Professional Documents

Culture Documents

Reflection

Uploaded by

Lindbergh SyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reflection

Uploaded by

Lindbergh SyCopyright:

Available Formats

Reflection

In my accounting class, I have learned to compute profit or loss, get the amount of total assets, liabilities

and equity, and prepare basic financial statements. However, I have looked at the amounts that I was

computing as merely figures. But upon doing this activity, I acquired a deeper understanding and

appreciation of financial statements.

I finally understood why some say that financial statements tell the story of a business. The financial

statements are summarized diaries which show what happened in the past. But these are not just

records of mere empty experiences. Financial statements are records of how well the entity has

performed and offers a glimpse of how the entity has been managed and has been affected by certain

events during a certain period. This activity has further opened my eyes to the importance of the

financial statements and the difficulty in gathering data to be used in completing the financial reports.

I have also learned that Financial Ratios can help accountants and users of FS to further analyze

information provided in the financial statements. Upon glancing at the Financial Statements, a user can

see the various elements – assets, liabilities, equity, revenues, and expenses. But upon using financial

ratios, the user of the Financial Statements can determine how often a company pays their short-term

obligations (accounts payable ratio) and how long before they pay their obligations (average age of

payables), how long it takes for entities to sell their inventory (average age of inventories), how often

they can sell their inventory (inventory turnover), how efficient an entity can utilize their resources (total

asset turnover and fixed asset turnover), how liquid an entity is (current ratio and quick ratio), and many

more.

In this activity, I also learned how government rulings and court decisions can adversely affect an

entity’s operations. ABS-CBN has faced the wrath of the government and the Duterte administration and

it shows in the 2019 financial statements and financial ratios of the company that they have clearly

struggled.

Overall, this activity has been an eye-opener for me. It opened my eyes to all the information that could

be found in an entity’s financial statements and the importance of computing financial ratios and using

them to analyze further the status of a business. As a future accountant, entrepreneur and

businessman, being equipped with knowledge about financial statements and financial ratios is vital

towards success.

You might also like

- RESEARCHDocument5 pagesRESEARCHvarun v sNo ratings yet

- Module 1 Introduction To AccountingDocument8 pagesModule 1 Introduction To AccountingShårmāinë Iniégø DimâänōNo ratings yet

- FundAcc Exercise WorkbookDocument33 pagesFundAcc Exercise WorkbookJosef SamoranosNo ratings yet

- My Life Journey Through . . . with God: Reality and Facts of Life!From EverandMy Life Journey Through . . . with God: Reality and Facts of Life!No ratings yet

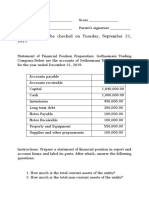

- Answer This To Be Checked On Tuesday, September 21, 2021Document2 pagesAnswer This To Be Checked On Tuesday, September 21, 2021Teresa Mae OrquiaNo ratings yet

- Negros Occidental (ACCOUNTING1)Document7 pagesNegros Occidental (ACCOUNTING1)Maxine Ceballos Glodove100% (1)

- FABM1 Lesson1-2 Nature of AccountingDocument9 pagesFABM1 Lesson1-2 Nature of AccountingKassandra KayNo ratings yet

- Comprehensive Illustrative ProblemDocument2 pagesComprehensive Illustrative ProblemLyssa Marie Avenido GuelosNo ratings yet

- ACFAR ReviewDocument39 pagesACFAR ReviewYza IgartaNo ratings yet

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Shepherdville College: STATISTICS: Measure of Central TendencyDocument8 pagesShepherdville College: STATISTICS: Measure of Central TendencyCarlo Jay BuelaNo ratings yet

- Application Letter & ResumeDocument3 pagesApplication Letter & ResumeJacquelyn Bataluna CastreNo ratings yet

- OLIVO - Lesson-1-Statistics-Quiz (1)Document2 pagesOLIVO - Lesson-1-Statistics-Quiz (1)Christine Joy DañosNo ratings yet

- Cbmec 1 New Module 1Document22 pagesCbmec 1 New Module 1Calabia, Angelica MerelosNo ratings yet

- Financial Statements AnalysisDocument35 pagesFinancial Statements AnalysisKiarra Nicel De TorresNo ratings yet

- Source: Medina, Dr. Roberto G. Human Behavior in Organization. Manila: Rex Book Store. 2011Document5 pagesSource: Medina, Dr. Roberto G. Human Behavior in Organization. Manila: Rex Book Store. 2011John Lexter MagnayeNo ratings yet

- 9 - Special JournalDocument30 pages9 - Special JournalYallyNo ratings yet

- Filipino Value System2Document2 pagesFilipino Value System2Florante De LeonNo ratings yet

- Book of Accounts WD ActivityDocument3 pagesBook of Accounts WD ActivityChristopher SelebioNo ratings yet

- Business Ethics - Module 2 - Ethical and Unethical BehaviorDocument8 pagesBusiness Ethics - Module 2 - Ethical and Unethical BehaviorJoanna Mae CanonoyNo ratings yet

- Typical Account Titles UsedDocument3 pagesTypical Account Titles Usedwenna janeNo ratings yet

- 1Document26 pages1Cresca Cuello CastroNo ratings yet

- Chan Accounting FirmDocument45 pagesChan Accounting FirmNina Gaboy100% (1)

- Merchandising Accounting Cycle: Periodic: Subject-Descriptive Title Subject - CodeDocument22 pagesMerchandising Accounting Cycle: Periodic: Subject-Descriptive Title Subject - CodeRose LaureanoNo ratings yet

- We Have Studied The Different Ethical Principles in Our Search For The Morality of Human Acts. These Are The FollowingDocument3 pagesWe Have Studied The Different Ethical Principles in Our Search For The Morality of Human Acts. These Are The FollowingRosemarie CruzNo ratings yet

- Business Finance Module Mod6Document5 pagesBusiness Finance Module Mod6jelay agresorNo ratings yet

- Taholiciously Healthy!: Taho BlendsDocument21 pagesTaholiciously Healthy!: Taho BlendsAileen Gabriel BondocNo ratings yet

- Example of Oam Analysis ReportDocument15 pagesExample of Oam Analysis ReportRevo VillarminoNo ratings yet

- 5th Activity Reyes Laundry ShopDocument17 pages5th Activity Reyes Laundry Shoprain suansing100% (1)

- NestleDocument5 pagesNestleAdrian Capanzana OliverosNo ratings yet

- Normal Balance For AssetsDocument2 pagesNormal Balance For AssetsAshhyyNo ratings yet

- Acctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemDocument15 pagesAcctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemAngel Justine BernardoNo ratings yet

- ABM PM 2nd QTR SLM Week12Document9 pagesABM PM 2nd QTR SLM Week12ganda dyosaNo ratings yet

- Chapter 1 - EthicsDocument7 pagesChapter 1 - EthicsEzekylah AlbaNo ratings yet

- 3 Users of Accounting InformationDocument29 pages3 Users of Accounting InformationAdrianChrisArciagaArevaloNo ratings yet

- Recollection ReflectionDocument1 pageRecollection ReflectionBug AphidNo ratings yet

- Week 011 - Module Analysis and Interpretation of Financial StatementsDocument7 pagesWeek 011 - Module Analysis and Interpretation of Financial StatementsJoana Marie100% (1)

- Baltazar G. Damance: Province of Quirino Quirino State UniversityDocument1 pageBaltazar G. Damance: Province of Quirino Quirino State UniversityronronNo ratings yet

- Artahum Business Plan ExampleDocument11 pagesArtahum Business Plan ExampleAlyssa del PilarNo ratings yet

- (Business Finance) - M1 - LOLO - GATESDocument3 pages(Business Finance) - M1 - LOLO - GATESCriestefiel LoloNo ratings yet

- Review Center Interview QuestionsDocument6 pagesReview Center Interview QuestionsDcimasaNo ratings yet

- 2QUIZ1Document3 pages2QUIZ1Marilyn Nelmida Tamayo100% (1)

- Account TitlesDocument4 pagesAccount TitlesErin Jane FerreriaNo ratings yet

- Economics PrelimsDocument2 pagesEconomics PrelimsYannie Costibolo IsananNo ratings yet

- Chapter 1Document7 pagesChapter 1Lhea Tomas Bicera-AlcantaraNo ratings yet

- Lili Marlene Aviation SchoolDocument1 pageLili Marlene Aviation SchoolKatie MoreeNo ratings yet

- Business Finance - LAS - q1 - w1 Introduction To Financial Management PDFDocument9 pagesBusiness Finance - LAS - q1 - w1 Introduction To Financial Management PDFJustineNo ratings yet

- 2 - Acct 1 Branchs and UsersDocument17 pages2 - Acct 1 Branchs and UsersJoana AutosNo ratings yet

- 7FABM 1 Module Accounting EquationDocument6 pages7FABM 1 Module Accounting EquationKristhine DarvinNo ratings yet

- Senior 12 FABM2 Q1 - M1Document19 pagesSenior 12 FABM2 Q1 - M1Sitti Halima Amilbahar AdgesNo ratings yet

- Lozano L.J. BSCE 3A Mod 4Document5 pagesLozano L.J. BSCE 3A Mod 4Lyndon John Jonco LozanoNo ratings yet

- Final-Chapter-1-11 EditedDocument57 pagesFinal-Chapter-1-11 EditedAnonymous pHooz5aH6VNo ratings yet

- RRL GroupDocument3 pagesRRL GroupUnlithug lifeNo ratings yet

- Chapter 5 Financial Statement Analysis 1Document3 pagesChapter 5 Financial Statement Analysis 1Syrill CayetanoNo ratings yet

- REVIEWER ACCOUNTING TUTORIAL Chapter 1-4Document20 pagesREVIEWER ACCOUNTING TUTORIAL Chapter 1-4bae joohyunNo ratings yet

- Chapter 2 ActivityDocument10 pagesChapter 2 ActivityBELARMINO LOUIE A.No ratings yet

- Lesson 4 Wk12 4th Fundamental Operations of Mathematics As Applied in Salaries and WagesDocument15 pagesLesson 4 Wk12 4th Fundamental Operations of Mathematics As Applied in Salaries and WagesFrancine Arielle BernalesNo ratings yet

- Accounting 2 - 2nd ModuleDocument8 pagesAccounting 2 - 2nd ModuleJessalyn Sarmiento Tancio100% (1)

- Forda FinalDocument151 pagesForda FinalNirvana GolesNo ratings yet

- New Garbage SignsDocument2 pagesNew Garbage SignsLindbergh SyNo ratings yet

- Topics Audit in Specialized Industries A267Document1 pageTopics Audit in Specialized Industries A267Lindbergh SyNo ratings yet

- Topics Audit in Specialized Industries A253Document1 pageTopics Audit in Specialized Industries A253Lindbergh SyNo ratings yet

- Topics Audit in Specialized Industries A253Document1 pageTopics Audit in Specialized Industries A253Lindbergh SyNo ratings yet

- Cheryll Escano Reinhard Dale AnabanDocument6 pagesCheryll Escano Reinhard Dale AnabanLindbergh SyNo ratings yet

- Assignment Sir RamDocument1 pageAssignment Sir RamLindbergh SyNo ratings yet

- Zyren May: Lindbergh LendlDocument12 pagesZyren May: Lindbergh LendlLindbergh SyNo ratings yet

- Estate TaxDocument18 pagesEstate TaxLindbergh Sy67% (3)

- BSA April 2014Document3 pagesBSA April 2014Lindbergh SyNo ratings yet

- Obe ENTREP Part1Document5 pagesObe ENTREP Part1Lindbergh SyNo ratings yet

- MCQ INCOME TAXATION Chapter 13Document14 pagesMCQ INCOME TAXATION Chapter 13Lindbergh Sy0% (1)

- Faculty Development PlanDocument2 pagesFaculty Development PlanLindbergh SyNo ratings yet

- Survey FormsDocument4 pagesSurvey FormsLindbergh SyNo ratings yet

- RR No. 8-2018Document27 pagesRR No. 8-2018deltsen100% (1)

- Arb PDFDocument1 pageArb PDFLindbergh SyNo ratings yet

- WeirdmeDocument12 pagesWeirdmeLindbergh SyNo ratings yet

- Arb PDFDocument1 pageArb PDFLindbergh SyNo ratings yet

- Estate TaxDocument18 pagesEstate TaxLindbergh Sy67% (3)

- Arb PDFDocument1 pageArb PDFLindbergh SyNo ratings yet

- Obtl AisDocument5 pagesObtl AisLindbergh SyNo ratings yet

- CPA1018t10 jg18Document1 pageCPA1018t10 jg18Mark Domingo MendozaNo ratings yet

- Obe ENTREP Part1Document5 pagesObe ENTREP Part1Lindbergh SyNo ratings yet

- Partnership-Accounting 5a21e9361723ddd448361182Document31 pagesPartnership-Accounting 5a21e9361723ddd448361182Jason Cabrera0% (1)

- Entrp Part 1Document6 pagesEntrp Part 1Lindbergh SyNo ratings yet

- Tax 1 Midterm Exam 2019Document4 pagesTax 1 Midterm Exam 2019Lindbergh SyNo ratings yet

- Bell Single-Sleeve Shrug Crochet PatternDocument2 pagesBell Single-Sleeve Shrug Crochet PatternsicksoxNo ratings yet

- Review Systems of Linear Equations All MethodsDocument4 pagesReview Systems of Linear Equations All Methodsapi-265647260No ratings yet

- Exam C - HANATEC142: SAP Certified Technology Associate - SAP HANA (Edition 2014)Document10 pagesExam C - HANATEC142: SAP Certified Technology Associate - SAP HANA (Edition 2014)SadishNo ratings yet

- A Review On Different Yogas Used in The Management of Mandali Damsa Vrana W.S.R. To KriyakaumudiDocument11 pagesA Review On Different Yogas Used in The Management of Mandali Damsa Vrana W.S.R. To KriyakaumudiTiya TiwariNo ratings yet

- Cyrille MATH INVESTIGATION Part2Document18 pagesCyrille MATH INVESTIGATION Part2Jessie jorgeNo ratings yet

- One God One People February 2013Document297 pagesOne God One People February 2013Stig DragholmNo ratings yet

- Avanquest Perfect Image V.12 User GuideDocument174 pagesAvanquest Perfect Image V.12 User GuideShafiq-UR-Rehman Lodhi100% (1)

- Van Daley - Leadership ResumeDocument1 pageVan Daley - Leadership Resumeapi-352146181No ratings yet

- 2019q123.ev3-Descon Engro Level Gauges-QDocument7 pages2019q123.ev3-Descon Engro Level Gauges-Qengr_umer_01No ratings yet

- English Assignment - October 6, 2020 - Group AssignmentDocument3 pagesEnglish Assignment - October 6, 2020 - Group AssignmentDaffa RaihanNo ratings yet

- Introduction To Physiotherapy PracticeDocument22 pagesIntroduction To Physiotherapy PracticejNo ratings yet

- What On Earth Is A MainframeDocument132 pagesWhat On Earth Is A MainframeCarlos DantasNo ratings yet

- Individual Reflection ScribdDocument4 pagesIndividual Reflection ScribdJamie Chan JieminNo ratings yet

- Essential Study SkillsDocument86 pagesEssential Study SkillsFady NgunyuNo ratings yet

- Delegate List - 10th IMRC With Contact Details - Removed (1) - Removed (1) - Removed (1) - RemovedDocument100 pagesDelegate List - 10th IMRC With Contact Details - Removed (1) - Removed (1) - Removed (1) - RemovedSharon SusmithaNo ratings yet

- Pointers in CDocument25 pagesPointers in CSainiNishrithNo ratings yet

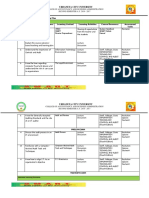

- Technical Assistance Plan School Year 2020-2021 Prioritized Needs of The Clients Objectives Strategies Activities MOV Time-Frame ResourcesDocument3 pagesTechnical Assistance Plan School Year 2020-2021 Prioritized Needs of The Clients Objectives Strategies Activities MOV Time-Frame ResourcesDon Angelo De Guzman95% (19)

- About TableauDocument22 pagesAbout TableauTarun Sharma67% (3)

- 1.6 FSI Inlet Manifold Removal Guide - Audi A2 Owners' ClubDocument3 pages1.6 FSI Inlet Manifold Removal Guide - Audi A2 Owners' Clubdusan jovanovicNo ratings yet

- GCG Damri SurabayaDocument11 pagesGCG Damri SurabayaEndang SusilawatiNo ratings yet

- Combat Storm - Shipping ContainerDocument6 pagesCombat Storm - Shipping ContainermoiNo ratings yet

- Data Analyst Chapter 3Document20 pagesData Analyst Chapter 3Andi Annisa DianputriNo ratings yet

- Nokia 3g Full Ip CommissioningDocument30 pagesNokia 3g Full Ip CommissioningMehul JoshiNo ratings yet

- Taxonomy: Family StaphylococcaceaeDocument40 pagesTaxonomy: Family StaphylococcaceaeMarissa Terrado SorianoNo ratings yet

- 7 ApportionmentDocument46 pages7 Apportionmentsass sofNo ratings yet

- Bank OD Account in Tally 1Document3 pagesBank OD Account in Tally 1yashusahu180No ratings yet

- 3S Why SandhyavandanDocument49 pages3S Why SandhyavandanvivektonapiNo ratings yet

- EPA NCP Technical Notebook PDFDocument191 pagesEPA NCP Technical Notebook PDFlavrikNo ratings yet

- T10 - PointersDocument3 pagesT10 - PointersGlory of Billy's Empire Jorton KnightNo ratings yet

- Massey Ferguson MF7600 Technician Workshop ManualDocument798 pagesMassey Ferguson MF7600 Technician Workshop Manualgavcin100% (5)