Professional Documents

Culture Documents

Summary

Uploaded by

uwxodjiuwuui0 ratings0% found this document useful (0 votes)

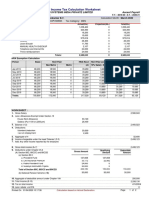

3 views2 pagesThis document calculates taxable income and tax payable for an individual. It shows gross income of Rs. 2,23,805 including salary of Rs. 2,17,891 and other sources of Rs. 5,914. Total deductions under section 80C are Rs. 18,408, resulting in total taxable income of Rs. 2,05,400. No tax is payable as total TDS of Rs. 2,000 exceeds the tax liability. A refund of Rs. 2,000 is due.

Original Description:

Original Title

summary

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document calculates taxable income and tax payable for an individual. It shows gross income of Rs. 2,23,805 including salary of Rs. 2,17,891 and other sources of Rs. 5,914. Total deductions under section 80C are Rs. 18,408, resulting in total taxable income of Rs. 2,05,400. No tax is payable as total TDS of Rs. 2,000 exceeds the tax liability. A refund of Rs. 2,000 is due.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesSummary

Uploaded by

uwxodjiuwuuiThis document calculates taxable income and tax payable for an individual. It shows gross income of Rs. 2,23,805 including salary of Rs. 2,17,891 and other sources of Rs. 5,914. Total deductions under section 80C are Rs. 18,408, resulting in total taxable income of Rs. 2,05,400. No tax is payable as total TDS of Rs. 2,000 exceeds the tax liability. A refund of Rs. 2,000 is due.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Calculation of Your Taxable Income

A. Gross Total Income V 2,23,805

Hide Details

Income Chargeable under the head ’Salaries’ V 2,17,891

Income Chargeable under the head ’House Property’ V0

Income Chargeable under the head ’Other Sources’ V 5,914

Gross Total Income V 2,23,805

B. Total Deductions V 18,408

Hide Details

80C - Life insurance premia, deferred annuity, contributions to provident fund, V 18,408

subscription to certain equity shares or debentures, etc under section 80C

Total Deductions ( - ) V 18,408

C. Total Taxable Income (A-B) V 2,05,400

Calculation of Tax Payable

D. Total Tax, Fee and Interest V0

Hide Details

Tax Payable on Total Income V0

Rebate u/s 87A V0

Tax payable after rebate V0

Health and Education Cess at 4% V0

Total Tax & Cess V0

Relief u/s 89 V0

Balance Tax After Relief V0

Interest u/s 234A V0

Interest u/s 234B V0

Interest u/s 234C V0

Fees u/s 234F V0

Total Interest and Fee Payable V0

Total Tax, Fee and Interest V0

E. Total Tax Paid V 2,000

Hide Details

Tax Deducted at Source (TDS1) on Salary Income V0

Tax Deducted at Source (TDS) from Income Other than Salary V 2,000

Tax Deducted at Source (TDS) as furnished by Payer(s) V0

Tax Collected at Source (TCS) V0

Advance Tax V0

Self Assessment Tax V0

Total Tax Paid V 2,000

Refund Amount V 2,000

Hide Details

Total Tax Liability V0

Total Tax Paid V 2,000

Total Amount Refund V 2,000

You might also like

- SummaryDocument2 pagesSummaryAmit ParouhaNo ratings yet

- SummaryDocument2 pagesSummarynilnikNo ratings yet

- SummaryDocument3 pagesSummaryDIPAK SINGHANo ratings yet

- SummaryDocument3 pagesSummaryMayakuntla NeeladriNo ratings yet

- SummaryDocument2 pagesSummaryRAJ KUMHARENo ratings yet

- SummaryDocument2 pagesSummaryASWIN.M.MNo ratings yet

- SummaryDocument2 pagesSummarySachin KumarNo ratings yet

- SummaryDocument2 pagesSummaryAbhishekNo ratings yet

- CalculateDocument1 pageCalculateanurag tiwariNo ratings yet

- SummaryDocument1 pageSummarySkill IndiaNo ratings yet

- 2015 - Question 2 ANSWERDocument1 page2015 - Question 2 ANSWERTan TaylorNo ratings yet

- Salary SleepDocument1 pageSalary Sleepdk_2k2002No ratings yet

- Hide DetailsDocument2 pagesHide Detailskanth_kNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- CalculateDocument1 pageCalculateJaya Prakash ReddyNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruATSI InstituteNo ratings yet

- Judicial Reforms in IndiDocument1 pageJudicial Reforms in IndiArsalan KhanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDIVYANSHU SHEKHARNo ratings yet

- Acknowledgement HamidDocument1 pageAcknowledgement HamidDIVYANSHU SHEKHARNo ratings yet

- Mashood K ITR COMPUTATION AY 2022-23Document3 pagesMashood K ITR COMPUTATION AY 2022-23sidvikventuresNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruKokila Sham100% (1)

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- CalculateDocument1 pageCalculateSneha dhakoliyaNo ratings yet

- Malarmangai 2021-2022Document10 pagesMalarmangai 2021-2022Karthick KumarNo ratings yet

- Submission Tutorial 2 - SolutionDocument5 pagesSubmission Tutorial 2 - SolutionNdisa ChumaNo ratings yet

- Transactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500Document10 pagesTransactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500abhishauryaNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- 2016 Vol 2 CH 5 AnswersDocument9 pages2016 Vol 2 CH 5 AnswersHohohoNo ratings yet

- TaxComputation SYEDL PUN0157 2023 2024Document2 pagesTaxComputation SYEDL PUN0157 2023 2024nitin patilNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruanmolNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- EstimateDocument1 pageEstimateHimali BarmanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, Bengaluruvijay choudharyNo ratings yet

- Accounting For Income TaxDocument3 pagesAccounting For Income TaxDaniel Kahn GillamacNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- ComputationDocument3 pagesComputationRuloans VaishaliNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- GAMDOORDocument2 pagesGAMDOORRashpreet PandiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, Bengalurutech bookNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengalurunilnikNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- UntitledDocument45 pagesUntitledWS KNIGHTNo ratings yet

- Activity 1Document4 pagesActivity 1Louisa de VeraNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- SummaryDocument2 pagesSummarySanjeet DuhanNo ratings yet

- Bac316 018358Document4 pagesBac316 018358arthurNo ratings yet

- BLT FINAL Assignment (Feb - June 2020) FINALDocument16 pagesBLT FINAL Assignment (Feb - June 2020) FINALSalman SajidNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Strike of Whichever Is Not ApplicableDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Strike of Whichever Is Not ApplicableHussain YadavNo ratings yet

- Ewac Alloys Limited: Uan No Aadhar NoDocument1 pageEwac Alloys Limited: Uan No Aadhar NoNapoleon DasNo ratings yet

- Coi 23-24 Lalu YadavDocument2 pagesCoi 23-24 Lalu Yadavtejpalsinghyadav786No ratings yet

- Computation of Total Income Mitaben Fy 22-23Document2 pagesComputation of Total Income Mitaben Fy 22-23RaviNo ratings yet

- Acknowledgement of Reliance JioDocument1 pageAcknowledgement of Reliance JioPranav BhakareNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Bank Merger List 2020 inDocument5 pagesBank Merger List 2020 inuwxodjiuwuuiNo ratings yet

- J&K Bank - EwsDocument2 pagesJ&K Bank - EwsuwxodjiuwuuiNo ratings yet

- Session 5Document36 pagesSession 5uwxodjiuwuuiNo ratings yet

- Planning Communication - EvaluationMemoDocument3 pagesPlanning Communication - EvaluationMemouwxodjiuwuuiNo ratings yet

- Planning Communication - v1Document2 pagesPlanning Communication - v1uwxodjiuwuuiNo ratings yet

- Planning Communication - InformativeMemoDocument2 pagesPlanning Communication - InformativeMemouwxodjiuwuuiNo ratings yet

- Planning Communication - v3Document3 pagesPlanning Communication - v3uwxodjiuwuuiNo ratings yet

- Session 2Document48 pagesSession 2uwxodjiuwuuiNo ratings yet

- Quants 6Document54 pagesQuants 6uwxodjiuwuuiNo ratings yet

- Session 9Document50 pagesSession 9uwxodjiuwuuiNo ratings yet

- Session 4Document54 pagesSession 4uwxodjiuwuuiNo ratings yet

- Session 3Document48 pagesSession 3uwxodjiuwuuiNo ratings yet

- 1018202372529PM - 0 - 6. Adc-Jc PaDocument73 pages1018202372529PM - 0 - 6. Adc-Jc PaIAS MeenaNo ratings yet

- F2019 Final Exam Review With AnswersDocument16 pagesF2019 Final Exam Review With AnswersRob WangNo ratings yet

- Payslip - 2022 12 31Document1 pagePayslip - 2022 12 31mateivalentin94No ratings yet

- FandI SubjACiD 200004 ExamreportDocument13 pagesFandI SubjACiD 200004 Examreportdickson phiriNo ratings yet

- Chheang Eng Nuon - Chapter 9 CASE STUDY 2 (An In-N-Out Pay Strategy Costa Vida's Decision To Boost Pay)Document3 pagesChheang Eng Nuon - Chapter 9 CASE STUDY 2 (An In-N-Out Pay Strategy Costa Vida's Decision To Boost Pay)Chheang Eng NuonNo ratings yet

- Pay Slip 17623 March, 2022Document1 pagePay Slip 17623 March, 2022Abrham TadesseNo ratings yet

- Tax 1 - Summary of Important MattersDocument18 pagesTax 1 - Summary of Important MattersBon BonsNo ratings yet

- ACCT 3326 Tax II Cengage CH 2 199ADocument6 pagesACCT 3326 Tax II Cengage CH 2 199Abarlie3824No ratings yet

- 04 - Taxation Law QDocument4 pages04 - Taxation Law QKiko BautistaNo ratings yet

- Leave Rules After Sixth Pay CommissionDocument38 pagesLeave Rules After Sixth Pay CommissionKetan GuptaNo ratings yet

- Set 3 - Pce Sample Questions 1. Which Act Is ... - ZurichDocument17 pagesSet 3 - Pce Sample Questions 1. Which Act Is ... - ZurichJasveen KaurNo ratings yet

- AP 9102 1 LiabilitiesDocument4 pagesAP 9102 1 LiabilitiesSydney De NievaNo ratings yet

- Common HR Error Messages 59f41c201723dd4d02735a0fDocument10 pagesCommon HR Error Messages 59f41c201723dd4d02735a0fDinkan TalesNo ratings yet

- SRL Limited: Payslip For The Month of FEBRUARY 2019Document1 pageSRL Limited: Payslip For The Month of FEBRUARY 2019mkumarsejNo ratings yet

- Apy ChartDocument1 pageApy ChartpraveenaNo ratings yet

- Krishna Project PDFDocument50 pagesKrishna Project PDFPriyanka SatamNo ratings yet

- Chapter 12-The Benefits Determination ProcessDocument15 pagesChapter 12-The Benefits Determination ProcessBebe phaguNo ratings yet

- FNP ContractDocument11 pagesFNP ContractUmar AshrafNo ratings yet

- Compute Taxable IncomeDocument5 pagesCompute Taxable IncomeShraddha TiwariNo ratings yet

- Pension Finance AssingmentDocument3 pagesPension Finance AssingmentFridah ApondiNo ratings yet

- Employees' Deposit Linked Insurance Scheme, 1976Document1 pageEmployees' Deposit Linked Insurance Scheme, 1976vaidehiNo ratings yet

- Processing Payroll Acc L3Document19 pagesProcessing Payroll Acc L3ADISU HABTAMUNo ratings yet

- Intermediate Examination Syllabus 2016 Paper 7: Direct Taxation (DTX)Document18 pagesIntermediate Examination Syllabus 2016 Paper 7: Direct Taxation (DTX)GopalNo ratings yet

- IT-02 Residential StatusDocument26 pagesIT-02 Residential StatusAkshat GoyalNo ratings yet

- Comparative Studies in Pension FundDocument7 pagesComparative Studies in Pension Fundela mukNo ratings yet

- MPU3353-Quiz 4 QuestionsDocument2 pagesMPU3353-Quiz 4 QuestionsRishiaendra CoolNo ratings yet

- Working Capital Management in Icici PrudentialDocument83 pagesWorking Capital Management in Icici PrudentialVipul TandonNo ratings yet

- Part A Candlelight Corporation Whose Fiscal Year Ended June 30Document1 pagePart A Candlelight Corporation Whose Fiscal Year Ended June 30Amit PandeyNo ratings yet

- Bill of Supply For Electricity: Due DateDocument1 pageBill of Supply For Electricity: Due DateDivyanshu GuptaNo ratings yet

- Principles of InsuranceDocument9 pagesPrinciples of InsuranceAjay PawarNo ratings yet