Professional Documents

Culture Documents

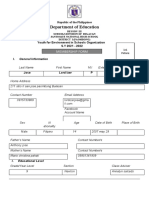

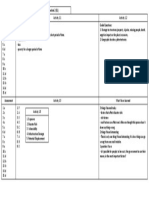

Asdfdsfgf

Uploaded by

mr. oneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asdfdsfgf

Uploaded by

mr. oneCopyright:

Available Formats

Qua Chee Gan vs. Law Union and Rock Insurance Co., Ltd., 98 Phil. 85, No.

L-4611

December 17, 1955

Facts:

Qua Chee Gan, a merchant of Albay instituted this action in 1940, in the

Court of First Instance of said province, seeking to recover the proceeds of

certain fire insurance policies totalling P370,000, issued by the Law Union & Rock

Insurance Co., Ltd., through its agent, Warner, Barnes & Co., Ltd., upon certain

bodegas and merchandise of the insured that were burned on June 21, 1940. The CFI

decide in favor of the insured palintiff, hence, this appeal filed by the insurance

company.

The record shows that before the last war, plaintiffappellee owned four

warehouses or bodegas (designated as Bodegas Nos. 1 to 4) in the municipality of

Tabaco, Albay, used for the storage of stocks of copra and of hemp, baled and

loose, in which the appellee dealt extensively.

Fire of undetermined origin that broke out in the early morning of July 21,

1940, and lasted almost one week, gutted and completely destroyed Bodegas Nos. 1, 3

and 4, with the merchandise stored therein. Plaintiff-appellee informed the insurer

by telegram on the same date; and on the next day, the fire adjusters engaged by

appellant insurance company arrived and proceeded to examine and photograph the

premises, pored over the books of the insured and conducted an extensive

investigation. The plaintiff having submitted the corresponding fire claims,

totalling P398,562.81 (but reduced to the full amount of the insurance, P370,000),

the Insurance Company resisted payment, claiming violation of warranties and

conditions, filing of fraudulent claims, and that the fire had been deliberately

caused by the insured or by other persons in connivance with him.

The insurance company alleges that the trial Court should have held that the

policies were avoided for breach of warranty.It is argued that since the bodegas

insured had an external wall perimeter of 500 meters or 1,640 feet, the appellee

should have eleven (11) fire hydrants in the compound, and that he actually had

only two (2), with a f urther pair nearby, belonging to the municipality of Tabaco.

Issue:

WON the insurance company can invoke the breach of warranty when it fully

knows that such never existed in the beginning yet still issued the policy. (No)

Ruling:

The insurer is barred by estoppel to claim violation of the so-called fire

hydrant warranty where, knowing fully well that the number of hydrants demanded in

the warranty never existed from the very beginning, it nevertheless issued the

policies subject to such warranty, and received the corresponding premiums.

The contract of insurance is one of perfect good faith (uberrimae fidei) not

for the insured alone, but equally so for the insurer; in fact, it is more so for

the latter, since its dominant bargaining position carries with it stricter

responsibility. By reason of the exclusive control of the insurance company over

the terms and phraseology of the insurance contract, the ambiguity must be strictly

interpreted against the insurer and liberally in favor of the insured, specially to

avoid a forfeiture (44 C.J. S., pp. 1166–1175; 29 Am. Jur. 180).

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- City Faces Lawsuit After Cop Pulls Gun On Newspaper Delivery ManDocument24 pagesCity Faces Lawsuit After Cop Pulls Gun On Newspaper Delivery ManDaily KosNo ratings yet

- MS-P01 Management Responsibility ProcedureDocument8 pagesMS-P01 Management Responsibility ProcedureMuhammad ZafarNo ratings yet

- Lease Agreement For Office SpaceDocument3 pagesLease Agreement For Office SpaceRan Dom100% (1)

- FOP/Dale Surbaugh ComplaintDocument13 pagesFOP/Dale Surbaugh ComplaintWSYX/WTTENo ratings yet

- Duties & Responsibilities of A Construction Safety OfficerDocument4 pagesDuties & Responsibilities of A Construction Safety OfficerBruce LiNo ratings yet

- Trust 1 Ramos vs. RamosDocument3 pagesTrust 1 Ramos vs. Ramosmr. oneNo ratings yet

- Professional Ethics Law ProjectDocument43 pagesProfessional Ethics Law ProjectAmrutha PrakashNo ratings yet

- FAR EAST CORPORATION VS AIRTROPOLIS CONSOLIDATORS PHILIPPINES - Full TextDocument9 pagesFAR EAST CORPORATION VS AIRTROPOLIS CONSOLIDATORS PHILIPPINES - Full TextSam LeynesNo ratings yet

- Abutment A & BDocument1 pageAbutment A & Bmr. oneNo ratings yet

- Top of Deck SlabDocument1 pageTop of Deck Slabmr. oneNo ratings yet

- Chef Monica's ContractDocument12 pagesChef Monica's Contractmr. oneNo ratings yet

- Incident Report Starbucks Wall NewDocument4 pagesIncident Report Starbucks Wall Newmr. oneNo ratings yet

- SDFDFGDFGDocument2 pagesSDFDFGDFGmr. oneNo ratings yet

- SdadfdsfaDocument1 pageSdadfdsfamr. oneNo ratings yet

- Circular Column Axial Load Enhancement: Code: NCHRP/ Aashto LRFD 2012Document1 pageCircular Column Axial Load Enhancement: Code: NCHRP/ Aashto LRFD 2012mr. oneNo ratings yet

- FGHFDocument1 pageFGHFmr. oneNo ratings yet

- Combined Footing Design: ASDIP Foundation 4.4.2Document4 pagesCombined Footing Design: ASDIP Foundation 4.4.2mr. oneNo ratings yet

- SdasfdfaDocument1 pageSdasfdfamr. oneNo ratings yet

- SdasaDocument1 pageSdasamr. oneNo ratings yet

- Base Plate / Anchorage Design: ASDIP Steel 5.0.5Document3 pagesBase Plate / Anchorage Design: ASDIP Steel 5.0.5mr. oneNo ratings yet

- 2nd Quarter ScienceDocument1 page2nd Quarter Sciencemr. oneNo ratings yet

- Circular Column Axial Load Enhancement: Code: NCHRP/ Aashto LRFD 2012Document1 pageCircular Column Axial Load Enhancement: Code: NCHRP/ Aashto LRFD 2012mr. oneNo ratings yet

- Circular Column Axial Load Enhancement: Code: NCHRP/ Aashto LRFD 2012Document1 pageCircular Column Axial Load Enhancement: Code: NCHRP/ Aashto LRFD 2012mr. oneNo ratings yet

- PS No. 18Document1 pagePS No. 18mr. oneNo ratings yet

- Circular Column Axial Load Enhancement: Code: NCHRP/ Aashto LRFD 2012Document1 pageCircular Column Axial Load Enhancement: Code: NCHRP/ Aashto LRFD 2012mr. oneNo ratings yet

- Rep Strike Revilla - Roll-Over Internet Bill - With EsigDocument5 pagesRep Strike Revilla - Roll-Over Internet Bill - With Esigmr. oneNo ratings yet

- Office of Congressman Strike B. RevillaDocument1 pageOffice of Congressman Strike B. Revillamr. oneNo ratings yet

- SdasdasdDocument1 pageSdasdasdmr. oneNo ratings yet

- Rep Strike Revilla - E-Sports BillDocument4 pagesRep Strike Revilla - E-Sports Billmr. oneNo ratings yet

- Spread Footing Design: ASDIP Foundation 4.4.2Document4 pagesSpread Footing Design: ASDIP Foundation 4.4.2heherson juanNo ratings yet

- Briefer - 15 Sept 2020 - CHTEDocument6 pagesBriefer - 15 Sept 2020 - CHTEmr. oneNo ratings yet

- Rep Strike Revilla - E-Sports Bill - FinalDocument5 pagesRep Strike Revilla - E-Sports Bill - Finalmr. oneNo ratings yet

- Rep Strike Revilla - Roll-Over Internet Bill - With EsigDocument5 pagesRep Strike Revilla - Roll-Over Internet Bill - With Esigmr. oneNo ratings yet

- Briefer - 15 March 2021 - Subcommittee On Police AdminDocument7 pagesBriefer - 15 March 2021 - Subcommittee On Police Adminmr. oneNo ratings yet

- Committee On Local Government: Prepared by LUJDocument6 pagesCommittee On Local Government: Prepared by LUJmr. oneNo ratings yet

- Briefer - 17 March 2021 - HealthDocument5 pagesBriefer - 17 March 2021 - Healthmr. oneNo ratings yet

- Respondent Memorial (LLDC - 019)Document46 pagesRespondent Memorial (LLDC - 019)Rohan VermaNo ratings yet

- Pre Test 2020 CDIDocument3 pagesPre Test 2020 CDIJamella GarzonNo ratings yet

- Doctrine of Lis Pendens ExplainedDocument10 pagesDoctrine of Lis Pendens ExplainedAN HadNo ratings yet

- Death certificate details in MathuraDocument1 pageDeath certificate details in MathuraManav PARMARNo ratings yet

- ICO Decision 20 2021 Office of The Clerk of The LegislatureDocument18 pagesICO Decision 20 2021 Office of The Clerk of The LegislatureBernewsAdminNo ratings yet

- Zaldivia v. Reyes, 211 SCRA 277Document2 pagesZaldivia v. Reyes, 211 SCRA 277Andrea GarciaNo ratings yet

- Right To Strike and The Role of Judiciary in IndiaDocument5 pagesRight To Strike and The Role of Judiciary in IndiaIJAR JOURNALNo ratings yet

- SJ-20180108102206-008-NetNumen U31 (ICT) R22 (V12.18.10) Management System Alarm Handling - 806898Document181 pagesSJ-20180108102206-008-NetNumen U31 (ICT) R22 (V12.18.10) Management System Alarm Handling - 806898Neus MifNo ratings yet

- Organizational Behaviour Part 2Document14 pagesOrganizational Behaviour Part 2KZ MONTAGENo ratings yet

- Module 7 Safety Health Management SystemsDocument34 pagesModule 7 Safety Health Management SystemsKavin RajNo ratings yet

- Familylaw: Hong Kong SarDocument81 pagesFamilylaw: Hong Kong SarTom HonNo ratings yet

- Act No. 11 Sheria Ya Ulinzi Wa Taarifa Binafsi, 2022Document37 pagesAct No. 11 Sheria Ya Ulinzi Wa Taarifa Binafsi, 2022Kibembe RanchesNo ratings yet

- Ramaiah Institute of Legal Studies 1 National Moot Court Competition, 2023Document27 pagesRamaiah Institute of Legal Studies 1 National Moot Court Competition, 2023superman1996femaleNo ratings yet

- CRIME CANw2020Document58 pagesCRIME CANw2020RonakNo ratings yet

- PetitionerDocument20 pagesPetitionerBravishhNo ratings yet

- 5 Koike V Koike DONEDocument2 pages5 Koike V Koike DONEDanielle Kaye TurijaNo ratings yet

- Registration FormDocument3 pagesRegistration FormFail Express CO.No ratings yet

- Freedom of Information Act IntroductionDocument12 pagesFreedom of Information Act IntroductionTarang AgarwalNo ratings yet

- Module 2 DRRR AnswersDocument1 pageModule 2 DRRR AnswersDalmendozaNo ratings yet

- Chapter 5 Managing DiversityDocument12 pagesChapter 5 Managing DiversityMuhammad HarisNo ratings yet

- 2014 S C M R 914Document5 pages2014 S C M R 914NaveedNo ratings yet

- Non-Conformance & Corrective Action MethodologyDocument1 pageNon-Conformance & Corrective Action MethodologysimoneNo ratings yet

- Renewal of Contract of Lease of Fagokho 2021 3RD FloorDocument5 pagesRenewal of Contract of Lease of Fagokho 2021 3RD FloorMarichu NavarroNo ratings yet