Professional Documents

Culture Documents

AEC 209 Income Taxation Problem Solving 3

AEC 209 Income Taxation Problem Solving 3

Uploaded by

Abegail MadridOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AEC 209 Income Taxation Problem Solving 3

AEC 209 Income Taxation Problem Solving 3

Uploaded by

Abegail MadridCopyright:

Available Formats

AEC 209- Income Taxation

Problem Solving

Problem 3

A government rank and file employee had the following summary of his compensation

and benefits in 2019.

Gross compensation P 939,000

Employee payroll deduction:

Employee contribution to GSIS,PHIC,HDMF P 72,000

Withholding tax 57,600 129,600

Net regular payroll P810, 000

Representation and transportation allowance 16,200

PERA 21,600

Christmas bonus 78,300

Uniform allowance 10,800

m

Christmas gift 4,500

er as

Honoraria 13,500

co

Total compensation P 954,900

eH w

Required: Compute for taxable compensation income

o.

rs e De Minimis Non- Other Taxable

ou urc

taxable benefits benefits

Regular and supplementary compensation:

Mandatory deductions P 72,000

o

Regular compensation P 867,000

aC s

Supplemental compensation

vi re

Honoraria 13,500

RATA 16,200

y

PERA 21,600

Total P0 P 880,500

ed d

13 month pay and other benefits

ar stu

Christmas bonus P 78,300

Christmas gift 4,500

Excess De minimis

is

Uniform Allowance P 10,800 6,000 4,800

Total 10,800 43,800 87,600

Th

Exclusion threshold ```90,000 -90,000

Total 133,800 0

Total non-taxable compensation 205,800

sh

Taxable excess 13th month pay and other benefits 0 0

Taxable compensation income P 880,500

This study source was downloaded by 100000809470096 from CourseHero.com on 12-09-2021 10:50:19 GMT -06:00

https://www.coursehero.com/file/104292180/AEC-209-Income-Taxation-Problem-Solving-3docx/

Powered by TCPDF (www.tcpdf.org)

You might also like

- How To Hack Wi-Fi: Automating Wi-Fi Hacking With Besside-Ng Null Byte :: WonderHowToDocument17 pagesHow To Hack Wi-Fi: Automating Wi-Fi Hacking With Besside-Ng Null Byte :: WonderHowToVictor ManuelNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- Pivot Point Indicator: Cheat SheetDocument4 pagesPivot Point Indicator: Cheat SheetOlalekan Akinola100% (1)

- IT Strategic Plan PDFDocument8 pagesIT Strategic Plan PDFendeNo ratings yet

- Bajaj Capital LimitedDocument1 pageBajaj Capital LimitedSunny JohnsonNo ratings yet

- Sant BhindranwaleDocument28 pagesSant BhindranwaleHarpreet Singh88% (16)

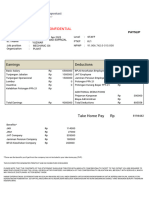

- Salary Slip JuneDocument1 pageSalary Slip JuneMD AliNo ratings yet

- Salary Slip MayDocument1 pageSalary Slip MayselvaNo ratings yet

- Automated Revised SBM Assessment Tool and District Consolidation AgpsDocument6 pagesAutomated Revised SBM Assessment Tool and District Consolidation AgpsDivine Grace SamortinNo ratings yet

- This Study Resource Was: AEC 209-Income TaxationDocument1 pageThis Study Resource Was: AEC 209-Income TaxationAbegail MadridNo ratings yet

- A62da2466a154a 1658463334poovarasan Murugasamy UJJ39393 Elevation Letter Updated 20220722 094412 67460965062da24144cf94435614311Document2 pagesA62da2466a154a 1658463334poovarasan Murugasamy UJJ39393 Elevation Letter Updated 20220722 094412 67460965062da24144cf94435614311Poovarasan MNo ratings yet

- POA Summer 2020 - Tut 3 ExerciseDocument13 pagesPOA Summer 2020 - Tut 3 ExerciseNguyen Dinh Quang MinhNo ratings yet

- Security Regional (LMP, PLB, MDN)Document18 pagesSecurity Regional (LMP, PLB, MDN)Biyan FarabiNo ratings yet

- Ep60 2023Document1 pageEp60 2023Bogdan AlecsaNo ratings yet

- Do Not Destroy: P60 End of Year CertificateDocument1 pageDo Not Destroy: P60 End of Year Certificatevickythom10No ratings yet

- Shaikh Sohail Shaikh KaleemDocument1 pageShaikh Sohail Shaikh KaleemMantra SriNo ratings yet

- It Statement Ay 20-21Document1 pageIt Statement Ay 20-21creditNo ratings yet

- Offer Compensation Breakup: Estimate Based On Current Conversion RateDocument1 pageOffer Compensation Breakup: Estimate Based On Current Conversion RateAyush Gupta 4-Year B.Tech. Electrical EngineeringNo ratings yet

- Closing Journal Entries - Post Closing Trial Balance - Sheet1Document1 pageClosing Journal Entries - Post Closing Trial Balance - Sheet1crobalde aeronNo ratings yet

- Ptba April 2023 - Ahmad Saprizal YuzwarDocument1 pagePtba April 2023 - Ahmad Saprizal YuzwarasyuzwarNo ratings yet

- Catalbas, Joshua Galura 13588176 80031716 11,000.00 07/15/2023 09/08/2023Document4 pagesCatalbas, Joshua Galura 13588176 80031716 11,000.00 07/15/2023 09/08/2023catalbasNo ratings yet

- CHAPTER9-NEWDocument27 pagesCHAPTER9-NEWredegeneratedNo ratings yet

- MRSUQ3A04Document2 pagesMRSUQ3A04James ConNo ratings yet

- Tauhid Ahmed - Payslip May'2021Document1 pageTauhid Ahmed - Payslip May'2021pooja sandhuNo ratings yet

- MRSUQ4C04Document2 pagesMRSUQ4C04Chinna ThambiNo ratings yet

- IS - FY 16 - Comp Plan Group III (CL10 - CL13) - Revised - June 29 2016Document3 pagesIS - FY 16 - Comp Plan Group III (CL10 - CL13) - Revised - June 29 2016Sujan RajNo ratings yet

- MRSUQ3A04Document2 pagesMRSUQ3A04souvik_cNo ratings yet

- MRSUQ3C06Document3 pagesMRSUQ3C06live ur dream fullyNo ratings yet

- MRSUQ3C04Document2 pagesMRSUQ3C04Chinna ThambiNo ratings yet

- Muhammad Javed S/O Muhammad Hanif City Road Basir Pur: Web Generated BillDocument1 pageMuhammad Javed S/O Muhammad Hanif City Road Basir Pur: Web Generated BillBaD cHaUhDrYNo ratings yet

- MRSUQ1R09Document2 pagesMRSUQ1R09mayanksadaniNo ratings yet

- MRSUQ2D04Document3 pagesMRSUQ2D04Balaji AllupatiNo ratings yet

- Following: Rs by ProfessionalDocument6 pagesFollowing: Rs by ProfessionalJayNo ratings yet

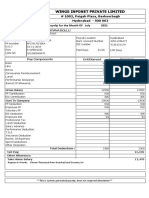

- Wings Infonet Private Limited: # 1002, Paigah Plaza, Basheerbagh Hyderabad - 500 063 2021Document1 pageWings Infonet Private Limited: # 1002, Paigah Plaza, Basheerbagh Hyderabad - 500 063 2021Venkatanarayana BolluNo ratings yet

- Receipts Expenditu: 2019-June Payments 01.04.2018Document3 pagesReceipts Expenditu: 2019-June Payments 01.04.2018dbNo ratings yet

- Mrsuq3m08 PDFDocument3 pagesMrsuq3m08 PDFkrisNo ratings yet

- Slip Gaji AriesDocument1 pageSlip Gaji AriesDaniel Tommy PassarellaNo ratings yet

- Medilife Polyclinic LLC New November PayslipDocument1 pageMedilife Polyclinic LLC New November Payslipahaad ahmedNo ratings yet

- Doshion Environment Water Solutions LLP: This Is A Computer Generated Document and Does Not Require SignatureDocument1 pageDoshion Environment Water Solutions LLP: This Is A Computer Generated Document and Does Not Require Signatureroman reignsNo ratings yet

- Pay SlipDocument1 pagePay SlipSonuNo ratings yet

- P60-Alberto AndreiDocument1 pageP60-Alberto AndreiAndrei AlbertoNo ratings yet

- 06-2023 Bill DR Office, NRTDocument12 pages06-2023 Bill DR Office, NRTHird High SchoolNo ratings yet

- Bajaj Capital LimitedDocument1 pageBajaj Capital LimitedSunny JohnsonNo ratings yet

- This Study Resource Was: AnswerDocument2 pagesThis Study Resource Was: AnswermerryNo ratings yet

- Doshion Environment Water Solutions LLP: This Is A Computer Generated Document and Does Not Require SignatureDocument1 pageDoshion Environment Water Solutions LLP: This Is A Computer Generated Document and Does Not Require Signatureroman reignsNo ratings yet

- Tax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsduhgyusdfuiosNo ratings yet

- Ashok COMPUTATION 2019-20Document2 pagesAshok COMPUTATION 2019-20SHIFAZ SULAIMANNo ratings yet

- Aamir 22-23 Income StatementDocument1 pageAamir 22-23 Income StatementMohammed MoizNo ratings yet

- Particulars Actuals Earnings Particulars DeductionsDocument1 pageParticulars Actuals Earnings Particulars DeductionsPravalika SiliveriNo ratings yet

- Adobe Scan Apr 16, 2024Document6 pagesAdobe Scan Apr 16, 2024SPYDER GRAPHICSNo ratings yet

- Adobe Scan Apr 16, 2024Document6 pagesAdobe Scan Apr 16, 2024SPYDER GRAPHICSNo ratings yet

- Jun 18 PDFDocument1 pageJun 18 PDFDASAPPA.K.ANo ratings yet

- Finance Booklet For StudentsDocument7 pagesFinance Booklet For StudentsMohamedNo ratings yet

- IA 3 Chapter 20 River CoDocument1 pageIA 3 Chapter 20 River CoPrytj Elmo QuimboNo ratings yet

- PG 3Document6 pagesPG 3Prish AnandNo ratings yet

- Particulars Actuals Earnings Particulars DeductionsDocument1 pageParticulars Actuals Earnings Particulars DeductionsPravalika SiliveriNo ratings yet

- Team 6: ChanakyaDocument3 pagesTeam 6: ChanakyasrinuvoodiNo ratings yet

- Sanket DissertationDocument17 pagesSanket DissertationSanket MhetreNo ratings yet

- FORM47Document2 pagesFORM47Rider AbhiNo ratings yet

- Remuneration StructureDocument1 pageRemuneration StructureKiran Kumar JNo ratings yet

- Provisional Tax Calculation For The Financial Year 2010-2011 Name Divyesh Desai ID Pan No. Designation SexDocument3 pagesProvisional Tax Calculation For The Financial Year 2010-2011 Name Divyesh Desai ID Pan No. Designation Sexdivyesh_desaiNo ratings yet

- Mrsuq4n13 PDFDocument3 pagesMrsuq4n13 PDFdhinakaran aNo ratings yet

- Cont Payslip May-2022 42Document1 pageCont Payslip May-2022 42Aftab Hussain ChaudhryNo ratings yet

- Adobe Scan 29-Apr-2024Document1 pageAdobe Scan 29-Apr-2024nishant08smcNo ratings yet

- This Study Resource Was: Rainel T. Polenio Rizal Sbit-3NgDocument4 pagesThis Study Resource Was: Rainel T. Polenio Rizal Sbit-3NgAbegail MadridNo ratings yet

- PANALAGAO REA JHOI 19th CENTURYDocument9 pagesPANALAGAO REA JHOI 19th CENTURYAbegail MadridNo ratings yet

- This Study Resource Was: AEC 209-Income TaxationDocument1 pageThis Study Resource Was: AEC 209-Income TaxationAbegail MadridNo ratings yet

- Importance:: Activity SheetDocument7 pagesImportance:: Activity SheetAbegail MadridNo ratings yet

- Audio Visual Media PresentationDocument9 pagesAudio Visual Media PresentationAbegail MadridNo ratings yet

- Basic Democracies 1959: Historical BackgroundDocument3 pagesBasic Democracies 1959: Historical BackgroundEishaAnwarCheema100% (3)

- Malin Kundang StoryDocument2 pagesMalin Kundang StoryDamarFajarTanjung50% (2)

- John Carroll University Magazine Spring 2011Document52 pagesJohn Carroll University Magazine Spring 2011johncarrolluniversityNo ratings yet

- CRI - Solved Valuation Practical Sums - CS Vaibhav Chitlangia - Yes Academy, PuneDocument37 pagesCRI - Solved Valuation Practical Sums - CS Vaibhav Chitlangia - Yes Academy, Punegopika mundraNo ratings yet

- ACFrOgBfaPHUTGTFzw4pkKEtzAS8qCvRQlFv8YcUhmWv8tSnJM-2OpBZr-M sKPCz8BR1znu2SUQqjSOtDF EQXL6EIVm3i6mkm3OchoCHFgfQJ2Xlc9I3zn3wdZrjo PDFDocument7 pagesACFrOgBfaPHUTGTFzw4pkKEtzAS8qCvRQlFv8YcUhmWv8tSnJM-2OpBZr-M sKPCz8BR1znu2SUQqjSOtDF EQXL6EIVm3i6mkm3OchoCHFgfQJ2Xlc9I3zn3wdZrjo PDFArun SharmaNo ratings yet

- Pakistan Nursing Council Pakistan Nursing Council Pakistan Nursing CouncilDocument2 pagesPakistan Nursing Council Pakistan Nursing Council Pakistan Nursing CouncilHameed Khan100% (2)

- An Essay - Advantages & Disadvantages of EUDocument1 pageAn Essay - Advantages & Disadvantages of EUdebirules0% (1)

- Trends Lecture Notes Q2Document10 pagesTrends Lecture Notes Q2Pagaduan R-mie JaneNo ratings yet

- Notice: Amended Complaint: BP West Coast Products LLC v. Calnev Pipe Line LLCDocument1 pageNotice: Amended Complaint: BP West Coast Products LLC v. Calnev Pipe Line LLCJustia.comNo ratings yet

- ASPL 06 September PNLDocument1,012 pagesASPL 06 September PNLsaattvicassistNo ratings yet

- UntitledDocument41 pagesUntitledJon EggersNo ratings yet

- Non-Finite Forms of The VerbDocument25 pagesNon-Finite Forms of The VerbCésar TapiaNo ratings yet

- SecuritizationDocument76 pagesSecuritizationsrinu RizarrdsNo ratings yet

- Bad Sex: Lessons For LifeDocument3 pagesBad Sex: Lessons For Lifestefanaserafina9421No ratings yet

- Sustainable Energy Review July-September 2016Document16 pagesSustainable Energy Review July-September 2016Har HamNo ratings yet

- Yaskawa 22 KW VVVFDDocument2 pagesYaskawa 22 KW VVVFDsseem52kgpw003No ratings yet

- Whitepaper - Vormetric Data Security For CloudsDocument2 pagesWhitepaper - Vormetric Data Security For CloudsgastonpantanaNo ratings yet

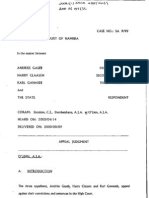

- Gaseb and 2 Others Versus The StateDocument70 pagesGaseb and 2 Others Versus The StateAndré Le RouxNo ratings yet

- Prepositions PaysDocument4 pagesPrepositions PaysBulut MümünNo ratings yet

- 2011 AprDocument56 pages2011 AprDeacon WesterveltNo ratings yet

- JPM Ayala LandDocument6 pagesJPM Ayala LandJT GalNo ratings yet

- Wild Animal Welfare: Management of Wildlife: World Animal Protection by DR Christine LeebDocument43 pagesWild Animal Welfare: Management of Wildlife: World Animal Protection by DR Christine LeebYOUSAFNo ratings yet

- SP 53611Document2 pagesSP 53611amrefat77No ratings yet

- PMS Syllabus 2024 DownloadDocument14 pagesPMS Syllabus 2024 Downloadadnang77129No ratings yet

- EDCART - by DarwinDocument42 pagesEDCART - by DarwinDarWin MarCeloNo ratings yet