Professional Documents

Culture Documents

Income from Profession for Doctor

Uploaded by

hanumanthaiahgowda50%(2)50% found this document useful (2 votes)

1K views4 pagesDr. Satya Prakash is a medical practitioner who maintains accounts on a cash basis. His receipts for the year include fees from consultation and visits, gifts from patients, payments from a hospital and insurance. Expenses include rent, staff salaries, medicine purchases, equipment depreciation, car expenses and personal expenses. To calculate income from profession, total receipts are reduced by allowable expenses. Expenses related to the loan, gifts from relatives and personal use of car are not deductible.

Original Description:

Income from profession

Original Title

Doctor - income from profession

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDr. Satya Prakash is a medical practitioner who maintains accounts on a cash basis. His receipts for the year include fees from consultation and visits, gifts from patients, payments from a hospital and insurance. Expenses include rent, staff salaries, medicine purchases, equipment depreciation, car expenses and personal expenses. To calculate income from profession, total receipts are reduced by allowable expenses. Expenses related to the loan, gifts from relatives and personal use of car are not deductible.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

50%(2)50% found this document useful (2 votes)

1K views4 pagesIncome from Profession for Doctor

Uploaded by

hanumanthaiahgowdaDr. Satya Prakash is a medical practitioner who maintains accounts on a cash basis. His receipts for the year include fees from consultation and visits, gifts from patients, payments from a hospital and insurance. Expenses include rent, staff salaries, medicine purchases, equipment depreciation, car expenses and personal expenses. To calculate income from profession, total receipts are reduced by allowable expenses. Expenses related to the loan, gifts from relatives and personal use of car are not deductible.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

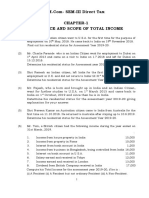

Format for computation of Income from Profession

In case of Doctor or Medical Practitioner

Particulars ₹ ₹

Professional Receipts:

1. Fees for conducting operation XXX

2. Consulting fees XXX

3. Visiting fees XXX

4. Sale of Medicines XXX

5. Gifts received from Patients for professional services XXX

rendered

XXX

6. Examiner’s fees

XXX

7. Nursing home receipts

XXX

8. Any other professional receipts

XXX

Total Professional Receipts XXX

Less: Professional Expenses:

1. Rent, Light, Water charges salary to staff, telephone expenses

of clinic or hospital

XXX

2. Cost of medicines are determined in two days

a. If accounts are maintained on cash basis:

Cost of actual medicines purchased during the previous year

XXX

(Or)

b. If accounts are maintained on mercantile basis:

Opening stock (+) New purchases (-) Closing stock XXX

3. Depreciation on surgical equipment and X-ray M/C etc. at XXX

prescribed rates

XXX

4. Depreciation on books at prescribed rates

5. Motor car expenses: Depreciation relating to professional

XXX

work

XXX

6. Expenditure incurred to increase professional knowledge

XXX

7. Hospital or clinic expenses

XXX

8. Ant other expenditure incurred during the year pertaining to

profession XXX

Income from Profession XXX

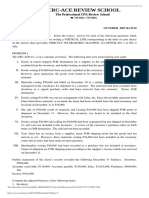

Example:

Dr. Satya Prakash is a medical practitioner who maintains cash system of accounting. Compute his gross total income from the

following particulars:

Receipts and Payments A/c for the year

₹ ₹

To Balance b/d 28,000 By Rent of clinic:

To Consultation fees 2017-18 20,000

2017-18 10,000 2018-19 1,80,000

2018-19 3,60,000 By Electricity and Water 40,000

2019-20 30,000

To Visiting fees 4,25,000 By Purchase of Professional

To Loan from SBI 2,25,000 books 30,000

To Gifts and Presents 60,000 By Car purchased on 1-1-2019 5,00,000

To Honorarium from By Expenses of car 20,000

Private hospital 1,00,000 By Collection charges on

To Dividend from foreign on dividend 1,000

Company 1,10,000 By Salary to staff 1,30,000

To Interest on POSB A/c 10,000 By Life Insurance Premium 1,00,000

To Sale of medicine 2,50,000 By Municipal tax on

To Rent received 20,000 let out house 2,000

To Receipt from LIC By Interest on bank loan 25,000

policy matured 70,000 By Purchase of medicine 2,00,000

By Purchase of surgical

equipments 1,80,000

By Personal expenses 1,56,000

By Balance b/d 1,14,000

16,98,000 16,98,000

Additional Information:

a) Allowable depreciation on car is 15% and car is used equally for personal use and professional purposes.

b) Gifts and presents include ₹ 25,000 received from patients and the remaining relatives.

c) SBI loan is taken for daughter’s marriage.

d) Outstanding salary payable to staff is ₹ 20,000.

e) Depreciation allowable on surgical equipments 15% and books 40%.

You might also like

- Profits and Gains From Business and ProfessionDocument4 pagesProfits and Gains From Business and ProfessionAyaan AhmedNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Characteristics of Business Economics1Document6 pagesCharacteristics of Business Economics1ihavenoidea33No ratings yet

- Taxable Income Calculation Mrs. NarayaniDocument5 pagesTaxable Income Calculation Mrs. NarayaniSumit PattanaikNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- New Business Tax PlanningDocument47 pagesNew Business Tax PlanningashishNo ratings yet

- Costing AssignmentDocument15 pagesCosting AssignmentSumit SumanNo ratings yet

- Internship Final ReportDocument77 pagesInternship Final ReportSri Harsha100% (1)

- Problems On Taxable Salary Income Additional PDFDocument24 pagesProblems On Taxable Salary Income Additional PDFNALIN MEHTA 1713068No ratings yet

- A) Startup India QuestionnaireDocument1 pageA) Startup India Questionnairesubudhiprasanna50% (2)

- Direct Taxes Sem-Iii-20Document22 pagesDirect Taxes Sem-Iii-20Pranita MandlekarNo ratings yet

- Sidco Functions and SchemesDocument11 pagesSidco Functions and SchemesKarthikacauraNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Royalty AccountsDocument5 pagesRoyalty AccountsRobert Henson100% (2)

- Tax Planning and Employee RemunerationDocument10 pagesTax Planning and Employee Remunerationabdulraqeeb alareqiNo ratings yet

- Assessment of CompaniesDocument5 pagesAssessment of Companiesmohanraokp22790% (1)

- Maratha Samaj Seva Mandal’s Farm Accounting ProblemsDocument7 pagesMaratha Samaj Seva Mandal’s Farm Accounting ProblemsAniket BhojaneNo ratings yet

- Whirlpool Financial AnalysisDocument5 pagesWhirlpool Financial AnalysisuddhavkulkarniNo ratings yet

- Worksheet For Issue of Share and DebentureDocument2 pagesWorksheet For Issue of Share and DebentureLaxmi Kant SahaniNo ratings yet

- Problems With Solution Capital GainsDocument12 pagesProblems With Solution Capital Gainsnaqi ali100% (1)

- Branch Account Problems & AnswerDocument11 pagesBranch Account Problems & Answeranand dpiNo ratings yet

- Residential StatusDocument15 pagesResidential StatusDeepak MinhasNo ratings yet

- What is TDS? Advance Tax and ProblemsDocument8 pagesWhat is TDS? Advance Tax and ProblemsNishantNo ratings yet

- Income from Salaries: Calculating Exempted Allowances, Taxable Gratuity & PensionDocument53 pagesIncome from Salaries: Calculating Exempted Allowances, Taxable Gratuity & PensionSiva SankariNo ratings yet

- Royalty AccountsDocument11 pagesRoyalty AccountsVipin Mandyam Kadubi0% (1)

- Request Letter - Shivakumar-FertilizerDocument5 pagesRequest Letter - Shivakumar-Fertilizernaveen KumarNo ratings yet

- Income Tax Salary NotesDocument48 pagesIncome Tax Salary NotesTanya AntilNo ratings yet

- 6 Sem Bcom - Management Accounting PDFDocument71 pages6 Sem Bcom - Management Accounting PDFaldhhdNo ratings yet

- Marginal Costing and Its Application - ProblemsDocument5 pagesMarginal Costing and Its Application - ProblemsAAKASH BAIDNo ratings yet

- Fin Account-Sole Trading AnswersDocument10 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- Fortune TellerDocument3 pagesFortune TellerbharatNo ratings yet

- Mrs. Batliboi's income from other sourcesDocument5 pagesMrs. Batliboi's income from other sourcesSarvar PathanNo ratings yet

- Taxable Salary Problem With Solution Part 1Document2 pagesTaxable Salary Problem With Solution Part 1NagadeepaNo ratings yet

- Income From House PropertyDocument26 pagesIncome From House PropertySuyash Patwa100% (1)

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- PCA & RD Bank PDFDocument86 pagesPCA & RD Bank PDFmohan ks100% (2)

- Working Capital Requirement QuestionsDocument2 pagesWorking Capital Requirement QuestionsVIRAL DOSHI100% (1)

- B.Com. Degree Exam Income Tax PaperDocument0 pagesB.Com. Degree Exam Income Tax PaperbkamithNo ratings yet

- Final Summer Training Report Mohit PalDocument110 pagesFinal Summer Training Report Mohit Palbharat sachdevaNo ratings yet

- Unit - V Budget and Budgetary Control ProblemsDocument2 pagesUnit - V Budget and Budgetary Control ProblemsalexanderNo ratings yet

- Deductions under Section 80C to 80U of the Income Tax ActDocument9 pagesDeductions under Section 80C to 80U of the Income Tax ActSarvar PathanNo ratings yet

- Tax PlanDocument2 pagesTax PlanMrigendra MishraNo ratings yet

- Employee Loan AgreementDocument3 pagesEmployee Loan Agreementshannbaby22No ratings yet

- Problems On Income From Salaries: Tax SupplementDocument20 pagesProblems On Income From Salaries: Tax SupplementJkNo ratings yet

- Course Name: 2T7 - Cost AccountingDocument56 pagesCourse Name: 2T7 - Cost Accountingjhggd100% (1)

- Describe The Scope of Payment of Gratuity Act 1972Document3 pagesDescribe The Scope of Payment of Gratuity Act 1972Jaspreet SinghNo ratings yet

- Functions of A SalesmanDocument2 pagesFunctions of A SalesmanpilotNo ratings yet

- Residential Status Problems 2021-2022-1Document5 pagesResidential Status Problems 2021-2022-120-UCO-517 AJAY KELVIN ANo ratings yet

- As-11 The Effects of Changes in Foreign Exchange RatesDocument21 pagesAs-11 The Effects of Changes in Foreign Exchange RatesDipen AdhikariNo ratings yet

- Tally Journal Entry QuestionsDocument3 pagesTally Journal Entry QuestionsVikas KumarNo ratings yet

- Problems On Joint VentureDocument8 pagesProblems On Joint VentureKrishna Prince M MNo ratings yet

- Consignment CorrectDocument51 pagesConsignment CorrectPraveetha Prakash75% (4)

- Double Tax Avoidance AgreementDocument13 pagesDouble Tax Avoidance AgreementRavi SinghNo ratings yet

- Industrial Securities MarketDocument16 pagesIndustrial Securities MarketNaga Mani Merugu100% (3)

- Objectives & Functions of IDBI BankDocument2 pagesObjectives & Functions of IDBI BankParveen SinghNo ratings yet

- Customs Duty: 1) Trisha Company Imported A Machine From Europe. From The FollowingDocument32 pagesCustoms Duty: 1) Trisha Company Imported A Machine From Europe. From The FollowingAneesh D'souzaNo ratings yet

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocument25 pagesChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxSonu KumarNo ratings yet

- Trademark NOC FormatDocument1 pageTrademark NOC FormatVIBHOR100% (2)

- Project ReportDocument14 pagesProject Reportsee248985No ratings yet

- Illustrative Examples Accounting For Health Care Providers-HospitalsDocument2 pagesIllustrative Examples Accounting For Health Care Providers-HospitalsLa MarieNo ratings yet

- Holding Company Accounts - TheoryDocument4 pagesHolding Company Accounts - TheoryhanumanthaiahgowdaNo ratings yet

- Chapter 1 - Red. of Pref - Shares 2Document4 pagesChapter 1 - Red. of Pref - Shares 2hanumanthaiahgowdaNo ratings yet

- Income Tax - SalaryDocument18 pagesIncome Tax - SalaryhanumanthaiahgowdaNo ratings yet

- Liquidation of CompaniesDocument4 pagesLiquidation of CompanieshanumanthaiahgowdaNo ratings yet

- Chapter 4 - Valuation of SharesDocument11 pagesChapter 4 - Valuation of ShareshanumanthaiahgowdaNo ratings yet

- Types of AmalgamationDocument10 pagesTypes of AmalgamationhanumanthaiahgowdaNo ratings yet

- Compute the income from profession of Mr. Sanath Kumar for AY 2019-20Document3 pagesCompute the income from profession of Mr. Sanath Kumar for AY 2019-20hanumanthaiahgowdaNo ratings yet

- Banking Practices 2Document11 pagesBanking Practices 2hanumanthaiahgowdaNo ratings yet

- Income From House PropertyDocument36 pagesIncome From House PropertyhanumanthaiahgowdaNo ratings yet

- Financial Accounting V: Chapter - 1Document17 pagesFinancial Accounting V: Chapter - 1hanumanthaiahgowdaNo ratings yet

- Certificate Prog - PDF: 1.2 Academic FlexibilityDocument2 pagesCertificate Prog - PDF: 1.2 Academic FlexibilityhanumanthaiahgowdaNo ratings yet

- IT Problem 1 2Document1 pageIT Problem 1 2hanumanthaiahgowdaNo ratings yet

- Redemption of Preference Shares: Financial Accounting - VDocument8 pagesRedemption of Preference Shares: Financial Accounting - VhanumanthaiahgowdaNo ratings yet

- HP - Interest CalculationDocument4 pagesHP - Interest CalculationhanumanthaiahgowdaNo ratings yet

- Single Entry ProblemsDocument2 pagesSingle Entry ProblemshanumanthaiahgowdaNo ratings yet

- Banking PracticesDocument29 pagesBanking PracticeshanumanthaiahgowdaNo ratings yet

- Redemption of Preference Shares Format of Balance Sheet Particulars Note No. I Equity & Liabilities 1. Shareholders FundDocument2 pagesRedemption of Preference Shares Format of Balance Sheet Particulars Note No. I Equity & Liabilities 1. Shareholders FundhanumanthaiahgowdaNo ratings yet

- Answer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120Document5 pagesAnswer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120hanumanthaiahgowdaNo ratings yet

- Chapter - 1 GST - IntroductionDocument24 pagesChapter - 1 GST - IntroductionhanumanthaiahgowdaNo ratings yet

- Banking Practices 2Document11 pagesBanking Practices 2hanumanthaiahgowdaNo ratings yet

- LTC exemption and tax on retrenchment compensationDocument2 pagesLTC exemption and tax on retrenchment compensationhanumanthaiahgowdaNo ratings yet

- FA - Problem 1Document1 pageFA - Problem 1hanumanthaiahgowdaNo ratings yet

- HP - Interest CalculationDocument4 pagesHP - Interest CalculationhanumanthaiahgowdaNo ratings yet

- Income From House PropertyDocument32 pagesIncome From House PropertyhanumanthaiahgowdaNo ratings yet

- FA - Problem 8Document1 pageFA - Problem 8hanumanthaiahgowdaNo ratings yet

- IFHP - ProblemsDocument2 pagesIFHP - ProblemshanumanthaiahgowdaNo ratings yet

- E-Commerce HistoryDocument2 pagesE-Commerce HistoryhanumanthaiahgowdaNo ratings yet

- Session 5Document6 pagesSession 5hanumanthaiahgowdaNo ratings yet

- Why Is It Important?: Exchange and Progression of Goods - Marketing Is HighlyDocument11 pagesWhy Is It Important?: Exchange and Progression of Goods - Marketing Is HighlyhanumanthaiahgowdaNo ratings yet

- IGCSE Accounting Chapter 1-3 Exam Questions by Mrs Sana AbdullahDocument7 pagesIGCSE Accounting Chapter 1-3 Exam Questions by Mrs Sana AbdullahMeredith TwinnNo ratings yet

- FSI Financial Statements SummaryDocument14 pagesFSI Financial Statements SummaryEmosNo ratings yet

- Chapter 9 - Interim Financial ReportingDocument8 pagesChapter 9 - Interim Financial ReportingXiena0% (1)

- Engineering Economics Course OverviewDocument2 pagesEngineering Economics Course OverviewAnil MarsaniNo ratings yet

- TUI AG Bericht 2019 ENDocument48 pagesTUI AG Bericht 2019 ENgoggsNo ratings yet

- BV2018 - MFRS 141Document15 pagesBV2018 - MFRS 141iqbalhakim123No ratings yet

- Ais ExerciseDocument26 pagesAis ExerciseLele DongNo ratings yet

- MSU-CBA Finance Lease Accounting ConceptsDocument4 pagesMSU-CBA Finance Lease Accounting ConceptsJayr BVNo ratings yet

- Perez Long Quiz Auditing and Assurance Concepts and ApplicationDocument7 pagesPerez Long Quiz Auditing and Assurance Concepts and ApplicationMitch MinglanaNo ratings yet

- Accounting InformationDocument3 pagesAccounting Informationnenette cruzNo ratings yet

- Overview of Indian Accounting Standards For SMEsDocument44 pagesOverview of Indian Accounting Standards For SMEsSamrat JonejaNo ratings yet

- IAS 41 Agriculture OverviewDocument45 pagesIAS 41 Agriculture OverviewEmily Rose ZafeNo ratings yet

- Manufacturing and Trading AccountsDocument5 pagesManufacturing and Trading AccountsFarrukhsgNo ratings yet

- Infocept Pte LTD - 2021Document47 pagesInfocept Pte LTD - 2021Lin ZincNo ratings yet

- Model Question Paper for Valuation ExamDocument16 pagesModel Question Paper for Valuation ExamAnshul Chauhan50% (2)

- Final Exam - FA PDFDocument7 pagesFinal Exam - FA PDFNga NguyễnNo ratings yet

- Auditing Problems 2Document8 pagesAuditing Problems 2Rujean Salar AltejarNo ratings yet

- Step by Step Guide On Discounted Cash Flow Valuation Model - Fair Value AcademyDocument25 pagesStep by Step Guide On Discounted Cash Flow Valuation Model - Fair Value AcademyIkhlas SadiminNo ratings yet

- Chapter 3 Target CostingDocument32 pagesChapter 3 Target CostingĐạt DươngNo ratings yet

- Infrastructure Asset Register MaintenanceDocument19 pagesInfrastructure Asset Register MaintenanceTino MatsvayiNo ratings yet

- 11 x09 Capital BudgetingDocument29 pages11 x09 Capital BudgetingKatherine Cabading Inocando100% (10)

- All Subj - Mock Board Exam BBDocument9 pagesAll Subj - Mock Board Exam BBMJ YaconNo ratings yet

- 5Document2 pages5ABDUL WAHABNo ratings yet

- M5&M6 SC - Other AJE & WorksheetDocument47 pagesM5&M6 SC - Other AJE & WorksheetLady Ysabel HechanovaNo ratings yet

- Acc05 Far Handout 7Document5 pagesAcc05 Far Handout 7Jullia BelgicaNo ratings yet

- Chemical Process Design Analysis NPVDocument7 pagesChemical Process Design Analysis NPVHaematomaNo ratings yet

- Partnership Dissolution and Admission ExplainedDocument14 pagesPartnership Dissolution and Admission ExplainedMila aguasanNo ratings yet

- Assignment Chapter 2 SOLUTIONDocument6 pagesAssignment Chapter 2 SOLUTIONBeatrice BallabioNo ratings yet

- Worktext Fabm1 Q4 W1-WokDocument19 pagesWorktext Fabm1 Q4 W1-WokQuincy Lawrence DimaanoNo ratings yet