Professional Documents

Culture Documents

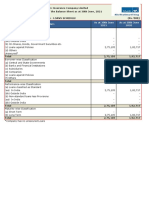

NYC and Federal Bankruptcy Exemptions Chart

Uploaded by

Gavi Fried0 ratings0% found this document useful (0 votes)

67 views2 pagesThis document summarizes exemptions from money judgments and bankruptcy under New York state law and federal bankruptcy law. It lists various types of property that are exempt, such as household items, clothing, wedding rings, tools of trade, vehicles, retirement accounts, income, and homestead equity. It notes some key differences between state and federal exemptions, such as higher caps under federal law. It also specifies that exemptions may still be subject to domestic support and child support claims in some cases, both within and outside of bankruptcy proceedings.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes exemptions from money judgments and bankruptcy under New York state law and federal bankruptcy law. It lists various types of property that are exempt, such as household items, clothing, wedding rings, tools of trade, vehicles, retirement accounts, income, and homestead equity. It notes some key differences between state and federal exemptions, such as higher caps under federal law. It also specifies that exemptions may still be subject to domestic support and child support claims in some cases, both within and outside of bankruptcy proceedings.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

67 views2 pagesNYC and Federal Bankruptcy Exemptions Chart

Uploaded by

Gavi FriedThis document summarizes exemptions from money judgments and bankruptcy under New York state law and federal bankruptcy law. It lists various types of property that are exempt, such as household items, clothing, wedding rings, tools of trade, vehicles, retirement accounts, income, and homestead equity. It notes some key differences between state and federal exemptions, such as higher caps under federal law. It also specifies that exemptions may still be subject to domestic support and child support claims in some cases, both within and outside of bankruptcy proceedings.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

NYS Non-Bankruptcy Exception NYS Bankruptcy Federal Bankruptcy Exceptions to Exemption

- Exempt both from the satisfaction of Exemptions (Menu allows for Exemptions - Unless otherwise specified, within bankruptcy, none of

money judgments and when filing for B maximum aggregate limit of these exemptions are exempt from the satisfaction of

under NY menu. $11,375 for 5205(a) domestic support claims under 523(a)(5)

- Unless otherwise specified, non-B exemptions)

exemptions also exempt from DS claims

5205(a)(1): Stoves, fuel, sewing machine D&C 282

5205(a)(2): Religious texts, family pictures, D&C 282 §522(d)(3): $13,400 in

school books; other books not exceeding $575 aggregate value for HH items,

in value not exceeding $625 for any

particular item

5205(a)(3): A seat in church pew D&C 282 N/A NO.

5205(a)(4): Domestic animals with necessary D&C 282 §522(d)(3): $13,400 in

food for 120 days, no more than $1,150 aggregate value for HH items,

not exceeding $625 for any

particular item

5205(a)(5): Clothing, furniture, clothing, D&C 282 §522(d)(3): $13,400 in

cellphone, computer, instruments, necessary aggregate value for HH items,

for D and family not exceeding $625 for any

particular item

5205(a)(6): Wedding ring (not engagement D&C 282 §522(d)(4): $1,700 jewelry

ring, unless used at ceremony), of any exemption

amount

5205(a)(6): Watch not exceeding $1,150 D&C 282 §522(d)(4): $1,700 jewelry

exemption

5205(a)(7) Tools of trade up to $3,400 D&C 282 §522(d)(4): Tools of the trade

up to $2,525

5205(a)(8): Car exemption D&C 282(1) §522(d)(2): $4,000 car 5205(a)(8): Car exemption is subject to the satisfaction of

exemption DS/CS claims outside of bankruptcy

- not exceeding $4,550 above liens and If filing for B under NY state

encumbrances of D menus, choose 282(1), so car

is not included in maximum

- if equipped for disabled person, $11,375

aggregate limit

Spillover Exemption Wildcard Exemption

5205(a)(9): If no homestead claimed, then D’s aggregate interest in any

$1,150 in personal property, cash. property up to $1,325 plus up

to $12,575 of any unused

portion of the 522(d)(1)

homestead exemption

§522(d)(5)

5205(c)(1), (2): ERISA Account, IRA account ERISA not POE, don’t have to ERISA not POE, don’t have to - ERISA accounts, while not POE, are nevertheless

exempt exempt subject to satisfaction of DS/CS claims in bankruptcy

under 362(b)(2) exemption to automatic stay

- Outside B, subject to DS/CS claims under 5205(c)(4)

- Fraud alert: 5205(c)(5)—funds deposited within 90

days before assertion of claim on which judgment is

entered against D are not subject to exemption and

may be considered a fraudulent transfer.

5205(d)(1): 90% of distributed income from Can receive up to 10% of income unless court determines

spendthrift trust more.

5205(d)(2): 90% of the debtor’s income D&C 282 Can reach the other 10%.

earned for personal services rendered within

Note that in Ch 11 and 13 cases, post-petition earnings are

60 days prior to and after an income

property of the estate.

execution is delivered

5206(a): Homestead (owned and occupied as D&C 282 §522(d)(1) $25,150 exempted

principal residence). $170,825 exempted in

Kings, Queens, NY, Bronx, et al. See statute

for full exemptions amounts

You might also like

- TXN 2301E PC06.CaseDocument6 pagesTXN 2301E PC06.CasejobaratetaNo ratings yet

- FND GFM 72339771Document16 pagesFND GFM 72339771Geetha ReddyNo ratings yet

- 2011 Verizon Foundation Tax Package PDFDocument302 pages2011 Verizon Foundation Tax Package PDFArlanda JacksonNo ratings yet

- Particulars As at 30th June 2021 As at 30th June 2020Document1 pageParticulars As at 30th June 2021 As at 30th June 2020Lucifer MorningstarNo ratings yet

- Fin5203 Module 8 Fl22Document78 pagesFin5203 Module 8 Fl22merly chermonNo ratings yet

- B Nkruptcy: Discharge of A BankruptDocument2 pagesB Nkruptcy: Discharge of A BankruptZeyad El-sayedNo ratings yet

- Scan 0007Document2 pagesScan 0007El Sayed AbdelgawwadNo ratings yet

- Tax Answers - Chapter 3Document4 pagesTax Answers - Chapter 3Jonathan VelaNo ratings yet

- Solutions Totutorial 2-Fall 2022Document8 pagesSolutions Totutorial 2-Fall 2022chtiouirayyenNo ratings yet

- CHAPTER 3 SEC. 5 Arts. 1223 1225Document6 pagesCHAPTER 3 SEC. 5 Arts. 1223 1225Vince Llamazares Lupango100% (6)

- Accounting IAS Model Answers Series 2 2010Document17 pagesAccounting IAS Model Answers Series 2 2010Aung Zaw HtweNo ratings yet

- SEC Complaint Against Dell Inc.: Presented By: William GrowDocument11 pagesSEC Complaint Against Dell Inc.: Presented By: William Growbd090411No ratings yet

- P6Document15 pagesP6lakshmananrm2005No ratings yet

- Ch. 10 - Audit of Dividends CA Study NotesDocument2 pagesCh. 10 - Audit of Dividends CA Study NotesUnpredictable TalentNo ratings yet

- Lembar JasaDocument40 pagesLembar JasaSindi YulianiNo ratings yet

- Documents: Common Proficiency TestDocument41 pagesDocuments: Common Proficiency TestKamal VirkNo ratings yet

- Dell Inc Is A Leading Global Provider of Computer ProductsDocument1 pageDell Inc Is A Leading Global Provider of Computer Productshassan taimourNo ratings yet

- Accounting Assignment New 1 To 8 TodayDocument14 pagesAccounting Assignment New 1 To 8 TodayTEXTILIONSNo ratings yet

- Bankruptcy Starter OLDocument30 pagesBankruptcy Starter OLN AaNo ratings yet

- 2022 Form 10-K Debt SecurityDocument2 pages2022 Form 10-K Debt SecurityYashasvi RaghavendraNo ratings yet

- Accounts U1 Spec2022Document41 pagesAccounts U1 Spec2022AbbyNo ratings yet

- Assignment #5 Chapter 6.Document15 pagesAssignment #5 Chapter 6.ValentinaNo ratings yet

- Name: Anglican Cathedral College Class APRIL 23, 2021 4 Principles of Accounts Graded QuizDocument2 pagesName: Anglican Cathedral College Class APRIL 23, 2021 4 Principles of Accounts Graded QuizChristopher TrujilloNo ratings yet

- Government Budget and The EconomyDocument1 pageGovernment Budget and The EconomyAdwaith c AnandNo ratings yet

- Return of Private FoundationDocument13 pagesReturn of Private FoundationJoaquín SiabraNo ratings yet

- Tax ReturnDocument16 pagesTax ReturnJameriaNo ratings yet

- Customs External Policy Refunds and Drawbacks: Effective 30 July 2021Document20 pagesCustoms External Policy Refunds and Drawbacks: Effective 30 July 2021joel enciso enekeNo ratings yet

- SC DT C 13 Refunds and Drawbacks External PolicyDocument21 pagesSC DT C 13 Refunds and Drawbacks External PolicyNeutralGuyRSANo ratings yet

- P3 2aDocument10 pagesP3 2adzaky2303No ratings yet

- 2022 ZB Q7 - MP (Sda, 994)Document3 pages2022 ZB Q7 - MP (Sda, 994)Vvishaline SubramaniamNo ratings yet

- Decision GameDocument27 pagesDecision GameThomasNo ratings yet

- B Kruptcy: E Chapter 1 Bankruptc ProceedingDocument2 pagesB Kruptcy: E Chapter 1 Bankruptc ProceedingZeyad El-sayedNo ratings yet

- IrrecoverablwDocument11 pagesIrrecoverablwgunasekarasugeethaNo ratings yet

- Ledger Accounts and Double Entry Course NotesDocument7 pagesLedger Accounts and Double Entry Course Notesshakhawat_cNo ratings yet

- Bankruptcy OutlineDocument29 pagesBankruptcy Outlinechristensen_a_g100% (2)

- Suggested Solutions To Homework 3 - Deductible ExpensesDocument2 pagesSuggested Solutions To Homework 3 - Deductible ExpensesLIAW ANN YINo ratings yet

- DLink DCH-G020 Manual v1.1Document14 pagesDLink DCH-G020 Manual v1.1paul4ringsNo ratings yet

- 2020-21 TDS Rates 2020 21 TaxpertDocument12 pages2020-21 TDS Rates 2020 21 TaxpertHarun AccountantNo ratings yet

- MCQ CmaDocument255 pagesMCQ CmaMahak AgarwalNo ratings yet

- Worksheet FinalDocument2 pagesWorksheet FinalVyomNo ratings yet

- (uploadMB - Com) CPT - mtp1Document41 pages(uploadMB - Com) CPT - mtp1Srinivas YadavNo ratings yet

- Questions Chapter 10Document21 pagesQuestions Chapter 10SA 10No ratings yet

- Trademark FeeDocument7 pagesTrademark FeeAzka Nuriel ShiddiqNo ratings yet

- Taxes: Nsacti Ns in E TY: D. Ain and Losse On Bu Pe TDocument1 pageTaxes: Nsacti Ns in E TY: D. Ain and Losse On Bu Pe TEl Sayed AbdelgawwadNo ratings yet

- Fr342. Afr (Al-I) Solution Cma May-2023 Exam.Document6 pagesFr342. Afr (Al-I) Solution Cma May-2023 Exam.practice78222No ratings yet

- Midland Balance SheetDocument3 pagesMidland Balance Sheetahn.teiNo ratings yet

- Dell Alienware Ryzen Edition d23m d23m004 United Kingdom - Declaration of Conformity En-UsDocument2 pagesDell Alienware Ryzen Edition d23m d23m004 United Kingdom - Declaration of Conformity En-UsJacinto PerezNo ratings yet

- Atm Cafm Practical Revision NotesDocument95 pagesAtm Cafm Practical Revision Notesdroom8521No ratings yet

- 12th Sample Paper 6Document8 pages12th Sample Paper 6Amit ChaudhryNo ratings yet

- Multiple Choice Questions Raw Materials and Merchandise Purchased Can Be IncludedDocument1 pageMultiple Choice Questions Raw Materials and Merchandise Purchased Can Be IncludedTaimour HassanNo ratings yet

- Annual Report: The Year in ReviewDocument42 pagesAnnual Report: The Year in ReviewSabina MunteanuNo ratings yet

- Accounting Assignment #2..Document13 pagesAccounting Assignment #2..TEXTILIONSNo ratings yet

- Week 8 - Tutorial SolutionDocument3 pagesWeek 8 - Tutorial SolutionAvishchal ChandNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Vasanth Kumar AllaNo ratings yet

- SP 7Document8 pagesSP 7Amit ChaudhryNo ratings yet

- 10 CPT Model Papers - With AnswersDocument558 pages10 CPT Model Papers - With AnswersRajesh DorbalaNo ratings yet

- 2021 Instructions For Schedule E: Supplemental Income and LossDocument12 pages2021 Instructions For Schedule E: Supplemental Income and Lossjyoti06ranjanNo ratings yet

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonNo ratings yet

- The Insider's Guide to Tax-Free Real Estate Investments: Retire Rich Using Your IRAFrom EverandThe Insider's Guide to Tax-Free Real Estate Investments: Retire Rich Using Your IRANo ratings yet

- The Insider's Guide to Making Money in Real Estate: Smart Steps to Building Your Wealth Through PropertyFrom EverandThe Insider's Guide to Making Money in Real Estate: Smart Steps to Building Your Wealth Through PropertyRating: 3 out of 5 stars3/5 (5)

- Data Science Tech Cover Letter TemplateDocument1 pageData Science Tech Cover Letter Templatemaqbool bhaiNo ratings yet

- Pleural Fluid AspirationDocument2 pagesPleural Fluid AspirationThe Multilingual MedicNo ratings yet

- Questionnaire Financial LiteracyDocument6 pagesQuestionnaire Financial LiteracyAmielyn Kieth L. SarsalejoNo ratings yet

- One Pager by Capgemini Mechanical Design and Simulation ServicesDocument4 pagesOne Pager by Capgemini Mechanical Design and Simulation ServicesSmita GadreNo ratings yet

- Othello JourneyDocument38 pagesOthello Journeyapi-270897909No ratings yet

- Haciendo Negocios VenezuelaDocument101 pagesHaciendo Negocios VenezuelawilkiprcNo ratings yet

- CASE OF VRZIC v. CROATIADocument22 pagesCASE OF VRZIC v. CROATIAVeronica PozneacovaNo ratings yet

- Results College Magazines Competition 2021Document4 pagesResults College Magazines Competition 2021Fida HussainNo ratings yet

- 1.10 2.30 20-10betway - Odds FilterDocument2 pages1.10 2.30 20-10betway - Odds FilterFrancescoNo ratings yet

- Pts B.inggris Kelas 3Document3 pagesPts B.inggris Kelas 3Azizah ArifahNo ratings yet

- Unit 4 - MarketingDocument27 pagesUnit 4 - MarketingSorianoNo ratings yet

- Moxa Iologik E1200 Series Manual v15.2Document129 pagesMoxa Iologik E1200 Series Manual v15.2yeng menNo ratings yet

- D D D D D D P P P D: Procedure For Calculating Apparent-Pressure Diagram From Measured Strut LoadsDocument1 pageD D D D D D P P P D: Procedure For Calculating Apparent-Pressure Diagram From Measured Strut LoadsjcvalenciaNo ratings yet

- High School Religious Education Curriculum Framework From USCCBDocument59 pagesHigh School Religious Education Curriculum Framework From USCCBBenj EspirituNo ratings yet

- Shotlist and Script For Eco Friendly WorldDocument3 pagesShotlist and Script For Eco Friendly Worldapi-426197673No ratings yet

- TH I Gian Làm Bài: 180'Document17 pagesTH I Gian Làm Bài: 180'Duy HảiNo ratings yet

- Zenith Aircraft Stol CH 701: Wing Spar Wing Spar Main Gear StiffenerDocument16 pagesZenith Aircraft Stol CH 701: Wing Spar Wing Spar Main Gear StiffenerSteven100% (1)

- Tunnel Format 1 - MergedDocument9 pagesTunnel Format 1 - MergedLovely SinghNo ratings yet

- Rules and Reminders For Online Classes 2Document14 pagesRules and Reminders For Online Classes 2api-220703221No ratings yet

- Plan B ModuleDocument220 pagesPlan B ModuledamarwtunggadewiNo ratings yet

- The Daily Tar Heel For February 1, 2011Document8 pagesThe Daily Tar Heel For February 1, 2011The Daily Tar HeelNo ratings yet

- 1 Manalo Vs Sistoza DigestDocument2 pages1 Manalo Vs Sistoza DigestRowell Ian Gana-an0% (1)

- Whare Group Final PresentationDocument19 pagesWhare Group Final PresentationAruna MadasamyNo ratings yet

- Hm1317cb PBDocument4 pagesHm1317cb PBJose SanchezNo ratings yet

- Bca Internship Certifeciates PDFDocument33 pagesBca Internship Certifeciates PDF09 BCA devendravenkatasaiNo ratings yet

- Crossed Roller DesignGuideDocument17 pagesCrossed Roller DesignGuidenaruto256No ratings yet

- IJSCR 109192 Session ReportDocument11 pagesIJSCR 109192 Session ReportFarhan ShahzadNo ratings yet

- Price Reference Guide For Security Services 2021Document4 pagesPrice Reference Guide For Security Services 2021Dulas DulasNo ratings yet

- Making LoveDocument5 pagesMaking LoveapplecommentNo ratings yet

- Ramesh Patel Resume (Civil) 02Document4 pagesRamesh Patel Resume (Civil) 02RameshNo ratings yet