Professional Documents

Culture Documents

Tax Invoice Sample

Uploaded by

Tushar0 ratings0% found this document useful (0 votes)

17 views2 pagesCopyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views2 pagesTax Invoice Sample

Uploaded by

TusharCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

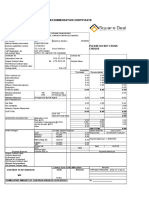

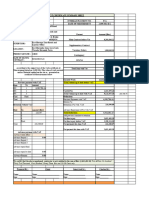

Invoice / Bill To, : From :

Name of the Client :

Address :

Name of the Project :

Location :

Our Service Tax Registration No : VAT TIN :

Division No. : V, Mumbai CST TIN :

Our PAN NO. :

Period of Measurement Bill Date :

Invoice No. / Bill No. Date of Submission :

TAX INVOICE

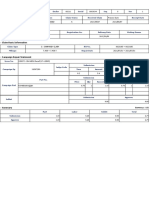

1. Name of Work

2. Purchase Order No./ Work Order No. & date

3. Contractual Completion date

4. Project duration as per contract 14 Months

5. Extension of Time period, (If any) NA

6. W.C.Policy NA

7. a) Security Deposit B.G. B.G. No. Rs.________ Date of Expiry

b) SD BG Extended upto B.G. No. Rs.________ Date of Expiry

8. a) Advance B.G B.G. No. Rs.________ Date of Expiry

b) Advance BG Extended upto B.G. No. Rs.________ Date of Expiry

9. Performance B.G. B.G. No. Rs.________ Date of Expiry

Advance Paid Adv. Recovered Bal. Advance

10. Mobilisation Advance 100.00 22.50 77.50

11. Material Advance/Secured Advance 0.00 0.00 0.00

12. Contract Value 1,000.00

13. Value of Work Done 250.00

14. Percentage Progress (%) 25% amount in laks

Upto Date Upto Prev. Bill In this Bill

15. Work Done 225.00 190.00 35.00

Extra Item 20.00 15.00 5.00

Escalation 5.00 5.00 0.00

Gross Value of Work Done 250.00 210.00 40.00

Add Amount for Rate Difference 15.00 10.00 5.00

Add :- Vat @ 4% on Work Done 10.60 8.80 1.80

Add Service Tax @ 4 % on work done 10.60 8.80 1.80

Add Edu Cess Tax @ 2% on service tax 0.21 0.18 0.04

Add High Edu. Cess Tax @ 1% on service tax 0.11 0.09 0.02

Total Bill Amount A 286.52 237.86 48.65

Add Material advance on Steel at Site 15.00 10.00 5.00

Total Bill Amount B 301.52 247.86 53.65

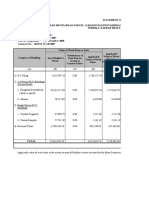

16. Recoveries

1. Security Deposit 0.00 0.00

2. Mobilisation Advance @ 10 % on 15 A 22.50 19.00 3.50

3. Material Advance 0.00 0.00 0

4. Retention Amount @ 5 % on 15 A 12.50 10.50 2.00

5. Cost of Material issued 0.00 0.00 0.00

6. Other Debits 7.00 5.00 2.00

17. Total Recoveries - (B) 42.00 34.50 7.50

18. Net Amount after recoveries (A-B) 259.52 213.36 46.15

19. Amount Received Till date 203.37

20. Net Amount payable 56.15

21. Net Amount payable (in words) Rupees Fifty Only.

"I / We hereby certify that my / our registration certificate under the

Maharashtra Value Added Tax Act, 2002 is in force on the date on

which the sale of the goods specified in this tax invoice is made by me /

us and that the transaction of sale covered by this tax invoice has been

effected by me / us and it shall be accounted for in the turnover of sales

while filing of return and the due tax, if any, payable on the sale has

been paid or shall be paid"

E.& O.E.

For

Authorised Signatory

You might also like

- Fedex AssignmentDocument20 pagesFedex AssignmentAibak Irshad100% (2)

- SHALDOR CONSULTING - BUSINESS CASE EX Growth+StrategyDocument5 pagesSHALDOR CONSULTING - BUSINESS CASE EX Growth+StrategyBenji PremingerNo ratings yet

- 1Document5 pages1venom_ftw100% (1)

- Case Problem StatementDocument11 pagesCase Problem StatementSourabh Chiprikar100% (1)

- From Complexity To SimplicityDocument48 pagesFrom Complexity To SimplicityJuanCamiloNo ratings yet

- Roll# 37 ThalNayZarLinn SM IC Chapter 05Document13 pagesRoll# 37 ThalNayZarLinn SM IC Chapter 05Thal Nay Zar SoeNo ratings yet

- Ipc 02Document3 pagesIpc 02mohammad abdul hameedNo ratings yet

- Vietti SOlution Full CycleDocument8 pagesVietti SOlution Full CycleShaina AragonNo ratings yet

- IPA For Construction (Payment Application)Document1 pageIPA For Construction (Payment Application)D DonNo ratings yet

- Wca CaseDocument8 pagesWca CaseAum RaoNo ratings yet

- Ra 02Document128 pagesRa 02Anil GiriNo ratings yet

- Subcontract Progress Payment ClaimDocument3 pagesSubcontract Progress Payment Claimvuhanvu2003No ratings yet

- Chappan Bhog 26.11.2018Document6 pagesChappan Bhog 26.11.2018PRAHARSHITANo ratings yet

- Unistar - Expansion Project 2013Document38 pagesUnistar - Expansion Project 2013Aniruddha DasNo ratings yet

- Free Monthly Cost Excel Template For Construction ProjectsDocument4 pagesFree Monthly Cost Excel Template For Construction ProjectsFrancisco SalazarNo ratings yet

- Tax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byDocument31 pagesTax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byMoidutty NuchiyadNo ratings yet

- Foot Bridge 2nd SWA BillingFINALDocument2 pagesFoot Bridge 2nd SWA BillingFINALcimpstazNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceZABIHULLAH HABIBNo ratings yet

- Payment Certificate FormatDocument1 pagePayment Certificate FormatLizmelanie Trinidad GarciaNo ratings yet

- Schedule 9 - Form of Progress Payment ClaimDocument2 pagesSchedule 9 - Form of Progress Payment ClaimMandalinaQitryNo ratings yet

- Dem-Soho 2324 208 75508 100469Document2 pagesDem-Soho 2324 208 75508 100469Ayush ChouhanNo ratings yet

- 02 Proforma InvoiceDocument13 pages02 Proforma InvoiceVinodNo ratings yet

- Final Report - Financial ModelDocument10 pagesFinal Report - Financial ModelDrishti SrivatavaNo ratings yet

- Payment CertificationDocument2 pagesPayment CertificationMohammad UmmerNo ratings yet

- Certificate 1 - Mayrose SamynadenDocument2 pagesCertificate 1 - Mayrose SamynadenDeepum HalloomanNo ratings yet

- Boq Grand SummaryDocument44 pagesBoq Grand Summaryelsabet gezahegnNo ratings yet

- Billing Certificate SampleDocument1 pageBilling Certificate SampleGenevieve GayosoNo ratings yet

- PAYMENT MOYALE 2015 Checked EditedDocument84 pagesPAYMENT MOYALE 2015 Checked Editediqramoyale022No ratings yet

- Free Cash Flow Initial Equity Dividend Change in Cash BalanceDocument6 pagesFree Cash Flow Initial Equity Dividend Change in Cash BalanceAbhinav SinhaNo ratings yet

- Cash FlowsDocument17 pagesCash FlowsMARIAN POLANCONo ratings yet

- Srs Design Financial Sheble Gust HouseDocument6 pagesSrs Design Financial Sheble Gust Houseeagle engineeringNo ratings yet

- Shail End RaDocument24 pagesShail End Rabharat khandelwalNo ratings yet

- Quiz 2 - Income Tax Concepts and ComplianceDocument3 pagesQuiz 2 - Income Tax Concepts and ComplianceDela cruz, Hainrich (Hain)No ratings yet

- 7.0 Financial Plan: 7.1 Income Statement For 10 Days (27/11 - 6/12)Document5 pages7.0 Financial Plan: 7.1 Income Statement For 10 Days (27/11 - 6/12)Nor Syazwani SharudinNo ratings yet

- FINAL PAYMENT Certificate: - 15,563.87 Final Payment Is Negative As Contractor Is Overpaid ofDocument1 pageFINAL PAYMENT Certificate: - 15,563.87 Final Payment Is Negative As Contractor Is Overpaid ofJamal RkhNo ratings yet

- ARH Documentation Extra Costs: Amount CalculationDocument3 pagesARH Documentation Extra Costs: Amount CalculationNadhir AbdelaliNo ratings yet

- COST ESTIMATE FOR Mwera Learning CentreDocument12 pagesCOST ESTIMATE FOR Mwera Learning CentreChobwe Stephano KanyinjiNo ratings yet

- It 2023 2024 7Document2 pagesIt 2023 2024 7luciferangellordNo ratings yet

- Vat Summary-30-09-2010Document2 pagesVat Summary-30-09-2010anon_978060No ratings yet

- Final Invoice Storage Tank MagdyDocument6 pagesFinal Invoice Storage Tank MagdyAhmed KhalifaNo ratings yet

- 99 A Benzeer Tanha Funfin FinalsDocument7 pages99 A Benzeer Tanha Funfin FinalsBenzeer TanhaNo ratings yet

- Timeline: Project Name AddressDocument16 pagesTimeline: Project Name AddressVaibhavJainNo ratings yet

- Amir PyDocument1 pageAmir PyRiyaad MandisaNo ratings yet

- Cma FormatDocument14 pagesCma FormatBISHNU PADA DASNo ratings yet

- Kar Bik Ipc 1200fDocument39 pagesKar Bik Ipc 1200fmohammedshaddin260No ratings yet

- Pilerne Reserve Villa 9 Cost SheetDocument1 pagePilerne Reserve Villa 9 Cost SheetOnshi AhujaNo ratings yet

- Project Report ON Pickle UnitDocument8 pagesProject Report ON Pickle UnitShijil VellekatNo ratings yet

- Bca Work Book T P&L Bs & RatiosDocument2 pagesBca Work Book T P&L Bs & Ratiosimanishchoudhary97No ratings yet

- VCB Extra ItemDocument3 pagesVCB Extra ItemNarayan Kumar GoaNo ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- RTB Income Statement 06302022Document2 pagesRTB Income Statement 06302022Norberto F. BarsalNo ratings yet

- Mahamaya Project V2Document6 pagesMahamaya Project V2Sumit AhujaNo ratings yet

- Claim VIN Information: Currency: USDDocument1 pageClaim VIN Information: Currency: USDLeonardo Albinagorta ParedesNo ratings yet

- International Granimarmo CMA DTA 115 LACS CC - FinalDocument63 pagesInternational Granimarmo CMA DTA 115 LACS CC - FinalSURANA1973No ratings yet

- Test Sheet-Accounts v1Document6 pagesTest Sheet-Accounts v1Minaketan DasNo ratings yet

- Enjoy Connection Globally.: Tax Invoice/ Tax Credit NoteDocument30 pagesEnjoy Connection Globally.: Tax Invoice/ Tax Credit NoteahsanukkakarNo ratings yet

- Tax InvoiceDocument9 pagesTax Invoicereyanass98No ratings yet

- RAJGHARANADocument20 pagesRAJGHARANAPriyanshu tripathiNo ratings yet

- Enjoy Connection Globally.: Tax Invoice/ Tax Credit NoteDocument42 pagesEnjoy Connection Globally.: Tax Invoice/ Tax Credit NoteahsanukkakarNo ratings yet

- VopDocument3 pagesVopKamarul MayoNo ratings yet

- IPC No. ChamberDocument3 pagesIPC No. ChamberMBURU CONSULTNo ratings yet

- Financial ModelDocument10 pagesFinancial ModelShazmeenNo ratings yet

- Tax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byDocument28 pagesTax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byahsanukkakarNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Case Study MMK SirDocument10 pagesCase Study MMK SirFarzana Akter 28No ratings yet

- Jinnah University For Women: Department: EnglishDocument4 pagesJinnah University For Women: Department: EnglishHurain ZahidNo ratings yet

- Aprds Safety ValveDocument2 pagesAprds Safety ValveMandeep SinghNo ratings yet

- Organization ProfileDocument2 pagesOrganization ProfilebalasudhakarNo ratings yet

- Financial Management BY Prasanna Chandra Financial Management BY Khan and Jain Financial Management BY I.M.PandeyDocument106 pagesFinancial Management BY Prasanna Chandra Financial Management BY Khan and Jain Financial Management BY I.M.PandeyAksh KhandelwalNo ratings yet

- Juntunen Sanna-MariDocument67 pagesJuntunen Sanna-MariKnow yourselfNo ratings yet

- Case 3.1 Enron - A Focus On Company Level ControlsDocument5 pagesCase 3.1 Enron - A Focus On Company Level ControlsgandhunkNo ratings yet

- Receipt Types (Receiving Transactions)Document16 pagesReceipt Types (Receiving Transactions)prashanthav2006No ratings yet

- Planning, Implementation and Control in Business MarketingDocument26 pagesPlanning, Implementation and Control in Business MarketingTanya Naman SarafNo ratings yet

- Incident Management TrainingDocument30 pagesIncident Management TrainingUsman Hamid100% (1)

- Commonwealth Act No 444 - 8 Hour Labor LawDocument2 pagesCommonwealth Act No 444 - 8 Hour Labor Lawirakrizia11No ratings yet

- Inbound 9092675230374889652Document14 pagesInbound 9092675230374889652Sean Andrew SorianoNo ratings yet

- WBI01 01 Que 20160526Document20 pagesWBI01 01 Que 20160526Farhad AhmedNo ratings yet

- (By Cash Only) : State Bank of IndiaDocument2 pages(By Cash Only) : State Bank of IndiaPiyushNo ratings yet

- 0 0 0 15000 0 15000 SGST (0006)Document2 pages0 0 0 15000 0 15000 SGST (0006)Pruthiv RajNo ratings yet

- Vossmann Industrial Sdn. Bhd. - DennisDocument6 pagesVossmann Industrial Sdn. Bhd. - Dennisnishio fdNo ratings yet

- About Ibm Food Trust - 89017389USENDocument17 pagesAbout Ibm Food Trust - 89017389USENMatheus SpartalisNo ratings yet

- Clelland (2014) The Core of The Apple Dark Value and Degrees ofDocument31 pagesClelland (2014) The Core of The Apple Dark Value and Degrees ofTales FernandesNo ratings yet

- Organizational Plan Draft 2Document5 pagesOrganizational Plan Draft 2Jeffrey Fernandez75% (4)

- Supply ManagementDocument22 pagesSupply ManagementmagicforNo ratings yet

- CertAlarm Certificate FC460P FireClass Photoelectric DetectorDocument3 pagesCertAlarm Certificate FC460P FireClass Photoelectric DetectortbelayinehNo ratings yet

- Banking in JapanDocument15 pagesBanking in JapanWilliam C JacobNo ratings yet

- Energy Derivatives: Sonal GuptaDocument48 pagesEnergy Derivatives: Sonal GuptaVindyanchal Kumar100% (1)

- Week 2 Lecture SlidesDocument32 pagesWeek 2 Lecture SlidesMike AmukhumbaNo ratings yet

- Transform Your Business Using Design ThinkingDocument3 pagesTransform Your Business Using Design ThinkingLokesh VaswaniNo ratings yet