronic value products and services.

The European Union (EU) has been involved in defining terms related to e-money since 2000,

which is much longer than many other countries or regions. The following definitions are

included in the most recent proposed directive from the EU.

Electronic Money Institution. A legal person that has been granted authorization to issue

electronic money.

Hybrid Issuers. Service providers who issue e-money as an accessory activity to their core

business, ie mobile phone companies, public transport companies, etc.

Mobile Financial Services

Mobile Financial Services or MFS is another broad term that refers to a range of financial

services that can be offered across the mobile phone. Three of the leading forms of MFS are

mobile money transfer, mobile payments, and mobile banking.

Mobile Money Transfer (MMT). Services whereby customers use their mobile device to send

and receive monetary value - or more simply put, to transfer money electronically from one

person to another using a mobile phone. Both domestic transfers as well as international, or

cross-border, remittances are money transfer services.

Mobile Payments. While MMT addresses person-to-person money transfers, mobile payments

refer to person-to-business payments that are made with a mobile phone. Mobile proximity

payments involve a mobile phone being used to make payments at a point-of-sale (POS)

terminal. In these cases, the mobile phone may communicate with the POS through

contactless technologies, such as Near Field Communication (NCR). Mobile remote

payments involve using the phone as a mechanism to purchase mobile-related services, such

as ring tones, or as an alternate payment channel for goods sold online. Mobile bill

payments tend to require interconnection with the bank account of the receiving business,

and hence are considered part of mobile banking.

Mobile Banking. The connection between a mobile phone and a personnel or business bank

account. Mobile banking allows customers to use their mobile phone as another channel for

their banking services, such as deposits, withdrawals, account transfer, bill payment, and

balance inquiry. Most mobile banking applications are additive in that they provide a new

delivery channel to existing bank customers. Transformative models integrate unbanked

populations into the formal financial sector.

Other Terms

Other terms that are often used in association with, or interchangeably with, e-money, mobile

financial services include:

Electronic Wallet (eWallet). Refers to the cash value that is stored on a card, phone, or other

electronic device. Pre-paid cards are one form of electronic wallet. Electronic wallets can

represent a fixed value. In this case, once the value has been spent, the card can no longer

be used. Or wallets can be reloaded – to be used again and again. The term wallet is used

because the card or phone is considered a substitute for the cash normally carried in a

person’s wallet.

Electronic Vouchers. Refer to definition for electronic wallet.

Mobile Money. Refer to definition for mobile financial services.

Mobile Wallet (mWallet). An electronic wallet that is stored on a phone. GSMA provides the

following more specific definition: “mWallet is a data repository that houses consumer data

sufficient to facilitate a financial transaction from a mobile handset, and the applicable

intelligence to translate an instruction from a consumer through a mobile

handset/bearer/application into a message that a financial institution can use to debit or credit

bank accounts or payment instruments.”

Stored Value. Refer to definition for electronic wallet.

What is the difference between

mobile payments, mobile money, and

mobile banking?

In the trade, there are five different services in the mobile payments space, which

are roughly bucketed as:

m-commerce - buying stuff from websites and apps with your phone (e.g. via

PayPal)

mobile payments - buying stuff in stores with your phone (e.g. via Apple Pay)

mobile banking - interacting with a financial institution via your phone (e.g.

banking with Simple)

mobile point of sale - taking in-store payments when you are the merchant

(e.g. using Square), and

mobile money - sending and receiving payments with your phone (e.g. by M-

Pesa or Venmo)

You might also like

- Mobile Money Definitions No Marks 56Document4 pagesMobile Money Definitions No Marks 56MasimbaNo ratings yet

- Chap TwoDocument10 pagesChap Twoakandwanaho timothyNo ratings yet

- TelecomDocument51 pagesTelecomTimothy NshimbiNo ratings yet

- Mobile Banking ServicesDocument11 pagesMobile Banking ServicesDiksha SadanaNo ratings yet

- Surecash Mobile BankingDocument36 pagesSurecash Mobile Bankingমেহেদি তসলিমNo ratings yet

- Marketing Strategies of Phonepe E Walle RemovedDocument68 pagesMarketing Strategies of Phonepe E Walle RemovedSimaant JenaNo ratings yet

- Overview of Mobile Payment SystemDocument7 pagesOverview of Mobile Payment Systemhadi_masoodNo ratings yet

- Daniel Peter Mobile MoneyDocument3 pagesDaniel Peter Mobile MoneyDaniel PeterNo ratings yet

- SMS SMS Banking Smart Phones WAP Mobile Web: Accounting BrokerageDocument9 pagesSMS SMS Banking Smart Phones WAP Mobile Web: Accounting BrokerageAckyeem Igwee Sanya0% (1)

- Mobile Banking: Mobile Banking Is A Service Provided by A Bank or Other Financial Institution That Allows ItsDocument11 pagesMobile Banking: Mobile Banking Is A Service Provided by A Bank or Other Financial Institution That Allows Itsএক মুঠো স্বপ্নNo ratings yet

- Thesis PreDocument11 pagesThesis PreAsnake MekonnenNo ratings yet

- Mobile Banking ProjectDocument7 pagesMobile Banking ProjectAnonymous FMNH3ZpNo ratings yet

- Mobile Wallet ProjectDocument21 pagesMobile Wallet ProjectGeetika AroraNo ratings yet

- Ruchi Finance LabDocument35 pagesRuchi Finance LabNitish BhardwajNo ratings yet

- Cashless Society RRLDocument14 pagesCashless Society RRLLouize Sebastian100% (1)

- Module Four MnnuzDocument10 pagesModule Four MnnuzMoideenNo ratings yet

- Mobile Banking Services: by Niina Mallat, Matti Rossi, and Virpi Kristiina TuunainenDocument5 pagesMobile Banking Services: by Niina Mallat, Matti Rossi, and Virpi Kristiina TuunainenMosiuzzaman SumonNo ratings yet

- Overview of Mobile Payments WhitepaperDocument14 pagesOverview of Mobile Payments WhitepapertderuvoNo ratings yet

- Marshall Final ReportDocument37 pagesMarshall Final ReportPradeep JosephNo ratings yet

- Mobile BankingDocument8 pagesMobile Bankingapi-19917160No ratings yet

- Chapter 1Document7 pagesChapter 1ZyZy ArradazaNo ratings yet

- A Mobile Banking ConceptualDocument16 pagesA Mobile Banking ConceptualAvtaar SinghNo ratings yet

- 13 Prime Indexes Mobile Payments Industry Review 11102018Document20 pages13 Prime Indexes Mobile Payments Industry Review 11102018AmanNo ratings yet

- State of The Art Secure Mobile PaymentDocument18 pagesState of The Art Secure Mobile Paymentswati sinhaNo ratings yet

- Mobile Commerce in BankingDocument29 pagesMobile Commerce in BankingRuchy SinghNo ratings yet

- 2mobile Banking System in Bangladesh A Closer StudyDocument8 pages2mobile Banking System in Bangladesh A Closer StudyRawnak AdnanNo ratings yet

- Mobile BankingDocument14 pagesMobile BankingBiplob BoraNo ratings yet

- The Influence of Mobile Banking Services On The Financial Performance ofDocument12 pagesThe Influence of Mobile Banking Services On The Financial Performance ofDanielNo ratings yet

- Note For Chapter 6Document11 pagesNote For Chapter 6Lingayenregcenter SupervisorNo ratings yet

- Mobile BankingDocument20 pagesMobile BankingRahmatullah AbirNo ratings yet

- Fpoha17074 Complete WorkDocument15 pagesFpoha17074 Complete WorkPrince TreasureNo ratings yet

- Mobile Money Adoption in A Fragile Economy: The Case of A Seven Year Failed Experiment in NigeriaDocument10 pagesMobile Money Adoption in A Fragile Economy: The Case of A Seven Year Failed Experiment in NigeriainventionjournalsNo ratings yet

- Mobile BankingDocument12 pagesMobile BankingPriyansiNo ratings yet

- Unit 2 M CommerceDocument2 pagesUnit 2 M CommerceAkshay ChutaniNo ratings yet

- Project Paytm IPODocument35 pagesProject Paytm IPOnaina karraNo ratings yet

- Mobile Banking - Wikipedia PDFDocument74 pagesMobile Banking - Wikipedia PDFpes 77No ratings yet

- The Use of M-Payment Services in South Africa A Value Based Perceptions ApproachDocument21 pagesThe Use of M-Payment Services in South Africa A Value Based Perceptions ApproachAyu DamanikNo ratings yet

- Week 3 Group AssignmentDocument4 pagesWeek 3 Group AssignmentFlora WairimuNo ratings yet

- Mobile Banking Conceptual ModelDocument21 pagesMobile Banking Conceptual ModelGill Varinder SinghNo ratings yet

- Review of Literature:: Definition of Electronic Payment SystemsDocument3 pagesReview of Literature:: Definition of Electronic Payment SystemsAvula Shravan YadavNo ratings yet

- Sia 2 AssDocument3 pagesSia 2 AssLeica EspirituNo ratings yet

- Mobile Commerce: Unique Features of M-CommerceDocument12 pagesMobile Commerce: Unique Features of M-CommerceShreyas SatardekarNo ratings yet

- B - Heijden (2002) Cost As Factor Mobile Payment SystemDocument15 pagesB - Heijden (2002) Cost As Factor Mobile Payment SystemDiana HartonoNo ratings yet

- Mobile Payment Method Based On Public KeDocument12 pagesMobile Payment Method Based On Public KeDEVANG PARABNo ratings yet

- 7th Page BodyDocument50 pages7th Page BodybhawanachitlangiaNo ratings yet

- Mobile BankingDocument11 pagesMobile Bankingsurajitbijoy0% (1)

- Agent Networks FullDocument25 pagesAgent Networks FullMuhammad KaleemNo ratings yet

- M-Commerce - Lec 1Document39 pagesM-Commerce - Lec 1Mahyy AdelNo ratings yet

- Final Use of MobileDocument32 pagesFinal Use of MobileVarun AgarwalNo ratings yet

- Chapter 1 Introduction PartDocument4 pagesChapter 1 Introduction Parttravon8877No ratings yet

- Mobile BankingDocument17 pagesMobile BankingSuchet SinghNo ratings yet

- Implications For Central Banks of The Development of Electronic MoneyDocument20 pagesImplications For Central Banks of The Development of Electronic MoneyAnonymous PnXCkKIagNo ratings yet

- Mobile Payment Tutor Institution Date A Systematic Literature Review On Mobile PaymentDocument14 pagesMobile Payment Tutor Institution Date A Systematic Literature Review On Mobile PaymentShikz Alexine100% (1)

- Mobile Banking by Irfan ArifDocument20 pagesMobile Banking by Irfan ArifMuhammad Talha KhanNo ratings yet

- NO. Particulars PG No. 1Document58 pagesNO. Particulars PG No. 1Sunil ColacoNo ratings yet

- Ecom Assignment Unit 4Document23 pagesEcom Assignment Unit 4Kanishka SharmaNo ratings yet

- Review of Related Literature and StudiesDocument16 pagesReview of Related Literature and StudiesMikay MendozaNo ratings yet

- Payments IndustryDocument58 pagesPayments IndustryArindam VatsaNo ratings yet

- Thesis1 Pelonia-Saculo Thesis1Document9 pagesThesis1 Pelonia-Saculo Thesis1Joshua Del Rosario SaculoNo ratings yet

- 5g Mobile Core Competitive Landscape Assessment Globaldata IntelligentDocument9 pages5g Mobile Core Competitive Landscape Assessment Globaldata IntelligentabdulqaderNo ratings yet

- Key Features - eSRVCC SolutionDocument1 pageKey Features - eSRVCC SolutionabdulqaderNo ratings yet

- Understanding 4G LTE For BusinessDocument10 pagesUnderstanding 4G LTE For BusinessabdulqaderNo ratings yet

- Benefits of VoLTERCS To Carriers and SubscribersDocument13 pagesBenefits of VoLTERCS To Carriers and SubscribersabdulqaderNo ratings yet

- Orange Rcsvolte Iot Event Vf2Document12 pagesOrange Rcsvolte Iot Event Vf2abdulqaderNo ratings yet

- 5G Networks - Technologies, Capabilities and DeploymentsDocument20 pages5G Networks - Technologies, Capabilities and DeploymentsabdulqaderNo ratings yet

- 5G Is Now, From eMBB To Digital SocietyDocument18 pages5G Is Now, From eMBB To Digital SocietyabdulqaderNo ratings yet

- 5G RAN Standards Developments (3GPP) : Dr. Ivo MaljevicDocument24 pages5G RAN Standards Developments (3GPP) : Dr. Ivo MaljevicabdulqaderNo ratings yet

- ZTE - Network Slicing Building Next Generation Networks V1.1Document18 pagesZTE - Network Slicing Building Next Generation Networks V1.1abdulqaderNo ratings yet

- Peter Skov - Nokia - 5G Basestations Aalborg v1Document11 pagesPeter Skov - Nokia - 5G Basestations Aalborg v1abdulqaderNo ratings yet

- The 5 Best 5G Use Cases: Brian SantoDocument4 pagesThe 5 Best 5G Use Cases: Brian SantoabdulqaderNo ratings yet

- 5g Use CasesDocument18 pages5g Use CasesabdulqaderNo ratings yet

- Basic WiFi Net Planning v140516 PDFDocument51 pagesBasic WiFi Net Planning v140516 PDFabdulqaderNo ratings yet

- 4 WiFi Small Cells.Document16 pages4 WiFi Small Cells.abdulqaderNo ratings yet

- Wi-Fi Calling For Customer Retention: (Solution Datasheet)Document4 pagesWi-Fi Calling For Customer Retention: (Solution Datasheet)abdulqaderNo ratings yet

- Wi-Fi Calling White PaperDocument16 pagesWi-Fi Calling White PaperabdulqaderNo ratings yet

- Wlan - 3gpp Cellular Interworking (Wi-Fi Offload)Document13 pagesWlan - 3gpp Cellular Interworking (Wi-Fi Offload)abdulqaderNo ratings yet

- Part 3-Wi-Fi Network DesignDocument65 pagesPart 3-Wi-Fi Network DesignabdulqaderNo ratings yet

- Class 02Document3 pagesClass 02Aasim Bin BakrNo ratings yet

- The World's Top 50 Banks and Institutions That No Longer ExistDocument1 pageThe World's Top 50 Banks and Institutions That No Longer Existnikkei225traderNo ratings yet

- Receivables NotesDocument12 pagesReceivables NotesJohn Cedfrey NarneNo ratings yet

- Transactions May23Document1 pageTransactions May23John FarrellNo ratings yet

- M2Ubiz MandateDocument1 pageM2Ubiz MandateVanessa LimNo ratings yet

- Investagrams ReportDocument6 pagesInvestagrams ReportKaren Jella EscobinNo ratings yet

- Gmail - PSA Serbilis AcknowledgementDocument1 pageGmail - PSA Serbilis AcknowledgementSimon TantuanNo ratings yet

- 7Document22 pages7Sanket MhetreNo ratings yet

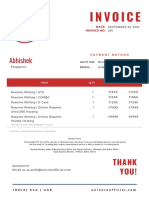

- Unicore InvoiceDocument1 pageUnicore InvoiceUNICORE No.1 Resume Writer in IndiaNo ratings yet

- CIMBClicksDocument6 pagesCIMBClicksmaxNo ratings yet

- Marketing Strategy Analysis of NAGAD How "NAGAD" Will Compete "Bkash"Document1 pageMarketing Strategy Analysis of NAGAD How "NAGAD" Will Compete "Bkash"2801 Dewan Foysal HaqueNo ratings yet

- Brealey-Fundamentals-Of-Corporate-Finance-10e ch05-ppt-S2qZDocument56 pagesBrealey-Fundamentals-Of-Corporate-Finance-10e ch05-ppt-S2qZKinNo ratings yet

- Santander: A Story of GrowthDocument30 pagesSantander: A Story of GrowthJavier PalaciosNo ratings yet

- Deed of Agreement Blank-V9-Doa-SblcDocument20 pagesDeed of Agreement Blank-V9-Doa-SblcLIOE JINNo ratings yet

- SUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowDocument2 pagesSUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowSayanta Biswas100% (1)

- Cash Management of Icici BankDocument19 pagesCash Management of Icici BankBassam QureshiNo ratings yet

- Challan Form SargodhaDocument1 pageChallan Form SargodhaUsama NazirNo ratings yet

- Effects of FailureDocument2 pagesEffects of FailureAman JainNo ratings yet

- Beneficiary Details SBCOADUD2795489: (Items Marked Must Be Incorporated in The NEFT/RTGS Message)Document1 pageBeneficiary Details SBCOADUD2795489: (Items Marked Must Be Incorporated in The NEFT/RTGS Message)thweesha tanejaNo ratings yet

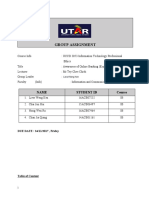

- Group Assignment: Name Student Id CourseDocument30 pagesGroup Assignment: Name Student Id CourseGONG HUEY WEN MoeNo ratings yet

- Types of Bank AccountsDocument20 pagesTypes of Bank AccountsNisarg Khamar73% (11)

- HDFC ProjectDocument122 pagesHDFC Projectmanbesh50% (2)

- Aqeeq-Far East - Special DirectDocument2 pagesAqeeq-Far East - Special DirectRyan DarmawanNo ratings yet

- Factura 77501Document1 pageFactura 77501Evelina CristinaNo ratings yet

- Letter of InstructionDocument4 pagesLetter of Instructionmptacly9152No ratings yet

- Master Circular - Scheme of Penalties For Bank Branches Based On Performance in Rendering Customer Service To The Members of PublicDocument4 pagesMaster Circular - Scheme of Penalties For Bank Branches Based On Performance in Rendering Customer Service To The Members of PublicVasu Ram JayanthNo ratings yet

- Promotion Study Material For BanksDocument2 pagesPromotion Study Material For Bankspunj2463% (19)

- Citi Bank in BangladeshDocument2 pagesCiti Bank in BangladeshSSN073068No ratings yet

- Accounting Treatment of Import PurchaseDocument3 pagesAccounting Treatment of Import PurchasePallavi ChawlaNo ratings yet

- Wells Fargo Expresssend Remittance Transfer RecordDocument1 pageWells Fargo Expresssend Remittance Transfer RecordCarlos Eduardo Najera Farias100% (1)