Professional Documents

Culture Documents

ENGG522 - HWAC2 Manuscript

Uploaded by

hamzaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ENGG522 - HWAC2 Manuscript

Uploaded by

hamzaCopyright:

Available Formats

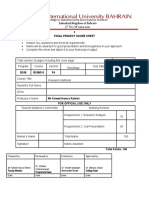

COLLEGE OF ENGINEERING

3rd Tri, SY 2021-2022

ENGG522 – ENGINEERING ECONOMY

Assignment 2

Total Points: 30

Student ID Student Name

Course Code ENGG522 Course Title ENGINEERING ECONOMY Section

(10 points each)

DIRECTIONS: SOLVE THE FOLLOWING PROBLEMS SHOWING FULL ANSWER

1. Consider the following data on a car:

Cost basis of the asset, CO = BD 10,000

Useful life, N = 5 years

Estimated Salvage value, CL = BD 2,000

Compute the annual depreciation allowances and the resulting book values. Using straight line method.

2. Consider the following data on a car:

Cost basis of the asset, CO = BD 5423

Useful life, N = 2 years

Estimated Salvage value, CL = BD 2,000

Interest rate, i = 15%

Compute the annual depreciation allowances and the resulting book values. Using sinking fund method.

3. Calculate the annual depreciation and book value of the construction equipment using declining balance

method. The interest rate is 8% per year. Co= BD 3,500,000 - Sv = BD 500,000 n = 10 years.

*********************************END OF QUESTIONS************************************

Rubrics scoring:

For 10 marks

10 marks: correct answer

6-9 marks: maximum correct answer

1-5 marks: minimum correct answer

0 mark: No answer or wrong answer.

Prepared by: Reviewed/Checked by: Verified by: Approved by:

Engr. Zahra Merza Dr. Essam Alnatsheh Dr. Beda T. Aleta

Subject Coordinator Department Head Dr. Noaman M. Noaman

Associate Dean College Dean

Date : July 3,2022 Date : July 3,2022 Date : July 3,2022 Date : July 3,2022

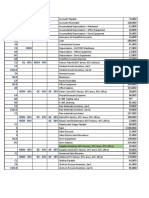

(a) Computation of annual depreciation allownaces and Book Values

Cost of asset =$10,000

Useful life =5 years

Estimated salvege Value =$2000

Depreciation per year = (Cost - salvege value) / Number of years =($10,000 -$2000) /5

=$1600

Closing

Year Opening value Depreciation Book

value

1 10000 1600 8400

2 8400 1600 6800

3 6800 1600 5200

4 5200 1600 3600

5 3600 1600 2000

(b) Depreciation under Double declining method

Declining balance rate = 2* (1/ Useful life) = 2* (1/5) =40%

End of year Depreciation Book value

1 0.4*$10,000 =$4000 $10,000 - $ 4000 =$6000

2 0.40*$6000=$2400 $6000-$2400=$3600

3 0.40*$3600=$1440 $3600-$1440=$2160

4 0.40*$2160=$864 $2160-$864=$1296

5 ($1296-$778) =$518 $778

Prepared by: Reviewed/Checked by: Verified by: Approved by:

Engr. Zahra Merza Dr. Essam Alnatsheh Dr. Beda T. Aleta

Subject Coordinator Department Head Dr. Noaman M. Noaman

Associate Dean College Dean

Date : June 1,2022 Date : June 1,2022 Date : June 1,2022 Date : June 1,2022

Q3

Answer:

Cost: $3,500,000.00, Salvage: $500,000.00

Life: 10 years, Factor: 1.5

Convention: Full-Month

First Year: 6 months

Depreciation

Year Depreciation Expense

2022 $ 262,500

2023 $ 485,625

2024 $ 412,781

2025 $ 350,864

2026 $ 298,234

2027 $ 253,499

2028 $ 215,474

2029 $ 183,153

2030 $ 155,680

2031 $ 132,328

2032 $ 56,239

Prepared by: Reviewed/Checked by: Verified by: Approved by:

Engr. Zahra Merza Dr. Essam Alnatsheh Dr. Beda T. Aleta

Subject Coordinator Department Head Dr. Noaman M. Noaman

Associate Dean College Dean

Date : June 1,2022 Date : June 1,2022 Date : June 1,2022 Date : June 1,2022

You might also like

- Mount Moreland Hospital: Perform Financial CalculationsDocument9 pagesMount Moreland Hospital: Perform Financial CalculationsJacob Sheridan0% (1)

- Manual UBS PDFDocument112 pagesManual UBS PDFRonar Bermudez50% (2)

- Macroeconomic Dashboards For Tactical Asset AllocationDocument12 pagesMacroeconomic Dashboards For Tactical Asset Allocationyin xuNo ratings yet

- Audit of LiabilitiesDocument33 pagesAudit of Liabilitiesxxxxxxxxx96% (28)

- Assignment 5.2 Note PayableDocument2 pagesAssignment 5.2 Note PayableKate HerederoNo ratings yet

- Fa 2 1Document8 pagesFa 2 1Quỳnh Anh NguyễnNo ratings yet

- Transmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument2 pagesTransmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueLayne Kendee100% (2)

- DepreciationDocument4 pagesDepreciationMùhammad TàhaNo ratings yet

- UTS Managerial FinanceDocument6 pagesUTS Managerial FinanceSatria PgNo ratings yet

- Chapter 4-Book ExercisesDocument3 pagesChapter 4-Book ExercisesRita Angela DeLeonNo ratings yet

- Sheena Burns Chapter 10 Practice Problems: 1. Straight Line MethodDocument5 pagesSheena Burns Chapter 10 Practice Problems: 1. Straight Line MethodDanicia TillettNo ratings yet

- Jawaban Handout Week 9 Nomor 2 Dan 3 1Document6 pagesJawaban Handout Week 9 Nomor 2 Dan 3 1Nafilah RahmaNo ratings yet

- Cambridge IGCSE: ACCOUNTING 0452/23Document20 pagesCambridge IGCSE: ACCOUNTING 0452/23Mangesh RahateNo ratings yet

- Avocado TeaDocument61 pagesAvocado TeaManto RoderickNo ratings yet

- NP EX19 9a JinruiDong 2Document9 pagesNP EX19 9a JinruiDong 2Ike DongNo ratings yet

- Tugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BDocument23 pagesTugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BAdam PalmaleoNo ratings yet

- Intermidiate 1 Quiz ExamDocument2 pagesIntermidiate 1 Quiz ExamLT pudgeNo ratings yet

- 1t Chan Activity2Document14 pages1t Chan Activity2irish chanNo ratings yet

- CC 0742 - 2031 AnnuityDocument1 pageCC 0742 - 2031 AnnuityterrygohNo ratings yet

- Tutorial Worksheet SolutionsDocument12 pagesTutorial Worksheet SolutionsHhvvgg BbbbNo ratings yet

- Repe Model 1 0Document51 pagesRepe Model 1 0Caio HenriqueNo ratings yet

- IA2Document9 pagesIA2Claire BarbaNo ratings yet

- MB2001 FA 2025 Week5B Liabilities Practice ExercisesDocument31 pagesMB2001 FA 2025 Week5B Liabilities Practice ExerciseschloeileenspearsNo ratings yet

- Akuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-IDocument14 pagesAkuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-Imuhammad alfariziNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Answer Key - Assignment PPE Part 2Document8 pagesAnswer Key - Assignment PPE Part 2Silvermist AriaNo ratings yet

- FINANCIALSDocument7 pagesFINANCIALSAmmon BelyonNo ratings yet

- ACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleDocument8 pagesACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleCoc AndreiNo ratings yet

- FINC 721 Project 1Document5 pagesFINC 721 Project 1Sameer BhattaraiNo ratings yet

- Act05!2!1 Esman Giecel E.Document16 pagesAct05!2!1 Esman Giecel E.Kate ManalansanNo ratings yet

- Bucyrus EMS Cost OptionsDocument8 pagesBucyrus EMS Cost OptionsGere GobleNo ratings yet

- Del Capítulo 9, Resolver: 1. Ejercicio E9-3 Página 428Document10 pagesDel Capítulo 9, Resolver: 1. Ejercicio E9-3 Página 428Estefanía ZavalaNo ratings yet

- A. Straight Line MethodDocument5 pagesA. Straight Line MethodEliza Gail ConsuegraNo ratings yet

- ENGG522 - HWAC1 ManuscriptDocument2 pagesENGG522 - HWAC1 ManuscripthamzaNo ratings yet

- 28498f7dafef57b361720d949d97c384Document2 pages28498f7dafef57b361720d949d97c384priyaNo ratings yet

- Flex Budget Report MaDocument4 pagesFlex Budget Report MaKashif KashifNo ratings yet

- Construction Engineering Tutorial Work 1 9Document47 pagesConstruction Engineering Tutorial Work 1 9Matthew100% (1)

- TR-01 - Rochelle Damages ModelDocument150 pagesTR-01 - Rochelle Damages ModelSUDHANSHU SINGHNo ratings yet

- Date Descriptions 2020: General JournalDocument10 pagesDate Descriptions 2020: General JournalDanica RamosNo ratings yet

- Radex Electric Co. Forecasting and InvestmentDocument3 pagesRadex Electric Co. Forecasting and InvestmentJacquin MokayaNo ratings yet

- M3 CPRDocument4 pagesM3 CPRAngela LapuzNo ratings yet

- Group B Assignment Week 13Document6 pagesGroup B Assignment Week 13fghhjjjnjjnNo ratings yet

- Master in Civil Engineering - UKDocument5 pagesMaster in Civil Engineering - UKKirushanthan NaguleswaranNo ratings yet

- Engr. Charity Hope GayatinDocument5 pagesEngr. Charity Hope Gayatinmedwin moralesNo ratings yet

- Leases SolManDocument15 pagesLeases SolManElaine Joyce GarciaNo ratings yet

- Assessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Document7 pagesAssessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Jaydeep KushwahaNo ratings yet

- 123 - 17-chapter-17-FeasibilityAnalysisDocument21 pages123 - 17-chapter-17-FeasibilityAnalysisHrvoje ErorNo ratings yet

- Engineering Economics Final QSDocument6 pagesEngineering Economics Final QSAyugma Acharya0% (1)

- Intacc2 M2 Ass2Document14 pagesIntacc2 M2 Ass2Rosette SANTOSNo ratings yet

- Y12 Life Mathematics 2022 PaperDocument28 pagesY12 Life Mathematics 2022 PaperRupesh KumarNo ratings yet

- TM 5 AKM 3 Ananda Dika M. 164Document4 pagesTM 5 AKM 3 Ananda Dika M. 164Bam BamNo ratings yet

- Deshmukh Gruh UdyogDocument10 pagesDeshmukh Gruh UdyogJITNo ratings yet

- De Matta, Nicka Suzane-Bsa22a1-Case-Problems-Lease-ModificationsDocument3 pagesDe Matta, Nicka Suzane-Bsa22a1-Case-Problems-Lease-ModificationsNita Costillas De MattaNo ratings yet

- Investment PropertyDocument9 pagesInvestment PropertyNathalie GetinoNo ratings yet

- Assignment 1 2020 SVDocument19 pagesAssignment 1 2020 SVNguyen Dinh Quang MinhNo ratings yet

- 2 - C. Problems - DepreciationDocument76 pages2 - C. Problems - DepreciationPia Shannen OdinNo ratings yet

- Chapter 11 Bonds PayableDocument27 pagesChapter 11 Bonds PayableNicho Deven HamawiNo ratings yet

- Fra 3Document7 pagesFra 3Subhajyoti MukhopadhyayNo ratings yet

- 3 - IAS 36 SolutionDocument3 pages3 - IAS 36 Solutionsandeshjhanbia021No ratings yet

- CHP 9 Plant Assets and Depreciation AccountingDocument15 pagesCHP 9 Plant Assets and Depreciation AccountingRASHONNo ratings yet

- ECO202 - Extra Questions F2Document6 pagesECO202 - Extra Questions F2H pmNo ratings yet

- Faculty of Health and Medical Sciences: Academic Terms and Fee Schedule For 2022Document3 pagesFaculty of Health and Medical Sciences: Academic Terms and Fee Schedule For 2022Sadwi MulatsihNo ratings yet

- Aol AccDocument19 pagesAol AccANGELYCA LAURANo ratings yet

- Bsib 621-Fa 4Document2 pagesBsib 621-Fa 4hamzaNo ratings yet

- Bsib 621-Fma 3Document3 pagesBsib 621-Fma 3hamzaNo ratings yet

- Bsib514 HW 3 - 1ST Tri - 2020-2021Document4 pagesBsib514 HW 3 - 1ST Tri - 2020-2021hamzaNo ratings yet

- BSIB 621 HWAC2 Case 2Document3 pagesBSIB 621 HWAC2 Case 2hamzaNo ratings yet

- Bsib 621-Hwac 2Document4 pagesBsib 621-Hwac 2hamzaNo ratings yet

- Bsib421 - Final Project Set ADocument11 pagesBsib421 - Final Project Set AhamzaNo ratings yet

- BSIB 616 Research Methods - Final Project ADocument15 pagesBSIB 616 Research Methods - Final Project AhamzaNo ratings yet

- COMP515 FA Formative Assignment 1 20213Document4 pagesCOMP515 FA Formative Assignment 1 20213hamzaNo ratings yet

- MGT 315 Assignment Summer 2022Document7 pagesMGT 315 Assignment Summer 2022hamzaNo ratings yet

- ENGG522 - HWAC1 ManuscriptDocument2 pagesENGG522 - HWAC1 ManuscripthamzaNo ratings yet

- COMP512Final Project-20212Document6 pagesCOMP512Final Project-20212hamzaNo ratings yet

- Bsib 621-Test 1Document10 pagesBsib 621-Test 1hamzaNo ratings yet

- BSIB 621 Case 1Document3 pagesBSIB 621 Case 1hamzaNo ratings yet

- ACC416 - Case Study - Answer SheetDocument6 pagesACC416 - Case Study - Answer SheethamzaNo ratings yet

- Lecture Graded Assigiment 2: Topics Assignment Direction & Requirement/ SDocument5 pagesLecture Graded Assigiment 2: Topics Assignment Direction & Requirement/ ShamzaNo ratings yet

- CH 5 Assignment 4Document4 pagesCH 5 Assignment 4hamzaNo ratings yet

- Assignment 5 - MGT230 Mock Final Exam.Document6 pagesAssignment 5 - MGT230 Mock Final Exam.hamzaNo ratings yet

- College of Administrative & Financial Sciences: COMP643 - Accounting Information Systems Laboratory Report 1Document2 pagesCollege of Administrative & Financial Sciences: COMP643 - Accounting Information Systems Laboratory Report 1hamzaNo ratings yet

- ECON440 Project Group1Document14 pagesECON440 Project Group1hamzaNo ratings yet

- MGT 504 - MidtermDocument12 pagesMGT 504 - MidtermhamzaNo ratings yet

- Negotiation and Conflict Resolution HUR382 Midterm ExamDocument5 pagesNegotiation and Conflict Resolution HUR382 Midterm ExamhamzaNo ratings yet

- 118-Reflective Report Final (2) Ali FuadDocument13 pages118-Reflective Report Final (2) Ali FuadhamzaNo ratings yet

- Student Name: Student ID: Strength of Materials: ENGG533-Section: - Assignment No: 3 Date: 23 /3/ 2021 Due:1/4/2022Document4 pagesStudent Name: Student ID: Strength of Materials: ENGG533-Section: - Assignment No: 3 Date: 23 /3/ 2021 Due:1/4/2022hamzaNo ratings yet

- Ans-Assignment QM 204.editedDocument9 pagesAns-Assignment QM 204.editedhamzaNo ratings yet

- Final Project: BSBI 422 - Financial AccountingDocument4 pagesFinal Project: BSBI 422 - Financial AccountinghamzaNo ratings yet

- MGT 202 OB Assignment 2022Document8 pagesMGT 202 OB Assignment 2022hamzaNo ratings yet

- Comp633 Icpc 20212 V2Document9 pagesComp633 Icpc 20212 V2hamzaNo ratings yet

- Overview:: Ama International University - Bahrain Center For General EducationDocument9 pagesOverview:: Ama International University - Bahrain Center For General EducationhamzaNo ratings yet

- College of Administrative and Financial Sciences Lab Report1 2 TRI-2021-2022Document3 pagesCollege of Administrative and Financial Sciences Lab Report1 2 TRI-2021-2022hamzaNo ratings yet

- COMP532 IT Infrastructure ICPC 20212Document14 pagesCOMP532 IT Infrastructure ICPC 20212hamzaNo ratings yet

- Course Syllabus - The Economics of Cities and Regions 2017-2018Document8 pagesCourse Syllabus - The Economics of Cities and Regions 2017-2018FedeSivakNo ratings yet

- 5 02-09-2022 Sale On Approval FTDocument4 pages5 02-09-2022 Sale On Approval FTShweta BhadauriaNo ratings yet

- AON Kelompok 5Document39 pagesAON Kelompok 5Berze VessaliusNo ratings yet

- InvocieDocument1 pageInvociepankajsabooNo ratings yet

- Dividend Policy and Financial Performance of Nigerian Pharmaceutical FirmsDocument17 pagesDividend Policy and Financial Performance of Nigerian Pharmaceutical FirmsRitesh ChatterjeeNo ratings yet

- Self Sabotage Reexamined: by Van K. Tharp, PH.DDocument8 pagesSelf Sabotage Reexamined: by Van K. Tharp, PH.DYashkumar JainNo ratings yet

- Accounting Professionalism-They Just Don't Get It!: Arthur R. WyattDocument10 pagesAccounting Professionalism-They Just Don't Get It!: Arthur R. WyattFabian QuincheNo ratings yet

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDocument1 pageACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNo ratings yet

- RSU (Cash Agreement Letter) .RDLDocument6 pagesRSU (Cash Agreement Letter) .RDLRakeshSahuNo ratings yet

- Early Warning Signals: Retail and Corporate LoansDocument3 pagesEarly Warning Signals: Retail and Corporate Loanseo publicationsNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Final JV Agreement Dated 14.07.2011 (MPS, Integral Acres & Pembangunan Samudera)Document54 pagesFinal JV Agreement Dated 14.07.2011 (MPS, Integral Acres & Pembangunan Samudera)multiideaNo ratings yet

- IAS 38 HomeworkDocument6 pagesIAS 38 HomeworkSheilaNo ratings yet

- "Financial Markets - Yale" Plus 3 More CoursesDocument4 pages"Financial Markets - Yale" Plus 3 More Coursessamudragupta06No ratings yet

- Pdic 2Document6 pagesPdic 2jeams vidalNo ratings yet

- (Midterm-Second Week) Maam CJ Chris Ramtom: Technical English 1 (Investigative Report Writing and Presentation) Cdi 5Document7 pages(Midterm-Second Week) Maam CJ Chris Ramtom: Technical English 1 (Investigative Report Writing and Presentation) Cdi 5Givehart Mira BanlasanNo ratings yet

- Exercise E3-10 and E3-22Document4 pagesExercise E3-10 and E3-22api-269347566No ratings yet

- Dissertation Michael AgstenDocument5 pagesDissertation Michael AgstenCanYouWriteMyPaperForMeCanada100% (1)

- Fac 3703Document99 pagesFac 3703Nozipho MpofuNo ratings yet

- Yu v. NLRCDocument3 pagesYu v. NLRCMaria Lourdes DatorNo ratings yet

- Business Plan Template-ECI11Document21 pagesBusiness Plan Template-ECI11Mawada MawadaNo ratings yet

- Mumbai Port Trust Land DevelopmentDocument69 pagesMumbai Port Trust Land DevelopmentAniruddh Kanade100% (2)

- G Holdings Vs National Mines and Allied Workers UnionDocument1 pageG Holdings Vs National Mines and Allied Workers UnionKrizea Marie DuronNo ratings yet

- Welcome Letter BonanzzaDocument3 pagesWelcome Letter BonanzzaNimish MethiNo ratings yet

- Repo Vs Reverse RepoDocument9 pagesRepo Vs Reverse RepoRajesh GuptaNo ratings yet

- Step by Step Procedure For Creation of IDOCDocument34 pagesStep by Step Procedure For Creation of IDOCjolliestNo ratings yet