Professional Documents

Culture Documents

Current Account Opening Form

Uploaded by

Gopal GOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Current Account Opening Form

Uploaded by

Gopal GCopyright:

Available Formats

Current Account Opening Form

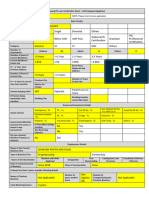

Customer Details (Confidential)

BIC IBAN IP B SIE2 D For Bank use only

Account Type IEIP B S

CIF No. 1 9 9 0

Branch

CIF No. 2

Customer Details (Applicant 1)

Customer Details (Applicant 2)

Name Name

Address Address

Address Since / / Address Since / /

Previous Address if at your current address less than three years Previous Address if at your current address less than three

years

Prev. Address Since Householder /Status Date

/ of Birth Gender

Marital Status Mother’s Maiden Name Home Phone

Mobile

/ /

Female

Male

Prev. Address Since Householder /Status Date

/ of Birth Gender

Marital Status Mother’s Maiden Name Home Phone

Mobile

/ /

Female

Male

Resident in U.S. for tax purposes or a U.S. citizen? Resident in U.S. for tax purposes or a U.S. citizen?

Yes No

Yes No

If yes, state U.S. TIN (Tax Identification Number) If yes, state U.S. TIN (Tax Identification Number)

9 9

Nationality Are you a non-resident for tax purposes? Yes No Do

If not Irish do you have a stamp 4/5? Yes No you want to switch your current account

Dont forget to sign the next page

Are you switching accounts? Yes No

Nationality

If yes fill out the Account Switching Form provided

If not Irish do you have a stamp 4/5? Yes No

Preferred home branch

Are you a non-resident for tax purposes? Yes No

Employment details

Do you want to switch your current account

Occupation

Are you switching accounts? Yes No

Income details

If yes fill out the Account Switching Form provided

Gross Annual Income

Preferred home branch

Employment details

Occupation

Income details

Gross Annual Income

Salary type Weekly

Fortnightly Monthly Salary type Weekly Fortnightly Monthly

Will you lodge your salary to this

new account? Yes No

Will you lodge your salary to this Yes No

new account?

Dont forget to sign the next page

Important information

Payment Instructions

Direct Marketing, Third Party Products

If a joint application, please choose whether you want either or

Permanent TSB would like to use your personal data to provide you with

both account holders to sign when making in-branch

information about products, services or special offers (for example rewards,

withdrawals.

discounts and cashback programmes) from carefully selected third parties.

By Either or Survivor By Both or Survivor Permanent TSB will never share your personal data with these third parties for

marketing purposes.

I hereby consent to being contacted for direct marketing of third party products

Warning to Joint Account Holders: If you instruct the and services using the methods selected above:

Bank to allow payments from the account on the

instruction of any, but not all of you, funds in the Applicant 1 YES NO Applicant2 YES NO

account may be used and/or accessed without the If at any time you change your mind and you wish to amend your direct

marketing preferences, you may contact us by writing to FREEPOST F4940,

Source of Funds/Reason for opening Customer Data Quality (Direct Marketing ), Permanent TSB p.l.c., 56-59 St.

Under the Criminal Justice (Money Laundering and Terrorist Financing) Act Stephen’s Green, Dublin 2, by phone on 1890 500 121 or +353 1 212 4101 or go

2010, all Financial Service Providers are obliged to obtain information on the to your local branch.

“purpose and intended nature of the relationship”, i.e. reason for opening an Current Account Application

account, along with details of where the funds to open the account have come

I/We hereby apply to permanent tsb p.l.c (The “Bank”) for a current account

from i.e. “source of funds”. To ensure compliance with this obligation, can you

of the type described above (the “Account”) to be operated in my/our

please complete both fields below in detail (see some examples provided)

personal capacity and not in relation to my/our trade, business or profession.

Source of Funds I/We confirm that

Please advise where has this money come from in the space below (e.g. Inheritance; retirement; redundancy; social welfare payments; children’s allowance; salary/wages; intern

the information given in the application is true and accurate. I/We have had the

necessary time to consider and query the information provided to me/us in

relation to my/our application.

I/We apply for the issue to me/us, of a Permanent TSB debit card and agree

that such debit card will be subject to the Bank’s terms and conditions

Reason for Opening applicable

Please detail what do you intend to use this account for, in the space below. (e.g. general savings;

to such debitworking account;

card from time torainy

time.day account;

Please note interest rates;

debit card children’s

facilities education; retire

are not

available where the payment instructions provide for more than one person to

give instructions on the Account.

I/We have also received the Bank’s ‘Terms of Business’ letter.

I/We have also received the Bank’s current Terms and Conditions, Personal &

Business banking charges booklet and the summary Data Protection Notice.

I/We have read and have had an opportunity of becoming acquainted with,

have understood and agree to be bound by the said terms and conditions and

charges in relation to the facilities applied for above, which may be amended

from time to time.

I/We hereby acknowledge that the Bank may refuse to open the Account or

Distance Marketing grant any of the other services requested above without stating any reason.

If you are opening the account by post we recommend you read the information

under “Distance Marketing” on page 1 of our Terms and Conditions, Personal Signature (Applicant 1)

& Business banking charges booklet prior to submitting the account opening

7

application.

Borrowing Rates & Charges

If you apply for an overdraft facility the following charges and interest will

apply: Date

• The borrowing/interest rate is Reference Rate A, currently 15%. This is

a variable rate and may change. Only for joint applications. Signature (Applicant 2)

7

• A Set-up fee/Renewal fee €25 will apply. We will notify you of any

changes to this fee by advertisement in a national newspaper or by

writing to you.

Where there is a debit balance on an account for which no facility has been

authorised, Surcharge interest of 12% per annum will apply, which you must pay Date

in addition to the borrowing rate of interest set out above.

Direct Marketing, Permanent TSB

Deposit Guarantee Scheme

Permanent TSB will use your personal data to identify our products, services

and benefits which we believe may be of interest to you. Please see the back of this pack for information on the Deposit Guarantee Scheme.

Based on your indicated direct marketing preferences below we will inform you I/We confirm that I/we have received the ‘Deposit Guarantee Scheme -

on how you can avail of these products and services using the following Depositor Information Sheet’ prior to completing this application to open an

methods: account with permanent tsb.

Applicant1 Applicant2 Applicant1 Applicant2

Applicant 1 Applicant 2

Y N Y N Y N Y N

Using your personal data

Post Online In providing personal banking services to you, we need to process personal data

about you. This involves asking you for specific personal data, processing this

Home phone Email personal data and storing it for a period of time. An explanation of how your

Text message personal data is used in the provision of our services to you, our running of the

bank and your rights in relation to your personal data is provided in the summary

Data Protection Notice included with this pack.

Please indicate your consent to be contacted by mobile phone

If you would like a copy of the full Data Protection Notice, please ask a

Applicant 1 YES NO Applicant2 YES NO branch staff member, call Open24 on 1890 500 121 or view it at

www.permanenttsb.ie

If at any time you change your mind and you wish to amend your direct

marketing preferences, you may contact us by writing to FREEPOST F4940,

Customer Data Quality (Direct Marketing ), Permanent TSB p.l.c., 56-59 St.

Stephen’s Green, Dublin 2, by phone on 1890 500 121 or +353 1 212 4101 or go to

your local branch.

permanent tsb p.l.c. is regulated by the Central Bank of BMK2545 (Rev

You might also like

- 2022 Turbo Tax ReturnDocument6 pages2022 Turbo Tax ReturnAbisola Adeyemi75% (4)

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- Consent To Disclose Your Information For The Credit Karma OfferDocument4 pagesConsent To Disclose Your Information For The Credit Karma OfferDonald PetersonNo ratings yet

- CA Inter Audit Question BankDocument315 pagesCA Inter Audit Question BankKhushi SoniNo ratings yet

- AF - Sole and CAL BB DocusignDocument9 pagesAF - Sole and CAL BB DocusignManuel Castro IINo ratings yet

- Mckinsey - Style Practice Case #8: Ronald ChocolatesDocument12 pagesMckinsey - Style Practice Case #8: Ronald ChocolatesHiếu LươngNo ratings yet

- NatWest Current Account Application Form Non UK EU ResDocument17 pagesNatWest Current Account Application Form Non UK EU ResL mNo ratings yet

- Fixed Deposit Account Opening Form SummaryDocument10 pagesFixed Deposit Account Opening Form SummarySandeepReddyNo ratings yet

- Service Bulletin Atr72: Transmittal Sheet Revision No. 08Document13 pagesService Bulletin Atr72: Transmittal Sheet Revision No. 08Pradeep K sNo ratings yet

- Add a new party to an accountDocument7 pagesAdd a new party to an accountSumNo ratings yet

- Tax Credit Claim Form 2018: For Donation Claims OnlyDocument2 pagesTax Credit Claim Form 2018: For Donation Claims OnlyasdfNo ratings yet

- Coa PDFDocument4 pagesCoa PDFmel69694No ratings yet

- Contractors Right of Action For Late or Non Payment by The EmployerADocument31 pagesContractors Right of Action For Late or Non Payment by The EmployerArokiahhassan100% (1)

- Manotok IV v. Heirs of BarqueDocument5 pagesManotok IV v. Heirs of BarqueSienna NacarioNo ratings yet

- Getting Started Pack - IEA Only Oct 2020Document9 pagesGetting Started Pack - IEA Only Oct 2020Akitha SiyaginaNo ratings yet

- Current Account ApplicationDocument4 pagesCurrent Account ApplicationSourabh TiwariNo ratings yet

- Myplan 2018 - EnglishDocument1 pageMyplan 2018 - EnglishkleansoulNo ratings yet

- Malaysia US Others Malaysia US OthersDocument1 pageMalaysia US Others Malaysia US OthersDaniel WigginsNo ratings yet

- Retailer Supplier Registration FormDocument3 pagesRetailer Supplier Registration FormConan McClellandNo ratings yet

- SBI UK account openingDocument4 pagesSBI UK account openingTeja VaitlaNo ratings yet

- Account Management 2Document1 pageAccount Management 2Emmanuel OguaforNo ratings yet

- Account Opening Application: Citibank Singapore LTDDocument16 pagesAccount Opening Application: Citibank Singapore LTDJoris RectoNo ratings yet

- Update Nationwide address detailsDocument2 pagesUpdate Nationwide address detailsGiorgel RabeiNo ratings yet

- ISLU Mortgages Buy To Let - Application Form PDFDocument20 pagesISLU Mortgages Buy To Let - Application Form PDFges176No ratings yet

- Photo SB Account FormDocument1 pagePhoto SB Account FormShyam RoutNo ratings yet

- CCM Form PDFDocument8 pagesCCM Form PDFSenthilKumar kanagarajanNo ratings yet

- Mymoney App Form PDFDocument12 pagesMymoney App Form PDFaNo ratings yet

- Direct Deposit RequestDocument2 pagesDirect Deposit RequestAndrewNo ratings yet

- Broker-Assisted Customer Account Information Form (CAIF) - IndividualDocument6 pagesBroker-Assisted Customer Account Information Form (CAIF) - Individualmunic14No ratings yet

- Europe - and - Africa - Resident - Complete Investment Account Aplication Bank Account Application FormDocument7 pagesEurope - and - Africa - Resident - Complete Investment Account Aplication Bank Account Application FormIyke AniagbosoNo ratings yet

- Drop-Off Tax Return PrepDocument2 pagesDrop-Off Tax Return PrepAngel Lynn AgeeNo ratings yet

- Consolidated CRF For Non BOTDocument2 pagesConsolidated CRF For Non BOTfloridaroxangregoNo ratings yet

- FCB Acc OpeningAppFormCorporate 2Document12 pagesFCB Acc OpeningAppFormCorporate 2Matthew12Alexander12No ratings yet

- New Format Application Form CLRDocument8 pagesNew Format Application Form CLRtheonelNo ratings yet

- Savers: Bank AL Habib LimitedDocument2 pagesSavers: Bank AL Habib LimitedAhmedNo ratings yet

- 2021 Loanappformsoleprop 85 X 13Document4 pages2021 Loanappformsoleprop 85 X 13Jeffrey Ru LouisNo ratings yet

- Change of Personal Particulars FormDocument3 pagesChange of Personal Particulars FormAntony VijayNo ratings yet

- Personal Account Application Form PDFDocument2 pagesPersonal Account Application Form PDFHugh O'Brien GwazeNo ratings yet

- UGC Bulletin 185Document18 pagesUGC Bulletin 185Rafin সাজ্জাদNo ratings yet

- For Individuals and Sole Proprietorship (BALH)Document6 pagesFor Individuals and Sole Proprietorship (BALH)Ghulam Hyder100% (1)

- NRI Form Ver5Document12 pagesNRI Form Ver5enterprisesshreemarutiNo ratings yet

- Personal Current Acc App SoleDocument7 pagesPersonal Current Acc App Soleaiss.ay.moussNo ratings yet

- Supplemental Customer Relationship FormDocument2 pagesSupplemental Customer Relationship FormMay Rojas Mortos100% (1)

- TermSukuk App Form Individual E Mrs ANISHADocument2 pagesTermSukuk App Form Individual E Mrs ANISHAsunij.chackoNo ratings yet

- Standard Withdrawal FormDocument8 pagesStandard Withdrawal FormAntónio MoreiraNo ratings yet

- HBL Additional Request Form (Conventional Banking)Document2 pagesHBL Additional Request Form (Conventional Banking)zakir soomroNo ratings yet

- Account Opening Form Individuals: Section I Applicant Second ApplicantDocument5 pagesAccount Opening Form Individuals: Section I Applicant Second ApplicantsumersinghNo ratings yet

- 2021-Application To Join VitalityDocument4 pages2021-Application To Join VitalityMNQOBINo ratings yet

- NSF PWSDocument3 pagesNSF PWSj2thegoughNo ratings yet

- Banking App FormDocument20 pagesBanking App Formjustin.toddNo ratings yet

- FilledDocument11 pagesFilledMatias SantillanNo ratings yet

- Personal - Ac - App - Form - V 2 - 29 - Nov2013Document3 pagesPersonal - Ac - App - Form - V 2 - 29 - Nov2013nzekwesiliekenedilichukwuNo ratings yet

- Are You Thinking Of: Working For Yourself?Document12 pagesAre You Thinking Of: Working For Yourself?talonisNo ratings yet

- MFCApplication FinanceDocument3 pagesMFCApplication Financejoeline danielsNo ratings yet

- Account Opening Form For Company: Section IDocument9 pagesAccount Opening Form For Company: Section ISiddharth KumarNo ratings yet

- Fixed Deposit Account Opening FormDocument10 pagesFixed Deposit Account Opening FormZeba TabassumNo ratings yet

- Individuals Fund Application SummaryDocument19 pagesIndividuals Fund Application SummaryJordan BrodieNo ratings yet

- Loan Application FormDocument10 pagesLoan Application FormAlexanderDaviesNo ratings yet

- Aetna California Application For Individuals Families CA 2011Document11 pagesAetna California Application For Individuals Families CA 2011Dennis AlexanderNo ratings yet

- Interben Trustees Limited Withdrawal FormDocument8 pagesInterben Trustees Limited Withdrawal FormAmenAllah DghimNo ratings yet

- KB J012868-Kina-Bank Account Opening Form Updated-July-2022Document7 pagesKB J012868-Kina-Bank Account Opening Form Updated-July-2022Josh Philip100% (1)

- Aprnasachindixit Shravanphotoandfilms User044 150220231232Document8 pagesAprnasachindixit Shravanphotoandfilms User044 150220231232Satyasheel ChandaneNo ratings yet

- Change of Details Form Generic Do-Ec-087Document2 pagesChange of Details Form Generic Do-Ec-087AlvaroNo ratings yet

- File Your US Tax ReturnDocument1 pageFile Your US Tax ReturnAlexandru BushNo ratings yet

- New Hire Welcome KitDocument15 pagesNew Hire Welcome KitmariegsanzNo ratings yet

- Mumbai To Shirdi Vande Bharat PDFDocument21 pagesMumbai To Shirdi Vande Bharat PDFvivek patilNo ratings yet

- Form of Memorandum of AssociationDocument4 pagesForm of Memorandum of AssociationMansoor Ul Hassan SiddiquiNo ratings yet

- Requirements For First-Time ApplicantsDocument12 pagesRequirements For First-Time ApplicantsRafsanjani AbasNo ratings yet

- Department of Education: Calpi Elementary SchoolDocument6 pagesDepartment of Education: Calpi Elementary Schoolmarix teopeNo ratings yet

- The Peregrinations of David Myatt: National Socialist IdeologistDocument46 pagesThe Peregrinations of David Myatt: National Socialist IdeologistDark Japer0% (1)

- Venugopal Gopinatha N Nair: Shoppers Stop LimitedDocument2 pagesVenugopal Gopinatha N Nair: Shoppers Stop LimitedAkchikaNo ratings yet

- Snitches Get Stitches A Reading Responce To The Book KindredDocument3 pagesSnitches Get Stitches A Reading Responce To The Book KindredDanielle BlumeNo ratings yet

- Permanent Disability RiderDocument10 pagesPermanent Disability RiderVaibhav ShirodkarNo ratings yet

- Constitution Notes2Document44 pagesConstitution Notes2San MitNo ratings yet

- Santos - Rizal LawDocument1 pageSantos - Rizal LawJamesss PatrickNo ratings yet

- Oblicon - 111. Bpi v. Fernandez, G.R. 173134, Sept. 2, 2015Document2 pagesOblicon - 111. Bpi v. Fernandez, G.R. 173134, Sept. 2, 2015Abdullah JulkanainNo ratings yet

- Role of A Company SecretaryDocument5 pagesRole of A Company Secretaryaishwarya iyerNo ratings yet

- Democracy and Development in IndiaDocument6 pagesDemocracy and Development in IndiaMarvin AugustineNo ratings yet

- 2.3 Gendered Identities, IdeologiesDocument8 pages2.3 Gendered Identities, IdeologiesAlmiraNo ratings yet

- Department of Education: Office of The Undersecretary Planning, Human Resource and Organizational DevelopmentDocument3 pagesDepartment of Education: Office of The Undersecretary Planning, Human Resource and Organizational Developmentjanette riveraNo ratings yet

- Rights and Liabilities of The Raiyats (Maliks)Document33 pagesRights and Liabilities of The Raiyats (Maliks)Manjare Hassin RaadNo ratings yet

- Module 1 - The Nature and Importance of LeadershipDocument25 pagesModule 1 - The Nature and Importance of Leadershipamaethys BucilloNo ratings yet

- Nicholas II or Nicholas The Bloody 1Document9 pagesNicholas II or Nicholas The Bloody 1Yaryna DrabykNo ratings yet

- Pradip Bakshi On Karl MarxDocument21 pagesPradip Bakshi On Karl MarxaniruddhankNo ratings yet

- Mwachiro - Effects of Internal Controls On Revenue Collection - A Case of Kenya Revenue AuthorityDocument60 pagesMwachiro - Effects of Internal Controls On Revenue Collection - A Case of Kenya Revenue Authoritygabriel katamaNo ratings yet

- Solution Manual For Auditing Assurance Services by William F Messier Steven M Glover Douglas F Prawitt Edition 9Document36 pagesSolution Manual For Auditing Assurance Services by William F Messier Steven M Glover Douglas F Prawitt Edition 9lyermanseamellrl8zhNo ratings yet

- Expansionism: Theories of Expansionism Past Examples 21st CenturyDocument5 pagesExpansionism: Theories of Expansionism Past Examples 21st CenturyFiruzaNo ratings yet

- Higher Ability AnswersDocument2 pagesHigher Ability AnswersnellytusiimeNo ratings yet

- A Study of The New Woman in Tendulkar's Silence! The Court Is in SessionDocument8 pagesA Study of The New Woman in Tendulkar's Silence! The Court Is in SessionWungreiyon moinaoNo ratings yet

- Essence of CommunicationDocument59 pagesEssence of CommunicationKrisha FernandezNo ratings yet