Professional Documents

Culture Documents

PPE Acquisition Methods

Uploaded by

Sharmin ReulaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PPE Acquisition Methods

Uploaded by

Sharmin ReulaCopyright:

Available Formats

CHARACTERISTICS OF PPE The cost of an item of PPE is the

a) Tangible assets – items of PPE have cash price equivalent at the

physical substance recognition date. If payment is

b) Used in normal operations – items of deferred beyond normal credit

PPE are used in the production or terms, the difference between the

supply of goods or services, for cash price equivalent and the total

rental, or for administrative purposes payment is recognized as interest

c) Long-term in nature – items of PPE over the period of credit unless such

are expected to be used from more interest is capitalized in accordance

than a year with PAS 23 Borrowing Costs.

Modes of Acquisition

RECOGNITION Cash Basis

The cost of an item of property, plant and On Account

equipment shall be recognized as an asset Installment Basis

only if: Issuance of share capital

a) it is probable that future economic Issuance of Bonds payable

benefits associated with the item will Exchange

flow to the entity; and Donation

b) the cost of the item can be Grants

measured reliably. Construction

1. CASH BASIS

INITIAL MEASUREMENTS Cost of asset acquired on cash basis

An item of PPE is initially measured is the cash price equivalent at the

at its cost. recognition date. It includes the

Elements of Cost cash paid plus directly

attributable cost and other cost

1. Purchase price, including non- necessary in bringing the asset to

refundable purchase taxes, after the location and condition for its

deducting trade discounts and intended use.

rebates. The acquisition cost of a group of

2. Costs directly attributable to bringing items of PPE acquired on a lump-

the asset to the location and sum price (basket price) is allocated

condition necessary for it to be to the individual assets based on

capable of operating in the manner their relative fair values at the date

intended by the management. of purchase.

3. Present value of decommissioning Example:

For Lump Sum

and restoration costs to the extent

Land and Building are acquired at a single

that they are recognized as

cost of P5,500,000. At the time of

obligation acquisition, the land has a fair value of

Cessation of capitalizing costs to P1,000,000 and the building, P4,000,000

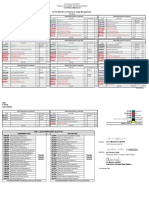

PPE FV Fraction Allocated Cost

Recognition of costs in the carrying Land 1,000,000 1/5 1,100,000

amount of an item of PPE ceases Bldg. 4,000,000 4/5 4,400,000

when the item is in the location and JOURNAL ENTRY

condition necessary for it to be Land 1,100,000

capable of operating in the manner Bldg. 4,400,000

intended by management. Cash 5,500,000

Measurement of Cost 2. ON ACCOUNT

Gross Method Net Method

o Acquisition Implied Interest rate: 10% PV ordinary

Equip 100,000 Equip 98,000 annuity: 2.487

A/P 100,000 A/P 98,000 To record acquisition

Machinery 597,400

Discount on N/P 102,600

o Payment within discount period N/P 600,000

A/P 100,000 A/P 98,000 Cash 100,000

Cash 98,000 Cash 98,000 (Machinery = DP + PV of N/P)

DP = 100,000

Equip 2,000 PV = (2.487 x 200,000) = 497,400

TOTAL 597,400

o Beyond the discount period EXAMPLE 3

A/P 100,000 A/P 98,000 To record 1st installment

N/P 200,000

PDL 2,000 PDL 2,000 Cash 200,000

Cash 100,000 Cash 100,000

Equip 2,000 To amortize the discount in N/P.

Interest Expense 49,740

3. INSTALLMENT BASIS

Discount on N/P 49,740

The cost on installment basis is the

CASH PRICE EQUIVALENT. YEAR PAYMENT INTEREST PRINCIPAL PV

If an asset is offered at CASH PRICE JAN 1 497,400

and at an INSTALLMENT PRICE and 1ST YR 200,000 49,740 150,260 347,140

is purchased at the installment price, 2ND 200,000 34,714 165,286 181,854

YR

the asset shall be recorded at the 3RD 200,000 18,146 181,854 -

CASH PRICE. YR

EXAMPLE 1

Installment price: 350,000 Exercise 1.1

Cash price: 290,000

Down payment: 50,000 Credulous Company purchased equipment

Balance payable in 3 equal annual on January 1, 2020 under the following

installments. terms:

To record acquisition

Machinery 290,000 a. P200,000 downpayment

Discount on N/P 60,000

N/P 300,000 b. Five annual payments of P100,000,

Cash 50,000 the first installment note to be paid

To record 1st installment on December 31, 2020.

N/P 100,000

Cash 100,000 The same equipment was available at a

To amortize the discount in N/P. cash price of P580,000.

Interest Expense 30,000

Discount on N/P 30,000 Required:

(300,000/600,000 x 60,000) Prepare journal entries

EXAMPLE 2 for 2020 and 2021.

Installment price: 700,000

Cash price: none

Exercise 2.2

Down payment: 100,000

Balance payable in 3 equal annual

installments.

On January 1, 2020, Illustration

Enrich Company The cash flows of the asset received do not

purchased a machine differ from the cash flows of asset

under the following terms: transferred.

Yee Zee

a. P100,000 downpayment

b. Four annual payments of P200,000, Equipment 800,000 1,000,000

the first installment note to be paid

on December 31, 2020. Accumulated 380,000 400,000

depreciation

The fair value of the machine is not clearly Carrying amount 420,000 600,000

determinable on the date of acquisition.

Fair value 450,000 500,000

The prevailing rate of interest for this type of

obligation is 10%. The present value factors Cash paid by Yee to 50,000 50,000

Zee

at 10% for four periods are:

Present value of 1 .683

Present value of ordinary annuity of 1

3.170 Books of Yee (Payor) 470,000

Equipment - new 380,000

Accumulated

Acquisition through exchange depreciation

o If the exchange has commercial Equipment- old 800,000

substance, the asset received from

the exchange is measured using the Cash 50,000

following order of priority:

Books of Zee

a. Fair value of asset Given up Plus (Recipient)

cash Paid/ minus cash received Equipment - new 550,000

b. Fair value of asset Received Accumulated 400,000

depreciation

c. Carrying amount of asset Given

Cash 50,000

up Plus cash Paid/ minus cash

received

Equipment - old 1,000,000

Acquisition through issuance of debt

instrument

Illustration

A building is acquired by issuing bonds

payable with face amount of P5,000,000.

At the time of acquisition, the fair value of

the building is P6,000,000 and the quoted

price of the bonds is P5,800,000.

Journal entry

The fair value of the bonds payable is

used.

Building The fair value of the share capital

5,800,000 is used:

Bonds Land (20,000 x 90)

payable 5,000,000 1,800,000

Share capital

Premium on bonds payable 1,000,000

800,000

Share premium

The fair value of the building is used. 800,000

The par value of the share capital

Building 6,000,000 is used:

Land 1,000,000

Bonds payable Share capital

5,000,000 1,000,000

Acquisition by donation

Items of PPE received as donation are

Premium on bonds payable measured at fair value and accounted for

1,000,000 as:

The face amount of the bonds payable is a. Income – if the donor is an

used. unrelated party.

b. Donated capital – if the donor is an

Building 5,000,000 owner (shareholder).

Bonds payable c. Government grant, in accordance

5,000,000 with PAS 20 Accounting for

Acquisition through issuance of own Government Grants and Disclosure

equity instrument of Government Assistance.

Illustration Accounting

A piece of land is acquired by issuing d. (see Chapter 17) – if the donor is

20,000 shares with par value of P50. At the the government.

time of acquisition, the fair value of the land Cost of self-constructed Building (Plant)

is P1,600,000 and the share is quoted at 1. Materials, labor, and overhead costs

P90 per share. incurred during construction.

Journal entry' to record the acquisition 2. Architectural costs, supervision costs,

The fair value of the land is used. and costs of building permit

Land 1,600,000 3. Excavation costs

Share capital 4. Insurance costs and safety inspection

(20,000 x P50) 1,000,000 fees

Share 5. Costs of temporary structures built

premium 600,000 during construction

6. Interest on borrowings made to finance

construction (Borrowing costs are

discussed in Chapter 18)

Cost of self-constructed Building –

continuation

The following costs are not included in the

cost of a self-constructed building:

1. Internal profits or savings on self-

construction

2. Cost of abnormal amounts of wasted

material, labor, or other resources due

to inefficiencies

3. Costs of uninsured hazards or claims

for uninsured accidents

Costs of private driveways, walks,

permanent fences, parking lots, and

drainages and water systems that are not

included in the building’s blueprint

You might also like

- Financial Asset at Fair Value ModuleDocument5 pagesFinancial Asset at Fair Value ModuleNorfaidah Didato GogoNo ratings yet

- Pas 16 Property, Plant and EquipmentDocument7 pagesPas 16 Property, Plant and EquipmentElaiza Jane CruzNo ratings yet

- 6905 - Land, Building and MachineryDocument2 pages6905 - Land, Building and MachineryAljur SalamedaNo ratings yet

- Accounting 102 Intermediate Accounting Depreciation QuizDocument6 pagesAccounting 102 Intermediate Accounting Depreciation QuizApril Mae Intong TapdasanNo ratings yet

- Reclassification: of Financial AssetsDocument15 pagesReclassification: of Financial AssetsHazel Jane EsclamadaNo ratings yet

- Property, Plant and Equipment (PAS 16)Document10 pagesProperty, Plant and Equipment (PAS 16)VIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- Midterms Conceptual Framework and Accounting StandardsDocument9 pagesMidterms Conceptual Framework and Accounting StandardsMay Anne MenesesNo ratings yet

- Chapter 17 Depletion of Mineral Resources ProblemsDocument3 pagesChapter 17 Depletion of Mineral Resources ProblemsMahasia MANDIGANNo ratings yet

- PPE Asset Accounting GuideDocument5 pagesPPE Asset Accounting GuideWertdie stanNo ratings yet

- Chapter 15 Ppe Part 1Document28 pagesChapter 15 Ppe Part 1marianNo ratings yet

- Investment PropertyDocument3 pagesInvestment PropertyacyNo ratings yet

- Shareholder's Equity: ReviewDocument12 pagesShareholder's Equity: ReviewG7 HexagonNo ratings yet

- APC 403 PFRS For SEs (Section 1-2)Document3 pagesAPC 403 PFRS For SEs (Section 1-2)AnnSareineMamadesNo ratings yet

- Investment Property Is Defined As Property (Land and Building of Part of A Building or Both) HeldDocument11 pagesInvestment Property Is Defined As Property (Land and Building of Part of A Building or Both) HeldRNo ratings yet

- Lecture Notes On Trade and Other ReceivablesDocument5 pagesLecture Notes On Trade and Other Receivablesjudel ArielNo ratings yet

- Since 1977Document4 pagesSince 1977Edmark LuspeNo ratings yet

- Depreciated Separately.: Property, Plant and EquipmentDocument5 pagesDepreciated Separately.: Property, Plant and EquipmentEmma Mariz GarciaNo ratings yet

- FAR.2906 - PPE-Depreciation and Derecognition.Document4 pagesFAR.2906 - PPE-Depreciation and Derecognition.John Nathan KinglyNo ratings yet

- Effective Interest AmortizationDocument25 pagesEffective Interest AmortizationSheila Grace BajaNo ratings yet

- Chapter 28: Depletion Pfrs/Ifrs 6: Financial Reporting For The Exploration and Evaluation of Mineral ResourcesDocument3 pagesChapter 28: Depletion Pfrs/Ifrs 6: Financial Reporting For The Exploration and Evaluation of Mineral ResourcesKaryl FailmaNo ratings yet

- Modul E: Review of Accounting ProcessDocument23 pagesModul E: Review of Accounting ProcessAlijah MercadoNo ratings yet

- Studet Practical Accounting Ch17 PPE AcquisitionDocument16 pagesStudet Practical Accounting Ch17 PPE Acquisitionsabina del monteNo ratings yet

- The Common Forms of Debt Restructuring: Asset SwapDocument5 pagesThe Common Forms of Debt Restructuring: Asset SwapJonathan VidarNo ratings yet

- Chapter 9 InvestmentsDocument18 pagesChapter 9 InvestmentsChristian Jade Lumasag NavaNo ratings yet

- Loans and Receivables ReportingDocument10 pagesLoans and Receivables ReportingElaineJrV-IgotNo ratings yet

- IAS 40 - Investment PropertyDocument16 pagesIAS 40 - Investment Propertywakemeup143No ratings yet

- Audit of LiabilitiesDocument12 pagesAudit of LiabilitiesAcier KozukiNo ratings yet

- Overview of Auditing ProfessionDocument23 pagesOverview of Auditing ProfessionLiam ArmendrudNo ratings yet

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity SecuritiesElaineJrV-IgotNo ratings yet

- Quiz 4 - Unit 4 - Investment in Equity Securities Quiz InstructionsDocument22 pagesQuiz 4 - Unit 4 - Investment in Equity Securities Quiz InstructionsCharmaine Mari OlmosNo ratings yet

- f06 136A1 FinalrevisedDocument16 pagesf06 136A1 FinalrevisedMitz ArzadonNo ratings yet

- AUDIT OF LIABILITIESDocument46 pagesAUDIT OF LIABILITIESDan Andrei BongoNo ratings yet

- Non-Current Asset Held For SaleDocument28 pagesNon-Current Asset Held For SaleTrisha Mae AlburoNo ratings yet

- PRACTICE EXERCISES INTANGIBLES Students 2021Document3 pagesPRACTICE EXERCISES INTANGIBLES Students 2021Nicole Anne Santiago SibuloNo ratings yet

- Lecture 3 Provisions - Contingent Liabilities and Contingent AssetsDocument23 pagesLecture 3 Provisions - Contingent Liabilities and Contingent AssetsBrenden KapoNo ratings yet

- Module 5 Property Plant EquipmentDocument16 pagesModule 5 Property Plant EquipmentTrine De LeonNo ratings yet

- Vallix QuestionnairesDocument14 pagesVallix QuestionnairesKathleen LucasNo ratings yet

- SIC InterpretationsDocument42 pagesSIC InterpretationsJean Fajardo Badillo100% (1)

- AC1203 Chapter 1 Cluster 1Document23 pagesAC1203 Chapter 1 Cluster 1Armyl Raul CanadaNo ratings yet

- Solved Stan Rented An Office Building To Clay For 3 000 PerDocument1 pageSolved Stan Rented An Office Building To Clay For 3 000 PerAnbu jaromiaNo ratings yet

- FS Overview: Cash and Cash EquivalentsDocument14 pagesFS Overview: Cash and Cash EquivalentsRommel estrellado100% (1)

- Using Accounting Information in DecisionDocument15 pagesUsing Accounting Information in DecisionMarj AgustinNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document7 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)rain06021992No ratings yet

- Cost Concept, Terminologies and BehaviorDocument8 pagesCost Concept, Terminologies and BehaviorANDREA NICOLE DE LEONNo ratings yet

- CH 6 (WWW - Jamaa Bzu - Com)Document8 pagesCH 6 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (2)

- Investment Property: Investment Property Is Defined As Property (Land or Building or Part of A Building or Both) HeldDocument7 pagesInvestment Property: Investment Property Is Defined As Property (Land or Building or Part of A Building or Both) HeldMark Anthony SivaNo ratings yet

- Calculating construction contract revenue and costsDocument8 pagesCalculating construction contract revenue and costsCeline Marie AntonioNo ratings yet

- Absorption Costing Vs Variable CostingDocument20 pagesAbsorption Costing Vs Variable CostingMa. Alene MagdaraogNo ratings yet

- E. Biological AssetsDocument1 pageE. Biological AssetsDerick Ocampo FulgencioNo ratings yet

- Take Home QuizDocument4 pagesTake Home QuizFrank Jey PamintuanNo ratings yet

- Chapter 5: The Expenditure Cycle Part 1: Purchases and Cash Disbursements ProceduresDocument7 pagesChapter 5: The Expenditure Cycle Part 1: Purchases and Cash Disbursements ProceduresAstxilNo ratings yet

- Inventory Estimation MethodsDocument14 pagesInventory Estimation Methodskrisha milloNo ratings yet

- Reviewer in InventoriesDocument2 pagesReviewer in InventoriesNicole AutrizNo ratings yet

- SEO-Optimized title for mixed cost separation documentDocument10 pagesSEO-Optimized title for mixed cost separation documentVincent AbellaNo ratings yet

- Debt RestructuringDocument4 pagesDebt RestructuringAra BellaNo ratings yet

- Cash Price Equivalent at The Deferred Beyond Normal CreditDocument5 pagesCash Price Equivalent at The Deferred Beyond Normal CreditSharmin ReulaNo ratings yet

- PAS16Document62 pagesPAS16Sel BarrantesNo ratings yet

- IA1-Continuation PPEDocument13 pagesIA1-Continuation PPEJhunnie LoriaNo ratings yet

- PPE_1Document12 pagesPPE_1Jerome_JadeNo ratings yet

- Filipino Traits and Weaknesses Explored in SEO-Optimized TitleDocument2 pagesFilipino Traits and Weaknesses Explored in SEO-Optimized TitleSharmin ReulaNo ratings yet

- Typhoon and TempestDocument3 pagesTyphoon and TempestSharmin ReulaNo ratings yet

- Asynchronous Task (04.21.22)Document1 pageAsynchronous Task (04.21.22)Sharmin ReulaNo ratings yet

- Worksheet For Pre-Colonial PhilippinesDocument5 pagesWorksheet For Pre-Colonial PhilippinesSharmin Reula50% (2)

- Final ActivityDocument1 pageFinal ActivitySharmin ReulaNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasCharise PerezNo ratings yet

- Problems DepletionDocument21 pagesProblems DepletionSharmin ReulaNo ratings yet

- Filipino Traits and Weaknesses Explored in SEO-Optimized TitleDocument2 pagesFilipino Traits and Weaknesses Explored in SEO-Optimized TitleSharmin ReulaNo ratings yet

- Juan de Plasencia Customs of The Tagalogs PDFDocument15 pagesJuan de Plasencia Customs of The Tagalogs PDFNiño Robin Mar PericoNo ratings yet

- Ge 2 - Readings in Philippine History: Module No: 1 Module Title: Taxation Topic: NO. 9 WriterDocument10 pagesGe 2 - Readings in Philippine History: Module No: 1 Module Title: Taxation Topic: NO. 9 WriterSharmin ReulaNo ratings yet

- LEADERSHIPDocument3 pagesLEADERSHIPSharmin ReulaNo ratings yet

- Topic 1 - Activity 2 (APPLICATION)Document2 pagesTopic 1 - Activity 2 (APPLICATION)Sharmin ReulaNo ratings yet

- Worksheet Pigafetta and PlasenciaDocument3 pagesWorksheet Pigafetta and PlasenciaSharmin ReulaNo ratings yet

- REVALUATIONDocument7 pagesREVALUATIONSharmin ReulaNo ratings yet

- Deferred AnnuityDocument2 pagesDeferred AnnuitySharmin Reula0% (1)

- Preliminary Exam: Module 2: National Situation and Social AnalysisDocument3 pagesPreliminary Exam: Module 2: National Situation and Social AnalysisSharmin ReulaNo ratings yet

- Benta UpdateDocument1 pageBenta UpdateSharmin ReulaNo ratings yet

- Topic 2 (Compound Interest)Document2 pagesTopic 2 (Compound Interest)Sharmin ReulaNo ratings yet

- Worksheet For Primary vs. Secondary Sources On Tejeros Convention (1897)Document6 pagesWorksheet For Primary vs. Secondary Sources On Tejeros Convention (1897)Sharmin Reula75% (4)

- Overview of The Training ProcessDocument28 pagesOverview of The Training ProcessSharmin ReulaNo ratings yet

- #NAME? Name Not Recognized: Mispelled FunctionDocument8 pages#NAME? Name Not Recognized: Mispelled FunctionSharmin ReulaNo ratings yet

- Excel Logical Functions: Guide To Topics: For A Result That... ... Is A Logical Value (True or False) UseDocument33 pagesExcel Logical Functions: Guide To Topics: For A Result That... ... Is A Logical Value (True or False) UserajNo ratings yet

- Concept MapDocument5 pagesConcept MapSharmin ReulaNo ratings yet

- Parallelism With The Actual Philippine Situation: (Individual Activity)Document3 pagesParallelism With The Actual Philippine Situation: (Individual Activity)Sharmin ReulaNo ratings yet

- Analysis: Actual Time Approximate Time May June JulyDocument4 pagesAnalysis: Actual Time Approximate Time May June JulySharmin Reula100% (1)

- Relative Absolute PracticeDocument4 pagesRelative Absolute PracticeLouie de la TorreNo ratings yet

- Worksheet No.1 (02/03/22)Document3 pagesWorksheet No.1 (02/03/22)Sharmin ReulaNo ratings yet

- #NAME? Name Not Recognized: Mispelled FunctionDocument8 pages#NAME? Name Not Recognized: Mispelled FunctionSharmin ReulaNo ratings yet

- First: Last DOB Age SegmentDocument5 pagesFirst: Last DOB Age SegmentSharmin ReulaNo ratings yet

- Book Sales by Genre 2016-2020Document7 pagesBook Sales by Genre 2016-2020Sharmin ReulaNo ratings yet

- Essentials of The Oil & Gas Industry - Course OutlineDocument2 pagesEssentials of The Oil & Gas Industry - Course OutlineLevantine TrainingCentreNo ratings yet

- Week 1 Business Math 1Document12 pagesWeek 1 Business Math 1Marissa Corral MatabiaNo ratings yet

- Max Life Insurance Company LimitedDocument8 pagesMax Life Insurance Company LimitedVaibhav ShirodkarNo ratings yet

- Standard Form of Contract For Engg Consultancy Services (Lump Sum Assignment)Document45 pagesStandard Form of Contract For Engg Consultancy Services (Lump Sum Assignment)euthan100% (3)

- Business Excellence Model in Indian Context: A Select Study: Sushil Kumar AgrawalDocument13 pagesBusiness Excellence Model in Indian Context: A Select Study: Sushil Kumar Agrawaldebo001No ratings yet

- CV SummaryDocument3 pagesCV SummaryNaseer AhmedNo ratings yet

- Stock Trading Mastery - Explainer PDFDocument19 pagesStock Trading Mastery - Explainer PDFAG ShayariNo ratings yet

- SuzlonDocument4 pagesSuzlonsiva157No ratings yet

- BarcelonaDocument15 pagesBarcelonaSyed Quasain Ali NaqviNo ratings yet

- De La Salle University Course Checklist for Bachelor of Science in Legal ManagementDocument2 pagesDe La Salle University Course Checklist for Bachelor of Science in Legal ManagementGil ChanNo ratings yet

- The Complete Rebar Solution: Applied Systems Associates, IncDocument4 pagesThe Complete Rebar Solution: Applied Systems Associates, Inckyaw myo ooNo ratings yet

- Back Office Employee Data (GORO)Document15 pagesBack Office Employee Data (GORO)Muhamad HafizNo ratings yet

- LEAP Standard Operating Procedures ManualDocument72 pagesLEAP Standard Operating Procedures Manualsumit.aryan100% (1)

- Customer Analytics CoverageDocument296 pagesCustomer Analytics CoverageClaudine NaturalNo ratings yet

- How To Procure DPINDocument2 pagesHow To Procure DPINCorproNo ratings yet

- Volume and Pricing Ramp Up FormDocument3 pagesVolume and Pricing Ramp Up FormDEVIKA PHULENo ratings yet

- NIST Cybersecurity Framework Policy Template Guide V2111onlineDocument13 pagesNIST Cybersecurity Framework Policy Template Guide V2111onlineSomashekar DharnappagoudarNo ratings yet

- JaguarDocument7 pagesJaguarPurab MohapatraNo ratings yet

- Citi TTS Seminar BASEL III Intraday LiquidityDocument13 pagesCiti TTS Seminar BASEL III Intraday LiquidityCezara EminescuNo ratings yet

- Business Plan SampleDocument11 pagesBusiness Plan SampleChristian Alejandrino100% (1)

- Sideqik Ebook The 21st Century Social Circle 10 2021Document7 pagesSideqik Ebook The 21st Century Social Circle 10 2021Evgenia Jenia BrukNo ratings yet

- 2023 15 11 18 42 18 Statement - 1700053937963Document32 pages2023 15 11 18 42 18 Statement - 1700053937963Anand RajNo ratings yet

- EDP Audit MCQsDocument3 pagesEDP Audit MCQsSaria Waqas0% (1)

- AMBIZ - Official INSPIRE Booklet 2023 PDFDocument13 pagesAMBIZ - Official INSPIRE Booklet 2023 PDFsalsabilaNo ratings yet

- Interpretation Note On ES CategorizationDocument10 pagesInterpretation Note On ES CategorizationMahdi PutraNo ratings yet

- PIP Policy & Process - TemplateDocument4 pagesPIP Policy & Process - TemplateAmita Wahi100% (1)

- Wica Guide 2020Document40 pagesWica Guide 2020Arthur LimNo ratings yet

- Installment Payment AgreementDocument1 pageInstallment Payment AgreementBaisy VillanozaNo ratings yet

- Framework for Internal Control Systems in Banking OrganisationsDocument34 pagesFramework for Internal Control Systems in Banking OrganisationsLovelyn AtienzaNo ratings yet

- EW Ch3 Case Audit Planning MemoDocument7 pagesEW Ch3 Case Audit Planning MemoNursalihah Binti Md NorNo ratings yet