Professional Documents

Culture Documents

Master Mechanics Part Deux

Uploaded by

CSCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Master Mechanics Part Deux

Uploaded by

CSCopyright:

Available Formats

Short Put

tastytrade.com - Sell put OTM

- Probability of profit around 80%

Covered Call

- Long stock plus a short OTM call

- Probability of profit around 60%

Bullish Wide Iron Condor

- Credit put vertical OTM and credit

call vertical OTM.

- Probabiltiy of profit around 60%

High Volatility Strangle

Neutral

(30+ IV Rank) - Short OTM put plus a short OTM

call

- Probability of profit around 70%

Short Call

Bearish

- Sell call OTM

- Probability of profit around 80%

Call Ratio Credit Spread

- Sell two OTM Calls buy one call

closer to ATM

- Probabilty of profit around 85%

Start Here Debit Call Vertical

- Buy call ITM, sell call OTM

- Probability of profit around 50%

Call Diagonal

- Short front month OTM call, long

back month ATM call

- Probability of profit less than 50%

Bullish Calendar Spread

- Short ATM call in front month,

long same strike call in back

month

Low Volatility Neutral - Increases in implied volatility

(<30 IV Rank) beneift this position

- Positive time decay

- Low probability trade

Bearish Debit Put Vertical

- Buy put ITM, sell put OTM

- Probability of profit around 50%

Anton Kulikov, BS

Put Diagonal

anton@tastytrade.com - Short front month OTM put, long

Mike Hart, MBA back month ATM put

mike@tastytrade.com - Probability of profit less than 50%

Michael Rechenthin, PhD

You might also like

- Make Your Family Rich: Why to Replace Retirement Planning with Succession PlanningFrom EverandMake Your Family Rich: Why to Replace Retirement Planning with Succession PlanningNo ratings yet

- Derivatives SnapshotDocument1 pageDerivatives SnapshotkeyulbohraNo ratings yet

- The Long and Short Of Hedge Funds: A Complete Guide to Hedge Fund Evaluation and InvestingFrom EverandThe Long and Short Of Hedge Funds: A Complete Guide to Hedge Fund Evaluation and InvestingNo ratings yet

- Index Investment and Exchange Traded FundsDocument39 pagesIndex Investment and Exchange Traded FundsEint PhooNo ratings yet

- Market Manipulation in the VIX. Are illiquid options regularly used to manipulate the cash settlement?From EverandMarket Manipulation in the VIX. Are illiquid options regularly used to manipulate the cash settlement?No ratings yet

- Stocks With Potential Movement 3-Month Correlations of Popular SymbolsDocument5 pagesStocks With Potential Movement 3-Month Correlations of Popular SymbolsRajeshbhai vaghaniNo ratings yet

- The Complete Options Trader: A Strategic Reference for Derivatives ProfitsFrom EverandThe Complete Options Trader: A Strategic Reference for Derivatives ProfitsNo ratings yet

- Adjusting Option Trades With Bill LaddDocument3 pagesAdjusting Option Trades With Bill LaddAndrew ChanNo ratings yet

- 2011oct17 Foundations Class OneDocument11 pages2011oct17 Foundations Class OneMario Javier PakgoizNo ratings yet

- Wiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Document2 pagesWiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Rushikesh Inamdar100% (1)

- 3 1 Gavin HolmesDocument38 pages3 1 Gavin HolmesjokoNo ratings yet

- The Profitability of Technical Trading Rules in US Futures Markets: A Data Snooping Free TestDocument36 pagesThe Profitability of Technical Trading Rules in US Futures Markets: A Data Snooping Free TestCodinasound CaNo ratings yet

- Scott BauerDocument18 pagesScott BauerCircuit MediaNo ratings yet

- 3 026 R7XX ManualDocument78 pages3 026 R7XX ManualroadiewebNo ratings yet

- Cottle BWBDocument68 pagesCottle BWBam13469679No ratings yet

- Get Your Free Covered Call CalculatorDocument5 pagesGet Your Free Covered Call CalculatorafaefNo ratings yet

- Sector Business Cycle AnalysisDocument9 pagesSector Business Cycle AnalysisGabriela Medrano100% (1)

- Proffesional Option TraderDocument15 pagesProffesional Option TraderNehang PandyaNo ratings yet

- A Primer On Hedge FundsDocument10 pagesA Primer On Hedge FundsOladipupo Mayowa PaulNo ratings yet

- Options 101 Get Trading With Options NPDocument47 pagesOptions 101 Get Trading With Options NPjoseluisvazquezNo ratings yet

- SMB - Options - Tribe - 8!20!2013 (Jeff Augen - Short Butterfly)Document8 pagesSMB - Options - Tribe - 8!20!2013 (Jeff Augen - Short Butterfly)Peter Guardian100% (4)

- Passive Activity Loss Audit Technique GuideDocument154 pagesPassive Activity Loss Audit Technique GuidePeter Ben EzraNo ratings yet

- Equity Collar StrategyDocument3 pagesEquity Collar StrategypkkothariNo ratings yet

- Thrive On ThrowingDocument7 pagesThrive On ThrowingEric DanielsNo ratings yet

- Greeks and Volatility SmileDocument51 pagesGreeks and Volatility SmilestanNo ratings yet

- Fodmap Eat This Not ThatDocument2 pagesFodmap Eat This Not ThatctoecekxvimwvwizjkNo ratings yet

- WyckoffDocument2 pagesWyckoffHafezan OmarNo ratings yet

- E-Mini Chart UpdateDocument3 pagesE-Mini Chart UpdateZerohedge100% (1)

- The Rock-Bearish-M3 Small Position Modifications Capital Reduction Corrected 4-22-13Document89 pagesThe Rock-Bearish-M3 Small Position Modifications Capital Reduction Corrected 4-22-13damienancoNo ratings yet

- Dragons and Bull by KrollDocument4 pagesDragons and Bull by KrollPatrick YongNo ratings yet

- Looking Under The Hood With Market Internals (Part 2) - Answer KeyDocument6 pagesLooking Under The Hood With Market Internals (Part 2) - Answer KeyCr HtNo ratings yet

- Strategy View Strategy Risk Reward Breakeven Profit, When Loss, WhenDocument2 pagesStrategy View Strategy Risk Reward Breakeven Profit, When Loss, Whensharath100% (1)

- DiagonalsDocument5 pagesDiagonalsLuis FerNo ratings yet

- Wycoff Course NotesDocument1 pageWycoff Course Notesraj78krNo ratings yet

- Bollinger Band Keltner Cheat SheetDocument2 pagesBollinger Band Keltner Cheat SheetMian Umar RafiqNo ratings yet

- Pub - Trading Index Options PDFDocument318 pagesPub - Trading Index Options PDF9510501537No ratings yet

- Institutional Buying Indicator PDFDocument4 pagesInstitutional Buying Indicator PDFBalajii RangarajuNo ratings yet

- Income On Demand Guide No 2Document9 pagesIncome On Demand Guide No 2ShamusORookeNo ratings yet

- Trade Adjustments Author Michael CatalicoDocument24 pagesTrade Adjustments Author Michael Catalicomaostojic56No ratings yet

- Putting Volatility To WorkDocument8 pagesPutting Volatility To WorkhotpariNo ratings yet

- Charles Cottle - Risk DoctorDocument6 pagesCharles Cottle - Risk Doctorrbgainous2199No ratings yet

- Which Shorts Are Informed?Document48 pagesWhich Shorts Are Informed?greg100% (1)

- Lecture 6 Auction TheoryDocument36 pagesLecture 6 Auction TheoryBri MinNo ratings yet

- 2017 04 Ebook Butterfly 4 3 2017 1 PDFDocument19 pages2017 04 Ebook Butterfly 4 3 2017 1 PDFGrbayern MunchenNo ratings yet

- Trading PsychologyDocument1 pageTrading PsychologyZafar ShaikhNo ratings yet

- Intermediate Guide To E-Mini Futures Contracts - Rollover Dates and Expiration - InvestopediaDocument5 pagesIntermediate Guide To E-Mini Futures Contracts - Rollover Dates and Expiration - Investopediarsumant1No ratings yet

- Ira Strategies 010615 Iwm Big LizardDocument7 pagesIra Strategies 010615 Iwm Big Lizardrbgainous2199No ratings yet

- 10 Skip The Dip Andrew A FaldeDocument137 pages10 Skip The Dip Andrew A FaldePrasad BandaruNo ratings yet

- The Forex Scalpers Community - Introductory PDF: House RulesDocument3 pagesThe Forex Scalpers Community - Introductory PDF: House Rulesarman mancesNo ratings yet

- Volatility DerivativesDocument21 pagesVolatility DerivativesjohamarNo ratings yet

- 11 SAMT Journal Spring 2017 PDFDocument57 pages11 SAMT Journal Spring 2017 PDFpatthai100% (1)

- Fisker Ocean Trim Comparison USDocument1 pageFisker Ocean Trim Comparison USMaria MeranoNo ratings yet

- Time Series MomentumDocument23 pagesTime Series MomentumpercysearchNo ratings yet

- Options Trade Evaluation Case StudyDocument7 pagesOptions Trade Evaluation Case Studyrbgainous2199No ratings yet

- CHAPTER 10 One and Two Bar Price PatternDocument21 pagesCHAPTER 10 One and Two Bar Price Patternnurul zulaikaNo ratings yet

- Why Iron Condors Are The Worst Option StrategyDocument5 pagesWhy Iron Condors Are The Worst Option StrategygargNo ratings yet

- Characteristics and Risks of Standardized OptionsDocument188 pagesCharacteristics and Risks of Standardized OptionsfinntheceltNo ratings yet

- Joe Ross - Spread Trading PDFDocument79 pagesJoe Ross - Spread Trading PDFRazvanCristian100% (1)

- How 1% Performance Improvements Led To Olympic GoldDocument5 pagesHow 1% Performance Improvements Led To Olympic GoldDavid Méndez0% (1)

- TM Pathways - Short - Path DescriptionsDocument1 pageTM Pathways - Short - Path DescriptionsCSNo ratings yet

- 23 03 21 Futures Cheat SheetDocument2 pages23 03 21 Futures Cheat SheetCSNo ratings yet

- Pathways: Base Camp Manager DutiesDocument44 pagesPathways: Base Camp Manager DutiesCSNo ratings yet

- Advanced TM Legacy ManualsDocument1 pageAdvanced TM Legacy ManualsCSNo ratings yet

- How To Build A Toastmasters ClubDocument20 pagesHow To Build A Toastmasters ClubCSNo ratings yet

- Table Topics - 2022 EditionDocument11 pagesTable Topics - 2022 EditionCSNo ratings yet

- Suddenly Hybrid - c09Document2 pagesSuddenly Hybrid - c09CSNo ratings yet

- Aim Worksheet: ContinueDocument1 pageAim Worksheet: ContinueCSNo ratings yet

- Critical Thinking ResourcesDocument1 pageCritical Thinking ResourcesCSNo ratings yet

- L0629 - Koerners Ultrarunning - BonusPDFDocument5 pagesL0629 - Koerners Ultrarunning - BonusPDFCSNo ratings yet

- Food & Nutrition For RunnersDocument13 pagesFood & Nutrition For RunnersCSNo ratings yet

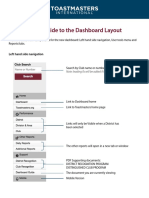

- TI Dashboard GuideDocument7 pagesTI Dashboard GuideCSNo ratings yet

- Topic:: Core Message: Catch Phrase (10 Words or Less) : Transition: 1. Hook: 2. Setup: 3. Main TakeawayDocument1 pageTopic:: Core Message: Catch Phrase (10 Words or Less) : Transition: 1. Hook: 2. Setup: 3. Main TakeawayCSNo ratings yet

- Condo ACT Changes 2017Document13 pagesCondo ACT Changes 2017CSNo ratings yet

- TABLE TOPICS - Inspriring QuotesDocument18 pagesTABLE TOPICS - Inspriring QuotesCSNo ratings yet

- 104 - TM Debate HandbookDocument18 pages104 - TM Debate HandbookCSNo ratings yet

- LL Hits & Miss Gen Eval FormDocument2 pagesLL Hits & Miss Gen Eval FormCSNo ratings yet

- Suddenly Hybrid - c12Document2 pagesSuddenly Hybrid - c12CSNo ratings yet

- Security-Checklist - AllThingsSecuredDocument5 pagesSecurity-Checklist - AllThingsSecuredCSNo ratings yet

- TM Club-Officer - Nomination Committee - Pre-Election TimelineDocument1 pageTM Club-Officer - Nomination Committee - Pre-Election TimelineCSNo ratings yet

- Ear N in G Season "Officially" BeginsDocument14 pagesEar N in G Season "Officially" BeginsCSNo ratings yet

- 21 10 26 Tastytrade ResearchDocument7 pages21 10 26 Tastytrade ResearchCSNo ratings yet

- Ear N in G Season So Far - 51% of Sym Bols Were Positive After The Lookingfor Alower Pricedgold?Document7 pagesEar N in G Season So Far - 51% of Sym Bols Were Positive After The Lookingfor Alower Pricedgold?CSNo ratings yet

- Pathways: Base Camp Manager DutiesDocument44 pagesPathways: Base Camp Manager DutiesCSNo ratings yet

- 21 12 14 Tastytrade ResearchDocument5 pages21 12 14 Tastytrade Researchpta123No ratings yet

- Bitoisnot Asuitablelongterm Investment - TheDocument6 pagesBitoisnot Asuitablelongterm Investment - TheCSNo ratings yet

- CH An Ges in IV. More Volat IleDocument6 pagesCH An Ges in IV. More Volat IleCSNo ratings yet

- 2112 LuckboxDocument70 pages2112 LuckboxCS100% (1)

- Fu T U R Es Sizes? We Got The Hook Up For You! Don't Trade Without Knowing The True Size! That SaidDocument5 pagesFu T U R Es Sizes? We Got The Hook Up For You! Don't Trade Without Knowing The True Size! That SaidCSNo ratings yet

- 21 11 16 Tastytrade ResearchDocument5 pages21 11 16 Tastytrade ResearchCSNo ratings yet

- Public and Private Management Compared. Escrito Por Hal G. Rainey & Young Han ChunDocument19 pagesPublic and Private Management Compared. Escrito Por Hal G. Rainey & Young Han ChunmceciliagomesNo ratings yet

- L.E.K. Consulting - Mock Exam 2019Document13 pagesL.E.K. Consulting - Mock Exam 2019Carlos Eduardo100% (1)

- Gantt ChartDocument22 pagesGantt ChartKanwal AliNo ratings yet

- Pampers Term ProjectDocument20 pagesPampers Term ProjectAbdul Razzak100% (1)

- Dutch Flower Cluster v2Document9 pagesDutch Flower Cluster v2gagafikNo ratings yet

- Analisis Penentuan Harga Jual Apartemen - CompressDocument14 pagesAnalisis Penentuan Harga Jual Apartemen - Compressriko andreanNo ratings yet

- Colgate PalmoliveDocument7 pagesColgate PalmoliveSai VasudevanNo ratings yet

- Bonus Shares, Right Shares PDFDocument30 pagesBonus Shares, Right Shares PDFNaga ChandraNo ratings yet

- Accounts Receivable and Inventory ManagementDocument54 pagesAccounts Receivable and Inventory Managementirma makharoblidzeNo ratings yet

- Customer Satisfaction On Marketing Mix of Lux SoapDocument14 pagesCustomer Satisfaction On Marketing Mix of Lux SoapJeffrin Smile JNo ratings yet

- Statement of Account: Pt. Stockbit Sekuritas DigitalDocument1 pageStatement of Account: Pt. Stockbit Sekuritas DigitalKelake LaotNo ratings yet

- Integrated Case 8-23 Financial ManagementDocument1 pageIntegrated Case 8-23 Financial ManagementMutia WardaniNo ratings yet

- Introduction: ExamplesDocument6 pagesIntroduction: ExamplesSadia Noor100% (1)

- Fuqua Casebook 2010 For Case Interview Practice - MasterTheCaseDocument112 pagesFuqua Casebook 2010 For Case Interview Practice - MasterTheCaseMasterTheCase.com100% (2)

- Principal Agent in BanksDocument13 pagesPrincipal Agent in BanksTomasz Szlazak100% (1)

- The Road Trip - 14.05.2016 - V2Document5 pagesThe Road Trip - 14.05.2016 - V2barkha raniNo ratings yet

- ECON 11 Activity 3Document2 pagesECON 11 Activity 3Kenzie AlmajedaNo ratings yet

- Money MarketDocument20 pagesMoney MarketThiên TrangNo ratings yet

- Mod 4 NotesDocument34 pagesMod 4 NotesMew MewNo ratings yet

- Case Study Report On Inventory Management at Amazon ComDocument25 pagesCase Study Report On Inventory Management at Amazon ComRohit NanwaniNo ratings yet

- Competing in The Global MarketplaceDocument10 pagesCompeting in The Global MarketplaceAdib NazimNo ratings yet

- Distribution Management Module 3Document58 pagesDistribution Management Module 3Adam Nicole Sta AnaNo ratings yet

- Managerial EconomicDocument79 pagesManagerial EconomicJagjit Kaur100% (2)

- Emotional BrandingDocument15 pagesEmotional BrandingAakash PareekNo ratings yet

- Digital Marketing Importance in The New Era: M.ShirishaDocument6 pagesDigital Marketing Importance in The New Era: M.ShirishaAfad KhanNo ratings yet

- Swing Trading ChecklistDocument1 pageSwing Trading ChecklistSanat Mishra50% (2)

- Chapter 6 Hedge Accounting IG (FINAL Draft)Document51 pagesChapter 6 Hedge Accounting IG (FINAL Draft)aNo ratings yet

- Advantages of Allocation of Sales TerritoriesDocument4 pagesAdvantages of Allocation of Sales TerritoriesManish AroraNo ratings yet

- PESTEL Analysis (External) : PoliticalDocument3 pagesPESTEL Analysis (External) : PoliticalWasif AzimNo ratings yet

- A Guide To Listing On The Victoria Falls Stock ExchangeDocument5 pagesA Guide To Listing On The Victoria Falls Stock Exchangetaps tichNo ratings yet