Professional Documents

Culture Documents

Problem 2 1. Goodwill: Books of Acquirer

Uploaded by

Nikki Coleen SantinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 2 1. Goodwill: Books of Acquirer

Uploaded by

Nikki Coleen SantinCopyright:

Available Formats

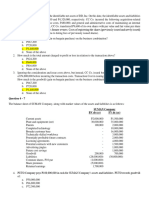

PROBLEM 2

1. GOODWILL

Consideration transferred:

Cash 18,000,000

Expected par value of Contingent 400,000

Consideration - 1M x 40% probability

Common Stock (P80 market value x 50k 4,000,000

shares)

Consideration transferred 22,400,000

Less: Market Value of Assets and Liabilities

acquired:

Cash 90,000

Receivables 190,000

Inventories 7,000,000

Plant and equipment, net 40,000,000

Secret formula 7,000,000

Brand names 5,000,000

Trademark 4,000,000

Decrease in Liabilities (400,000)

Long-term Liabilities (47,000,000) 15,880,000

Positivie excess - Goodwill 6,520,000

Books of Acquirer

Journal entries of Tony, Inc. in the Acquisition of Assets and Liabilities

Cash 90,000

Receivables 190,000

Inventories 7,000,000

Plant and equipment, net 40,000,000

Secret formula 7,000,000

Brand names 5,000,000

Trademark 4,000,000

Goodwill 6,520,000

Current Liabilities 400,000

Long-term Liabilities 47,000,000

Cash 18,000,000

Estimated Liability for Contingent 400,000

Consideration - 1M x 40% probability

Common Stock (P2 par value x 50k 100,000

shares)

Additional paid-in capital (P80- P2) x 50k 3,900,000

shares

Journal entries of Tony, Inc. in the Acquisition expenses

Acquisition-related expenses/ Accumulated 1,100,000

profit or loss/ Retained Earnings

Cash 1,100,000

Journal entries of Tony, Inc. in the Cost to Issue and Register Stocks

Additional paid-in capital/ Share premium 500,000

Cash 500,000

You might also like

- AFAR C1 MC AnswersDocument39 pagesAFAR C1 MC Answersheyhey84% (19)

- Hotel Financial StatementsDocument27 pagesHotel Financial StatementsVera Yuk86% (7)

- Chapter 31Document7 pagesChapter 31AnonnNo ratings yet

- Accounting Principles Chapter 1 NotesDocument3 pagesAccounting Principles Chapter 1 NotesHansAxel100% (2)

- Chapter 1-SolutionsDocument14 pagesChapter 1-SolutionsPrince CalicaNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep DadyalNo ratings yet

- Finding Operating and Free Cash FlowsDocument5 pagesFinding Operating and Free Cash FlowsM.TalhaNo ratings yet

- FINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationDocument17 pagesFINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationAiron Keith Along100% (1)

- DLL GM LoansDocument6 pagesDLL GM LoansCarol Zamora50% (2)

- Fine Dining Restaurant Business PlanDocument46 pagesFine Dining Restaurant Business PlanPinaki Sengupta100% (1)

- Asset Accounting Interview QuestionsDocument12 pagesAsset Accounting Interview QuestionsvinayNo ratings yet

- Module 1 Comprehensive - MergerDocument5 pagesModule 1 Comprehensive - MergerGenevieve Manalo100% (6)

- Bargain Purchase Gain/ Gain On Acquisition: Books of AcquirerDocument2 pagesBargain Purchase Gain/ Gain On Acquisition: Books of AcquirerNikki Coleen SantinNo ratings yet

- Buscom Problems 2 4Document5 pagesBuscom Problems 2 4De Jesus, Tracy Marie L.No ratings yet

- Business Combination MergerDocument108 pagesBusiness Combination Mergergojo satoruNo ratings yet

- Bus. Combi Probs and SolnDocument3 pagesBus. Combi Probs and SolnRyan Prado AndayaNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 14Document29 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 14jayson100% (2)

- Acquisition of Assets and Liabilities:: Problem IDocument17 pagesAcquisition of Assets and Liabilities:: Problem IklairvaughnNo ratings yet

- 1SolMan ProblemsDocument17 pages1SolMan ProblemsBianca AcoymoNo ratings yet

- Merger Problems & SolutionsDocument8 pagesMerger Problems & Solutionsmisonim.eNo ratings yet

- SolutionChapter1RevFinal EditedDocument25 pagesSolutionChapter1RevFinal EditedkimberlyroseabianNo ratings yet

- Accounting For Business Combi SolutionDocument4 pagesAccounting For Business Combi SolutionSophia Anne Margarette NicolasNo ratings yet

- Multiple Choice ProblemsDocument17 pagesMultiple Choice ProblemsDieter LudwigNo ratings yet

- Post-Combination Balance Sheet: (Requirement 1) : Total Liabilities and Stockholder'S EquityDocument2 pagesPost-Combination Balance Sheet: (Requirement 1) : Total Liabilities and Stockholder'S Equityjayjay storageNo ratings yet

- ACFrOgCXlqyBubUO 0k2 oqedP7h-nBYz6kyTwIOUtsM8YzGP85yKUDWiFtg8sxBlV4Hw82Zrv8Ha9zgsOOJOU6tLz838EivSxvzOqilLjimAlle6rnKpoa8Bur97ErTWtcl mZnrslLoC3IU KDocument2 pagesACFrOgCXlqyBubUO 0k2 oqedP7h-nBYz6kyTwIOUtsM8YzGP85yKUDWiFtg8sxBlV4Hw82Zrv8Ha9zgsOOJOU6tLz838EivSxvzOqilLjimAlle6rnKpoa8Bur97ErTWtcl mZnrslLoC3IU KStefanie Jane Royo PabalinasNo ratings yet

- Solution Chapter 14Document26 pagesSolution Chapter 14grace guiuanNo ratings yet

- Chapter 15Document9 pagesChapter 15Coleen Joy Sebastian PagalingNo ratings yet

- Entry Made Correct/Should Be EntryDocument15 pagesEntry Made Correct/Should Be EntryLove FreddyNo ratings yet

- Acctg 601Document2 pagesAcctg 601Maria Regina Javier100% (1)

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Advacc Buscom Prob IVDocument2 pagesAdvacc Buscom Prob IVEdward James SantiagoNo ratings yet

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Pembahasan Genap ACT Genap 2020 19 MarDocument12 pagesPembahasan Genap ACT Genap 2020 19 MarSoca NarendraNo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- PROBLEM 1: Goodwill and Barain Purchase Option Requirement 1Document2 pagesPROBLEM 1: Goodwill and Barain Purchase Option Requirement 1PrincessNo ratings yet

- P1-43 Comprehensive Business Combination ProblemDocument3 pagesP1-43 Comprehensive Business Combination ProblemkathNo ratings yet

- Business CombinationDocument3 pagesBusiness CombinationkathNo ratings yet

- P1-43 Comprehensive Business Combination ProblemDocument3 pagesP1-43 Comprehensive Business Combination ProblemkathNo ratings yet

- Chapter 14 Business CombinationDocument5 pagesChapter 14 Business CombinationAshNor Randy0% (1)

- Adv Acc 2 Module 1 Topic1.2Document5 pagesAdv Acc 2 Module 1 Topic1.2James CantorneNo ratings yet

- Ans 31 To 41Document2 pagesAns 31 To 41Mallet S. GacadNo ratings yet

- Model Paper AnswersDocument12 pagesModel Paper AnswersShenali NupehewaNo ratings yet

- Problem 1: Books of Acquirer/AcquiringDocument6 pagesProblem 1: Books of Acquirer/Acquiringaleigna tan100% (1)

- Problem 2.3.Document4 pagesProblem 2.3.ArtisanNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- Problems Week 1 2Document6 pagesProblems Week 1 2Maria Jessa HernaezNo ratings yet

- Buscom 3Document4 pagesBuscom 3dmangiginNo ratings yet

- 001 AdvanceDocument6 pages001 AdvanceSa BilNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- Asset AcquisitionDocument3 pagesAsset AcquisitionMerliza JusayanNo ratings yet

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- Note 5: PPE: Acc. Dep. Book Value Acquisition CostDocument5 pagesNote 5: PPE: Acc. Dep. Book Value Acquisition CostSabel LagoNo ratings yet

- Buscom For 2nd QuizDocument4 pagesBuscom For 2nd QuizSantiago BuladacoNo ratings yet

- Rulona, Kerby Gail P. Bsa-3A Problem 6 1. BDocument12 pagesRulona, Kerby Gail P. Bsa-3A Problem 6 1. BCassandra KarolinaNo ratings yet

- Chapter 33Document7 pagesChapter 33Shane Ivory ClaudioNo ratings yet

- ACCTG 028 - MOD 5 Corporate LiquidationDocument4 pagesACCTG 028 - MOD 5 Corporate LiquidationAlliah Nicole RamosNo ratings yet

- Josie B. Aguila, Mbmba: Financial Accounting For IeDocument6 pagesJosie B. Aguila, Mbmba: Financial Accounting For IeCATHERINE FRANCE LALUCISNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Discussion Problems and Solutions On Module 3, Part 1Document28 pagesDiscussion Problems and Solutions On Module 3, Part 1AJ Biagan MoraNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- Attempt All Questions: Summer Exam-2015Document25 pagesAttempt All Questions: Summer Exam-2015ag swlNo ratings yet

- Business Combination Stock AcquisitionDocument2 pagesBusiness Combination Stock AcquisitionTEOPE, EMERLIZA DE CASTRONo ratings yet

- CorporationDocument4 pagesCorporationJasmine ActaNo ratings yet

- PREA4Document7 pagesPREA4Buenaventura, Elijah B.No ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- Bus Com 12Document3 pagesBus Com 12Chabelita MijaresNo ratings yet

- Assignment 1Document25 pagesAssignment 1Judy ZhangNo ratings yet

- Fic 6Document1 pageFic 6Nikki Coleen SantinNo ratings yet

- Fic 7Document1 pageFic 7Nikki Coleen SantinNo ratings yet

- UntitledDocument1 pageUntitledNikki Coleen SantinNo ratings yet

- Fic 3Document1 pageFic 3Nikki Coleen SantinNo ratings yet

- Fic 5Document1 pageFic 5Nikki Coleen SantinNo ratings yet

- Fic 8Document1 pageFic 8Nikki Coleen SantinNo ratings yet

- Student-Internship-Pledge WFH-OJT Cemds 2.7.22Document1 pageStudent-Internship-Pledge WFH-OJT Cemds 2.7.22Nikki Coleen SantinNo ratings yet

- Bilateral Quotas or ContractualDocument1 pageBilateral Quotas or ContractualNikki Coleen SantinNo ratings yet

- 7 - The Other Sides of Trade Barriers Re-Election of PoliticiansDocument1 page7 - The Other Sides of Trade Barriers Re-Election of PoliticiansNikki Coleen SantinNo ratings yet

- Bit 4Document1 pageBit 4Nikki Coleen SantinNo ratings yet

- According To Rates of Duty A. Ad ValoremDocument1 pageAccording To Rates of Duty A. Ad ValoremNikki Coleen SantinNo ratings yet

- Bit 2Document1 pageBit 2Nikki Coleen SantinNo ratings yet

- Bit 8Document1 pageBit 8Nikki Coleen SantinNo ratings yet

- Bit 1Document1 pageBit 1Nikki Coleen SantinNo ratings yet

- Corpgov Act 3Document1 pageCorpgov Act 3Nikki Coleen SantinNo ratings yet

- Bit 6Document1 pageBit 6Nikki Coleen SantinNo ratings yet

- Auditing Problems Intangibles Impairment and Revaluation PDFDocument44 pagesAuditing Problems Intangibles Impairment and Revaluation PDFMark Domingo MendozaNo ratings yet

- Finman CH 1.2Document1 pageFinman CH 1.2Nikki Coleen SantinNo ratings yet

- Finman CH 1Document1 pageFinman CH 1Nikki Coleen SantinNo ratings yet

- Finmar CH 2.2Document1 pageFinmar CH 2.2Nikki Coleen SantinNo ratings yet

- Corpgov 2Document1 pageCorpgov 2Nikki Coleen SantinNo ratings yet

- Finmar CH 4.2Document1 pageFinmar CH 4.2Nikki Coleen SantinNo ratings yet

- Case Study: Enron ScandalDocument1 pageCase Study: Enron ScandalNikki Coleen SantinNo ratings yet

- Case Study: Enron ScandalDocument1 pageCase Study: Enron ScandalNikki Coleen SantinNo ratings yet

- Bus. Combi 2Document2 pagesBus. Combi 2Nikki Coleen SantinNo ratings yet

- Corpgov 3Document1 pageCorpgov 3Nikki Coleen SantinNo ratings yet

- Case Study: Enron ScandalDocument1 pageCase Study: Enron ScandalNikki Coleen SantinNo ratings yet

- Corpgov 1Document1 pageCorpgov 1Nikki Coleen SantinNo ratings yet

- Blaw Pt. 6Document2 pagesBlaw Pt. 6Nikki Coleen SantinNo ratings yet

- Fmac Chapter One CpuDocument121 pagesFmac Chapter One CpuMasresha Tasew100% (1)

- Valuation of SharesDocument10 pagesValuation of SharesMeraj HassanNo ratings yet

- Mba ReportDocument89 pagesMba ReportRiddhi KakkadNo ratings yet

- Provision For DepreciationDocument10 pagesProvision For DepreciationAsh InuNo ratings yet

- JP Morgan Financial StatementsDocument8 pagesJP Morgan Financial StatementsTamar PirtskhalaishviliNo ratings yet

- Toaz - Info Partnership Qs PRDocument8 pagesToaz - Info Partnership Qs PRToni Rose Hernandez LualhatiNo ratings yet

- 11 Accountancy SP 01Document33 pages11 Accountancy SP 01Abhay ChoudharyNo ratings yet

- (KELOMPOK 4) Latihan Soal Cash FlowDocument5 pages(KELOMPOK 4) Latihan Soal Cash FlowꧾꧾNo ratings yet

- Lgu Naguilian HousingDocument13 pagesLgu Naguilian HousingLhyenmar HipolNo ratings yet

- Business Finance - Chapter 2 Assessment 1 - Rudsan T.Document3 pagesBusiness Finance - Chapter 2 Assessment 1 - Rudsan T.Rudsan TurquezaNo ratings yet

- Aa2e Hal SM Ch09Document19 pagesAa2e Hal SM Ch09Jay BrockNo ratings yet

- Chapter 2 - Plant AssetDocument8 pagesChapter 2 - Plant AssetMelkamu Dessie TamiruNo ratings yet

- FSA Ch13 Bamber PDFDocument50 pagesFSA Ch13 Bamber PDFThameem Ul AnsariNo ratings yet

- Chap 4 The Recording ProcessDocument58 pagesChap 4 The Recording ProcesstamimNo ratings yet

- Combining Liability Structure and Current Asset DecisionDocument13 pagesCombining Liability Structure and Current Asset DecisionAsjad BashirNo ratings yet

- Intro To Accounting - One Credit Assignment ContdDocument8 pagesIntro To Accounting - One Credit Assignment Contdapi-342895963No ratings yet

- Mid Year AcqusitionDocument4 pagesMid Year AcqusitionOmolaja IbukunNo ratings yet

- DSBM Mcqs of All Chapters PDF. 0815Document26 pagesDSBM Mcqs of All Chapters PDF. 0815gaurang media50% (2)

- Filinvest Land, Inc. Horizontal Analysis of Comparative Balance SheetsDocument6 pagesFilinvest Land, Inc. Horizontal Analysis of Comparative Balance SheetsMarcos BallesterosNo ratings yet

- Capital Gain and IFOS - SolutionDocument6 pagesCapital Gain and IFOS - SolutionVenkataRajuNo ratings yet

- Business Loan ServiceDocument4 pagesBusiness Loan ServicevikashNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- FFR 2Document9 pagesFFR 2Jai KishanNo ratings yet