Professional Documents

Culture Documents

Learning Activity 7 Variable Fixed Costs

Learning Activity 7 Variable Fixed Costs

Uploaded by

Energy Trading QUEZELCO 1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Learning Activity 7 Variable Fixed Costs

Learning Activity 7 Variable Fixed Costs

Uploaded by

Energy Trading QUEZELCO 1Copyright:

Available Formats

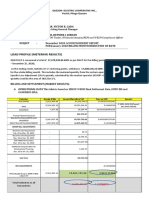

JORDAN, REA MARIZ I.

MANAGEMENT ACCOUNTING & CONTROL

VARIABLE COSTING

Lesson Activity 7. Variable & Fixed Costs

Maricel is a management accountant in an organization. She has been

assigned the task of budgeting payroll costs for the next quarter.

Payroll information of the last 4 quarters is as follows:

Quarte Work Hours Cost in Php

r

1 15,000 400,000

2 20,000 480,000

3 18,000 440,000

4 21,000 500,000

The organization increments salaries and wages by 10% at the start of the

3rd quarter each year. Twenty-three thousand (23,000) hours are expected to be

worked in the first quarter of the next year.

Required: Calculate the following:

1. Variable Cost per Unit

2. Fixed Cost

3. Total Variable Costs

SOLUTION.

Highest working hours = 21,000 hrs (4th quarter)

Lowest working hours= 15,000 hrs (1st quarter)

Cost for the first quarter = P400,000

The inflated cost = P400,000 x 1.10 = P440,000

1. Variable Cost per Unit

Variable cost per unit = P500,000 - 440,000/21,000 hrs - 15,000 hrs

= P60,000/6,000 hrs

Variable cost per unit = P10 per hour

2. Fixed cost

TFC= TC-TVC

TVC= Highest working hrs x variable cost per unit

= 21,000 x P 10 =P 210,000

TVC= Lowest working hrs x variable cost per unit

=15,000 x P 10 =P 150,000

Work Hours Cost in Php TVC

Highest 21,000 P500,000 P210,000

Lowest 15,000 P 440,000 P150,000

Total Fixed Cost = Total Cost – Total Variable Cost

Highest

= P500,000-210,000

=P290,000

Lowest

=P440,000-150,000

=P290,000

3. Total Variable Costs = Work hours x variable cost per unit

= P23,000 x P10

= P 230,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- What Are The Advantages and Disadvantages of Series and Parallel Circuits?Document1 pageWhat Are The Advantages and Disadvantages of Series and Parallel Circuits?Energy Trading QUEZELCO 1No ratings yet

- Active Parallel: Advantages DisadvantagesDocument34 pagesActive Parallel: Advantages DisadvantagesEnergy Trading QUEZELCO 1No ratings yet

- Individual Monthly Accomplishment Report Period Covering: - October 1-15, 2021Document2 pagesIndividual Monthly Accomplishment Report Period Covering: - October 1-15, 2021Energy Trading QUEZELCO 1No ratings yet

- Lipa City Colleges Eastern Quezon College, IncDocument65 pagesLipa City Colleges Eastern Quezon College, IncEnergy Trading QUEZELCO 1No ratings yet

- Individual Work Plan Schedule For The Period Covering October 16-30, 2021Document2 pagesIndividual Work Plan Schedule For The Period Covering October 16-30, 2021Energy Trading QUEZELCO 1No ratings yet

- Southern Luzon State University Gumaca CampusDocument2 pagesSouthern Luzon State University Gumaca CampusEnergy Trading QUEZELCO 1No ratings yet

- Quezon I Electric CooperativeDocument9 pagesQuezon I Electric CooperativeEnergy Trading QUEZELCO 1No ratings yet

- Objectives of Cash ManagementDocument6 pagesObjectives of Cash ManagementEnergy Trading QUEZELCO 1No ratings yet

- QUEZELCO I Action and Justification On TORDocument7 pagesQUEZELCO I Action and Justification On TOREnergy Trading QUEZELCO 1No ratings yet

- TOR RemarksDocument4 pagesTOR RemarksEnergy Trading QUEZELCO 1No ratings yet

- Sse08 Table of SpecificationDocument3 pagesSse08 Table of SpecificationEnergy Trading QUEZELCO 1No ratings yet

- Republic of The Philippines Southern Luzon State University - Gumaca Campus Gumaca, Quezon Table of Specification PRELIM PERIOD AY 2021-2022Document3 pagesRepublic of The Philippines Southern Luzon State University - Gumaca Campus Gumaca, Quezon Table of Specification PRELIM PERIOD AY 2021-2022Energy Trading QUEZELCO 1No ratings yet

- Wesm Report - January 2020Document5 pagesWesm Report - January 2020Energy Trading QUEZELCO 1No ratings yet

- Challenges and ObstaclesDocument11 pagesChallenges and ObstaclesEnergy Trading QUEZELCO 1No ratings yet

- Power Supply AgreementDocument24 pagesPower Supply AgreementEnergy Trading QUEZELCO 1No ratings yet

- View Bill Detail 2020 10 23 11 31 34 - 2 - 2Document2 pagesView Bill Detail 2020 10 23 11 31 34 - 2 - 2Energy Trading QUEZELCO 1No ratings yet

- Strategic Plan 2022Document3 pagesStrategic Plan 2022Energy Trading QUEZELCO 1No ratings yet

- Learning Activity 6 Variable Vs Absorption CostingDocument3 pagesLearning Activity 6 Variable Vs Absorption CostingEnergy Trading QUEZELCO 1No ratings yet

- Intent Transfer JannaDocument1 pageIntent Transfer JannaEnergy Trading QUEZELCO 1No ratings yet

- Renewable Energy Development Plan Template Over Contract ModelDocument12 pagesRenewable Energy Development Plan Template Over Contract ModelEnergy Trading QUEZELCO 1No ratings yet