Professional Documents

Culture Documents

Certificate Course Digital Banking Syllabus

Uploaded by

lekshmi priya0 ratings0% found this document useful (0 votes)

109 views3 pagesThis document outlines the syllabus for a Certificate Course in Digital Banking. The syllabus covers various digital banking products like cards, ATMs, cash deposit machines, cash recyclers, mobile banking, internet banking, POS terminals, branchless banking and their marketing. It also discusses domestic and global payment systems used in India like RuPay, IMPS, NACH, AEPS, CTS, RTGS, NEFT and innovative technologies impacting digital banking like fintechs, blockchain, cloud computing and artificial intelligence. The course aims to provide candidates an overview of digital banking products, services and the technologies enabling digital transformation in the banking industry.

Original Description:

Syllabus_Certificate course in Digital Banking

Original Title

Syllabus_Certificate course in Digital Banking

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the syllabus for a Certificate Course in Digital Banking. The syllabus covers various digital banking products like cards, ATMs, cash deposit machines, cash recyclers, mobile banking, internet banking, POS terminals, branchless banking and their marketing. It also discusses domestic and global payment systems used in India like RuPay, IMPS, NACH, AEPS, CTS, RTGS, NEFT and innovative technologies impacting digital banking like fintechs, blockchain, cloud computing and artificial intelligence. The course aims to provide candidates an overview of digital banking products, services and the technologies enabling digital transformation in the banking industry.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

109 views3 pagesCertificate Course Digital Banking Syllabus

Uploaded by

lekshmi priyaThis document outlines the syllabus for a Certificate Course in Digital Banking. The syllabus covers various digital banking products like cards, ATMs, cash deposit machines, cash recyclers, mobile banking, internet banking, POS terminals, branchless banking and their marketing. It also discusses domestic and global payment systems used in India like RuPay, IMPS, NACH, AEPS, CTS, RTGS, NEFT and innovative technologies impacting digital banking like fintechs, blockchain, cloud computing and artificial intelligence. The course aims to provide candidates an overview of digital banking products, services and the technologies enabling digital transformation in the banking industry.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Certificate Course in Digital Banking

SYLLABUS:

Candidates are advised to refer to financial newspapers/ periodicals more particularly “IIBF

VISION” and “BANK QUEST” published by the Institute.

The topics covered for the subject are as under:

DIGITAL BANKING PRODUCTS

a. Introduction

b. Need for Digital Banking Products

c. Customer Education for Digital Banking Products

CARDS

a. Overview and brief history

b. Various types of cards

c. Product features

EMV technology

a. New Technologies – Tap and Go, NFC, etc.

b. Approval Processes for Cards

c. Profitability of Cards

d. Back End operations

e. Recovery and Follow up

ATMs

a. Overview and Brief History

b. Product Features

c. Instant Money Transfer Systems

d. Various Value-Added Services (e.g., bill payments, donations, etc.)

e. Proprietary, Brown Label and White Label ATMs

f. ATM Network Planning – Onsite/ Offsite

g. Security and Surveillance of ATM Sites

h. Profitability of ATMs

i. Risk Management and Frauds

j. Back End Operations and Technology

CASH DEPOSIT MACHINES

a. Overview and Brief History

b. Product Features

c. CDM Network Planning – Onsite/ Offsite

d. Profitability of CDMs

e. Risk Management and Frauds

f. Back End Operations and Technology

CASH RE-CYCLERS

a. Overview

b. Product Features

c. Risk Management and Frauds

d. Back End Operations and Technology

MOBILE BANKING

a. Overview and Brief History

b. Product Features and Diversity

c. IMPS

d. Profitability of Mobile Banking

e. Risk Management and Frauds

f. Back End Operations and Technology

INTERNET BANKING

a. Overview and Brief History

b. Product Features

c. Corporate and Individual Internet Banking Integration with e-Commerce Merchant

sites

d. Profitability of Internet Banking

e. Risk Management and Frauds

f. Back End Operations and Technology

POS TERMINALS

a. Overview and Brief History

b. Product Features

c. Approval processes for POS Terminals

d. Profitability of POS business Risk Management and Frauds

e. Back End Operations and Technology

BRANCHLESS BANKING

a. Objectives

b. Introduction

c. Financial Inclusion – Logic and logistics

d. Vehicles for Financial Inclusion

e. Business Correspondents/ Business facilitators

f. Digital Banking Products for Financial Inclusion

MARKETING OF DIGITAL BANKING PRODUCTS

a. Objectives

b. Introduction

c. Product Planning

d. Structure for Marketing Digital Banking Products

e. Sales delivery to customers

f. Concept of e-Galleries

g. After sales service to customers

h. Marketing for Financial Inclusion

i. Dangers of Mis-selling

j. Use of analytics in marketing Digital Banking Products

PAYMENT SYSTEMS

a. Overview of global payment systems

b. Overview of domestic payment systems

c. RuPay and RuPay Secure

d. Immediate Payment Service (IMPS)

e. National Unified USSD Platform (NUUP)

f. National Automated Clearing House (NACH)

g. Aadhaar Enabled Payment System (AEPS) e-KYC

h. Cheque truncation System (CTS)

i. National Financial Switch (NFS)

j. RTGS

k. NEFT

l. Forex settlements

m. Securities Settlement

n. Innovative Banking & Payment Systems

NEW DEVELOPMENTS IN DIGITAL BANKING

a. Fintechs

b. Business ecosystems

c. Block chain

d. Crypto Currencies

e. Peer Financing

7

f. Cloud

g. Virtualisation

h. Analytics

i. Artificial Intelligence

j. Machine Learning

k. Internet of things (IoT)

You might also like

- Digital BankingDocument2 pagesDigital BankingsonaNo ratings yet

- IIBF Digital Banking Free Mock TestDocument8 pagesIIBF Digital Banking Free Mock TestNikhilNo ratings yet

- Learning Capsule On Aml Kyc - FinalDocument5 pagesLearning Capsule On Aml Kyc - FinalAjay SharmaNo ratings yet

- Indian Institute of Banking & Finance: Certificate Course in Digital BankingDocument6 pagesIndian Institute of Banking & Finance: Certificate Course in Digital BankingKay Aar Vee RajaNo ratings yet

- JIIB Test PpersDocument51 pagesJIIB Test PpersPriyanka LincolnNo ratings yet

- Msme Py Que PDFDocument9 pagesMsme Py Que PDFTamadaRamaraoNo ratings yet

- Fintech Challenges ResearchDocument3 pagesFintech Challenges Research3037 Vishva RNo ratings yet

- Fintech - BBA MaterialDocument41 pagesFintech - BBA MaterialkarthikNo ratings yet

- Indicative MCQS: For Limited Insolvency ExaminationDocument33 pagesIndicative MCQS: For Limited Insolvency ExaminationArpan NathNo ratings yet

- Preventing Money Laundering and Terrorist Financing, Second Edition: A Practical Guide for Bank SupervisorsFrom EverandPreventing Money Laundering and Terrorist Financing, Second Edition: A Practical Guide for Bank SupervisorsNo ratings yet

- Delivery Challan TitleDocument1 pageDelivery Challan TitleRaman KatiyarNo ratings yet

- Internet and Mobile BankingDocument53 pagesInternet and Mobile BankingShruti PatilNo ratings yet

- Banking and Financial Institution MOST IMPORTANT MCQ by AKASHDocument100 pagesBanking and Financial Institution MOST IMPORTANT MCQ by AKASHAkash YadavNo ratings yet

- 7 - Banking Case Study TwoDocument4 pages7 - Banking Case Study TwoAshish BnNo ratings yet

- MCQ 1 SakshuDocument196 pagesMCQ 1 SakshuSakshi mishraNo ratings yet

- SIP - Project Titles - NewDocument15 pagesSIP - Project Titles - Newrohan asawaleNo ratings yet

- Digital Banking Project - BubunaDocument20 pagesDigital Banking Project - BubunaRaghunath AgarwallaNo ratings yet

- Keys Updated As On 17.09.2022Document118 pagesKeys Updated As On 17.09.2022Juhi AgrawalNo ratings yet

- A-Z Guide to IIBF AML/KYC Certification Exam ResourcesDocument2 pagesA-Z Guide to IIBF AML/KYC Certification Exam ResourcesCHANDRAKISHORE SINGHNo ratings yet

- Credit Risk ManagementDocument92 pagesCredit Risk ManagementVenkatesh NANo ratings yet

- Material 2008 BDocument227 pagesMaterial 2008 BshikumamaNo ratings yet

- Icici Bank CBRDocument49 pagesIcici Bank CBRHarshad Sutar100% (1)

- Syllabus Banking Diploma, IBB 5Document2 pagesSyllabus Banking Diploma, IBB 5sohanantashaNo ratings yet

- Fraud Risk ManagementDocument8 pagesFraud Risk ManagementAshutosh100% (1)

- Case Study: Tata Nano Akanksha Verma, Abdularahman Alenezi, Abdelaziz Alkandari, AmiraDocument5 pagesCase Study: Tata Nano Akanksha Verma, Abdularahman Alenezi, Abdelaziz Alkandari, AmiraAyesha Mukadam100% (1)

- Microfinance PDFDocument170 pagesMicrofinance PDFADDA247 JAIIB Mentor0% (1)

- FEMA Overview: Establishing BO/LO and Overseas InvestmentDocument33 pagesFEMA Overview: Establishing BO/LO and Overseas Investmentshikhasharmajpr8146No ratings yet

- Basel III Capital RegulationsDocument328 pagesBasel III Capital Regulationspadam_09100% (1)

- Manthan Report - Banking and FinanceDocument31 pagesManthan Report - Banking and FinanceAtul sharmaNo ratings yet

- MF0007 Treasury Management MQPDocument11 pagesMF0007 Treasury Management MQPNikhil Rana0% (1)

- Jaiib PPT Downloaded From IibfDocument42 pagesJaiib PPT Downloaded From IibfSuranjit BaralNo ratings yet

- Cryptocurrency JudgmentDocument180 pagesCryptocurrency Judgmentmrinal lalNo ratings yet

- MCQ Law and Emerging Technology (LLB 405)Document19 pagesMCQ Law and Emerging Technology (LLB 405)varunendra pandey100% (1)

- (Anirudh Sood) (1496) Company Law One AssignmentDocument23 pages(Anirudh Sood) (1496) Company Law One AssignmentSuryaNo ratings yet

- NIBM - Risk MGMTDocument5 pagesNIBM - Risk MGMTNB SouthNo ratings yet

- Growth and Development of Online BankingDocument45 pagesGrowth and Development of Online BankingSwati SrivastavNo ratings yet

- New Certified Credit Professional PDF - PDF Version 1Document205 pagesNew Certified Credit Professional PDF - PDF Version 1Treena Majumder Sarkar0% (1)

- IOB & UBI Promotion TEST MaterialDocument2 pagesIOB & UBI Promotion TEST MaterialANshulNo ratings yet

- Comparison of Sbi Yono With Other Banking AppsDocument16 pagesComparison of Sbi Yono With Other Banking AppsgaganpreetNo ratings yet

- Digitalization in Banking SectorDocument6 pagesDigitalization in Banking SectorEditor IJTSRDNo ratings yet

- ZYDUSLIFE 30052022203428 DLOFCoverLetterExchangesdt30052022Document81 pagesZYDUSLIFE 30052022203428 DLOFCoverLetterExchangesdt30052022Swarup JadhavNo ratings yet

- Commodity MarketDocument8 pagesCommodity MarketDavid jsNo ratings yet

- Moodys Prodegree EbrochureDocument6 pagesMoodys Prodegree EbrochureJayakumarNo ratings yet

- Recruitment Recruitment of Clerical Staff in Sbi (Advertisement No. Crpd/Cr/2009-10/04)Document4 pagesRecruitment Recruitment of Clerical Staff in Sbi (Advertisement No. Crpd/Cr/2009-10/04)netrakashyapNo ratings yet

- A Study On Foreign Exchange Operations in Union Bank ofDocument87 pagesA Study On Foreign Exchange Operations in Union Bank ofNidhi YadavNo ratings yet

- JANBI Model Questions - Principles & Practices of Banking - 0Document8 pagesJANBI Model Questions - Principles & Practices of Banking - 0Biswajit Das0% (1)

- Digital Banking Notes: Key Aspects and Customer ExpectationsDocument8 pagesDigital Banking Notes: Key Aspects and Customer ExpectationsAnuradhaNo ratings yet

- Indian Institute of Banking & Finance: Caiib-Elective SubjectsDocument12 pagesIndian Institute of Banking & Finance: Caiib-Elective SubjectsrahulNo ratings yet

- Abbreviations of BanksDocument13 pagesAbbreviations of BanksDhamodhar ReddyNo ratings yet

- IIBFDocument3 pagesIIBFRauShan RajPutNo ratings yet

- Details & Time Table of AML & KYC - IIBF ExaminationDocument1 pageDetails & Time Table of AML & KYC - IIBF Examinationupasana rajNo ratings yet

- Bidding Document For Core Bank System For Tadb 2018Document282 pagesBidding Document For Core Bank System For Tadb 2018Krishna BabuNo ratings yet

- Digital Banking Notes 2 PDFDocument7 pagesDigital Banking Notes 2 PDFafroz shaikNo ratings yet

- Allied Bank LTD.: "App K Dil Mein Hamara Account"Document53 pagesAllied Bank LTD.: "App K Dil Mein Hamara Account"Isma Nizam100% (2)

- Impact of Technology in Banking Industry FINAL PAPERDocument8 pagesImpact of Technology in Banking Industry FINAL PAPERSam MumoNo ratings yet

- 08L0767 Fy18-19 Kyc Aml CFT Fatca CRSDocument13 pages08L0767 Fy18-19 Kyc Aml CFT Fatca CRSabhi646son5124No ratings yet

- CITI Research Report On Supply ChainDocument56 pagesCITI Research Report On Supply ChainGanesh LadNo ratings yet

- Guide to Online Payment Methods for BusinessesDocument46 pagesGuide to Online Payment Methods for BusinessesNaveen K100% (1)

- Fair Lending Compliance: Intelligence and Implications for Credit Risk ManagementFrom EverandFair Lending Compliance: Intelligence and Implications for Credit Risk ManagementNo ratings yet

- FacebookH Cking 1 3 (SFILEDocument10 pagesFacebookH Cking 1 3 (SFILEFitra AkbarNo ratings yet

- Ip 19 3RD EditionDocument240 pagesIp 19 3RD EditionSumanta Bhaya100% (13)

- M.Com Second Semester – Advanced Cost Accounting MCQDocument11 pagesM.Com Second Semester – Advanced Cost Accounting MCQSagar BangreNo ratings yet

- 01 The-Mckinsey-Edge-Hattori-En-26154Document5 pages01 The-Mckinsey-Edge-Hattori-En-26154Waqar AhmedNo ratings yet

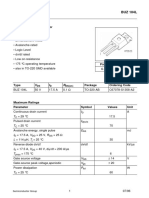

- Sipmos Power Transistor: BUZ 104LDocument10 pagesSipmos Power Transistor: BUZ 104LAlexsander MeloNo ratings yet

- Fellowship in OncotherapeutDocument3 pagesFellowship in OncotherapeutNayan ChaudhariNo ratings yet

- Power System Analysis and Design, SI EditionDocument5 pagesPower System Analysis and Design, SI EditionAkimeNo ratings yet

- Addressable Fire Detection and Control Miniplex TranspondersDocument8 pagesAddressable Fire Detection and Control Miniplex TranspondersAfdhal SyahrullahNo ratings yet

- Gartner CRM Handbook FinalDocument0 pagesGartner CRM Handbook FinalghanshyamdassNo ratings yet

- SecASC - M02 - Azure Security Center Setup and ConfigurationDocument53 pagesSecASC - M02 - Azure Security Center Setup and ConfigurationGustavo WehdekingNo ratings yet

- Effect of Upstream Dam Geometry On Peak Discharge During Overtopping Breach in Noncohesive Homogeneous Embankment Dams Implications For Tailings DamsDocument22 pagesEffect of Upstream Dam Geometry On Peak Discharge During Overtopping Breach in Noncohesive Homogeneous Embankment Dams Implications For Tailings DamsHelvecioNo ratings yet

- 0 Plan Lectie Cls XDocument3 pages0 Plan Lectie Cls Xevil100% (1)

- 01 - PV - RESCO 1d Workshop - S1 PDFDocument61 pages01 - PV - RESCO 1d Workshop - S1 PDFDeasy KurniawatiNo ratings yet

- Parts of The Analog MultitesterDocument4 pagesParts of The Analog MultitesterDestiny Marasigan CanacanNo ratings yet

- Retaining Wall DetailsDocument1 pageRetaining Wall DetailsWilbert ReuyanNo ratings yet

- Theory and Practice of Crown and Bridge Prosthodontics 4nbsped CompressDocument1,076 pagesTheory and Practice of Crown and Bridge Prosthodontics 4nbsped CompressYuganya SriNo ratings yet

- Covid 19 PDFDocument117 pagesCovid 19 PDFvicky anandNo ratings yet

- Lab Experiment 2Document6 pagesLab Experiment 2api-309262457No ratings yet

- Surge arrester protects electrical equipmentDocument25 pagesSurge arrester protects electrical equipmentSyed Ahsan Ali Sherazi100% (3)

- Mycophenolic Acid Chapter-1Document34 pagesMycophenolic Acid Chapter-1NabilaNo ratings yet

- Raiseyourvoice SFDocument26 pagesRaiseyourvoice SFAttila Engin100% (1)

- FIL M 216 2nd Yer Panitikan NG PilipinasDocument10 pagesFIL M 216 2nd Yer Panitikan NG PilipinasJunas LopezNo ratings yet

- BSNL TrainingDocument25 pagesBSNL TrainingAditya Dandotia68% (19)

- 2019 Implementasie-SamsatdiBaliDocument10 pages2019 Implementasie-SamsatdiBaliDiannita SusantiNo ratings yet

- BC Sample Paper-3Document4 pagesBC Sample Paper-3Roshini ANo ratings yet

- F FS1 Activity 3 EditedDocument15 pagesF FS1 Activity 3 EditedRayshane Estrada100% (1)

- S 1804 2019 (E) - 0Document9 pagesS 1804 2019 (E) - 0Juan Agustin CuadraNo ratings yet

- A Rail-To-Rail Constant Gain Buffered Op-Amp For Real Time Video ApplicationsDocument8 pagesA Rail-To-Rail Constant Gain Buffered Op-Amp For Real Time Video Applicationskvpk_vlsiNo ratings yet

- RTR Piping Inspection GuideDocument17 pagesRTR Piping Inspection GuideFlorante NoblezaNo ratings yet

- Engagement LetterDocument1 pageEngagement LetterCrystal Jenn Balaba100% (1)