Professional Documents

Culture Documents

Summary

Uploaded by

DIPAK SINGHA0 ratings0% found this document useful (0 votes)

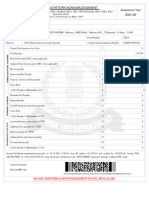

4 views3 pagesThis document calculates taxable income and tax payable for an individual. It shows gross total income of Rs. 8,061 consisting of Rs. 8,000 from business/profession and Rs. 61 from other sources. Total deductions are Rs. 0, making the total taxable income Rs. 8,060. The total tax, fee and interest payable is Rs. 0. The total tax paid through TDS is Rs. 2, which is greater than the total tax liability of Rs. 0, so the refund amount is Rs. 0.

Original Description:

Summary

Original Title

summary

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document calculates taxable income and tax payable for an individual. It shows gross total income of Rs. 8,061 consisting of Rs. 8,000 from business/profession and Rs. 61 from other sources. Total deductions are Rs. 0, making the total taxable income Rs. 8,060. The total tax, fee and interest payable is Rs. 0. The total tax paid through TDS is Rs. 2, which is greater than the total tax liability of Rs. 0, so the refund amount is Rs. 0.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pagesSummary

Uploaded by

DIPAK SINGHAThis document calculates taxable income and tax payable for an individual. It shows gross total income of Rs. 8,061 consisting of Rs. 8,000 from business/profession and Rs. 61 from other sources. Total deductions are Rs. 0, making the total taxable income Rs. 8,060. The total tax, fee and interest payable is Rs. 0. The total tax paid through TDS is Rs. 2, which is greater than the total tax liability of Rs. 0, so the refund amount is Rs. 0.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Calculation of Your Taxable Income

A. Gross Total Income

V8,061

Hide Details

Income Chargeable under the head ’Salaries’

V0

Income Chargeable under the head ’House Property’

V0

Income chargeable under the head ’Business or Profession’

V 8,000

Income Chargeable under the head ’Other Sources’

V 61

Gross Total Income

V 8,061

B. Total Deductions

V0

Hide Details

Total Deductions

V0

C. Total Taxable Income (A-B)

V8,060

Calculation of Tax Payable

D. Total Tax, Fee and Interest Payable

V0

Hide Details

Tax Payable on Total Income

V0

Rebate u/s 87A

V0

Tax payable after rebate

V0

Health and Education Cess at 4%

V0

Total Tax & Cess

V0

Relief u/s 89

V0

Balance Tax After Relief

V0

Interest u/s 234A

V0

Interest u/s 234B

V0

Interest u/s 234C

V0

Fees u/s 234F

V0

Total Tax, Fee and Interest Payable

V0

E. Total Tax Paid

V2

Hide Details

Tax Deducted at Source (TDS1) on Salary Income

V0

Tax Deducted at Source (TDS2i) from Income Other than Salary

V2

Tax Deducted at Source (TDS2ii) from Income Other than Salary

V0

Tax Collected at Source (TCS)

V0

Advance Tax

V0

Self Assessment Tax

V0

Total Tax Paid

V2

Refund Amount

V0

Hide Details

Total Tax Liability

V0

Total Tax Paid

V2

Total Amount Refund

V0

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- SummaryDocument2 pagesSummarynilnikNo ratings yet

- SummaryDocument2 pagesSummaryRAJ KUMHARENo ratings yet

- SummaryDocument2 pagesSummaryuwxodjiuwuuiNo ratings yet

- SummaryDocument2 pagesSummaryAmit ParouhaNo ratings yet

- SummaryDocument3 pagesSummaryMayakuntla NeeladriNo ratings yet

- SummaryDocument2 pagesSummaryASWIN.M.MNo ratings yet

- SummaryDocument2 pagesSummarySachin KumarNo ratings yet

- SummaryDocument2 pagesSummaryAbhishekNo ratings yet

- CalculateDocument1 pageCalculateanurag tiwariNo ratings yet

- SummaryDocument1 pageSummarySkill IndiaNo ratings yet

- CalculateDocument1 pageCalculateJaya Prakash ReddyNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruATSI InstituteNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- EstimateDocument1 pageEstimateHimali BarmanNo ratings yet

- Hide DetailsDocument2 pagesHide Detailskanth_kNo ratings yet

- CalculateDocument1 pageCalculateSneha dhakoliyaNo ratings yet

- Acknowledgement HamidDocument1 pageAcknowledgement HamidDIVYANSHU SHEKHARNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDIVYANSHU SHEKHARNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruKokila Sham100% (1)

- SummaryDocument2 pagesSummarySanjeet DuhanNo ratings yet

- EstimateDocument1 pageEstimateshrikrishnapunjabNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- SummaryDocument2 pagesSummarysachin saurabhNo ratings yet

- EstimateDocument1 pageEstimateikan flyNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSwapna BahaddurNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, Bengalurutech bookNo ratings yet

- 2015 - Question 2 ANSWERDocument1 page2015 - Question 2 ANSWERTan TaylorNo ratings yet

- TaxComputation SYEDL PUN0157 2023 2024Document2 pagesTaxComputation SYEDL PUN0157 2023 2024nitin patilNo ratings yet

- Transactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500Document10 pagesTransactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500abhishauryaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengalurunilnikNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruanmolNo ratings yet

- GAMDOORDocument2 pagesGAMDOORRashpreet PandiNo ratings yet

- Salary SleepDocument1 pageSalary Sleepdk_2k2002No ratings yet

- XXXXDocument1 pageXXXXravinakhanhifiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearIshan DhodyNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, Bengaluruvijay choudharyNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- PDF 882266220231121Document1 pagePDF 882266220231121EmperorNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruShreedhar MurthyNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearshivu patilNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearImtiaz SkNo ratings yet

- PDF 664808730301221Document1 pagePDF 664808730301221Murlidhar TeliNo ratings yet

- PDF 441907670270322Document1 pagePDF 441907670270322shryeasNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruSHEETANSHU BHANDARINo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDivyaraj JadejaNo ratings yet

- Projected Income Tax Computation Statement For The Month of Apr 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Apr 2021Lady KillerNo ratings yet

- PDF 716981210221021Document1 pagePDF 716981210221021kmco dhnNo ratings yet

- PDF 763168470311221Document1 pagePDF 763168470311221jasjeetNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearncc ltdNo ratings yet

- Itr 21-22Document1 pageItr 21-22Ashwani KumarNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNilotpol RoyNo ratings yet

- Coi 23-24 Lalu YadavDocument2 pagesCoi 23-24 Lalu Yadavtejpalsinghyadav786No ratings yet

- Itrv Sarath 21-22Document1 pageItrv Sarath 21-22bindu mathaiNo ratings yet

- Basic Details: Detailed Computation As Per OLD Tax RegimeDocument2 pagesBasic Details: Detailed Computation As Per OLD Tax RegimeVishal SharmaNo ratings yet

- Income Tax Calculator ForscribdDocument4 pagesIncome Tax Calculator ForscribdmazinNo ratings yet

- 1 ST Variation Statement SK GoswamiDocument21 pages1 ST Variation Statement SK GoswamiDIPAK SINGHANo ratings yet

- 5t-31 4miniaturebayonetbaseDocument1 page5t-31 4miniaturebayonetbaseDIPAK SINGHANo ratings yet

- Loa 00898320043475Document3 pagesLoa 00898320043475DIPAK SINGHANo ratings yet

- Loa 00891650056251Document3 pagesLoa 00891650056251DIPAK SINGHANo ratings yet

- Approval of Pinaki Garai P.Way Maintenance KWAE (ML)Document2 pagesApproval of Pinaki Garai P.Way Maintenance KWAE (ML)DIPAK SINGHANo ratings yet

- Variation 19 Rev 1Document5 pagesVariation 19 Rev 1DIPAK SINGHANo ratings yet

- En 5817Document1 pageEn 5817hirenNo ratings yet

- OUR ImpactDocument58 pagesOUR ImpactNesNosssNo ratings yet

- Unit 1 IhrmDocument102 pagesUnit 1 IhrmNAMRATA SHARMANo ratings yet

- Whitepaper LeaxcoinDocument38 pagesWhitepaper LeaxcoinSigit AgasiNo ratings yet

- Economy Epaper 24th Nov 2020Document24 pagesEconomy Epaper 24th Nov 2020Sasha KingNo ratings yet

- MOTHER CARE HOSPITAL Registration NumberDocument2 pagesMOTHER CARE HOSPITAL Registration Numberareebashaukat72No ratings yet

- Rfpi & RigidlamDocument60 pagesRfpi & RigidlamJake YalongNo ratings yet

- San Miguel Financial AnalysisDocument11 pagesSan Miguel Financial AnalysisMalou De MesaNo ratings yet

- Production Possiblities CurveDocument2 pagesProduction Possiblities CurveJay MehtaNo ratings yet

- PACE Lawsuit Release 7-5-2023Document5 pagesPACE Lawsuit Release 7-5-2023Brandon ChewNo ratings yet

- Discover Bank Statement BankStatementsDocument7 pagesDiscover Bank Statement BankStatementsTyvette VentersNo ratings yet

- Balance of Payment of PakistanDocument27 pagesBalance of Payment of PakistanAwais AwanNo ratings yet

- Harris 2000 Sustainable DevelopmentDocument27 pagesHarris 2000 Sustainable DevelopmentChantel SwabyNo ratings yet

- Managerial Economics: Definition, Nature, ScopeDocument24 pagesManagerial Economics: Definition, Nature, ScopePooja dharNo ratings yet

- Social Science Map Works - 2023-24Document70 pagesSocial Science Map Works - 2023-24tinitnthesaiyanNo ratings yet

- Brochure Trading Strategy For Market 0Document19 pagesBrochure Trading Strategy For Market 0mohanNo ratings yet

- 14e GNB ch08 SM CGGDocument97 pages14e GNB ch08 SM CGGAhmed El KhateebNo ratings yet

- FFTT "Tree Rings": The 10 Most Interesting Things: We 'Ve Read RecentlyDocument25 pagesFFTT "Tree Rings": The 10 Most Interesting Things: We 'Ve Read RecentlyMadeleine ChewNo ratings yet

- Robert Mondavi Case StudyDocument3 pagesRobert Mondavi Case StudyKrithika NaiduNo ratings yet

- Cambridge International AS & A Level Business - Notes On Unit 4Document12 pagesCambridge International AS & A Level Business - Notes On Unit 4fopabip33No ratings yet

- B.A. / B.SC.: III Year-2021-22Document4 pagesB.A. / B.SC.: III Year-2021-22Tannu TannuNo ratings yet

- PF Midterm 2023 - 1Document5 pagesPF Midterm 2023 - 1BhavnaNo ratings yet

- SEBI N FEMADocument28 pagesSEBI N FEMAD Attitude KidNo ratings yet

- Mini Project - On Rural Based CompanyDocument21 pagesMini Project - On Rural Based CompanyShivam JadhavNo ratings yet

- This Bill $262.45 Previous Balance - $1.45 Total: Tax Invoice For..Document19 pagesThis Bill $262.45 Previous Balance - $1.45 Total: Tax Invoice For..Emmanuel AdjeiNo ratings yet

- GVCSO Legislative Positions Statement 2023Document3 pagesGVCSO Legislative Positions Statement 2023Watertown Daily TimesNo ratings yet

- Agriculture, Livestock Fisheries: Comparative Advantages of Jute Export in Bangladesh, China and IndiaDocument8 pagesAgriculture, Livestock Fisheries: Comparative Advantages of Jute Export in Bangladesh, China and IndiaMuna AlamNo ratings yet

- J17 DipIFR - AnswersDocument8 pagesJ17 DipIFR - Answers刘宝英No ratings yet

- Cosmetology SchoolsDocument9 pagesCosmetology SchoolsIbrahim KalokohNo ratings yet

- Chapter 2Document17 pagesChapter 2Amanuel GenetNo ratings yet