0% found this document useful (0 votes)

82 views13 pagesRisk Management Tools & Techniques

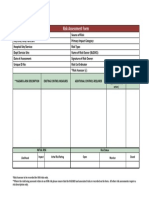

The document summarizes tools and techniques for risk management in 3 stages: [1] Risk identification using techniques like the Delphi technique, root cause analysis, and diagramming; [2] Quantitative analysis using techniques like failure mode and effects analysis, sensitivity analysis, and decision trees; [3] Qualitative analysis using techniques like Red-Amber-Green status, risk categorization, and risk assessment. It also discusses monitoring the risk management plan through status meetings and risk audits.

Uploaded by

20MC205004 mba.20Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

82 views13 pagesRisk Management Tools & Techniques

The document summarizes tools and techniques for risk management in 3 stages: [1] Risk identification using techniques like the Delphi technique, root cause analysis, and diagramming; [2] Quantitative analysis using techniques like failure mode and effects analysis, sensitivity analysis, and decision trees; [3] Qualitative analysis using techniques like Red-Amber-Green status, risk categorization, and risk assessment. It also discusses monitoring the risk management plan through status meetings and risk audits.

Uploaded by

20MC205004 mba.20Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 13