Professional Documents

Culture Documents

Life Commission For B2B - AMJ 2021 With Renewal

Uploaded by

niranjan sahu0 ratings0% found this document useful (0 votes)

23 views2 pagesOriginal Title

Life commission for B2B - AMJ 2021 with Renewal

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views2 pagesLife Commission For B2B - AMJ 2021 With Renewal

Uploaded by

niranjan sahuCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

HDFC Life – Product List

Product Category Criteria NB BWRP Renewal

Super Income Plan Traditional PPT 8 27% 70 2.5%

Super Income Plan Traditional PPT 10 32% 100 2.5%

Super Income Plan Traditional PPT 12 37% 100 2.5%

Youngstar Udaan (Aspiration) Traditional PPT 7 22% 70 2.5%

Youngstar Udaan (Aspiration) Traditional PPT 10 32% 100 2.5%

Youngstar Udaan (Aspiration) Traditional PPT 11 32% 100 2.5%

Youngstar Udaan (Aspiration) Traditional PPT 12+ 37% 100 2.5%

Youngstar Udaan (Academia & Career) Traditional PPT 7 17% 70 2.5%

Youngstar Udaan (Academia & Career) Traditional PPT 10 32% 100 2.5%

Youngstar Udaan (Academia & Career) Traditional PPT 11 32% 100 2.5%

Youngstar Udaan (Academia & Career) Traditional PPT 12+ 37% 100 2.5%

Sampoorn Samridhi Plus Traditional PPT 10 32% 100 2.5%

Sampoorn Samridhi Plus Traditional PPT 11 32% 100 2.5%

Sampoorn Samridhi Plus Traditional PPT 12+ 37% 100 2.5%

HDFC Life Uday Traditional PPT 8. term 12 22% 70 0.85%

HDFC Life Uday Traditional PPT 8. term 15 27% 70 2.5%

HDFC Life Uday Traditional PPT 10. term 15 32% 100 2.5%

Click 2 Protect 3D / Plus Term Single premium 1.5% 5 NIL

Click 2 Protect 3D / Plus Term PPT 5 25% 50 1.7%

Click 2 Protect 3D / Plus Term PPT 7 28% 70 1.7%

Click 2 Protect 3D / Plus Term PPT 10 40% 100 1.7%

Click 2 Protect 3D / Plus Term PPT 11 40% 100 1.7%

Click 2 Protect 3D / Plus Term PPT 12+ 42% 100 1.7%

Click 2 Invest ULIP All Terms 4% 15 NIL

Click 2 Invest ULIP Single Premium 1.5% 5 NIL

Sanchay Traditional PPT 5 22% 50 1.7%

Sanchay Traditional PPT 8 27% 70 1.7%

Sanchay Traditional PPT 10 37% 100 1.7%

ClassicAssure Plus Traditional PPT 10 37% 100 2.5%

HDFC Life PrGrowth Plus ULIP All Terms 15% 20 0.4%

HDFC Life PrGrowth Flexi ULIP All Terms 10% 20 0.4%

Sanchay Plus Traditional PPT < 10 25% 50 NIL

Sanchay Plus Traditional PPT =>10 37% 100 NIL

Pension Guaranteed Plan Pension Single pay 1.5% 5 NIL

Sanchay Par (Immediate option) Traditional All Terms 32% 80 NIL

Sanchay Par (Deferred option) Traditional All Terms 40% 100 NIL

Sampoorna Nivesh ULIP PPT 5 2% 5 NIL

Sampoorna Nivesh ULIP PPT 7 4% 10 NIL

Sampoorna Nivesh ULIP PPT 10 5% 10 NIL

Guaranteed Savings Plan Traditional All Terms 32% 80 NIL

Guaranteed Savings Plan Traditional Single Pay 1.5% 5 NIL

* NB: - New Business

ICICI Pru Life – Product

Product Category Criteria NB BWRP Renewal

Savings Suraksha Traditional PPT 5 14% 40 4.25%

Savings Suraksha Traditional PPT 7 23% 70 4.25%

Savings Suraksha Traditional PPT 10 32% 100 4.25%

Savings Suraksha Traditional PPT 11 32% 100 4.25%

Savings Suraksha Traditional PPT 12 37% 100 4.25%

Cash Advantage Traditional PPT 5 14% 40 4.25%

Cash Advantage Traditional PPT 7 23% 70 4.25%

Cash Advantage Traditional PPT 10 32% 100 4.25%

ASIP (Annual Mode) Traditional PPT 5 14% 40 4.25%

ASIP (Annual Mode) Traditional PPT 7 32% 100 4.25%

ASIP (Non Annual Mode) Traditional PPT 5 10% 30 4.25%

ASIP (Non Annual Mode) Traditional PPT 7 23% 70 4.25%

Life Time Classic ULIP PPT 7 & Above 10% 30 1.5%

Guranteed Wealth Protector ULIP 5Pay & Regular Pay 8% 20 1.5%

Future Perfect Traditional PPT 5 14% 40 4.25%

Future Perfect Traditional PPT 7 23% 70 4.25%

Future Perfect Traditional PPT 10 & Above 32% 100 4.25%

iProtect Smart (Limited pay) Term PPT 5 32% 100 4.25%

iProtect Smart (Limited pay) Term PPT 7 37% 100 4.25%

iProtect Smart (Limited pay) Term PPT 10 37% 100 4.25%

iProtect Smart (Limited pay) Term Pay till 60 years 37% 100 4.25%

iProtect Smart (regular Pay) Term PPT < 10 23% 70 4.25%

iProtect Smart (regular Pay) Term PPT 10 & above 37% 100 4.25%

Heart / Cancer Protect Health < 10 PPT 11% 20 0.8%

Heart / Cancer Protect Health >10 PPT 11% 20 0.8%

Signature Advantage ULIP < 7 years 11% 30 0.8%

Signature Advantage ULIP > = 7 years 11% 30 0.8%

Signature Premier ULIP < 7 years 11% 30 NIL

Signature Premier ULIP > = 7 years 11% 30 NIL

Signature Exclusive ULIP < 7 years 8% 20 0.8%

Signature Exclusive ULIP > = 7 years 8% 20 0.8%

Lakshya Traditional PPT 5 14% 40 4.25%

Lakshya Traditional PPT 7 32% 100 4.25%

Lakshya Traditional PPT 10 37% 100 4.25%

Lakshya Traditional PPT 10 + 37% 100 4.25%

G.I.F.T. Traditional PPT 5 14% 40 4.25%

G.I.F.T. Traditional PPT 6 18% 50 4.25%

G.I.F.T. Traditional PPT 7 32% 100 4.25%

G.I.F.T. Traditional PPT 10 37% 100 4.25%

GPP (immediate & deferred annuity) Annuity Single pay 1.5% 5 NIL

Saral beema yojna Term Any PPT 35% 100 4.25%

* NB: - New Business

You might also like

- Commission StructureDocument11 pagesCommission Structuredreamz unfulfilledNo ratings yet

- The Lean Dairy Farm: Eliminate Waste, Save Time, Cut Costs - Creating a More Productive, Profitable and Higher Quality FarmFrom EverandThe Lean Dairy Farm: Eliminate Waste, Save Time, Cut Costs - Creating a More Productive, Profitable and Higher Quality FarmNo ratings yet

- UL Vs Other Life CompaniesDocument74 pagesUL Vs Other Life CompaniesJexter FabrigaNo ratings yet

- HDFC Life and ICICI Prudential insurance products comparisonDocument17 pagesHDFC Life and ICICI Prudential insurance products comparisonAhmed AnsariNo ratings yet

- Commission and CreditDocument1 pageCommission and Creditrockyj47No ratings yet

- Exide Commission Structure AdvisorDocument5 pagesExide Commission Structure Advisorashok7jNo ratings yet

- ULIP Bench Marking - September 2010Document8 pagesULIP Bench Marking - September 2010maulikshah_23No ratings yet

- RP133 Training Completed Report - Training Record DetailsDocument9 pagesRP133 Training Completed Report - Training Record DetailsmatsuyalNo ratings yet

- Ultratech Cement Limited Goal Setting For 2021-22 Name: Nitin Ladke-BAGA No. KRA Weightage NoDocument10 pagesUltratech Cement Limited Goal Setting For 2021-22 Name: Nitin Ladke-BAGA No. KRA Weightage Nokishana ramNo ratings yet

- North Dec 23 - BMDocument28 pagesNorth Dec 23 - BMSanjeetNo ratings yet

- Bonus Rates-FY 2017-18 - tcm47-67139Document2 pagesBonus Rates-FY 2017-18 - tcm47-67139KaranNo ratings yet

- Bonus Rates-FY 2017-18 - tcm47-67139Document2 pagesBonus Rates-FY 2017-18 - tcm47-67139Lokesh singhNo ratings yet

- BonusHistory2020 21Document3 pagesBonusHistory2020 21sunil CNo ratings yet

- Agent Compensation Schedule - 16april2020 PDFDocument9 pagesAgent Compensation Schedule - 16april2020 PDFRajat GuptaNo ratings yet

- Preliminary Business ProposalDocument6 pagesPreliminary Business ProposalFrelyn Caro LauNo ratings yet

- Deposit Rate sheet-ED 01 July 2022 EBL WEB VersionDocument4 pagesDeposit Rate sheet-ED 01 July 2022 EBL WEB VersionMohammad AliNo ratings yet

- Pdu Category Caps and Rules: Maximum Earnable PdusDocument3 pagesPdu Category Caps and Rules: Maximum Earnable Pdusalimech_2000No ratings yet

- Indicators Organization (10%) : (0 or 5) (0 or 5) (0, 0.5, 1.5 or 2)Document2 pagesIndicators Organization (10%) : (0 or 5) (0 or 5) (0, 0.5, 1.5 or 2)Abe AnshariNo ratings yet

- Assessment Form Tulungatung: Monitoring The Functionality of Barangay Council For The Protection of Children (BCPC)Document2 pagesAssessment Form Tulungatung: Monitoring The Functionality of Barangay Council For The Protection of Children (BCPC)Nald Cervas91% (11)

- 2021 Part-Time Apple Dental Plan Overview: Carrier MetlifeDocument1 page2021 Part-Time Apple Dental Plan Overview: Carrier MetlifeCT NguonNo ratings yet

- First Time in The History of MLM A Unique PlanDocument22 pagesFirst Time in The History of MLM A Unique PlanPrem Karan0% (1)

- Commission Rates For All Plans-1Document1 pageCommission Rates For All Plans-1Gaurav KumarNo ratings yet

- 2022 1027 Ahs SD 1058-1 BroDocument8 pages2022 1027 Ahs SD 1058-1 BroFernanda VargasNo ratings yet

- Bonus Information FY 19-20 - v2 - tcm47-73104Document2 pagesBonus Information FY 19-20 - v2 - tcm47-73104KaranNo ratings yet

- BCPC Functionality - Dilg MC 2008-126Document1 pageBCPC Functionality - Dilg MC 2008-126Barangay Panoloon100% (1)

- MNLDocument5 pagesMNLReim 11No ratings yet

- TP Link Partner Program FlyerDocument2 pagesTP Link Partner Program FlyerRodrigo SenadorNo ratings yet

- Commission Structure - Agency Channel - FCs V4Document16 pagesCommission Structure - Agency Channel - FCs V4Raghuraman PillaiNo ratings yet

- LoyaltyCard 2016 July11 PDFDocument14 pagesLoyaltyCard 2016 July11 PDFchico_belandresNo ratings yet

- MRP May 2023Document3 pagesMRP May 2023princeNo ratings yet

- A - PMLI - Group - Commission Chart-MergedDocument3 pagesA - PMLI - Group - Commission Chart-MergedVanshNo ratings yet

- Bonus Rates FY 2016-17 - tcm47-63300-v0Document1 pageBonus Rates FY 2016-17 - tcm47-63300-v0Abhinav VermaNo ratings yet

- Page 3Document1 pagePage 3John MichaelNo ratings yet

- Dental OH EHB Low 2024Document3 pagesDental OH EHB Low 2024Clifton JuraNo ratings yet

- Anamed University: System Training EducationDocument28 pagesAnamed University: System Training EducationLia MasturaNo ratings yet

- ReversionaryBonus PDFDocument4 pagesReversionaryBonus PDFPiyush BhartiNo ratings yet

- Aza Smart Pen Pre-Operating & Working Capital Projections: Main MenuDocument1 pageAza Smart Pen Pre-Operating & Working Capital Projections: Main MenuAzran AfandiNo ratings yet

- Every Filipino Can Become ADocument18 pagesEvery Filipino Can Become Agr8lyfNo ratings yet

- WeightagesDocument16 pagesWeightagesMilind navalkarNo ratings yet

- NRB Bank Bangladesh Deposit RateDocument2 pagesNRB Bank Bangladesh Deposit RateAlamin AlexNo ratings yet

- COMMISSION STRUCTURE - 01 April, 2021 To 30 June, 2021: OrangeDocument2 pagesCOMMISSION STRUCTURE - 01 April, 2021 To 30 June, 2021: Orangekapoor_mukesh4uNo ratings yet

- Primer With SIPERNAT® 11 PC (W - o Emulsion)Document2 pagesPrimer With SIPERNAT® 11 PC (W - o Emulsion)Yeraldine RVNo ratings yet

- Marketing Plan For LOBDocument90 pagesMarketing Plan For LOBAta Al HaqueNo ratings yet

- Personal Account Interest Rate: (Golden Benefits)Document4 pagesPersonal Account Interest Rate: (Golden Benefits)Md Ashikur RahmanNo ratings yet

- LCPC Evaluation CriteriaDocument10 pagesLCPC Evaluation CriteriaPhong PhongNo ratings yet

- IC Business Plan 10937Document47 pagesIC Business Plan 10937nhivnsgNo ratings yet

- BCPC AssessmentDocument5 pagesBCPC AssessmentBarangay MabacanNo ratings yet

- HDFC Life SARAL JEEVAN BROCHUREDocument12 pagesHDFC Life SARAL JEEVAN BROCHURESatyajeet AnandNo ratings yet

- Katalog Bando ChainDocument14 pagesKatalog Bando ChainDedi R.No ratings yet

- CMR Data Jul 2021 User InputDocument5 pagesCMR Data Jul 2021 User Inputirfan zulfiqarNo ratings yet

- In-Company Training BrochureDocument1 pageIn-Company Training BrochureRabia JamilNo ratings yet

- Opportunity Day: FY'2022 Financial Performance and OutlookDocument25 pagesOpportunity Day: FY'2022 Financial Performance and OutlooksozodaaaNo ratings yet

- Business Plan Template GuideDocument39 pagesBusiness Plan Template GuideAbhishek SinghNo ratings yet

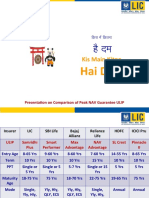

- Hai Dum: Kis Main KitnaDocument14 pagesHai Dum: Kis Main KitnaAnand PrasadNo ratings yet

- Tourist Privilege PDFDocument27 pagesTourist Privilege PDFnadine margarethaNo ratings yet

- Round 1 CASEDocument4 pagesRound 1 CASEEshraq MostafiNo ratings yet

- Insurance and Investment OptionsDocument1 pageInsurance and Investment Optionsjane8midwatersNo ratings yet

- Simple SDI Manual 6 2005Document22 pagesSimple SDI Manual 6 2005Pria Gita MaulanaNo ratings yet

- India Business Unit PEP Status DashboardDocument6 pagesIndia Business Unit PEP Status DashboardKiran JoshiNo ratings yet

- Internship Opportunity @: Banaras Hindu UniversityDocument7 pagesInternship Opportunity @: Banaras Hindu Universityniranjan sahuNo ratings yet

- Jobs at LearningShalaDocument9 pagesJobs at LearningShalaniranjan sahuNo ratings yet

- Insurance Plan for 35 Year Old EarnerDocument11 pagesInsurance Plan for 35 Year Old Earnerniranjan sahuNo ratings yet

- Credit Point SystemDocument5 pagesCredit Point SystemMurali KrishnanNo ratings yet

- Ic 46 Book General Insurance Accounts Preparation and Regulation of InvestmentDocument823 pagesIc 46 Book General Insurance Accounts Preparation and Regulation of InvestmentDr. S100% (1)

- Fire Insurance: Banaras Hindu UniversityDocument35 pagesFire Insurance: Banaras Hindu Universityniranjan sahuNo ratings yet

- HDFC Life Click 2 Protect 3D Plus BrochureDocument28 pagesHDFC Life Click 2 Protect 3D Plus Brochureniranjan sahuNo ratings yet

- Assignment Corporate TaxDocument1 pageAssignment Corporate Taxniranjan sahuNo ratings yet

- Summer Internship Report at Jagran PehelDocument11 pagesSummer Internship Report at Jagran PehelbalamadheshNo ratings yet

- Non Life Product Commission For B2B - AMJ 2021 With RenewalDocument3 pagesNon Life Product Commission For B2B - AMJ 2021 With Renewalniranjan sahuNo ratings yet

- Guide To Marine Cargo Insurance 5a2924c57b5b2 PDFDocument70 pagesGuide To Marine Cargo Insurance 5a2924c57b5b2 PDFNitin KoundalNo ratings yet

- Non Life Product Commission For B2B - AMJ 2021 With RenewalDocument3 pagesNon Life Product Commission For B2B - AMJ 2021 With Renewalniranjan sahuNo ratings yet

- Impact of Fringe Benefits On Employee Productivity: Under The Guidance Of: Prepared byDocument57 pagesImpact of Fringe Benefits On Employee Productivity: Under The Guidance Of: Prepared byjaspreet raghuNo ratings yet

- Governments Should Spend Money to Save Endangered LanguagesDocument4 pagesGovernments Should Spend Money to Save Endangered LanguagesLê Mai Huyền Linh100% (4)

- Public Officers' Right To Retirement PayDocument5 pagesPublic Officers' Right To Retirement PayMiguel AlagNo ratings yet

- Case Study Thanks For 24 YearsDocument4 pagesCase Study Thanks For 24 Yearseeoo50% (2)

- HRA in InfosysDocument17 pagesHRA in Infosysअंजनी श्रीवास्तवNo ratings yet

- National Pensions Scheme Authority ACT ZambiaDocument41 pagesNational Pensions Scheme Authority ACT Zambiaachikungu2225100% (1)

- TB 19Document57 pagesTB 19Hasan75% (4)

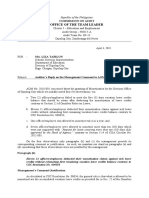

- Office of The Team Leader: Commission On AuditDocument4 pagesOffice of The Team Leader: Commission On Auditrussel1435100% (1)

- Brea ch05 BMM 7e SGDocument85 pagesBrea ch05 BMM 7e SGSarosh Ata100% (1)

- Economic Financial IssuingDocument11 pagesEconomic Financial Issuingdamahoj412No ratings yet

- Code of Ethics For Professional TeachersDocument12 pagesCode of Ethics For Professional TeachersAndrianNo ratings yet

- Top Tips For Choosing InvestmentsDocument6 pagesTop Tips For Choosing InvestmentsBey Bi NingNo ratings yet

- 9 - Future and Confirm FutureDocument4 pages9 - Future and Confirm FutureMatangi DaveNo ratings yet

- Rate of ReturnDocument4 pagesRate of ReturnMichael MarioNo ratings yet

- 2022 Personal Finance Statistics: 34% Feel Financially Healthy as Costs RiseDocument15 pages2022 Personal Finance Statistics: 34% Feel Financially Healthy as Costs RiseMasab AsifNo ratings yet

- P&A - Taxation of Retirement BenefitsDocument2 pagesP&A - Taxation of Retirement BenefitsCkey ArNo ratings yet

- Individual Retirement Accounts - Backdoor Roth IRA 2021Document2 pagesIndividual Retirement Accounts - Backdoor Roth IRA 2021Finn KevinNo ratings yet

- Retiree Entitled to Monthly Pension for LifeDocument2 pagesRetiree Entitled to Monthly Pension for LifeEarvin Joseph BaraceNo ratings yet

- Nism Series Xvii Retirement Adviser Exam Workbook PDFDocument273 pagesNism Series Xvii Retirement Adviser Exam Workbook PDFChandradeep Reddy Teegala100% (1)

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samNo ratings yet

- 5-Nueva Ecija Vs NLRCDocument4 pages5-Nueva Ecija Vs NLRCSophiaFrancescaEspinosaNo ratings yet

- Dpfps V Alexander CounterclaimDocument36 pagesDpfps V Alexander CounterclaimSchutzeNo ratings yet

- Benefits and Services: Part Four - CompensationDocument20 pagesBenefits and Services: Part Four - CompensationnewaznahianNo ratings yet

- Intimation Form Dd44e4Document2 pagesIntimation Form Dd44e4Manoj MantriNo ratings yet

- Policing Systems ComparedDocument95 pagesPolicing Systems ComparedJohn Paul RonquilloNo ratings yet

- Sanket Mhaiskey Week 3 (Task - Friday)Document7 pagesSanket Mhaiskey Week 3 (Task - Friday)Sanket DholeNo ratings yet

- Life Insurance ArshiyaDocument8 pagesLife Insurance ArshiyaArun kumarNo ratings yet

- 6 Sources of Retirement Income: How To Create Your Retirement PaycheckDocument27 pages6 Sources of Retirement Income: How To Create Your Retirement PaycheckGerman Briceño0% (1)

- Is the American Dream Still PossibleDocument2 pagesIs the American Dream Still PossibleJames in CalabriaNo ratings yet