Professional Documents

Culture Documents

FAR MODULE 1 Introduction To Accounting

Uploaded by

Katherine MagpantayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR MODULE 1 Introduction To Accounting

Uploaded by

Katherine MagpantayCopyright:

Available Formats

COLLEGE OF BUSINESS AND MANAGEMENT

Dr. Glen D.V. De Leon, CPA

glen.deleon@dlsau.edu.ph

Module 1

Introduction to Accounting____________________________________________

LEARNING OBJECTIVES:

After studying this chapter, you should be able to:

1. Define accounting.

2. Describe the nature and purpose of accounting.

3. Give examples of branches of accounting.

4. State the function of accounting in a business.

5. Differentiate between external and internal users of accounting information.

6. Narrate the history/origin of accounting.

7. State the forms of business organization.

8. State the types of business according to their activities.

Definition of accounting

Accounting is a process of identifying, recording and communicating economic

information that is useful in making economic decisions.

Essential elements of the definition of accounting

1. Identifying – The accountant analyzes each business transaction and identifies whether

the transaction is an “accountable event” or “non-accountable event.” This is because

only “accountable events” are recorded in the books of accounts. “Non-accountable

events” are not recorded in the books of accounts.

FINANCIAL ACCOUNTING & REPORTING 1

2. Recording – The accountant recognizes (i.e., records) the “accountable events” he has

identified. This process is called “journalizing.” After journalizing, the accountant then

classifies the effects of the event on the “accounts.” This process is called “posting.”

3. Communicating – At the end of each accounting period, the accountant summarizes the

information processed in the accounting system in order to produce meaningful reports.

Accounting information is communicated to interested users through accounting

reports, the most common form of which is the financial statements.

Nature of accounting

Accounting is a process with the basic purpose of providing information about economic

activities intended to be useful in making economic decisions.

Types of information provided by accounting

1. Quantitative information

2. Qualitative information

3. Financial information

Functions of Accounting in Business

1. To provide external users with information that is useful in making investment and

credit decisions; and

2. To provide internal users with information that is useful in managing the business.

Brief history of accounting

Accounting can be traced as far back as the prehistoric times, perhaps more than 10,000 years

ago.

Archaeologists have found clay tokens as old as 8500 B.C. in Mesopotamia which were usually

cones, disks, spheres and pellets. These tokens correspond to commodities like sheep, clothing

or bread. They were used in the Middle West in keeping records. After some time, the tokens

were replaced by wet clay tablets. During such time, experts concluded this to be the start of

the art of writing. (Source: http://EzineArticles.com/456988)

• Double entry records first came out during 1340 A.D. in Genoa.

• In 1494, the first systematic record keeping dealing with the “double entry recording

system” was formulated by Fra Luca Pacioli, a Franciscan monk and mathematician. The

“double entry recording system” was included in Pacioli’s book titled “Summa di

Arithmetica Geometria Proportioni and Proportionista,” published on November 10,

1494 in Venice.

The concept of “double entry recording” is being used to this day. Thus, Fra Luca Pacioli is

considered as the father of modern accounting

FINANCIAL ACCOUNTING & REPORTING 2

Common Branches of Accounting

FINANCIAL ACCOUNTING & REPORTING 3

Users of Accounting Information

1. Internal users – those who are directly involved in managing the business. Examples:

• Business owners who are directly involved in managing the business

• Board of directors

• Managerial personnel

2. External users – those who are not directly involved in managing the business.

Examples:

• Existing and potential investors (e.g., stockholders who are not directly

involved in managing the business)

• Lenders (e.g., banks) and Creditors (e.g., suppliers)

• Non-managerial employees

• Public

Forms of Business Organizations

FINANCIAL ACCOUNTING & REPORTING 4

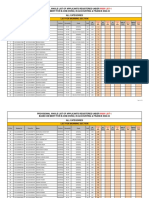

Advantages and Disadvantages

FINANCIAL ACCOUNTING & REPORTING 5

FINANCIAL ACCOUNTING & REPORTING 6

FINANCIAL ACCOUNTING & REPORTING 7

Types of Business According to Activities

1. Service business

2. Merchandising (Trading)

3. Manufacturing

FINANCIAL ACCOUNTING & REPORTING 8

“Do not be anxious about anything, but in everything by prayer and supplication with thanksgiving let your

requests be made known to God. And the peace of God, which surpasses all understanding, will guard your

hearts and your minds in Christ Jesus.” (Philippians 4:6-7)

- END –

Barnes & Noble. Nobles, Scott, et al. (2019). College Accounting (11th ed). Cengage Learning.

Beticon, J., Hinayon, M., and Ireneo, S. (2019). Fundamentals of Accounting. Manila: FCA

Publishing.

Empleo, P., German, C., and Cruz. (2019). Fundamentals of Accounting Vol. 2. Mutual Books,

Inc.

Millan Z.V. (2019) Financial Accounting and Reporting

Saguinsin, A. T. (2013). Basic Concept of Accounting.

FINANCIAL ACCOUNTING & REPORTING 9

You might also like

- CHAPTER 1: Introduction To AccountingDocument26 pagesCHAPTER 1: Introduction To AccountingBellela DumpNo ratings yet

- Acctg 102Document95 pagesAcctg 102Yoonah KimNo ratings yet

- Chapter 1 Intro To AcctgDocument27 pagesChapter 1 Intro To AcctgJesseca JosafatNo ratings yet

- Module For Fundamentals of AccountingDocument26 pagesModule For Fundamentals of AccountingVan MateoNo ratings yet

- PCOA-02-FAR - Module1 and 2Document25 pagesPCOA-02-FAR - Module1 and 2Rex ParillaNo ratings yet

- Chapter 1: Introduction To AccountingDocument8 pagesChapter 1: Introduction To AccountingShemara AlonzoNo ratings yet

- 11 Fabm1 Q3 - M1Document13 pages11 Fabm1 Q3 - M1Syrwin SedaNo ratings yet

- Chapter 1 FarDocument7 pagesChapter 1 FarThalia Jubel TabucolNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document5 pagesFundamentals of Accountancy, Business and Management 1Remar Jhon PaineNo ratings yet

- Fa1 WK1 ModuleDocument10 pagesFa1 WK1 ModuleJoseph GernaleNo ratings yet

- CH-1 The Accounting Equation2Document47 pagesCH-1 The Accounting Equation2Yasin Arafat ShuvoNo ratings yet

- Chapter 1 Intro To AcctgDocument31 pagesChapter 1 Intro To AcctgEowyn DianaNo ratings yet

- Module Sample ShsDocument8 pagesModule Sample ShsJoke JoNo ratings yet

- Introduction To Accounting Learning ObjectivesDocument20 pagesIntroduction To Accounting Learning ObjectivesSABORDO, MA. KRISTINA COLEENNo ratings yet

- Fundamentals of Accounting 1 - G11 - WK1 2 - LBelenDocument8 pagesFundamentals of Accounting 1 - G11 - WK1 2 - LBelenjeymararizalapayumo.bascNo ratings yet

- FABM 1 Module by L. DimataloDocument109 pagesFABM 1 Module by L. Dimataloseraphinegod267No ratings yet

- GR 11 Module in Fundamentals of Accountancy and Business Management 1Document35 pagesGR 11 Module in Fundamentals of Accountancy and Business Management 1tallerrayallen4No ratings yet

- Accounting-Definition Process Objective Origin and EvolutionDocument7 pagesAccounting-Definition Process Objective Origin and EvolutionYakkstar 21No ratings yet

- Module 1Document11 pagesModule 1ysa tolosaNo ratings yet

- Module 1Document11 pagesModule 1ysa tolosaNo ratings yet

- Fabm1 - wEEK 1Document95 pagesFabm1 - wEEK 1Jennifer EstebanNo ratings yet

- Fabm 1 - Week 1Document5 pagesFabm 1 - Week 1FERNANDO TAMZ2003No ratings yet

- Introduction To AccountingDocument20 pagesIntroduction To AccountingJosh ChuaNo ratings yet

- Learning Objectives: Chapter 1: Introduction To Accounting (FAR By: Millan)Document27 pagesLearning Objectives: Chapter 1: Introduction To Accounting (FAR By: Millan)Mera zapicoNo ratings yet

- Acctg Module 1 QuarterDocument22 pagesAcctg Module 1 QuarterAlthea Escarpe MartinezNo ratings yet

- EL201 Accounting Learning Module Lessons 1Document13 pagesEL201 Accounting Learning Module Lessons 1BabyjoyNo ratings yet

- ACCTG - 1 - Chapter 1 & 2Document39 pagesACCTG - 1 - Chapter 1 & 2Aldeguer Joy PenetranteNo ratings yet

- Notes For MBA 2Document254 pagesNotes For MBA 2Pramod Vasudev100% (1)

- Accounting For ManagementDocument662 pagesAccounting For Managementdorababu2007100% (1)

- FABM 1 Lesson 1 June 4Document38 pagesFABM 1 Lesson 1 June 4RenzNo ratings yet

- Accounting For ManagersDocument287 pagesAccounting For ManagersmenakaNo ratings yet

- 1st Quarter AccountingDocument29 pages1st Quarter AccountingAlfred Lawrence HonralesNo ratings yet

- Chapter 1: Introduction To Accounting (FAR By: Millan)Document28 pagesChapter 1: Introduction To Accounting (FAR By: Millan)Ella MontefalcoNo ratings yet

- TKM Institute of Management, Kollam Study Notes, Semester I Accounting For ManagersDocument28 pagesTKM Institute of Management, Kollam Study Notes, Semester I Accounting For ManagersAhsan DileepNo ratings yet

- Introduction To AccountingDocument38 pagesIntroduction To AccountingMeljohn BarinaNo ratings yet

- Grade 11 - Fundamentals of Accountancy, Business and Management 1Document126 pagesGrade 11 - Fundamentals of Accountancy, Business and Management 1Marionne Jose TitanNo ratings yet

- Accounting-1 Reading Materials#1Document53 pagesAccounting-1 Reading Materials#1Nardsdel RiveraNo ratings yet

- Principles of AccountancyDocument9 pagesPrinciples of Accountancyvigneshwar23No ratings yet

- Chapter 1 Introduction To AccountingDocument13 pagesChapter 1 Introduction To AccountingAngellouiza MatampacNo ratings yet

- MBA Accounting Managers 1styear Notes 1Document286 pagesMBA Accounting Managers 1styear Notes 1gibNo ratings yet

- Unit I - INTRODUCTION TO ACCTGDocument7 pagesUnit I - INTRODUCTION TO ACCTGJudy Mar Valdez, CPANo ratings yet

- FABM 1 Lesson 1-Introdcution To AccountingDocument7 pagesFABM 1 Lesson 1-Introdcution To AccountingJon Carlo Garcia MacheteNo ratings yet

- Chapter 1 - Introduction To AccountingDocument17 pagesChapter 1 - Introduction To AccountingAnn Margaret BalajadiaNo ratings yet

- Ac 1&2 Module 1Document11 pagesAc 1&2 Module 1ABM-5 Lance Angelo SuganobNo ratings yet

- HM 203Document229 pagesHM 203Heintz LangdetNo ratings yet

- Financial Accounting NotesDocument662 pagesFinancial Accounting NotesjharabulashidNo ratings yet

- Cape Accounting Unit 1 (Notes 1)Document21 pagesCape Accounting Unit 1 (Notes 1)DWAYNE HARVEYNo ratings yet

- Financial Accounting Part IDocument18 pagesFinancial Accounting Part Idannydoly100% (1)

- Chapter 1 AccountingDocument4 pagesChapter 1 AccountingAlthea AsuncionNo ratings yet

- Introduction To AccountingDocument28 pagesIntroduction To AccountingLiya Mae SantiagoNo ratings yet

- Modules For Online Learning Management System: Computer Communication Development InstituteDocument20 pagesModules For Online Learning Management System: Computer Communication Development InstituteAngeline Asejo100% (1)

- Fundamentals of Accountancy, Bus Iness and ManagementDocument10 pagesFundamentals of Accountancy, Bus Iness and ManagementzahjNo ratings yet

- Important Notes For AccountingDocument66 pagesImportant Notes For AccountingSana KhursheedNo ratings yet

- Q3 Fundamentals of ABM 1 Module 1Document19 pagesQ3 Fundamentals of ABM 1 Module 1Krisha Fernandez100% (1)

- Introduction To AccountingDocument25 pagesIntroduction To AccountingLizel Dizon Miranda100% (1)

- Accounting 12 Module 1Document12 pagesAccounting 12 Module 1Kristy Veyna BautistaNo ratings yet

- Fundamentals of ABM 01 Lesson 1 and 2Document29 pagesFundamentals of ABM 01 Lesson 1 and 2Aldin J PototNo ratings yet

- Introduction To Accounting: ContentsDocument251 pagesIntroduction To Accounting: ContentsJaya Bala ChandranNo ratings yet

- AccountingDocument50 pagesAccountingAshyanna UletNo ratings yet

- MODULE 2 Accounting Concepts and PrinciplesDocument4 pagesMODULE 2 Accounting Concepts and PrinciplesKatherine MagpantayNo ratings yet

- FAR MODULE 3 The Accounting EquationDocument3 pagesFAR MODULE 3 The Accounting EquationKatherine MagpantayNo ratings yet

- Equipment Shall Be ExcludedDocument2 pagesEquipment Shall Be ExcludedKatherine MagpantayNo ratings yet

- Equipment Shall Be ExcludedDocument2 pagesEquipment Shall Be ExcludedKatherine MagpantayNo ratings yet

- Module 1: The Basic Principles of Income TaxationDocument11 pagesModule 1: The Basic Principles of Income TaxationAgnes Baldovino NazarroNo ratings yet

- Resit Examinations For 2004 - 2005 / Semester 2: Module: Financial AccountingDocument6 pagesResit Examinations For 2004 - 2005 / Semester 2: Module: Financial AccountingBasilio MaliwangaNo ratings yet

- COSMY - Perfume & Cosmetic TemplateDocument43 pagesCOSMY - Perfume & Cosmetic Templaterosylia tchitemboNo ratings yet

- Class 6Document23 pagesClass 6Sahil NoorzaiNo ratings yet

- International Business 16th Edition Daniels Test BankDocument24 pagesInternational Business 16th Edition Daniels Test BankCynthiaWangeagjy100% (31)

- Quiz 7 (HRM 2022)Document6 pagesQuiz 7 (HRM 2022)Sandipan DawnNo ratings yet

- SE AssignmentAsPerSPPUDocument2 pagesSE AssignmentAsPerSPPUkedarNo ratings yet

- Maru BattingDocument28 pagesMaru BattingRealChiefNo ratings yet

- Frozen Fruit & Juice Production: Brain Freeze: Low Demand For Frozen Juice Is Expected To Limit Revenue GrowthDocument47 pagesFrozen Fruit & Juice Production: Brain Freeze: Low Demand For Frozen Juice Is Expected To Limit Revenue GrowthArnu Felix CamposNo ratings yet

- Broadband Bill AugustDocument1 pageBroadband Bill AugustkarthikNo ratings yet

- Business Plan FOR: AppendixDocument23 pagesBusiness Plan FOR: AppendixNOUN UPDATENo ratings yet

- Modul Minggu Ke-2Document14 pagesModul Minggu Ke-2Sandi AdityaNo ratings yet

- Assessment of Promotional Practice: A Case of Africa Insurance Company in Hawassa BranchDocument26 pagesAssessment of Promotional Practice: A Case of Africa Insurance Company in Hawassa BranchHACHALU FAYE100% (2)

- Dmart: Disrupting Food RetailingDocument4 pagesDmart: Disrupting Food RetailingShubham ThakurNo ratings yet

- AA Haroon ChartDocument2 pagesAA Haroon Chartmick4648No ratings yet

- Pulman Steel Guide PDFDocument29 pagesPulman Steel Guide PDFNaveenNo ratings yet

- Detailed Result : 1. A) Rs.40,000/ - (Your Answer Is Incorrect)Document8 pagesDetailed Result : 1. A) Rs.40,000/ - (Your Answer Is Incorrect)Amit PalNo ratings yet

- Transactions That Affect Revenue, Expenses, and Withdrawals: What You'll LearnDocument28 pagesTransactions That Affect Revenue, Expenses, and Withdrawals: What You'll LearnKaden Kelly100% (1)

- Jones Corportion SoluationDocument14 pagesJones Corportion SoluationShakilNo ratings yet

- Aqualisa Quartz: Presented By: - Amit Mallick - Shourya Nagaria - Ankit PandeyDocument20 pagesAqualisa Quartz: Presented By: - Amit Mallick - Shourya Nagaria - Ankit Pandeysamiksha bagdi100% (1)

- Olansi Catalogue 1Document16 pagesOlansi Catalogue 1Duy NamNo ratings yet

- Goenka 2022 MORNING WISH List 01 FINAL PUBLISHDocument99 pagesGoenka 2022 MORNING WISH List 01 FINAL PUBLISHAditya AgarwalNo ratings yet

- How Are The 3 Financial Statements LinkedDocument7 pagesHow Are The 3 Financial Statements LinkedMuiz SaddozaiNo ratings yet

- Controlling RobbinsDocument30 pagesControlling RobbinsDantaPlayzNo ratings yet

- Namibia PROCUREMENT COORDINATOR JOB DESCRIPTIONDocument2 pagesNamibia PROCUREMENT COORDINATOR JOB DESCRIPTIONTsholofeloNo ratings yet

- 7 Non-Probability Sampling Methods in Ag - LammDocument8 pages7 Non-Probability Sampling Methods in Ag - LammAi CaidenNo ratings yet

- Hariom Work OrderDocument2 pagesHariom Work OrderAman DubeyNo ratings yet

- Chapter 6 - Strategy Analysis and ChoiceDocument28 pagesChapter 6 - Strategy Analysis and ChoiceSadaqat AliNo ratings yet

- PHD Monthly Connect - January'24Document27 pagesPHD Monthly Connect - January'24varun.ramakrishnaNo ratings yet

- AIS AssignmentDocument18 pagesAIS AssignmentImran Azad100% (1)

- Dialog Axiata PLC Capital TRUST Securities 14-03-2016 PDFDocument16 pagesDialog Axiata PLC Capital TRUST Securities 14-03-2016 PDFerandi.pereraNo ratings yet