Professional Documents

Culture Documents

A. Mr. Samuel Misa: To Protect The Certificate of Certified Public Accountants Granted by The Republic of The Philippines

Uploaded by

Shaira Iwayan0 ratings0% found this document useful (0 votes)

20 views6 pages1. The founding president of NFJPIA was Santiago dela Cruz.

2. The current national council president is Vicente L. Quimbo, Jr.

3. One of the organization's objectives is to protect the Certificate of Certified Public Accountants granted by the Republic of the Philippines.

Original Description:

Original Title

EZ

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The founding president of NFJPIA was Santiago dela Cruz.

2. The current national council president is Vicente L. Quimbo, Jr.

3. One of the organization's objectives is to protect the Certificate of Certified Public Accountants granted by the Republic of the Philippines.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views6 pagesA. Mr. Samuel Misa: To Protect The Certificate of Certified Public Accountants Granted by The Republic of The Philippines

Uploaded by

Shaira Iwayan1. The founding president of NFJPIA was Santiago dela Cruz.

2. The current national council president is Vicente L. Quimbo, Jr.

3. One of the organization's objectives is to protect the Certificate of Certified Public Accountants granted by the Republic of the Philippines.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

EZ

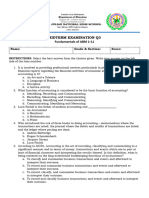

1. The founding president of NFJPIA

a. Mr. Samuel Misa

b. Enrique Caguiat

c. Santiago dela Cruz,

d. Clemente Uson

2. Current national council president of the federation

a. ASHERAH J. ENGKONG

b. RHEA ANGIELA V. MENESIS

c. AXL ROME P. FLORES

d. VICENTE L. QUIMBO, JR.

3. The following are amongst the organization’s objectives, except:

a. To promote fellowship and familiarity among accounting students from all walks of life

b. To serve as an instrument for the gradual exposure of the students to the network of

opportunities that awaits them

c. To protect the Certificate of Certified Public Accountants granted by the Republic

of the Philippines

d. To adapt necessary measures to foster academic advancement in the field of

accounting.

4. In what Federation Year did NFJPIA received a diamond year award from picpa for its

support in the fulfillment of its objectives to strengthen the bond between JPIA and PICPA?

a. 1998-1999

b. 1999-2000

c. 2000-2001

d. 1997-1998

5. Cash on hand is expressed in peso and is assumed that its purchasing power does not change.

a. Monetary unit

b. Going concern

c. Cost principle

d. Materiality

6. The company purchased 2 boxes of staples immaterial relative to its assets. The purchase is to be

recorded as a/an?

a. Asset

b. Purchases

c. Expense

d. Prepaid expense

7. The business’s payments for the owner’s personal expenses shall be reduced from the owner’s

capital contribution and shall be treated as:

a. Liability

b. Expenses

c. Drawings

d. Loss

8. A fixed asset with an estimated life of 10 yrs shall be recorded at:

a. Retail cost

b. Acquisition cost

c. Salvage value

d. Future value

9. Asses the following statements:

1. PPE must not be depreciated over their estimated useful life.

2. Stock valuation sticks to the rule of the higher of cost and net realizable value.

a. Both statements are true

b. Both statements are false

c. Statement 1-true; statement 2-false

d. Statement 1-false; statement 2-true

10. A leading company in the Philippines records its income in pesos—rounded to the nearest

1,000. Which accounting principle justifies the rounding off of its income?

a. Monetary unit

b. Materiality

c. Going concern

d. Cost principle

11. When a corporation records less profit, less asset amount, or a greater liability amount it

follows what principle?

a. Materiality

b. Conservatism

c. Cost principle

d. Matching

12. An accounting transaction shall at least affect how many accounts?

a. 1

b. 2

c. 3

d. 4

13. NFJPIA has over how many accredited local chapters?

a. 275

b. 257

c. 370

d. 730

14. The retail value of an equipment purchased by jean is 50,000. How should the equipment be

recorded upon purchase?

a. Retail value

b. 50,000

c. Purchase cost

d. Future cost

15. Which represents the FIFO method?

a. First units purchased are the first units sold

b. Last units purchased are the last units sold

c. Last units purchased are the first units sold

d. Both a and b

16. Beginning Inventory, 1,000 units at P4/unit: Purchases, 600 units at P5/unit: Units

sold, 700: Ending Inventory, 900 units: Average cost per, P4.375 per unit. Using the

given information, how should the Cost of goods sold be calculated?

a. Multiply the average cost per unit by the number of units sold.

b. Multiple the average cost per unit by the ending inventory.

c. Multiply the number of units sold by the ending inventory

d. Multiply the number of units sold by the beginning inventory

17. Trent runs a business as an engineering consultant. He proposed a new system for

constructing bridges to deal with extreme weather conditions. He spends P30,000

securing a 14-year patent for his invention. To record the amortization expense each

year, what account should be credited?

a. Amortization expense

b. Patent

c. Accumulated amortization

d. Cash

18. Liliana spends P20,000 (cash) on a piece of equipment for use in her restaurant. She

plans to use the straight-line method to depreciate the equipment over 5 years. She

expects it to have no value at the end of the 5 years. If Liliana sells the equipment for

P6,000, she will record P2,000 as?

a. A loss—following the conservatism principle

b. A gain

c. Depreciation expense

d. Net profit

19. How many executive officers are there in NFJPIA?

a. 10

b. 11

c. 12

d. 13

20. I. Machinery

II. Owner’s Equity

III. Land

IV. Cash

V. Debtor

Which of the following items fall under the definition of an asset?

a. I, II, III, & IV

b. I, III, & IV

c. IV only

d. I, III, IV, & V

21. Which among the items is/are considered a liability?

a. Cash

b. Debtors

c. Tax Owed

d. Both b & C

22. Assess the following statements:

1. The accounting equation shows how much of your assets belong to the owner,

and how much ‘belong’ to people outside the business.

2. If you cannot work out a value for an item that will bring you future benefits, then

you cannot keep this as an asset in your records.

a. Both statements are true

b. Both statements are false

c. Statement 1-true; statement 2-false

d. Statement 1-false; statement 2-true

23. Assess the following statements:

1. A liability is a debt for your business.

2. Debtors are a debt for your business.

a. Both statements are true

b. Both statements are false

c. Statement 1-true; statement 2-false

d. Statement 1-false; statement 2-true

24. Assess the following statements:

1. A business whose liabilities are greater than its assets has a bad financial position.

2. A business whose liabilities are greater than its owner’s equity has a bad financial position.

a. Both statements are true

b. Both statements are false

c. Statement 1-true; statement 2-false

d. Statement 1-false; statement 2-true

25. Assess the following statements:

1. A business whose assets exceeds its equity simply means that it has debts or liabilities, which

does not necessarily mean a bad financial position.

2. A business whose assets are greater than its owner’s equity has a bad financial position.

a. Both statements are true

b. Both statements are false

c. Statement 1-true; statement 2-false

d. Statement 1-false; statement 2-true

26. Which among the following is/are the two characteristic/s of the monetary unit principle?

a. transactions are recorded in terms of money

b. purchasing power of the dollar is stable

c. the business enterprise is considered one accounting entity

d. both a & b

27. which of the following statements is/are true?

a. Capital is increased by additional contributions and income, and decreased by expenses

and withdrawals.

b. Capital is increased by additional distributions and income, and decreased by expenses and

withdrawals

c. Both a & b

d. None of the above

28. What is obtained when cost of goods sold is subtracted from revenue?

a. Profit

b. Net profit

c. Gross profit

d. Operating profit

29. Which of the following statements is/are false?

a. Gross profit is equal to revenue less COGS

b. Operating profit is equal to gross profit less COGS

c. Both a and b

d. None of the above

30. Which financial statement is affected when a company issues stock?

a. Balance sheet

b. Income statement

c. Both a & b

d. None of the above

31. The following are included in the accounting conventions, except:

a. Depreciation convention

b. Conservatism convention

c. Consistency convention

d. Full disclosure convention

32. Which statement/s is/are true about the realization concept?

i. The concept stresses that revenues should only be recorded if there is reasonable certainty

about their realization

ii. The concept explains that the comparison of incomes and expenses for a particular period

can give the period's net result.

iii. The concept stresses that revenues should only be recorded if there is reasonable certainty

about their realization.

a. i only

b. ii only

c. iii & ii

d. i & iii

33. Which of the following does not exemplify the materiality concept?

a. Purchase of pencil recorded as an expense instead of including in stock

b. Purchase of car for private use

c. Purchase of plant for business

d. Purchase of building to extend the business

34. Which of the following is true about the disclosure convention?

a. Full disclosure of all material facts that can affect the financial statement

b. That profit should be realized.

c. Matching of incomes and expenses for a particular period

d. The business to avoid being dissolved in the near future

35. In evaluating audit risk, the auditor is needless to investigate the

a. legal counsel

b. Boardof governance

c. Stakeholders

d. Middle-level management

36. Which among the following is not considered as cash?

a. Bank deposits

b. Checks

c. Postdated checks

d. Money orders

37. To achieve control objectives, cash sales are to be recorded when

a. cash sales are made

b. purchase order is received from a customer

c. After some period

d. Weekly

38. According to accrual concept of accounting, financial or business transaction is recorded:

when cash is received or paid

when transaction occurs

when profit is computed

when balance sheet is prepared

You might also like

- Easy Round B. Acquisition Cost: When A Corporation Records Less Profit, Less Asset Amount, or A Greater Liability AmountDocument8 pagesEasy Round B. Acquisition Cost: When A Corporation Records Less Profit, Less Asset Amount, or A Greater Liability AmountShaira IwayanNo ratings yet

- FAR First Grading ExaminationDocument9 pagesFAR First Grading ExaminationRoldan ManganipNo ratings yet

- Important Mcqs Regarding Nts TestsDocument129 pagesImportant Mcqs Regarding Nts Testsk.shaikh100% (3)

- Level Three Theory (Knowledge) Choice: C. Journalizing - Posting - Trial Balance - Financial StatementsDocument17 pagesLevel Three Theory (Knowledge) Choice: C. Journalizing - Posting - Trial Balance - Financial Statementseferem0% (1)

- 201 EXM2 XComp Pract Exam MCDocument11 pages201 EXM2 XComp Pract Exam MCvonns80No ratings yet

- MCQ With AnsDocument68 pagesMCQ With AnsRosemarie Cruz0% (2)

- Seeds of The Nations Review-MidtermsDocument9 pagesSeeds of The Nations Review-MidtermsMikaela JeanNo ratings yet

- Questionnaire-CFAS Prelims (BSMA 2-A 2-B and 2-C)Document11 pagesQuestionnaire-CFAS Prelims (BSMA 2-A 2-B and 2-C)RENZEL MAGBITANGNo ratings yet

- Level 3 TheoryDocument19 pagesLevel 3 TheoryMarta GobenaNo ratings yet

- 2nd Quarter Exam in Fabm1Document3 pages2nd Quarter Exam in Fabm1Marilyn Nelmida Tamayo100% (1)

- Accounting 101 FinalsDocument16 pagesAccounting 101 FinalsDanilo Diniay Jr100% (1)

- 26u9ofk7l - FAR - FINAL EXAMDocument18 pages26u9ofk7l - FAR - FINAL EXAMLyra Mae De BotonNo ratings yet

- Activity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVDocument8 pagesActivity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVPrecious mae BarrientosNo ratings yet

- Pre BoardDocument7 pagesPre BoardJose Dula II50% (2)

- Financial Accounting and Reporting-Preliminary ExamDocument7 pagesFinancial Accounting and Reporting-Preliminary Examromark lopezNo ratings yet

- 2ND Online Quiz Level 1 Set A (Questions)Document5 pages2ND Online Quiz Level 1 Set A (Questions)Vincent Larrie MoldezNo ratings yet

- Accounting L-III & IV COC 207 Multiple ChoicesDocument31 pagesAccounting L-III & IV COC 207 Multiple ChoicesYasinNo ratings yet

- Theory of Accounts (No Ak)Document10 pagesTheory of Accounts (No Ak)Irish Joy AlaskaNo ratings yet

- AC 501 (Pre-Mid)Document3 pagesAC 501 (Pre-Mid)RodNo ratings yet

- Abo Royce Stephen Cfas Activities AnswersDocument37 pagesAbo Royce Stephen Cfas Activities Answerscj gamingNo ratings yet

- AC503 - Finals Reviewer 2Document10 pagesAC503 - Finals Reviewer 2Ashley Levy San PedroNo ratings yet

- Level Three Theory (Knowledge) ChoiceDocument17 pagesLevel Three Theory (Knowledge) ChoiceYaa Rabbii100% (1)

- Theory (1) 1Document18 pagesTheory (1) 1Debela RegasaNo ratings yet

- Problems: Problem I: True or FalseDocument75 pagesProblems: Problem I: True or FalseRosemarie Cruz100% (1)

- Choice 1-1Document17 pagesChoice 1-1Dagnachew WeldegebrielNo ratings yet

- Prefinal Review AcfarDocument8 pagesPrefinal Review AcfarBugoy CabasanNo ratings yet

- PS - BasicDocument4 pagesPS - BasicErwin Dave M. DahaoNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 2Document11 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 2JordanNo ratings yet

- 85184767Document9 pages85184767Garp BarrocaNo ratings yet

- 35 Basic Accounting Test QuestionsDocument9 pages35 Basic Accounting Test QuestionsDenny OctavianoNo ratings yet

- Accounting ReviewerDocument6 pagesAccounting ReviewerHarry EvangelistaNo ratings yet

- Accounting and Finance For ManagementDocument42 pagesAccounting and Finance For Managementsuresh84123No ratings yet

- Far ReviewerDocument18 pagesFar RevieweremmanuelanecesitoNo ratings yet

- 5 13Document13 pages5 13rain06021992No ratings yet

- Basic Accounting Chapter 1-5 QuizzesDocument6 pagesBasic Accounting Chapter 1-5 QuizzesLuna Shi100% (1)

- Auditing.: A. B. C. DDocument12 pagesAuditing.: A. B. C. DbiniamNo ratings yet

- Midterms Q3 FABM1Document10 pagesMidterms Q3 FABM1Emerita MercadoNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 4Document6 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 4JordanNo ratings yet

- Xy95lywmi - Midterm Exam FarDocument12 pagesXy95lywmi - Midterm Exam FarLyra Mae De BotonNo ratings yet

- Quiz 1 - Chapters 1-2Document4 pagesQuiz 1 - Chapters 1-2Kim Nicole ReyesNo ratings yet

- Fabm1 Pre TestDocument6 pagesFabm1 Pre Testlynlynie0613No ratings yet

- Amoni Edome Coc Sample Exam-Level LLLDocument13 pagesAmoni Edome Coc Sample Exam-Level LLLAmoni EdomeNo ratings yet

- Model Exit Exam 3Document36 pagesModel Exit Exam 3mearghaile4No ratings yet

- First Quarter Assessment in FABM2Document4 pagesFirst Quarter Assessment in FABM2Nhelben ManuelNo ratings yet

- Fundamentals of Accountancy, Business & Management 1 Second Grading ExaminationDocument6 pagesFundamentals of Accountancy, Business & Management 1 Second Grading ExaminationMc Clent CervantesNo ratings yet

- Review Questions - New Conceptual Framework - Summer 2015Document7 pagesReview Questions - New Conceptual Framework - Summer 2015Roen Jasper EviaNo ratings yet

- Basic Acc CFAS ANSWERSDocument13 pagesBasic Acc CFAS ANSWERSEzra CalayagNo ratings yet

- Quiz Bee QuestionsDocument19 pagesQuiz Bee QuestionsBelen VergaraNo ratings yet

- Accounting (@JohnASTU)Document38 pagesAccounting (@JohnASTU)bezib7987No ratings yet

- Of Alabang: Multiple ChoiceDocument8 pagesOf Alabang: Multiple ChoiceLEE ANNNo ratings yet

- Simulated Midterm Exam. Far1 PDFDocument11 pagesSimulated Midterm Exam. Far1 PDFDyosang BomiNo ratings yet

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- Toa 2022 Q1 PDFDocument6 pagesToa 2022 Q1 PDFNiña Yna Franchesca PantallaNo ratings yet

- Test Begins HereDocument6 pagesTest Begins HereRichardDinongPascual100% (1)

- Acctg 1a Bsba Final ExamDocument6 pagesAcctg 1a Bsba Final ExamJao FloresNo ratings yet

- MidtermDocument9 pagesMidtermSohfia Jesse VergaraNo ratings yet

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamMikaela SalvadorNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Market StructureDocument7 pagesMarket StructureShaira IwayanNo ratings yet

- Originofthe ChurchDocument2 pagesOriginofthe ChurchShaira IwayanNo ratings yet

- Phedo 704a Learning Module Midterm 2021 2022Document15 pagesPhedo 704a Learning Module Midterm 2021 2022Shaira IwayanNo ratings yet

- Slide 1: Standard Normal DistributionDocument5 pagesSlide 1: Standard Normal DistributionShaira IwayanNo ratings yet

- Stansa Activity Template - M2-A1Document8 pagesStansa Activity Template - M2-A1Shaira IwayanNo ratings yet

- C06 - Presentation - Group 2 - Tech - NinjasDocument151 pagesC06 - Presentation - Group 2 - Tech - NinjasShaira IwayanNo ratings yet

- All Knowledge Degenerate Into ProbabilityDocument3 pagesAll Knowledge Degenerate Into ProbabilityShaira IwayanNo ratings yet

- Demo Screenshots - 7Document2 pagesDemo Screenshots - 7Shaira IwayanNo ratings yet

- Example: The COMELEC Committees Are Counting Votes For Election 2021 - Quantitative Data - Discrete DataDocument5 pagesExample: The COMELEC Committees Are Counting Votes For Election 2021 - Quantitative Data - Discrete DataShaira IwayanNo ratings yet

- Demo ScreenshotsDocument2 pagesDemo ScreenshotsShaira IwayanNo ratings yet

- 1Document1 page1Shaira IwayanNo ratings yet

- ACTIVITIES - Group 1 - IWAYANDocument4 pagesACTIVITIES - Group 1 - IWAYANShaira IwayanNo ratings yet

- Time Series Analysis - IwayanDocument4 pagesTime Series Analysis - IwayanShaira IwayanNo ratings yet

- The Ten Commandments (Aseret Badevarim) (St. Augustine) Script /movie TrailerDocument1 pageThe Ten Commandments (Aseret Badevarim) (St. Augustine) Script /movie TrailerShaira IwayanNo ratings yet

- UnivariateDocument2 pagesUnivariateShaira IwayanNo ratings yet

- Answer Key (Group8)Document1 pageAnswer Key (Group8)Shaira IwayanNo ratings yet

- Answer Key (Group8)Document1 pageAnswer Key (Group8)Shaira IwayanNo ratings yet

- The World Needs More Educated Minds To SurviveDocument1 pageThe World Needs More Educated Minds To SurviveShaira IwayanNo ratings yet

- Illustration ProblemDocument2 pagesIllustration ProblemShaira IwayanNo ratings yet

- Chapter 16 Problem SolvingDocument3 pagesChapter 16 Problem SolvingWeStan LegendsNo ratings yet

- Chapter 5 Adjustments and The WorksheetDocument23 pagesChapter 5 Adjustments and The WorksheetReynaleen Agta100% (1)

- Accounting Cycle of A Service BusinessDocument11 pagesAccounting Cycle of A Service BusinessJb Guab0% (1)

- Financial Modeling Case - Premium Bus ServiceDocument1 pageFinancial Modeling Case - Premium Bus Servicericha krishnaNo ratings yet

- Kashaf New Bsns Plan BbaDocument22 pagesKashaf New Bsns Plan BbaMirza Zain WalliNo ratings yet

- Worksheet AssignmentDocument2 pagesWorksheet AssignmentLyca MaeNo ratings yet

- The Statement of Financial Position or (SFP)Document4 pagesThe Statement of Financial Position or (SFP)UnkownamousNo ratings yet

- Finals Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Document6 pagesFinals Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNo ratings yet

- Chapter 03 PenDocument27 pagesChapter 03 PenJeffreyDavidNo ratings yet

- Statement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Document2 pagesStatement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Alyssa AlejandroNo ratings yet

- Accounting For Government Organizations Mock CEDocument15 pagesAccounting For Government Organizations Mock CEDena Heart OrenioNo ratings yet

- MCQ On Final AccountDocument5 pagesMCQ On Final AccountAnonymous b4qyne73% (11)

- Business Combi. Chapter 1 PROBLEM 3Document4 pagesBusiness Combi. Chapter 1 PROBLEM 3latte aeriNo ratings yet

- 8a. Responsibility and Segment Accounting CRDocument20 pages8a. Responsibility and Segment Accounting CRAngelica Gaspay EstalillaNo ratings yet

- Unit 2: Financial Analysis 2.0 Aims and ObjectivesDocument13 pagesUnit 2: Financial Analysis 2.0 Aims and ObjectiveshabtamuNo ratings yet

- Homework ch3-3Document3 pagesHomework ch3-3Qasim MansiNo ratings yet

- FY 2015 VRNA Verena+Multi+Finance+TbkDocument91 pagesFY 2015 VRNA Verena+Multi+Finance+Tbkpkm.sdjNo ratings yet

- FAR460 - S - June 2018 - StudentsDocument6 pagesFAR460 - S - June 2018 - StudentsRuzaikha razaliNo ratings yet

- Notes To The Financial StatementsDocument4 pagesNotes To The Financial StatementsROB101512No ratings yet

- Module in Cash To Accrual and Vice VersaDocument12 pagesModule in Cash To Accrual and Vice Versayugyeom rojasNo ratings yet

- Accounts 1Document9 pagesAccounts 1Sapna SetiaNo ratings yet

- Par CorDocument11 pagesPar CorIts meh Sushi100% (1)

- AP 5904Q InvestmentsDocument6 pagesAP 5904Q InvestmentsRhea NograNo ratings yet

- Exemplar Company - Acctg 211Document6 pagesExemplar Company - Acctg 211JamesNo ratings yet

- Full Download Solution Manual For Accounting Tools For Business Decision Making 7th by Kimmel PDF Full ChapterDocument36 pagesFull Download Solution Manual For Accounting Tools For Business Decision Making 7th by Kimmel PDF Full Chapterpryingly.curdlessri8zp100% (16)

- Module 2b Allowance For Bad DebtsDocument14 pagesModule 2b Allowance For Bad DebtsChen HaoNo ratings yet

- To Record The Purchase of EquipmentDocument13 pagesTo Record The Purchase of EquipmentShane Nayah100% (1)

- Crompton Greaves Consumer Electricals LTD Q4fy22 Result UpdateDocument12 pagesCrompton Greaves Consumer Electricals LTD Q4fy22 Result Updateharsh agarwalNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocument3 pagesAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNo ratings yet