Professional Documents

Culture Documents

Kolej Negeri Chedang Campus: (Diploma)

Uploaded by

Rai LyeensOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kolej Negeri Chedang Campus: (Diploma)

Uploaded by

Rai LyeensCopyright:

Available Formats

Kolej Negeri Chedang Campus: [Diploma ]

1 Name of Course INTERMEDIATE ACCOUNTING 1

2 Course Code DDW2133

3 Name(s) of

academic staff

4 Rationale for the Program Requirement

inclusion of the

course

5 Semester and Semester 2 Year 1

Year Offered

6 Total Student Learning Time Face To Face Total Guided and Independent

SLT Learning

L=Lecture L T P O

T=Tutorial 54 18 69 141

P=Praktikal (hr per week)

O=Others

7 Credit Value 3

8 Prerequisite Nil

9 Objective 1. Describe the acounting treatment for acquiring, disposal, and valuing property, plant and

equipment and the concept of depreciation and impairment.

2. Axquire and mange relevent information from various sources as well as accept new ideas.

10 Learning By the end of the practicum course, students will be able to:

Outcomes 1. Understand and identify the issues related to accounting framework, standards, basic

principles, information and ethics, and differenciate the cash and acrual basis of accounting.

2. Identify the uses and limitations of financial statements and Time Value Of Money.

3. Identify major classifications of inventory and inventory errors on the financial statements.

4. Describe the accounting treatment for receivables.

5. Explain how property, plant and equipment andnatural resources are reported and analyzed.

11 Transferable Co-operative learning,

Skills:

Able to lead a group project

Ablo to improve communication skill

Alert with the changing in their environment

12 Teaching- Teaching-learning

learning and

Case study

assessment

strategy Assessment strategy

Continuous assessment : 40%

Term end assessment : 60%

13 Synopisis This course is designed to provide in-depth knowledge about the accounting framework and

financial reports. It will cover various topics in the Income Statement and Balance Sheet items

including time value of money, inventory valuation, cash and cash equivalent and revenue

recognition principles, acquisition and disposition of tangible and intangible assets, depreciation

and depletion, and goodwill treatments.

14 Mode of delivery Lecture and discussion, co-operative learning, group project, presentation

15 Assessment Assessment by Mentor 40%

Methods and Assessment by Academic supervisor 60%

Types

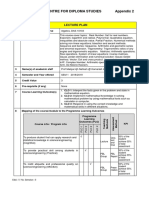

Part C_Area 2_1

Kolej Negeri Chedang Campus: [Diploma ]

16 Mapping of the

course to the Subject Los/ Programme Aims

Programme A01

Programme A02

Programme A03

Programme A04

Programme A05

Programme A06

Program

Learning

Outcomes

Subject Learning Outcome 1

Subject Learning Outcome 2

Subject Learning Outcome 3

Subject Learning Outcome 4

Subject Learning Outcome 5

17 Mapping of the

course to the Subject LOs/ Programme

Programme LO1

Programme LO2

Programme LO3

Programme LO4

Programme LO5

Programme LO6

Programme LO7

Program LOs

Learning

Outcomes

Subject Learning Outcome 1

Subject Learning Outcome 2

Subject Learning Outcome 3

Subject Learning Outcome 4

Subject Learning Outcome 5

18

Total SLT (hours)

Library search

Assignment

Self-study

Lecture

Tutorial

Exam

Quiz

Test

Course Materials

Part C_Area 2_2

Kolej Negeri Chedang Campus: [Diploma ]

Topic 1: Introduction To The Conceptual

Framework Underlying Financial Accounting

1.1 Definitions

1.2 General Principle

3 1 3 0 0 1 8

1.3 Accounting Information And Standard

1.4 First Level

1.5 Second Level: Fundamental Concept

1.6 Third Level: Recognition And

Measurement Concept

1.7 Comparison Of IAS and FRS

Topic 2: Income Statement and Related

Information

2.1 Income Statement Format: Computation

And Recording.

3 1 3 0 0 1 8

2.2 Income Statement: Reporting Irregular

Items

2.3 Special Reporting Issues

2.4 Corresponding FRS

Topic 3: Balance Sheet

3.1 Balance Sheet Format

3.2 Additional Reporting Issues 6 2 6 0 0 1 9

3.3 Presentation And Analysis

3.4 Corresponding FRS

Topic 4: Accounting and Time Value Of

Money

4.1 Basic Time Value Concept 6 2 6 1 1 1 11

4.2 Single Sum and Annuities

4.3 More Complex Situation

Topic 5: Revenue Recognition

5.1 Guidelines And Principles

5.2 Valuation And Recording: At Point of Sale 3 1 3 0 0 1 8

Criteria

Topic 6: Revenue Recognition

6.1 Valuation and Recording: Before Delivery.

6.2 Valuation and Recording: After Delivery

6.3 Corresponding Frs 3 1 3 0 0 1 8

Part C_Area 2_3

Kolej Negeri Chedang Campus: [Diploma ]

Topic 7: Accounting For Hire Purchase

3 1 3 0 0 1 8

Topic 8: Tangible Assets Concept

8.1 Cash

8.2 Cash Management

3 1 3 1 0 1 9

8.3 Receivables

8.4 Notes Receivables

8.5 Corresponding FRS

Topic 9: Inventories Valuation: A Cost Basic

Approach

9.1 Classification And Control

3 1 3 1 1 1 10

9.2 Cost Flow Assumption

9.3 Inventory Valuation And Analysis

9.4 Corresponding FRS

Topic 10: Inventories: Additional Valuation

Issues

10.1 Lower Of Cost Or Market

10.2 Valuation Basis 3 1 3 1 0 1 9

10.3 The Gross Profit Method Of Estimating

Inventory

10.4 Retail Inventory Method

Topic 11: Acquisition and Diposition Of

Property Plant, and Equipment

11.1 Acquisition Concept And Cost

6 2 6 0 0 1 9

11.2 Valuation And Accounting Treatment

11.3 Costs Subsequent To Acquisition

11.4 Corresponding FRS

Topic 12 : Depreciation, Impairments and

Depletion

12.1 Depreciation 6 2 6 0 0 1 9

12.2 Impairments

12.3 Depletion

Topic 13: Intangible Assets

13.1 Intangible Assets Issues

13.2 Types: Specifically Identifiable Intangibles

6 2 6 0 0 1 9

13.3 Goodwill

13.4 Reseach And Development

13.5 Cerresponding FRS

Total hours 54 18 54 2 13 141

Part C_Area 2_4

Kolej Negeri Chedang Campus: [Diploma ]

19 Main Keiso D.E Weygrant, T.D (2008), Intermediate Acounting (12th edition updated) john Wiley &

Reference (s) Sons, NY

20 Additional Weygrant, J.J, Keiso D.E, kimmel, P.D (2008), Acounting Principles, (8th edition), john Wiley Sons

Reference (s) Inc, NY.

Hashanah, Perakaunan Kewangan dan [elaporan, Kuala Lumpur, McGraw Hill.

Lembaga Piawaian Perakaunan Malaysia; MASB Standards.

21 Other Students have 14weeks

additional

information Every weeks 10 hours * 14 = 140 hours

Part C_Area 2_5

You might also like

- COPPA - Introduction To BusinessDocument4 pagesCOPPA - Introduction To BusinessNabeel KamranNo ratings yet

- Table 3: Summary of Information On Each Course/ModuleDocument4 pagesTable 3: Summary of Information On Each Course/Moduleewan_0306No ratings yet

- Operational Research EACDocument5 pagesOperational Research EACchandruNo ratings yet

- Module 4 Outline PDFDocument12 pagesModule 4 Outline PDFPrasannaNo ratings yet

- NITTTR Module 4Document349 pagesNITTTR Module 4Indrajeet MoreNo ratings yet

- Engineering Mathematics-3 EACDocument3 pagesEngineering Mathematics-3 EACchandruNo ratings yet

- BAAAX3A and BAAAX3B Fin Acc 3 Study Guide - 2024 LBG ManuelDocument20 pagesBAAAX3A and BAAAX3B Fin Acc 3 Study Guide - 2024 LBG Manuelmmatsepe04No ratings yet

- ACC 12 - Entrepreneurial Accounting Course Study GuideDocument66 pagesACC 12 - Entrepreneurial Accounting Course Study GuideHannah Jean MabunayNo ratings yet

- Leading University Department of Business Administration: Course ProfileDocument4 pagesLeading University Department of Business Administration: Course ProfileDipika tasfannum salamNo ratings yet

- Engineering Mathematics-1 EAC FormatDocument4 pagesEngineering Mathematics-1 EAC FormatchandruNo ratings yet

- Teacher Portfolio EnglishDocument42 pagesTeacher Portfolio Englishkirito2311510No ratings yet

- Sesi 3 - Paper 2 - RoziliniDocument22 pagesSesi 3 - Paper 2 - Rozilininazarin.nordinNo ratings yet

- Course Outline - BismathDocument7 pagesCourse Outline - BismathGhazi AzhariNo ratings yet

- MGC4013 Synopsis 2017Document4 pagesMGC4013 Synopsis 2017hisyamstarkNo ratings yet

- Eda 834 Budgeting and Financial Management in EducationDocument121 pagesEda 834 Budgeting and Financial Management in EducationogNo ratings yet

- Design 1 - The Design Phase - Version - 2007 - 2010Document18 pagesDesign 1 - The Design Phase - Version - 2007 - 2010Dreana MarshallNo ratings yet

- BHMH1041 Accounting For Non-Business StudentsDocument3 pagesBHMH1041 Accounting For Non-Business Studentstaikiki676No ratings yet

- Bcom New SyllDocument54 pagesBcom New SyllNaveen Jacob JohnNo ratings yet

- BBSSM1202: Business StudiesDocument7 pagesBBSSM1202: Business StudiesakmohideenNo ratings yet

- Applied Portfolio Management Ms UcpDocument4 pagesApplied Portfolio Management Ms UcpSheraz HassanNo ratings yet

- TOC OUMH2203 English For Workplace Communication - BASSDocument4 pagesTOC OUMH2203 English For Workplace Communication - BASSSarannyaRajendraNo ratings yet

- Construction of Community Project IIDocument4 pagesConstruction of Community Project IISani Oghang PekanNo ratings yet

- Đề Cương - Tiếng ANH - KTQT II - CTTTDocument7 pagesĐề Cương - Tiếng ANH - KTQT II - CTTTduong leNo ratings yet

- MADRID Syllabus Natural Science LT 6 EnglishDocument110 pagesMADRID Syllabus Natural Science LT 6 EnglishAchraf HauachiNo ratings yet

- Eco 415Document163 pagesEco 415OLUWAGBOTEMI SANUSINo ratings yet

- Centre For Diploma Studies Appendix 2: Lecture PlanDocument4 pagesCentre For Diploma Studies Appendix 2: Lecture PlanMuhd Qayyum Mohd FuadNo ratings yet

- L1A1 - LDM Course OverviewDocument6 pagesL1A1 - LDM Course OverviewCristina InfiestoNo ratings yet

- Mtes3213 Financial MathematicsDocument10 pagesMtes3213 Financial MathematicsZulatfi Bin Mat Ripin JSMNo ratings yet

- DLP TemplateDocument4 pagesDLP TemplateAnne Marie Campos Tacadao100% (1)

- Pes Institute of Technology - Bangalore South Campus Dept. of MBADocument30 pagesPes Institute of Technology - Bangalore South Campus Dept. of MBADuma DumaiNo ratings yet

- Sílabo MPAL4 V5Document4 pagesSílabo MPAL4 V5jacquelineNo ratings yet

- Total Student Learning Time (SLT) :: Table 3: Summary of Information On Each CourseDocument4 pagesTotal Student Learning Time (SLT) :: Table 3: Summary of Information On Each CourseNadzri YahayaNo ratings yet

- Table 3: Summary of Information On Each Course Design Development StageDocument15 pagesTable 3: Summary of Information On Each Course Design Development StageSani Oghang PekanNo ratings yet

- 16mbahr403 IhrmDocument23 pages16mbahr403 Ihrmshwetauttam0056296No ratings yet

- PRKA3012 RMK Students VersionDocument4 pagesPRKA3012 RMK Students VersionWCKelvinNo ratings yet

- Kategori Aktiviti Aktiviti Jumlah Jam / SemDocument8 pagesKategori Aktiviti Aktiviti Jumlah Jam / SemHafizul ZaidanNo ratings yet

- Pes Institute of Technology - Bangalore South Campus Dept. of MBADocument21 pagesPes Institute of Technology - Bangalore South Campus Dept. of MBADuma DumaiNo ratings yet

- Course OutlineDocument8 pagesCourse OutlineNormazlaMahirNo ratings yet

- APEL.A PDFDocument18 pagesAPEL.A PDFFilex De Randy IndraNo ratings yet

- HPGD4606 Practicum SG - Emay23Document33 pagesHPGD4606 Practicum SG - Emay23Nurul WahidahNo ratings yet

- Conceptual Framework SyllabusDocument14 pagesConceptual Framework SyllabusMariya BhavesNo ratings yet

- Course Outline Djj614Document3 pagesCourse Outline Djj614Bryan RayNo ratings yet

- SYLLABUS Curriculum DevelopmentDocument3 pagesSYLLABUS Curriculum DevelopmentErica DumlaoNo ratings yet

- Acc 419 PDFDocument228 pagesAcc 419 PDFKamauWafulaWanyamaNo ratings yet

- Kategori Aktiviti Aktiviti Jumlah Jam / SemDocument8 pagesKategori Aktiviti Aktiviti Jumlah Jam / SemNurul SyahirahNo ratings yet

- Silibus DHB 2234 Pastry Making - Final - 26 Feb 2021Document9 pagesSilibus DHB 2234 Pastry Making - Final - 26 Feb 2021khairuddin mohamadNo ratings yet

- ECON6001CD Course Outline - 2023Document5 pagesECON6001CD Course Outline - 2023bing zhuoNo ratings yet

- Mac 234 2023 Course Outline - 5Document26 pagesMac 234 2023 Course Outline - 5Mika-eelNo ratings yet

- APC 316 Accounting For Special Transactions OkayDocument14 pagesAPC 316 Accounting For Special Transactions Okaynot funny didn't laughNo ratings yet

- Statics & DynamicsDocument4 pagesStatics & DynamicschandruNo ratings yet

- (EDC 1230) Integrating Technology Across The Curriculum 1Document8 pages(EDC 1230) Integrating Technology Across The Curriculum 1Abu UbaidahNo ratings yet

- A212 - BWFF2033 SyllabusDocument9 pagesA212 - BWFF2033 SyllabusLi XuanNo ratings yet

- Plan C Course Outline Form-BSBF 2107-BA-FL21Document13 pagesPlan C Course Outline Form-BSBF 2107-BA-FL21RaaNo ratings yet

- Format For Course Curriculum: Course Objectives: Pre-Requisites: Course Learning OutcomeDocument4 pagesFormat For Course Curriculum: Course Objectives: Pre-Requisites: Course Learning OutcomeHarsh KumarNo ratings yet

- Lesson PlanDocument12 pagesLesson PlanIeymarh FatimahNo ratings yet

- Administrative Law SyllabusDocument14 pagesAdministrative Law SyllabusKarl Lenin BenignoNo ratings yet

- Outcome-based-TL - Leni-S-HelianiDocument15 pagesOutcome-based-TL - Leni-S-Helianitribowo fauzanNo ratings yet

- MPU3343 SyllabusDocument4 pagesMPU3343 SyllabusG00GLR100% (1)

- Management and Technologies of Water, Wastewater, Waste and Cir-cular Economy: WWW&CEFrom EverandManagement and Technologies of Water, Wastewater, Waste and Cir-cular Economy: WWW&CENo ratings yet

- PRIMARY Vs Secondary Vs TertiaryDocument1 pagePRIMARY Vs Secondary Vs TertiaryIshi Pearl Tupaz100% (1)

- (FORD) Manual de Propietario Ford Ranger 1998Document160 pages(FORD) Manual de Propietario Ford Ranger 1998Marly Salas GonzalezNo ratings yet

- FeCl3 Msds - VISCOSITYDocument9 pagesFeCl3 Msds - VISCOSITYramkesh rathaurNo ratings yet

- PESTEL AnalysisDocument2 pagesPESTEL AnalysisSayantan NandyNo ratings yet

- Advertisement For Recruitment of Non-Teaching StaffDocument3 pagesAdvertisement For Recruitment of Non-Teaching StaffGoogle AccountNo ratings yet

- HDMI To MIPI and LVDS To MIPI Converter Rotator Board Solutions From Q VioDocument2 pagesHDMI To MIPI and LVDS To MIPI Converter Rotator Board Solutions From Q VioSubham KumarNo ratings yet

- NBPME Part II 2008 Practice Tests 1-3Document49 pagesNBPME Part II 2008 Practice Tests 1-3Vinay Matai50% (2)

- Ekoplastik PPR Catalogue of ProductsDocument36 pagesEkoplastik PPR Catalogue of ProductsFlorin Maria ChirilaNo ratings yet

- Waste SM4500-NH3Document10 pagesWaste SM4500-NH3Sara ÖZGENNo ratings yet

- Debit Note and Credit NoteDocument2 pagesDebit Note and Credit Noteabdul haseebNo ratings yet

- Everyday Life - B1 - ShoppingDocument7 pagesEveryday Life - B1 - ShoppingAmi BarnesNo ratings yet

- Basic DWDM Components.Document16 pagesBasic DWDM Components.Pradeep Kumar SahuNo ratings yet

- Legal NoticeDocument3 pagesLegal NoticeT Jayant JaisooryaNo ratings yet

- Fruit Brearing CropsDocument177 pagesFruit Brearing CropsJoshua G. Sapin100% (1)

- Computer ArchitectureDocument46 pagesComputer Architecturejaime_parada3097100% (2)

- Piezometers: Types, Functions, & How It Works?Document38 pagesPiezometers: Types, Functions, & How It Works?Encardio RiteNo ratings yet

- Akebono NVH White PaperDocument4 pagesAkebono NVH White Paperapi-3702571100% (1)

- Sri Anjaneya Cotton Mills LimitedDocument63 pagesSri Anjaneya Cotton Mills LimitedPrashanth PB50% (2)

- Table of SpecificationDocument2 pagesTable of SpecificationAya AlisasisNo ratings yet

- Product Data Sheet: Type: P25-34/0DDocument1 pageProduct Data Sheet: Type: P25-34/0DAlejandro RustrianNo ratings yet

- Libra Office Question Answer EnglishDocument11 pagesLibra Office Question Answer EnglishAndrew ParkarNo ratings yet

- Ocular Trauma - BantaDocument211 pagesOcular Trauma - BantaLuisa Fernanda Arboleda100% (1)

- Examples of Consonant BlendsDocument5 pagesExamples of Consonant BlendsNim Abd MNo ratings yet

- Prayer For Protection PDFDocument3 pagesPrayer For Protection PDFtim100% (1)

- 1353apni KakshaDocument43 pages1353apni KakshaArush GautamNo ratings yet

- Drive Engineering - Practical Implementation SEW Disc Brakes 09202218 - G1Document90 pagesDrive Engineering - Practical Implementation SEW Disc Brakes 09202218 - G1Anonymous ntE0hG2TPNo ratings yet

- Eimco Elecon Initiating Coverage 04072016Document19 pagesEimco Elecon Initiating Coverage 04072016greyistariNo ratings yet

- EL119 Module 2Document4 pagesEL119 Module 2Kristine CastleNo ratings yet

- Bird Beak Adaptations: PurposeDocument9 pagesBird Beak Adaptations: PurposelilazrbNo ratings yet

- Safety Data Sheet: Section 1. IdentificationDocument10 pagesSafety Data Sheet: Section 1. IdentificationAnonymous Wj1DqbENo ratings yet