Professional Documents

Culture Documents

Equipment Shall Be Excluded

Uploaded by

Katherine MagpantayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equipment Shall Be Excluded

Uploaded by

Katherine MagpantayCopyright:

Available Formats

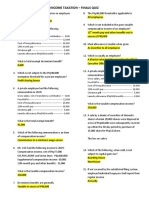

Final Exam

Please show solution (if necessary).

I.

What are the salient features of CREATE law?

II.

Give instances of short accounting period for tax purposes?

III.

Mr. X sold his principal residence for P2M. What are the requisites to claim exemption from CGT on the

sale of his house?

IV.

Mr. X invested in the stocks of ABC Corporation, a domestic corporation, by purchasing 1,000 shares for

P100,000 on July 1, 2016. ABC declared a P10/share cash dividend on November 12, 2021 payable on

January 12, 2021 for stockholders of record December 12, 2021. On December 8, 2021, Mr X disposed of

his share investment for a total consideration of P120,000. Explain the tax treatment in the transaction.

V.

A taxpayer reported the following:

Capital loss – current year P50,000

Capital gain – current year 200,000

Net capital loss – last year 70,000

Q1. Assuming the taxpayer is an individual, compute the capital loss deductible against capital gain in

the current year.

Q2. Assuming the taxpayer is a corporation, compute the capital loss deductible against capital gain in

the current year.

VI.

Mr. Z, a manufacturer of goods under accrual basis, opted to claim optional standard deduction. Aside

from manufacturing, Mr. Z also leases a portion of his business to other businesses. The following relate

to his income:

Gross Sales P4,000,000

Sales returns and allowances 200,000

Rental Income 300,000

Interest Income from bond investment 15,000

Interest Income from customers’ notes 100,000

Gain on sale of old equipment 20,000

Dividend from a domestic corporation 18,000

What is the amount of taxable income?

NOTE: In computing OSD, non-operating income such as interest from bonds and gain on sale of

equipment shall be excluded.

VII.

A taxpayer under the cash basis had the following expenditures:

Acquisition of office equipment at the

Middle of the year (5-year useful life) P200,000

Payment of employee salaries 40,000

Payment for office utilities expenses 60,000

How much is the claimable deductible expenses for the year?

VIII.

True or False.

1. The sick leave credit of private employees up to 10 days is exempt de minimis benefits.

2. A non-stock, non-profit entity is subject to tax on income from unrelated activities.

3. Personal expenses can be claimed as part of itemized deductions.

4. The tax sparing rule is applicable to RFC and NRFC.

5. General Professional Partnerships are subject to final tax but not to regular income tax.

- end -

You might also like

- KOBEDocument2 pagesKOBEJHASDFIJKSDF100% (1)

- A Study On CSR Activities Initiated by Hul and Its Impact On ProfitabilityDocument52 pagesA Study On CSR Activities Initiated by Hul and Its Impact On ProfitabilitySunil BaliyanNo ratings yet

- Tax Summative 2Document14 pagesTax Summative 2Von Andrei MedinaNo ratings yet

- Tax Computations SampleDocument5 pagesTax Computations Samplelcsme tubodaccountsNo ratings yet

- PGBP New SlidesDocument40 pagesPGBP New SlidesSachin Jain100% (2)

- Premium CH 16 Monopolistic CompetitionDocument24 pagesPremium CH 16 Monopolistic CompetitionMelgy Viora Aquary ArdianNo ratings yet

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- Session 8 - Gross Income - Inclusions and ExclusionsDocument12 pagesSession 8 - Gross Income - Inclusions and ExclusionsMitzi WamarNo ratings yet

- TX 201Document4 pagesTX 201Pau SantosNo ratings yet

- Corporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMDocument3 pagesCorporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMChirag JainNo ratings yet

- BAM031 P3 Q1 Answer FBT DeductionsDocument12 pagesBAM031 P3 Q1 Answer FBT DeductionsMary Lyn DatuinNo ratings yet

- Item 1 of 5Document4 pagesItem 1 of 5Claudette ClementeNo ratings yet

- Taxation Preweek and Additional MaterialsDocument26 pagesTaxation Preweek and Additional MaterialsMarvin ClementeNo ratings yet

- Egyptian Income Tax Part OneDocument14 pagesEgyptian Income Tax Part OneAhmed Abdel-FattahNo ratings yet

- Incotax GT1 PDFDocument3 pagesIncotax GT1 PDFSoahNo ratings yet

- Acc05 Far Handout 7Document5 pagesAcc05 Far Handout 7Jullia BelgicaNo ratings yet

- FA2 - SFP and SCI-Answers 1Document5 pagesFA2 - SFP and SCI-Answers 1Angel AtirazanNo ratings yet

- Illustrative Examples - Financial StatementsDocument6 pagesIllustrative Examples - Financial StatementsChuchi SubardiagaNo ratings yet

- Ia3 Midterm QuizDocument11 pagesIa3 Midterm QuizJalyn Jalando-onNo ratings yet

- IT Module No. 6 Capital Gains Taxation Module Specific Learning OutcomesDocument18 pagesIT Module No. 6 Capital Gains Taxation Module Specific Learning Outcomesdesiree bautistaNo ratings yet

- W7-Module Concept of Income-Part 2Document21 pagesW7-Module Concept of Income-Part 2Danica VetuzNo ratings yet

- AccountingDocument9 pagesAccountingTakuriNo ratings yet

- Illustrative Examples - Accounting For Income TaxDocument3 pagesIllustrative Examples - Accounting For Income Taxr3rvpaudit.nfjpia2324supaccNo ratings yet

- Elimination Round QuestionnairesDocument5 pagesElimination Round Questionnairesmitakumo uwuNo ratings yet

- Tax-May 8Document1 pageTax-May 8Ella Apelo100% (1)

- Income Taxation - Finals QuizzesDocument12 pagesIncome Taxation - Finals QuizzesJalyn Jalando-onNo ratings yet

- Regular Income Tax: Inclusions in Gross IncomeDocument10 pagesRegular Income Tax: Inclusions in Gross IncomeAngelica PagaduanNo ratings yet

- Tax 1st Drills Answer KeyDocument18 pagesTax 1st Drills Answer KeyJerma Dela Cruz100% (1)

- Tax Finals Summative s02Document13 pagesTax Finals Summative s02Von Andrei MedinaNo ratings yet

- Session 2 - Deductions From Gross Income, Part 1Document10 pagesSession 2 - Deductions From Gross Income, Part 1ABBIE GRACE DELA CRUZNo ratings yet

- The Chartered Tax Adviser Examination: Taxation of Owner-Managed BusinessesDocument11 pagesThe Chartered Tax Adviser Examination: Taxation of Owner-Managed BusinessesmeatloafNo ratings yet

- Assessment of CompaniesDocument5 pagesAssessment of Companiesmohanraokp22790% (1)

- Basic Accounting - With AnswersDocument12 pagesBasic Accounting - With AnswersMarie MeridaNo ratings yet

- Chapter 2 Capsule SessionDocument40 pagesChapter 2 Capsule SessionKshitishNo ratings yet

- ACC311 Exe 022022Document1 pageACC311 Exe 022022Saya PascualNo ratings yet

- Act 102 FinalsDocument5 pagesAct 102 FinalsJamii Dalidig MacarambonNo ratings yet

- Seatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWDocument5 pagesSeatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWChristine Joy LanabanNo ratings yet

- Income From BusinessDocument23 pagesIncome From Businesskhushi shahNo ratings yet

- DeductionsDocument4 pagesDeductionsDianna RabadonNo ratings yet

- It 2Document44 pagesIt 2Business RecoveryNo ratings yet

- BTAXREV Week 4 ACT185 Preferential Taxation 2Document16 pagesBTAXREV Week 4 ACT185 Preferential Taxation 2gatotkaNo ratings yet

- Regular Income Taxation: Inclusion in Gross Income: Chan, John Mark Juganas, Hazel Madayag, Jovie AnnDocument43 pagesRegular Income Taxation: Inclusion in Gross Income: Chan, John Mark Juganas, Hazel Madayag, Jovie AnnAngelica PagaduanNo ratings yet

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboNo ratings yet

- Afar 2019Document9 pagesAfar 2019TakuriNo ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- Take Home Quiz 2Document6 pagesTake Home Quiz 2Jane Tuazon100% (1)

- 5 6053042764831000707Document16 pages5 6053042764831000707SoNam ZaNgmoNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- 93-09 - Capital AssetsDocument8 pages93-09 - Capital AssetsJuan Miguel UngsodNo ratings yet

- Taxation Material 2Document7 pagesTaxation Material 2Shaira BugayongNo ratings yet

- IFRS - 2017 - Solved QPDocument15 pagesIFRS - 2017 - Solved QPSharan ReddyNo ratings yet

- TAXATIONDocument83 pagesTAXATIONKofo IswatNo ratings yet

- PDF May 2017 - CompressDocument7 pagesPDF May 2017 - Compresscasual viewerNo ratings yet

- Exercise CorporationDocument3 pagesExercise CorporationJefferson MañaleNo ratings yet

- Requirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Document5 pagesRequirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Srikrishna DharNo ratings yet

- 1 Deductions From Gross Income-FinalDocument24 pages1 Deductions From Gross Income-FinalSharon Ann BasulNo ratings yet

- Fa Topic 17-23Document34 pagesFa Topic 17-23MehakpreetNo ratings yet

- 1 Financial Statements Exercises 2022Document9 pages1 Financial Statements Exercises 2022Alyssa TolcidasNo ratings yet

- 06 Actvity 1 1Document4 pages06 Actvity 1 14mpspxd5msNo ratings yet

- Topic 3 Computation of Taxable Profit or LossDocument25 pagesTopic 3 Computation of Taxable Profit or LossitulejamesNo ratings yet

- Capital Gains Tax PDFDocument6 pagesCapital Gains Tax PDFjanus lopezNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- MODULE 2 Accounting Concepts and PrinciplesDocument4 pagesMODULE 2 Accounting Concepts and PrinciplesKatherine MagpantayNo ratings yet

- FAR MODULE 1 Introduction To AccountingDocument9 pagesFAR MODULE 1 Introduction To AccountingKatherine MagpantayNo ratings yet

- FAR MODULE 3 The Accounting EquationDocument3 pagesFAR MODULE 3 The Accounting EquationKatherine MagpantayNo ratings yet

- Equipment Shall Be ExcludedDocument2 pagesEquipment Shall Be ExcludedKatherine MagpantayNo ratings yet

- Module 1: The Basic Principles of Income TaxationDocument11 pagesModule 1: The Basic Principles of Income TaxationAgnes Baldovino NazarroNo ratings yet

- Contracts, Torts, Family Law, Civil ProcedureDocument18 pagesContracts, Torts, Family Law, Civil ProcedureepravnaNo ratings yet

- Mercedes - Benz - PresentationDocument31 pagesMercedes - Benz - Presentationdev26v8No ratings yet

- Yash Bhandari - Final ReportDocument73 pagesYash Bhandari - Final ReportYash BhandariNo ratings yet

- Law On Partnership and Corporation by Hector de Leon - Compress - 084442Document113 pagesLaw On Partnership and Corporation by Hector de Leon - Compress - 084442Jeny Princess FrondaNo ratings yet

- Business Income Tax Guide FinalDocument40 pagesBusiness Income Tax Guide FinalOlaNo ratings yet

- Future Leaders: Accelerating The Next Generation of Emerging LeadersDocument12 pagesFuture Leaders: Accelerating The Next Generation of Emerging LeadersChennu Naveen ReddyNo ratings yet

- Chapter 6 - Test Bank of Managerial Accounting BookDocument48 pagesChapter 6 - Test Bank of Managerial Accounting BookNguyễn ThảoNo ratings yet

- Chaper 2 CostDocument4 pagesChaper 2 CostJapPy QuilasNo ratings yet

- Druk WangDocument24 pagesDruk WangSonam Peldon (Business) [Cohort2020 RTC]No ratings yet

- Donor Funded Project RequirementDocument8 pagesDonor Funded Project RequirementBUKENYA BEEE-2026100% (1)

- Case StudyDocument8 pagesCase StudyCarlo AlancadoNo ratings yet

- Second Interview QuestionsDocument3 pagesSecond Interview QuestionsAkhilesh SinghNo ratings yet

- 19upa514-Cost Accounting-Test-IDocument5 pages19upa514-Cost Accounting-Test-IJaya KumarNo ratings yet

- Unit 4 Economics Market Structure.Document68 pagesUnit 4 Economics Market Structure.Devyani ChettriNo ratings yet

- Kj1010-6804-Man604-Man205 - Chapter 7Document16 pagesKj1010-6804-Man604-Man205 - Chapter 7ghalibNo ratings yet

- 1036 Scriptie HiralallDocument72 pages1036 Scriptie HiralalltharindhuNo ratings yet

- EXIN Data Privacy Foundation Online Course & CertificationDocument12 pagesEXIN Data Privacy Foundation Online Course & CertificationIevision ConnectNo ratings yet

- Math PTDocument3 pagesMath PTPauline LavillaNo ratings yet

- Business Impact Analysis Template v3.9.4Document27 pagesBusiness Impact Analysis Template v3.9.4Great WishNo ratings yet

- Synopsis On A Study On Production and Inventory Control KFCDocument7 pagesSynopsis On A Study On Production and Inventory Control KFCMrinal KalitaNo ratings yet

- United Colors of Benetton: Supply Chain ManagementDocument32 pagesUnited Colors of Benetton: Supply Chain ManagementBayu AnugrahNo ratings yet

- TC BR 38 Discussion of OffersDocument7 pagesTC BR 38 Discussion of OffersIES-GATEWizNo ratings yet

- CR 11 Darren Dwitama PDFDocument5 pagesCR 11 Darren Dwitama PDFDarren LatifNo ratings yet

- The Relationship of System Engineering To The Project Cycle PDFDocument12 pagesThe Relationship of System Engineering To The Project Cycle PDFpirotte100% (1)

- GST - It's Meaning and ScopeDocument11 pagesGST - It's Meaning and ScopeRohit NagarNo ratings yet

- Middle Managers Role in Strategy ImplementationDocument20 pagesMiddle Managers Role in Strategy Implementationrajivsharma79No ratings yet

- Positioning Services in Competitive Markets: General Content Multiple Choice QuestionsDocument8 pagesPositioning Services in Competitive Markets: General Content Multiple Choice QuestionsNhật TuấnNo ratings yet