Professional Documents

Culture Documents

MODULE 2: Introduction To Financial Management

Uploaded by

Jm JuanillasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MODULE 2: Introduction To Financial Management

Uploaded by

Jm JuanillasCopyright:

Available Formats

Universidad de Sta.

Isabel | Basic Education Department

MODULE 2: Introduction to Financial Management

I. OVERVIEW

Financial Management starts with a plan. This applies to both individuals and

companies. It is not enough to have cash and other resources today. Such resources, if

not managed properly, can be wiped out. Hence, financial management is a must.

From the perspective of a corporation, financial management deals with decisions

that are supposed to maximize the value of shareholders’ wealth. This means

maximizing the market value of the share of stocks. Shares of stocks represent the form

of ownership in a corporation.

II. TIME FRAME

You are given 4 days ( January 26-29, 2022) to complete this module. Every Friday is a

PRIME day. If you encounter difficulty along the way, do not hesitate to message me

through my email mpabico@usi.edu.ph or message me via my messenger Marga Garcia

Pabico every Tuesday and Thursday (―). This module should be returned on ―

January 31, 2022

III. STANDARDS

A. CONTENT STANDARD

The learner demonstrates an understanding of the definition of finance, the activities

of the financial manager, and financial institutions and markets.

B. PERFORMANCE STANDARD

The learner can define finance, describe are who responsible for financial

management within an organization, describe how the financial manager helps in

achieving the goal of the organization, and the role of financial institutions and

markets.

C. VALUE STANDARD

The learner can process from knowledge, analysis, evaluation, and application to

preparathe tion and development of financial plans and programs suited for a small

business to come up wh a sound jujudgmentnd decisions with integrity and honesty.

IV. LEARNING TARGETS

At the end of this module, you should be able to say, “I can…”

1. Explain the major role of financial management and the different individuals involve

2. Distinguish a financial institution from financial instrument and financial market

Module 2 | Business Finance | Third Quarter Page | 1

Universidad de Sta. Isabel | Basic Education Department

3. enumerate the varied financial institutions and their corresponding services

4. compare and contrast the varied financial instrument

V. INSTRUCTIONAL DESIGN

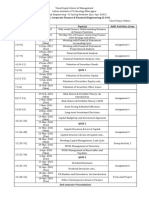

Day 1-2

1. Accomplish Worksheet 1: Answer the “ Self –Test Questions page 3 nos. 1-3

2. Refer to your Business Finance Book Read Chapter 1, Introduction to Financial

Management on pages 1-12 and answer the following questions provided on page 4

of this module.

3. List the important concepts you have learned from your readings.

Day 3-4

1. Accomplish Worksheet 3 found on page 4 of this module.

REFERENCES

1. Arthur S. Cayanan , Business Finance ,First Ed., Quezon City : Rex Publishing, Inc., 2017

2. Tugas , Florence. Business Finance, First ED, Quezon City, Vibal Group Inc, 2017

Module 2 | Business Finance | Third Quarter Page | 2

Universidad de Sta. Isabel | Basic Education Department

Name: Juliana Marie B. Juanillas Section: 12-ABM A

GRADED

Worksheet 1. : Answer the “ Self –Test “ Questions page 3/ or see last ppt

( Financial System ) nos. 1-5.

1. Why is it that the same company can be a saver and a user of funds?

2. What is the role of financial intermediaries in the financial system?

3. What is the role or function of the Philippine Stock Exchange in the financial system?

4. What are the differences between the Philippine Stock Exchange and the stock

brokerage firms?

5. How can you describe the role of tanks in the financial system?

Answer:

1. Because the purpose of financial intermediaries is to bring together those economic

actors who have surpluses. Finances willing to lend (invest) to those with a scarcity of

funds willing to borrow

2. It serves as a go-between for two parties in a financial transaction, such as a

commercial bank, investment bank, mutual fund, or pension fund. As we have seen,

financial intermediaries play an important role in the global economy today. They are

the "lubricants" that power the economy. Because of the rising complexity of financial

transactions, financial intermediaries must constantly reinvent themselves to meet the

different portfolios and demands of investors. Financial intermediaries are held

accountable to both borrowers and lenders. The word intermediate implies that these

institutions are critical to the functioning of the economy, and they, together with

monetary authorities, must guarantee that credit reaches the needy without risking

the interests of investors. This is one of the most significant issues they face.

3. The PSE brings together businesses that want to generate funds by issuing new

securities. Companies might have easier access to money by listing their shares on

the stock exchange. When a firm is already listed on the exchange, raising fresh

money through an additional public offering is easier and less expensive. As a result,

the PSE plays an important role in the financing of productive firms, which use the

money to expand and create new employment. As a result, it is critical to the

Philippine economy's growth. Furthermore, the PSE makes it easier to sell and

purchase issued stocks and warrants. It provides an appropriate market for the

trading of securities by people and organizations looking to invest their savings or

excess assets through the acquisition of securities. Aside from these tasks, the PSE

Module 2 | Business Finance | Third Quarter Page | 3

Universidad de Sta. Isabel | Basic Education Department

has committed to (a) defending the investing public's interests and (b) establishing

and maintaining an efficient, fair, orderly, and transparent market.

4. PSE is a private, non-profit, non-stock corporation established to offer and maintain a

fair, efficient, transparent, and orderly market for the buying and selling of securities

such as stocks, warrants, bonds, options, and other derivatives. A stock brokerage

business is a financial institution that helps buyers and sellers purchase and sell

financial securities. Brokerage businesses also service a clientele of investors who

trade public stocks and other assets, typically through the firm's agent stockbrokers.

5. Banks play a crucial function in the financial system as an intermediate, or go-

between. They serve three primary purposes:

A. Banks are venues where people may deposit their savings and earn interest on

them. People would have to store and preserve their funds individually if there were

no banks, which would pose significant dangers.

B. Banks are generally in charge of the payment system. People are using less cash,

so electronic payments are becoming more important. This implies that banks are

processing more card payments, transfers, direct debits, and other transactions daily.

C. Banks make loans to both individuals and businesses. Without banks, it would be

extremely difficult for individuals to purchase a home, establish a business, or for

corporations to make investments, to name a few examples. Banks also assist firms

with their (sometimes more sophisticated) financial requirements. This might include

the many methods for gaining access to a cap.

Module 2 | Business Finance | Third Quarter Page | 4

Universidad de Sta. Isabel | Basic Education Department

Name: Juliana Marie B. Juanillas Section: 12-ABM A

Worksheet 2.

Instruction: Refer to your Business Finance textbook. Read Chapter 1, Introduction to Financial

Management on pages 1-12 and answer the following questions.

1. Give at least three important reasons why the board of directors is the highest policy-making

body in the corporation?

The first is that they ensure the proper functioning of the company by collectively

detecting the company's affairs while meeting the appropriate interests of its

shareholders and relevant stakeholders.

They defined their strategic direction, mission, vision, and values.

They are also responsible for their investment, structure, and dividend policies.

2. How is a director elected in the board of directors?

-The persons who originally incorporate the business—typically the founders—appoint the

board of directors. Once shareholders vote, those members are either re-elected or

removed.

3. Identify the four important roles of a finance manager and explain each function briefly

The Four important roles of finance manager are:

Fund raising-Cash and liquidity are critical components of successful

company financing. The organization can raise funding using either stock

shares or debentures.

Allocation of the funds in the right place-The next big step is to properly

allocate the monies after they have been raised. Allocating monies is

once again the responsibility of a financial manager. When allocating

cash, the management should examine the company's size and growth

potential.

Profit and its planning-Aside from client happiness, the primary goal of

every firm is to make a profit. Profit provides a motive for the company to

stay in business and thrive.

Module 2 | Business Finance | Third Quarter Page | 5

Universidad de Sta. Isabel | Basic Education Department

Considering the capital market- The stock exchange market is constantly

trading shares, which entails significant risks. A financial manager must

be well-versed in the capital market in order to protect the organization

against such hazards.

Name: Juliana Marie B. Juanillas Section: 12-ABM A

Formative Assessment: Write your answer in your NoteBook

Worksheet 3. List the important concepts you have learned from your readings.

Module 2 | Business Finance | Third Quarter Page | 6

You might also like

- Financial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessFrom EverandFinancial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessNo ratings yet

- The Path to Successful Entrepreneurship: Essential Steps for Building a StartupFrom EverandThe Path to Successful Entrepreneurship: Essential Steps for Building a StartupNo ratings yet

- Montessori Professional College of Asia: Republic of The Philippines Department of EducationDocument34 pagesMontessori Professional College of Asia: Republic of The Philippines Department of EducationPaula RealcoNo ratings yet

- Business Finance: Basic Education Department Senior High School ABM SY 2023-2024Document28 pagesBusiness Finance: Basic Education Department Senior High School ABM SY 2023-2024LuWiz DiazNo ratings yet

- Business Finance-Module 1Document15 pagesBusiness Finance-Module 1Alex PrioloNo ratings yet

- Business Finance Module 1 Edited VersionDocument4 pagesBusiness Finance Module 1 Edited VersionMay ManongsongNo ratings yet

- College of Maasin Business Finance CourseDocument2 pagesCollege of Maasin Business Finance CourseClarence CaberoNo ratings yet

- Business Finance12 Q3 M1Document24 pagesBusiness Finance12 Q3 M1Chriztal TejadaNo ratings yet

- Business FinanceDocument32 pagesBusiness FinanceEowyn DianaNo ratings yet

- Cover Designed By: Mr. Medel ValenciaDocument12 pagesCover Designed By: Mr. Medel ValenciaKeahlyn BoticarioNo ratings yet

- Personal Budget As A List of All of My Expenses Such As Tuition Fees School SuppliesDocument10 pagesPersonal Budget As A List of All of My Expenses Such As Tuition Fees School SuppliesJanine IgdalinoNo ratings yet

- Top 10 career options in finance - from investment banking to wealth managementDocument3 pagesTop 10 career options in finance - from investment banking to wealth managementManish Kumar GuptaNo ratings yet

- BusinessFinance Lesson1Document17 pagesBusinessFinance Lesson1Regine Estrada JulianNo ratings yet

- Business Finance - 12 - Third - Week 2Document8 pagesBusiness Finance - 12 - Third - Week 2AngelicaHermoParasNo ratings yet

- 1.5 Advanced Financial Management Objective:: Page 1 of 1Document95 pages1.5 Advanced Financial Management Objective:: Page 1 of 1Sandeep As SandeepNo ratings yet

- Institute-University School of Business Department-CommerceDocument14 pagesInstitute-University School of Business Department-CommerceAmrit KaurNo ratings yet

- Financial Management Role and FunctionsDocument8 pagesFinancial Management Role and FunctionsAsiNo ratings yet

- MODULE 1 Business FinanceDocument13 pagesMODULE 1 Business FinanceWinshei CaguladaNo ratings yet

- Understanding the Basics of FinanceDocument7 pagesUnderstanding the Basics of FinanceKanton FernandezNo ratings yet

- LM Business Finance Q3 W1 Module 1Document15 pagesLM Business Finance Q3 W1 Module 1Minimi LovelyNo ratings yet

- Business Finance - ModuleDocument33 pagesBusiness Finance - ModuleMark Laurence FernandoNo ratings yet

- Business FinanceDocument5 pagesBusiness FinanceJojie Mae GabunilasNo ratings yet

- BF 1118Document14 pagesBF 1118maria vierrasNo ratings yet

- FinMan AE 19 Module 1 Intro To FinManDocument8 pagesFinMan AE 19 Module 1 Intro To FinManMILLARE, Teddy Glo B.No ratings yet

- Business FinanceDocument49 pagesBusiness FinanceFrancis GeboneNo ratings yet

- Financial Management: Learning Objectives (Slides 1-1 To 1-3)Document19 pagesFinancial Management: Learning Objectives (Slides 1-1 To 1-3)Ekaterina MazyarkinaNo ratings yet

- Unit 1: Introduction To FinanceDocument18 pagesUnit 1: Introduction To FinancehabtamuNo ratings yet

- 08 - Chapter 2Document63 pages08 - Chapter 2haikalNo ratings yet

- Business Finance Quarter1 Module 1.1 Week 1 1Document12 pagesBusiness Finance Quarter1 Module 1.1 Week 1 1Peyti PeytNo ratings yet

- Business Finance Lesson-Exemplar - Module 1Document7 pagesBusiness Finance Lesson-Exemplar - Module 1Divina Grace Rodriguez - LibreaNo ratings yet

- Reflective Essay - TVDocument21 pagesReflective Essay - TVAnthony MuchiriNo ratings yet

- Chapter One:An Overview of Financial Management Part I: Introduction To Finance 1.0 Aims and ObjectivesDocument9 pagesChapter One:An Overview of Financial Management Part I: Introduction To Finance 1.0 Aims and ObjectiveswubeNo ratings yet

- Introduction to Corporate Finance FundamentalsDocument142 pagesIntroduction to Corporate Finance FundamentalsesubalewkumsaNo ratings yet

- Full Notes (168) AFM-1 PDFDocument95 pagesFull Notes (168) AFM-1 PDFmanjula7nagarajNo ratings yet

- Business Finance Module 1Document10 pagesBusiness Finance Module 1Adoree RamosNo ratings yet

- FM1, CH01-EditedDocument17 pagesFM1, CH01-Editedsamuel kebedeNo ratings yet

- Unit 1: Introduction To Finance 1.0 Aims and ObjectivesDocument9 pagesUnit 1: Introduction To Finance 1.0 Aims and ObjectivesEsirael BekeleNo ratings yet

- CHP 1Document30 pagesCHP 1Faedullah Ridwan HanifNo ratings yet

- Enterprenership Assignment QDocument5 pagesEnterprenership Assignment QDesta DabiNo ratings yet

- Introduction to Financial ManagementDocument25 pagesIntroduction to Financial ManagementKayceeNo ratings yet

- Q1-Module 1-Week 1-Role of Financial Mgmt.Document19 pagesQ1-Module 1-Week 1-Role of Financial Mgmt.Jusie ApiladoNo ratings yet

- Lecture 1 Financial ManagementDocument14 pagesLecture 1 Financial ManagementAnabelle Gutierrez JulianoNo ratings yet

- Entrep1 3Document57 pagesEntrep1 3Grachylle UmaliNo ratings yet

- 3-ABM-BUSINESS FINANCE 12_Q1_W3_Mod3Document23 pages3-ABM-BUSINESS FINANCE 12_Q1_W3_Mod3melvinlloyd.limheyaNo ratings yet

- Financail Management 2 NotesDocument86 pagesFinancail Management 2 NotesRalph MindaroNo ratings yet

- Fundamentals of Finance and Financial ManagementDocument4 pagesFundamentals of Finance and Financial ManagementCrisha Diane GalvezNo ratings yet

- Memo Eng Fin 1Document16 pagesMemo Eng Fin 1api-357022570No ratings yet

- Business Finance Quarter 1 SLM Final As of June 25 2021Document60 pagesBusiness Finance Quarter 1 SLM Final As of June 25 2021aliNo ratings yet

- Business Finance 3: Learning Area Grade Level Quarter DateDocument5 pagesBusiness Finance 3: Learning Area Grade Level Quarter DatePrincess Charmee BernasNo ratings yet

- Uma Industry Assets and Liabilities MGTDocument80 pagesUma Industry Assets and Liabilities MGTKirthi KshatriyasNo ratings yet

- Lagare, Rubie A. (Act. 3)Document2 pagesLagare, Rubie A. (Act. 3)Rubie Aranas LagareNo ratings yet

- Module 1 - BFDocument13 pagesModule 1 - BFAustin MauzarNo ratings yet

- Business Finance Pre - Test and Lesson 1Document29 pagesBusiness Finance Pre - Test and Lesson 1Iekzkad RealvillaNo ratings yet

- Econ f315 Summer Term 2016-17 IdDocument13 pagesEcon f315 Summer Term 2016-17 IdSrikar RenikindhiNo ratings yet

- I.Lesson Title Ii. Most Essential Learning Competencies (Melcs)Document6 pagesI.Lesson Title Ii. Most Essential Learning Competencies (Melcs)Maria Lutgarda Tumbaga100% (2)

- Introduction to Business Finance ConceptsDocument7 pagesIntroduction to Business Finance ConceptsMich ValenciaNo ratings yet

- Eed 326Document93 pagesEed 326Arinze samuelNo ratings yet

- Unit 1n2 MFIDocument10 pagesUnit 1n2 MFIWasil AliNo ratings yet

- Module in Financial Management 01Document17 pagesModule in Financial Management 01Karen DammogNo ratings yet

- Topic 1Document8 pagesTopic 1Regine TorrelizaNo ratings yet

- Understanding Social Sciences Through Anthropology, Sociology and Political ScienceDocument35 pagesUnderstanding Social Sciences Through Anthropology, Sociology and Political ScienceJm JuanillasNo ratings yet

- Behavioral Style of LearningDocument3 pagesBehavioral Style of LearningJm JuanillasNo ratings yet

- Unlocking of VocabularyDocument2 pagesUnlocking of VocabularyJm JuanillasNo ratings yet

- Group 3 Oral ComDocument2 pagesGroup 3 Oral ComJm JuanillasNo ratings yet

- Name of Synthetic ElementDocument4 pagesName of Synthetic ElementJm JuanillasNo ratings yet

- The World of Media and Information LiteracyDocument10 pagesThe World of Media and Information LiteracyJm JuanillasNo ratings yet

- ABM BF PPT2 Organizational Chart and The Roles of The VP Finance 1Document36 pagesABM BF PPT2 Organizational Chart and The Roles of The VP Finance 1Jm JuanillasNo ratings yet

- "His Mother Treasured All These Things in Her Heart": WorksheetDocument2 pages"His Mother Treasured All These Things in Her Heart": WorksheetJm JuanillasNo ratings yet

- IMG 3879.jpgDocument1 pageIMG 3879.jpgJm JuanillasNo ratings yet

- Happy Totes Business Plan Promotes Eco-Friendly Tote BagsDocument16 pagesHappy Totes Business Plan Promotes Eco-Friendly Tote BagsAnne Victoria Camilion100% (8)

- WORKSHEET - Faith ResponseDocument3 pagesWORKSHEET - Faith ResponseJm JuanillasNo ratings yet

- Preliminary ActivityDocument1 pagePreliminary ActivityJm JuanillasNo ratings yet

- Business Plan PresentationDocument24 pagesBusiness Plan PresentationJm JuanillasNo ratings yet

- Business FinanceDocument6 pagesBusiness FinanceJm JuanillasNo ratings yet

- Worksheet Word of GodDocument2 pagesWorksheet Word of GodJm JuanillasNo ratings yet

- Entrepreneurship Performance Task Business PlanDocument25 pagesEntrepreneurship Performance Task Business PlanJm JuanillasNo ratings yet

- Eapp Pre TestDocument2 pagesEapp Pre TestJm JuanillasNo ratings yet

- Oral ComDocument2 pagesOral ComJm JuanillasNo ratings yet

- What Are The Forms of BusinessDocument1 pageWhat Are The Forms of BusinessJm JuanillasNo ratings yet

- Worksheet: Coffee-Vending-Machine-Tied-Pole-BulacanDocument2 pagesWorksheet: Coffee-Vending-Machine-Tied-Pole-BulacanJm JuanillasNo ratings yet

- AutobiographyDocument1 pageAutobiographyJm JuanillasNo ratings yet

- Name: - Date: - SectionDocument1 pageName: - Date: - SectionJm JuanillasNo ratings yet

- Statement of The ProblemDocument1 pageStatement of The ProblemJm JuanillasNo ratings yet

- MODULE 09 FABM2 Bank ReconciliationDocument9 pagesMODULE 09 FABM2 Bank ReconciliationJm JuanillasNo ratings yet

- Module 2Document1 pageModule 2Jm JuanillasNo ratings yet

- Lack of Information: BodyDocument2 pagesLack of Information: BodyJm JuanillasNo ratings yet

- Definition of TermsDocument1 pageDefinition of TermsJm JuanillasNo ratings yet

- Reflecting on leadership and the refugee experienceDocument2 pagesReflecting on leadership and the refugee experienceJm JuanillasNo ratings yet

- Take the Career Test and Discover YourselfDocument2 pagesTake the Career Test and Discover YourselfJm JuanillasNo ratings yet

- External Assessment PDFDocument4 pagesExternal Assessment PDFDSAW VALERIONo ratings yet

- Organizational Feasibility Analysis for Educational InstitutionDocument3 pagesOrganizational Feasibility Analysis for Educational InstitutionSai RillNo ratings yet

- Power - Power and Influence in OrganizationsDocument4 pagesPower - Power and Influence in OrganizationsPNo ratings yet

- NUS AMP BrochureDocument15 pagesNUS AMP BrochurekaskaraitNo ratings yet

- 200 ChatGPT Money Making PromptsDocument8 pages200 ChatGPT Money Making PromptsChandan KarNo ratings yet

- RMIT International University Vietnam: Assignment Cover Page (INDIVIDUAL)Document7 pagesRMIT International University Vietnam: Assignment Cover Page (INDIVIDUAL)Quynh NguyenNo ratings yet

- Corporate Finance Course at IIT KharagpurDocument2 pagesCorporate Finance Course at IIT KharagpurMousumiNo ratings yet

- Igcse MockDocument9 pagesIgcse MockWincci WongNo ratings yet

- ABDC JQL 2022 v3 100523Document600 pagesABDC JQL 2022 v3 100523arijitbhaduri2012No ratings yet

- Learning Curves: Discussion QuestionsDocument8 pagesLearning Curves: Discussion QuestionsTTNo ratings yet

- Cambridge International AS & A Level: BUSINESS 9609/11Document4 pagesCambridge International AS & A Level: BUSINESS 9609/11VenonNo ratings yet

- Statement of PurposeDocument9 pagesStatement of Purposevarinder kumar KumarNo ratings yet

- CSS110 Capstone Project Part 1Document3 pagesCSS110 Capstone Project Part 1gourish paiNo ratings yet

- Todd Combs Transcript Art of Investing 10 Oct 2023Document22 pagesTodd Combs Transcript Art of Investing 10 Oct 2023ACasey101No ratings yet

- BCM6C3Document1,001 pagesBCM6C3Vivek PrajapatiNo ratings yet

- Women EntrepreneurshipDocument45 pagesWomen EntrepreneurshipSupriya GuptaNo ratings yet

- Hospitality and Tourism 110Document52 pagesHospitality and Tourism 110king coNo ratings yet

- Wealth-X Hamad Abdullah Rashid Al Obeaid AL SHAMSI DossierDocument12 pagesWealth-X Hamad Abdullah Rashid Al Obeaid AL SHAMSI DossierFouzia MahiNo ratings yet

- The Startup Master PlanDocument25 pagesThe Startup Master PlanCharlene Kronstedt100% (1)

- Global Marketing Module Handbook 2020-21Document19 pagesGlobal Marketing Module Handbook 2020-21Badshah Bolna BadshahNo ratings yet

- Global Strategy Development & Implementation Teaching Plan (Campus 2022)Document16 pagesGlobal Strategy Development & Implementation Teaching Plan (Campus 2022)LawalNo ratings yet

- Appendices Appendix I: Survey QuestionnareDocument6 pagesAppendices Appendix I: Survey Questionnarehabtamu fentaNo ratings yet

- Tax Handbook KPMG-2022Document102 pagesTax Handbook KPMG-2022Md. Mostafizur RahmanNo ratings yet

- Module 4 Reasons Why People Go To BusinessDocument23 pagesModule 4 Reasons Why People Go To BusinessNick Allan PiojoNo ratings yet

- Indore CaDocument57 pagesIndore CadevNo ratings yet

- Auditor Qualifications and DisqualificationsDocument10 pagesAuditor Qualifications and DisqualificationsÅPEX々 N33JÜNo ratings yet

- 10 Common IT Project Management Challenges Managers FaceDocument5 pages10 Common IT Project Management Challenges Managers Faceprince christopherNo ratings yet

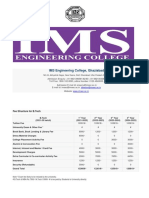

- IMSEC Fee DetailsDocument4 pagesIMSEC Fee Detailsmanish parasharNo ratings yet

- Case Study Topic PANASONICDocument6 pagesCase Study Topic PANASONICmayankagrawal549No ratings yet

- Personal Statement For Masters in Applied Data Science - NuelDocument1 pagePersonal Statement For Masters in Applied Data Science - NuelGerman Emmanuel100% (1)