Professional Documents

Culture Documents

Economy - MSCI SAIR - LUCK, MEBL, and TRG in The Race

Uploaded by

Muhammad Ovais AhsanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economy - MSCI SAIR - LUCK, MEBL, and TRG in The Race

Uploaded by

Muhammad Ovais AhsanCopyright:

Available Formats

Economy

Apr 23, 2021

MSCI May-21 SAIR Preview

LUCK, MEBL, and TRG in the race

Best Equity research report (Runner up) – 2020

Best Equity Trader (Runner up) – 2019

Fahad Rauf Fahad.rauf@ismailiqbal.com Phone: (+92-21) 34320375 1

Economy

LUCK, MEBL, and TRG in the race Apr 23, 2021

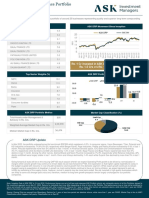

The MSCI is scheduled to announce Semi-Annual Index Review (SAIR) on May 11, 2021, which will Pakistan has underperformed MSCI EM since last

be effective from May 28, 2021. Contrary to the previous SAIR, which remained a non-event for review

140

Pakistan, we may witness a couple of changes in the upcoming SAIR. LUCK is likely to replace

OGDC in the standard index, while in the small cap index, PKGS could be replaced by TRG or 130

MEBL. 120

110

Pakistan’s MSCI Standard Index market cap has remained flat as compared to Nov-20 SAIR,

underperforming the MSCI EM index by 20%. This would further reduce Pakistan’s weight to 100

1.6bps (1.7bps if LUCK is added) from 2.0bps at the previous SAIR and 14.0bps at the time of

90

inclusion in 2017.

80

Dec-20

Dec-20

Oct-20

Mar-21

Mar-21

Apr-21

Apr-21

Nov-20

Nov-20

Nov-20

Jan-21

Jan-21

Feb-21

Feb-21

Pakistan has been surviving on the index continuity rule since May-19, and none of the three

stocks in the MSCI Standard Index (OGDC, MCB and HBL) meet free float or total market cap

criteria (refer to the table on page 3). Even after applying the 2/3rd buffer rule, none of the MSCI EM KSE 100 Pak Standard Index

source: Bloomberg, IIS Research

stocks meet the free float criteria, while only OGDC meets full market cap criteria. Looking at the

scenario, there are increased chances of Pakistan being put on the monitoring list for a potential Pakistan's weight in MSCI EM Index - Estimated

downgrade in the near future (potentially in the annual market reclassification review in Jun-21). Free Float Market Cap USD 'bn

To note, index continuity has also been applied to Argentina, Czech Republic, and Egypt. MSCI EM Index Free Float M.cap - as at 19-04-2021 8,252

Pakistan Standard Index Free Float M.cap 1.3

Based on index continuity rules, LUCK is likely to beat OGDC on a free float market cap basis (even Weight 0.016%

after applying a 1.5x factor to OGDC’s market cap), thus landing a place in the standard index. In

Changes in market caps - Standard Index

small cap index, PKGS is likely to be deleted. In replacement, TRG looks to have a more stronger Free Float Market Cap - USDmn Apr/21 Oct/20 ▲

case than MEBL based on most of the criteria; however, TRG price run-up has been rather HBL 461 498 -8%

extreme, which might restrict it from getting added in the current review. To note, we had MCB 469 435 8%

expected PKGS to be deleted in Nov-20 SAIR as well. However, it somehow managed to maintain OGDC 411 405 1%

its place. Total 1,341 1,338 0%

Source: MSCI, IIS Research

Fahad Rauf Fahad.rauf@ismailiqbal.com Phone: (+92-21) 34320375

2

Economy

LUCK, MEBL, and TRG in the race Apr 23, 2021

Existing Stocks in MSCI EM Standard and Small Cap Index

Stock M.Cap Free Float FIF ATVR ATVR Minimum Criteria for MSCI EM Standard Index

USD mn USD mn x 3M 12M EM Standard Index USD 'mn

Standard Index - criteria before buffer 2,190 1,095 0.15 15% 15% Market Cap

Standard Index - criteria after buffer 1,467 734 0.15 5% 10% Criteria Free Float Market Cap - as at last review 915

OGDC 2,738 411 0.15 7% 8% Criteria Total Market Cap - as at last review 1,831

MCB 1,340 469 0.35 2% 2% EM Return since last review 20%

HBL 1,152 461 0.40 7% 6% Adjusted Free Float Criteria - estimated 1,095

Adjusted Total Market Cap. Criteria - estimated 2,190

Small Cap Index - criteria before buffer 382 191 0.15 15% 15%

Small Cap Index - criteria after buffer 256 128 0.15 5% 10% Market Cap Criteria - Post 2/3rd Buffer Rule

PPL 1,507 369 0.24 6% 9% Free Float Criteria - estimated 734

LUCK 1,803 721 0.40 10% 13% Total Market Cap. Criteria - estimated 1,467

MARI 1,386 277 0.20 2% 2% Source: MSCI, IIS Research

ENGRO 1,123 618 0.55 3% 3%

UBL 954 381 0.40 10% 6%

Minimum Criteria for MSCI EM Small Cap Index

FFC 865 476 0.55 2% 2%

EM Small Cap Index USD 'mn

POL 681 311 0.46 3% 5%

Market Cap

HUBC 659 494 0.75 7% 6%

Criteria Free Float Market Cap - as at last review 160

INDU 570 97 0.17 5% 3%

PSO 663 298 0.45 14% 13% Criteria Total Market Cap - as at last review 319

EFERT 583 262 0.45 6% 7% EM Return since last review 20%

NBP 493 117 0.24 5% 6% Adjusted Free Float Criteria - estimated 191

BAFL 349 139 0.40 4% 4% Adjusted Total Market Cap. Criteria - estimated 382

SEARL 388 175 0.45 13% 21%

MTL 397 179 0.45 3% 2% Market Cap Criteria - Post 2/3rd Buffer Rule

PKGS 275 69 0.25 2% 4% Free Float Criteria - estimated 128

Total Market Cap. Criteria - estimated 256

Potential candidates in race to replace PKGS in small cap Source: MSCI, IIS Research

TRG 618 525 0.85 114% 87%

MEBL 1,010 252 0.25 5% 6%

Source: MSCI, Bloomberg, IIS Research

ATVR cut-off date: 31-Mar-21, Price cut-off date: 19-Apr-21

Fahad Rauf Fahad.rauf@ismailiqbal.com Phone: (+92-21) 34320375

3

Economy REP-092

Apr 23, 2021

Disclaimer

Ismail Iqbal Securities (Pvt.) Limited does not warrant the timeliness, sequence, accuracy or completeness of this information. In no event will Ismail Iqbal Securities

(Pvt.) Limited be liable for any special, indirect, incidental, or consequential damages without limitation which includes lost revenues, lost profits, or loss of

prospective economic advantage resulting from the use of the information or for any omission or inaccuracies resulting from the use of information from this market

Disclosures

Ismail Iqbal Securities (Pvt) Limited, hereinafter referred to as IISPL, acts as a market maker in the security(ies) mentioned in this report. IISPL, its officers, directors,

associates or their close relatives might have financial interests in the security(ies) mentioned in this report, including a significant financial interest (1% of the

value of the securities of the subject company). IISPL is doing business, or seeking to to do business, with the company(ies) mentioned in this report, and therefore

receives/has received/intending to receive compensation from these company(ies) in a non-research capacity.

IISPL has previously or might in the future trade or deal in the subject company in a manner contrary to the recommendation in this report, due to differences of

opinion between the research department and sales desk or traders, and investment time period differences.

The analyst associated with the writing of this report either reports directly to the research department head or is the department head. The department head in

turn reports directly to the Chief Executive Officer of IISPL. The analyst's compensation is not determined by nor based on other business activities of IISPL.

Research reports are disseminated through email or mail/courier to all clients at the same time. No class of client or internal trading person gets this report in

advance of other clients. Due to factors outside of IISPL's control, including speed of the internet, some clients may receive the report before others.

Monetary compensation of research analysts is neither determined nor based on any other service(s) that IISPL offers, and the compensatory evaluation is not

influenced nor controlled by anyone belonging to a non-research department. Further, the research analysts are headed by the Head of Research, who reports

Recommendations are based on the following conditions:

Rating criteria Stance

(Target Price/Current Price - 1) > 10% Positive

(Target Price/Current Price - 1) < -10% Negative

9% > (Target Price/Current Price -1) > -9% Neutral

Investors should carefully read the definitions of all rating used within every research report. In addition, research reports carry an analyst’s independent view and

investors should ensure careful reading of the entire research reports and not infer its contents from the rating ascribed by the analyst. Ratings should not be used or

relied upon as investment advice. An investor’s decision to buy, hold or sell a stock should depend on said individual’s circumstances and other considerations.

Valuation Methodology

To arrive at our period end target prices, IISPL uses different valuation methadologies including

Discounted cash flow (DCF, DDM)

Relative Valuation (P/E, P/B, P/S etc.)

Equity & Asset return based methodologies (EVA, Residual Income etc.)

Analyst Disclaimer

The author(s) of this report hereby certifiies that this report accurately reflects her/his/their own independent opinions and views as of the time this report went

into publication and that no part of her/his/their compensation was, is or will be affected by the recommendation(s) in this report.

The research analyst or any of her/his/their close relatives do not have a financial interest in the securities of the subject company aggregating more than 1% of the

value of the company and the research analyst or their close relatives have neither served as a director/officer in the past 3 years nor received any compensation

from the subject company in the past 12 months. The Research analyst or her/his/their close relatives have not traded in the subject security in the past 7 days and

will not trade for 5 days post publication of the report.

Fahad Rauf Fahad.rauf@ismailiqbal.com Phone: (+92-21) 34320375

4

You might also like

- Accenture: Not RatedDocument4 pagesAccenture: Not RatedAryan SharmaNo ratings yet

- Pakistan Macro Monthly April 2023Document36 pagesPakistan Macro Monthly April 2023Tahir QayyumNo ratings yet

- 5-Year ReportDocument60 pages5-Year ReportSaravana Kumar NachimuthuNo ratings yet

- CONSTRUCTION PROGRAM - FinalDocument45 pagesCONSTRUCTION PROGRAM - FinalMohammad UmmerNo ratings yet

- Years of Commitment: A Statistical Report On Completion of 4 Years of GSTDocument56 pagesYears of Commitment: A Statistical Report On Completion of 4 Years of GSTKevin SmithNo ratings yet

- Earned Value Sheet - Oct.-2022Document2 pagesEarned Value Sheet - Oct.-2022Shakti Sourava RautrayaNo ratings yet

- 03 34 11 - MSL Intel - Mughal Initiation - Capitalizing On The Global Base Metal FiestaDocument15 pages03 34 11 - MSL Intel - Mughal Initiation - Capitalizing On The Global Base Metal FiestaMehroz KhanNo ratings yet

- New Zealand: Australia's Monetary Policy Canary?: 12 September 2022Document6 pagesNew Zealand: Australia's Monetary Policy Canary?: 12 September 2022Muhammad ImranNo ratings yet

- FQ.221.00 - Cronograma de Inspeção de LayoutDocument2 pagesFQ.221.00 - Cronograma de Inspeção de LayoutAlexandre BelarminoNo ratings yet

- CrupDocument3 pagesCrupNARUdaARCNo ratings yet

- Latest Work Programe As Per Schedule-H and J (IPRCL)Document2 pagesLatest Work Programe As Per Schedule-H and J (IPRCL)rohit singhNo ratings yet

- KMMP Collaboration - Base Timeline WB0.8Document1 pageKMMP Collaboration - Base Timeline WB0.8Luiggi RubiniNo ratings yet

- Monetary Policy Mar-21-3Document1 pageMonetary Policy Mar-21-3kalimNo ratings yet

- CBP Weekly Report Feb 13'21Document2 pagesCBP Weekly Report Feb 13'21rcpepitobauerNo ratings yet

- Insight: Resurgence in Cotton Crop Spurs Hope Pakistan TextileDocument4 pagesInsight: Resurgence in Cotton Crop Spurs Hope Pakistan TextileAsra IsarNo ratings yet

- India Oil Prices - Research Note - FINALDocument10 pagesIndia Oil Prices - Research Note - FINALBharat NarrativesNo ratings yet

- KASB 2021 Equity StrategyDocument98 pagesKASB 2021 Equity StrategymirzaNo ratings yet

- Compounder Vs CyclicalsDocument25 pagesCompounder Vs CyclicalsKrishna Raj KNo ratings yet

- Overview of Air Transporte in 2021 IataDocument11 pagesOverview of Air Transporte in 2021 IatajuanNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- Markets at 60000 Level Our View and RecommendationDocument7 pagesMarkets at 60000 Level Our View and Recommendationamit raviNo ratings yet

- Nuvama Initiating Coverage On V2 Retail With 77% UPSIDE Acing TheDocument34 pagesNuvama Initiating Coverage On V2 Retail With 77% UPSIDE Acing Themanitjainm21No ratings yet

- Sco Eot1Document1 pageSco Eot1NAVEEN SNo ratings yet

- Draft: Interface at TPS: Potential ScenariosDocument2 pagesDraft: Interface at TPS: Potential ScenariosPalash DasNo ratings yet

- Price Report 20220207eDocument2 pagesPrice Report 20220207eLanka RegisterNo ratings yet

- Air Transport Outlook Q23Document18 pagesAir Transport Outlook Q23Greg VenanceNo ratings yet

- Schedule 26thdecDocument2 pagesSchedule 26thdecdinesh2056No ratings yet

- SRH EOT Ac1Document1 pageSRH EOT Ac1NAVEEN SNo ratings yet

- Essence of The Week: What Goes Down Must Come Up?Document35 pagesEssence of The Week: What Goes Down Must Come Up?Anil KiniNo ratings yet

- Coronation Research Investment Opportunities From Fuel Subsidy Removal 09 June 2023Document19 pagesCoronation Research Investment Opportunities From Fuel Subsidy Removal 09 June 2023Adedayo-ojo FiyinfoluwaNo ratings yet

- SFMRDocument6 pagesSFMRAli RazaNo ratings yet

- Et - Mar 23Document2 pagesEt - Mar 23coureNo ratings yet

- Progress Harian Minggu Ke 3Document1 pageProgress Harian Minggu Ke 3raja perkasaNo ratings yet

- NBG Corporate Presentation Apr21Document61 pagesNBG Corporate Presentation Apr21Dimitrios LiakosNo ratings yet

- Gantt Chart Excel Template With DependenciesDocument5 pagesGantt Chart Excel Template With DependenciesGuendouz GuendouzNo ratings yet

- Jadwal Jaga Iship Februari-Mei 2022 - RSUD I LagaligoDocument9 pagesJadwal Jaga Iship Februari-Mei 2022 - RSUD I Lagaligoabd asisNo ratings yet

- August 2021 August 2021: Bank of Tanzania Bank of TanzaniaDocument30 pagesAugust 2021 August 2021: Bank of Tanzania Bank of TanzaniaArden Muhumuza KitomariNo ratings yet

- 03FMR - March 2021Document1 page03FMR - March 2021Ali RazaNo ratings yet

- Coronavirus Covid 19 at A Glance 30 May 2021Document1 pageCoronavirus Covid 19 at A Glance 30 May 2021Amalia ChairunnisaNo ratings yet

- Timesheet Roto # 16 Feb - 15 Mar 2022Document2 pagesTimesheet Roto # 16 Feb - 15 Mar 2022setianidarwatiNo ratings yet

- Gantt Chart Excel Template With SubtasksDocument3 pagesGantt Chart Excel Template With Subtaskszeni romdhoniNo ratings yet

- Kartu Stock Festive BJM 2024Document1 pageKartu Stock Festive BJM 2024Fadrian NoorNo ratings yet

- CITP Weekly Report Feb 15'21Document3 pagesCITP Weekly Report Feb 15'21rcpepitobauerNo ratings yet

- PHDCCI Economic and Business Momentum EBM Index 1619191630 PDFDocument13 pagesPHDCCI Economic and Business Momentum EBM Index 1619191630 PDFassmexellenceNo ratings yet

- Event Planning Gantt Chart Excel TemplateDocument3 pagesEvent Planning Gantt Chart Excel TemplateGuendouz GuendouzNo ratings yet

- NIT Jan'20Document11 pagesNIT Jan'20afnaniqbalNo ratings yet

- Master Plan BravoxDocument52 pagesMaster Plan BravoxAriel BorgesNo ratings yet

- Project Management Gantt Chart Excel TemplateDocument3 pagesProject Management Gantt Chart Excel TemplateGuendouz GuendouzNo ratings yet

- Actual and Forecasted ManpowerDocument1 pageActual and Forecasted Manpowerusmannaeem1017No ratings yet

- IAC 2-Year Audit ProgrammeDocument1 pageIAC 2-Year Audit ProgrammeSADHEDNo ratings yet

- MacroScenario-BRAZIL Jan22Document5 pagesMacroScenario-BRAZIL Jan22Matheus AmaralNo ratings yet

- CRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2021Document52 pagesCRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2021winas30187No ratings yet

- The Coming Collapse of Inflation and How To Benefit From It July 2022Document29 pagesThe Coming Collapse of Inflation and How To Benefit From It July 2022Dinesh RupaniNo ratings yet

- SD New Time Frame - R1Document17 pagesSD New Time Frame - R1hkhxrcts44No ratings yet

- Grey Fabric Receive Status TodayDocument12 pagesGrey Fabric Receive Status TodaysaidurtexNo ratings yet

- Spark How Economic Activities Shaping Under Covid 19 Week 5Document17 pagesSpark How Economic Activities Shaping Under Covid 19 Week 5ABHISHEK DALAL 23No ratings yet

- Economy: IndiaDocument8 pagesEconomy: IndiaRavichandra BNo ratings yet

- Pakistan Cements - Coal Inventory Costs To Witness An Uptick in FY22 - 201021Document4 pagesPakistan Cements - Coal Inventory Costs To Witness An Uptick in FY22 - 201021hasboo86No ratings yet

- Simple Time Schedule v0 Rocketsheets - Com - Eyjl7mDocument4 pagesSimple Time Schedule v0 Rocketsheets - Com - Eyjl7mAVNo ratings yet

- IBAN or Truncated IBAN Iban Country Code Iban National IdDocument20 pagesIBAN or Truncated IBAN Iban Country Code Iban National IdGanapathi RajNo ratings yet

- Course Overview: ContentsDocument8 pagesCourse Overview: ContentsArindam GhoshNo ratings yet

- Beyond Covid 19 The New Consumer Behavior Is Sticking in The Tissue IndustryDocument5 pagesBeyond Covid 19 The New Consumer Behavior Is Sticking in The Tissue IndustrymedanlowkerNo ratings yet

- Techanalysis PDFDocument56 pagesTechanalysis PDFYktashNo ratings yet

- Tiscon Case-Published Version Strategy Renewal at Tata SteelDocument29 pagesTiscon Case-Published Version Strategy Renewal at Tata Steelsuhasinidx2024No ratings yet

- Maurece Schiller - StubsDocument15 pagesMaurece Schiller - StubsMihir ShahNo ratings yet

- Questionnaire On Mutual Fund InvetmentDocument4 pagesQuestionnaire On Mutual Fund InvetmentSafwan mansuriNo ratings yet

- Understanding Managed FuturesDocument12 pagesUnderstanding Managed FuturesJohnNo ratings yet

- Prof. M.K Gandhi: A Project Report OnDocument87 pagesProf. M.K Gandhi: A Project Report OnShivani AwasthyNo ratings yet

- FIN448 Practice Final Exam Fall2020 SolutionDocument14 pagesFIN448 Practice Final Exam Fall2020 SolutionMay ChenNo ratings yet

- GlobalmarketingDocument15 pagesGlobalmarketingTeesha shahNo ratings yet

- Chapter 3Document29 pagesChapter 3Minh Khanh LeNo ratings yet

- Unsolved Problems 1-8Document26 pagesUnsolved Problems 1-8AsħîŞĥLøÝå60% (5)

- Super AdxDocument5 pagesSuper AdxpudiwalaNo ratings yet

- AutoTrade Investment RobotDocument2 pagesAutoTrade Investment RobotDaniel keith LucasNo ratings yet

- Jindal Steel & Power: CMP: INR357 Management Meeting UpdateDocument8 pagesJindal Steel & Power: CMP: INR357 Management Meeting UpdateRomelu MartialNo ratings yet

- LESSON 1: Introduction To Financial Management: TargetDocument51 pagesLESSON 1: Introduction To Financial Management: Targetmardie dejanoNo ratings yet

- Dr. Samuel Xin Liang Dr. Samuel Xin Liang Fina 110 Spring 2009Document14 pagesDr. Samuel Xin Liang Dr. Samuel Xin Liang Fina 110 Spring 2009jacobCCNo ratings yet

- The Role of Profitability On Dividend Policy in Property and Real Estate Registered Subsector Company in IndonesiaDocument8 pagesThe Role of Profitability On Dividend Policy in Property and Real Estate Registered Subsector Company in IndonesiaWiduri PutriNo ratings yet

- Population: This Is The Required or Expected Rate of Return On XYZDocument3 pagesPopulation: This Is The Required or Expected Rate of Return On XYZArshad KhanNo ratings yet

- Adx PDFDocument6 pagesAdx PDFpaolo100% (1)

- FIN620 FormulasDocument1 pageFIN620 FormulasPinkera -No ratings yet

- Causes of Financial Crisis: Bubble, A Financial Bubble, A Speculative Mania or A Balloon) Is "Trade in High Volumes atDocument7 pagesCauses of Financial Crisis: Bubble, A Financial Bubble, A Speculative Mania or A Balloon) Is "Trade in High Volumes atyohannes kindalemNo ratings yet

- 2.technical Analysis Part 2Document20 pages2.technical Analysis Part 2trisha chandrooNo ratings yet

- Liability Products: Personal Banking Segment of SBIDocument4 pagesLiability Products: Personal Banking Segment of SBIapu20090% (2)

- Module 9 - Harvesting & Exiting A Business VentureDocument17 pagesModule 9 - Harvesting & Exiting A Business VentureYong ArifinNo ratings yet

- FM M.com 2nd Sem 2015Document4 pagesFM M.com 2nd Sem 2015Khurshid AlamNo ratings yet

- Basel 3 ImplementationDocument20 pagesBasel 3 Implementationsh_chandraNo ratings yet

- FAA Ratio AnalysisDocument4 pagesFAA Ratio AnalysisRishav BhattacharjeeNo ratings yet

- JPM Insurance PrimerDocument104 pagesJPM Insurance Primerdamon_enola3313No ratings yet