Professional Documents

Culture Documents

Summary

Uploaded by

ASWIN.M.M0 ratings0% found this document useful (0 votes)

15 views2 pagessummaaaryyyy

Original Title

summary (3)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsummaaaryyyy

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesSummary

Uploaded by

ASWIN.M.Msummaaaryyyy

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

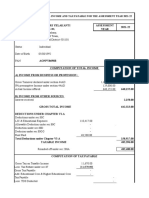

Calculation of Your Taxable Income

A. Gross Total Income V 9,68,556

Hide Details

Income Chargeable under the head ’Salaries’ V 9,68,556

Income Chargeable under the head ’House Property’ V0

Income Chargeable under the head ’Other Sources’ V0

Gross Total Income V 9,68,556

B. Total Deductions V 2,45,834

Hide Details

80C - Life insurance premia, deferred annuity, contributions to provident fund, V 1,50,000

subscription to certain equity shares or debentures, etc under section 80C

80CCD(1B) - Contribution to pension scheme of Central Government V 50,000

80D - Deduction in respect of health insurance premia, medical expenditure, V 2,160

preventive health check-up

80EEA - Deduction in respect of interest on loan taken for certain house property V 40,831

80G - Donations to Certain Funds V 2,843

Total Deductions ( - ) V 2,45,834

C. Total Taxable Income (A-B) V 7,22,720

Calculation of Tax Payable

D. Total Tax, Fee and Interest V 59,326

Hide Details

Tax Payable on Total Income V 57,044

Rebate u/s 87A V0

Tax payable after rebate V 57,044

Health and Education Cess at 4% V 2,282

Total Tax & Cess V 59,326

Relief u/s 89 V0

Balance Tax After Relief V 59,326

Interest u/s 234A V0

Interest u/s 234B V0

Interest u/s 234C V0

Fees u/s 234F V0

Total Interest and Fee Payable V0

Total Tax, Fee and Interest V 59,326

E. Total Tax Paid V 59,326

Hide Details

Tax Deducted at Source (TDS1) on Salary Income V 59,326

Tax Deducted at Source (TDS) from Income Other than Salary V0

Tax Deducted at Source (TDS) as furnished by Payer(s) V0

Tax Collected at Source (TCS) V0

Advance Tax V0

Self Assessment Tax V0

Total Tax Paid V 59,326

Amount Payable V0

Hide Details

Total Tax Liability V 59,326

Total Tax Paid V 59,326

Total Amount Payable V0

You might also like

- SummaryDocument2 pagesSummarySachin KumarNo ratings yet

- SummaryDocument2 pagesSummaryAbhishekNo ratings yet

- SummaryDocument3 pagesSummaryMayakuntla NeeladriNo ratings yet

- SummaryDocument2 pagesSummaryAmit ParouhaNo ratings yet

- SummaryDocument2 pagesSummaryuwxodjiuwuuiNo ratings yet

- SummaryDocument2 pagesSummarynilnikNo ratings yet

- Calculate your taxable income and tax payableDocument3 pagesCalculate your taxable income and tax payableDIPAK SINGHANo ratings yet

- SummaryDocument1 pageSummarySkill IndiaNo ratings yet

- SummaryDocument2 pagesSummaryRAJ KUMHARENo ratings yet

- CalculateDocument1 pageCalculateanurag tiwariNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Hide DetailsDocument2 pagesHide Detailskanth_kNo ratings yet

- Malarmangai 2021-2022Document10 pagesMalarmangai 2021-2022Karthick KumarNo ratings yet

- Book 1Document1 pageBook 1gras2007No ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- $REGJV24Document2 pages$REGJV24akxerox47No ratings yet

- Salary SleepDocument1 pageSalary Sleepdk_2k2002No ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Direct Tax SolutionsDocument8 pagesDirect Tax SolutionsGaurav SoniNo ratings yet

- UnknownDocument1 pageUnknownrahulagarwal33No ratings yet

- Computation of Total Income: Zenit - A KDK Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software ProductAbhishek SaxenaNo ratings yet

- Monthly payslip summary for Ankit KumarDocument1 pageMonthly payslip summary for Ankit Kumarrajkannamdu100% (1)

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- Compute Income Tax 2021-22Document2 pagesCompute Income Tax 2021-22naveen kumarNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- Vishal Thakkar ComputationDocument4 pagesVishal Thakkar ComputationHemant SurgicalNo ratings yet

- Salary Details and Tax DeductionsDocument1 pageSalary Details and Tax DeductionsArsalan KhanNo ratings yet

- Salary Slip - Quess)Document1 pageSalary Slip - Quess)gamersingh098123No ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Com 23Document3 pagesCom 23TAX INDIANo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Acknowledgement HamidDocument1 pageAcknowledgement HamidDIVYANSHU SHEKHARNo ratings yet

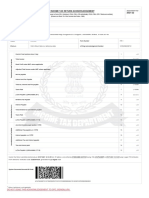

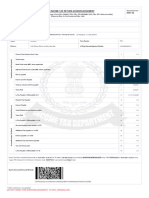

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDIVYANSHU SHEKHARNo ratings yet

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanNo ratings yet

- Chapter 1 - Hightech Single Step vs. Multi-Step Income StatementDocument2 pagesChapter 1 - Hightech Single Step vs. Multi-Step Income StatementvarshithagangavarapuNo ratings yet

- 2015 - Question 2 ANSWERDocument1 page2015 - Question 2 ANSWERTan TaylorNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- IT Returns 2021-22Document3 pagesIT Returns 2021-22srinivas maguluriNo ratings yet

- Rajat Gaur's Payslip for January 2021Document1 pageRajat Gaur's Payslip for January 2021Rahul GaurNo ratings yet

- Activity 1Document4 pagesActivity 1Louisa de VeraNo ratings yet

- PAYSLIPDocument1 pagePAYSLIPKolkata Jyote MotorsNo ratings yet

- Pay Slip: Payroll Basic DataDocument2 pagesPay Slip: Payroll Basic DataAdarsha ChandelNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- Draft Computation SheetDocument3 pagesDraft Computation Sheettax advisorNo ratings yet

- R1 (Answers) 20200915174338prl3 - v1 - 0 - Exercise - Year - End - Qu - Bec - 2017 - 0120Document8 pagesR1 (Answers) 20200915174338prl3 - v1 - 0 - Exercise - Year - End - Qu - Bec - 2017 - 0120Arslan HafeezNo ratings yet

- 480786Document4 pages480786gardenergardenerNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Chapter 7 Payroll Project 2018Document60 pagesChapter 7 Payroll Project 2018yesi25% (12)

- Rahul CompDocument2 pagesRahul CompCorman LimitedNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Research Challenges For Code Complex BeginnersDocument45 pagesResearch Challenges For Code Complex BeginnersASWIN.M.MNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Prérńã K K ŚhãhNo ratings yet

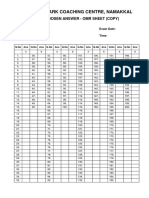

- Green Park Coaching Centre, Namakkal: Choosen Answer - Omr Sheet (Copy)Document1 pageGreen Park Coaching Centre, Namakkal: Choosen Answer - Omr Sheet (Copy)ASWIN.M.MNo ratings yet

- Green Park Coaching Centre, Namakkal: Choosen Answer - Omr Sheet (Copy)Document1 pageGreen Park Coaching Centre, Namakkal: Choosen Answer - Omr Sheet (Copy)ASWIN.M.MNo ratings yet

- Green Park Coaching Centre, Namakkal: Choosen Answer - Omr Sheet (Copy)Document1 pageGreen Park Coaching Centre, Namakkal: Choosen Answer - Omr Sheet (Copy)ASWIN.M.MNo ratings yet

- Green Park Coaching Centre, Namakkal: Choosen Answer - Omr Sheet (Copy)Document1 pageGreen Park Coaching Centre, Namakkal: Choosen Answer - Omr Sheet (Copy)ASWIN.M.MNo ratings yet

- Green Park Coaching Centre, Namakkal: Choosen Answer - Omr Sheet (Copy)Document1 pageGreen Park Coaching Centre, Namakkal: Choosen Answer - Omr Sheet (Copy)ASWIN.M.MNo ratings yet

- WEG Low Voltage Motor Control Center ccm03 50044030 Brochure English PDFDocument12 pagesWEG Low Voltage Motor Control Center ccm03 50044030 Brochure English PDFRitaban222No ratings yet

- Probability Tree Diagrams Solutions Mathsupgrade Co UkDocument10 pagesProbability Tree Diagrams Solutions Mathsupgrade Co UknatsNo ratings yet

- Smart Panels - Digitized Switchboards - Blokset Desing and Assembly GuideDocument94 pagesSmart Panels - Digitized Switchboards - Blokset Desing and Assembly Guidelorentz franklinNo ratings yet

- Exercise 1: Chọn đáp án đúng:: Buổi 9: Động từ khuyết thiếu (Modal verb)Document6 pagesExercise 1: Chọn đáp án đúng:: Buổi 9: Động từ khuyết thiếu (Modal verb)Huyền HồNo ratings yet

- dgx670 Es Om b0Document116 pagesdgx670 Es Om b0rafael enrique cely rodriguezNo ratings yet

- CV Jubilee Bubala Environmental SpecialistDocument4 pagesCV Jubilee Bubala Environmental SpecialistNomayi100% (2)

- 337 686 1 SMDocument8 pages337 686 1 SMK61 ĐOÀN HỒ GIA HUYNo ratings yet

- X-Plane Installer LogDocument3 pagesX-Plane Installer LogMarsala NistoNo ratings yet

- 3152-4 Data SheetDocument2 pages3152-4 Data SheetPhuongNguyenDinhNo ratings yet

- Student quiz answer sheetsDocument26 pagesStudent quiz answer sheetsSeverus S PotterNo ratings yet

- English Assignment Team:: Devia Annisa E. E44190045 2. TB. Aditia Rizki E44190027 3. Tedi Irfan Jelata E44190028Document3 pagesEnglish Assignment Team:: Devia Annisa E. E44190045 2. TB. Aditia Rizki E44190027 3. Tedi Irfan Jelata E4419002856TB. Aditia RizkiNo ratings yet

- tmp82D3 TMPDocument12 pagestmp82D3 TMPFrontiersNo ratings yet

- Telangana Energy Dept Contact NumbersDocument27 pagesTelangana Energy Dept Contact Numbersstarpowerzloans rjyNo ratings yet

- Linkstar RCST Installation Guide: Version DDocument56 pagesLinkstar RCST Installation Guide: Version Djorge_chavez01No ratings yet

- HackSpace - June 2021Document116 pagesHackSpace - June 2021Somnath100% (1)

- Remove Fuel Sub TankDocument9 pagesRemove Fuel Sub Tankthierry.fifieldoutlook.comNo ratings yet

- GogikavofobifigukidonDocument2 pagesGogikavofobifigukidonMd. Bepul HossainNo ratings yet

- LinAlg CompleteDocument331 pagesLinAlg Completes0uizNo ratings yet

- 3 Payroll ReportDocument4 pages3 Payroll ReportBen NgNo ratings yet

- Quiz - Limits and ContinuityDocument3 pagesQuiz - Limits and ContinuityAdamNo ratings yet

- Astm D 2783 - 03Document9 pagesAstm D 2783 - 03Sérgio Luiz RodriguesNo ratings yet

- Eddy Current Testing Exam Questions Assignment2Document1 pageEddy Current Testing Exam Questions Assignment2Narotam Kumar GupteshwarNo ratings yet

- ALGEBRA Groups 1Document34 pagesALGEBRA Groups 1bravemacnyNo ratings yet

- From Birth Till Palatoplasty Prosthetic.20Document5 pagesFrom Birth Till Palatoplasty Prosthetic.20Maria FernandaNo ratings yet

- EEE111_Multisim_ManualDocument14 pagesEEE111_Multisim_ManualSHADOW manNo ratings yet

- Water TreatmentDocument6 pagesWater TreatmentSantiago LarrazNo ratings yet

- Pub1308 WebDocument193 pagesPub1308 WebyucemanNo ratings yet

- Hatsun Supplier Registration RequestDocument4 pagesHatsun Supplier Registration Requestsan dipNo ratings yet

- Sunday School Lesson Activity 219 Moses Builds A Tablernacle in The Wilderness - Printable 3D Model KitDocument17 pagesSunday School Lesson Activity 219 Moses Builds A Tablernacle in The Wilderness - Printable 3D Model Kitmcontrerasseitz3193No ratings yet

- DGN ExamDocument5 pagesDGN ExamMaiga Ayub HusseinNo ratings yet