Professional Documents

Culture Documents

Prelim Quiz 02 Partnerhsip Operation

Uploaded by

Garp BarrocaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prelim Quiz 02 Partnerhsip Operation

Uploaded by

Garp BarrocaCopyright:

Available Formats

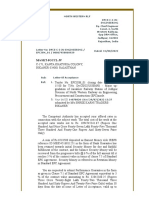

RAMON MAGSAYSAY MEMORIAL COLLEGES

COLLEGE OF ACCOUNTANCY

Pioneer Ave., General Santos City

Tel. No. 552-3348

Name: ______________________________ Date: ___________ Score: _____________

Subject : ACCTG 13 PRELIM QUIZ 02

Instructor: Mrs. Marivic B. Peñaflor, CPA, MBA AY: 2021-2022 1st Semester

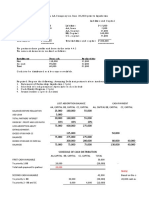

1. In the calendar year 2020, the partnership of A and B realized a net profit of P 240,000. The capital

accounts of the partners show the following postings:

A capital B, capital

Debit Credit Debit Credit

Jan. 200,000 280,000

May1 25,000 16,000

July 1 29,000

Aug 1 18,000

Oct 1 15,000 5,000

a. If the profits are to be divided based on average capital, the share of A and B, respectively

are :

b. If 20% interest based on the capital at the end of the year is allowed and given and the balance

of the 240,000 profit is divided equally, the total share of A and B, respectively are:

c. Prepare journal entry to record the distribution of profit of each of the given case.

2. In the calendar year 2020, the partnership of Ana and Fe show the postings on their capital accounts

presented below:

Ana, capital Fe, capital

Debit Credit Debit Credit

Jan. 300,000 330,000

June 1 24,000 50,000

August 1 45,000

Oct 1 50,000

Nov 1 30,000 22,000

A. For each of the following independent profit and loss agreement cases, prepare a schedule to

distribute profit: (5 pts each)

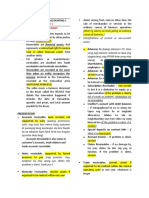

1. Salaries are provided to Ana of 32,000 and 23,000 to Fe. Ana receives a bonus of 5 % of profit after

bonus. Interest of 15% based on ending capital balances and remainder will be shared on the ratio of

3:2. Profit for distribution was P 600,000.

2. Ana receives a bonus of 5% of profit after bonus and salaries. Salaries are P

50,000 to Ana and 40,000 to Fe. Interest of 10% based on average capital balances and any remainder

will be divided equally. Profit for distribution was P 640,000.

3. Both Ana and Fe are given an interest of 8% based on their respective average

capital balances, salaries of P 60,000 and 80,000 are given respectively. Ana receives a bonus of 15%

of profit after interest salaries and bonus and any remainder will be divided equally. Profit for

distribution was P 550,000.

B. Prepare journal entry to record the distribution of profit of each of the given case. (2 points each)

You might also like

- Full Download Experimental Organic Chemistry A Miniscale and Microscale Approach 6th Edition Gilbert Solutions ManualDocument36 pagesFull Download Experimental Organic Chemistry A Miniscale and Microscale Approach 6th Edition Gilbert Solutions Manualtotallystance4z36h100% (34)

- MDZ01-200 Seller Contract 13sept2018Document5 pagesMDZ01-200 Seller Contract 13sept2018Vaithiswari100% (1)

- Exam Booster For Bulgaria Student's BookDocument269 pagesExam Booster For Bulgaria Student's BookNatalia Lesnikova-Byandova100% (1)

- Sadhana For A Devotee of Ramakrishna MathDocument9 pagesSadhana For A Devotee of Ramakrishna MathSwami Vedatitananda100% (3)

- Accounting For Special Transactions First Grading ExaminationDocument22 pagesAccounting For Special Transactions First Grading Examinationaccounts 3 life94% (18)

- Summary of Evangelii NuntiandiDocument2 pagesSummary of Evangelii NuntiandiFray Gen Pacaldo Labana94% (32)

- COPC CSP Standard Release 4.3 Version 1.1 PDFDocument153 pagesCOPC CSP Standard Release 4.3 Version 1.1 PDFMohammed El-Haddad100% (1)

- Parcor CompuDocument14 pagesParcor CompuErika delos Santos100% (3)

- Arts Cpa Review: BatchDocument8 pagesArts Cpa Review: BatchKristel Sumabat0% (1)

- Reminder: Use Your Official Answer Sheet: Universidad de ManilaDocument25 pagesReminder: Use Your Official Answer Sheet: Universidad de ManilaMarcellana ArianeNo ratings yet

- Practical Accounting 2: Angelito R. Punzalan, CPA, MBADocument33 pagesPractical Accounting 2: Angelito R. Punzalan, CPA, MBADaniella Mae Elip100% (1)

- Afar ParcorDocument271 pagesAfar Parcorawesome bloggers0% (1)

- Tik Tok - Case StudyDocument5 pagesTik Tok - Case StudyMd Firdaus Hj MashorNo ratings yet

- Prelim Graded Exercises 0007Document2 pagesPrelim Graded Exercises 0007Garp BarrocaNo ratings yet

- Prelim Graded Exercises 0007Document2 pagesPrelim Graded Exercises 0007Garp BarrocaNo ratings yet

- ARTS CPA Review Practical Accounting 2 Multiple Choice Problems 1Document3 pagesARTS CPA Review Practical Accounting 2 Multiple Choice Problems 1Ruffa Mae MaldoNo ratings yet

- 1st Year ExamDocument9 pages1st Year ExamMark Domingo MendozaNo ratings yet

- Accountancy Unit Test 1 Paper Shalom 2ndDocument4 pagesAccountancy Unit Test 1 Paper Shalom 2ndTûshar ThakúrNo ratings yet

- Midterm Exams - 1ST YrDocument7 pagesMidterm Exams - 1ST YrMark Domingo MendozaNo ratings yet

- Partnership CE W Control Ans PDFDocument10 pagesPartnership CE W Control Ans PDFRedNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines Manilaxara mizpahNo ratings yet

- Fixed and Flucuating Capital AccountDocument3 pagesFixed and Flucuating Capital AccountArun AroraNo ratings yet

- Long Quiz - Ast - MarcellanaDocument11 pagesLong Quiz - Ast - MarcellanaMarcellana ArianeNo ratings yet

- Finals ProblemsDocument9 pagesFinals Problemsr3gjc.nfjpia2223No ratings yet

- Acctg13 Midterm Exam TQ 2021 2022 2nd SemDocument6 pagesAcctg13 Midterm Exam TQ 2021 2022 2nd SemGarp BarrocaNo ratings yet

- 1ST GRADING EXAM For StudentsDocument12 pages1ST GRADING EXAM For StudentsAndrea Florence Guy VidalNo ratings yet

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- No Solutions, No PointsDocument5 pagesNo Solutions, No PointsLois Yanzeigh Habbiling BalachaweNo ratings yet

- AFAR-01 PartnershipDocument6 pagesAFAR-01 PartnershipRamainne Ronquillo0% (1)

- Afar 01Document11 pagesAfar 01Raquel Villar DayaoNo ratings yet

- Afar Partnership Operation BagayaoDocument3 pagesAfar Partnership Operation BagayaoShampaigne Mheg PadaoNo ratings yet

- PacoaDocument18 pagesPacoaBianca VinluanNo ratings yet

- Screenshot 2023-08-14 at 1.31.19 PMDocument4 pagesScreenshot 2023-08-14 at 1.31.19 PMEri ChaNo ratings yet

- Midterm Exam Part1 DFCM Act SPCL Trans 2020 Edition Feb 2020Document19 pagesMidterm Exam Part1 DFCM Act SPCL Trans 2020 Edition Feb 2020calliemozartNo ratings yet

- ExmDocument18 pagesExmRoy Mitz Bautista0% (2)

- Act. Partnership AccountDocument10 pagesAct. Partnership AccountPaupau100% (1)

- 12 Accountancy SQP 4Document11 pages12 Accountancy SQP 4KandaroliNo ratings yet

- Partnership Q5Document2 pagesPartnership Q5Lorraine Mae RobridoNo ratings yet

- 1st Grading Exam - Key AnswersDocument28 pages1st Grading Exam - Key AnswersAmie Jane MirandaNo ratings yet

- CBSE Gulf Board Class 12 ACCOUNTANCY Exam Sample Question Paper 2020Document13 pagesCBSE Gulf Board Class 12 ACCOUNTANCY Exam Sample Question Paper 2020Kunal KapoorNo ratings yet

- Assets: Name: Date: Professor: Section: ScoreDocument2 pagesAssets: Name: Date: Professor: Section: ScoreAndrea Florence Guy VidalNo ratings yet

- Prelim Quiz 02 Partnerhsip OperationDocument9 pagesPrelim Quiz 02 Partnerhsip OperationGarp BarrocaNo ratings yet

- Partnership OperationDocument3 pagesPartnership OperationBianca Iyiyi0% (1)

- 10 Sample PaperDocument41 pages10 Sample Papergaming loverNo ratings yet

- Jeremeh V Querol Bachelor of Science in Tourism ManagementDocument8 pagesJeremeh V Querol Bachelor of Science in Tourism ManagementJasmine ActaNo ratings yet

- Ac 16 MidtermDocument20 pagesAc 16 MidtermMarjorie AmpongNo ratings yet

- Saint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Document3 pagesSaint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Abhishek SharmaNo ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDocument6 pagesCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06No ratings yet

- p1 Quiz With TheoryDocument15 pagesp1 Quiz With TheoryGrace CorpoNo ratings yet

- SATURDAYDocument20 pagesSATURDAYkristine bandaviaNo ratings yet

- Integ02 A QuestionsDocument20 pagesInteg02 A QuestionsRonald CorunoNo ratings yet

- Accounting For Special Transactions First Grading ExaminationDocument22 pagesAccounting For Special Transactions First Grading ExaminationJasmine Sollestre100% (1)

- Accountancy Unit Test 2 - WorksheetDocument12 pagesAccountancy Unit Test 2 - WorksheetFawaz YoosefNo ratings yet

- Accounts TestDocument2 pagesAccounts TestAPS Apoorv prakash singhNo ratings yet

- Solutions Ang UbanDocument20 pagesSolutions Ang UbanPrincess Frean VillegasNo ratings yet

- p1 Quiz With TheoryDocument16 pagesp1 Quiz With TheoryRica RegorisNo ratings yet

- Anas - Afar - Prelim Module - Ivisan - Bsa 4 - A B 2Document13 pagesAnas - Afar - Prelim Module - Ivisan - Bsa 4 - A B 2nisutrackerNo ratings yet

- Quiz in PartnershipDocument13 pagesQuiz in PartnershipKianJohnCentenoTuricoNo ratings yet

- 2122 1st AC - FAR Act. 05Document2 pages2122 1st AC - FAR Act. 05Airish GeronimoNo ratings yet

- Accounting For Special Transactions Prelim Examination: Use The Following Information For The Next Two QuestionsDocument24 pagesAccounting For Special Transactions Prelim Examination: Use The Following Information For The Next Two QuestionsArtisan82% (11)

- Assignment Accountancy Class 12 PartnershipDocument4 pagesAssignment Accountancy Class 12 PartnershipVarun HurriaNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- The Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaFrom EverandThe Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- 85184767Document9 pages85184767Garp BarrocaNo ratings yet

- Partnership FormationDocument51 pagesPartnership FormationGarp BarrocaNo ratings yet

- Problem 1Document5 pagesProblem 1Garp BarrocaNo ratings yet

- Ans Key Inst Liq4Document7 pagesAns Key Inst Liq4Garp BarrocaNo ratings yet

- Cash and Cash Equivalents: Answer: CDocument142 pagesCash and Cash Equivalents: Answer: CGarp BarrocaNo ratings yet

- Acctg13 Midterm Exam TQ 2021 2022 2nd SemDocument6 pagesAcctg13 Midterm Exam TQ 2021 2022 2nd SemGarp BarrocaNo ratings yet

- InstructionsDocument7 pagesInstructionsGarp BarrocaNo ratings yet

- 52055576Document1 page52055576Garp BarrocaNo ratings yet

- AtelengDocument2 pagesAtelengGarp BarrocaNo ratings yet

- Prelim Exercises Partnership Operation 28Document5 pagesPrelim Exercises Partnership Operation 28Garp BarrocaNo ratings yet

- City of Iriga Vs CASURECODocument2 pagesCity of Iriga Vs CASURECOGarp BarrocaNo ratings yet

- College of Accountancy Pioneer Avenue, General Santos City: Ramon Magsaysay Memorial CollegesDocument21 pagesCollege of Accountancy Pioneer Avenue, General Santos City: Ramon Magsaysay Memorial CollegesGarp BarrocaNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015 PDFDocument81 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015 PDFGarp BarrocaNo ratings yet

- Prelim Quiz 1Document1 pagePrelim Quiz 1Garp BarrocaNo ratings yet

- Intacc 1 Notes Part 3Document17 pagesIntacc 1 Notes Part 3Crizelda BauyonNo ratings yet

- NDCP 'S ChallengeDocument19 pagesNDCP 'S ChallengeRj BawitNo ratings yet

- Ramagya School, Noida HOLIDAY H.W WORKSHEET-1 (2021-22) Subject: Computer Class: IiiDocument4 pagesRamagya School, Noida HOLIDAY H.W WORKSHEET-1 (2021-22) Subject: Computer Class: IiiYogeeta Rahul SoodNo ratings yet

- "The Question Concerning Technology" by Martin HeideggerDocument4 pages"The Question Concerning Technology" by Martin HeideggerFranzelle JaictenNo ratings yet

- Physical Self Sexual Self Digital Self Material Self Spiritual Self LearningDocument1 pagePhysical Self Sexual Self Digital Self Material Self Spiritual Self LearningPatricia Ortega100% (1)

- Assignment 3 LRWIIDocument4 pagesAssignment 3 LRWIIAnonymous DxiKHQNo ratings yet

- Blake's Theory of ContrarinessDocument3 pagesBlake's Theory of Contrarinessjazib1200100% (1)

- Pidilite WinnerDocument18 pagesPidilite WinnerRahul AgrawalNo ratings yet

- BibliographyDocument23 pagesBibliographyCodyNo ratings yet

- The Earth Dragon Awakes, Reading Comprehension Worksheet - Answer KeyDocument2 pagesThe Earth Dragon Awakes, Reading Comprehension Worksheet - Answer KeyRania FarranNo ratings yet

- Table of Specification: Ikatlong MarkahanDocument1 pageTable of Specification: Ikatlong MarkahanJemarie QuiacusanNo ratings yet

- Loa Epc JSMDocument2 pagesLoa Epc JSMIES-GATEWizNo ratings yet

- ER Form Revised April 2014Document1 pageER Form Revised April 2014gopikrish04No ratings yet

- Salah-Namaz Mentioned in The Holy QuranDocument4 pagesSalah-Namaz Mentioned in The Holy QuranainseanNo ratings yet

- EthicsDocument8 pagesEthicsNameNo ratings yet

- MotiveWave - Connect Your AccountDocument8 pagesMotiveWave - Connect Your AccountThe Trading PitNo ratings yet

- Son of God and The Angelomorphic Holy SpiritDocument23 pagesSon of God and The Angelomorphic Holy Spiritjayemcee2100% (1)

- An Excerpt From 'The Hardest Place'Document4 pagesAn Excerpt From 'The Hardest Place'wamu885No ratings yet

- Application For ProbationDocument2 pagesApplication For ProbationpaoNo ratings yet

- 5Fqj (LQ ZFVF: Lziff Dgqfno S) Z/DXN Pre NominationDocument8 pages5Fqj (LQ ZFVF: Lziff Dgqfno S) Z/DXN Pre NominationMahesh ShresthaNo ratings yet

- Revised GMSA UEW-K ConstitutionDocument23 pagesRevised GMSA UEW-K ConstitutionAwanzy0% (1)

- Questions 80-82 Refer To The Following Radio Advertisement.: Arts DirectionsDocument6 pagesQuestions 80-82 Refer To The Following Radio Advertisement.: Arts DirectionsPh0nG TrAnNo ratings yet

- Discpline and Ideas in Social Sciences: GradeDocument17 pagesDiscpline and Ideas in Social Sciences: GradeJ-Ann FloresNo ratings yet