Professional Documents

Culture Documents

Report 38

Uploaded by

Sandesh GhandatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Report 38

Uploaded by

Sandesh GhandatCopyright:

Available Formats

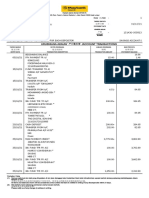

ATLANTIC 21ST

MARCH

CAPESIZE INDEX 2016

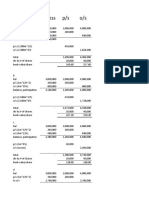

The Atlantic Capesize Index rose for a 14/03/2016 21/03/2016

second consecutive week to 2,590 Trade Cargo Size Weight $/t $/t

points and is still 1,300 points below the

year-ago level. The gain in the voyage NARVIK/ROTTERDAM 150,000/10% 10.0% 2.40 2.45

rates was linked to rising bunker prices. TUBARAO/ROTTERDAM 160,000/10% 10.0% 2.75 3.05

However, there was a weekly decline of RICHARDS BAY/ROTTERDAM 150,000/10% 10.0% 2.45 2.80

$750/day in the Atlantic round voyage

HAMPTON ROADS/ROTTERDAM 120,000/10% 10.0% 3.25 3.55

rate for 180 kdwt vessels to $1,200/day,

while the fronthaul rate slipped by $250/ PUERTO BOLIVAR/ROTTERDAM 150,000/10% 10.0% 3.15 3.30

day to $6,000/day. NOUADIBOU/QINGDAO 140,000/10% 10.0% 6.85 7.20

TUBARAO/JAPAN 160,000/10% 10.0% 5.95 6.30

TUBARAO/QINGDAO 160,000/10% 10.0% 5.45 5.80

T/C TRIP CONT/FAR EAST 180,000 DWT 10.0% 1.06 1.01

T/C TRANSATLANTIC ROUND 180,000 DWT 10.0% 0.33 0.20

100.0%

CALCULATED INDEX 2,469 2,590

Change on Previous Week +50 +121

Change on Four Weeks Ago -127 +22

For more information contact David

Beard/John Kearsey Change on Previous Year -1,452 -1,300

Change on Two Years Ago -8,537 -8,007

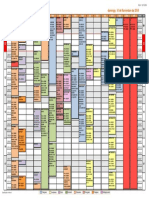

The Atlantic Capesize Index started at SSY Atlantic Capesize Index

5,000 points on 2 October 1989 and

has since been subject to periodic

updating to reflect changing trade 14,000

patterns. The latest update was on 17

July 2015. 2014 2015 2016

12,000

10,000

8,000

Index

6,000

4,000

2,000

0

Jan

Jan

Jun

Jul

Jul

Feb

Aug

Sep

Apr

Oct

Oct

Nov

Dec

May

May

Mar

Mar

SSY Consultancy & Research Ltd Lloyds Chambers | 1 Portsoken Street | London | E1 8PH

T: +44 (0)20 7977 7404 ASSOCIATE OFFICES | Bergen | Bermuda | Hong Kong | Houston | Jakarta | London | Mumbai | Miami | New

F: +44 (0) 20 7265 1549 York | Oslo | Shanghai | Singapore | Sydney | Tokyo | Vancouver | Zug |

While every care has been taken to ensure that the information in this publication is accurate, SSY Consultancy & Research Ltd., can accept no responsibility for any

E: research@ssy.co.uk errors or omissions or any consequences arising therefrom. Figures are based on the latest available information, which is subject to subsequent revision and correction.

The views expressed are those of SSY Consultancy and Research Ltd., and do not necessarily reflect the views of any other associated company. Re-producing any

www.ssyonline.com material from this report without permission from SSY is strictly prohibited.

You might also like

- Initial Mv. Apiradee NareeDocument26 pagesInitial Mv. Apiradee NareeWinston RodriguesNo ratings yet

- Shipping Market Fearnleys Week 52Document1 pageShipping Market Fearnleys Week 52VizziniNo ratings yet

- Penanshin Shipping (Phils.) Inc.: Debit NoteDocument1 pagePenanshin Shipping (Phils.) Inc.: Debit NoteEnriquez Martinez May AnnNo ratings yet

- Formato Draft Survey Intermaris1666140842939Document9 pagesFormato Draft Survey Intermaris1666140842939Deysi Ç.G100% (1)

- 14.draft Survey MV Eurus VentureDocument15 pages14.draft Survey MV Eurus VentureHussain KaddourahNo ratings yet

- Skipness and Loch Fyne Steamers - 2004Document32 pagesSkipness and Loch Fyne Steamers - 2004Clyde Steamers100% (3)

- MBBsavings - 112111 083189 - 2020 12 31Document8 pagesMBBsavings - 112111 083189 - 2020 12 31Kevin WhitteNo ratings yet

- Report 24Document1 pageReport 24Sandesh GhandatNo ratings yet

- Aban To VillegasDocument7 pagesAban To VillegasRicardoNo ratings yet

- Platou Dry 130710Document2 pagesPlatou Dry 130710Mustafa Ozkara100% (1)

- BW 20240404Document10 pagesBW 20240404ajdcavalcante78No ratings yet

- INTACCDocument6 pagesINTACCAeliey AceNo ratings yet

- WK 42 - 20 CARRIERS - S&P MARKET REPORTdraftDocument2 pagesWK 42 - 20 CARRIERS - S&P MARKET REPORTdraftFotini HalouvaNo ratings yet

- Redwood Residences: Pulong Buhangin, Sta Maria Bulacan Pricelist As of November 17, 2017 Caroline (Single Attached)Document1 pageRedwood Residences: Pulong Buhangin, Sta Maria Bulacan Pricelist As of November 17, 2017 Caroline (Single Attached)Bong DominguezNo ratings yet

- Insentif Operator He Dept. CPP Jan-Feb 2023Document1 pageInsentif Operator He Dept. CPP Jan-Feb 2023Heru PrastNo ratings yet

- WK 41 - 20 Carriers - S&P Market ReportDocument2 pagesWK 41 - 20 Carriers - S&P Market ReportFotini HalouvaNo ratings yet

- Working Papers Presentation-Ap-NpDocument6 pagesWorking Papers Presentation-Ap-NpAngelica Mae MarquezNo ratings yet

- Statement of Draught Survey: No. FormDocument1 pageStatement of Draught Survey: No. Formayik muhammadNo ratings yet

- BW 20231117Document10 pagesBW 20231117fysimveeNo ratings yet

- Fracturing Quality Control (QC) Check ListDocument2 pagesFracturing Quality Control (QC) Check ListKamelNo ratings yet

- v1806 Pre-Stowage Plan - Ocean ScallionDocument2 pagesv1806 Pre-Stowage Plan - Ocean ScallionRizky KazamaNo ratings yet

- Lembar Kerja Yuana UnsDocument68 pagesLembar Kerja Yuana UnsYuana Umi Nanda SasmitaNo ratings yet

- Target RajawaliDocument24 pagesTarget Rajawaliyohanes suryonoNo ratings yet

- Specifications Guide: Global CoalDocument27 pagesSpecifications Guide: Global CoalVijay Kumar SiripurapuNo ratings yet

- A.J. Mark Home Resources Development Corporation: Sub-Contract Accomplishment ReportDocument5 pagesA.J. Mark Home Resources Development Corporation: Sub-Contract Accomplishment Reportwarren madayagNo ratings yet

- MCEISADocument13 pagesMCEISACarlos Lopez AriasNo ratings yet

- 1.B Lembar Kerja JurnalDocument8 pages1.B Lembar Kerja JurnalRizqi AzizahNo ratings yet

- MISC Monthly Aug 2017Document6 pagesMISC Monthly Aug 2017Samu MenendezNo ratings yet

- MISC Monthly April 2018Document6 pagesMISC Monthly April 2018Samu MenendezNo ratings yet

- Carbolite PDFDocument2 pagesCarbolite PDFJeffrey JohnsonNo ratings yet

- Fact Sheet - Constant Power Voyage StrategyDocument3 pagesFact Sheet - Constant Power Voyage StrategyManoj KumarNo ratings yet

- Prices Are Starting From: Quantum of The SeasDocument1 pagePrices Are Starting From: Quantum of The SeasoverpopulationNo ratings yet

- MBBsavings - 151436 059563 - 2021 12 31Document13 pagesMBBsavings - 151436 059563 - 2021 12 31geethaNo ratings yet

- Berthing 10.11.2019Document1 pageBerthing 10.11.2019Elvis BallonaNo ratings yet

- Materia Prima InsumosDocument2 pagesMateria Prima InsumosDYLAN MAYKOL BENJAMIN QUISPE CASTRONo ratings yet

- Resolución Pavón SADocument2 pagesResolución Pavón SAlourdes.r.paredesNo ratings yet

- Cash FlowDocument1 pageCash FlowDEDYNo ratings yet

- Ascdc-Man-Op-Concrete Pouring & Testing Monitoring02Document15 pagesAscdc-Man-Op-Concrete Pouring & Testing Monitoring02aristeo garzonNo ratings yet

- DTR 2210Document8 pagesDTR 2210jasuNo ratings yet

- Financial AnalysisDocument3 pagesFinancial AnalysisMarinette MedranoNo ratings yet

- Water Salinity To Gradient ConversionDocument2 pagesWater Salinity To Gradient ConversionStanley OkaforNo ratings yet

- Ach Jnri 2012Document26 pagesAch Jnri 2012Fakhri Rizky AufarNo ratings yet

- ACC PROFORM Feb 2018 NewDocument7 pagesACC PROFORM Feb 2018 NewBharat DafalNo ratings yet

- Inv E230016Document1 pageInv E230016Fitri SukendarNo ratings yet

- Daily Market Report: Poten & PartnersDocument1 pageDaily Market Report: Poten & PartnersalgeriacandaNo ratings yet

- SquatDocument8 pagesSquatRazvan RaduNo ratings yet

- Profit and LossDocument9 pagesProfit and LossAlbiyara MannNo ratings yet

- Duraflex Wires PriceDocument1 pageDuraflex Wires PriceJay TabagoNo ratings yet

- Repair Chiller No. 2Document1 pageRepair Chiller No. 2Rangga NoparaNo ratings yet

- MES Producto: VC TV Volumen de CompraDocument12 pagesMES Producto: VC TV Volumen de CompraJeancarlos Raul AzcaNo ratings yet

- July 1 To 15 NewDocument29 pagesJuly 1 To 15 NewDolores AroNo ratings yet

- Account Statement: Penyata AkaunDocument2 pagesAccount Statement: Penyata AkaunAIKAL ABDULLAHNo ratings yet

- So LLLLLDocument12 pagesSo LLLLLYeiko YamocaNo ratings yet

- Ogjournal20201005 DL PDFDocument68 pagesOgjournal20201005 DL PDFMarcelo SchaderNo ratings yet

- Q66 Catterpillar Generator (Brandnew)Document2 pagesQ66 Catterpillar Generator (Brandnew)Jeffcaster ComelNo ratings yet

- Water Levels of Cauvery Basin Reservoirs As On: 18-06-2021: (River Sluice)Document1 pageWater Levels of Cauvery Basin Reservoirs As On: 18-06-2021: (River Sluice)umera shah aliNo ratings yet

- Ekonomi Hans DadiDocument279 pagesEkonomi Hans DadiHans DadiNo ratings yet

- BROKERAGE ANG TRUCKING RATES 2021Document6 pagesBROKERAGE ANG TRUCKING RATES 20212023charlutinNo ratings yet

- Report 202Document6 pagesReport 202Sandesh GhandatNo ratings yet

- Report 38Document1 pageReport 38Sandesh GhandatNo ratings yet

- February 26: Reading Tanker Tea LeavesDocument1 pageFebruary 26: Reading Tanker Tea LeavesSandesh GhandatNo ratings yet

- Report 200Document6 pagesReport 200Sandesh GhandatNo ratings yet

- February 26: Reading Tanker Tea LeavesDocument1 pageFebruary 26: Reading Tanker Tea LeavesSandesh GhandatNo ratings yet

- Growing at Ludicrous Speed?: Oten Anker PinionDocument1 pageGrowing at Ludicrous Speed?: Oten Anker PinionSandesh GhandatNo ratings yet

- Growing at Ludicrous Speed?: Oten Anker PinionDocument1 pageGrowing at Ludicrous Speed?: Oten Anker PinionSandesh GhandatNo ratings yet

- Growing at Ludicrous Speed?: Oten Anker PinionDocument1 pageGrowing at Ludicrous Speed?: Oten Anker PinionSandesh GhandatNo ratings yet

- Tanker Report - Week 8: VlccsDocument3 pagesTanker Report - Week 8: VlccsSandesh GhandatNo ratings yet

- Tanker Report - Week 8: VlccsDocument3 pagesTanker Report - Week 8: VlccsSandesh GhandatNo ratings yet

- Defever Cruisers: Two Defevers Cruise Mexico & BelizeDocument32 pagesDefever Cruisers: Two Defevers Cruise Mexico & BelizemiroslaNo ratings yet

- Homework Reading UNIT 9Document2 pagesHomework Reading UNIT 9Cajas Jami ArielNo ratings yet

- VCV Crew Brief A4 LandscapeDocument15 pagesVCV Crew Brief A4 LandscapeAnthony Guillermo Chachico AlvaradoNo ratings yet

- Kuta Software - Distance Rate ProblemsDocument3 pagesKuta Software - Distance Rate Problemssundarismails544No ratings yet

- G5-Prepositions Practice W.SDocument3 pagesG5-Prepositions Practice W.SSyeda Tahreen Waqar KhanNo ratings yet

- ĐỤC LỖ - Phần 6Document8 pagesĐỤC LỖ - Phần 6Pham Tran That Bao B2016093No ratings yet

- Srri SPK Public Senior Secondary School, KadachanallurDocument3 pagesSrri SPK Public Senior Secondary School, KadachanallurDhanush KumarNo ratings yet

- Studii de Caz PDFDocument2 pagesStudii de Caz PDFClaudiu RachieruNo ratings yet

- Antonio PigafettaDocument3 pagesAntonio Pigafettafreshe RelatoNo ratings yet

- Welcome Aboard The Swedish Ship Götheborg: From Shipwreck To New ExpeditionsDocument2 pagesWelcome Aboard The Swedish Ship Götheborg: From Shipwreck To New Expeditions李翔宇No ratings yet

- Twenty Thousand Leagues Under These AsDocument275 pagesTwenty Thousand Leagues Under These AsrivieryNo ratings yet

- 10-PER Form 103-Chief Officers Handover ReportDocument2 pages10-PER Form 103-Chief Officers Handover ReportAbu Syeed Md. Aurangzeb Al MasumNo ratings yet

- T1 CA FLE MS Directed Writing 202223Document5 pagesT1 CA FLE MS Directed Writing 202223Kalaivani RajendranNo ratings yet

- Project of Sea Models of TransportDocument8 pagesProject of Sea Models of TransportАполлінарія МальованаNo ratings yet

- Gulliver's Travels Drama ScriptDocument2 pagesGulliver's Travels Drama ScriptShuchi67% (3)

- Nomenclature History: General CharacteristicsDocument26 pagesNomenclature History: General CharacteristicsZvonko TNo ratings yet

- Ship49417 - en - Economic Impact of Cruise Ports - Case of MiamiDocument33 pagesShip49417 - en - Economic Impact of Cruise Ports - Case of MiamiRebeca Paz Aguilar MundacaNo ratings yet

- Adventure, From 1772 Umtil 1775. On This Voyage He Disproved The Rumour of A Great SouthernDocument3 pagesAdventure, From 1772 Umtil 1775. On This Voyage He Disproved The Rumour of A Great SouthernDindya Luthfiah FaizahNo ratings yet

- Bernard Magee's Acol Bidding Quiz: Number One Hundred and Thirty-Eight June 2014Document48 pagesBernard Magee's Acol Bidding Quiz: Number One Hundred and Thirty-Eight June 2014rprafal100% (1)

- Module 2 - Lesson 1 First Voyage Around The WorldDocument22 pagesModule 2 - Lesson 1 First Voyage Around The WorldFrance PilapilNo ratings yet

- Letter From King of Castile To Magellan and FaleiroDocument2 pagesLetter From King of Castile To Magellan and FaleiroMicsjadeCastilloNo ratings yet

- Prince Henry - The Navigator (Homework)Document2 pagesPrince Henry - The Navigator (Homework)Pranav BISUMBHERNo ratings yet

- SS1C - 3 Magellan's Voyage Around The WorldDocument5 pagesSS1C - 3 Magellan's Voyage Around The WorldJay-pNo ratings yet

- I Used To Work On Cruise Ships As A MusicianDocument2 pagesI Used To Work On Cruise Ships As A MusicianCharlyPérezNo ratings yet

- PIA The Manila Galleon - Elizabeth HernandezDocument14 pagesPIA The Manila Galleon - Elizabeth HernandezElizabeth Hdz100% (1)

- Load Line RelatedDocument61 pagesLoad Line RelatedNgoc BangNo ratings yet

- Etextbook 978 1305271531 Interpersonal Process in Therapy An Integrative ModelDocument33 pagesEtextbook 978 1305271531 Interpersonal Process in Therapy An Integrative Modeljoshua.little480100% (43)

- Sea AccidentDocument7 pagesSea Accidentmishal chNo ratings yet

- Etextbook 978 0078028663 Comprehensive Stress Management 14th EditionDocument32 pagesEtextbook 978 0078028663 Comprehensive Stress Management 14th Editionruth.thomas337100% (40)