Professional Documents

Culture Documents

Itr-V: Indian Income Tax Return Verification Form

Uploaded by

NOOBS TEAMOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr-V: Indian Income Tax Return Verification Form

Uploaded by

NOOBS TEAMCopyright:

Available Formats

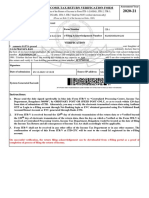

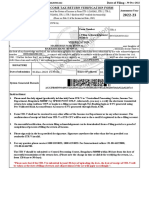

FORM INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, 2020-21

ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically]

(Please see Rule 12 of the Income-tax Rules, 1962)

Name MITHALAL

PAN AQUPM5951G Form Number ITR-4

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 145355140090121

VERIFICATION

I, _________________________________________________________________________________________son/

MITHALAL daughter of

___________________________________________________________________________________,

SUMER MALJI JAIN solemnly declare that to

the best of my knowledge and belief, the information given in the return which has been submitted by me vide acknowledgement

number __________________________

145355140090121 is correct and complete and is in accordance with the provisions of the Income-tax Act,

1961. I further declare that I am making this return in my capacity as____________________

Self and I am also competent to make

this return and verify it. I am holding permanent account number ________________.

AQUPM5951G .

Signature

Date of submission 09-01-2021 11:47:40 Source IP address 35.154.246.243

System Generated barcode

AQUPM5951G04145355140090121CA72759ADABCB4C9EFA47E6E2D12896774535664

Instructions:

1. Please send the duly signed (preferably in blue ink) Form ITR-V to “Centralized Processing Centre, Income Tax

Department, Bengaluru 560500”, by ORDINARY POST OR SPEED POST ONLY, so as to reach within 120 days

from date of submission of ITR. Alternately, you may e-verify the electronic transmitted return data using Aadhaar

OTP or Login to e-Filing account through Net-Banking login or EVC obtained generated using Pre-Validated Bank

Account/Demat Account or EVC generated through Bank ATM.

2. If Form ITR-V is received beyond the 120th day of electronic transmission of the return data or e-Verified beyond

the 120th day of electronic transmission of the return data, then the day on which e-Verified or the Form ITR-V is

received at Centralized Processing Centre, Income Tax Department, Bengaluru would be treated as the date of filing

the Income Tax Return and all consequences of Income Tax Act shall accordingly will be applicable.

3. Form ITR-V shall not be received in any other office of the Income Tax Department or in any other manner. The

confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail Id registered in the e-Filing

account.

On successful verification, the return filing acknowledgement can be downloaded from e-Filing portal as a proof of

completion of process of filing the return of Income.

You might also like

- Aszpl1595q ItrvDocument1 pageAszpl1595q ItrvNitish JulkaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMurari AgarwalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- 2021 01 08 20 23 43 556 - 1610117623556 - XXXPV9294X - ItrvDocument1 page2021 01 08 20 23 43 556 - 1610117623556 - XXXPV9294X - Itrvanusha.veldandiNo ratings yet

- Itr-V Bizpr9935f 2020-21 200956830110121Document1 pageItr-V Bizpr9935f 2020-21 200956830110121Rashi SrivastavaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormShyamala SubramanianNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVivek BajajNo ratings yet

- 2021 02 13 18 38 02 527 - 1613221682527 - XXXPS3184X - Itrv PDFDocument1 page2021 02 13 18 38 02 527 - 1613221682527 - XXXPS3184X - Itrv PDFtavenderpal singhNo ratings yet

- 2020 12 30 13 13 43 919 - 1609314223919 - XXXPP0183X - ItrvDocument1 page2020 12 30 13 13 43 919 - 1609314223919 - XXXPP0183X - Itrvtushar guptaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormRaghu TNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMahendra PatilNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormDevesh Singh SenwalNo ratings yet

- 2020 07 15 21 11 18 480 - 1594827678480 - XXXPJ9614X - ItrvDocument1 page2020 07 15 21 11 18 480 - 1594827678480 - XXXPJ9614X - Itrvishasalex03No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormRohit SharmaNo ratings yet

- Itr VDocument1 pageItr VsuneetbansalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbhavya gowdaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVikash SoniNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVikash SoniNo ratings yet

- 2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvDocument1 page2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvRohan KapurNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formdibyan dasNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormInderdeepNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMadhan Kumar BobbalaNo ratings yet

- Nagji Badhabhai Rabari Itrv Ay 2020-21Document1 pageNagji Badhabhai Rabari Itrv Ay 2020-21B N MishraNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formjyothi venkat sainathNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formjyothi venkat sainathNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- 2021 05 31 11 01 39 957 - 1622439099957 - Xxxpy5228x - ItrvDocument1 page2021 05 31 11 01 39 957 - 1622439099957 - Xxxpy5228x - Itrvjohnyadav.ryNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formravi rajaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormviveknaikNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormviveknaikNo ratings yet

- 2021 01 16 13 47 21 871 - 1610785041871 - XXXPC3129X - ItrvDocument1 page2021 01 16 13 47 21 871 - 1610785041871 - XXXPC3129X - ItrvDibyo ChatterjeeNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formvarghese philip kottaramNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementrushikeshlohe01No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormBaby MazumdarNo ratings yet

- 2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2Document1 page2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2sunny.likescatNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormArun VeeraniNo ratings yet

- PDF 269385040200221Document1 pagePDF 269385040200221ananya dasNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNikhil SinghNo ratings yet

- 2021 05 30 15 03 03 762 - 1622367183762 - XXXPG3713X - ItrvDocument1 page2021 05 30 15 03 03 762 - 1622367183762 - XXXPG3713X - ItrvvarughesevgeorgeNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNavis AntonyNo ratings yet

- KiranDocument3 pagesKiransuneetbansalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument2 pagesItr-V: Indian Income Tax Return Verification FormMemories2022No ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearShraddha JagadNo ratings yet

- Income Tax ReturnDocument1 pageIncome Tax ReturnalharamislamicfoundationNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearkeval limbasiyaNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearAnil kadamNo ratings yet

- Ack Aggpr0859n 2022-23 893522620301222Document1 pageAck Aggpr0859n 2022-23 893522620301222CMA RAJESH RunwalNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearaccount patnaNo ratings yet

- PDF 994551360250722Document1 pagePDF 994551360250722ca.bhagirathbariNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Arihant SatpathyNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearL ROMANANDA SINGHNo ratings yet

- PDF 334657210280923Document1 pagePDF 334657210280923Manish NirwanNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Chetanya VigNo ratings yet

- Itrv EnglishDocument1 pageItrv Englishniko belicNo ratings yet

- 1 - 2015 FRENIC-Ace Instruction Manual OriginalDocument158 pages1 - 2015 FRENIC-Ace Instruction Manual OriginalJoaquim PedroNo ratings yet

- Presentation-1 INTEGRITYDocument10 pagesPresentation-1 INTEGRITYRonnel Andres HernandezNo ratings yet

- Green-Mode PWM Controller With Frequency Swapping and Audio Noise PreventionDocument18 pagesGreen-Mode PWM Controller With Frequency Swapping and Audio Noise PreventionPaulo Roberto s freireNo ratings yet

- Learning DjangoDocument228 pagesLearning DjangoSunil SinghNo ratings yet

- Installation, Use and Maintenance: ManualDocument15 pagesInstallation, Use and Maintenance: ManualOswaldo JavierNo ratings yet

- AG GCS300-400 Manual de ReferenciaDocument86 pagesAG GCS300-400 Manual de ReferenciaSimbarashe NjekuNo ratings yet

- Finite Math and Applied Calculus 6Th Edition Waner Test Bank Full Chapter PDFDocument34 pagesFinite Math and Applied Calculus 6Th Edition Waner Test Bank Full Chapter PDFTerryCoxfmat100% (11)

- Exercise 01Document13 pagesExercise 01QsdtYudeNo ratings yet

- Chapter-85 (Electrical Items)Document13 pagesChapter-85 (Electrical Items)Atiqur RahmanNo ratings yet

- Strategi Serikat Pekerja Ditengah Industri 4.0: Bhima Yudhistira AdhinegaraDocument17 pagesStrategi Serikat Pekerja Ditengah Industri 4.0: Bhima Yudhistira AdhinegaraAhmad MustajibNo ratings yet

- Lifting and Hoisting: Fabrication Site Construction Safety Recommended Practice - Hazardous ActivitiesDocument3 pagesLifting and Hoisting: Fabrication Site Construction Safety Recommended Practice - Hazardous ActivitiesjoosuasinagaNo ratings yet

- Attendence Monitoring System: November 2019Document24 pagesAttendence Monitoring System: November 2019manish guptaNo ratings yet

- Dokumen - Tips Outlook150silver CA Black b5 Whitewf Blue SP Catalog For Keeway OutlookDocument27 pagesDokumen - Tips Outlook150silver CA Black b5 Whitewf Blue SP Catalog For Keeway OutlookRafael GuaicaraNo ratings yet

- Pixelmon Server Plugins RPixelmonModDocument1 pagePixelmon Server Plugins RPixelmonModKritsamasNo ratings yet

- Slickline Operations Safety PracticesDocument4 pagesSlickline Operations Safety PracticesYermi ParabangNo ratings yet

- Internal Verification - Assessment Decisions (Single Learner)Document2 pagesInternal Verification - Assessment Decisions (Single Learner)Muhammad AkhtarNo ratings yet

- Chap02 - 1 - Nonlinear Equs - BisectionFalse-PositionDocument35 pagesChap02 - 1 - Nonlinear Equs - BisectionFalse-PositionaliNo ratings yet

- Otherhardware Updated Js2019 Clo1 Week3Document54 pagesOtherhardware Updated Js2019 Clo1 Week3somerandomhedgehog100% (1)

- Goodrive100 - PV Series Solar Pumping InverterDocument86 pagesGoodrive100 - PV Series Solar Pumping InverterSoufien SoltaniNo ratings yet

- Capstone Project Report (AST)Document44 pagesCapstone Project Report (AST)MSV ForeverNo ratings yet

- JegiDocument5 pagesJegiAnonymous Feglbx5No ratings yet

- DataTables Example - Bootstrap 5Document2 pagesDataTables Example - Bootstrap 5Omar RaygozaNo ratings yet

- 6-52-0043 Rev 4Document7 pages6-52-0043 Rev 4SujithkumarNo ratings yet

- User Manual: RS232/RS485/RS422 / Modbus - ConverterDocument26 pagesUser Manual: RS232/RS485/RS422 / Modbus - Converterel misNo ratings yet

- Ce Drawing QuestionsDocument6 pagesCe Drawing Questionsসন্দীপ চন্দ্রNo ratings yet

- A Court Chronicle - The Karagwe Kingdom by Israel K KatokeDocument5 pagesA Court Chronicle - The Karagwe Kingdom by Israel K KatokeAkiiki KasaijaNo ratings yet

- Automating Scientific Data Analysis Part 1 - by Peter Grant - Towards Data ScienceDocument7 pagesAutomating Scientific Data Analysis Part 1 - by Peter Grant - Towards Data ScienceMarcial Puente ChavezNo ratings yet

- ZVEI Industrie 40 Component EnglishDocument2 pagesZVEI Industrie 40 Component EnglishAllagui AmalNo ratings yet

- Stat 1ST Quarter NotesDocument11 pagesStat 1ST Quarter NotesaliasdrebNo ratings yet

- HR Hyderabad, Secundrabad Count3056Document54 pagesHR Hyderabad, Secundrabad Count3056krono1230% (1)