Professional Documents

Culture Documents

IMT Castrol SS

Uploaded by

Sandeep SurendranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IMT Castrol SS

Uploaded by

Sandeep SurendranCopyright:

Available Formats

Name SS

Question 1

Write your answer for Part A here.

Period Rate of Growth

2000-2004 27.27%

2004-2010 90%

2010-2015 50%

Write your answer for Part B here.

The factors that contributed for the two wheeler market growth from 2004 to 2015 were,

1. Consumer’s increasing disposable incomes

2. Aspiration to own a motorized vehicle

3. Availability of easy financing

Question 2

Write your answer for Part A here.

Private sector players:

a. Shell

b. Gulf

c. Valvoline

d. Veedol

e. Elf

Public sector players:

a. Indian Oil

b. Bharat Petroleum

c. Hindustan Petroleum

Write your answer for Part B here.

Direct Distribution channels:

1. Forecourts: Petrol pumps and gasoline stations

2. Franchised Workshops (FWs): Authorized workshops that serviced vehicles under

warranty, providing all services related to the vehicles.

Distributors (Retail) Distribution channels:

1. Non-Franchised workshops: Small mechanics who set up shop to service motorcycles.

2. Accessories and spare parts: Stores that stock and sell vehicle accessories and spare

parts

3. Pure lubricant outlets: Stores that stock and sell lubricants of all companies.

Question 3

Write your answer for Part A here.

Consumer buying behavior: Once the warranty period of the bike is over, the vehicle entered

the after-warranty market; consumers who previously choose to buy the oil of their choice and

take it to preferred mechanics for service now more likely wanted to take their bikes directly to

mechanic’s shops and trust the mechanics to use the right oil.

Write your answer for Part B here.

There was a shift from 2 stroke engines to 4 stroke engine bikes which had a great impact on

the motorcycle oil industry. In 2 stroke vehicle, the lubricating oil would be mixed with fuel

and burned along with fuel whereas in 4 stoke vehicles, the lubrication system was separate

and oil needed to be changed only once in every 2000 to 2500 kms. Consumers would change

the oil only during maintenance service at a workshop. This trend let to a complete shift from

forecourts to the open market.

Question 4

Write your answer for Part A here.

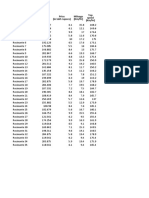

Channel Partner Channel Share (%) 2010

Franchised workshops 30.95%

Spare part outlets 42.85%

Oil shops 11.90%

Non-Franchised workshops 14.28%

Write your answer for Part B here.

For the analysis in 2005 –

The total potential for FW is 30 million litres and Castrol’s share is 3.54 million litres,

[30mn/76mn X 100 as against 3.54mn/11.89mn X 100 translating to 39.4% >29.77% ]

The total potential for NFW is 8 million litres and Castrol’s share is 0.85 million litres,

[8mn/76mn X 100 as against 0.85mn/11.89mn X 100 translating to 10.52% >7.14% ]

Write your answer for Part C here.

Channel Partner Sales (in litre) per channel outlet, 2005

Franchised workshops 6667 Ltrs

Spare part outlets 579 Ltrs

Oil shops 1103 Ltrs

Non-Franchised workshops 400 Ltrs

Write your answer for Part D here.

Channel Partner Sales (in litre) per channel outlet, 2005

Franchised workshops 5323 Ltrs

Spare part outlets 577 Ltrs

Oil shops 884 Ltrs

Non-Franchised workshops 671 Ltrs

Write your answer for Part E here.

In 2005, the Franchised workshops sold 1343 litres more than the per channel outlet of

Castrol in the same channel partner.

Write your answer for Part F here.

As per the analysis, Castrol is facing problems in Franchised Workshops and Oil Shops

channels.

Question 5

Write your answer for Part A here.

Segment Size:

1. Stock and sell mechanics (Ustaad) – 10% of the market

2. Mechanics who worked at the FW and set up their own business – 40% of the market

3. Small job mechanics apprenticed under ustaads – 50% of the market

Share in the oil change process:

1. Stock and sell mechanics (Ustaad) – 30% share in oil change process

2. Mechanics who worked at the FW and set up their own business – 50% share in oil

change process

3. Small job mechanics apprenticed under ustaads – 20% share in oil change process

Oil Buying behavior:

1. Stock and sell mechanics shops were routinely serviced by a distributor either castrol

or a competitor

2. Mechanic shops were hesitant to stock oil products due to low in finance

3. Small job mechanics apprenticed under ustaad lacked basic understanding of credit

risk.

Financial Condition:

1. Stock and sell mechanics shops – commanded a premium price for their services and

customers never questioned their abilities. These stock and sell mechanics shops were

routinely serviced by the distributors.

2. Mechanics – These highly skilled mechanics were short on finances and looking for

financial support. Distributors refuse to service their shops as there was no guarantee

about their existence and payments

3. Small time mechanics were struggling to build their clientele and reputation, lacked

basic understanding of cash flows and payment cycles. If credit was extended to these

mechanic shops the available cash would likely be spent on daily necessities.

Write your answer for Part B here.

Module Parameter 1 Parameter 2 Parameter 3 Parameter 4 Parameter 5

1 Low High Low Low High

2 High High High Low Medium

3 High Low Low High Low

Question 6

Write your answer here.

These CASAs will first be trained and eventually report to the distributors.

CASAs will exclusively serve the NFWs (Non Franchised Workshops)

You might also like

- Random Motors Project Submission: Name - Surendranath KolachalamDocument10 pagesRandom Motors Project Submission: Name - Surendranath KolachalamSurendranath Kolachalam92% (13)

- Random Motors ProjectDocument10 pagesRandom Motors ProjectRia Sankhyan71% (7)

- IMT Covid19 PDFDocument10 pagesIMT Covid19 PDFPrabhat Mishra100% (2)

- IMT CastrolDocument9 pagesIMT Castrolravithejahr100% (6)

- Harsh Vardhan - Project Submission - Change ManagementDocument14 pagesHarsh Vardhan - Project Submission - Change ManagementHarsh Vardhan33% (3)

- Question 1 (A&B) : Respectfully, Mahesh Iyer Co Founder, SineflexDocument2 pagesQuestion 1 (A&B) : Respectfully, Mahesh Iyer Co Founder, SineflexRahul Dinesh60% (5)

- Starbucks Marketing Strategies in ChinaDocument81 pagesStarbucks Marketing Strategies in ChinaM.Maulana Iskandar Zulkarnain70% (10)

- Covid-19 - Global Shutdown PDF Case Study Solution - IFinTaleDocument3 pagesCovid-19 - Global Shutdown PDF Case Study Solution - IFinTalePranjal Parihar0% (1)

- This Study Resource Was: Name Shivam GuglaniDocument6 pagesThis Study Resource Was: Name Shivam GuglaniSUDHIR KAUSHIK100% (2)

- Growth factors and distribution channels of two-wheeler lubricant market in IndiaDocument7 pagesGrowth factors and distribution channels of two-wheeler lubricant market in IndiaSurendranath Kolachalam50% (2)

- IMT OCEAN Activity 2Document3 pagesIMT OCEAN Activity 2rency thomasNo ratings yet

- Question 1 (13 Marks) : Graded QuestionsDocument5 pagesQuestion 1 (13 Marks) : Graded QuestionsKamaljeet Singh Malhotra25% (4)

- Question 1 (4 Marks) : Information Given in The Case StudyDocument2 pagesQuestion 1 (4 Marks) : Information Given in The Case StudySUDHIR KAUSHIKNo ratings yet

- Question 1 (13 Marks)Document4 pagesQuestion 1 (13 Marks)SUDHIR KAUSHIK20% (5)

- RAJEEV RANJAN - Project Submission - LeadershipDocument8 pagesRAJEEV RANJAN - Project Submission - LeadershipRajeev RanjanNo ratings yet

- IMT Covid19 SSDocument3 pagesIMT Covid19 SSSandeep Surendran0% (1)

- CPIM Part 1 Section ADocument2 pagesCPIM Part 1 Section ASaurabhNo ratings yet

- Segmentation, Targeting, PositioningDocument6 pagesSegmentation, Targeting, Positioningsumit shewaniNo ratings yet

- Overcoming challenges as a new employeeDocument6 pagesOvercoming challenges as a new employeeNayeem UddinNo ratings yet

- Regression Analysis Random MotorsDocument11 pagesRegression Analysis Random MotorsNivedita Nautiyal100% (1)

- Tata Motors EV Case Study: Leading Change for Sustainable FuturesDocument13 pagesTata Motors EV Case Study: Leading Change for Sustainable FuturesamitNo ratings yet

- Imt Lisa Benton Atanu SahaDocument5 pagesImt Lisa Benton Atanu SahaAtanu Saha100% (1)

- Castrol Submission TemplateDocument7 pagesCastrol Submission Templatekshitij mundra50% (2)

- Final Presentation by Mittal ShahDocument10 pagesFinal Presentation by Mittal ShahPradeep Nambiar100% (3)

- Random Motors Presentation Ganesh MisraDocument10 pagesRandom Motors Presentation Ganesh MisraGanesh Misra100% (2)

- Course: Leadership, Engagement, and People Performance Case Study: The Team That Wasn'TDocument8 pagesCourse: Leadership, Engagement, and People Performance Case Study: The Team That Wasn'Tbalpreet singh100% (1)

- Shivam Guglani ERM C4 PDFDocument9 pagesShivam Guglani ERM C4 PDFabhijitNo ratings yet

- IMT - LisaBenton - Surendranath KolachalamDocument5 pagesIMT - LisaBenton - Surendranath KolachalamSurendranath KolachalamNo ratings yet

- Ganesh Bhushan Misra: Write Your Answer HereDocument8 pagesGanesh Bhushan Misra: Write Your Answer HereGanesh Misra100% (1)

- Random Motors Project Submission: Name - Avanish Pratap PauliDocument10 pagesRandom Motors Project Submission: Name - Avanish Pratap Pauliavanish pratap100% (1)

- IMT LisaBentonDocument6 pagesIMT LisaBentonPRANAYNo ratings yet

- VikramShermale Project Submission LeadershipDocument6 pagesVikramShermale Project Submission Leadershipvikram shermale100% (1)

- Alap Kavishwar - Project - Submission - ChangeManagementDocument12 pagesAlap Kavishwar - Project - Submission - ChangeManagementA KNo ratings yet

- Sumit Mudgil - Project Submission - Change ManagementDocument8 pagesSumit Mudgil - Project Submission - Change ManagementSumit100% (2)

- IMT Submission LBDocument5 pagesIMT Submission LBRahul DineshNo ratings yet

- Shrey Lath - Project Submission - LeadershipDocument14 pagesShrey Lath - Project Submission - LeadershipShrey LathNo ratings yet

- OPSCM ProjectDocument7 pagesOPSCM ProjectRish JayNo ratings yet

- Patanjali DCF ValuationDocument5 pagesPatanjali DCF ValuationAakash RathorNo ratings yet

- Business Plan On Bagasse PDFDocument64 pagesBusiness Plan On Bagasse PDFbiswajitNo ratings yet

- IMT CastrolDocument8 pagesIMT CastrolJayanth Kn0% (1)

- Write Your Answer For Part A HereDocument6 pagesWrite Your Answer For Part A Hereabdul gani khanNo ratings yet

- Answer For Part ADocument6 pagesAnswer For Part ARajeev Ranjan100% (1)

- Name Muhammed Abdul VarisDocument9 pagesName Muhammed Abdul VarisMuhammed Abdul varisNo ratings yet

- IMT Covid19Document10 pagesIMT Covid19Ganesh MisraNo ratings yet

- Dev Sharma Project Submission Change Management PDFDocument10 pagesDev Sharma Project Submission Change Management PDFShashikant SharanNo ratings yet

- IMT LisaBenton Vikram ShermaleDocument6 pagesIMT LisaBenton Vikram Shermalevikram shermaleNo ratings yet

- IMT LisaBenton SSDocument6 pagesIMT LisaBenton SSSandeep Surendran100% (1)

- Project Submission LeadershipDocument15 pagesProject Submission LeadershipJayanth KnNo ratings yet

- Digital Business Innovation TK PDFDocument7 pagesDigital Business Innovation TK PDFAbhishek SadanandNo ratings yet

- IMT LisaBentonDocument5 pagesIMT LisaBentonD&D career guidance100% (1)

- Digital Business Innovation Project: Evaluating Hamley's PerformanceDocument5 pagesDigital Business Innovation Project: Evaluating Hamley's Performancebrajesh singhNo ratings yet

- Mohammad Anzar Draboo Project Submission LeadershipDocument21 pagesMohammad Anzar Draboo Project Submission Leadershipanzardraboo50% (2)

- Friction between Lisa and coworkers at new jobDocument5 pagesFriction between Lisa and coworkers at new jobSahil MongaNo ratings yet

- Random Motors Project Submission: Name - Neethu NairDocument10 pagesRandom Motors Project Submission: Name - Neethu NairNeethu NairNo ratings yet

- Tushar Wadhwa - Project Submission - Change ManagementDocument13 pagesTushar Wadhwa - Project Submission - Change ManagementTushar WadhwaNo ratings yet

- IMT - LisaBenton - Rajeev RanjanDocument6 pagesIMT - LisaBenton - Rajeev RanjanRajeev RanjanNo ratings yet

- Random Motors BriefingDocument43 pagesRandom Motors BriefingAndy KumarNo ratings yet

- RahulPandey - Project Submission - Change ManagementDocument13 pagesRahulPandey - Project Submission - Change ManagementRahul Pandey100% (1)

- IMT CeresDocument7 pagesIMT CeresRajat KumarNo ratings yet

- Q&a-Mcq (HR & Ob)Document124 pagesQ&a-Mcq (HR & Ob)Madan G Koushik100% (1)

- DigitalBusinessInnovation Vikram ShermaleDocument6 pagesDigitalBusinessInnovation Vikram Shermalevikram shermale50% (2)

- DigitalBusinessInnovation AravindaPKDocument6 pagesDigitalBusinessInnovation AravindaPKAravind Bhat PkNo ratings yet

- IMT LisaBenton Deblina MitraDocument5 pagesIMT LisaBenton Deblina MitraDeblina MitraNo ratings yet

- Factors Driving Growth in Indian 2 Wheeler MarketDocument7 pagesFactors Driving Growth in Indian 2 Wheeler MarketSambhav VermaNo ratings yet

- IMT CastrolDocument8 pagesIMT CastrolAnant ChauhanNo ratings yet

- IMT LisaBenton SSDocument6 pagesIMT LisaBenton SSSandeep Surendran100% (1)

- SineflexProject SSDocument10 pagesSineflexProject SSSandeep SurendranNo ratings yet

- DecisionScience ProjectDocument4 pagesDecisionScience ProjectSandeep SurendranNo ratings yet

- Financial Forecasting (Example)Document9 pagesFinancial Forecasting (Example)Naven PillaiNo ratings yet

- ESM TB Ch04Document8 pagesESM TB Ch04Nhật TuấnNo ratings yet

- Supply Chain Management - Module 4Document41 pagesSupply Chain Management - Module 4sandeep kumarNo ratings yet

- Mini-Case: CabanaDocument2 pagesMini-Case: CabanaMAHESWAR PANDANo ratings yet

- Aerotech-NIB 2022 (Provincial Level)Document25 pagesAerotech-NIB 2022 (Provincial Level)Uzair KhalidNo ratings yet

- Ebook KFIC 12 Top Sales Practices 2022Document21 pagesEbook KFIC 12 Top Sales Practices 2022vijayjain347No ratings yet

- Website RFP Pure & GenDocument10 pagesWebsite RFP Pure & Genmohammed bharmalNo ratings yet

- Marketing - Plan MGDDocument11 pagesMarketing - Plan MGDNauman MalikNo ratings yet

- Firm Strategy, Structure and Rivalry in Automotive IndustryDocument3 pagesFirm Strategy, Structure and Rivalry in Automotive Industryjinto jamesNo ratings yet

- B2B MARKETING INSIGHTSDocument14 pagesB2B MARKETING INSIGHTSAnuraag KulkarniNo ratings yet

- Organizational Ethics Chapter GuideDocument22 pagesOrganizational Ethics Chapter GuideTrúc NguyễnNo ratings yet

- GSSN StudioCapitalEfficiency WhitepaperDocument23 pagesGSSN StudioCapitalEfficiency WhitepapermberensteinNo ratings yet

- Marketing Strategies On Sales and Distribution of Haldiram'S NamkeenDocument15 pagesMarketing Strategies On Sales and Distribution of Haldiram'S NamkeenApoorv AgrawalNo ratings yet

- Write Effective Letters of Enquiry and ReplyDocument2 pagesWrite Effective Letters of Enquiry and ReplyTRANG TRỊNH NGUYỄN QUỲNHNo ratings yet

- Today The Import Duty On A Complete MachineDocument37 pagesToday The Import Duty On A Complete MachineharshsrivastavaalldNo ratings yet

- TMW6104 Project Management: Booking SystemDocument10 pagesTMW6104 Project Management: Booking SystemfatihahNo ratings yet

- Case Birota-2023 PDFDocument7 pagesCase Birota-2023 PDFJack MitchellNo ratings yet

- An Overview of Indian Stock Market in Special Reference To)Document72 pagesAn Overview of Indian Stock Market in Special Reference To)Master Printers100% (1)

- The Link Between Corporate Social Responsibility and Customer Loyalty Empirical Evidence From The Islamic Banking IndustryDocument8 pagesThe Link Between Corporate Social Responsibility and Customer Loyalty Empirical Evidence From The Islamic Banking IndustryErfina Mei RahmawatiNo ratings yet

- Customer Loyalty and Cineplex PatronageDocument35 pagesCustomer Loyalty and Cineplex PatronageEldho RoyNo ratings yet

- Projects For Mba Marketing PDFDocument2 pagesProjects For Mba Marketing PDFRahulNo ratings yet

- Technopreneurship - Module1 - Introduction (Final)Document12 pagesTechnopreneurship - Module1 - Introduction (Final)Merry JosephineNo ratings yet

- Cantabil OS - by TJDocument96 pagesCantabil OS - by TJYounus ahmedNo ratings yet

- Digital Marketing RemovedDocument11 pagesDigital Marketing RemovedManoj DewanNo ratings yet

- PDF Chetan CV 22Document2 pagesPDF Chetan CV 22Nidhi YAdavNo ratings yet

- Burie University Computer Science Honey Production Business PlanDocument34 pagesBurie University Computer Science Honey Production Business PlanBisrateab GebrieNo ratings yet