Professional Documents

Culture Documents

Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return

Uploaded by

Keller Brown JnrOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return

Uploaded by

Keller Brown JnrCopyright:

Available Formats

NYS-45 (1/19) Quarterly Combined Withholding, Wage Reporting,

And Unemployment Insurance Return 41919415

Reference these numbers in all correspondence:

Mark an X in only one box to indicate the quarter (a separate

return must be completed for each quarter) and enter the year.

UI Employer

registration number 6605367 3 1 2 3 4 Y Y For office use only

Jan 1 - Apr 1 - July 1 - Oct 1 - Postmark

Mar 31 Jun 30 Sep 30 Dec 31 Year 19

Withholding

identification number 660536732

Are dependent health insurance benefits

Employer legal name: available to any employee? ...................... Yes No Received date

Juan Rivera, Esq. PC If seasonal employer, mark an X in the box .........

Number of employees a. First month b. Second month c. Third month

Enter the number of full-time and part-time covered UI AI SI WT

employees who worked during or received pay for SK SK

the week that includes the 12th day of each month.

Part A - Unemployment insurance (UI) information Part B - Withholding tax (WT) information

1. Total remuneration paid this 12. New York State

quarter ..............................

0 00 tax withheld .......................... 0 00

2. Remuneration paid this quarter 13. New York City

in excess of the UI wage base 0 0 00

since January 1 (see instr.)....... 00 tax withheld ..........................

3. Wages subject to contribution 14. Yonkers tax

(subtract line 2 from line 1) ......... 0 00 withheld ...............................

0 00

4. UI contributions due

Enter your 15. Total tax withheld

0 00

(add lines 12, 13, and 14) ............

0 00

UI rate %

5. Re-employment service fund 16. WT credit from previous

(multiply line 3 × .00075) ...............

0 00 quarter’s return (see instr.) .......

0 00

6. UI previously underpaid with 17. Form NYS-1 payments made

0 00 0 00

interest.................................. for quarter ............................

18. Total payments

7. Total of lines 4, 5, and 6 ............

0 00 (add lines 16 and 17) .................

0 00

19. Total WT amount due (if line 15

0 00 is greater than line 18, enter difference) ... 0 00

8. Enter UI previously overpaid......

20. Total WT overpaid (if line 18

9. Total UI amounts due (if line 7 is 0 00 is greater than line 15, enter difference 0 00

greater than line 8, enter difference) .... here and mark an X in 20a or 20b) *....

10. Total UI overpaid (if line 8 is

20b. Credit to next quarter

greater than line 7, enter difference 0 00 0a. Apply to outstanding

2 or

*

and mark box 11 below) ............. liabilities and/or refund ....... withholding tax ........

11. Apply to outstanding liabilities 21. Total payment due (add lines 9 and 19; make one

and/or refund .......................... remittance payable to NYS Employment Contributions

0 00

and Taxes) ...............................................................

* An overpayment of either UI contributions or withholding tax cannot be used to offset an amount due for the other.

Complete Parts D and E on back of form, if required.

Part C – Employee wage and withholding information

Quarterly employee/payee wage reporting and withholding information

(If more than five employees or if reporting other wages, do not make entries in this section; complete Form NYS-45-ATT.

Do not use negative numbers; see instructions.)

Total UI remuneration Gross federal wages or Total NYS, NYC, and

a Social Security number b Last name, first name, middle initial c

paid this quarter d

distribution (see instructions) e Yonkers tax withheld

Totals (column c must equal remuneration on line 1; see instructions for exceptions)

Sign your return: I certify that the information on this return and any attachments is to the best of my knowledge and belief true, correct, and complete.

Signature (see instructions) Signer’s name (please print) Title

Attorney

Date Telephone number

06-07-2021 872 212 6517

Withholding

identification number 660536732

41919422

Part D - Form NYS-1 corrections/additions

Use Part D only for corrections/additions for the quarter being reported in Part B of this return. To correct original withholding information

reported on Form(s) NYS-1, complete columns a, b, c, and d. To report additional withholding information not previously submitted on

Form(s) NYS-1, complete only columns c and d. Lines 12 through 15 on the front of this return must reflect these corrections/additions.

a b c d

Original Original Correct Correct

last payroll date reported total withheld last payroll date total withheld

on Form NYS-1, line A (mmdd) reported on Form NYS-1, line 4 (mmdd)

Part E - Change of business information

22. This line is not in use for this quarter.

23. If you permanently ceased paying wages, enter the date (mmddyy) of the final payroll (see Note below).........

24. If you sold or transferred all or part of your business:

• Mark an X to indicate whether in whole or in part

• Enter the date of transfer (mmddyy).................................................................................................................

• Complete the information below about the acquiring entity

Legal name EIN

Robert J Musso 660536732

Address

101 Chestnut St, Garden City, NY, 11530

Note: For questions about other changes to your withholding tax account, call the Tax Department at 518-485-6654; for your unemployment insurance

account, call the UI Employer Hotline at 1-888-899-8810. If you are using a paid preparer or a payroll service, the section below must be completed.

Preparer’s signature Date Preparer’s NYTPRIN Preparer’s SSN or PTIN NYTPRIN

Paid excl. code

preparer’s 06-07-2021 660536732 075 40 9530

use Preparer’s firm name (or yours, if self-employed) Address Firm’s EIN Telephone number

Juan Rivera, Esq. PC 26 Court St #2610, Brooklyn, NY 6605367-32 ( )

872 212-6517

Payroll service’s name Payroll

service’s

Juan Rivera, Esq. PC EIN 660536732

Checklist for mailing: Mail to:

• File original return and keep a copy for your records.

NYS EMPLOYMENT

• Complete lines 9 and 19 to ensure proper credit of payment.

• Enter your withholding ID number on your remittance. CONTRIBUTIONS AND TAXES

• Make remittance payable to NYS Employment Contributions and Taxes. PO BOX 4119

• Enter your telephone number in boxes below your signature. BINGHAMTON NY 13902-4119

• See Need help? on Form NYS-45-I if you need forms or assistance.

NYS-45 (1/19) (back)

You might also like

- UCard Drop GuideDocument4 pagesUCard Drop GuideOna MooreNo ratings yet

- Elektronik Vizesi: Türkiye CumhuriyetiDocument1 pageElektronik Vizesi: Türkiye CumhuriyetiKeller Brown Jnr100% (1)

- Statement For 2022-1Document2 pagesStatement For 2022-1Hengki Yono100% (1)

- DD Form 2789, Waiver - Remission of Indebtedness Application, 20140917 DraftDocument6 pagesDD Form 2789, Waiver - Remission of Indebtedness Application, 20140917 DraftKeller Brown JnrNo ratings yet

- Lease For NatalieDocument6 pagesLease For NatalieKeller Brown JnrNo ratings yet

- Accountable Plan - Excel TemplateDocument9 pagesAccountable Plan - Excel Templateelnara safronovaNo ratings yet

- Florida Department of Revenue Employer's Quarterly Report: Use To Complete This FormDocument3 pagesFlorida Department of Revenue Employer's Quarterly Report: Use To Complete This FormjackNo ratings yet

- 4th Quarter NYS-45 2014 PDFDocument2 pages4th Quarter NYS-45 2014 PDFMichael WalkerNo ratings yet

- Do Not Submit Photocopies of This Form: Kansas Fiduciary Income TaxDocument4 pagesDo Not Submit Photocopies of This Form: Kansas Fiduciary Income TaxArchibald BareassoleNo ratings yet

- State Tax FormDocument2 pagesState Tax FormSaintjinx21No ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsrj aNo ratings yet

- 10 1041sbDocument9 pages10 1041sbTham DangNo ratings yet

- 1601-C July For ApprovalDocument1 page1601-C July For ApprovalJa'maine ManguerraNo ratings yet

- Page 4 ItrDocument1 pagePage 4 ItrariannemungcalcpaNo ratings yet

- 2016 Ohio Schedule of Credits: Nonrefundable and RefundableDocument2 pages2016 Ohio Schedule of Credits: Nonrefundable and RefundablePNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument1 pageEFPS Home - EFiling and Payment SystemANTHONY CALDERONNo ratings yet

- Individuals (Self-Employed Persons) Annual Return of Income and Tax PayableDocument5 pagesIndividuals (Self-Employed Persons) Annual Return of Income and Tax PayableTahj BrownNo ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument2 pages1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationJa'maine ManguerraNo ratings yet

- 01.dcreative 1601c Jan2019 FinalDocument2 pages01.dcreative 1601c Jan2019 FinalChristopher John CarmenNo ratings yet

- VL Yap 1601-c August 2019 FormDocument1 pageVL Yap 1601-c August 2019 FormAnimeMusicCollectionBacolod0% (1)

- © The Institute of Chartered Accountants of India: ST STDocument6 pages© The Institute of Chartered Accountants of India: ST STVishal MehraNo ratings yet

- 1601C MarchDocument2 pages1601C Marchnaim indahiNo ratings yet

- Appendix I: Payroll AccountingDocument22 pagesAppendix I: Payroll AccountingDerian WijayaNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsRyan VillamorNo ratings yet

- Professional Tax Jan 2023 PDFDocument1 pageProfessional Tax Jan 2023 PDFRaghavendra GandodiNo ratings yet

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- Chapter 10 Review Updated 11th EdDocument15 pagesChapter 10 Review Updated 11th EdalmazwmbashiraNo ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 page1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationEljoe Vinluan0% (1)

- Jawaban Tabel MatkeuDocument4 pagesJawaban Tabel MatkeuIntan Nur PutriNo ratings yet

- F7.2 - Mock Test 2Document5 pagesF7.2 - Mock Test 2huusinh2402No ratings yet

- 1601C JanuaryDocument3 pages1601C JanuaryJoshua Honra0% (1)

- ESIC PF Contributions Holiday SheetDocument2 pagesESIC PF Contributions Holiday SheetdyutimanhazraNo ratings yet

- Tugas 2. Proses PencatatanDocument5 pagesTugas 2. Proses Pencatatantheresia betveneNo ratings yet

- CMA FormatDocument21 pagesCMA Formatapi-377123878% (9)

- Answer To The Question No. 1 (A) General JournalDocument16 pagesAnswer To The Question No. 1 (A) General JournalSurmaNo ratings yet

- Chapter 1 Exercise and SolutionsDocument6 pagesChapter 1 Exercise and SolutionsMariamNo ratings yet

- Income Taxes (Module 8)Document8 pagesIncome Taxes (Module 8)Paulo Emmanuel SantosNo ratings yet

- Accounting Information System: Section B6Document20 pagesAccounting Information System: Section B6Claire Mae AniñonNo ratings yet

- Mastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresDocument66 pagesMastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresClarine Kyla Bautista100% (1)

- Chapter 2 Assignment-Second Part-AccountDocument8 pagesChapter 2 Assignment-Second Part-AccountR and F Love ForeverNo ratings yet

- 1601C Sept 2019Document2 pages1601C Sept 2019Virnadette Lopez0% (1)

- Calc - Staff Housing Loan To Check Eligibility With Amortization Schedule and Tax BenefitDocument11 pagesCalc - Staff Housing Loan To Check Eligibility With Amortization Schedule and Tax BenefitDigesh ShahNo ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 page1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationNards SVNo ratings yet

- Proj - No.04. Salary July - 2023Document7 pagesProj - No.04. Salary July - 2023EENo ratings yet

- PLBC FY2022 AmendedDocument4 pagesPLBC FY2022 AmendedstillwinmsNo ratings yet

- Practice Problems CH 13Document11 pagesPractice Problems CH 13Samira PereziqNo ratings yet

- 1601C FebruaryDocument2 pages1601C Februarynaim indahiNo ratings yet

- US Internal Revenue Service: F5500si - 2003Document3 pagesUS Internal Revenue Service: F5500si - 2003IRSNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 137628670080121 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 137628670080121 Assessment Year: 2020-21Gana C RoverNo ratings yet

- MacysInc Q117 10QDocument38 pagesMacysInc Q117 10Q76132No ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement Sanoj Kumar Potdar Amounts in Rs. LacsDocument34 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement Sanoj Kumar Potdar Amounts in Rs. LacsRakesh YadavNo ratings yet

- BIR Form No. 2551MDocument1 pageBIR Form No. 2551MLorraine Steffany BanguisNo ratings yet

- 4 Worked ExamplesDocument28 pages4 Worked ExamplesJester LabanNo ratings yet

- Maman MagalDocument6 pagesMaman MagalmaheshkumarNo ratings yet

- NYS - 45 Fill inDocument2 pagesNYS - 45 Fill inSalameh LaurieNo ratings yet

- The Value Added Tax Act - Section 22Document4 pagesThe Value Added Tax Act - Section 22Лена КиселеваNo ratings yet

- Accountancy & Auditing-II-2017Document2 pagesAccountancy & Auditing-II-2017Mahnoor SaleemNo ratings yet

- The City of New York New York Reported The Following: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe City of New York New York Reported The Following: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- 2020 Form 1099-MISCDocument1 page2020 Form 1099-MISCKeller Brown JnrNo ratings yet

- Polisens Blanketter 442-4 EngelskaDocument3 pagesPolisens Blanketter 442-4 EngelskaKeller Brown JnrNo ratings yet

- Pay Stub - ROY STEPHENDocument6 pagesPay Stub - ROY STEPHENKeller Brown JnrNo ratings yet

- Irs Gov Forms-SignedDocument2 pagesIrs Gov Forms-SignedKeller Brown JnrNo ratings yet

- TSYS Bank Request Change Document-101Document1 pageTSYS Bank Request Change Document-101Keller Brown JnrNo ratings yet

- Military Live Document THAILAND LANGUAGE - JUNG SUNGHODocument7 pagesMilitary Live Document THAILAND LANGUAGE - JUNG SUNGHOKeller Brown JnrNo ratings yet

- Dd2656-Data For Payment of Retired PersonnelDocument8 pagesDd2656-Data For Payment of Retired PersonnelKeller Brown JnrNo ratings yet

- 위임장 최종 지불 편지Document1 page위임장 최종 지불 편지Keller Brown JnrNo ratings yet

- DD Form 108, Application For Retired Pay Benefits, July 2002Document2 pagesDD Form 108, Application For Retired Pay Benefits, July 2002Keller Brown JnrNo ratings yet

- Irs Letter - Balance DueDocument1 pageIrs Letter - Balance DueKeller Brown JnrNo ratings yet

- Moving-Goods Declaration FormDocument2 pagesMoving-Goods Declaration FormKeller Brown JnrNo ratings yet

- 위탁 상자 위임장Document1 page위탁 상자 위임장Keller Brown JnrNo ratings yet

- House Rental Agreement: Tenant Information Landlord InformationDocument3 pagesHouse Rental Agreement: Tenant Information Landlord InformationKeller Brown JnrNo ratings yet

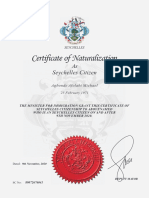

- SC No 89072676041 Agbonde Afolabi Michael 20-11-09 NaturalizationDocument1 pageSC No 89072676041 Agbonde Afolabi Michael 20-11-09 NaturalizationKeller Brown JnrNo ratings yet

- ChequeeeDocument1 pageChequeeeKeller Brown JnrNo ratings yet

- 14 424 Malaysia Employment NotesDocument7 pages14 424 Malaysia Employment NotesKeller Brown JnrNo ratings yet

- Field Attachment ReportDocument4 pagesField Attachment ReportCivilian De'Liverpool MamseraNo ratings yet

- JobPlanDocument2 pagesJobPlanHarrison KerrNo ratings yet

- Rusmini (30418011) Inggris 5Document6 pagesRusmini (30418011) Inggris 5NugiTariousNo ratings yet

- View FileDocument5 pagesView FileJason KirkpatrickNo ratings yet

- Base Builder - New Hire PaperworkDocument10 pagesBase Builder - New Hire Paperworkelhard shalloNo ratings yet

- M Fitra Rezeqi - 30418007 - D3TgDocument6 pagesM Fitra Rezeqi - 30418007 - D3TgNugi AshterNo ratings yet

- Pag Ibig Form H2 20022Document5 pagesPag Ibig Form H2 20022cLaire aLcaLaNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryRejmali GoodNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryBenevolent Care Program Association ,INc.No ratings yet

- MOF Suspension Letter TCF - J307415625Document2 pagesMOF Suspension Letter TCF - J307415625Thomas BarnettNo ratings yet

- W2 PreviewDocument1 pageW2 Previewmrs merle westonNo ratings yet

- CTDOL BRI Summary StatementDocument2 pagesCTDOL BRI Summary StatementmeNo ratings yet

- Job Fair Placement Registration FormDocument1 pageJob Fair Placement Registration FormNoble Gee100% (1)

- Comparing Social Security Benefits Background: Case StudyDocument2 pagesComparing Social Security Benefits Background: Case StudyAhmedNo ratings yet

- Social Security Administration Retirement, Survivors, and Disability InsuranceDocument12 pagesSocial Security Administration Retirement, Survivors, and Disability Insurancedsaer100% (1)

- Employee Information Form: Denotes Required FieldDocument1 pageEmployee Information Form: Denotes Required FieldAplus Recycling, LLCNo ratings yet

- Driver Privilege Card Checklist (RIDMV)Document2 pagesDriver Privilege Card Checklist (RIDMV)Frank MaradiagaNo ratings yet

- Portability Law Q and ADocument31 pagesPortability Law Q and AJacques Fern'zNo ratings yet

- FINE PRINT - Pay StubDocument3 pagesFINE PRINT - Pay StubJofred Collazo CarrilloNo ratings yet

- W2 Taco BellDocument3 pagesW2 Taco BellJuan Diego Velandia DuarteNo ratings yet

- Certificate of Employment and Compensation: Notary PublicDocument1 pageCertificate of Employment and Compensation: Notary PublicMARILYN DimaiwatNo ratings yet

- Fact Sheet For Workers Ages 18-48: Retirement Is Different For EveryoneDocument2 pagesFact Sheet For Workers Ages 18-48: Retirement Is Different For EveryoneBrandon BachNo ratings yet

- SSS R1a Form Blank ExcelDocument5 pagesSSS R1a Form Blank ExcelgilleNo ratings yet

- Non Filing Letter Sample Templates Updated 11.09.2020Document2 pagesNon Filing Letter Sample Templates Updated 11.09.2020SophieNo ratings yet

- Request For Withdrawal of ApplicationDocument2 pagesRequest For Withdrawal of ApplicationEgziabher Bin JoAnnNo ratings yet

- How Work Affects Your Benefits: SSA - GovDocument10 pagesHow Work Affects Your Benefits: SSA - GovalexNo ratings yet

- Member Registration FormDocument2 pagesMember Registration FormDAVIES KOFYANo ratings yet