Professional Documents

Culture Documents

How Do Private Blockchains Work?

How Do Private Blockchains Work?

Uploaded by

nameOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How Do Private Blockchains Work?

How Do Private Blockchains Work?

Uploaded by

nameCopyright:

Available Formats

Private Blockchains

Introduction How do private blockchains work?

This briefing note summarises the basic principles Generally speaking, here's how it can work:

relating to private blockchains: what are they, how

do they work, why are they different to central Access to a private blockchain is controlled by a

databases and the legal issues to consider. trusted intermediary.

The trusted intermediary might be a joint

This note is high-level. For more in-depth content venture entity or a company limited by

on a variety of blockchain topics, please visit our guarantee, in each case, set up with the purpose

Blockchain in Focus webpage or download our of trying to solve a particular problem using

'Blockchains uncut' report. blockchain technology. It will therefore

comprise a number of interested parties who

What is a private blockchain? are shareholders/members in the joint venture

entity/company limited by guarantee.

In another briefing note (found on our Blockchain The trusted intermediary will build the

in Focus webpage) we summarised the basic blockchain software (that will underpin the

principles relating to public blockchains. There are private blockchain) itself or will license it from

however a number of reasons why public a third party (e.g. Corda or ConsenSys). This

blockchains may not be suitable for enterprises. For software is used to set up nodes that form the

example, for privacy reasons it may not suit an private blockchain network and need to be

enterprise for every participant on a blockchain to accessed in order to participate.

have access to its entire contents. Alternatively, The trusted intermediary will run the core

participants may want more accountability on the collection nodes itself or delegate the running

running and operation of the blockchain, which is of the nodes to subcontractors. This will help

not possible with public blockchains where there is ensure continued availability of the blockchain.

no entity in charge. Enterprises may therefore wish

The nodes run by (or on behalf of) the trusted

to set up a private blockchain.

intermediary will be in charge of validating the

transactions prior to them being recorded on

Private blockchains are often referred to as

the ledger (the "Validator Nodes").

'permissioned' blockchains. Unlike public

The trusted intermediary will build a software

blockchains, where anyone can download the

application ("app") that interfaces with the

software, form a node, view the ledger and interact

Validator Nodes via an API. The app will be

with the blockchain, private blockchains are often

accessed by participants and will enable them

run and operated by an entity (the "trusted

to send transactions for recording on the

intermediary").

blockchain.

As the trusted intermediary is in charge of the Participants can access the private blockchain

running of the blockchain it will control who can either by accessing the app on a software-as-a-

access the private blockchain and may also control service basis. In some cases, they may also be

the type of access rights each participant has. For permitted to set up their own node (this node

example, some participants may be restricted to will not be able to perform the same tasks as

viewing (some or all of) the data on the ledger , the Validator Nodes, e.g. it will not be able to

whereas others may also have permission to submit validate transactions).

new transactions for recording on the blockchain.

Private Blockchains

Expanding on this summary, there are two main Private blockchain or centralised

ways to set up a private blockchain:

database?

1. Distributed ledger model: the trusted

intermediary runs the Validator Nodes and As you can see from the two examples above, both

participants interact with the private private blockchain models require the presence of a

blockchain either by accessing: (1) the Validator trusted intermediary, this raises the question as to

Nodes via the app (access by participant X in how a private blockchain is different from a

the diagram below); or (2) their own operated traditional database controlled by a central

node via the app (access by participant Y in the authority (such as the Her Majesty's Land Registry

diagram below (where they are accessing part which controls the records of property ownership in

of the ledger covering data relevant to them the UK). Aren't we just swapping one central

only). authority for another? This is not an unfair

comparison on the face of things, however it

ignores some of the intrinsic features of blockchain

technology that make private blockchains

preferable to centralised databases in certain

circumstances.

For example:

Immutability: once data has been recorded in a

blockchain it is very difficult to change without it

becoming immediately obvious to all

participants, and rejected by them.

Distributed ledger model

2. Shared ledger model: the trusted intermediary Digital signatures: the use of digital signatures

runs a node that hosts a full copy of the ledger. makes it easier for parties that don't know or

Participants can also run their own nodes that trust each other to approve and send transaction

download a partial copy of the ledger (this copy data for recording on to the blockchain without

only includes data that the relevant participant third party involvement. This makes it easier to

is a counterparty to). coordinate input from disparate parties.

Shared ledger model

Private Blockchains

Private blockchain use cases Legal issues associated with

Below are just a few examples of how private

blockchain:

blockchain technology can be deployed. For a more

There are two key areas to consider. The

detailed breakdown, please see our 'Blockchain:

commercial contract workstream and the corporate

Use Case' briefing note, found on our Blockchain in

workstream.

Focus webpage.

Under the commercial contract workstream, there

Business-to-business communication: the are a variety of contracts for the trusted

deployment of private blockchains as a method intermediary to consider:

of storing and viewing information both within

Blockchain services agreement: if it is licensing

and between organisations offers a more secure

the blockchain software from a third party, the

way of information transmission. Due to the

trusted intermediary will need to have in place

immutability and cryptographic security of

an appropriate blockchain licence and services

blockchain technology, counterparties to a

agreement governing the rights to use the

transaction could use a private blockchain as a

software and provision of ancillary services.

method of sending confidential information that

Subcontracts: the trusted intermediary will

ensures its integrity, as an alternative to courier

need to have in place contracts with the

or email.

subcontractors it uses to operate the Validator

Nodes. These will include a variety of

'Track and trace' in a supply chain: private

responsibilities on the subcontractors to help

blockchains can be set up to track each stage of

ensure availability of the blockchain.

delivery of goods relating to a supply chain. For

Cloud services agreement: there will need to be

example, a supermarket may act as the trusted

a simple access agreement governing each

intermediary and establish a private blockchain.

participant's access to the private blockchain.

Farmers will act as participants and send

transactions for recording on this blockchain

Under the corporate workstream, there are a variety

(e.g. produce delivered to the supermarket's

of issues to consider. For example:

warehouse). The private blockchain will contain

the data entries from each stage of the supply Constitutional documentation: the trusted

chain, allowing the supermarket to more easily intermediary's articles of association and

track and verify a pallet of goods from pick-up of shareholders agreement will need to carefully

the goods from the farm to their delivery to the consider the rules governing how the

supermarket shelves. blockchain will be run. This may also include

the rules governing how the private blockchain

will be run, although this will often be a

separate document signed by all shareholders.

IP ownership: if the blockchain software or the

app is being developed in-house, based on

feedback from the shareholders, then they

should be asked to sign up to a separate IP

agreement making it clear that the shareholders

will assign any IPRs created as part of their

collaboration to the trusted intermediary.

Private Blockchains

For more information or a free initial meeting, please contact:

Key contacts

Jonathan Emmanuel Gavin Punia

Partner Senior Associate

Tel: +442074156052 Tel: +442030176884

jonathan.emmanuel@twobirds.com gavin.punia@twobirds.com

Ash Shah Thomas Hepplewhite

Associate Associate

Tel: +442074156606 Tel: +442074156777

ash.shah@twobirds.com tom.hepplewhite@twobirds.com

Charles Hill

Trainee Solicitor

Tel: +442074156745

charles.hill@twobirds.com

The firm is at the forefront of some of the most cutting-edge mandates

in the area, advising on innovative matters in payments,

crowdfunding, open banking and blockchain.

Chambers FinTech UK, 2020

twobirds.com

Abu Dhabi & Amsterdam & Beijing & Bratislava & Brussels & Budapest & Copenhagen & Dubai & Dusseldorf & Frankfurt & The Hague &

Hamburg & Helsinki & Hong Kong & London & Luxembourg & Lyon & Madrid & Milan & Munich & Paris & Prague & Rome & San

Francisco & Shanghai & Singapore & Stockholm & Sydney & Warsaw

The information given in this document concerning technical legal or professional subject matter is for guidance only and does not constitute legal or professional advice. Always

consult a suitably qualified lawyer on any specific legal problem or matter. Bird & Bird assumes no responsibility for such information contained in this document and disclaims all

liability in respect of such information.

This document is confidential. Bird & Bird is, unless otherwise stated, the owner of copyright of this document and its contents. No part of this document may be published,

distributed, extracted, re-utilised, or reproduced in any material form.

Bird & Bird is an international legal practice comprising Bird & Bird LLP and its affiliated and associated businesses.

Bird & Bird LLP is a limited liability partnership, registered in England and Wales with registered number OC340318 and is authorised and regulated by the Solicitors Regulation

Authority. Its registered office and principal place of business is at 12 New Fetter Lane, London EC4A 1JP. A list of members of Bird & Bird LLP and of any non-members who are

designated as partners, and of their respective professional qualifications, is open to inspection at that address.

You might also like

- Feasibility StudyDocument29 pagesFeasibility StudyKhairun NatsirunNo ratings yet

- Blockchain for Beginners: Understand the Blockchain Basics and the Foundation of Bitcoin and CryptocurrenciesFrom EverandBlockchain for Beginners: Understand the Blockchain Basics and the Foundation of Bitcoin and CryptocurrenciesRating: 4.5 out of 5 stars4.5/5 (7)

- Blockchain Security from the Bottom Up: Securing and Preventing Attacks on Cryptocurrencies, Decentralized Applications, NFTs, and Smart ContractsFrom EverandBlockchain Security from the Bottom Up: Securing and Preventing Attacks on Cryptocurrencies, Decentralized Applications, NFTs, and Smart ContractsNo ratings yet

- SiddhiDocument4 pagesSiddhiGourav GhodakeNo ratings yet

- 3 Internet of ThingsDocument5 pages3 Internet of ThingsmittleNo ratings yet

- Introduction To BlockchainDocument5 pagesIntroduction To Blockchainnaveenallapur2001No ratings yet

- Introduction To Blockchain: Learn In Depth About The Fundamentals Of Blockchain, Blockchain Architecture And Various Blockchain Use CasesFrom EverandIntroduction To Blockchain: Learn In Depth About The Fundamentals Of Blockchain, Blockchain Architecture And Various Blockchain Use CasesNo ratings yet

- Blockchain Note by HasanDocument6 pagesBlockchain Note by HasanMd.HasanNo ratings yet

- Block Chain TechnologyDocument7 pagesBlock Chain TechnologyBARATHRAJ D commerceNo ratings yet

- Enterprise Systems and Blockchain TechnologyDocument10 pagesEnterprise Systems and Blockchain Technologywm364740No ratings yet

- Blockchain AbstractDocument4 pagesBlockchain AbstractGourav GhodakeNo ratings yet

- Understanding Blockchain: Tips, Recommendations, and Strategies for SuccessFrom EverandUnderstanding Blockchain: Tips, Recommendations, and Strategies for SuccessNo ratings yet

- On Block ChainDocument16 pagesOn Block Chainshaik ashraffNo ratings yet

- 7 - 16 - 17 - 18 EtiDocument7 pages7 - 16 - 17 - 18 Etixb.vaibhavtadke37No ratings yet

- SeminarDocument46 pagesSeminarSubham Kumar SahooNo ratings yet

- Block ChainDocument9 pagesBlock ChainNurul Rofifah MNo ratings yet

- Blockchain: A Guide To Blockchain, The Technology Behind Bitcoin, Ethereum And Other Cryptocurrency: Blockchain, #1From EverandBlockchain: A Guide To Blockchain, The Technology Behind Bitcoin, Ethereum And Other Cryptocurrency: Blockchain, #1No ratings yet

- Fundamentals of The Blockchain PDFDocument12 pagesFundamentals of The Blockchain PDFApoorv Gupta LaviNo ratings yet

- BlockchainDocument5 pagesBlockchainGood for NothingNo ratings yet

- Chapter 2 BlockchainDocument7 pagesChapter 2 BlockchainFarheen AkramNo ratings yet

- Mahnoor Qaisar - #1056 - Computer Application in Education Assignment-2Document7 pagesMahnoor Qaisar - #1056 - Computer Application in Education Assignment-2HaseeB MalikNo ratings yet

- Blockchain: Let Us Understand This Concept, in The Light of An International Trade Example ofDocument25 pagesBlockchain: Let Us Understand This Concept, in The Light of An International Trade Example ofMenoddin shaikh100% (1)

- Block Chain TechnologyDocument15 pagesBlock Chain TechnologyHARI PRIYA KURRIMELANo ratings yet

- Blockchain Unit 1Document13 pagesBlockchain Unit 1sharmanikki8381No ratings yet

- The Essential Eight Technologies: Board Byte: BlockchainDocument12 pagesThe Essential Eight Technologies: Board Byte: BlockchainsilvofNo ratings yet

- Blockchain-Case Study (ETI)Document13 pagesBlockchain-Case Study (ETI)Omkar JadhavNo ratings yet

- Use of Blockchain Technology: By-Kunal Khandelwal Vikas Saini Arshdeep Rajnish KumarDocument8 pagesUse of Blockchain Technology: By-Kunal Khandelwal Vikas Saini Arshdeep Rajnish KumarRaj NishNo ratings yet

- BlockChain Technologies (20CS32015)Document16 pagesBlockChain Technologies (20CS32015)srinivas kanakalaNo ratings yet

- Blockchainbyamanthakur 220325164814Document22 pagesBlockchainbyamanthakur 220325164814salmanNo ratings yet

- Blockchain Consensus Protocols in The Wild: Christian Cachin Marko Vukoli C IBM Research - Zurich 2017-07-07Document24 pagesBlockchain Consensus Protocols in The Wild: Christian Cachin Marko Vukoli C IBM Research - Zurich 2017-07-07Mohamed Hechmi JERIDINo ratings yet

- Using Blockchain To Drive Supply Chain InnovationDocument12 pagesUsing Blockchain To Drive Supply Chain InnovationAhmed ZohairNo ratings yet

- The First Comprehensive Guide To Blockchain: Bitcoin, Cryptocurrencies, Smart Contracts, and the Future of BlockchainFrom EverandThe First Comprehensive Guide To Blockchain: Bitcoin, Cryptocurrencies, Smart Contracts, and the Future of BlockchainNo ratings yet

- What Is BlockchainDocument8 pagesWhat Is BlockchainKansha GuptaNo ratings yet

- Blockchain Glossary PDFDocument2 pagesBlockchain Glossary PDFDiego RomaNo ratings yet

- Blockchain and The Future of AccountancyDocument16 pagesBlockchain and The Future of AccountancyFreeman AbuNo ratings yet

- LMS 13Document11 pagesLMS 13prabakar1No ratings yet

- Unraveling the Enigma of Blockchain: The Revolutionary Technology Powering the FutureFrom EverandUnraveling the Enigma of Blockchain: The Revolutionary Technology Powering the FutureNo ratings yet

- Blockchain TechnologyDocument9 pagesBlockchain TechnologySakshi GaulNo ratings yet

- MB NotesDocument19 pagesMB NotesBhavik UpadhyayNo ratings yet

- Blockchain: Real-World Applications And UnderstandingFrom EverandBlockchain: Real-World Applications And UnderstandingRating: 4 out of 5 stars4/5 (11)

- Blockchain SecurityDocument24 pagesBlockchain SecurityVenkatraman KrishnamoorthyNo ratings yet

- Unlock The Power of Blockchain - DigitalOceanDocument14 pagesUnlock The Power of Blockchain - DigitalOceanMihai TiberiuNo ratings yet

- The Truth About BlockchainDocument9 pagesThe Truth About BlockchainRavikanth ReddyNo ratings yet

- Do You Need A Blockchain?Document7 pagesDo You Need A Blockchain?douhengNo ratings yet

- Blockchain As A ServiceDocument17 pagesBlockchain As A Serviceabhishek2k3prasadNo ratings yet

- Block Chain Overview (Updated)Document74 pagesBlock Chain Overview (Updated)vishesh Kumar singhNo ratings yet

- Block ChainDocument12 pagesBlock ChainISHA AGGARWALNo ratings yet

- Accenture Unlocking Infinite Value Blockchain Collateral Management UpdatedDocument20 pagesAccenture Unlocking Infinite Value Blockchain Collateral Management Updatedrbf.lima91No ratings yet

- Blockchain: The Building Blocks of Trust and Transparency in the Digital AgeFrom EverandBlockchain: The Building Blocks of Trust and Transparency in the Digital AgeNo ratings yet

- How Blockchain Is Transforming Capital Market PDFDocument18 pagesHow Blockchain Is Transforming Capital Market PDFYuva RanuNo ratings yet

- About Blockchain TechnologyDocument8 pagesAbout Blockchain TechnologyMadalina AlexandraNo ratings yet

- The Role of Blockchain in The Current It Industry ScenarioDocument3 pagesThe Role of Blockchain in The Current It Industry ScenarioSᴇʀᴇɴᴅɪᴘɪᴛʏNo ratings yet

- Blockchain The India Strategy Part I 2Document5 pagesBlockchain The India Strategy Part I 2Sayyeda SumaiyahNo ratings yet

- Validation and Verification of Smart Contracts: A Research Agenda PDFDocument8 pagesValidation and Verification of Smart Contracts: A Research Agenda PDFCleórbete SantosNo ratings yet

- Event Management Ticket Booking Using BlockChainDocument5 pagesEvent Management Ticket Booking Using BlockChainRitesh GuptaNo ratings yet

- Museum Security: How Do We Protect The Museum and Its Collection From Theft or Damage?Document2 pagesMuseum Security: How Do We Protect The Museum and Its Collection From Theft or Damage?arsiteksksNo ratings yet

- The Brand Equity Approach To Marketing of Malaysian Palm ProductDocument138 pagesThe Brand Equity Approach To Marketing of Malaysian Palm ProductEndi SingarimbunNo ratings yet

- QUE$TORDocument19 pagesQUE$TORMichael JoelNo ratings yet

- Sqlite Carving extractAndroidDataDocument13 pagesSqlite Carving extractAndroidDataMwamba Kyle JustinNo ratings yet

- Yacht 62Document14 pagesYacht 62Lucas AkiermanNo ratings yet

- TOI Full Page - Dehradun Edition - May 2023Document1 pageTOI Full Page - Dehradun Edition - May 2023SakshamNo ratings yet

- IWFM GPG BIM Data For FM Systems Screen DPSDocument21 pagesIWFM GPG BIM Data For FM Systems Screen DPSRodney Martin DassNo ratings yet

- Dodocool DA106 Instruction Manual PDFDocument1 pageDodocool DA106 Instruction Manual PDFginostraNo ratings yet

- Recycling of FRP BoatsDocument9 pagesRecycling of FRP Boatsjayaramsomarajan1975No ratings yet

- Chapter 1 IntroductionDocument4 pagesChapter 1 IntroductionVictor IgwemezieNo ratings yet

- Northern Elevator Engineering LLC, Dubai, U.A.E Method Statement For Elevator InstallationDocument8 pagesNorthern Elevator Engineering LLC, Dubai, U.A.E Method Statement For Elevator InstallationjonesNo ratings yet

- The Effects of Mobile Games On Senior High School Students of Marcos National High SchoolDocument6 pagesThe Effects of Mobile Games On Senior High School Students of Marcos National High SchoolJoyce Anne ManzanilloNo ratings yet

- Wesgewood Fab Five PDFDocument25 pagesWesgewood Fab Five PDFcalculatedrisk1No ratings yet

- Project Equity Research Analysis Between ICICI Bank and HDFC BankDocument3 pagesProject Equity Research Analysis Between ICICI Bank and HDFC BankMalay ShahNo ratings yet

- QSC rmx850 rmx1450 rmx1850hd rmx2450Document56 pagesQSC rmx850 rmx1450 rmx1850hd rmx2450JRPB ASCOPENo ratings yet

- Championing Learning Continuity in The New NormalDocument3 pagesChampioning Learning Continuity in The New NormalJade Jayvee100% (3)

- Sample Research Paper Literature ReviewDocument8 pagesSample Research Paper Literature Reviewfyt3rftv100% (1)

- RNP Rwy 18 Same/Mdz Mendoza, Argentina: LomadDocument1 pageRNP Rwy 18 Same/Mdz Mendoza, Argentina: Lomadfrancisco buschiazzoNo ratings yet

- Spec 2022Document399 pagesSpec 2022mubarek bekeleNo ratings yet

- Recently Announced A Slew of Reforms: Other ImpactsDocument27 pagesRecently Announced A Slew of Reforms: Other ImpactsPriya VermaNo ratings yet

- Project Risk AnalysisDocument2 pagesProject Risk AnalysisBIKASHNo ratings yet

- Sample Motion To Plea BargainDocument2 pagesSample Motion To Plea BargainPat BarrugaNo ratings yet

- 12 CFT - 21-BID-024 - FEED 2.0 ANNEX XI - Quality Management - VF FinalDocument3 pages12 CFT - 21-BID-024 - FEED 2.0 ANNEX XI - Quality Management - VF FinalbarryNo ratings yet

- Definition of M-WPS OfficeDocument2 pagesDefinition of M-WPS Officekeisha babyNo ratings yet

- A Common Frame of Reference For European Private LawDocument4 pagesA Common Frame of Reference For European Private LawswermarianaNo ratings yet

- Siasoco V CADocument2 pagesSiasoco V CAClaudine ArrabisNo ratings yet

- OP Malhotra-Law of Industrial DisputesDocument1,264 pagesOP Malhotra-Law of Industrial DisputesAnkita Shah Jain83% (6)

- Report Emulsion SS-1Document1 pageReport Emulsion SS-1RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- Enterprise CatalogDocument128 pagesEnterprise CatalogbuiquangsangNo ratings yet

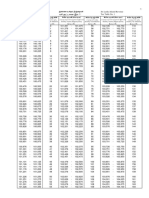

- Table 1 - Tax Table 01Document182 pagesTable 1 - Tax Table 01wellawalalasithNo ratings yet