Professional Documents

Culture Documents

Concept Map RC

Uploaded by

kat kale0 ratings0% found this document useful (0 votes)

303 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

303 views2 pagesConcept Map RC

Uploaded by

kat kaleCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

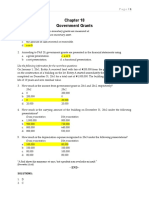

Concept Maps of Receivable Cycle

Account Receivable Sales / Revenue

Standard(s) PAS 32,39, PFRS 7,9,15 PAS 18, PFRS 15

Initial Recognition Current (Short-term) - Face value

Non-Current (Long-term)

- Face value if with same or

reasonable rate

- Present value if with

unreasonable or no interest rate

Subsequent Measurement Net realizable value (receivable Recognize revenue to depict

less allowance) the transfer of promised goods

Short-term: Gross AR - allowance or services to customers in an

Long-term: Present value or amount that reflects the

carrying value consideration to which the

entity expects to be entitled in

exchange for those goods or

services.

Impairment Provisions for Bad Debts (doubtful

accounts or uncollectible accounts)

Derecognition Collection, Write-off, Factored,

Discounted

FS Assertions - Balance Existence, Rights and Obligations, Rights and Obligations and

completeness and Valuation Completeness

FS Assertions - Transactions Occurrence, Completeness, Occurrence, Completeness.

Accuracy, Cut-off and Accuracy, Cut-off and

Classification Classification

Audit Risks Threats 1. The company intentionally 1. The company intentionally

overstates accounts receivable overstates revenue

2. Company employees steal 2. Without proper cutoff, an

collections overstatement of revenue

3. Without proper cutoff, an occurs

overstatement of accounts 3. Revenue recognition

receivables occurs

4. Allowances are understated

Appropriate Audit Procedures 1. Confirm accounts 1. Create comparative

receivable balances (especially summaries of all significant

larger amounts) revenue accounts,

2. Vouch subsequent period comparing the current year

collections, making sure the amounts with historical

subsequent collections relate to data (three or more years if

the period-end balances possible)

(sampling can be used) 2. Create summaries of

3. Thoroughly review average per customer

allowance computations to see income and compare with

if they are consistent with prior prior years (you may want

years; compare allowance to do this by specific

percentages to industry revenue categories)

averages; agree to supporting 3. Compute average profit

documentation (e.g., histories of margins by sales categories

uncollectible amounts); and compare with previous

recompute the related numbers years

You might also like

- INVESTMENTS W Matrix PFRS 9 PDFDocument7 pagesINVESTMENTS W Matrix PFRS 9 PDFAra DucusinNo ratings yet

- Mansci - Chapter 3Document2 pagesMansci - Chapter 3Rae WorksNo ratings yet

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- June 9-Acquisition of PPEDocument2 pagesJune 9-Acquisition of PPEJolo RomanNo ratings yet

- Home Office Chap. 1Document20 pagesHome Office Chap. 1Rei GaculaNo ratings yet

- Week 4 - Lesson 4 Cash and Cash EquivalentsDocument21 pagesWeek 4 - Lesson 4 Cash and Cash EquivalentsRose RaboNo ratings yet

- Problem 1Document14 pagesProblem 1Jerry DiazNo ratings yet

- Cebu Cpar Practical Accounting 1 InvestmentDocument11 pagesCebu Cpar Practical Accounting 1 InvestmentSky SoronoiNo ratings yet

- Investments AssignmentDocument3 pagesInvestments AssignmentKhai Supleo PabelicoNo ratings yet

- Conceptual Framework and Accounting StandardsDocument4 pagesConceptual Framework and Accounting StandardsKrestyl Ann GabaldaNo ratings yet

- Management Advisory Services - Part 1Document35 pagesManagement Advisory Services - Part 1For AcadsNo ratings yet

- Mock 3 FARDocument10 pagesMock 3 FARRodelLaborNo ratings yet

- Semi Final Exam AE23Document6 pagesSemi Final Exam AE23HotcheeseramyeonNo ratings yet

- Operating Segment: Intermediate Accounting 3Document51 pagesOperating Segment: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Chapter 1-Basic-Concepts-and-Job-Order-Cost-CycleDocument21 pagesChapter 1-Basic-Concepts-and-Job-Order-Cost-CycleRhodoraNo ratings yet

- Acquisition and Business Combination ProblemsDocument3 pagesAcquisition and Business Combination ProblemseildeeNo ratings yet

- Prelim Exam - Intermediate Accounting Part 1Document13 pagesPrelim Exam - Intermediate Accounting Part 1Vincent AbellaNo ratings yet

- ADDITIONAL PROBLEMS Variable and Absorption and ABCDocument2 pagesADDITIONAL PROBLEMS Variable and Absorption and ABCkaizen shinichiNo ratings yet

- 2019 Vol 1 CH 1 AnswersDocument17 pages2019 Vol 1 CH 1 AnswersTatangNo ratings yet

- Presumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateDocument5 pagesPresumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateLala AlalNo ratings yet

- AnswerQuiz - Module 8Document4 pagesAnswerQuiz - Module 8Alyanna AlcantaraNo ratings yet

- Government Grants: Use The Following Information For The Next Three QuestionsDocument2 pagesGovernment Grants: Use The Following Information For The Next Three QuestionsJEFFERSON CUTENo ratings yet

- Intermediate Accounting 1A Chapter 7 InventoriesDocument25 pagesIntermediate Accounting 1A Chapter 7 InventoriesAna Leah DelfinNo ratings yet

- Petty Cash and Cash Reconciliation ProblemsDocument9 pagesPetty Cash and Cash Reconciliation ProblemsKenncyNo ratings yet

- Practical Accounting by Valix Practical Accounting by ValixDocument24 pagesPractical Accounting by Valix Practical Accounting by ValixMartha Nicole MaristelaNo ratings yet

- AE 18 Financial Market Prelim ExamDocument3 pagesAE 18 Financial Market Prelim ExamWenjunNo ratings yet

- Midterm Quiz 2Document11 pagesMidterm Quiz 2SGwannaBNo ratings yet

- Receivable Financing Qualifying Exam Review Sample QuestionsDocument4 pagesReceivable Financing Qualifying Exam Review Sample QuestionsHannah Jane Umbay0% (1)

- Inventory and Accounts Payable AdjustmentsDocument3 pagesInventory and Accounts Payable AdjustmentsAngeline DalisayNo ratings yet

- Cortez Practice Set JanuaryDocument5 pagesCortez Practice Set JanuaryChristian LapidNo ratings yet

- Acctg201 IntroductionDocument10 pagesAcctg201 Introductionaaron manacapNo ratings yet

- Polytechnic University of The Philippines: Use The Following Information For The Next Two (2) QuestionsDocument2 pagesPolytechnic University of The Philippines: Use The Following Information For The Next Two (2) QuestionsSean ThyrdeeNo ratings yet

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFDocument10 pagesP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFrandy0% (1)

- Which Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in AssociatesDocument1 pageWhich Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in Associatesjahnhannalei marticio0% (1)

- CamScanner Scanned Document PagesDocument24 pagesCamScanner Scanned Document PagesRolan Lavadia II100% (1)

- Summary Bonds Payable PDFDocument6 pagesSummary Bonds Payable PDFRovi PatinoNo ratings yet

- 04sol-Investments WB 1stDocument21 pages04sol-Investments WB 1stNJ SyNo ratings yet

- Sales Chapter 13 Part II REPORTDocument50 pagesSales Chapter 13 Part II REPORTJeane Mae BooNo ratings yet

- Inventories Quiz NotesDocument7 pagesInventories Quiz NotesMikaella Nicole PechardoNo ratings yet

- Practical Exercise Gross EstateDocument1 pagePractical Exercise Gross EstateRNo ratings yet

- 6 Variable Full Costing Ue Caloocan May 2023Document8 pages6 Variable Full Costing Ue Caloocan May 2023Trisha Marie LeeNo ratings yet

- AIS - Chap 5 Questions (Midterms)Document3 pagesAIS - Chap 5 Questions (Midterms)natalie clyde matesNo ratings yet

- Partnership ExercisesDocument2 pagesPartnership ExercisesKoreangelica ChipeNo ratings yet

- Finance areas interconnectionDocument3 pagesFinance areas interconnectionCASTOR, Vincent PaulNo ratings yet

- Accounting concepts and principles quizDocument7 pagesAccounting concepts and principles quizjessamae gundanNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- ACC5116 - Module 1Document6 pagesACC5116 - Module 1Carl Dhaniel Garcia SalenNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- Microsoft Word - CPAT Reviewer - Law On SalesDocument14 pagesMicrosoft Word - CPAT Reviewer - Law On SaleselaineNo ratings yet

- 02 Task Performance 1Document3 pages02 Task Performance 1Dong Rosello100% (1)

- Conceptual Framework & Accounting: College of Business AdministrationDocument10 pagesConceptual Framework & Accounting: College of Business AdministrationRaphael GalitNo ratings yet

- Tax 01 FINALS Oct 6 2018 BSA4 Answer KeyDocument7 pagesTax 01 FINALS Oct 6 2018 BSA4 Answer KeyChryshelle LontokNo ratings yet

- RatioDocument13 pagesRatioKaren Joyce Sinsay50% (2)

- Module Far1 Unit-1 Part-1bDocument5 pagesModule Far1 Unit-1 Part-1bHazel Jane EsclamadaNo ratings yet

- Midterm RFBTDocument25 pagesMidterm RFBTPamela PerezNo ratings yet

- Intercompany Plant Asset TransactionsDocument11 pagesIntercompany Plant Asset TransactionsRo-Anne LozadaNo ratings yet

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieNo ratings yet

- Chapter 2 Cash and Cash Equivalents Exercises T3AY2021Document7 pagesChapter 2 Cash and Cash Equivalents Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- 2020 - Audcap1 - 2.3 RCCM - BunagDocument1 page2020 - Audcap1 - 2.3 RCCM - BunagSherilyn BunagNo ratings yet

- FR Prep Session (2) - 1-5Document38 pagesFR Prep Session (2) - 1-5mahachem_hariNo ratings yet

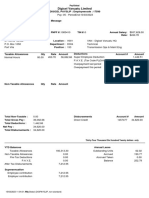

- Adjusted Cost of Goods Sold for Fiscal Year Ended June 30, 2018Document2 pagesAdjusted Cost of Goods Sold for Fiscal Year Ended June 30, 2018kat kaleNo ratings yet

- Production Cycle Concept Map & Audit ApproachDocument4 pagesProduction Cycle Concept Map & Audit Approachkat kaleNo ratings yet

- Case 1: Control Account and Subsidiary Ledger ReconciliationDocument5 pagesCase 1: Control Account and Subsidiary Ledger Reconciliationkat kaleNo ratings yet

- Case 1: Audit of Accounts Receivable and Related AccountsDocument6 pagesCase 1: Audit of Accounts Receivable and Related Accountskat kaleNo ratings yet

- Required: Provide Your Answers To The Following QuestionsDocument1 pageRequired: Provide Your Answers To The Following Questionskat kaleNo ratings yet

- Review QuestionsDocument1 pageReview Questionskat kaleNo ratings yet

- Required: Provide The Relevant Entries Given The Following Situations. (15pts)Document2 pagesRequired: Provide The Relevant Entries Given The Following Situations. (15pts)kat kaleNo ratings yet

- Home Office, Branch, and Agency AccountingDocument4 pagesHome Office, Branch, and Agency Accountingkat kaleNo ratings yet

- Stock Acquisition - Date of AcquisitionDocument2 pagesStock Acquisition - Date of Acquisitionkat kaleNo ratings yet

- Stock Acquisition - Subsequent To Date of AcquisitionDocument1 pageStock Acquisition - Subsequent To Date of Acquisitionkat kaleNo ratings yet

- Review QuestionsDocument1 pageReview Questionskat kaleNo ratings yet

- Installment SalesDocument4 pagesInstallment Saleskat kaleNo ratings yet

- Stock Acquisition - Subsequent To Date of AcquisitionDocument1 pageStock Acquisition - Subsequent To Date of Acquisitionkat kaleNo ratings yet

- Concept Map ECDocument2 pagesConcept Map ECkat kaleNo ratings yet

- Review Questions - M3Document1 pageReview Questions - M3kat kaleNo ratings yet

- Review Questions - M4Document1 pageReview Questions - M4kat kaleNo ratings yet

- General Instructions: Answer The Following Questions and Show Your Solution. Upload ADocument1 pageGeneral Instructions: Answer The Following Questions and Show Your Solution. Upload Akat kaleNo ratings yet

- Sidon Co subsidiary sale to Paya Corp journal entries for consolidationDocument1 pageSidon Co subsidiary sale to Paya Corp journal entries for consolidationkat kaleNo ratings yet

- Links To An External Site.Document1 pageLinks To An External Site.kat kaleNo ratings yet

- John and Paul partnership capital accounts after adjustmentsDocument4 pagesJohn and Paul partnership capital accounts after adjustmentskat kaleNo ratings yet

- Commission DecisionDocument1 pageCommission Decisionkat kaleNo ratings yet

- Construction ContractsDocument3 pagesConstruction Contractskat kaleNo ratings yet

- Partnership Liquidation and Capital Account CalculationsDocument4 pagesPartnership Liquidation and Capital Account Calculationskat kaleNo ratings yet

- Review Questions - M2Document1 pageReview Questions - M2kat kaleNo ratings yet

- Corporate LiquidationDocument1 pageCorporate Liquidationkat kaleNo ratings yet

- Classifications of Business CombinationsDocument1 pageClassifications of Business Combinationskat kaleNo ratings yet

- Audit Issues To Substantive TestingDocument1 pageAudit Issues To Substantive Testingkat kaleNo ratings yet

- Construction ContractsDocument3 pagesConstruction Contractskat kaleNo ratings yet

- Goodwill or Gain On Bargain PurchaseDocument1 pageGoodwill or Gain On Bargain Purchasekat kaleNo ratings yet

- Syl - M1Document1 pageSyl - M1kat kaleNo ratings yet

- Quiz 2 PDFDocument2 pagesQuiz 2 PDFxjuly mNo ratings yet

- A Seminar Project On A Study On Financial Statement Analysis of SailDocument37 pagesA Seminar Project On A Study On Financial Statement Analysis of SailRj BîmålkümãrNo ratings yet

- Final Project KusumgarDocument62 pagesFinal Project KusumgarAvinash SahuNo ratings yet

- ASX - A Systematic Approach To Selling PremiumDocument4 pagesASX - A Systematic Approach To Selling PremiumPablo PaolucciNo ratings yet

- Payslip 10-03-23Document1 pagePayslip 10-03-23gmelenamuNo ratings yet

- FFL SMU Finance For Law .Sample Exam With SolutionDocument7 pagesFFL SMU Finance For Law .Sample Exam With SolutionAaron Goh100% (1)

- Practice Set SSC-CGL TIER I PDFDocument16 pagesPractice Set SSC-CGL TIER I PDFmanu100% (1)

- St. Roch Community Partner Draft PlanDocument20 pagesSt. Roch Community Partner Draft PlanKatherine SayreNo ratings yet

- AAII-My Investment Letter Words of Advice For My GrandchildrenDocument5 pagesAAII-My Investment Letter Words of Advice For My Grandchildrenbhaskar.jain20021814No ratings yet

- Theories InvetoriesDocument44 pagesTheories InvetoriesllllNo ratings yet

- Bixprnt00 EngDocument4 pagesBixprnt00 EngXMLUser096No ratings yet

- On August 1 2015 Cheryl Newsome Established Titus Realty Which PDFDocument1 pageOn August 1 2015 Cheryl Newsome Established Titus Realty Which PDFLet's Talk With HassanNo ratings yet

- Analysis of Value Added Ratios - 1Document18 pagesAnalysis of Value Added Ratios - 1Bhagaban DasNo ratings yet

- Activities and Assignment 2-Regina Gulo PachoDocument8 pagesActivities and Assignment 2-Regina Gulo PachoAlthea RoqueNo ratings yet

- Pre-Joining Documents ChecklistDocument6 pagesPre-Joining Documents ChecklistHeyder HeyderovNo ratings yet

- Topic: Payroll Method CalculationDocument17 pagesTopic: Payroll Method CalculationsonalliNo ratings yet

- Tutorial 3 Answer EconomicsDocument9 pagesTutorial 3 Answer EconomicsDanial IswandiNo ratings yet

- Company Analysis - Applied Valuation by Rajat JhinganDocument13 pagesCompany Analysis - Applied Valuation by Rajat Jhinganrajat_marsNo ratings yet

- INDEX NUMBERS: A GUIDEDocument52 pagesINDEX NUMBERS: A GUIDERavNeet KaUrNo ratings yet

- KEY WORDS Income Taxation - BAR Q and ADocument14 pagesKEY WORDS Income Taxation - BAR Q and AAndrew Mercado NavarreteNo ratings yet

- Soal Latihan LiabilitiesDocument2 pagesSoal Latihan Liabilitieskpop 123No ratings yet

- Citibank CaseDocument6 pagesCitibank CaseLalatendu Das0% (1)

- Sudhir Mehta Chairman Markand Bhatt S. H. Bhojani Dr. PrasannaDocument2 pagesSudhir Mehta Chairman Markand Bhatt S. H. Bhojani Dr. Prasannagauravtandon123No ratings yet

- Intangible AssetsDocument4 pagesIntangible AssetsEuniceChungNo ratings yet

- PACRADocument35 pagesPACRAFahad RazaNo ratings yet

- GST (Goods & Service Tax: Submitted by Nikita Sawant 44 Aditya Kadam 22Document19 pagesGST (Goods & Service Tax: Submitted by Nikita Sawant 44 Aditya Kadam 22Balkrushna ShingareNo ratings yet

- 278 PDFDocument76 pages278 PDFUke FitrianiNo ratings yet

- KFC Swot AnalysisDocument1 pageKFC Swot Analysisrizalstarz100% (20)

- Tax Cases - Atty CatagueDocument264 pagesTax Cases - Atty CatagueJo-Al GealonNo ratings yet

- Bangladesh Development Bank loan application formDocument27 pagesBangladesh Development Bank loan application formJadid HoqueNo ratings yet