Professional Documents

Culture Documents

Sitxfin003 Learner Workbook v1.3 Acot

Uploaded by

pooja sainiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sitxfin003 Learner Workbook v1.3 Acot

Uploaded by

pooja sainiCopyright:

Available Formats

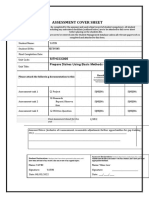

Unit Result Record Sheet

SITXFIN003 Manage finances within a budget

Student Name:

BLOCK Print

Student Number:

BLOCK Print

Assessment Reassessment

Completed Result Completed Result

(If required)

Satisfactory

Satisfactory

Satisfactory

Satisfactory

Date

Date

Not Yet

Not Yet

Reassessed

Assessed

(Evidence must be in

(Evidence must be

students file)

in students file)

Written Assessment

Questions

Summative Written

Assessment Questions

Summative Practical

Demonstration of Skills

Result for unit Competent Not Yet Competent

Assessor Name:

Signature:

& Signature

Date result

reached:

Comments:

Student Declaration:

I declare that:

• I was made aware of all assessment requirements for this/these unit/s

• I have received feedback from my assessor on the results of each individual assessment task and my overall result

for this/these unit/s

• I have been made aware of the reassessment policy for any assessment tasks and/or units that I have not yet

satisfactorily completed

• All work for assessment tasks submitted for this unit is my own with no part of any assessment being

copied/plagiarised from another person’s work, except where authorized and listed/referenced

Student Signature:

Student Name: _____________________________ Student ID: ___________________________

Received by Australian College of Trade:

NAME: ______________________________ Signature: _________________________ Date: __________

UNIT: SITXFIN003 Manage finances within a budget

Page |1

SITXFIN003

Manage finances within a

budget

Learner Workbook

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

Page |2

Table of Contents

Table of Contents ......................................................................................................................... 2

Instructions to Learner ................................................................................................................. 4

Assessment instructions ................................................................................................................. 4

Assessment requirements .............................................................................................................. 6

Observation/Demonstration ........................................................................................................ 7

Third Party Guide ......................................................................................................................... 8

Third party details (required information from the learner) .......................................................... 8

Activities ..................................................................................................................................... 9

Activity 1A ....................................................................................................................................... 9

Activity 1B ..................................................................................................................................... 10

Activity 1C ..................................................................................................................................... 11

Activity 1D ..................................................................................................................................... 12

Activity 1E...................................................................................................................................... 13

Activity 2A ..................................................................................................................................... 14

Activity 2B ..................................................................................................................................... 15

Activity 2C ..................................................................................................................................... 16

Activity 2D ..................................................................................................................................... 17

Activity 2E...................................................................................................................................... 18

Activity 3A ..................................................................................................................................... 19

Activity 3B ..................................................................................................................................... 20

Activity 3C ..................................................................................................................................... 21

Activity 3D ..................................................................................................................................... 22

Activity 3E...................................................................................................................................... 23

Activity 3F...................................................................................................................................... 24

Activity 4A ..................................................................................................................................... 25

Activity 4B ..................................................................................................................................... 26

Summative Assessments ............................................................................................................ 27

Section A: Skills activity ................................................................................................................. 28

Section B: Knowledge activity (Q & A) .......................................................................................... 32

Section C: Performance activity .................................................................................................... 34

Workplace Documentation – for learner ..................................................................................... 35

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

Page |3

Workplace documents checklist ................................................................................................... 35

Supplementary Oral Questions (optional) – for assessor ............................................................. 36

Competency record to be completed by assessor ........................................................................ 39

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

Page |4

Instructions to Learner

Assessment instructions

Overview

Prior to commencing the assessments, your trainer/assessor will explain each assessment task and

the terms and conditions relating to the submission of your assessment task. Please consult with

your trainer/assessor if you are unsure of any questions. It is important that you understand and

adhere to the terms and conditions, and address fully each assessment task. If any assessment task

is not fully addressed, then your assessment task will be returned to you for resubmission. Your

trainer/assessor will remain available to support you throughout the assessment process.

Written work

Assessment tasks are used to measure your understanding and underpinning skills and knowledge of

the overall unit of competency. When undertaking any written assessment tasks, please ensure that

you address the following criteria:

➢ Address each question including any sub-points

➢ Demonstrate that you have researched the topic thoroughly

➢ Cover the topic in a logical, structured manner

➢ Your assessment tasks are well presented, well referenced and word processed

➢ Your assessment tasks include your full legal name on each and every page.

Active participation

It is a condition of enrolment that you actively participate in your studies. Active participation is

completing all the assessment tasks on time.

Plagiarism

Plagiarism is taking and using someone else's thoughts, writings or inventions and representing them

as your own. Plagiarism is a serious act and may result in a learner’s exclusion from a course. When

you have any doubts about including the work of other authors in your assessment, please consult

your trainer/assessor. The following list outlines some of the activities for which a learner can be

accused of plagiarism:

➢ Presenting any work by another individual as one's own unintentionally

➢ Handing in assessments markedly similar to or copied from another learner

➢ Presenting the work of another individual or group as their own work

➢ Handing in assessments without the adequate acknowledgement of sources used, including

assessments taken totally or in part from the internet.

If it is identified that you have plagiarised within your assessment, then a meeting will be organised

to discuss this with you, and further action may be taken accordingly.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

Page |5

Collusion

Collusion is the presentation by a learner of an assignment as their own that is, in fact, the result in

whole or in part of unauthorised collaboration with another person or persons. Collusion involves

the cooperation of two or more learners in plagiarism or other forms of academic misconduct and,

as such, both parties are subject to disciplinary action. Collusion or copying from other learners is

not permitted and will result in a “0” grade and NYC.

Assessments must be typed using document software such as (or similar to) MS Office. Handwritten

assessments will not be accepted (unless, prior written confirmation is provided by the

trainer/assessor to confirm).

Competency outcome

There are two outcomes of assessments: S = Satisfactory and NS = Not Satisfactory (requires more

training and experience).

Once the learner has satisfactorily completed all the tasks for this module the learner will be

awarded “Competent” (C) or “Not yet Competent” (NYC) for the relevant unit of competency.

If you are deemed “Not Yet Competent” you will be provided with feedback from your assessor and

will be given another chance to resubmit your assessment task(s). If you are still deemed as “Not Yet

Competent” you will be required to re-enrol in the unit of competency.

Additional evidence

If we, at our sole discretion, determine that we require additional or alternative

information/evidence in order to determine competency, you must provide us with such

information/evidence, subject to privacy and confidentiality issues. We retain this right at any time,

including after submission of your assessments.

Confidentiality

We will treat anything, including information about your job, workplace, employer, with strict

confidence, in accordance with the law. However, you are responsible for ensuring that you do not

provide us with anything regarding any third party including your employer, colleagues and others,

that they do not consent to the disclosure of. While we may ask you to provide information or

details about aspects of your employer and workplace, you are responsible for obtaining necessary

consents and ensuring that privacy rights and confidentiality obligations are not breached by you in

supplying us with such information.

Assessment appeals process

If you feel that you have been unfairly treated during your assessment, and you are not happy with

your assessment and/or the outcome as a result of that treatment, you have the right to lodge an

appeal. You must first discuss the issue with your trainer/assessor. If you would like to proceed

further with the request after discussions with your trainer/assessor, you need to lodge your appeal

to the course coordinator, in writing, outlining the reason(s) for the appeal.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

Page |6

Recognised prior learning

Candidates will be able to have their previous experience or expertise recognised on request.

Special needs

Candidates with special needs should notify their trainer/assessor to request any required

adjustments as soon as possible. This will enable the trainer/assessor to address the identified needs

immediately.

Assessment requirements

Assessment can either be:

➢ Direct observation

➢ Product-based methods e.g. reports, role plays, work samples

➢ Portfolios – annotated and validated

➢ Questioning

➢ Third party evidence.

If submitting third party evidence, the Third Party Observation/Demonstration document must be

completed by the agreed third party.

Third parties can be:

➢ Supervisors

➢ Trainers

➢ Team members

➢ Clients

➢ Consumers.

The third party observation must be submitted to your trainer/assessor, as directed.

The third party observation is to be used by the assessor to assist them in determining competency.

The assessment activities in this workbook assess aspects of all the elements, performance criteria,

skills and knowledge and performance requirements of the unit of competency.

To demonstrate competence in this unit you must undertake all activities in this workbook and have

them deemed satisfactory by the assessor. If you do not answer some questions or perform certain

tasks, and therefore you are deemed to be Not Yet Competent, your trainer/assessor may ask you

supplementary questions to determine your competence. Once you have demonstrated the

required level of performance, you will be deemed competent in this unit.

Should you still be deemed Not Yet Competent, you will have the opportunity to resubmit your

assessments or appeal the result.

As part of the assessment process, all learners must abide by any relevant assessment policies as

provided during induction.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

Page |7

If you feel you are not yet ready to be assessed or that this assessment is unfair, please contact your

assessor to discuss your options. You have the right to formally appeal any outcome and, if you wish

to do so, discuss this with your trainer/assessor.

Observation/Demonstration

Throughout this unit, you will be expected to show your competency of the elements through

observations or demonstrations. Your trainer/assessor will have a list of demonstrations you must

complete or tasks to be observed. The observations and demonstrations will be completed as well as

the activities found in this workbook.

An explanation of observations and demonstrations:

Observation is on-the-job

The observation will usually require:

➢ Performing a work-based skill or task

➢ Interaction with colleagues and/or customers.

Demonstration is off-the-job

A demonstration will require:

➢ Performing a skill or task that is asked of you

➢ Undertaking a simulation exercise.

Your trainer/assessor will inform you of which one of the above they would like you to do. The

observation/demonstration will cover one of the unit’s elements.

The observation/demonstration will take place either in the workplace or the training environment,

depending on the task to be undertaken and whether it is an observation or demonstration. Your

trainer/assessor will ensure you are provided with the correct equipment and/or materials to

complete the task. They will also inform you of how long you have to complete the task.

You should be able to demonstrate the skills, knowledge and performance criteria required for

competency in this unit, as seen in the Learner Guide.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

Page |8

Third Party Guide

You should supply details of the third party to the assessor before you commence the activities (see

below), unless the assessor has already selected a third party themselves. The assessor can then

contact the third party in instances where they require more evidence to determine competency, or

they cannot observe certain tasks themselves.

The reasons to use a third party may include:

➢ Assessment is required in the workplace

➢ Where there are health and safety issues related to observation

➢ Patient confidentiality and privacy issues are involved.

If you are not employed, or able to complete demonstrative tasks in the workplace, you will need to

inform the assessor. They will be able to provide you with a simulated environment in which to

complete these tasks.

We would prefer that, wherever possible, these be “live” issues for your industry and require

application of the principles that you are learning as part of your training. Where this is not possible,

you and your third party should simulate the activity tasks and demonstrations that you believe

would be likely to arise in your organisation or job role.

Third party evidence can also be used to provide “everyday evidence” of tasks included in your work

role that relate to the unit of competency but are not a part of the formal assessment process.

The third party is not to be used as a co-assessor – the assessor must make the final decision on

competency themselves. Documents relevant to collection of third-party evidence are included in

the Third Party section in the Observations/Demonstrations document.

Third party details (where required from the learner)

A third party may be required for observations or demonstrations; please provide details below of

your nominated third party and obtain their signature to confirm their agreement to participate. This

information will be required by your trainer/assessor in advance of arranging any future

observations or demonstrations.

Third party name: ______________________________________________________________

Position of third party: ______________________________________________________________

Telephone number: ______________________________________________________________

Email address: ______________________________________________________________

Declaration for nominated third party

I declare my intention to act as third party for (learner’s name here) __________________________

Third party signature: _____________________________________ Date: ___________________

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

Page |9

Activities

Complete the following activities individually or in a group (as applicable to the specific activity

and the assessment environment).

Activity 1A

Estimated Time 15 minutes

Objective To provide you with an opportunity to identify how to allocate funds

according to budget and agreed priorities.

1. What do you need to do before you can allocate funds to budgets?

2. Explain why it is important to agree on organisational priorities before allocating funds.

Give three examples of agreed priorities in budgets that you have been involved with.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 10

Activity 1B

Estimated Time 45 minutes

Objective To provide you with an opportunity to discuss changes to income and

expenditure priorities with appropriate colleagues prior to implementation.

This activity will need to be observed for assessment.

As a simulated workplace activity as directed by the assessor; you will be given information on

the current income and expenditure for one work area/project (as relevant to your organisation

or area of work). You should read this through, looking for where any changes may be required.

With the person acting as the finance manager, discuss whether this needs to be changed,

identifying at least one change and your reason for this.

Write down the outcome of your meeting in your workbook, and the change(s) you have

recommended with your reason(s) why.

Note to the assessor:

You must ensure the learner has an appropriate simulated work environment to perform this

activity, with a person representing the finance manager. The income and expenditure

information must be relevant to the learner’s organisation or area of work; this only needs to be

for a short period of time, e.g., three months, and should highlight the need for more than one

change. The learner and the person acting as the finance manager must be given adequate time

to read this information prior to the meeting. The learner should be observed to ensure they

participate appropriately in the discussion and display relevant knowledge and understanding

about the information they have been given. Assessment of the learner’s notes in their

workbook must also be made to confirm they have correctly identified one change.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 11

Activity 1C

Estimated Time 15 minutes

Objective To provide you with an opportunity to consult with and inform relevant

personnel about resource decisions.

This activity will need to be observed for assessment.

Following on from Activity 1B; as a simulated workplace activity, consult with the work

area/project manager to discuss your identified change(s) regarding the income and

expenditure they have. You should inform them of the reason for the change(s) that you have

found.

Note to the assessor:

You must ensure the learner has an appropriate simulated work environment to perform this

activity, with a person representing the work area/project manager. The learner should be

observed to ensure they communicate professionally with the other person and to make sure

they provide clear information and reasoning for their change(s). This activity does not require a

two-way exchange, although the person acting as the manager can ask questions or provide

comments that are applicable to the discussions.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 12

Activity 1D

Estimated Time 15 minutes

Objective To provide you with an opportunity to identify how to promote awareness of

the importance of budget control.

When promoting awareness of budget control, what points should you make as a priority?

Provide three examples.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 13

Activity 1E

Estimated Time 20 minutes

Objective To provide you with an opportunity to identify how to maintain detailed

records of resource allocation according to organisational control systems.

1. Give four examples of different records of resource allocation that you use within your

organisation (or business industry). For one of these, explain what information you will

need to fill out and keep for financial recordkeeping.

2. Why it is important to maintain this information for business?

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 14

Activity 2A

Estimated Time 60-90 minutes

Objective To provide you with an opportunity to use financial records to regularly check

actual income and expenditure against budgets.

As a real or simulated work activity as directed by the assessor; you must check three records

relating to income and expenditure for the previous month. These records will be allocated to

you.

Identify the actual income and expenditure that took place and assess these against the

budgets they relate to.

You must answer the following questions:

➢ Do the income and expenditure match the budget(s)?

➢ If there are variations, where are these found?

Write up your conclusions as a report, providing clear details about your assessment and

relevant findings. If produced separately, attach this to your workbook. (No word count

specified; this can be as long or short as needed. However, reports must include all the relevant

details.)

Note to the assessor:

You must ensure the learner has access to these records and the relevant budgetary

information; this may be in collaboration with their organisation or from examples that have

been created for the purpose of this activity. Information should be relevant to the learner’s role

and area of work. The learner must be provided with an appropriate work environment with

equipment and technologies, to access and interpret these records. The learner’s final report

should be assessed for the successful completion of this activity against the information they

have worked with.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 15

Activity 2B

Estimated Time 15 minutes

Objective To provide you with an opportunity to include financial commitments in all

documentation to ensure accurate monitoring.

Explain what a financial commitment is and give three examples of regular financial

commitments that will need to be made at your organisation or in your area of work.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 16

Activity 2C

Estimated Time 30 minutes

Objective To provide you with an opportunity to identify and report deviations

according to significance of deviation.

This spoken communication in this activity will need to be observed for assessment.

As a real or simulated work activity as directed by the assessor; you will be given one financial

record with two deviations.

Read this record and identify the two deviations that are present and their level of significance

for reporting.

Report these deviations according to the level of importance; one will be minor and only need

to be reported as an email correspondence, and one is more urgent and must be reported in a

face-to-face meeting with the finance manager (or the person acting as the finance manager).

For the one deviation that is to be reported by email, write an email script in your workbook.

For the deviation that must be reported in a spoken communication, you must carry out this

communication, making sure you report what the deviation is and where it is found.

Note to the assessor:

You must ensure the learner is provided with one record with two deviations (one being minor

and one being major); this may be in collaboration with their organisation or from examples

that have been created for the purpose of this activity. Information should be relevant to the

learner’s role and area of work. The learner must be provided with an appropriate work

environment with equipment and technologies, to access and interpret information. They must

be provided with one person to report the major deviation to. The spoken communication must

be observed to ensure the learner successfully communicates the major deviation, and the email

script read and assessed for the minor deviation.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 17

Activity 2D

Estimated Time 15 minutes

Objective To provide you with an opportunity to identify how to investigate appropriate

options for more effective management of deviations.

1. From your own thinking, identify three options that you could take to investigate

deviations.

2. Suggest three actions you could take to manage deviations.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 18

Activity 2E

Estimated Time 15 minutes

Objective To provide you with an opportunity to identify how to advise appropriate

colleagues of budget status in relation to targets.

When advising colleagues of the budget status in relation to targets, what should you advise the

following personnel of?

➢ Senior and mid-level management

➢ The accounts department

➢ A budget committee.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 19

Activity 3A

Estimated Time 50-60 minutes

Objective To provide you with an opportunity to assess existing costs and resources and

proactively identify areas for improvement.

As a simulated work activity as directed by the assessor; you will be given information on five

main costs for an example organisation and their associated budgets.

Assess this information and determine where improvements can be made in spending and use

of resources. You should identify two improvements; write down your findings.

Note to the assessor:

You must ensure the learner is provided with example information to work with for this

simulated work activity; there must be at least two possible improvements that can be made

from this information. This must be relevant to the learner and their area of work. The learner

must be provided with an appropriate work environment with equipment and technologies (as

applicable).

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 20

Activity 3B

Estimated Time 30-45 minutes

Objective To provide you with an opportunity to discuss desired budget outcomes with

relevant colleagues.

This activity will need to be observed for assessment.

As a simulated work activity as directed by the assessor, and following on from Activity 3A;

discuss your findings regarding the five main costs and the associated budget(s), with the

persons representing the finance manager and organisational management (a total of two to

three persons).

In collaboration, identify the desired budget outcomes and how these can be achieved.

Note to the assessor:

You must ensure the learner has an appropriate simulated work environment to perform this

activity, with persons representing the managers. The learner must be observed discussing their

findings and identifying outcomes for their successful assessment. They must engage with the

managers professionally and seek solutions to achieve the desired budget outcomes.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 21

Activity 3C

Estimated Time 15 minutes

Objective To provide you with an opportunity to identify how to undertake appropriate

research to investigate new approaches to budget management.

Describe two research methods you can use to investigate new approaches to budget

management.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 22

Activity 3D

Estimated Time 15 minutes

Objective To provide you with an opportunity to identify how to define and

communicate the benefits and disadvantages of new approaches.

How can you define new approaches for the benefit of your colleagues? What information

should you provide them with?

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 23

Activity 3E

Estimated Time 15 minutes

Objective To provide you with an opportunity to take account of impacts on customer

service levels and colleagues in developing new approaches.

How can new approaches to managing finances affect the customer experience? Give at least

three examples.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 24

Activity 3F

Estimated Time 30 minutes

Objective To provide you with an opportunity to present clear and logical

recommendations for budget management.

This activity will need to be observed for assessment.

As a simulated work activity as directed by the assessor, and following on from Activity 3B; you

must develop three recommendations to manage the budget more appropriately. In a meeting

with the finance manager and organisation’s manager, present your recommendations in a

spoken communication.

Note to the assessor:

You must ensure the learner has an appropriate simulated work environment to perform this

activity, with persons representing the managers. The learner must be observed presenting their

three recommendations; they must speak clearly, confidently and with awareness to an

appropriate way to manage the budget.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 25

Activity 4A

Estimated Time 60 minutes

Objective To provide you with an opportunity to complete financial and statistical

reports within designated timelines.

As a real or simulated workplace activity as directed by the assessor; you must complete one

financial report and one statistical report. You should be provided with the information that

needs to be put into these reports.

When completed, print out these reports and attach these to your workbook.

Note to the assessor:

You must ensure the learner is provided with an appropriate work environment with equipment,

resources and technologies to complete this activity. They must be given the information for

creating the two reports, as relevant to their organisation or area of work, and be provided with

the correct document guidelines to ensure these are produced correctly. The finished reports

must be assessed for their correctness and against the original information. The timeline for

completing these is as stated in the estimated activity time, although this can be changed as

necessary to suit the given requirements.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 26

Activity 4B

Estimated Time 30 minutes

Objective To provide you with an opportunity to prepare and present clear and concise

information to enable informed decision making.

Following on from Activity 4A; for one of your reports, assess how the information is presented

and make two changes to this to help make the report clearer and easier to read; for example,

you can introduce a graph to illustrate data, or you may want to change the layout in some way.

When completed, re-print your report and attach this to your workbook. Note down in your

workbook the changes that you have made.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 27

Summative Assessments

The summative assessments are the major activities designed to assess your skills, knowledge and

performance, as required to show competency in this unit. These activities should be completed

after finishing the Learner Guide. You should complete these as stated below and as instructed by

your trainer/assessor.

Skills, knowledge and performance may be termed as:

➢ Skills – skill requirements, required skills, essential skills, foundation skills

➢ Knowledge – knowledge requirements, required knowledge, essential knowledge,

knowledge evidence

➢ Performance – evidence requirements, critical aspects of assessment, performance

evidence.

Section A: Skills activity

The skills activity is designed to be a series of demonstrative tasks that should be assessed by

observation (by the assessor or third party, depending on the circumstances).

It will demonstrate all of the skills required for this unit of competency – your assessor will provide

further instructions to you, if necessary.

Section B: Knowledge activity (Q & A)

The knowledge activity is designed to be a verbal questionnaire where the assessor asks you a series

of questions to confirm your competency for all of the required knowledge in the unit of

competency.

Section C: Performance activity

The performance activity is designed to be a practical activity performed either in the workplace or a

simulated environment. You should demonstrate the required practical tasks for the unit of

competency and be observed by the assessor and/or third party, as applicable to the situation. If the

third party is required to observe you, you will need to make the required arrangements with them.

If necessary for the activities, you should attached completed written answers, portfolios or any

evidence of competency to this workbook.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 28

Section A: Skills activity

Objective: To provide you with an opportunity to show you have the required skills for this unit.

A signed observation by either an approved third party or the assessor will need to be included in

this activity as proof of completion.

This activity will enable you to demonstrate the following skills:

➢ Reading skills

➢ Writing skills

➢ Oral communication

➢ Numeracy skills

➢ Problem-solving skills

➢ Teamwork skills

➢ Technology skills

Answer the activity in as much detail as possible, considering your organisational requirements.

As a workplace activity or simulated workplace activity (as directed by the assessor):

1. Obtain a copy of an expenditure report from a past budget, and thoroughly read this

document to identify and analyse any examples of wastage.

2. Using your organisation’s computer software (financial/accounting and/or layout software),

write up a mock purchase summary report for a recent order.

3. Organise a meeting with any staff who have financial decision-making authority, in order to

discuss the setting of priorities for an upcoming budget. Lead this meeting, using your oral

communication skills to make sure that details of priorities are communicated and understood

by everyone.

4. Use your numeracy skills to estimate expenditure for an upcoming project; this may be done

with the aid of financial/accounting software. Don’t forget to check previous budgets to check

the likely costs involved.

5. Use your problem-solving skills to develop a contingency plan for use in the event of a

significant deviation from the planned budget in question four.

6. Organise a meeting with those involved in the creation of the budget from question four and

five. Use teamwork skills to lead discussions and come to decisions on the desired outcomes

of the budget. Make sure everyone knows what part they play in budget control, and how

they can contribute to agreed outcomes.

7. Using your organisation’s financial/accounting software on computer, create a graph or chart

which shows overall levels of expenditure over the course of the budgetary period (using the

budget you created in the previous three questions).

Note to the assessor:

You must ensure the learner has access to a real or simulated workplace for this activity, with

access to equipment, resources, technologies and persons. They must be provided with access

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 29

to the necessary financial information and any organisational guidelines that will be required

for financial activities. All spoken communications and interactions should be observed for

assessment to ensure the learner conducts work and themselves in an appropriately

professional manner. Documentation produced for this activity must be assessed to ensure the

learner has completed written work correctly.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 30

Section B: Knowledge activity (Q & A)

Objective: To provide you with an opportunity to show you have the required knowledge for this

unit.

The answers to the following questions will enable you to demonstrate your knowledge of:

➢ Types of financial records:

o bank deposit documentation

o bank statements

o banking summaries

o business activity statements

o cheque books

o credit card transaction statements

o invoices

o journal entries

o labour and wages reports

o merchant statements

o merchant summaries

o transaction reports

➢ Types of budgets:

o cash budgets

o cash flow budgets

o departmental budgets

o event budgets

o project budgets

o purchasing budgets

o sales budgets

o wage budgets

o whole of organisation budgets

➢ Factors for consideration in the preparation of financial and statistical reports:

o cash flow

o commercial account activity

o commission earnings

o covers and financial return

o daily, weekly and monthly transactions

o expenditure

o income

o occupancy rates and financial return

o performance of department, project and/or products and services

o sales performance

o sales returns

o staff costs

o stock levels

o variance in income and/or expenditure

o wastage

o yield

➢ Use, contents of and formats for:

o budgets

o financial reports

o statistical reports

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 31

➢ Budget terminology

➢ Specific industry sector and organisation:

o use of budgets to control costs and enhance profitability

o importance of budget control

o techniques for maximising budget performance

o financial reporting procedures and cycles

o features and functions of accounting software programs used to manage budgets

Answer each question in as much detail as possible, considering your organisational requirements

for each one.

1. In your own words, explain what each of the following financial records show:

➢ Invoices

➢ Labour/wage reports

➢ Credit card transaction statements.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 32

2. Explain why having dedicated budgets for specific departments and projects can be useful (as

opposed to only relying on a budget for the whole organisation).

3. Why is it important to consider sales performance when monitoring budgets and preparing

financial reports?

4. What information is contained in the following document types:

➢ Budgets

➢ Financial reports

➢ Statistical reports?

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 33

5. Explain what the following budgetary terminology means:

➢ Revenue

➢ Financial commitment

➢ Debt.

6. Why is it important to promote budget control, and how can this enhance the overall

profitability of your organisation?

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 34

Section C: Performance activity

Objective: To provide you with an opportunity to demonstrate the required performance

elements for this unit.

A signed observation by either an approved third party or the assessor will need to be included in

this activity as proof of completion.

This activity will enable you to demonstrate the following performance evidence:

➢ Manage a budget for a business over a three-month period that meets the specific business’

needs

➢ Undertake at least two of the following to inform management of the above budget:

o discussions with existing suppliers

o evaluation of staffing and rostering requirements

o evaluation of impact of potential roster changes

o review of operating procedures

o sourcing new suppliers

➢ Monitor income and expenditure and evaluate budgetary performance over the above

budgetary life cycle

➢ Complete financial reports related to the above budget within designated timelines and

using correct budget terminology

Answer the activity in as much detail as possible, considering your organisational requirements.

As a workplace activity or simulated workplace activity (as directed by the assessor):

1. Create a budget for an event or project that will last for three months. Throughout this period,

you must show that you can create, monitor, and control the budget by doing the following:

➢ Show that you can work with colleagues to establish requirements and priorities (including

staffing requirements and stock requirements)

➢ Use financial records to monitor expenditure and income on a regular basis

➢ Identify any variances and deviations, and react to them – you may need to adapt the

budget

➢ Complete financial reports to ensure control of finances, and to update others on the

budget’s status; this must be performed at scheduled points (as agreed with management)

and using the appropriate budget terminology.

Note to the assessor:

You must ensure the learner has access to a real or simulated workplace for this activity, with

access to equipment, resources, technologies and persons. They must be provided with access

to the necessary financial information and any organisational guidelines that will be required

for financial activities. Spoken communications and interactions should be observed for

assessment to ensure the learner conducts work and themselves in an appropriately

professional manner. Documentation produced for this activity must be assessed to ensure the

learner has completed written work correctly.

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 35

Workplace Documentation – for learner

Workplace documents checklist

To demonstrate and support workplace knowledge, workplace documents can be submitted to the

assessor or third party. Indicate in the table below the documents that have been provided. Please

refer to your trainer/assessor if clarification is required or if you have any further questions on what

you are able to provide or use.

Document name/description Document attached

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

Yes No (Please circle)

For RTO use only

Have originals or digital copies been supplied for the workplace Yes No (Please circle)

documents?

If not originals, have the originals been validated or checked? Yes No (Please circle)

Learner’s signature

Assessor’s signature

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 36

Supplementary Oral Questions (optional) – for assessor

The below table is for you to document any supplementary verbal questions you have asked the

learner to determine their competency. For example, if you are unsure of their answer to a question

in the Learner Workbook, you may choose to ask them a supplementary question to clarify their

understanding of the relevant criteria.

Learner’s name

Assessor’s name

Unit of Competence

(Code and Title)

Date of assessment

Question:

Learner answer:

Assessor judgement: Satisfactory Not Satisfactory

Question:

Learner answer:

Assessor judgement: Satisfactory Not Satisfactory

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 37

Question:

Learner answer:

Assessor judgement: Satisfactory Not Satisfactory

Question:

Learner answer:

Assessor judgement: Satisfactory Not Satisfactory

Question:

Learner answer:

Assessor judgement: Satisfactory Not Satisfactory

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 38

Feedback for the learner

I have read, understood, and am satisfied with the feedback provided by the assessor.

Learner’s name

Learner’s signature

Assessor’s name

Assessor’s signature

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 39

Competency as recorded by Assessor

This should be used by the trainer/assessor to document the learner’s skills, knowledge and

performance as relevant to the overall unit. Indicate in the table below if the learner is deemed

competent or not yet competent for the unit or if reassessment is required.

Learner’s name

Assessor’s name

Unit of Competence

(Code and Title)

Date(s) of assessment

Activities List 1A-1E, 2A-2E, 3A – 3F, 4A – 4B S NS

Have the activities been answered and performed fully, as required to assess Yes No

the competency of the learner? (Please circle)

Has sufficient evidence and information been provided by the learner for the Yes No

activities? (Please circle)

Comments from trainer/assessor:

Summative Assessments: Section A checklist S NS

Has the activity been answered and performed fully, as required to assess the Yes No

competency of the learner? (Please circle)

Has sufficient evidence and information been provided by the learner for the Yes No

activity? (Please circle)

Comments from trainer/assessor:

Summative Assessments: Section B checklist S NS

Has the activity been answered and performed fully, as required to assess the Yes No

competency of the learner? (Please circle)

Has sufficient evidence and information been provided by the learner for the Yes No

activity? (Please circle)

Comments from trainer/assessor:

Summative Assessments: Section C checklist S NS

Has the activity been answered and performed fully, as required to assess the Yes No

competency of the learner? (Please circle)

Has sufficient evidence and information been provided by the learner for the Yes No

activity? (Please circle)

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

P a g e | 40

Comments from trainer/assessor:

Unit Result

Has the learner completed all required assessments to a satisfactory Yes No

standard? (Please circle)

Has sufficient evidence and information been provided by the learner to Yes No

prove their competency across the entire unit? (Please circle)

Has the learner completed all required assessments to a satisfactory Yes No

standard? (Please circle)

Has sufficient evidence and information been provided by the learner to Yes No

prove their competency across the entire unit? (Please circle)

Comments from trainer/assessor:

The learner has been assessed as competent in the elements and performance criteria and the evidence has

been presented as:

Yes No

Authentic

(Please circle)

Yes No

Valid

(Please circle)

Yes No

Reliable

(Please circle)

Yes No

Current

(Please circle)

Yes No

Sufficient

(Please circle)

The learner is deemed: Not yet Competent Competent

If not yet satisfactory, date for reassessment:

Comments from trainer/assessor:

Learner’s signature

Assessor’s signature

VCID. ACOT Training and Assessment/SITXFIN003/Learner Workbook/V1.3/July 2019

You might also like

- Oasis 360 Overview 0710Document21 pagesOasis 360 Overview 0710mychar600% (1)

- Unit Result Record Sheet: Jaskaran Singh HP05200069Document45 pagesUnit Result Record Sheet: Jaskaran Singh HP05200069Kavish SharmaNo ratings yet

- How To Attain Success Through The Strength of The Vibration of NumbersDocument95 pagesHow To Attain Success Through The Strength of The Vibration of NumberszahkulNo ratings yet

- Manage People PerformanceDocument49 pagesManage People PerformanceSamina AkhtarNo ratings yet

- Manage Operational PlanDocument66 pagesManage Operational PlanSamina AkhtarNo ratings yet

- Prepositions Below by in On To of Above at Between From/toDocument2 pagesPrepositions Below by in On To of Above at Between From/toVille VianNo ratings yet

- SITHCCC016 Pates and Terrines AnswersDocument46 pagesSITHCCC016 Pates and Terrines AnswerskarthikNo ratings yet

- 2.1 - SITXINV001 Receive and Store Stock Student Assessment GuideDocument61 pages2.1 - SITXINV001 Receive and Store Stock Student Assessment GuidePiyush Gupta100% (1)

- SITXCOM005 Learner Workbook V1.1 ACOT-4Document34 pagesSITXCOM005 Learner Workbook V1.1 ACOT-4brooke luffy100% (1)

- SITXFIN003 - Student Assessment Tool Manage Finaces Within A BudgettDocument37 pagesSITXFIN003 - Student Assessment Tool Manage Finaces Within A BudgettTina100% (2)

- 2 and 3 Hinged Arch ReportDocument10 pages2 and 3 Hinged Arch ReportelhammeNo ratings yet

- Midterm Exam StatconDocument4 pagesMidterm Exam Statconlhemnaval100% (4)

- Unit Result Record Sheet: Assessmen T Completed Result ResultDocument73 pagesUnit Result Record Sheet: Assessmen T Completed Result Resultmaimuna100% (3)

- 0 - SITXHRM001 Learner Workbook V1.1 ACOT - dn341Document31 pages0 - SITXHRM001 Learner Workbook V1.1 ACOT - dn341bhshdjnNo ratings yet

- 2.0 - SITHKOP002 - Plan and Cost Basic Menus Student GuideDocument166 pages2.0 - SITHKOP002 - Plan and Cost Basic Menus Student GuideNidhi Gupta100% (1)

- Assessment 1 Cluster SITXMGT001, SITXMGT002 KnowledgeDocument15 pagesAssessment 1 Cluster SITXMGT001, SITXMGT002 KnowledgeBoban Gorgiev33% (3)

- Reflection Paper 1Document5 pagesReflection Paper 1Juliean Torres AkiatanNo ratings yet

- Assessment Record SITXFIN004 Prepare and Monitor BudgetsDocument36 pagesAssessment Record SITXFIN004 Prepare and Monitor Budgetsemninaam71% (31)

- 2.1 - SITXFIN004 Prepare and Monitor Budgets Student Assessment GuideDocument65 pages2.1 - SITXFIN004 Prepare and Monitor Budgets Student Assessment GuideAmandeep KarwalNo ratings yet

- Optimization of Crude Oil DistillationDocument8 pagesOptimization of Crude Oil DistillationJar RSNo ratings yet

- Assessment 4Document30 pagesAssessment 4Aakash DaveNo ratings yet

- SITHKOP005 Learner Workbook V1.1 ACOT-9-2Document45 pagesSITHKOP005 Learner Workbook V1.1 ACOT-9-2brooke luffy100% (2)

- Unit Result Record Sheet: Amrinder SinghDocument45 pagesUnit Result Record Sheet: Amrinder SinghVirender Arya100% (1)

- BSBSUS201 Learner Workbook V1.1 ACOTDocument39 pagesBSBSUS201 Learner Workbook V1.1 ACOTGopi chand Deevala50% (2)

- SITXFIN003 Workbook 1Document47 pagesSITXFIN003 Workbook 1Kavish SharmaNo ratings yet

- Sitxglc001 Learner Workbook v1.1 AcotDocument39 pagesSitxglc001 Learner Workbook v1.1 AcotKomal SharmaNo ratings yet

- BSBSUS401 (Write ID and Student Name Here)Document73 pagesBSBSUS401 (Write ID and Student Name Here)Sehaj SharmaNo ratings yet

- SITHCCC011 Learner Workbook V1.1 ACOT PDFDocument38 pagesSITHCCC011 Learner Workbook V1.1 ACOT PDFnazifa zahid50% (2)

- SITHKOP004 Learner Workbook V1.1 ACOT-4 FinalllllDocument39 pagesSITHKOP004 Learner Workbook V1.1 ACOT-4 Finalllllbrooke luffy100% (1)

- SITHCCC011 Learner WorkbookDocument34 pagesSITHCCC011 Learner WorkbookrahulNo ratings yet

- BSBMGT517 Learner Workbook V1.2 ACOTDocument42 pagesBSBMGT517 Learner Workbook V1.2 ACOTPiyush GuptaNo ratings yet

- Sitxhrm002 Learner Workbook v1.1 AcotDocument37 pagesSitxhrm002 Learner Workbook v1.1 AcotSehaj SharmaNo ratings yet

- Sitxwhs003 Learner Workbook v1.2 AcotDocument57 pagesSitxwhs003 Learner Workbook v1.2 AcotKomal SharmaNo ratings yet

- Bsbdiv501 Nadir BhattiDocument32 pagesBsbdiv501 Nadir BhattiKavish SharmaNo ratings yet

- SITXCOM005 Learner Guide V1.2 ACOTDocument49 pagesSITXCOM005 Learner Guide V1.2 ACOTAshesh BasnetNo ratings yet

- Sithkop005 Learner Workbook v1.1 AcotDocument40 pagesSithkop005 Learner Workbook v1.1 AcotSehaj Sharma100% (1)

- SITHKOP004 (Write Here Your Learner ID and Student Name)Document39 pagesSITHKOP004 (Write Here Your Learner ID and Student Name)Sehaj SharmaNo ratings yet

- SITXCCS007 Learner Workbook V1.1 ACOTDocument56 pagesSITXCCS007 Learner Workbook V1.1 ACOTKushal BajracharyaNo ratings yet

- SITXMGT002 Harman KAurDocument53 pagesSITXMGT002 Harman KAurharmanNo ratings yet

- Unit Result Record Sheet: Nadir Bhatti HP04200133Document84 pagesUnit Result Record Sheet: Nadir Bhatti HP04200133Komal SharmaNo ratings yet

- SITHPAT006 Learner Workbook V1.1 ACOTDocument69 pagesSITHPAT006 Learner Workbook V1.1 ACOTParash Rijal100% (1)

- Sithccc019 Learner Workbook v1.2 AcotDocument40 pagesSithccc019 Learner Workbook v1.2 AcotJaspreet GillNo ratings yet

- SITXGLC001 Learner Workbook V1.1 ACOTDocument61 pagesSITXGLC001 Learner Workbook V1.1 ACOTMary Flor Agbayani KyosangshinNo ratings yet

- BSBDIV501 Learner Workbook V1.2 ACOTDocument33 pagesBSBDIV501 Learner Workbook V1.2 ACOTJaydeep Kushwaha100% (2)

- SITXHRM004 Learner Workbook V1.1 ACOTDocument66 pagesSITXHRM004 Learner Workbook V1.1 ACOTPalNo ratings yet

- Unit Result Record Sheet: Roman Bishwakarma HPO1220006 Assessment Completed Result ResultDocument86 pagesUnit Result Record Sheet: Roman Bishwakarma HPO1220006 Assessment Completed Result Resultroman darnalNo ratings yet

- 1st File EditDocument48 pages1st File EditH .SNo ratings yet

- Sitxwhs 001 Learner Workbook v11 AcotDocument36 pagesSitxwhs 001 Learner Workbook v11 Acotsandeep kesarNo ratings yet

- Sithccc005 Awb F V3 FinalDocument51 pagesSithccc005 Awb F V3 Finalyatin gognaNo ratings yet

- Manage People PerformanceDocument35 pagesManage People PerformanceSamina AkhtarNo ratings yet

- Manage Operational Plan AssessmentDocument18 pagesManage Operational Plan AssessmentManreet KaurNo ratings yet

- SITXFSA002 Student Assessment WorkbookDocument51 pagesSITXFSA002 Student Assessment WorkbookKomal SharmaNo ratings yet

- SITXMGT002 - VCI - (Student Name) - Assessment ToolDocument36 pagesSITXMGT002 - VCI - (Student Name) - Assessment ToolAshuNo ratings yet

- SITXINV004 - VCI - (Student Name) - Assessment ToolDocument47 pagesSITXINV004 - VCI - (Student Name) - Assessment ToolAshuNo ratings yet

- 2.0 SITXFIN003 Manage Fin Within A Budget Student Assessment Guide 2Document79 pages2.0 SITXFIN003 Manage Fin Within A Budget Student Assessment Guide 2Kitpipoj PornnongsaenNo ratings yet

- BSBMGT605 Provide Leadership Across The OrganisationDocument39 pagesBSBMGT605 Provide Leadership Across The OrganisationHabeeba MoinuddinNo ratings yet

- SITXMGT002 - VCI - (Student Name) - Assessment Tool ProjectDocument39 pagesSITXMGT002 - VCI - (Student Name) - Assessment Tool ProjectAshuNo ratings yet

- BSBFIM501-CAC Assessment Booklet PDFDocument28 pagesBSBFIM501-CAC Assessment Booklet PDFNooka MounikaNo ratings yet

- 2BSBRSK501 AssessementDocument34 pages2BSBRSK501 AssessementKibegwa Moria0% (3)

- SdasDocument62 pagesSdasMuhammad Sheharyar MohsinNo ratings yet

- Manage Operational PlanDocument56 pagesManage Operational PlanSamina AkhtarNo ratings yet

- Assessment 2 SITHIND004 Knowledge 2Document22 pagesAssessment 2 SITHIND004 Knowledge 2Boban Gorgiev100% (1)

- FNSINC601 Assessment Record Tool (ID 150764)Document7 pagesFNSINC601 Assessment Record Tool (ID 150764)Ramesh AdhikariNo ratings yet

- Manage Personal Work Priorities and Professional DevelopmentDocument50 pagesManage Personal Work Priorities and Professional DevelopmentSamina Akhtar100% (1)

- Results Only Work Environment A Complete Guide - 2020 EditionFrom EverandResults Only Work Environment A Complete Guide - 2020 EditionNo ratings yet

- Marketing Management - Pgpmi - Class 12Document44 pagesMarketing Management - Pgpmi - Class 12Sivapriya KrishnanNo ratings yet

- CoP - 6.0 - Emergency Management RequirementsDocument25 pagesCoP - 6.0 - Emergency Management RequirementsAnonymous y1pIqcNo ratings yet

- WVU's Response Letter To Campbell Regarding HugginsDocument4 pagesWVU's Response Letter To Campbell Regarding HugginsJosh JarnaginNo ratings yet

- Modal Case Data Form: GeneralDocument4 pagesModal Case Data Form: GeneralsovannchhoemNo ratings yet

- Sem 4 - Minor 2Document6 pagesSem 4 - Minor 2Shashank Mani TripathiNo ratings yet

- Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document28 pagesSelf-Instructional Manual (SIM) For Self-Directed Learning (SDL)Monique Dianne Dela VegaNo ratings yet

- I5386-Bulk SigmaDocument1 pageI5386-Bulk SigmaCleaver BrightNo ratings yet

- Deshidratador Serie MDQDocument4 pagesDeshidratador Serie MDQDAIRONo ratings yet

- European Steel and Alloy Grades: 16Mncr5 (1.7131)Document3 pagesEuropean Steel and Alloy Grades: 16Mncr5 (1.7131)farshid KarpasandNo ratings yet

- Incoterms 2010 PresentationDocument47 pagesIncoterms 2010 PresentationBiswajit DuttaNo ratings yet

- Fammthya 000001Document87 pagesFammthya 000001Mohammad NorouzzadehNo ratings yet

- Mathematical Geophysics: Class One Amin KhalilDocument13 pagesMathematical Geophysics: Class One Amin KhalilAmin KhalilNo ratings yet

- Omae2008 57495Document6 pagesOmae2008 57495Vinicius Cantarino CurcinoNo ratings yet

- DevelopersDocument88 pagesDevelopersdiegoesNo ratings yet

- Unit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARDocument9 pagesUnit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARAshraf EL WardajiNo ratings yet

- CasesDocument4 pagesCasesNaveen Stephen LoyolaNo ratings yet

- SWOT AnalysisDocument6 pagesSWOT AnalysisSSPK_92No ratings yet

- Double Inlet Airfoil Fans - AtzafDocument52 pagesDouble Inlet Airfoil Fans - AtzafDaniel AlonsoNo ratings yet

- COVID Immunization Record Correction RequestDocument2 pagesCOVID Immunization Record Correction RequestNBC 10 WJARNo ratings yet

- 3.1 Radiation in Class Exercises IIDocument2 pages3.1 Radiation in Class Exercises IIPabloNo ratings yet

- 8524Document8 pages8524Ghulam MurtazaNo ratings yet

- Charlemagne Command ListDocument69 pagesCharlemagne Command ListBoardkingZeroNo ratings yet

- G JaxDocument4 pagesG Jaxlevin696No ratings yet