Professional Documents

Culture Documents

HSN Code: Introduction of GST Floor

Uploaded by

VISHAL GUPTAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSN Code: Introduction of GST Floor

Uploaded by

VISHAL GUPTACopyright:

Available Formats

HSN code

India is a member of World Customs Organization (WCO) since 1971. It was originally using 6-

digit HSN codes to classify commodities for Customs and Central Excise. Later Customs and

Central Excise added two more digits to make the codes more precise, resulting in an 8 digit

classification. The purpose of HSN codes is to make GST systematic and globally accepted.

HSN codes will remove the need to upload the detailed description of the goods. This will save

time and make filing easier since GST returns are automated.

If a company has turnover up to ₹15 million (US$200,000) in the preceding financial year then

they did not mention the HSN code while supplying goods on invoices. If a company has turnover

more than ₹15 million (US$200,000) but up to ₹50 million (US$660,000), then they need to

mention the first two digits of HSN code while supplying goods on invoices. If turnover

crosses ₹50 million (US$660,000) then they shall mention the first 4 digits of HSN code on

invoices.

The newly-elected McGowan Government in WA had been relying upon a GST payment of 38

cents to the dollar to help return the state budget to surplus by 2019–20 financial year. Although

34 cents in the dollar was an improvement on the 2016–17 rate of approximately 30 cents in the

dollar, the reduction left the state with $241 million less than expected for the 2017–18 state

budget. State treasurer Ben Wyatt called the situation a "joke" and requested a top-up payment

of $226 million, claiming the state was "in the fourth year of what is effectively a domestic

recession". Then-federal treasurer Scott Morrison said he would consider the request for

additional payments. Government senator for WA Dean Smith also weighed in, calling HFE

"terminally diseased".[7]

However, Turnbull again stated that no floor would be introduced until WA's share had been

raised to between 70 and 75 cents to the dollar under the HFE system, [7][9] which was not

projected to occur for at least four years.[7] He added that no change could occur without the

agreement of other states and territories, [9][10] which Premier Mark McGowan claimed was false

given the CGC was a federal body.[9] Crossbench senator for Queensland Pauline Hanson said

she would be happy to support a reduction in Queensland's payments to improve WA's share,

but backtracked when asked to clarify her comments by the Queensland state government. [11]

The GST distribution was expected to become a political issue for the upcoming federal election,

which was due to be held in 2019. [12]

A review of the HFE system by the Productivity Commission was requested by Morrison in April

2017.[13] A draft copy of the report was released in October, recommending that WA's share rise

by $3.2–3.6 billion at the expense of all other state and territory shares. [14] This provoked a

vigorous reaction from South Australian Premier Steven Marshall, who said the state would not

support any change that would reduce South Australia's share. [15]

Morrison directed the Productivity Commission to undertake a second review of the HFE system

in May 2017.[16] Victoria made a submission to the Commission opposing any changes to the

distribution system.[17] The report was handed down in May 2018, and recommended that the

returns should be determined so as to allow for states to provide "a reasonable (rather than the

same) standard" of infrastructure and services.[18] However, the federal government decided to

use the payments made to Victoria and NSW as the benchmark for future payments, offering a

series of top-up payments to WA that would not come from the existing GST pool but from

federal revenue.[19]

Introduction of GST floor[edit]

The federal government announced its final model in July 2018. The plan, which began in 2019–

20, consisted of a floor of 70 cents per dollar in the financial year 2022–23, rising to 75 cents in

the dollar from 2024–25. The federal government would add additional federal funds to the GST

pool to smooth the transition through to 2026–27, to make a "no worse-off guarantee" that no

state or territory would have its share fall during this time. [12] The WA government called the plan

"compensation" for the state's previous low shares, and stated the new formula would ensure its

return to a budget surplus.[20]

At the 2019 federal election, the government campaigned on its GST solution in WA, as many of

the state's sixteen seats were under threat from the opposition. [21]

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Appendix ADocument29 pagesAppendix AUsmän Mïrżä11% (9)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SDG Primer Companion Textbook PDFDocument68 pagesSDG Primer Companion Textbook PDFAaron BareNo ratings yet

- Warcraft Takes Place Within The World ofDocument5 pagesWarcraft Takes Place Within The World ofVISHAL GUPTANo ratings yet

- SANGHARSH 2K22 Rule Book-1Document5 pagesSANGHARSH 2K22 Rule Book-1VISHAL GUPTANo ratings yet

- Russia Ukraine DataDocument7 pagesRussia Ukraine DataVISHAL GUPTANo ratings yet

- Russia Ukraine DetailsDocument5 pagesRussia Ukraine DetailsVISHAL GUPTANo ratings yet

- Case Analysis: Benetton S.p.A: Organization Structure and ProcessesDocument14 pagesCase Analysis: Benetton S.p.A: Organization Structure and ProcessesVISHAL GUPTANo ratings yet

- Russia Ukraine DetailsDocument4 pagesRussia Ukraine DetailsVISHAL GUPTANo ratings yet

- FINLATICS Pfizer Company ProfileDocument9 pagesFINLATICS Pfizer Company ProfileVISHAL GUPTANo ratings yet

- Glenmark Pharmaceuticals LTD.: General OverviewDocument6 pagesGlenmark Pharmaceuticals LTD.: General OverviewVISHAL GUPTANo ratings yet

- History: Goods and Services Tax (GST) Is AnDocument1 pageHistory: Goods and Services Tax (GST) Is AnVISHAL GUPTANo ratings yet

- Company 2: Aditya Birla Capital-Research Report: Sector 1: Banking and FinanceDocument6 pagesCompany 2: Aditya Birla Capital-Research Report: Sector 1: Banking and FinanceVISHAL GUPTANo ratings yet

- Word 3Document17 pagesWord 3VISHAL GUPTANo ratings yet

- Induction Program WorkingDocument11 pagesInduction Program WorkingVISHAL GUPTANo ratings yet

- Understanding What A CDP DoesDocument5 pagesUnderstanding What A CDP DoesVISHAL GUPTANo ratings yet

- Background: Goods and Services Tax (Australia)Document2 pagesBackground: Goods and Services Tax (Australia)VISHAL GUPTANo ratings yet

- Dissatisfaction With Payments Floor: OctroiDocument2 pagesDissatisfaction With Payments Floor: OctroiVISHAL GUPTANo ratings yet

- ImplementationDocument1 pageImplementationVISHAL GUPTANo ratings yet

- FormationDocument1 pageFormationVISHAL GUPTANo ratings yet

- History: Goods and Services Tax (GST) Is AnDocument1 pageHistory: Goods and Services Tax (GST) Is AnVISHAL GUPTANo ratings yet

- Local Governance: Party PoliticsDocument4 pagesLocal Governance: Party PoliticsVISHAL GUPTANo ratings yet

- ImplementationDocument1 pageImplementationVISHAL GUPTANo ratings yet

- Current Ruling Parties in The States and Union Territories of India (12) (6) (4) (2) Other Parties (,, ,, And)Document2 pagesCurrent Ruling Parties in The States and Union Territories of India (12) (6) (4) (2) Other Parties (,, ,, And)VISHAL GUPTANo ratings yet

- History India 1Document13 pagesHistory India 1VISHAL GUPTANo ratings yet

- Political Parties and AlliancesDocument2 pagesPolitical Parties and AlliancesVISHAL GUPTANo ratings yet

- Party Proliferation: Improve This SectionDocument1 pageParty Proliferation: Improve This SectionVISHAL GUPTANo ratings yet

- Politics of India Works Within The Framework of The Country'sDocument2 pagesPolitics of India Works Within The Framework of The Country'sVISHAL GUPTANo ratings yet

- History India 13 To 26Document14 pagesHistory India 13 To 26VISHAL GUPTANo ratings yet

- Letter of Intent For Financial AssistanceDocument9 pagesLetter of Intent For Financial AssistanceecsanjuanNo ratings yet

- Content/Elements of Business Plan: Mary Mildred P. de Jesus SHS TeacherDocument28 pagesContent/Elements of Business Plan: Mary Mildred P. de Jesus SHS TeacherMary De JesusNo ratings yet

- Trango Tech Digitalization Construction Report (Final)Document27 pagesTrango Tech Digitalization Construction Report (Final)Bilal KhanNo ratings yet

- Bay' Al-TawarruqDocument12 pagesBay' Al-TawarruqMahyuddin Khalid67% (3)

- Non Current Assets 2019ADocument4 pagesNon Current Assets 2019AKezy Mae GabatNo ratings yet

- Jetblue Airlines: (Success Story)Document23 pagesJetblue Airlines: (Success Story)Mantombi LekhuleniNo ratings yet

- Chapter 13Document26 pagesChapter 13YolandaNo ratings yet

- Architect / Contract Administrator's Instruction: Estimated Revised Contract PriceDocument6 pagesArchitect / Contract Administrator's Instruction: Estimated Revised Contract PriceAfiya PatersonNo ratings yet

- Quiz 7Document38 pagesQuiz 7nikhil gangwarNo ratings yet

- Template Tripartite AgreementDocument4 pagesTemplate Tripartite AgreementRami Reddy100% (1)

- Chapter 7: Internal Controls I: True/FalseDocument10 pagesChapter 7: Internal Controls I: True/FalseThảo NhiNo ratings yet

- AFM 131 Midterm 1 Prof. Bob Sproule Unknown YearDocument6 pagesAFM 131 Midterm 1 Prof. Bob Sproule Unknown YearGqn GanNo ratings yet

- Impots DifferesDocument174 pagesImpots DifferesomarlhNo ratings yet

- Expand/Collapsesd Expand/Collapse SD-BF Sd-Bf-AcDocument18 pagesExpand/Collapsesd Expand/Collapse SD-BF Sd-Bf-AcserradajaviNo ratings yet

- Introduction To Human Resource ManagementDocument5 pagesIntroduction To Human Resource ManagementJe SacdalNo ratings yet

- Indonesian Physician's CompetencyDocument34 pagesIndonesian Physician's CompetencyAdecha DotNo ratings yet

- APY 3202 PrelimAssignment2Document3 pagesAPY 3202 PrelimAssignment2JOANAFELIZ ROXASNo ratings yet

- EU Compendium of Spatial PlanningDocument176 pagesEU Compendium of Spatial PlanningVincent NadinNo ratings yet

- FINAL 07 Budget Speech - EngDocument81 pagesFINAL 07 Budget Speech - EngDefimediagroup LdmgNo ratings yet

- Coke Vs PepsiDocument3 pagesCoke Vs PepsiKanishk MendevellNo ratings yet

- To DoDocument3 pagesTo DoSolomon AttaNo ratings yet

- BUS 1102-1 Unit 1 Written AssignmentDocument3 pagesBUS 1102-1 Unit 1 Written AssignmentKG Yu WaiNo ratings yet

- MERCHANDISINGDocument74 pagesMERCHANDISINGKisha Nicole R. EnanoriaNo ratings yet

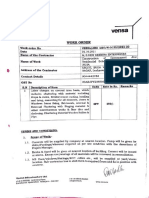

- Vensa WorkorderDocument9 pagesVensa WorkorderAshutosh Kumar DwivediNo ratings yet

- Principles in Halal PurchasingDocument15 pagesPrinciples in Halal PurchasingIvanPamuji100% (1)

- 00 +Resources+-+BlitzscalingDocument10 pages00 +Resources+-+BlitzscalingBruno DebonnetNo ratings yet

- Distribution Channel of United BiscuitsDocument5 pagesDistribution Channel of United BiscuitsPawan SharmaNo ratings yet

- Income and Substitution EffectsDocument1 pageIncome and Substitution EffectspenelopegerhardNo ratings yet