Professional Documents

Culture Documents

Assignment Accounting Merchendising #2

Uploaded by

NELVA QABLINAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Accounting Merchendising #2

Uploaded by

NELVA QABLINACopyright:

Available Formats

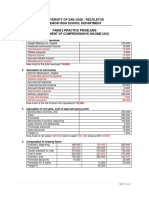

Quiz: Periodic Inventory System

Bedazzle Department Store is located in midtown Metropolis. At the end of the first quarter of

2019, the following accounts appeared in its unadjusted trial balance:

Bedazzle Department Store

Trial Balance

For the period of January 1 – March 31, 2019

Account Title Debit Credit

Cash 14,500

Accounts Receivable 11,770

Prepaid Insurance 4,500

Supplies 150,000

Merchandise Inventory 34,360

Store Equipment 125,000

Accum. Depr. Store Equipment 41,800

Building 210,000

Accum. Depr. Building 42,000

Accounts Payable 40,210

Property Taxes Payable

Sales Commissions Payable 8,000

Shared Capital 245,880

Retained Earnings 6,500

Dividend 12,000

Purchases 650,000

Freight-in 5,060

Purchases Discounts 8,900

Purchase Returns & Allow. 6,500

Sales 980,000

Sales Returns & Allowances 10,000

Cost of Goods Sold

Sales Salaries Expense 130,000

Sales Commissions Expense 12,000

Supplies Expense

Insurances Expense

Property Taxes Expense

Utilities Expense 10,600

Deprec. Expense-Store Equipment

Deprec. Expense-Building

1,379,790 1,379,790

Other data for adjustments:

1. The actual merchandise inventory on hand at March 31 is $50,000.

2. Total of the supplies remain in the company is $120,000.

3. Prepaid insurance is expired $250 per month.

4. Store equipment is depreciated for $100 per month.

5. Building is depreciated on the monthly rate of $1,210.

6. Property taxes rate is 2% of the cost of building for the first quarter of 2019.

7. During the first quarter of 2019, $1,000 of the sales commission has not been paid to the

salesmen.

Instruction: Prepare adjustment journal entries, worksheet, financial statements for the first

quarter of 2019, and closing entries.

You might also like

- Cost Acc. & Control QuizzesDocument18 pagesCost Acc. & Control Quizzesjessamae gundanNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- ITIL Continual Service Improvement PDFDocument262 pagesITIL Continual Service Improvement PDFgreeneyedprincess100% (3)

- Quizzer - Financial Accounting ProcessDocument8 pagesQuizzer - Financial Accounting ProcessLuisitoNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Acctg1205 - Chapter 8Document48 pagesAcctg1205 - Chapter 8Elj Grace BaronNo ratings yet

- 54R-07 - AACE InternationalDocument17 pages54R-07 - AACE InternationalFirasAlnaimiNo ratings yet

- Merchandising Accounting Cycle-Rev1 - 1Document33 pagesMerchandising Accounting Cycle-Rev1 - 1Hendra Setiyawan100% (4)

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- KPMG CIMA Business Partnering White Paper 280111Document9 pagesKPMG CIMA Business Partnering White Paper 280111Alifya ZahranaNo ratings yet

- Process Flow of Manpower BudgetDocument1 pageProcess Flow of Manpower BudgetHR Touch0% (1)

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- FDNACCT Business Case - 3T1819 PDFDocument2 pagesFDNACCT Business Case - 3T1819 PDFRoy BonitezNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- Audit Program LDRRMFDocument9 pagesAudit Program LDRRMFVAL REYNAND ABADNo ratings yet

- Sap PM OverviewDocument28 pagesSap PM OverviewBukenya Raymond100% (1)

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Capital and Revenue TransactionsDocument7 pagesCapital and Revenue Transactionscarolm790No ratings yet

- POF Class Activity - 1Document1 pagePOF Class Activity - 1Muhammad MansoorNo ratings yet

- Exercises Exercise 1 (Periodic) Cramer Company Uses Periodic Inventory Procedure. DetermineDocument9 pagesExercises Exercise 1 (Periodic) Cramer Company Uses Periodic Inventory Procedure. DetermineAllie LinNo ratings yet

- Accounting 1 - Part 2Document18 pagesAccounting 1 - Part 2Jessica ManuelNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Leone Lumber Company Trial Balance As of December 31 Debit CreditDocument3 pagesLeone Lumber Company Trial Balance As of December 31 Debit CreditMaitaNo ratings yet

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemENIDNo ratings yet

- Presentation of Properly Classified FSDocument9 pagesPresentation of Properly Classified FSpapa1No ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- Introduction To Accounting An Integrated Approach 6Th Edition Ainsworth Solutions Manual Full Chapter PDFDocument41 pagesIntroduction To Accounting An Integrated Approach 6Th Edition Ainsworth Solutions Manual Full Chapter PDFstevenwhitextsngyadmk100% (13)

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Goodah Products Company FSADocument1 pageGoodah Products Company FSAFood EyeNo ratings yet

- Ap.m-1401-Correction of ErrorsDocument12 pagesAp.m-1401-Correction of Errorsjulie anne mae mendozaNo ratings yet

- GROUP 6 Problem 3 7 To 3 9Document24 pagesGROUP 6 Problem 3 7 To 3 9Hans ManaliliNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- Cash and Accrual BasisDocument4 pagesCash and Accrual BasisSeulgi KangNo ratings yet

- Question 2 CashFlowDocument6 pagesQuestion 2 CashFlowsuraj lamaNo ratings yet

- Worksheet ProblemsDocument3 pagesWorksheet ProblemsClaren Sidnne MadridNo ratings yet

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- M4 Prac Exer. 2Document10 pagesM4 Prac Exer. 2Jasmine ActaNo ratings yet

- Soal UAS 2015.2016 KajianDocument4 pagesSoal UAS 2015.2016 Kajiansyafaatun munajahNo ratings yet

- The Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Document3 pagesThe Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Tahani Awar Gurar0% (1)

- Quiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditDocument2 pagesQuiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditEzra Mikah G. CaalimNo ratings yet

- Acc291t Week 5 Apply Exercise Score 100 PercentDocument7 pagesAcc291t Week 5 Apply Exercise Score 100 PercentG JhaNo ratings yet

- Module 2 - Quiz To Give 03.06.23-1Document1 pageModule 2 - Quiz To Give 03.06.23-1ZAIL JEFF ALDEA DALENo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Mendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditDocument9 pagesMendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditMecah Lou Odchigue LanzaderasNo ratings yet

- Module 4 Cash and Accrual BasisDocument4 pagesModule 4 Cash and Accrual BasisSeulgi KangNo ratings yet

- Financial Statements With Notes To FsDocument2 pagesFinancial Statements With Notes To Fsdimpy dNo ratings yet

- ISCool MerchandisingDocument6 pagesISCool MerchandisingJulian Adam PagalNo ratings yet

- AkuntansuDocument36 pagesAkuntansusuryati hungNo ratings yet

- Acc 111Document10 pagesAcc 111adrian CharlesNo ratings yet

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- AnsweredASS16 AccountingDocument6 pagesAnsweredASS16 Accountingvomawew647No ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- 648235Document5 pages648235mohitgaba19No ratings yet

- CE1 - Acctg - Final Exam - 2019 - P2 - QDocument7 pagesCE1 - Acctg - Final Exam - 2019 - P2 - QnadineNo ratings yet

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Tugas Kasus-2Document13 pagesTugas Kasus-2Adri MuliaNo ratings yet

- Bridging Program: Improving Your Reading SkillsDocument3 pagesBridging Program: Improving Your Reading SkillsNELVA QABLINANo ratings yet

- Chapter 2 - Activities 3 & 4Document2 pagesChapter 2 - Activities 3 & 4NELVA QABLINANo ratings yet

- Accounting Assingnment QuestionDocument1 pageAccounting Assingnment QuestionNELVA QABLINANo ratings yet

- Accounting Assessment 3Document4 pagesAccounting Assessment 3NELVA QABLINANo ratings yet

- Assignment Intermediate Accounting CH 123Document5 pagesAssignment Intermediate Accounting CH 123NELVA QABLINANo ratings yet

- Problem 4.6Document1 pageProblem 4.6NELVA QABLINANo ratings yet

- Problem 4. 2Document3 pagesProblem 4. 2NELVA QABLINANo ratings yet

- International Logistics Manager Job DescriptionDocument2 pagesInternational Logistics Manager Job DescriptionSufiyan JayaNo ratings yet

- CVP AnalysisDocument11 pagesCVP AnalysisAlexis Kaye DayagNo ratings yet

- Module 15 Review QuestionsDocument4 pagesModule 15 Review QuestionsUnnamed homosapienNo ratings yet

- Business Studies Paper 5Document8 pagesBusiness Studies Paper 5SAMARPAN CHAKRABORTYNo ratings yet

- INS202301 (2024SP) - Mid-Term ExamDocument6 pagesINS202301 (2024SP) - Mid-Term Examminhhoang37033No ratings yet

- 2021 Annual Financial Report For The National Government Volume IDocument506 pages2021 Annual Financial Report For The National Government Volume IAliah MagumparaNo ratings yet

- StratDocument20 pagesStratDhea MaligayaNo ratings yet

- Boston Lyric Opera PrintDocument11 pagesBoston Lyric Opera PrintIvan GiovanniNo ratings yet

- RTWG Resolution No. 2019 08 002Document3 pagesRTWG Resolution No. 2019 08 002Roy Luigi BuenaventuraNo ratings yet

- QD010532 NCC-SMC (Satis) JV-1Document2 pagesQD010532 NCC-SMC (Satis) JV-1NCCSTORES. TMCTHANENo ratings yet

- Software Project ManagementDocument3 pagesSoftware Project ManagementMelusi DemademaNo ratings yet

- Name of Work: Construction of Rainwater Harvesting at Sannidhi Layout Ward No 11 in Mudigere TownDocument31 pagesName of Work: Construction of Rainwater Harvesting at Sannidhi Layout Ward No 11 in Mudigere TownRahman Afrid036No ratings yet

- Ouagadougou ContractDocument2 pagesOuagadougou ContractLonely BoyNo ratings yet

- ICAO Universal Safety Oversight Audit ProgrammeDocument32 pagesICAO Universal Safety Oversight Audit Programmetanvir ehsanNo ratings yet

- A Study On Risk and Return Analysis and DataDocument10 pagesA Study On Risk and Return Analysis and DataShweta workNo ratings yet

- Anil & Sohan Vendors - Mar 21Document6 pagesAnil & Sohan Vendors - Mar 21Sahil BarejaNo ratings yet

- Comparative Statement of Profit and LossDocument6 pagesComparative Statement of Profit and LossHimanshi ChopraNo ratings yet

- 2021T1 ACC309 Final Exam (Online)Document5 pages2021T1 ACC309 Final Exam (Online)Shamha NaseerNo ratings yet

- Chapter 5Document77 pagesChapter 5Duy Bảo TrầnNo ratings yet

- Ushtrime Studente Tema 3, TezgjidhuraDocument25 pagesUshtrime Studente Tema 3, TezgjidhuraAndi HoxhaNo ratings yet

- Quiz 1Document5 pagesQuiz 1Azura RazaliNo ratings yet

- Activity Template - Project PlanDocument55 pagesActivity Template - Project PlanTAgore Ravi TejaNo ratings yet

- Project Report On Bajaj Electricals Ltd.Document96 pagesProject Report On Bajaj Electricals Ltd.Abhishek kumar60% (5)