Professional Documents

Culture Documents

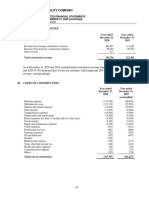

Net Sales: (Amounts in Thousand) (Amounts in Thousand)

Uploaded by

malihaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Net Sales: (Amounts in Thousand) (Amounts in Thousand)

Uploaded by

malihaCopyright:

Available Formats

(Amounts in thousand) (Amounts in thousand)

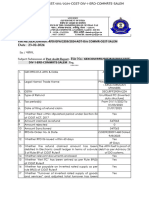

than the other fertilizer companies on the SNGPL system. The Holding Company has out rightly rejected 22. NET SALES

these contentions, and is of the view that it has a strong case for the reasons that (i) 100 mmscfd gas has 2017 2016

been allocated to the Holding Company through a transparent international competitive bidding process -----------------Rupees-----------------

held by the Government of Pakistan, and upon payment of valuable license fee; (ii) GSA guarantees Gross sales:

uninterrupted supply of gas to the expansion plant, with right to first 100 mmcfd gas production from the - manufactured product 54,134,282 50,899,776

Qadirpur gas field; and (iii) both the Holding Company and the Qadirpur gas field are located in Sindh. - purchased and packaged product 27,848,187 28,111,771

Also neither the gas allocation by the Government of Pakistan nor the GSA predicates the gas supply from 81,982,469 79,011,547

Less: Sales tax 4,853,126 9,474,294

Qadirpur gas field producing 100 mmscfd over 500 mmscfd. No orders have been passed in this regard

77,129,343 69,537,253

and the petition has also been adjourned sine die. However, the Holding Company’s management, as

confirmed by the legal advisor, considers chances of petitions being allowed to be remote.

22.1 The above amount includes trade discount amounting to Rs. 362 (2016: Rs. 406,277).

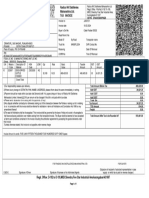

21.8 The Holding Company along with other fertilizer companies, received a show cause notice from the 23. COST OF SALES

Competition Commission of Pakistan (CCP) for initiating action under the Competition Act, 2010 in 2017 2016

relation to unreasonable increase in fertilizer prices. The Holding Company has responded in detail that -----------------Rupees-----------------

factors resulting in such increase were mainly the imposition of infrastructure cess and sales tax and Cost of sales - Manufactured product

partially the gas curtailment. The CCP has issued an order in March 2013, whereby it has held that the

Holding Company enjoys a dominant position in the urea market and that it has abused this position by Raw materials consumed 12,094,227 15,417,290

unreasonable increases of urea prices in the period from December 2010 to December 2011. The CCP Salaries, wages and staff welfare (note 23.1) 2,021,099 1,896,338

has also held another fertilizer company to be responsible for abusing its dominant position. In addition, Fuel and power 6,639,650 7,651,502

the CCP has imposed a penalty of Rs. 3,140,000 and Rs. 5,500,000 on the Holding Company and that Repairs and maintenance 1,025,019 1,813,913

other fertilizer company, respectively. An appeal has been filed in the Competition Appellate Tribunal Depreciation (note 4.2) 5,018,362 4,972,487

and a writ has been filed in the Sindh High Court and stay has been granted against the recovery of Amortisation (note 5.2) 15,700 13,410

the imposed penalty. Hearing have been conducted at Appellate Tribunal where Farmer Association Consumable stores 446,686 574,544

has filed an internal application. The Holding Company’s management believes that the chances of Training, HSE and other related expenses 404,448 408,061

ultimate success are very good, as confirmed by legal advisor, hence, no provision has been made in Purchased services 523,297 431,932

this respect. Travel 52,175 48,684

Communication, stationery and other office expenses 40,589 31,371

Insurance 329,605 359,334

21.9 During the year, the High Court of Islamabad in its order dated June 8, 2017 declared that the income

Rent, rates and taxes 21,078 19,577

derived by M/s Snamprogetti Engineering (the Contractor) from its contract with the Holding Company, is

Other expenses 2,576 3,304

subject to tax as per Clause 4 of Article 5 of Double Taxation Treaty between Pakistan and the Netherlands.

Manufacturing cost 28,634,511 33,641,747

As per the terms of the contract, the Holding Company is liable to reimburse the Contractor for any taxes Add: Opening stock of work in process 30,233 20,688

applied to the income of the Contractor under the contract by the taxation authorities. In respect thereof, Less: Closing stock of work in process (note 8) (18,526) (30,233)

the Contractor has preferred an appeal in the Supreme Court of Pakistan. Cost of goods manufactured 28,646,218 33,632,202

Add: Opening stock of finished goods manufactured - net of NRV 5,050,607 1,915,094

The management of the Holding Company based on the opinion of its legal counsel, is of the view that Less: Closing stock of finished goods manufactured

that the income of the Contractor is exempt from tax under the aforementioned clause of the Double - net of NRV (note 8) (1,733,036) (5,050,607)

Taxation Treaty and the matter will be decided in favour of the Contractor and, hence, no provision has 31,963,789 30,496,689

been made in this respect. Cost of sales - Purchased and packaged product

Opening stock - Purchased and packaged product - net of NRV 1,135,905 3,688,392

21.10 Commitments Add: Purchases during the year 25,449,489 19,048,910

2017 2016 Less: Closing stock - Purchased and packaged product

-----------------Rupees----------------- - net of NRV (note 8) (4,638,428) (1,135,905)

21,946,966 21,601,397

Commitments in respect of capital expenditure 53,910,755 52,098,086

and other operational items 2,626,904 2,483,898

23.1 Salaries, wages and staff welfare includes Rs. 130,347 (2016: Rs. 130,776) in respect of staff retirement

benefits.

119 engro fertilizers Annual Report 2017 120

You might also like

- Auditing MCQsDocument39 pagesAuditing MCQsHaroon AkhtarNo ratings yet

- Cochan Singapore Pte. Ltd. - Annual Report 2011Document30 pagesCochan Singapore Pte. Ltd. - Annual Report 2011aliciawittmeyerNo ratings yet

- Quiz1 PDFDocument45 pagesQuiz1 PDFShami Khan Shami KhanNo ratings yet

- Minutes RPC CPC PDFDocument5 pagesMinutes RPC CPC PDFLakshmi TunuguntlaNo ratings yet

- 257 GT 2020Document95 pages257 GT 2020CCPP ONGC ANKNo ratings yet

- SS&CGTODocument2 pagesSS&CGTOIrfan RazaNo ratings yet

- Director ReportDocument3 pagesDirector ReportZeeshan AzizNo ratings yet

- 142 GT 2022Document46 pages142 GT 2022taj shaikNo ratings yet

- Tender Document Liquid Fulfill 52MW Power Plant: For ForDocument7 pagesTender Document Liquid Fulfill 52MW Power Plant: For ForvskNo ratings yet

- Pilipinas Shell Petroleum CorporationDocument115 pagesPilipinas Shell Petroleum Corporationkiema katsutoNo ratings yet

- Query No.1 Oily SludgeDocument3 pagesQuery No.1 Oily SludgeAlok SinghNo ratings yet

- Motion No. M2020-27Document6 pagesMotion No. M2020-27The UrbanistNo ratings yet

- Status of ProposalsDocument10 pagesStatus of ProposalsMuhammad UsmanNo ratings yet

- File Page No 1706865889307Document26 pagesFile Page No 1706865889307agarwalpriyanka072No ratings yet

- Agro vs. VitarichDocument7 pagesAgro vs. VitarichKey ClamsNo ratings yet

- Transmission Corporation of Andhra Pradesh Limited: by Registered Post With Ack Due in DuplicateDocument10 pagesTransmission Corporation of Andhra Pradesh Limited: by Registered Post With Ack Due in DuplicateTender 247No ratings yet

- Versus: Efore Udhir Arain AND Nkareshwar HattDocument13 pagesVersus: Efore Udhir Arain AND Nkareshwar HatthhgghgNo ratings yet

- The Organic Meat Company Limited: Half Yearly Progress ReportDocument7 pagesThe Organic Meat Company Limited: Half Yearly Progress ReportHussain AliNo ratings yet

- PTX - Past Year Set ADocument8 pagesPTX - Past Year Set ANUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Document 1Document2 pagesDocument 1gstceraslmNo ratings yet

- Report DPWH vs. CMCDocument13 pagesReport DPWH vs. CMCEnnavy YongkolNo ratings yet

- Radico NV Distilleries Maharashtra Ltd. Tax InvoiceDocument1 pageRadico NV Distilleries Maharashtra Ltd. Tax Invoicemanoranjan3103No ratings yet

- Service Proforma Invoice - ACCEPTANCE Tata Projects-020Document1 pageService Proforma Invoice - ACCEPTANCE Tata Projects-020maneesh bhardwajNo ratings yet

- Claim Tenability Assesment Report: Project Background& HighlightsDocument8 pagesClaim Tenability Assesment Report: Project Background& HighlightsSvh KameshNo ratings yet

- Petroleum Law CADocument8 pagesPetroleum Law CAKodjovi DanielNo ratings yet

- History of The CompanyDocument5 pagesHistory of The CompanyAkshata HadimaniNo ratings yet

- Acctg. For INTANGIBLE ASSETSDocument5 pagesAcctg. For INTANGIBLE ASSETSKristine PerezNo ratings yet

- The Executive Engineer,: Ref: LNM/MSRDC/P-07/2021/3498 Date:12.11.2021Document7 pagesThe Executive Engineer,: Ref: LNM/MSRDC/P-07/2021/3498 Date:12.11.2021Manoj choudharyNo ratings yet

- E Loa DHTC 19 23Document6 pagesE Loa DHTC 19 23micell dieselNo ratings yet

- Advertisement Financial Results 310314Document1 pageAdvertisement Financial Results 310314DEVESH BHOLENo ratings yet

- Work Order - Service Order For IOCL BarauniDocument10 pagesWork Order - Service Order For IOCL Barauni9893203028No ratings yet

- Rohan TyagiDocument1 pageRohan TyagirohanZorbaNo ratings yet

- 210841-2017-Department of Public Works and Highways V.20220205-11-1oo5z1pDocument30 pages210841-2017-Department of Public Works and Highways V.20220205-11-1oo5z1pSalcedo YehoNo ratings yet

- QUESTIONSDocument13 pagesQUESTIONSriyaNo ratings yet

- DAC Minutes 7&8 Jan 2019 AmendedDocument19 pagesDAC Minutes 7&8 Jan 2019 AmendedarshadNo ratings yet

- Before The Haryana Electricity Regulatory Commission at Panchkula CASE NO. HERC /RA-4 of 2015 Date of Hearing: 29/05/2015 Date of Order 18.08.2015 in The Matter ofDocument23 pagesBefore The Haryana Electricity Regulatory Commission at Panchkula CASE NO. HERC /RA-4 of 2015 Date of Hearing: 29/05/2015 Date of Order 18.08.2015 in The Matter ofer4varunNo ratings yet

- Bill SepDocument2 pagesBill SepAbhishek GorisariaNo ratings yet

- A 30 1 2013 Tariff Proposal FY 14 DGVCLDocument27 pagesA 30 1 2013 Tariff Proposal FY 14 DGVCLJimit ShahNo ratings yet

- Dai-Ichi Karkaria v. ONGCDocument4 pagesDai-Ichi Karkaria v. ONGCIshita TomarNo ratings yet

- CASE 4 - DPWH VS CMC (G.R. No. 179732, September 13, 2017)Document24 pagesCASE 4 - DPWH VS CMC (G.R. No. 179732, September 13, 2017)Jacob BataquegNo ratings yet

- Paper17 Set1Document7 pagesPaper17 Set1Sa7hkr17h GaurNo ratings yet

- Sdabdkasjdnaskd Nsakjdnaskjdnsa Kjad ADocument13 pagesSdabdkasjdnaskd Nsakjdnaskjdnsa Kjad APatrick HidalgoNo ratings yet

- WashingDocument1 pageWashingPRADEEP RNo ratings yet

- 16th CC Minutes 27092022Document40 pages16th CC Minutes 27092022Ayush AgrawalNo ratings yet

- Case Law 2021 51 G S T L 187 Bom 22 12 2020Document10 pagesCase Law 2021 51 G S T L 187 Bom 22 12 2020Ashwini ChandrasekaranNo ratings yet

- ASEC Development and Construction Corp. v. Toyota Alabang, Inc., G.R. Nos. 243477-78, (April 27, 2022Document35 pagesASEC Development and Construction Corp. v. Toyota Alabang, Inc., G.R. Nos. 243477-78, (April 27, 2022Gerald MesinaNo ratings yet

- RMYC Tax Case 2019 R3Document2 pagesRMYC Tax Case 2019 R3KathleeneNo ratings yet

- The FDRE Irrigation Development Commission Contract Addendum No.3 For The Construction Supervision and Contract Administration For Tendaho Youth Irrigation ProjectDocument9 pagesThe FDRE Irrigation Development Commission Contract Addendum No.3 For The Construction Supervision and Contract Administration For Tendaho Youth Irrigation ProjectTikeher DemenaNo ratings yet

- Capital Gain CaseDocument2 pagesCapital Gain Casecasamba306No ratings yet

- Kapil Mittal (SR Garments)Document12 pagesKapil Mittal (SR Garments)SHRUTI AGRAWALNo ratings yet

- Government of Andhra Pradesh: Municipal Administration & Urban Development (Crda.2) DepartmentDocument6 pagesGovernment of Andhra Pradesh: Municipal Administration & Urban Development (Crda.2) DepartmentBalu Mahendra SusarlaNo ratings yet

- 2021 14726 111 FS Un 1 B052469eDocument10 pages2021 14726 111 FS Un 1 B052469eJose OrtizNo ratings yet

- Competition LawDocument6 pagesCompetition LawPRASHANT KUMARNo ratings yet

- Agenda Annual Greenbelt Housekeeping Scan 29 Dec 2020Document3 pagesAgenda Annual Greenbelt Housekeeping Scan 29 Dec 2020RishyaShringaNo ratings yet

- Nit Cpi2385p23Document291 pagesNit Cpi2385p23go2ashokkumardutta2505No ratings yet

- SRO 1873 XWDISCOs 29-12-2023Document13 pagesSRO 1873 XWDISCOs 29-12-2023Muhammad HashirNo ratings yet

- Mercury Vs CIRDocument16 pagesMercury Vs CIRDustin NitroNo ratings yet

- Ajanta Pharma Gabs Gaar NCLTDocument21 pagesAjanta Pharma Gabs Gaar NCLTRupanwita DeNo ratings yet

- Coal India Limited Contract Management Manual-2021 Chapter-6 Hiring of Equipment For Removal of Overburden & Extraction of CoalDocument160 pagesCoal India Limited Contract Management Manual-2021 Chapter-6 Hiring of Equipment For Removal of Overburden & Extraction of CoalKudlappa DesaiNo ratings yet

- Tarifforder 2023Document335 pagesTarifforder 2023surekha mbNo ratings yet

- PortalAdmin Uploads Content FastAccess 9d87ff3817201Document137 pagesPortalAdmin Uploads Content FastAccess 9d87ff3817201mkocaogluNo ratings yet

- 2020 33 1502 29954 Judgement 13-Sep-2021Document140 pages2020 33 1502 29954 Judgement 13-Sep-2021pradeepkumarsnairNo ratings yet

- Business Plan Format For Msmes (Manufacturing Industries)Document10 pagesBusiness Plan Format For Msmes (Manufacturing Industries)Shaikh WasimaNo ratings yet

- Chapter 4: Consolidation Techniques and Procedures: Advanced AccountingDocument48 pagesChapter 4: Consolidation Techniques and Procedures: Advanced AccountingDwi PutriAningrumNo ratings yet

- Ch03 - WORKING WITH FINANCIAL STATEMENTSDocument32 pagesCh03 - WORKING WITH FINANCIAL STATEMENTSMỹ Dung PhạmNo ratings yet

- Chap 022Document8 pagesChap 022Audrey TamNo ratings yet

- Proforma-Recon of SCBA and SFPDocument3 pagesProforma-Recon of SCBA and SFPdianajeanbucuNo ratings yet

- Boynton SM CH 17Document34 pagesBoynton SM CH 17jeankopler100% (1)

- "Azvirt" Limited Liability Company: 25. Construction RevenueDocument1 page"Azvirt" Limited Liability Company: 25. Construction RevenueŞeyxəli ŞəliyevNo ratings yet

- Eig 13Document76 pagesEig 13shau ildeNo ratings yet

- Master of Business Administration N.Manjunath: Project ReportDocument40 pagesMaster of Business Administration N.Manjunath: Project Reportgopal74No ratings yet

- Basic BookkeepingDocument80 pagesBasic BookkeepingCharity CotejoNo ratings yet

- 2016 Vol 1 CH 8 AnswersDocument7 pages2016 Vol 1 CH 8 AnswersIsla PageNo ratings yet

- RFP - Pkg-II & III Chhattisgarh (PBMC) Final ModeDocument233 pagesRFP - Pkg-II & III Chhattisgarh (PBMC) Final Modenaman naharNo ratings yet

- Toy World Case AnalysisDocument2 pagesToy World Case AnalysisMrDorakon100% (1)

- Project 3 Develop and Use A Personal Budget and Saving PlanDocument7 pagesProject 3 Develop and Use A Personal Budget and Saving PlanKen Lati100% (1)

- 6072 p3 Lembar JawabanDocument54 pages6072 p3 Lembar JawabanPeweNo ratings yet

- Tax Problem SolutionDocument5 pagesTax Problem SolutionSyed Ashraful Alam RubelNo ratings yet

- ESIP-Annual Report 2019 PDFDocument115 pagesESIP-Annual Report 2019 PDFSamanthameidelinNo ratings yet

- Four Pillars Financial Sustainability TNCDocument29 pagesFour Pillars Financial Sustainability TNCBlack Scorpion Entertainment (BSE)No ratings yet

- Taaaaax PDFDocument40 pagesTaaaaax PDFAnne Marieline BuenaventuraNo ratings yet

- Micky Tax LawDocument39 pagesMicky Tax LawŤşinu MđNo ratings yet

- Chapter 5 Corporations NoteDocument5 pagesChapter 5 Corporations NoteLihui ChenNo ratings yet

- Microsoft Word - Chapter 1Document4 pagesMicrosoft Word - Chapter 1SoblessedNo ratings yet

- Expense Category Amount (RM) Quantity Total Amount (RM) Sallary: Ceo: 10,000.00Document3 pagesExpense Category Amount (RM) Quantity Total Amount (RM) Sallary: Ceo: 10,000.00Mohd Hafizul Abdul KalamNo ratings yet

- Sunil Panda Commerce Classes: Before Exam Practice Questions For Term 2 Boards Accounts-Not For Profit OrganisationDocument3 pagesSunil Panda Commerce Classes: Before Exam Practice Questions For Term 2 Boards Accounts-Not For Profit OrganisationHigi SNo ratings yet

- HorngrenIMA14eSM ch16Document53 pagesHorngrenIMA14eSM ch16Piyal HossainNo ratings yet

- Mumbai Tribunal Rules Reimbursement of ExpensesDocument5 pagesMumbai Tribunal Rules Reimbursement of ExpensestongkiNo ratings yet

- Establishment of Medical College Regulations 1999 As On 25Document26 pagesEstablishment of Medical College Regulations 1999 As On 25drtpkNo ratings yet