Professional Documents

Culture Documents

Daily Equity Market Report - 13.06.2022

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 13.06.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

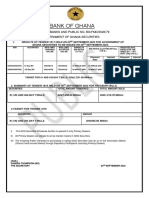

13TH JUNE, 2022

DAILY EQUITY MARKET REPORT

EQUITY MARKET HIGHLIGHTS: GSE-CI slipped by 8.52 GSE EQUITY MARKET PERFORMANCE

points to close at 2,543.22; returns -8.82% YTD. Indicator Current Previous Change

GSE-Composite Index 2,543.22 2,551.74 -8.52 pts

On the first trading session of the week, the benchmark GSE Composite

YTD (GSE-CI) -8.82% -8.52% 3.52%

Index (GSE-CI) decreased by 8.52 points to close trading at 2,543.22 points GSE-Financial Stock Index 2,171.56 2,187.03 -15.47 pts

representing a YTD return of -8.82%. The GSE Financial Stock Index (GSE- YTD (GSE-FSI) 0.92% 1.63% -43.56%

FSI) also lost 15.47 points to close trading at 2,171.56 points translating into Market Cap. (GH¢ MN) 61,990.06 62,244.68 -254.62

Volume Traded 744,981 32,728 2176.28%

a YTD return of 0.92%.

Value Traded (GH¢) 605,871.93 48,102.88 1159.53%

Fourteen (14) equities traded, ending with one (1) gainer and two (2) TOP TRADED EQUITIES

decliners. SIC Insurance Company Ltd. (SIC) was the sole gainer as it gained Ticker Volume Value (GH¢)

MTNGH 326,444 293,799.60

GH¢0.01 to close at GH¢0.31 whereas GCB Bank PLC. (GCB) and Ecobank

CAL 271,948 217,558.40

Transnational Inc. (ETI) were the decliners as they lost GH¢0.06 and

SIC 128,361 39,408.30

GH¢0.01 to close at GH¢5.00 and GH¢0.17 respectively. Market PBC 4,900 98.00

Capitalization for the day settled at GH¢61.99 billion. EGH 4,700 35,720.00 44.49%

SSSS KEY ECONOMIC INDICATORS

%

A total of 744,981 shares valued at GH¢605,871.93 was traded on the day.

Indicator Current Previous

Scancom PLC. (MTNGH) accounted for 44.49% of the total value traded

Monetary Policy Rate May 2022 19.00% 17.00%

whilst the stock recorded the largest volumes traded. Real GDP Growth December 2021 5.4% 0.4%

Inflation May 2022 27.6% 23.6%

EQUITY UNDER REVIEW: SCANCOM PLC. (MTNGH) Reference rate April 2022 16.58% 14.18%

Share Price GH¢0.90 Source: GSS, BOG, GBA

Price Change (YtD) -18.92% GAINER & DECLINERS

Market Capitalization GH¢11,061.43 million Ticker Close Price Open Price Change YTD

Dividend Yield 12.778% (GH¢) (GH¢) (GH¢) Change

Earnings Per Share GH¢0.2303 SIC 0.31 0.30 0.01 287.50%

Avg. Daily Volume Traded 3,890,169

Value Traded (YtD) GH¢969,691,562 GCB 5.00 5.06 -0.06 -4.58%

ETI 0.17 0.18 -0.01 21.43%

SUMMARY OF MAY 2022 MARKET ACTIVITIES

GSE-CI & GSE-FSI YTD PERFORMANCE

The GSE recorded an all-time high value traded of GH¢607.31 million in the 4.00%

0.92%

month of May 2022. 2.00%

Activity on the market remained high as the number of transactions in the 0.00%

4-Jan 4-Feb 4-Mar 4-Apr 4-May 4-Jun

month was 1,913 as compared to 1,618 for the same period last year.

-2.00%

Volume traded was 657,115,501 valued at GH¢607,313,468.20, both up

-4.00%

1,015.12% and 735.05% respectively on volumes and values traded same

-6.00%

period last year. Cumulative volume (1,042,836,043) and value -8.82%

(GH¢1,016,336,079.24) traded for the year represent an increase of -8.00%

260.06% and 295.12% over the same period last year. -10.00% GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- To Payment of Electricity Expenses For The Period of - As Per Billing Statement Hereto AttachedDocument6 pagesTo Payment of Electricity Expenses For The Period of - As Per Billing Statement Hereto AttachedShiela E. EladNo ratings yet

- Sheet 2Document21 pagesSheet 2yehyaNo ratings yet

- The Advanced Guide To Equity Research Report WritingDocument23 pagesThe Advanced Guide To Equity Research Report Writingsara_isarNo ratings yet

- The Wonderful World of Tax SalesDocument9 pagesThe Wonderful World of Tax Saleslyocco1No ratings yet

- DB09154 Sales Assignment Project in PBMDocument30 pagesDB09154 Sales Assignment Project in PBMParam SaxenaNo ratings yet

- Taglish Radio-Broadcasting Script Draft Example by Melbourne PomboDocument10 pagesTaglish Radio-Broadcasting Script Draft Example by Melbourne PomboEmma Belanigue-PomboNo ratings yet

- How To Trade With The VWAP IndicatorDocument29 pagesHow To Trade With The VWAP Indicatorhabibimario0% (1)

- Sime DarbyDocument410 pagesSime DarbyzatyNo ratings yet

- Chapter 2 FranchisingDocument34 pagesChapter 2 FranchisingPrinsesa EsguerraNo ratings yet

- Asean FDI Future Brighter Than China's - BeyondbricsDocument3 pagesAsean FDI Future Brighter Than China's - BeyondbricsMunniNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet

- Investment Proclamation No. 769 of 2012Document33 pagesInvestment Proclamation No. 769 of 2012abdume74No ratings yet

- Development Studies and The Development ImpasseDocument7 pagesDevelopment Studies and The Development ImpasseAysha Junaid50% (2)

- CP 04 - Tourism EntrepreneurshipDocument9 pagesCP 04 - Tourism EntrepreneurshipJOHN VINCENT AGLUGUBNo ratings yet

- Ice Cream Parlor Business Plan TemplateDocument44 pagesIce Cream Parlor Business Plan TemplateTasnim EdreesNo ratings yet

- Tally Notes: Basic AccountingDocument14 pagesTally Notes: Basic AccountingAAC aacNo ratings yet

- Sweet Temptations: ObjectivesDocument4 pagesSweet Temptations: ObjectivesJanea ArinyaNo ratings yet

- Nestle SpeechDocument3 pagesNestle Speechkapil chandwaniNo ratings yet

- Mueller, Socialism and Capitalism in The Work of Max WeberDocument22 pagesMueller, Socialism and Capitalism in The Work of Max Webersima_sociology100% (1)

- Unit 3 - Security AnalysisDocument33 pagesUnit 3 - Security AnalysisWasim DalviNo ratings yet

- Epzs, Eous, Tps and SezsDocument23 pagesEpzs, Eous, Tps and Sezssachin patel100% (1)

- Ate Mapa PrintDocument10 pagesAte Mapa PrintchosNo ratings yet

- Portfolio Management - ResearchDocument20 pagesPortfolio Management - ResearchHarsh Thakker100% (1)

- Hofstede Dimensions of Canada and South KoreaDocument8 pagesHofstede Dimensions of Canada and South KoreaWhileUsleepNo ratings yet

- Bim MercubuanaDocument19 pagesBim MercubuanaWallArsitekNewsNo ratings yet

- "Turning Glove From GOLD To DIAMOND": Supermax Corporation Berhad Analyst Briefing Slides 4Q'2020 RESULTSDocument35 pages"Turning Glove From GOLD To DIAMOND": Supermax Corporation Berhad Analyst Briefing Slides 4Q'2020 RESULTSmroys mroysNo ratings yet

- Calasanz V CIRDocument6 pagesCalasanz V CIRjonbelzaNo ratings yet

- 06 Task PerformanceDocument2 pages06 Task PerformanceKatherine Borja67% (3)

- The Potential For Blockchain Technology in Corporate GovernanceDocument32 pagesThe Potential For Blockchain Technology in Corporate GovernanceasdNo ratings yet

- Audit Module 1Document13 pagesAudit Module 1Danica GeneralaNo ratings yet