Professional Documents

Culture Documents

SOP For Field Visit

Uploaded by

Supaul Circle0 ratings0% found this document useful (0 votes)

32 views2 pagesOriginal Title

SOP for Field Visit

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views2 pagesSOP For Field Visit

Uploaded by

Supaul CircleCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

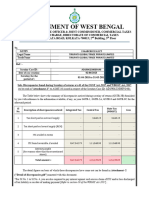

Post-Registration Field Visit

1. Taxpayer List for Field Visit:

List 1 = Tax payers who have filed GSTR-1 but not filed GSTR-3B in tax

period of April 2020 to December 2020 ( AS ON 31/8/21) with select

parameters.

List 2 = Tax payers with Registration Approval date between 01.04.2020 to

31.12.2020 with select parameters.

2. Days for field visit:-

Thursday , Friday and Saturday (3 days per week) starting from next week.

(Detail direction shall be communicated in the coming VC.)

3.Reporting Authority :- Additional Commissioner State Taxes (Admn)

4.Format for Report :-

{ To be sent to Div.Adnl comm.(admin) by circle and the Division wise report shall be sent by Div. Adnl.

comm.(admin) to HQ. in given format for follow up }

Name of the Division :-

Sl.No Name GSTIN Name of Commodity/sector Officer Date Whether Whether Any

. of the taxpayer name of business found other

circle Field premises found functional remarks

visit existent or not or

on given not(Yes/No)

address(Yes/No)

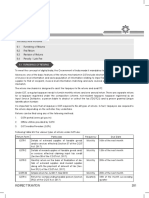

5. Procedure to be adopted:

GSTIN wise list 1 and 2 of identified tax payers is attached.

Circle-Incharge will allocate the field visit task through registration tab

->field visit-->allocate field visit tab in GSTBO.

Circle-Incharge will allocate the field visit task of one location to a particular

officer after proper desk work on location and route chart of place of

business premises.

The proper officer shall verify the registration particulars filed by the

taxable person in the GST BO. Verify the GSTR 3B returns, GSTR 2A and e-

Way Bill data, if any.

The proper officer shall identify the business place location /nearby

landmark by Road Maps / Google Map prior to field visit.

The proper officer shall plan field visit of the same area on the same day to

reduce time involved.

It is suggested to prepare a route plan for convenience.

The visit should be conducted between 10 am and 5 pm.

The proper officer shall talk to the tax payer / person in charge of the

business place regarding the activities of the business and upload detail as

required in REG-30.

Tax payers who are suspected to be not genuine, should be reported

immediately to the Circle- In charge for further necessary action as per Law.

Although utmost care has been taken in selection of taxpayers, even then if

there is any issue with regard to any tax payer in these 2 lists, please

intimate us.

Proper Officers are required to follow the procedures of Field visit as laid

down under the BGST Act and Rules along with subsequent Notification and

Circulars along with Departmental letter No.1213/2.7.2020.

****

You might also like

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- Record Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Document16 pagesRecord Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Sha dowNo ratings yet

- New Functionalities Compilation Aug 2022Document3 pagesNew Functionalities Compilation Aug 2022AmanNo ratings yet

- Unit 2 - Part III - Returns Under GST - 30!07!2021Document4 pagesUnit 2 - Part III - Returns Under GST - 30!07!2021Milan ChandaranaNo ratings yet

- Field Training Report 127411Document7 pagesField Training Report 127411deepak mauryaNo ratings yet

- Chapter 13 - Returns Under GSTDocument11 pagesChapter 13 - Returns Under GSTJay PawarNo ratings yet

- Chapter 11 GST ReturnsDocument18 pagesChapter 11 GST ReturnsDR. PREETI JINDALNo ratings yet

- SOP For ScrutinyDocument5 pagesSOP For Scrutinyacgstdiv4No ratings yet

- Bureau of Internal RevenueDocument3 pagesBureau of Internal RevenueReymund S BumanglagNo ratings yet

- Statement Outwrad SupplyDocument4 pagesStatement Outwrad SupplyTushar GoelNo ratings yet

- Rmo 5-2017Document12 pagesRmo 5-2017Romer LesondatoNo ratings yet

- Presentation 09.03.2017 CA - Shivani ShahDocument29 pagesPresentation 09.03.2017 CA - Shivani ShahPARESH KUVADIYANo ratings yet

- Faqs Form Gstr-3B About Form Gstr-3BDocument8 pagesFaqs Form Gstr-3B About Form Gstr-3BAsh WNo ratings yet

- GSTR 9 9A CA Mohit SinghalDocument61 pagesGSTR 9 9A CA Mohit SinghalRishav AnandNo ratings yet

- Advisory 2710 2Document20 pagesAdvisory 2710 2Pushpraj SinghNo ratings yet

- 28.01.2020, 1. v.D.N.sravanthi Madam, Asst. Commissioner (ST), Persons Liable To Registration, Compulsory Registration, ProcedureDocument52 pages28.01.2020, 1. v.D.N.sravanthi Madam, Asst. Commissioner (ST), Persons Liable To Registration, Compulsory Registration, ProcedureArchana LNo ratings yet

- GSTR ReturnDocument136 pagesGSTR Returnyoyorikee0% (1)

- TaxMarvel - Modifications in Form GSTR 3B and New Disclosure RequirementsDocument5 pagesTaxMarvel - Modifications in Form GSTR 3B and New Disclosure RequirementsAmit AgrawalNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- GST Automated NoticesDocument6 pagesGST Automated NoticesMaunik ParikhNo ratings yet

- DR - MGR E & RI - Chennai - 28.05.2021-1Document21 pagesDR - MGR E & RI - Chennai - 28.05.2021-1Sha dowNo ratings yet

- Latest Updation in GSTN PortalDocument47 pagesLatest Updation in GSTN PortalVenkat BalaNo ratings yet

- GST Return & FilingDocument14 pagesGST Return & Filingjibin samuelNo ratings yet

- Returns GSTDocument25 pagesReturns GSTRahul RockzzNo ratings yet

- GST Returns and FormsDocument46 pagesGST Returns and FormsSachin KhapareNo ratings yet

- Unit 5 GSTDocument3 pagesUnit 5 GSTNishu KatiyarNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Annual Return - Salem BranchDocument23 pagesAnnual Return - Salem BranchSureshkumarNo ratings yet

- Returns in Goods and Services Tax: Section 37-47 of CGST Act, 2017Document73 pagesReturns in Goods and Services Tax: Section 37-47 of CGST Act, 2017Nikhil PahariaNo ratings yet

- Cir 183 15 2022 CGSTDocument5 pagesCir 183 15 2022 CGSTAmritesh RaiNo ratings yet

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- New Presentation 2Document126 pagesNew Presentation 2prasadtanishquekumarNo ratings yet

- Chapter IX of CGST Act Read With CGST Rules, 2017 & Notifications PrescribedDocument26 pagesChapter IX of CGST Act Read With CGST Rules, 2017 & Notifications PrescribedManali PingaleNo ratings yet

- GST Reports ListsDocument8 pagesGST Reports Listsmandarjejurikar100% (1)

- Cir 170 02 2022 CGSTDocument7 pagesCir 170 02 2022 CGSTTushar AgrawalNo ratings yet

- Return Formats (Sahaj Return - FORM GST RET-2) (Quarterly) (Including Amendment)Document30 pagesReturn Formats (Sahaj Return - FORM GST RET-2) (Quarterly) (Including Amendment)ch7utiyapa9No ratings yet

- Do We Need A One Touch Report For The Below Form? If Yes, What Is The Format and Process Flow Should Be?Document1 pageDo We Need A One Touch Report For The Below Form? If Yes, What Is The Format and Process Flow Should Be?kumarzealNo ratings yet

- Do We Need A One Touch Report For The Below Form? If Yes, What Is The Format and Process Flow Should Be?Document1 pageDo We Need A One Touch Report For The Below Form? If Yes, What Is The Format and Process Flow Should Be?kumarzealNo ratings yet

- Do We Need A One Touch Report For The Below Form? If Yes, What Is The Format and Process Flow Should Be?Document1 pageDo We Need A One Touch Report For The Below Form? If Yes, What Is The Format and Process Flow Should Be?kumarzealNo ratings yet

- BLGF PPT On Coaches Training On The Enhanced BPLS (Revised)Document62 pagesBLGF PPT On Coaches Training On The Enhanced BPLS (Revised)DILG Manolo FortichNo ratings yet

- 2023721217646921CircularNo 1of2023-2024Document4 pages2023721217646921CircularNo 1of2023-2024krebs38No ratings yet

- New Functionalities Compilation September 2022Document3 pagesNew Functionalities Compilation September 2022Mayuri RaneNo ratings yet

- Eturns: This Chapter Will Equip You ToDocument52 pagesEturns: This Chapter Will Equip You ToShowkat MalikNo ratings yet

- Roll No C 17 Prakash Ochwanni Sem XDocument10 pagesRoll No C 17 Prakash Ochwanni Sem XPRAKASH OCHWANINo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Consolidation of BADocument12 pagesConsolidation of BAVikrant PathakNo ratings yet

- GST Return FilingDocument9 pagesGST Return FilingSanthosh K SNo ratings yet

- GST FormDocument16 pagesGST FormPruthiv RajNo ratings yet

- Circular 4 2019Document7 pagesCircular 4 2019Kartik Santhanam IyerNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- FCI - GST - Manual On Returns and PaymentsDocument30 pagesFCI - GST - Manual On Returns and PaymentsAmber ChaturvediNo ratings yet

- PPT-on-GST Annual-ReturnDocument33 pagesPPT-on-GST Annual-Returnshrutha p jainNo ratings yet

- SheetDocument1 pageSheetadjudicationagraNo ratings yet

- Forms in GSTDocument11 pagesForms in GSTsagayNo ratings yet

- Office of The Inland Revenue and Customs (South), Karachi: Director General AuditDocument14 pagesOffice of The Inland Revenue and Customs (South), Karachi: Director General AuditHamid AliNo ratings yet

- Withholding TaxesDocument29 pagesWithholding TaxesJoshua NotaNo ratings yet

- Indirect Tax Laws 1Document10 pagesIndirect Tax Laws 1GunjanNo ratings yet

- GST Pratical ApproachDocument20 pagesGST Pratical ApproachSanthoshNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Carlos Slay DocumentsDocument90 pagesCarlos Slay DocumentsPhil AmmannNo ratings yet

- Balatico v. RodriguezDocument5 pagesBalatico v. Rodriguezkim_santos_20No ratings yet

- GR No 108280-83 SisonDocument8 pagesGR No 108280-83 SisonJo ParagguaNo ratings yet

- 4 People V Dalisay 408 SCRA 375Document19 pages4 People V Dalisay 408 SCRA 375Angelina Villaver ReojaNo ratings yet

- Intestate Estate of Alexander Ty V CADocument8 pagesIntestate Estate of Alexander Ty V CAMp CasNo ratings yet

- United States v. Langel, 10th Cir. (2008)Document11 pagesUnited States v. Langel, 10th Cir. (2008)Scribd Government DocsNo ratings yet

- 1 Nollora V People GR NoDocument2 pages1 Nollora V People GR NoCamille Tapec100% (1)

- 70 - 154060 2008 PAO - v. - Sandiganbayan20210426 12 16wbrrtDocument6 pages70 - 154060 2008 PAO - v. - Sandiganbayan20210426 12 16wbrrtEulaNo ratings yet

- Research On Without Prejudice LetterDocument11 pagesResearch On Without Prejudice LetterevasopheaNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument15 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- 07 Mirando vs. Wellington Ty & Bros., Inc. (1978)Document12 pages07 Mirando vs. Wellington Ty & Bros., Inc. (1978)Nikko SilvaNo ratings yet

- IOS AssignmentDocument16 pagesIOS Assignmentuzair100% (1)

- In Re Emil Jurado (1995)Document8 pagesIn Re Emil Jurado (1995)UP LAW100% (3)

- Centrak Et. Al. v. EkahauDocument4 pagesCentrak Et. Al. v. EkahauPriorSmartNo ratings yet

- PATRAUCEANU-IFTIME v. ROMANIADocument11 pagesPATRAUCEANU-IFTIME v. ROMANIAMihai CeanNo ratings yet

- Public and Private Documents: SECTION74-78Document9 pagesPublic and Private Documents: SECTION74-78priyaNo ratings yet

- People v. Mogol (1984)Document19 pagesPeople v. Mogol (1984)cleofeabacahinNo ratings yet

- People Vs VasquezDocument1 pagePeople Vs VasquezCeledonio ManubagNo ratings yet

- Sample Motion To Compel Further Responses To Special Interrogatories For CaliforniaDocument4 pagesSample Motion To Compel Further Responses To Special Interrogatories For CaliforniaStan Burman60% (10)

- Memo: City Ethics CommissionsDocument25 pagesMemo: City Ethics CommissionsWVXU NewsNo ratings yet

- Eusebio vs. EusebioDocument5 pagesEusebio vs. EusebioRegion 6 MTCC Branch 3 Roxas City, CapizNo ratings yet

- Stat Con (Diaz) PDFDocument32 pagesStat Con (Diaz) PDFHazel ManuelNo ratings yet

- Samuel M. Alvarado v. Ayala Land, Inc.Document2 pagesSamuel M. Alvarado v. Ayala Land, Inc.MARIA KATHLYN DACUDAONo ratings yet

- 2019 (G.R. No. 217978, People V Ramirez)Document8 pages2019 (G.R. No. 217978, People V Ramirez)France SanchezNo ratings yet

- Chutkan Denies Trump Motion To RecuseDocument20 pagesChutkan Denies Trump Motion To RecuseBrett MeiselasNo ratings yet

- Noor Azahar Habin v. Rajaswari Sithampara Pillai & Anor. (1991) 3 CLJ Rep 339Document12 pagesNoor Azahar Habin v. Rajaswari Sithampara Pillai & Anor. (1991) 3 CLJ Rep 339merNo ratings yet

- 09-01-13 Samaan V Zernik (SC087400) Bank of America-Moldawsky Extortionist Second Supplemental Declaration-SDocument28 pages09-01-13 Samaan V Zernik (SC087400) Bank of America-Moldawsky Extortionist Second Supplemental Declaration-SHuman Rights Alert - NGO (RA)No ratings yet

- Blue ArgumentsDocument11 pagesBlue ArgumentsIlanieMalinisNo ratings yet

- N.V. Reederij Amsterdam vs. CIR DigestDocument1 pageN.V. Reederij Amsterdam vs. CIR DigestMitch AlleraNo ratings yet

- PLEADINGS - 2017 08 11 OS 20170006 Response To Motion To Dismiss 20170810 PDFDocument14 pagesPLEADINGS - 2017 08 11 OS 20170006 Response To Motion To Dismiss 20170810 PDFKristina CookNo ratings yet