Professional Documents

Culture Documents

Summary

Uploaded by

Mayakuntla NeeladriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary

Uploaded by

Mayakuntla NeeladriCopyright:

Available Formats

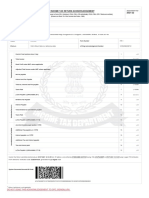

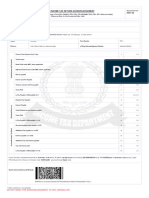

Calculation of Your Taxable Income

A. Gross Total Income V 4,93,666

Hide Details

Income Chargeable under the head ’Salaries’ V0

Income Chargeable under the head ’House Property’ V0

Income chargeable under the head ’Business or Profession’ V 4,92,500

Income Chargeable under the head ’Other Sources’ V 1,166

Gross Total Income V 4,93,666

B. Total Deductions V 70,000

Hide Details

80C - Life insurance premia, deferred annuity, contributions to provident fund, V 70,000

subscription to certain equity shares or debentures, etc under section 80C

80CCC - Payment in respect Pension Fund, etc V0

80CCD(1) - Contribution to pension scheme of Central Government V0

80CCD(1B) - Contribution to pension scheme of Central Government V0

80CCD2 - Contribution to pension scheme of Central Government by Employer V0

80D - Deduction in respect of health insurance premia, medical expenditure, V0

preventive health check-up

80DD - Maintenance including medical treatment of a dependent who is a person V0

with disability

80DDB - Medical treatment of specified disease V0

80E - Interest on loan taken for higher education V0

80EE - Deduction for Interest on Home Loan V0

80EEA - Deduction in respect of interest on loan taken for certain house property V0

80EEB - Deduction in respect of purchase of electric vehicle V0

80G - Donations to certain funds, charitable institutions, etc V0

80GG - Deduction in respect of Rent paid V0

80GGC - Donation to Political party V0

80TTA - Interest on saving bank Accounts in case of other than Resident senior citizens V0

80TTB - Interest from savings and deposits in case of resident senior citizen V0

80U - Deduction in case of persons with disability V0

Total Deductions V 70,000

C. Total Taxable Income (A-B) V 4,23,670

Calculation of Tax Payable

D. Total Tax, Fee and Interest V0

Hide Details

Tax Payable on Total Income V 8,684

Rebate u/s 87A V 8,684

Tax payable after rebate V0

Health and Education Cess at 4% V0

Total Tax & Cess V0

Relief u/s 89 V0

Balance Tax After Relief V0

Interest u/s 234A V0

Interest u/s 234B V0

Interest u/s 234C V0

Fees u/s 234F V0

Total Tax, Fee and Interest V0

E. Total Tax Paid V 51,170

Hide Details

Tax Deducted at Source (TDS1) on Salary Income V0

Tax Deducted at Source (TDS2i) from Income Other than Salary V 51,170

Tax Deducted at Source (TDS2ii) from Income Other than Salary V0

Tax Collected at Source (TCS) V0

Advance Tax V0

Self Assessment Tax V0

Total Tax Paid V 51,170

Refund V 51,170

Hide Details

Total Tax Liability V0

Total Tax Paid V 51,170

Total Amount Refund V 51,170

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- SummaryDocument2 pagesSummaryAmit ParouhaNo ratings yet

- SummaryDocument2 pagesSummarynilnikNo ratings yet

- SummaryDocument2 pagesSummaryuwxodjiuwuuiNo ratings yet

- SummaryDocument3 pagesSummaryDIPAK SINGHANo ratings yet

- SummaryDocument2 pagesSummaryASWIN.M.MNo ratings yet

- SummaryDocument2 pagesSummarySachin KumarNo ratings yet

- SummaryDocument2 pagesSummaryRAJ KUMHARENo ratings yet

- SummaryDocument2 pagesSummaryAbhishekNo ratings yet

- CalculateDocument1 pageCalculateanurag tiwariNo ratings yet

- SummaryDocument1 pageSummarySkill IndiaNo ratings yet

- CalculateDocument1 pageCalculateSneha dhakoliyaNo ratings yet

- TaxComputation SYEDL PUN0157 2023 2024Document2 pagesTaxComputation SYEDL PUN0157 2023 2024nitin patilNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- CalculateDocument1 pageCalculateJaya Prakash ReddyNo ratings yet

- 2015 - Question 2 ANSWERDocument1 page2015 - Question 2 ANSWERTan TaylorNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- Judicial Reforms in IndiDocument1 pageJudicial Reforms in IndiArsalan KhanNo ratings yet

- Acknowledgement HamidDocument1 pageAcknowledgement HamidDIVYANSHU SHEKHARNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDIVYANSHU SHEKHARNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruATSI InstituteNo ratings yet

- UntitledDocument45 pagesUntitledWS KNIGHTNo ratings yet

- Salary SleepDocument1 pageSalary Sleepdk_2k2002No ratings yet

- Hide DetailsDocument2 pagesHide Detailskanth_kNo ratings yet

- Malarmangai 2021-2022Document10 pagesMalarmangai 2021-2022Karthick KumarNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruKokila Sham100% (1)

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- EstimateDocument1 pageEstimateHimali BarmanNo ratings yet

- Transactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500Document10 pagesTransactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500abhishauryaNo ratings yet

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalNo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- Illustration 1Document9 pagesIllustration 1Thanos The titanNo ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Computation of Total Income Mitaben Fy 22-23Document2 pagesComputation of Total Income Mitaben Fy 22-23RaviNo ratings yet

- Projected Income Tax Computation Statement For The Month of Apr 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Apr 2021Lady KillerNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- GAMDOORDocument2 pagesGAMDOORRashpreet PandiNo ratings yet

- Shrey Payslip Apr 2023Document4 pagesShrey Payslip Apr 2023Shrey EducationNo ratings yet

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanNo ratings yet

- Summary 1689086671Document4 pagesSummary 1689086671Akshay SharmaNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- April May June July August September October November December January February March Bonus Other EarningsDocument8 pagesApril May June July August September October November December January February March Bonus Other EarningsdpsukhejaNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- Coi 23-24 Lalu YadavDocument2 pagesCoi 23-24 Lalu Yadavtejpalsinghyadav786No ratings yet

- HCL Technologies Ltd.Document76 pagesHCL Technologies Ltd.Hemendra GuptaNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software ProductKartik RajputNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, Bengaluruvijay choudharyNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Gross IncomeDocument5 pagesGross IncomeNavarro Cristine C.No ratings yet

- Important InfoDocument6 pagesImportant InfoPraveen BabuNo ratings yet

- Retire RichDocument313 pagesRetire RichNarendraDugar100% (2)

- The Employees' Pension SchemeDocument2 pagesThe Employees' Pension SchemeSk SahilNo ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- Bucket Strategy Allgoals Calculator (EarlyRetirement) 2019 v3.6Document27 pagesBucket Strategy Allgoals Calculator (EarlyRetirement) 2019 v3.6da MNo ratings yet

- Chapter 17 TaxationDocument4 pagesChapter 17 TaxationTess LiNo ratings yet

- 398 Special Teachers Notional Increments G.O.no.28 Dated 01.03.2019Document2 pages398 Special Teachers Notional Increments G.O.no.28 Dated 01.03.2019Abdul Aleem ShaikNo ratings yet

- Table of Content: A Project On Organization Study of Lic, BallariDocument57 pagesTable of Content: A Project On Organization Study of Lic, BallariSachin Kumar SakriNo ratings yet

- Intermediate Accounting 2 and 3 FinalDocument67 pagesIntermediate Accounting 2 and 3 FinalNah HamzaNo ratings yet

- Wa0005Document1 pageWa0005Ravi KumarNo ratings yet

- Income Under The Head Salaries: (Section 15 - 17)Document55 pagesIncome Under The Head Salaries: (Section 15 - 17)leela naga janaki rajitha attiliNo ratings yet

- National Pension System (NPS) : SR - No ParticularDocument9 pagesNational Pension System (NPS) : SR - No ParticularsantoshkumarNo ratings yet

- Part A: PersonalDocument2 pagesPart A: PersonaluJJwaL jнANo ratings yet

- Filipinos' Preferences For Employer Retirement Plans: Research PaperDocument16 pagesFilipinos' Preferences For Employer Retirement Plans: Research PaperRogationist College Campus Ministry OfficeNo ratings yet

- 000 - P46 New Starter ChecklistDocument4 pages000 - P46 New Starter ChecklistcallejerocelesteNo ratings yet

- Savings Account Home Mortgage Insurance Pension: AnnuityDocument3 pagesSavings Account Home Mortgage Insurance Pension: AnnuityRuffamae BartolomeNo ratings yet

- Part ADocument2 pagesPart AmdiparoyNo ratings yet

- Updated SaroDocument4 pagesUpdated SaroKenneth GangeNo ratings yet

- FAR.2932 - Employee Benefits.Document6 pagesFAR.2932 - Employee Benefits.Edmark LuspeNo ratings yet

- Paper Code 138Document23 pagesPaper Code 138Jaganmohan Medisetty100% (1)

- E Filing Income Tax Return OnlineDocument53 pagesE Filing Income Tax Return OnlineMd MisbahNo ratings yet

- IMC Unit 1 Syllabus Edition 20Document17 pagesIMC Unit 1 Syllabus Edition 20Luke100% (1)

- Shorter Life Expectancy Gives UK Pensions An Unexpected Windfall - Financial TimesDocument4 pagesShorter Life Expectancy Gives UK Pensions An Unexpected Windfall - Financial TimesAleksandar SpasojevicNo ratings yet

- Ilovepdf Merged PDFDocument4 pagesIlovepdf Merged PDFVikram SinghNo ratings yet

- Claim Age Pension FormDocument25 pagesClaim Age Pension FormMark LordNo ratings yet

- Ocampo VS CoaDocument9 pagesOcampo VS CoaRomy Ian Lim0% (1)

- Montgomery County Public Schools Trustee Candidate - Selection Process 2021Document1 pageMontgomery County Public Schools Trustee Candidate - Selection Process 2021Marshay HallNo ratings yet

- Analysis of The Survival of Pension Funds During Hyperinflationary Periods in ZimbabweDocument97 pagesAnalysis of The Survival of Pension Funds During Hyperinflationary Periods in ZimbabweTatenda Takie TakaidzaNo ratings yet

- Greenbury Report 1995 (Enhanced Version)Document58 pagesGreenbury Report 1995 (Enhanced Version)Jacques Deguest100% (9)